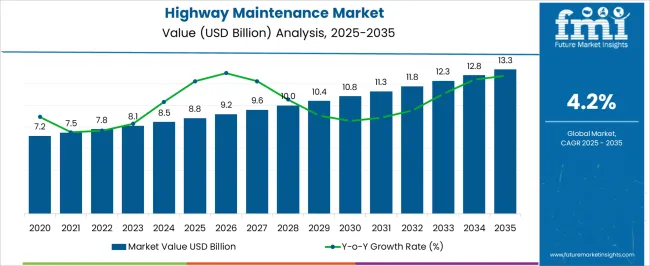

The highway maintenance market is projected to grow from USD 8.8 billion in 2025 to USD 13.3 billion in 2035, reflecting a CAGR of 4.2%. During the early adoption phase (2020–2024), the market expanded from USD 7.2 billion to USD 8.8 billion as maintenance practices, equipment, and materials were introduced and tested on road networks. Pilot programs were conducted to evaluate effectiveness, cost efficiency, and operational reliability. By 2025, the market is expected to reach USD 8.8 billion, with broader implementation observed as government agencies and private operators adopt new maintenance schedules, surface treatments, and repair techniques to extend road lifespan and improve safety. From 2025 to 2035, the market is projected to transition through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market is forecast to surpass USD 10.4 billion, driven by expanded application across highways, expressways, and arterial roads, along with increased funding and planned maintenance cycles. During the consolidation phase, growth is expected to moderate toward USD 13.3 billion by 2035 as leading contractors strengthen their presence and smaller players consolidate or exit. The 4.2% CAGR indicates steady expansion, establishing the market as a standard solution for road upkeep, repair management, and long-term infrastructure reliability across regions.

| Metric | Value |

|---|---|

| Highway Maintenance Market Estimated Value in (2025 E) | USD 8.8 billion |

| Highway Maintenance Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The highway maintenance market is influenced by several parent markets, each contributing to overall growth. The road construction and infrastructure sector is estimated to drive approximately 30%, as highway networks are maintained and upgraded using specialized equipment and materials. Government and municipal transportation budgets are considered responsible for 20%, as funding is allocated for scheduled repairs, resurfacing, and safety improvements. Asphalt and concrete production is assessed to account for 15%, as materials are supplied for patching, resurfacing, and reconstruction. Equipment manufacturing and supply is estimated to contribute 10%, as machinery such as pavers, rollers, and milling machines are produced and maintained.

Road safety and signage services influence around 8%, as proper markings and barriers are implemented during maintenance operations. Construction and civil engineering consulting are evaluated at 7%, as project planning, inspection, and quality control are conducted. Materials testing and laboratory services account for 5%, as durability and performance assessments are performed. Environmental monitoring and compliance services are estimated at 5%, as regulations regarding dust, runoff, and emissions are followed during maintenance activities.

The Highway Maintenance market is experiencing steady growth driven by increasing investments in road infrastructure, the need for extended lifecycle management of highways, and the rising focus on safety and efficiency in transportation networks. The market is being shaped by government initiatives to modernize roadways, enforce quality standards, and reduce maintenance-related disruptions. Current trends indicate a shift toward predictive and preventive maintenance practices, facilitated by advanced monitoring and assessment technologies.

As urbanization and vehicle density increase, the demand for timely repair and resurfacing services has become critical in ensuring smooth traffic flow and road safety. The integration of innovative materials, mechanized repair techniques, and software-driven asset management systems has further enhanced operational efficiency.

The growing public-private partnerships for highway projects, coupled with a focus on sustainable road management practices, are expected to drive long-term market expansion Future opportunities are anticipated in modular maintenance service models, advanced resurfacing solutions, and data-driven highway management frameworks, making the market increasingly attractive for service providers and investors.

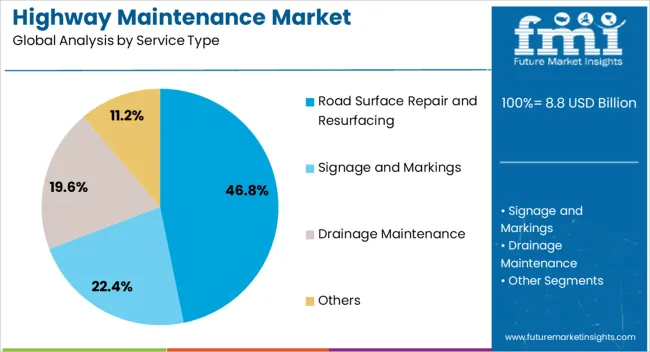

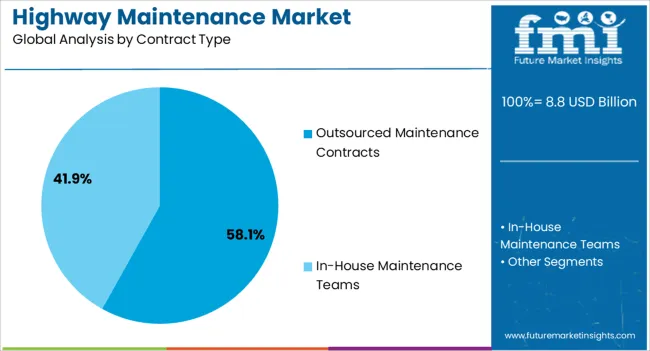

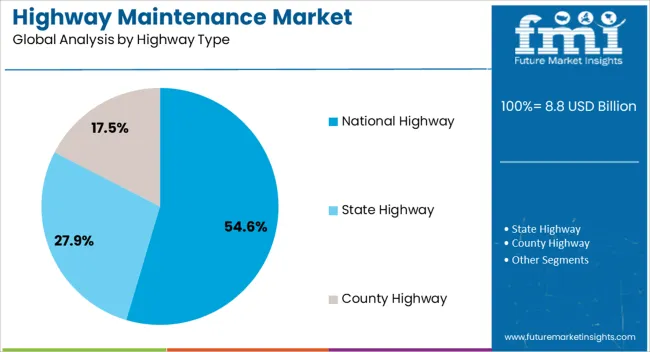

The highway maintenance market is segmented by service type, contract type, highway type, and geographic regions. By service type, highway maintenance market is divided into Road Surface Repair and Resurfacing, Signage and Markings, Drainage Maintenance, and Others. In terms of contract type, highway maintenance market is classified into Outsourced Maintenance Contracts and In-House Maintenance Teams. Based on highway type, highway maintenance market is segmented into National Highway, State Highway, and County Highway. Regionally, the highway maintenance industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Road Surface Repair and Resurfacing service type is projected to hold 46.8% of the Highway Maintenance market revenue share in 2025, making it the leading service category. This dominance is being attributed to the critical role that surface quality plays in ensuring safety, reducing vehicle wear, and optimizing traffic efficiency. The segment has been favored due to increased emphasis on preventive maintenance, which minimizes long-term infrastructure costs and reduces the frequency of major repairs.

Advanced resurfacing techniques and high-durability materials are enabling faster and longer-lasting repairs, which is encouraging adoption across both urban and rural highways. The growth of this segment has also been supported by regulatory mandates that prioritize road quality standards and durability benchmarks.

Additionally, the rising vehicle population and traffic density on key transport corridors have necessitated frequent surface repairs to maintain operational efficiency As highway authorities continue to focus on reducing maintenance downtime and ensuring smoother transit, road surface repair and resurfacing services are expected to sustain their leading position in the market.

The Outsourced Maintenance Contracts type is expected to capture 58.1% of the total Highway Maintenance market revenue in 2025, emerging as the dominant contract category. This prevalence has been driven by the increasing preference of government agencies and highway authorities to delegate maintenance responsibilities to specialized service providers. Outsourcing allows for access to advanced technical expertise, modern equipment, and optimized resource allocation, leading to cost-efficient and timely maintenance.

The segment has benefited from long-term contractual agreements that ensure predictable budgeting and performance accountability. Additionally, the complexity of modern highways, including multilane expressways and urban bypasses, requires specialized operations that are more efficiently managed by outsourced providers.

The ability to implement innovative repair methods, mechanized resurfacing, and predictive monitoring systems without overburdening in-house teams has reinforced the adoption of outsourced contracts As highway authorities continue to prioritize efficiency, quality, and safety in road maintenance, outsourced contracts are anticipated to maintain their market leadership.

The National Highway type is projected to hold 54.6% of the Highway Maintenance market revenue share in 2025, establishing it as the leading highway category. This dominance is being attributed to the strategic importance of national highways in supporting long-distance transportation, trade, and connectivity between major urban and industrial centers. National highways experience high traffic volumes, including heavy commercial vehicles, which accelerates wear and necessitates frequent maintenance interventions.

The growth of this segment has been reinforced by government programs aimed at upgrading and expanding national road networks, improving pavement quality, and reducing congestion. Advanced maintenance technologies, quality control protocols, and contract-based management have been applied extensively to national highways, ensuring higher service standards.

Additionally, public safety and economic efficiency considerations drive investments in timely repair and resurfacing of these key transport corridors As the demand for reliable and safe long-distance roadways continues to grow, maintenance activities on national highways are expected to sustain a leading share in the market.

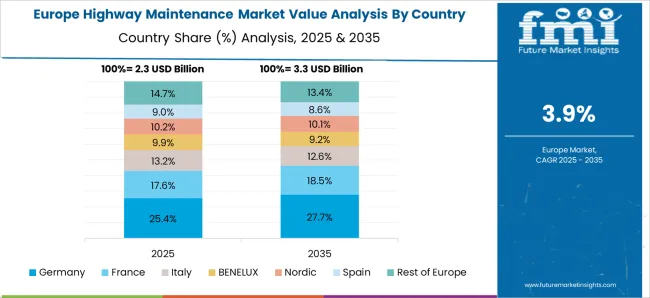

The highway maintenance market is growing due to increasing road infrastructure investments, rising vehicle traffic, and the need for safety and durability in transportation networks. North America and Europe lead with advanced maintenance equipment, smart monitoring, and automated repair systems for highways, bridges, and tunnels. Asia-Pacific shows rapid growth driven by expanding road networks, urbanization, and government initiatives. Manufacturers differentiate through durable materials, automated machinery, intelligent monitoring systems, and cost-efficient repair solutions. Regional variations in regulatory standards, traffic density, and budget allocation influence adoption and market positioning globally.

Adoption in highway maintenance depends on advanced equipment and machinery that optimize repair speed and accuracy. North America and Europe prioritize high-efficiency asphalt pavers, milling machines, and automated road marking systems to minimize traffic disruption while ensuring durability. Asia-Pacific markets adopt cost-effective machinery suitable for large-scale road networks and periodic maintenance, balancing performance and affordability. Differences in equipment sophistication affect repair quality, operational timelines, and labor requirements. Leading suppliers offer automated, precision-driven machinery and robust support services for premium applications, while regional manufacturers focus on reliable, scalable solutions. Equipment contrasts directly shape adoption, productivity, and competitiveness across global highway maintenance projects.

Material selection and durability significantly affect maintenance strategies. North America and Europe use high-performance asphalt, concrete blends, and protective coatings to enhance longevity and reduce lifecycle costs in highways and bridges. Asia-Pacific markets often employ cost-efficient materials suitable for large network coverage, balancing durability and budget constraints. Differences in material quality impact repair frequency, structural resilience, and safety standards. Suppliers offering premium, long-lasting materials and innovative coatings gain higher adoption in mature markets, while regional manufacturers focus on practical, reliable solutions. Material and longevity contrasts shape adoption, operational efficiency, and competitive positioning in global highway maintenance markets.

Integration of smart monitoring systems, sensors, and predictive maintenance solutions drives market adoption. North America and Europe focus on IoT-enabled road monitoring, automated defect detection, and predictive analytics to reduce accidents, optimize maintenance schedules, and control costs. Asia-Pacific markets adopt semi-automated monitoring for high-traffic and industrial corridors to improve maintenance planning while managing expenses. Differences in monitoring sophistication affect early damage detection, repair planning, and operational efficiency. Suppliers offering intelligent, data-driven maintenance systems gain premium adoption, while regional producers provide cost-effective, manual, or semi-automated solutions. Monitoring and predictive maintenance contrasts shape adoption, safety, and competitiveness in global highway maintenance projects.

Compliance with road safety regulations, environmental standards, and traffic management laws influences market adoption. North America and Europe enforce strict guidelines for emissions, noise, material handling, and work zone safety, affecting equipment selection and operational procedures. Asia-Pacific regulations vary; developed regions adopt global standards, while emerging markets focus on local compliance to accelerate infrastructure expansion. Differences in regulatory stringency impact procurement approval, project execution, and liability management. Suppliers providing certified, compliant equipment and materials gain higher adoption, while regional manufacturers focus on locally approved, cost-efficient solutions. Regulatory contrasts shape market accessibility, adoption rates, and strategic positioning in global highway maintenance markets.

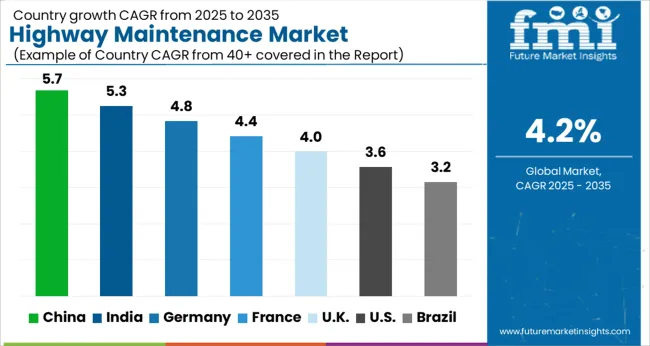

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

The global highway maintenance market was projected to grow at a 4.2% CAGR through 2035, driven by demand in road repair, infrastructure upkeep, and transportation network operations. Among BRICS nations, China recorded 5.7% growth as large-scale maintenance and service facilities were commissioned and compliance with industrial and safety standards was enforced, while India at 5.3% growth saw expansion of operational units to meet rising regional demand. In the OECD region, Germany at 4.8% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 4.0% relied on moderate-scale operations for commercial and public roadway maintenance. The USA, expanding at 3.6%, remained a mature market with steady demand across infrastructure and transportation segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The highway maintenance market in China is being driven at a CAGR of 5.7% due to increasing road construction, repair, and infrastructure development projects. Equipment and services for road resurfacing, pothole repair, pavement marking, and bridge maintenance are being adopted to improve safety and extend roadway lifespan. Manufacturers are being encouraged to provide durable, efficient, and technologically advanced solutions. Distribution through contractors, government agencies, and authorized suppliers is being maintained. Government policies supporting infrastructure development and highway modernization are being followed. Research and development in automated equipment, long-lasting materials, and efficient repair techniques is being conducted. Increasing vehicle traffic, expanding highway networks, and growing industrial transport needs are being considered key factors driving adoption of highway maintenance equipment and services in China.

Highway maintenance market in India is being expanded at a CAGR of 5.3% as road construction and repair activity grows across national and state highways. Equipment for resurfacing, pavement marking, pothole repair, and bridge maintenance is being adopted to enhance roadway safety and performance. Manufacturers are being focused on providing cost-effective, reliable, and durable solutions. Distribution through government contracts, contractors, and authorized suppliers is being ensured. Awareness programs and training workshops for highway maintenance best practices are being conducted. Rising vehicle traffic, highway network expansion, and government initiatives for road quality improvement are being considered key drivers of market growth in India.

The highway maintenance market in Germany is being driven at a CAGR of 4.8% due to demand from highway infrastructure projects, road repairs, and maintenance of transportation networks. Equipment and services for resurfacing, pothole repair, marking, and bridge upkeep are being adopted to ensure safety and long-term durability. Manufacturers are being encouraged to provide advanced, efficient, and reliable maintenance systems. Distribution through contractors, highway agencies, and authorized suppliers is being maintained. Research and development in automated machinery, long-lasting materials, and efficient repair processes is being undertaken. Germany’s focus on maintaining road quality and safety standards is being considered a key factor supporting adoption of highway maintenance solutions.

The United Kingdom highway maintenance market is being expanded at a CAGR of 4.0% with increasing road repair and infrastructure maintenance activities. Equipment for resurfacing, pavement marking, pothole repair, and bridge upkeep is being adopted to improve roadway safety and service life. Manufacturers are being focused on producing reliable, durable, and efficient solutions. Distribution through government contracts, authorized suppliers, and contractors is being ensured. Awareness campaigns and technical workshops are being conducted to educate maintenance personnel. Expansion of highway networks, increasing traffic density, and government initiatives for road quality improvement are being considered key factors supporting adoption in the United Kingdom.

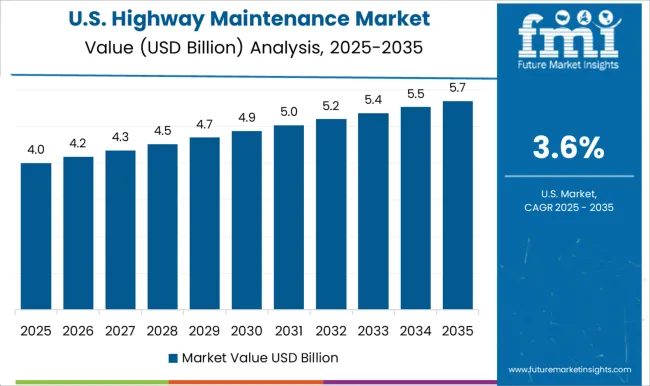

The United States highway maintenance market is being driven at a CAGR of 3.6% due to demand from federal, state, and municipal road maintenance projects. Equipment and services for resurfacing, pavement marking, pothole repair, and bridge maintenance are being adopted to ensure safety and extend roadway lifespan. Manufacturers are being encouraged to supply durable, reliable, and technologically advanced solutions. Distribution through contractors, highway authorities, and authorized suppliers is being maintained. Research and development in automated repair equipment, long-lasting materials, and efficient maintenance processes is being conducted. Growing highway networks, increased vehicle traffic, and infrastructure rehabilitation initiatives are being considered key drivers of market growth in the United States.

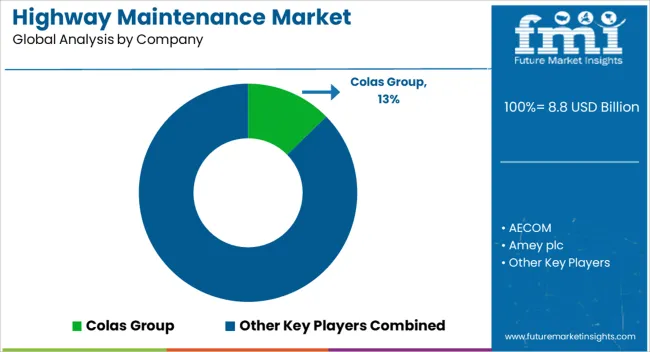

The highway maintenance market is driven by the growing demand for safer, durable, and well-maintained road infrastructure across urban and rural regions. Leading suppliers in this market include Colas Group, AECOM, Amey plc, Balfour Beatty, Eurovia, Ferrovial Services, Fluor Corporation, Galfar Engineering & Contracting SAOG, Galliford Try, Graham Construction, Interserve Group Limited, Jacobs Engineering Group Inc., Kier Group, Skanska AB, and Tarmac. These companies provide a wide array of services, including pavement repair, road resurfacing, traffic management, snow and ice control, and preventive maintenance, ensuring highway networks remain operational and safe. Advanced technologies and materials are increasingly being adopted by market leaders such as Colas Group, Eurovia, and Balfour Beatty to enhance the durability and sustainability of road surfaces. These suppliers focus on innovations like warm-mix asphalt, polymer-modified bitumen, and recycled materials to extend pavement life while reducing environmental impact. Engineering and consulting services, offered by firms like AECOM, Jacobs Engineering, and Fluor Corporation, enable efficient planning, project management, and adherence to local and international standards. The integration of digital solutions, such as road monitoring sensors, predictive maintenance software, and intelligent traffic management systems, is being promoted by Skanska AB, Kier Group, and Interserve Group Limited to improve operational efficiency and reduce downtime. With increasing investment in road infrastructure, urbanization, and government initiatives focused on smart cities and sustainable transport, these leading suppliers continue to drive the highway maintenance market by offering innovative, cost-effective, and resilient solutions tailored to evolving transportation needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.8 Billion |

| Service Type | Road Surface Repair and Resurfacing, Signage and Markings, Drainage Maintenance, and Others |

| Contract Type | Outsourced Maintenance Contracts and In-House Maintenance Teams |

| Highway Type | National Highway, State Highway, and County Highway |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Colas Group, AECOM, Amey plc, Balfour Beatty, Eurovia, Ferrovial Services, Fluor Corporation, Galfar Engineering & Contracting SAOG, Galliford Try, Graham Construction, Interserve Group Limited, Jacobs Engineering Group Inc., Kier Group, Skanska AB, and Tarmac |

| Additional Attributes | Dollar sales vary by equipment type, including asphalt pavers, road rollers, snowplows, and pavement maintenance machinery; by service type, such as resurfacing, pothole repair, snow & ice management, and signage installation; by end-use, spanning government agencies, contractors, and municipalities; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising infrastructure investment, urbanization, and road safety regulations. |

The global highway maintenance market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the highway maintenance market is projected to reach USD 13.3 billion by 2035.

The highway maintenance market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in highway maintenance market are road surface repair and resurfacing, signage and markings, drainage maintenance and others.

In terms of contract type, outsourced maintenance contracts segment to command 58.1% share in the highway maintenance market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Off Highway Vehicles Brake Systems Market Size and Share Forecast Outlook 2025 to 2035

Off-Highway Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Off-highway EV Component Market Size and Share Forecast Outlook 2025 to 2035

Off-highway Vehicle Engines Market Size and Share Forecast Outlook 2025 to 2035

Off Highway Radar Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Off-highway Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Off-Highway Vehicle Telematics Market - Growth, Trends & Forecast 2025 to 2035

Off Highway Tires Market Growth - Trends & Forecast 2025 to 2035

Yacht Maintenance and Refit Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Building Maintenance Unit (BMU) Market Size and Share Forecast Outlook 2025 to 2035

Road and Highway Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Maintenance Industry Analysis in Australia - Size, Share, and Forecast Outlook 2025 to 2035

Catenary Maintenance Vehicle Market

AR Remote Maintenance Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Aerospace Maintenance Chemical Market - Trends & Forecast 2025 to 2035

Locomotive Maintenance Market Size and Share Forecast Outlook 2025 to 2035

Predictive Maintenance Market Analysis – Growth & Industry Trends through 2034

Golf Course Maintenance Robot Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA