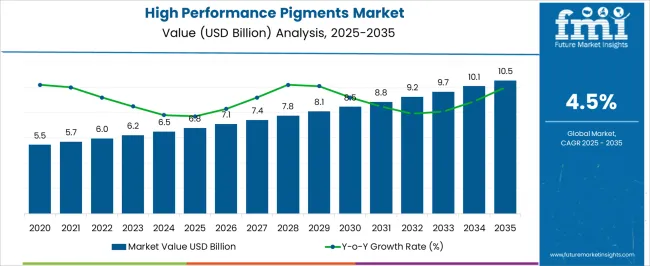

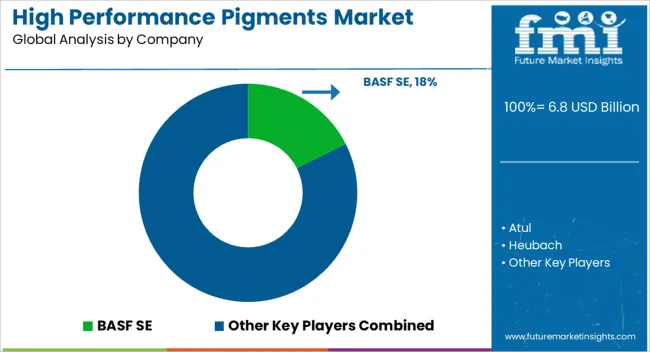

The high performance pigments market is projected to grow from USD 6.8 billion in 2025 to USD 10.5 billion by 2035, with a CAGR of 4.5%. Inflection point mapping reveals key transitions in growth dynamics over the forecast period. Between 2025 and 2030, the market grows from USD 6.8 billion to USD 8.5 billion, contributing USD 1.7 billion in growth, with a CAGR of 4.6%. This phase shows steady growth, driven by increasing demand for high-quality pigments in automotive, coatings, and consumer goods, where color consistency and durability are essential. The first inflection point occurs in 2030, when the market reaches USD 8.5 billion. From 2030 to 2035, the market continues to expand, moving from USD 8.5 billion to USD 10.5 billion, contributing USD 2.0 billion in growth. The growth rate increases slightly during this phase, with a CAGR of 4.6%, driven by the increasing demand for eco-friendly and sustainable pigments, as well as innovations in color technologies and performance-based coatings. The second inflection point around 2030 indicates the market’s shift from steady growth to acceleration, influenced by regulatory changes and the adoption of advanced pigments in emerging markets. Overall, the inflection points map a clear path from consistent growth to moderate acceleration in the latter half of the forecast.

| Metric | Value |

|---|---|

| High Performance Pigments Market Estimated Value in (2025 E) | USD 6.8 billion |

| High Performance Pigments Market Forecast Value in (2035 F) | USD 10.5 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The high performance pigments (HPP) market is gaining momentum as industries seek superior color durability, weather resistance, and environmental compliance in their formulations. Increasing regulatory pressure against heavy metals and solvent-based systems has catalyzed the shift toward environmentally friendly, high-stability pigments in coatings, plastics, and printing inks.

Manufacturers are prioritizing heat-resistant and lightfast materials to meet performance demands in automotive, architectural, and industrial segments. Advancements in pigment dispersion, nano-pigment development, and surface treatment technologies have further enhanced product compatibility and processing efficiency.

Strategic investments in backward integration and specialty pigment production are helping firms secure supply chain stability and value-added differentiation. Looking ahead, HPP demand is expected to accelerate in high-growth regions driven by infrastructure expansion, OEM refinishing, and evolving aesthetics in consumer goods.

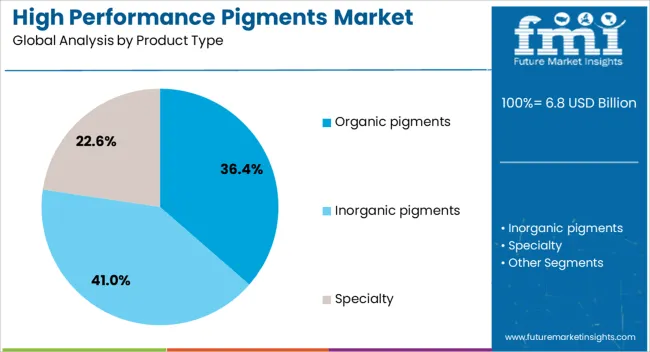

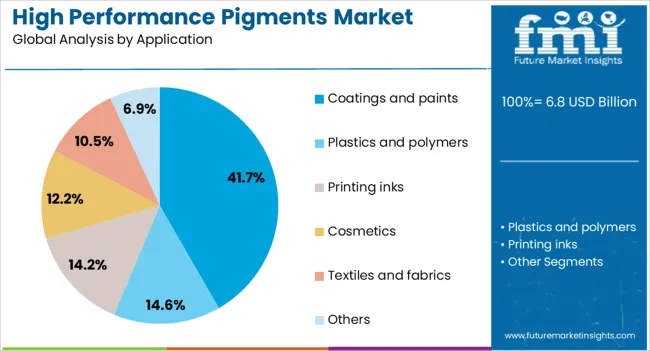

The market is segmented by product type, application, and region. By product type: organic pigments; inorganic pigments; specialty pigments. By application: coatings & paints; plastics & polymers; printing inks; cosmetics; textiles & fabrics; others. By region: North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

Organic pigments are expected to lead the high performance pigments market with a projected revenue share of 36.40% in 2025. Their dominance is being attributed to the growing demand for environmentally sustainable, low-toxicity pigment systems in premium industrial and consumer applications.

Organic pigments offer strong chromatic properties, superior tinting strength, and excellent dispersion characteristics across a wide variety of substrates. These qualities have been leveraged to meet the aesthetic and functional expectations in automotive refinishing, packaging, and construction coatings.

The segment has also benefited from rising adoption of bio-based feedstocks and waterborne systems in response to stringent VOC regulations. Enhanced performance through polymer stabilization and nanotechnology has expanded their applicability in high-heat and UV-resistant formulations, ensuring continued market leadership.

Coatings and paints are anticipated to contribute 41.70% of the total revenue share in the high performance pigments market by 2025, making it the largest application segment. This leadership is being driven by the demand for weatherproof, fade-resistant colorants in architectural and automotive coatings.

High performance pigments are being adopted for their ability to maintain optical properties and mechanical stability under prolonged UV, moisture, and chemical exposure. As sustainability goals and performance benchmarks rise across global coatings markets, the need for pigments that ensure durability without compromising on environmental standards has intensified.

Growth in infrastructure projects, urban development, and OEM paint consumption is reinforcing the application of HPPs, especially in high-gloss, matte, and textured finish systems that demand longevity and aesthetics.

The high performance pigments market is experiencing growth due to rising demand for vibrant, durable, and eco-friendly pigments across industries such as automotive, coatings, plastics, and consumer goods. These pigments offer superior color strength, lightfastness, and chemical resistance, making them essential for high-quality finishes in demanding applications. The increasing focus on aesthetic appeal and product longevity is contributing to the market expansion. While challenges such as raw material cost fluctuations and environmental regulations persist, opportunities exist in the development of eco-friendly pigments and the growth of the automotive and construction sectors.

The growing demand for high performance pigments is driven by industries looking for long-lasting, vibrant colors and superior durability in their products. In automotive coatings, the need for pigments that can withstand harsh environmental conditions while retaining their brightness and longevity is pushing the market forward. The rise in demand for high-quality, durable finishes in industrial coatings and plastics, where color and resistance to wear are critical, further boosts the need for high performance pigments. Consumer goods industries are increasingly adopting these pigments for packaging and decorative purposes, making color and durability central to product design. As industries across the board place more emphasis on aesthetics and quality, the demand for high performance pigments continues to grow.

A major challenge facing the high performance pigments market is the fluctuation in raw material costs. Many high performance pigments are derived from rare minerals or synthetic chemicals, which can be subject to price volatility due to supply chain disruptions or changes in global demand. These cost fluctuations can affect profitability and make pricing less predictable for manufacturers. The increasing number of environmental regulations and concerns over the use of hazardous chemicals in pigments pose challenges for manufacturers. Compliance with stricter regulations requires significant investments in research and development to ensure safer, more sustainable alternatives, adding complexity to the production process.

The high performance pigments market presents significant opportunities, particularly in the automotive and construction sectors. As demand for high-quality automotive coatings increases, driven by consumer preferences for aesthetic appeal and durability, there is a growing need for high performance pigments. These pigments are essential for automotive finishes that offer color retention and resistance to wear and tear. The construction industry is adopting high performance pigments for architectural coatings, where color longevity and resistance to environmental conditions are crucial. As urbanization accelerates and the need for advanced coatings in residential and commercial buildings rises, the market for high performance pigments in construction is expected to expand significantly. These industries provide new avenues for market growth, especially in emerging economies.

A significant trend in the high performance pigments market is the shift toward eco-friendly alternatives. As environmental concerns increase, consumers and manufacturers alike are pushing for pigments that have lower environmental impact without compromising on quality or performance. Manufacturers are developing new pigment formulations using renewable, non-toxic materials that meet stringent environmental standards. This trend is particularly strong in industries like cosmetics and food packaging, where eco-friendly ingredients are in high demand. Furthermore, advancements in technology are allowing for more efficient and cost-effective production of high performance pigments, reducing waste and energy consumption in the manufacturing process. These trends are shaping the future of the market, with increased investment in green technologies and sustainable production methods.

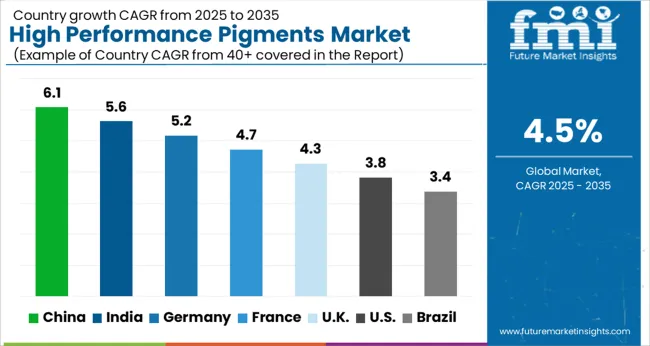

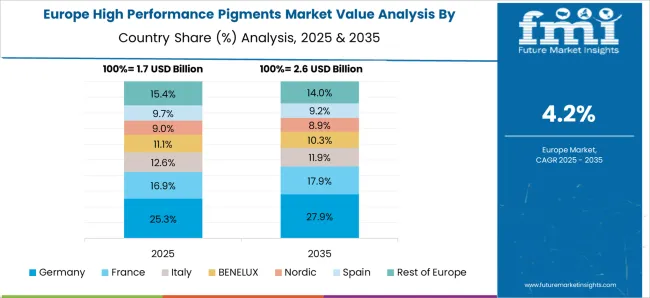

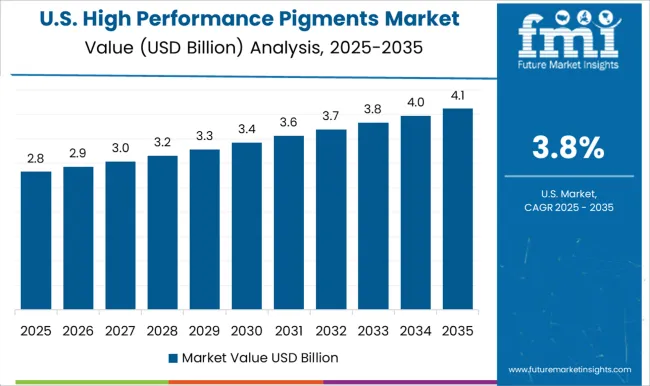

The high performance pigments market is projected to grow at a global CAGR of 4.5% from 2025 to 2035. China leads with a CAGR of 6.1%, followed by India at 5.6%, and France at 4.7%. The United Kingdom records 4.3%, while the United States stands at 3.8%. China and India show robust growth, supported by strong industrialization, expanding manufacturing sectors, and increasing demand for high-performance pigments in automotive, coatings, and packaging applications. Meanwhile, OECD countries such as France, the U.K., and the U.S. exhibit steady growth, driven by technological advancements and the growing need for high-quality pigments in specialized applications. The analysis spans over 40+ countries, with the top markets shown below.

China is projected to grow at a CAGR of 6.1% through 2035, driven by the booming industrial sector, increasing manufacturing capabilities, and strong demand for high-performance pigments in the automotive, coatings, and packaging industries. China’s push for innovation in manufacturing processes, along with its leadership in the automotive industry, continues to drive the demand for these pigments. The rise of new applications, such as in textiles, electronics, and construction, further accelerates market growth. The government’s focus on expanding infrastructure and promoting advanced manufacturing processes also plays a crucial role in the rapid adoption of high-performance pigments.

India is projected to grow at a CAGR of 5.6% through 2035, driven by expanding industrial applications and increasing demand for high-performance pigments in coatings, automotive, and packaging industries. India’s rising manufacturing sector and infrastructure development contribute to the growing demand for high-performance pigments, which are widely used for their durability and color intensity. The country’s growing middle class, along with increasing consumer demand for aesthetically enhanced products, further accelerates the market for high-performance pigments. The government initiatives to promote manufacturing under the "Make in India" program are expected to boost demand for these pigments.

Germany is projected to grow at a CAGR of 4.7% through 2035, supported by the increasing demand for high-performance pigments in automotive, coatings, and industrial applications. As a key manufacturing hub in Europe, Germany’s automotive industry plays a crucial role in the growing demand for high-performance pigments used in coatings and surface finishes. Additionally, Germany's emphasis on sustainable manufacturing and innovations in the coatings and packaging sectors contributes to the rising demand for high-performance pigments. The market’s growth is further fueled by the increasing preference for durable pigments that offer long-lasting color retention and resistance to wear.

The United Kingdom is projected to grow at a CAGR of 4.3% through 2035, with demand driven by the adoption of high-performance pigments in the automotive and coatings industries. The U.K. automotive sector, which focuses on advanced coatings and finishes, continues to drive demand for high-performance pigments. The increasing emphasis on aesthetics, product durability, and enhanced performance in consumer goods, automotive, and industrial applications further fuels market growth. Additionally, the growing shift toward sustainable manufacturing practices and environmentally friendly pigment formulations is contributing to the increased adoption of high-performance pigments in the country.

The United States is projected to grow at a CAGR of 3.8% through 2035, driven by the increasing demand for high-quality pigments in automotive, coatings, and packaging applications. The growing trend toward sustainable manufacturing practices and innovation in product development drives the demand for high-performance pigments in various end-use industries. Furthermore, the growing preference for durable and long-lasting pigments, especially in automotive coatings and consumer goods, contributes to market growth. Technological advancements in pigment formulations that offer superior durability, colorfastness, and resistance to environmental factors are expected to further support the market.

BASF SE is a market leader, providing a wide range of high-performance pigments, focusing on innovation, color consistency, and environmental sustainability. Atul and Heubach are significant players, specializing in high-quality pigments used in coatings, automotive, and plastic industries, with a focus on expanding their product portfolios to meet market demands for advanced applications.

Meghmani Organics and Sudarshan Chemical Industries focus on offering performance-driven pigments that cater to industries such as coatings, textiles, and printing, with an emphasis on improving the color strength and stability of their pigments. Solvay provides specialty pigments with superior technical properties, serving the automotive and industrial coatings sectors.

Sun Chemical and Synthesia offer a range of high-performance pigments for applications in printing inks, coatings, and plastics, emphasizing their versatility and innovation in product development. Trust Chem, Vijay Chemical Industries, and VOXCO are known for their focus on producing cost-effective high-performance pigments for various industrial applications, maintaining a strong presence in the global market.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product Type | Organic pigments, Inorganic pigments, and Specialty |

| Application | Coatings and paints, Plastics and polymers, Printing inks, Cosmetics, Textiles and fabrics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Atul, Heubach, Meghmani Organics, Solvay, Sudarshan Chemical Industries, Sun Chemical, Synthesia, Trust Chem, Vijay Chemical Industries, and VOXCO |

| Additional Attributes | Dollar sales by pigment type (organic pigments, inorganic pigments) and end-use segments (coatings, plastics, automotive, packaging). Demand dynamics are driven by the increasing need for durable and vibrant pigments across industrial applications, along with the growing demand for environmentally compliant products. Regional trends show strong growth in North America and Europe, with expanding opportunities in Asia-Pacific driven by manufacturing growth and industrialization. |

The global high performance pigments market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the high performance pigments market is projected to reach USD 10.5 billion by 2035.

The high performance pigments market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in high performance pigments market are organic pigments, inorganic pigments and specialty.

In terms of application, coatings and paints segment to command 41.7% share in the high performance pigments market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA