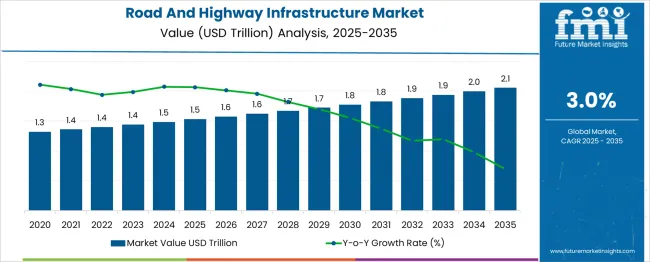

The Road and Highway Infrastructure Market is estimated to be valued at USD 1.5 trillion in 2025 and is projected to reach USD 2.1 trillion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

| Metric | Value |

|---|---|

| Road and Highway Infrastructure Market Estimated Value in (2025 E) | USD 1.5 trillion |

| Road and Highway Infrastructure Market Forecast Value in (2035 F) | USD 2.1 trillion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The road and highway infrastructure market is expanding steadily, supported by increasing government investments in transportation networks and growing demand for improved connectivity. National road projects have become a priority to enhance regional trade and mobility, contributing to higher spending on infrastructure development.

Advances in construction technologies and materials have improved project efficiency and durability, enabling faster completion of large-scale road projects. Urbanization and economic growth have further driven the need for new roads to accommodate rising vehicle numbers and reduce congestion.

Strategic initiatives focusing on upgrading national highways have enhanced safety and logistics capabilities. The market is expected to continue its upward trajectory with ongoing modernization efforts and increased funding directed at expanding and maintaining critical road infrastructure. Growth is expected to be led by the road component, national type segment, and new construction projects.

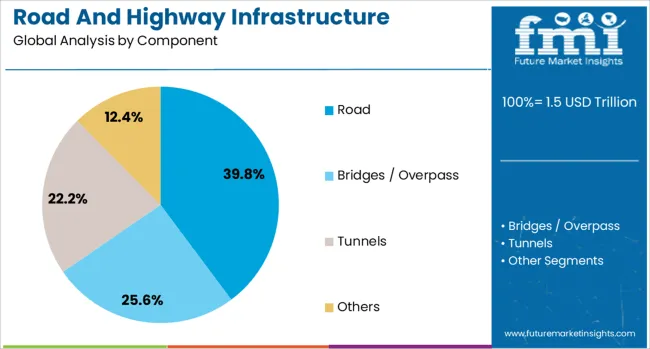

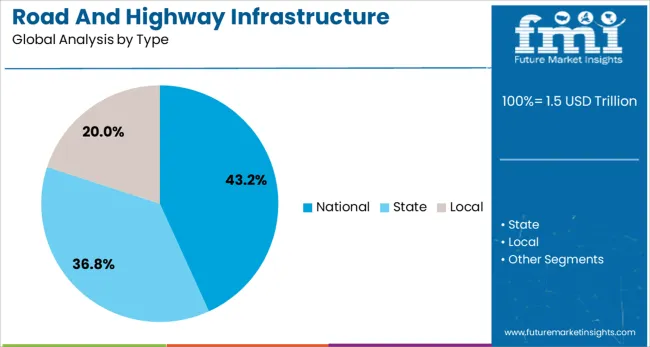

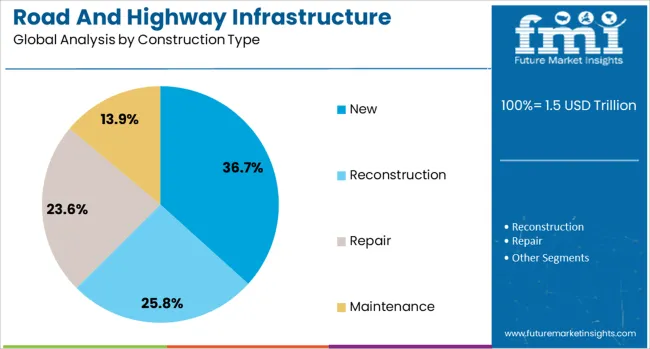

The road and highway infrastructure market is segmented by component, type, and construction type and geographic regions. By component of the road and highway infrastructure market is divided into Road, Bridges / Overpass, Tunnels, and Others. In terms of type of the road and highway infrastructure market is classified into National, State, and Local. Based on construction type of the road and highway infrastructure market is segmented into New, Reconstruction, Repair, and Maintenance. Regionally, the road and highway infrastructure industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Road component segment is projected to contribute 39.8% of the road and highway infrastructure market revenue in 2025, maintaining its dominance. This segment’s growth is driven by the essential role roads play in national and regional connectivity. Governments have prioritized road construction and upgrades as part of broader economic development and urban planning programs.

The segment benefits from ongoing efforts to expand road networks to underserved and rural areas. Improved road infrastructure supports freight movement and commuter traffic, enhancing overall transportation efficiency.

With increasing vehicle ownership and freight demand, investment in road components continues to grow, reinforcing the segment’s market leadership.

The National type segment is expected to hold 43.2% of the market revenue in 2025, leading the market by road classification. National highways are critical for connecting major cities and economic hubs, supporting trade and mobility at a country-wide level. Government focus on enhancing national highway infrastructure through widening, resurfacing, and smart road technologies has driven this segment’s growth.

The development of national highways often receives prioritized funding and regulatory support, which further accelerates project implementation.

As countries pursue economic diversification and regional integration, the National type segment is anticipated to maintain its leading position.

The New construction segment is projected to account for 36.7% of the market revenue in 2025, marking it as a significant growth driver. Increasing demand for new roadways to support urban expansion, industrial zones, and regional connectivity has fueled investments in new infrastructure projects. Governments and private sector participants are focusing on building new roads to alleviate congestion on existing routes and open new economic corridors.

The push for smart cities and sustainable urban planning has also contributed to new road construction initiatives.

With the continual need to address infrastructure deficits, the New construction segment is expected to play a key role in market growth.

Global road and highway construction continues to accelerate as governments allocate capital to expand and upgrade transport networks. In 2024, approximately 29 % of infrastructure projects in Asia and Latin America included accelerated construction techniques such as prefabricated bridge modules or asphalt recycling. Demand is driven by rising freight volumes, rural connectivity programmes, and backlog reduction efforts.

Contractors using prefabricated bridge decks and modular highway components reduced on-site construction cycles by approximately 18 %. In Southeast Asia, adoption of precast bridge sections cut traffic disruption during build phases by nearly 22 % and enabled earlier lane re-openings. Latin American road authorities using hot-in-place paving recycled old asphalt layers, decreasing raw material demand by 15 % and cutting stockpile inventory needs. Logistics firms in regional markets managed inventory through centralized staging yards, enabling faster allocation of materials to live zones and reducing buffer storage by 14 %. These practices supported scaling smaller season-limited contracts while maintaining fleet efficiency across road expansion corridors.

Despite efficiency gains, road project rollout faces headwinds from material cost volatility, approval delays, and labor shortages. Asphalt prices rose 10-12 % YoY in India and Brazil in 2024, increasing annual project budgets. Procurement timelines extended by 6-8 weeks due to new safety and environmental review requirements in North America. Skilled workforce gaps in modular construction led to rework in 11 % of bridge deployments across targeted zones. Contractors in remote areas saw average equipment idle days rise by 9 % due to parts and module delivery delays. Strict grading and mix design standards across regional authorities added unforeseen validation steps, further slowing commissioning schedules and risking milestone penalties.

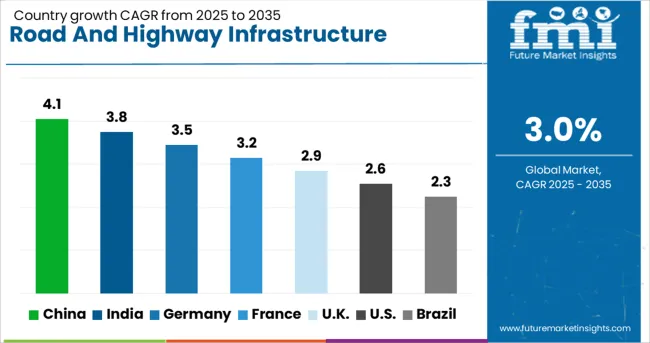

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

The global road and highway infrastructure market is projected to expand at a 3% CAGR between 2025 and 2035. China leads among the top five countries with a 4.1% growth rate, exceeding the global average by +37%. India follows at 3.8%, with a +27% premium, and Germany at 3.5%, ahead by +17%. The UK records a slightly lower growth of 2.9%, while the US shows a slower 2.6% CAGR, lagging the global baseline by -13%. China’s growth is tied to urban transit expansion and cross-provincial expressway projects. India’s uptrend is supported by central government corridor programs. Germany’s momentum reflects EU co-funded upgrades. Growth in the UK and US is steadier due to matured infrastructure and limited new builds.The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China's road and highway infrastructure market is expected to grow at a CAGR of 4.1% through 2035. Expansion focuses on expressways connecting urban clusters in the Greater Bay Area, Yangtze River Delta, and Beijing-Tianjin-Hebei regions. Projects such as the 3,200 km G228 coastal highway and upgrades under the National Trunk Highway System (NTHS) are ongoing. The Ministry of Transport is prioritizing smart highway features including ITS and automatic tolling. Key contractors include China Communications Construction Company and CRBC.

India’s road and highway infrastructure market is forecasted to grow at a CAGR of 3.8% from 2025 to 2035. The Bharatmala Phase II program continues to drive expressway construction, targeting 8,500 km of additional corridors. National Highways Authority of India (NHAI) is awarding hybrid annuity and BOT projects to expedite development. State highways and border infrastructure also receive budgetary prioritization. Companies like IRB Infrastructure and Dilip Buildcon hold project portfolios across multiple corridors.

Germany’s road and highway infrastructure market is projected to grow at a CAGR of 3.5% over the next decade. Autobahn rehabilitation and digital modernization are priority areas. Federal Transport Infrastructure Plan (BVWP 2030) allocates €130 billion for road upgrades, especially in North Rhine-Westphalia and Bavaria. Focus areas include congestion reduction, digital toll systems, and noise control measures. Autobahn GmbH manages operations and upgrades for 13,000 km of federal highways.

The UK road and highway infrastructure market is expected to grow at a CAGR of 2.9% through 2035. National Highways' Road Investment Strategy 3 (RIS3) allocates funds for safety upgrades and capacity expansion across major A-roads and motorways. Projects include smart motorway upgrades and congestion easing in the South East and Midlands. The Lower Thames Crossing project is also moving forward. Balfour Beatty and Skanska are among the main contractors in public-funded schemes.

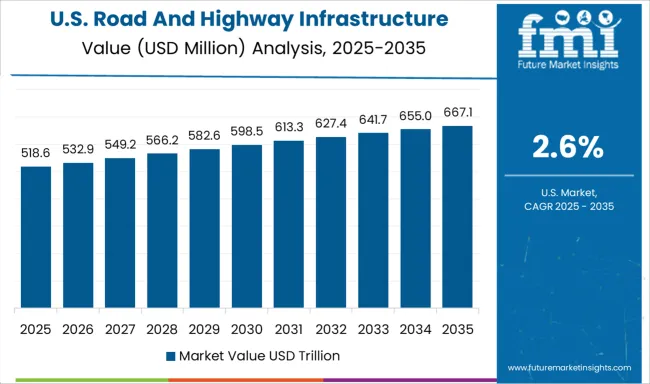

The United States road and highway infrastructure market is set to grow at a CAGR of 2.6% between 2025 and 2035. The Infrastructure Investment and Jobs Act (IIJA) allocates over $110 billion to highways and bridges, with large portions directed to California, Texas, and Florida. Departments of Transportation (DOTs) across states are advancing pavement rehabilitation, bridge widening, and intermodal connectivity. Federal Highway Administration (FHWA) prioritizes safety, resilience, and traffic flow enhancements.

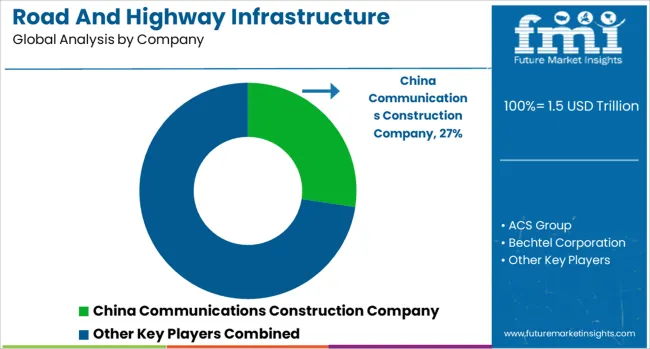

The global road and highway infrastructure market is led by China Communications Construction Company (27.4% share), with major competitors including Vinci Group, ACS Group, and Bechtel Corporation delivering large-scale transportation projects across multiple continents. European construction leaders such as Bouygues Construction, Skanska, and STRABAG specialize in sustainable infrastructure development, incorporating smart technologies and eco-friendly materials.

The market is experiencing significant growth due to government stimulus packages for transportation networks, particularly in emerging economies. Key trends include the integration of IoT sensors for smart highways, adoption of recycled materials in pavement construction, and modular bridge-building techniques to reduce project timelines.

Regional dynamics show Asia-Pacific dominating new construction, while North America and Europe focus on infrastructure rehabilitation and maintenance. The industry faces challenges from rising material costs but benefits from increasing public-private partnerships for toll road development.

In July 2025, the Telangana government approved a ₹6,478 crore rural infrastructure initiative under the Hybrid Annuity Model, targeting improved connectivity across the state. Phase I involves constructing 5,190 km of roads along 373 routes, linking villages, mandals, and district headquarters to support local access and regional development.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Trillion |

| Component | Road, Bridges / Overpass, Tunnels, and Others |

| Type | National, State, and Local |

| Construction Type | New, Reconstruction, Repair, and Maintenance |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | China Communications Construction Company, ACS Group, Bechtel Corporation, Bouyges Construction, Skanska, STRABAG, and Vinci Group |

| Additional Attributes | Dollar sales by project type (new construction, rehabilitation, maintenance) and material (asphalt, concrete, composite), demand dynamics across urban expressways, rural connectivity, and toll-based corridors, regional trends led by Asia‑Pacific with North America focusing on interstate upgrades, innovation in 3D paving control, precast modular systems, and cold in-place recycling, and operational impact of lifecycle cost optimization, lane availability metrics, and regulatory compliance for pavement durability. |

The global road and highway infrastructure market is estimated to be valued at USD 1.5 trillion in 2025.

The market size for the road and highway infrastructure market is projected to reach USD 2.1 trillion by 2035.

The road and highway infrastructure market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in road and highway infrastructure market are road, bridges / overpass, tunnels and others.

In terms of type, national segment to command 43.2% share in the road and highway infrastructure market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Infrastructure Projects Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Road Marking Paints and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Road Profile Laser Sensor Market Size and Share Forecast Outlook 2025 to 2035

Highway Maintenance Market Size and Share Forecast Outlook 2025 to 2035

Road Haulage Market Size and Share Forecast Outlook 2025 to 2035

Road Safety Market Size and Share Forecast Outlook 2025 to 2035

Road Marking Paint Market - Trends & Forecast 2025 to 2035

Road Speed Limiter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Road Marking Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Road Aggregates Market Growth - Trends & Forecast 2025 to 2035

Road Side Drug Testing Devices Market

Road-Rail Vehicles Market

Broadcast Switchers Market Size and Share Forecast Outlook 2025 to 2035

Broadband Network Gateway (BNG) Market by Component & Region Forecast till 2035

Broadcast Equipment Market Growth - Trends & Forecast 2025 to 2035

5G Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

IT Infrastructure Management Tools Market

Off Highway Vehicles Brake Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA