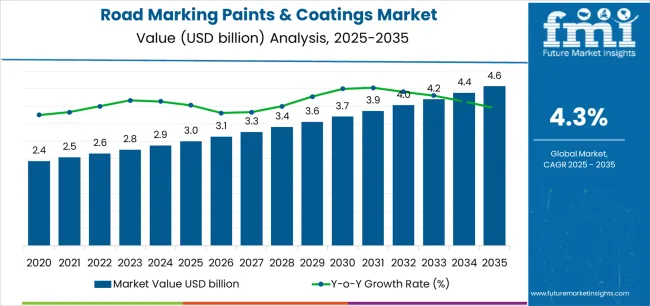

The road marking paints and coatings market is expected to expand from USD 3 billion in 2025 to USD 4.6 billion by 2035, representing substantial growth, as the adoption of advanced marking formulations and retroreflective systems accelerates across the highway construction, urban traffic management, and airport infrastructure sectors.

Based on FMI’s verified global materials database, covering industrial resins, coatings, and additives, the first half of the decade (2025 to 2030) will witness the market climbing from USD 3 billion to approximately USD 3.7 billion, adding USD 0.7 billion in value, which constitutes 44% of the total forecast growth period. This phase will be characterized by the rapid adoption of thermoplastic marking systems, driven by increasing road safety mandates and the growing need for durable, high-visibility marking solutions worldwide. Advanced retroreflective technologies and machine-readable marking systems will become standard expectations rather than premium options.

The latter half (2030 to 2035) will witness sustained growth from USD 3.7 billion to USD 4.6 billion, representing an addition of USD 0.9 billion or 56% of the decade's expansion. This period will be defined by mass market penetration of wet-night retroreflective markings, integration with comprehensive intelligent transportation systems, and seamless compatibility with ADAS vehicle technologies.

The market trajectory signals fundamental shifts in how highway authorities approach road safety optimization and visibility management, with participants positioned to benefit from sustained demand across multiple material types and application segments.

The Road Marking Paints & Coatings market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its infrastructure modernization phase, expanding from USD 3 billion to USD 3.7 billion with steady annual increments averaging 4.3% growth. This period showcases the transition from basic paint-based markings to performance-based systems with enhanced durability and integrated retroreflective capabilities becoming mainstream features.

The 2025 to 2030 phase adds USD 0.7 billion to market value, representing 44% of total decade expansion. Market maturation factors include standardization of road safety protocols, declining material costs for thermoplastic systems, and increasing highway authority awareness of visibility benefits reaching EN-1436 performance standards and wet-night retroreflectivity specifications.

Competitive landscape evolution during this period features established marking manufacturers like 3M Company and PPG Traffic Solutions expanding their performance-based portfolios while specialty producers focus on advanced retroreflective development and enhanced durability capabilities.

From 2030 to 2035, market dynamics shift toward smart infrastructure integration and global road safety enhancement, with growth continuing from USD 3.7 billion to USD 4.6 billion, adding USD 0.9 billion or 56% of total expansion.

This phase transition centers on machine-readable marking systems, integration with autonomous vehicle networks, and deployment across diverse transportation infrastructure scenarios, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic marking capability to comprehensive traffic management optimization systems and integration with intelligent transportation platforms.

The market demonstrates strong fundamentals with performance-based materials capturing a dominant share through advanced durability and retroreflective optimization capabilities. Roads and highways applications drive primary demand, supported by increasing infrastructure investment and traffic safety requirements.

Geographic expansion remains concentrated in developed markets with established highway infrastructure, while emerging economies show accelerating adoption rates driven by expressway construction and rising road safety standards.

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3 billion |

| Market Forecast (2035) | USD 4.6 billion |

| Growth Rate | 4.3% CAGR |

| Leading Material | Performance-based Material Type |

| Primary Application | Roads & Highways Segment |

Market expansion rests on three fundamental shifts driving adoption across the transportation infrastructure and road safety sectors. First, infrastructure investment programs create compelling operational demand through road marking systems that provide immediate visibility enhancement without roadway reconstruction, enabling highway authorities to meet safety standards while maintaining traffic flow and reducing accident rates.

Second, road safety regulation acceleration intensifies as transportation agencies worldwide seek advanced marking systems that complement traditional pavement management, enabling precise lane guidance and visibility improvement that align with traffic safety standards and accident reduction regulations.

Third, intelligent transportation development drives adoption from highway agencies and urban planners requiring durable marking solutions that support autonomous vehicle navigation while maintaining long-term visibility during day and night operations.

However, growth faces headwinds from raw material cost challenges that vary across resin suppliers regarding the sourcing of thermoplastic compounds and specialty glass beads, which may limit adoption in budget-constrained infrastructure projects. Technical limitations also persist regarding application weather windows and surface preparation requirements that may reduce installation efficiency in variable climate conditions, which affect project schedules and marking performance.

The road marking paints and coatings market represents a critical transportation safety opportunity driven by expanding global infrastructure investment, highway modernization, and the need for superior visibility performance in traffic management systems. As highway authorities worldwide seek to achieve EN-1436 compliance standards, reduce traffic accidents, and integrate machine-readable marking systems with autonomous vehicle platforms, road markings are evolving from basic pavement indicators to sophisticated safety solutions that ensure visibility performance and operational reliability.

The convergence of infrastructure spending acceleration, road safety regulation tightening, and advanced material development creates sustained demand drivers across multiple transportation segments. The market's growth trajectory from USD 3 billion in 2025 to USD 4.6 billion by 2035 at a 4.3% CAGR reflects fundamental shifts in highway safety requirements and traffic management optimization.

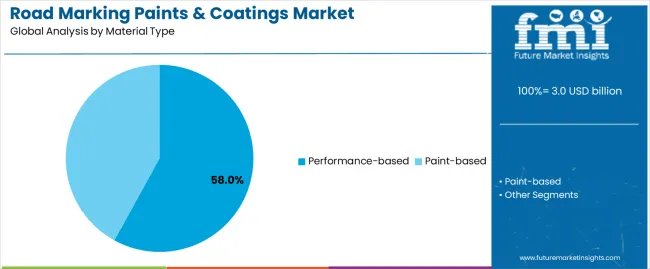

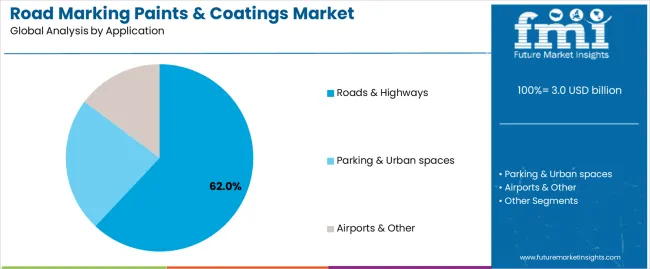

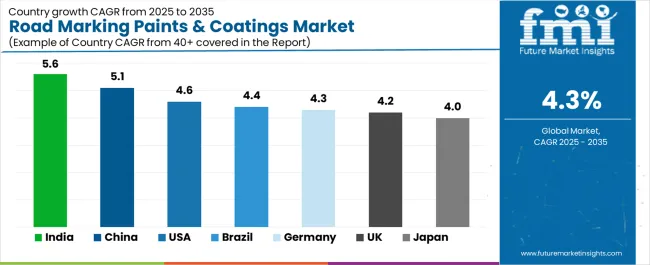

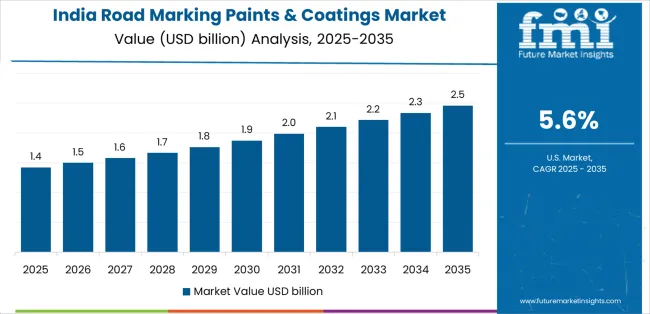

Geographic expansion opportunities are particularly pronounced in Asia-Pacific markets, where India (5.6% CAGR) and China (5.1% CAGR) lead through aggressive expressway construction and smart-city corridor development. The dominance of performance-based materials (58% market share) and roads & highways applications (62% share) provides clear strategic focus areas, while emerging wet-night retroreflective technology and ADAS-compatible marking systems open new revenue streams across diverse infrastructure markets.

Strengthening the dominant performance-based segment (58% market share) through enhanced thermoplastic formulations (34% share), superior durability characteristics, advanced retroreflective integration, and seamless compatibility with highway infrastructure.

This pathway focuses on optimizing polymer chemistry, improving wear resistance, extending service life to 3-5 years, and developing specialized formulations for diverse climate applications. Market leadership consolidation through advanced material engineering, comprehensive quality certification, and automated application integration enables premium positioning while defending competitive advantages against paint-based alternatives. Expected revenue pool: USD 0.9-1.4 billion

Expansion within retroreflective marking systems (71% market share) through wet-night enhanced formulations (17% share), advanced glass bead technology, and comprehensive visibility optimization for challenging weather conditions. This pathway addresses nighttime safety enhancement, adverse weather visibility, and ADAS sensor recognition with advanced optical engineering for demanding visibility standards. Premium positioning reflects performance leadership, safety effectiveness, and comprehensive testing capabilities while enabling access to specification-driven procurement programs and enhanced safety compliance support. Expected revenue pool: USD 0.8-1.3 billion

Expansion within the dominant roads & highways segment (62% market share) through specialized long-line center/edge marking formulations (38% share) addressing highway safety standards, high-speed traffic requirements, and comprehensive durability for expressway applications. This pathway encompasses automated application systems, quality assurance integration, cost-effective thermoplastic solutions, and compatibility with diverse pavement surfaces. Premium positioning reflects superior wear resistance, consistent retroreflectivity outcomes, and comprehensive specification compliance supporting modern highway operations. Expected revenue pool: USD 1.1-1.7 billion

Development within waterborne acrylic paint systems (27% share) addressing environmental compliance, low-VOC requirements, and sustainable marking solutions for urban and highway applications. This pathway encompasses rapid-dry formulations, environmental certification programs, budget-friendly options, and simplified application processes for diverse marking scenarios. Technology differentiation through eco-friendly chemistry, regulatory compliance expertise, and comprehensive environmental documentation enables competitive positioning while expanding addressable municipal and urban marking opportunities. Expected revenue pool: USD 0.5-0.8 billion

Rapid highway construction growth across India (5.6% CAGR) and China (5.1% CAGR) creates substantial expansion opportunities through local production capabilities, technology transfer partnerships, and comprehensive distribution development. Growing expressway networks, smart-city corridor implementation, and government infrastructure initiatives drive sustained demand for advanced marking systems. Localization strategies reduce import costs, enable faster project support, and position companies advantageously for highway authority procurement programs while accessing growing domestic markets requiring durable marking solutions. Expected revenue pool: USD 0.4-0.7 billion

Strategic expansion into airport runway/taxiway markings (11% share within 17% airports & other segment) requires enhanced durability, superior jet-blast resistance, and specialized formulations addressing aviation safety requirements. This pathway addresses commercial airport infrastructure, military airfield applications, and heliport marking systems with advanced material engineering for demanding operational conditions. Premium pricing reflects specialized performance requirements, aviation certification standards, and comprehensive technical support necessary for airport applications while creating opportunities for long-term maintenance contracts. Expected revenue pool: USD 0.3-0.5 billion

Integration of road marking systems with intelligent transportation infrastructure, machine-readable lane recognition, and ADAS vehicle compatibility enabling autonomous vehicle navigation, precision guidance, and comprehensive traffic management optimization. This pathway encompasses embedded sensor compatibility, standardized marking geometry, enhanced contrast ratios, and extensive machine vision optimization for connected vehicle ecosystems. Premium positioning through technology innovation, autonomous vehicle compatibility, and comprehensive system integration creates opportunities for specification leadership and ongoing partnerships through technology-enabled transportation advancement. Expected revenue pool: USD 0.3-0.5 billion

Primary Classification: The market segments by material type into Performance-based (Thermoplastic, Cold-plastic/MMA, Epoxy/Polyurea) and Paint-based (Waterborne acrylic, Solvent-borne alkyd, Epoxy paint) categories, representing the evolution from traditional paint systems to advanced durable formulations for comprehensive traffic management optimization.

Secondary Classification: Application segmentation divides the market into Roads & Highways (Long-line center/edge, Intersections & pedestrian, Expressways/toll), Parking & Urban spaces (Surface lots, Garages, EV lanes/zones), and Airports & Other (Runways/taxiways, Factories/warehouses, Sports/fields) sectors, reflecting distinct requirements for durability performance, visibility standards, and traffic volume capacity.

Tertiary Classification: Reflectivity/optics class segmentation encompasses Retroreflective (with optics) including Dry-night RL, Wet-night enhanced, and Profiled/rib categories, and Non-reflective/colored markings including Bike/bus/EV colored and Standard non-reflective applications.

Regional Classification: Geographic distribution covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by infrastructure expansion programs.

Market Position: Performance-based materials command the leading position in the road marking paints & coatings market with approximately 58% market share through advanced durability features, including thermoplastic formulations (34%), cold-plastic/MMA systems (15%), and epoxy/polyurea technologies (9%) that enable highway authorities to achieve optimal marking longevity across diverse traffic and climate environments.

Value Drivers: The segment benefits from transportation agency preference for long-lasting marking systems that provide extended service life, reduced maintenance frequency, and lifecycle cost optimization without requiring annual reapplication. Thermoplastic formulations enable rapid application, superior wear resistance, and integration with retroreflective glass beads, where material durability and visibility performance represent critical operational requirements.

Competitive Advantages: Performance-based materials differentiate through proven wear resistance, consistent retroreflective characteristics, and compatibility with automated application equipment that enhance operational effectiveness while maintaining optimal visibility suitable for high-traffic highway applications.

Key market characteristics:

Paint-based materials maintain a significant 42% market share in the Road Marking Paints & Coatings market, with waterborne acrylic systems (27%) leading due to environmental compliance and cost-effective application advantages. These systems appeal to municipal agencies requiring budget-friendly marking solutions with simplified application for urban street networks. Market presence continues through parking lot applications, temporary marking needs, and maintenance-oriented projects emphasizing application flexibility through conventional spray equipment.

Cold-plastic/MMA systems hold approximately 15% market share, focusing on chemical-cure applications and ambient-temperature installation capabilities. These formulations demand specialized mixing equipment for two-component systems requiring rapid cure and minimal traffic disruption.

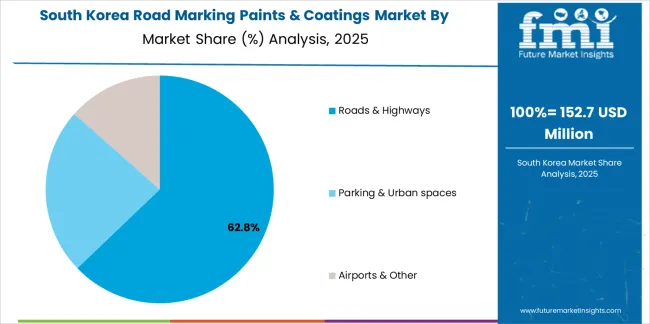

Market Context: Roads & highways applications dominate the road marking paints & coatings market with approximately 62% market share due to extensive highway network infrastructure and increasing focus on traffic safety optimization, accident reduction management, and visibility enhancement applications that minimize lane departure incidents while maintaining transportation safety standards.

Appeal Factors: Highway authorities prioritize marking durability, retroreflective performance, and compliance with national safety specifications that enable coordinated traffic guidance across interstate and arterial road networks. The segment benefits from substantial infrastructure investment and highway modernization programs that emphasize the deployment of performance-based marking systems for safety enhancement applications.

Growth Drivers: Federal highway programs incorporate advanced marking specifications as standard requirements for new construction and rehabilitation projects, while expressway expansion increases demand for long-line center/edge marking capabilities (38% share) that comply with visibility standards and minimize maintenance interventions.

Market Challenges: Varying highway specifications and traffic volume differences may limit material standardization across different jurisdictions or climate scenarios.

Application dynamics include:

Parking and urban spaces capture approximately 21% market share through surface parking lot striping (12%), garage marking systems (6%), and EV charging lane designation (3%) applications. These facilities demand cost-effective marking solutions capable of providing clear guidance in moderate traffic environments while supporting specialized color requirements for designated parking zones.

Airport and other applications account for approximately 17% market share, including runway/taxiway markings (11%), factory/warehouse floor striping (4%), and sports field marking (2%) requiring specialized formulations for aviation safety and industrial operational scenarios.

Growth Accelerators: Infrastructure investment acceleration drives primary adoption as road marking systems provide safety enhancement capabilities that enable highway authorities to meet visibility standards without complete pavement reconstruction, supporting traffic management missions and accident reduction objectives that require precise lane delineation applications. Road safety regulation compliance intensifies market expansion as transportation agencies seek durable marking systems that minimize maintenance frequency while maintaining retroreflective effectiveness during nighttime and adverse weather driving scenarios. Highway modernization spending increases worldwide, creating sustained demand for performance-based marking systems that complement pavement management programs and provide operational longevity in high-traffic infrastructure environments.

Growth Inhibitors: Raw material cost volatility varies across thermoplastic resin suppliers regarding the sourcing of hydrocarbon feedstocks and specialty glass beads, which may limit project scalability and market penetration in regions with commodity price fluctuations or budget-constrained transportation departments. Application weather limitations persist regarding temperature requirements and surface moisture conditions that may restrict installation windows in variable climate regions, affecting project scheduling and contractor productivity. Market fragmentation across multiple national specifications and retroreflectivity standards creates compatibility concerns between different material systems and existing highway maintenance protocols.

Market Evolution Patterns: Adoption accelerates in highway construction and infrastructure renewal sectors where safety requirements justify performance-based material investments, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by expressway construction and urban corridor development. Technology development focuses on enhanced wet-night retroreflectivity, improved wear resistance, and integration with machine-readable marking systems that optimize ADAS compatibility and autonomous vehicle navigation. The market could face disruption if alternative pavement guidance technologies or embedded sensor systems significantly change the deployment of surface-applied marking materials in transportation infrastructure applications.

| Country | CAGR (2025-2035) |

|---|---|

| India | 5.6% |

| China | 5.1% |

| USA | 4.6% |

| Brazil | 4.4% |

| Germany | 4.3% |

| UK | 4.2% |

| Japan | 4% |

The Road Marking Paints & Coatings market demonstrates varied regional dynamics with Growth Leaders including India (5.6% CAGR) and China (5.1% CAGR) driving expansion through expressway construction and smart-city corridor development.

Steady Performers encompass United States (4.6% CAGR), Brazil (4.4% CAGR), and Germany (4.3% CAGR), benefiting from established infrastructure investment programs and advanced marking technology adoption. Mature Markets feature United Kingdom (4.2% CAGR) and Japan (4% CAGR), where network renewal and visibility enhancement integration support consistent growth patterns.

Regional synthesis reveals Asia-Pacific markets leading adoption through highway network expansion and infrastructure investment acceleration, while European countries maintain steady growth supported by road safety specification advancement and environmental compliance requirements. North American markets show moderate growth driven by federal highway funding and performance-based specification trends.

India establishes high-growth leadership through aggressive expressway construction programs and comprehensive smart-city corridor development, integrating advanced road marking systems as standard components in national highway and urban infrastructure installations.

The country's 5.6% CAGR reflects government initiatives promoting transportation infrastructure and road safety capabilities that mandate the deployment of durable marking systems in highway construction and urban corridor operations.

Growth concentrates in major expressway corridors, including Delhi-Mumbai, Bangalore-Chennai, and Golden Quadrilateral networks, where thermoplastic marking adoption showcases integrated retroreflective systems that appeal to highway authorities seeking enhanced visibility capabilities and monsoon-resistant performance solutions.

Indian highway contractors are implementing cost-effective thermoplastic solutions that combine domestic production advantages with advanced wet-night visibility features, including enhanced glass bead systems and profiled marking structures.

Distribution channels through highway construction contractors and infrastructure developers expand market access, while government road safety programs support adoption across diverse expressway construction and urban traffic management segments.

Strategic Market Indicators:

In Beijing, Shanghai, and Guangzhou, urban ring-road expansions and expressway network extensions are implementing advanced road marking systems as standard infrastructure for traffic management and vehicle navigation enhancement, driven by increasing smart transportation initiatives and road network modernization programs that emphasize the importance of machine-readable marking capabilities.

The market holds a 5.1% CAGR, supported by tightening emissions regulations and urban infrastructure development programs that promote low-VOC marking systems for highway construction and traffic management facilities.

Chinese transportation agencies are adopting waterborne marking systems that provide environmental compliance and application flexibility, particularly appealing in urban regions where VOC restrictions and construction activity represent critical operational considerations.

Market expansion benefits from growing domestic marking material manufacturing capabilities and technology development programs that enable local production of advanced thermoplastic and waterborne systems for highway and urban applications. Technology adoption follows patterns established in infrastructure materials, where quality and environmental compliance drive procurement decisions and project deployment.

Market Intelligence Brief:

Brazil's highway infrastructure market demonstrates expanding road marking activity with documented performance effectiveness in federal highway concession projects and airport infrastructure maintenance through integration with existing pavement management systems and construction protocols.

The country leverages tropical climate expertise and concession-based infrastructure models to maintain a 4.4% CAGR. Highway corridors, including São Paulo-Rio, Brasília networks, and coastal routes, showcase thermoplastic installations where cold-plastic MMA systems integrate with comprehensive asset management platforms and quality monitoring to optimize marking durability and retroreflective effectiveness.

Brazilian highway concessionaires prioritize lifecycle cost optimization and tropical climate durability in marking material selection, creating demand for performance-based systems with features, including UV resistance and humidity tolerance capabilities. The market benefits from established public-private partnership infrastructure and willingness to invest in durable marking technologies that provide long-term operational benefits and compliance with concession quality requirements.

Market Intelligence Brief:

The USA market expansion benefits from Infrastructure Investment and Jobs Act (IIJA) funding tailwinds, including interstate highway rehabilitation, state DOT specification upgrades, and smart corridor implementation programs that increasingly require advanced marking systems for safety enhancement applications.

The country maintains a 4.6% CAGR, driven by wet-night retroreflectivity mandates and increasing recognition of thermoplastic benefits, including extended service life and reduced maintenance frequency capabilities.

Market dynamics focus on performance-based marking specifications that balance advanced visibility characteristics with lifecycle cost considerations important to state transportation departments. Growing federal infrastructure investment creates sustained demand for certified marking systems in highway rehabilitation projects and new construction modernization initiatives.

Strategic Market Considerations:

The German market emphasizes advanced marking features, including EN 1436 wet-night performance classes and integration with comprehensive highway management systems that handle traffic flow optimization, safety monitoring, and maintenance scheduling applications through unified infrastructure platforms.

The country holds a 4.3% CAGR, driven by Autobahn network modernization and specialty infrastructure upgrades that support advanced marking integration. German highway authorities prioritize operational effectiveness with marking systems delivering consistent retroreflectivity through advanced formulation chemistry and certified performance capabilities.

Technology deployment channels include major highway construction contractors, specialized marking application companies, and federal infrastructure procurement programs that support professional applications for complex expressway requirements. Environmental compliance capabilities with established EU standards expand market appeal across diverse operational requirements seeking sustainability and performance benefits.

Performance Metrics:

British motorway networks and urban safety corridors are implementing advanced marking systems to enhance smart-motorway asset capabilities and support modern traffic management operations that align with carbon reduction targets and road safety standards. The U.K. market holds a 4.2% CAGR, driven by smart infrastructure programs and environmental compliance initiatives that emphasize waterborne systems for highway construction and urban safety applications.

British highway authorities are prioritizing eco-friendly marking systems that provide carbon footprint reduction while maintaining visibility quality, particularly important in urban pedestrian/cycle safety zones and motorway active traffic management installations.

Market expansion benefits from government carbon budget requirements that influence marking material specifications, creating sustained demand across the UK's highway and urban infrastructure sectors, where environmental compliance and application efficiency represent critical procurement requirements. The regulatory framework supports waterborne adoption through environmental standards and sustainability requirements that promote low-VOC systems aligned with carbon reduction management capabilities.

Strategic Market Indicators:

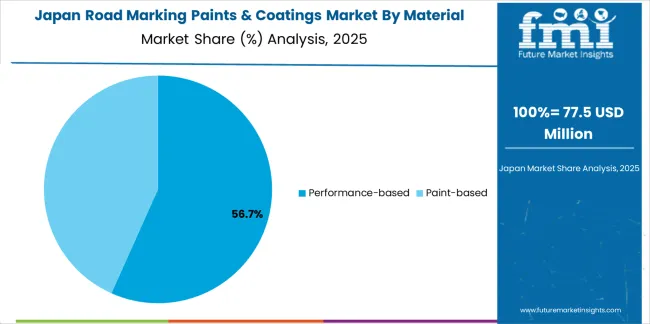

The Japanese market demonstrates steady development with a 4% CAGR, distinguished by transportation agencies' preference for premium-quality marking systems that integrate seamlessly with advanced highway infrastructure and provide reliable long-term visibility in challenging weather applications including snow, rain, and fog conditions. The market prioritizes advanced features, including superior wet-weather retroreflectivity, ADAS sensor compatibility, and durability optimization that reflect Japanese infrastructure industry expectations for technological sophistication and safety performance excellence.

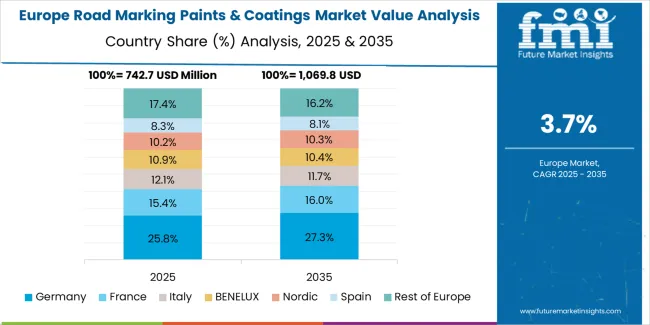

The European Road Marking Paints & Coatings market is projected to grow steadily over the forecast period. Germany is expected to maintain its leadership position with a 21% market share in 2025, supported by its advanced Autobahn infrastructure and major highway construction centers across Bavaria, North Rhine-Westphalia, and Baden-Württemberg regions.

United Kingdom follows with a 15% share in 2025, driven by comprehensive smart motorway programs and environmental compliance initiatives. France holds a 14% share in 2025 through TEN-T corridor development and national highway maintenance programs. Italy commands an 11% share, while Spain accounts for 8% in 2025. Netherlands maintains a 6% share through advanced cycling infrastructure and port access corridor requirements.

The Nordic region (Sweden, Norway, Denmark, Finland, Iceland) holds a 7% share, Central & Eastern Europe accounts for 10%, while Rest of Europe (Ireland, Switzerland, Austria, Bulgaria, Romania, Baltics) represents 8% attributed to increasing EN-1436 performance class adoption, TEN-T corridor refreshes, and rising thermoplastic penetration across highway modernization programs.

In Japan, the Road Marking Paints & Coatings market prioritizes thermoplastic material systems, which capture the dominant share of expressway and national highway installations due to their advanced features, including superior wear resistance and seamless integration with existing highway maintenance infrastructure.

Japanese transportation agencies emphasize durability, visibility consistency, and long-term performance excellence, creating demand for thermoplastic systems that provide reliable retroreflectivity and adaptive performance based on traffic volume requirements and weather conditions. Other material types maintain secondary positions primarily in urban applications and parking facilities where paint-based systems meet operational requirements without demanding extended durability specifications.

Market Characteristics:

In South Korea, the market structure favors international road marking manufacturers, including 3M Company, PPG Traffic Solutions, and SWARCO AG, which maintain dominant positions through comprehensive product portfolios and established highway contractor networks supporting expressway construction and urban infrastructure installations.

These providers offer integrated solutions combining advanced marking materials with professional application services and ongoing technical support that appeal to Korean transportation agencies seeking reliable visibility systems.

Local contractors and material suppliers capture a moderate market share by providing localized application capabilities and competitive pricing for municipal road projects, while domestic manufacturers focus on specialized applications and cost-effective solutions tailored to Korean highway characteristics.

Channel Insights:

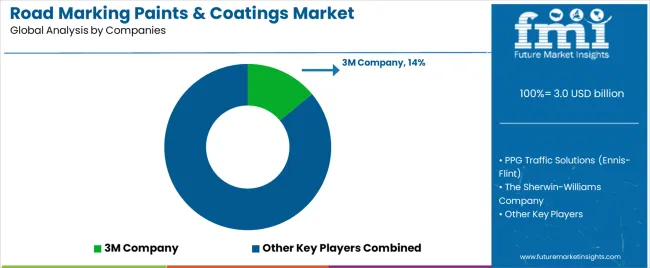

The road marking paints & coatings market operates with moderate concentration, featuring approximately 12-18 meaningful participants, where leading companies control roughly 50-55% of the global market share through established highway contractor relationships and comprehensive material portfolios. 3M Company maintains the leading position with approximately 14% market share through extensive traffic safety expertise and global distribution operations. Competition emphasizes material performance, retroreflective capability, and specification compliance rather than price-based rivalry.

Market Leaders encompass 3M Company, PPG Traffic Solutions (Ennis-Flint), and The Sherwin-Williams Company, which maintain competitive advantages through extensive road marking technology expertise, global highway contractor networks, and comprehensive certification capabilities that create specification compliance and support premium pricing. These companies leverage decades of transportation infrastructure experience and ongoing research investments to develop advanced marking systems with enhanced retroreflectivity and ADAS compatibility features.

Technology Innovators include Geveko Markings, Nippon Paint Holdings, and Hempel A/S, which compete through specialized formulation technology focus and innovative application systems that appeal to highway authorities seeking advanced wet-night capabilities and environmental compliance. These companies differentiate through rapid product development cycles and specialized transportation application focus.

Regional Specialists feature companies like SWARCO AG, Asian Paints PPG, and Berger Paints, which focus on specific geographic markets and specialized applications, including airport markings and urban infrastructure solutions. Market dynamics favor participants that combine reliable material formulations with advanced technical services, including specification consultation and application training capabilities. Competitive pressure intensifies as traditional paint manufacturers expand into road marking systems, while specialized traffic safety companies challenge established players through innovative thermoplastic solutions and machine-readable marking platforms targeting intelligent transportation segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 3 billion |

| Material Type | Performance-based (Thermoplastic, Cold-plastic/MMA, Epoxy/Polyurea), Paint-based (Waterborne acrylic, Solvent-borne alkyd, Epoxy paint) |

| Application | Roads & Highways (Long-line center/edge, Intersections & pedestrian, Expressways/toll), Parking & Urban spaces (Surface lots, Garages, EV lanes/zones), Airports & Other (Runways/taxiways, Factories/warehouses, Sports/fields) |

| Reflectivity/Optics Class | Retroreflective (Dry-night RL, Wet-night enhanced, Profiled/rib), Non-reflective/colored markings (Bike/bus/EV colored, Standard non-reflective) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | India, China, Brazil, United States, Germany, United Kingdom, Japan, and 25+ additional countries |

| Key Companies Profiled | 3M Company, PPG Traffic Solutions (Ennis-Flint), The Sherwin-Williams Company, Nippon Paint Holdings, Geveko Markings, Hempel A/S |

| Additional Attributes | Dollar sales by material type and application categories, regional adoption trends across North America, Europe, and Asia-Pacific, competitive landscape with marking manufacturers and highway contractors, transportation agency preferences for retroreflective performance and system durability, integration with automated application equipment and intelligent transportation systems, innovations in wet-night visibility formulations and ADAS compatibility. |

The global Road Marking Paints and Coatings Market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the Road Marking Paints and Coatings Market is projected to reach USD 4.6 billion by 2035.

The Road Marking Paints and Coatings Market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in Road Marking Paints and Coatings Market are performance-based and paint-based.

In terms of application, roads & highways segment to command 62.0% share in the Road Marking Paints and Coatings Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Road Profile Laser Sensor Market Size and Share Forecast Outlook 2025 to 2035

Road Haulage Market Size and Share Forecast Outlook 2025 to 2035

Road Safety Market Size and Share Forecast Outlook 2025 to 2035

Road Speed Limiter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Road Aggregates Market Growth - Trends & Forecast 2025 to 2035

Road Side Drug Testing Devices Market

Road-Rail Vehicles Market

Road and Highway Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Road Marking Paint Market - Trends & Forecast 2025 to 2035

Road Marking Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Broadcast Switchers Market Size and Share Forecast Outlook 2025 to 2035

Broadcast Equipment Market Growth - Trends & Forecast 2025 to 2035

Broadband Network Gateway (BNG) Market by Component & Region Forecast till 2035

Railroad Market Size and Share Forecast Outlook 2025 to 2035

Off-road Tires Market Size and Share Forecast Outlook 2025 to 2035

Off Road Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Railroad Ties Market Growth - Trends & Forecast 2025 to 2035

Off-Road All Terrain E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Off-road Motorcycle Market Growth – Trends & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA