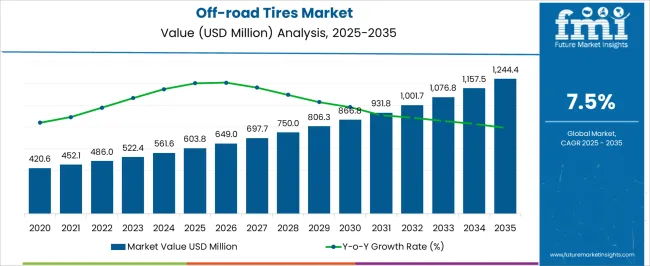

The Off-road Tires Market is estimated to be valued at USD 603.8 million in 2025 and is projected to reach USD 1244.4 million by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. From 2020 to 2024, the market expanded from USD 420.6 million to USD 561.6 million, with annual growth rates ranging between 6.5% and 7.3%. Early adoption was gradual, driven by demand from the construction, mining, and agriculture sectors. Year-on-year growth during this phase reflects incremental fleet expansion, replacement of worn tires, and increased procurement across industrial and recreational applications. These years established the foundation for broader adoption and consistent market momentum.

Between 2025 and 2030, the market enters a scaling phase, rising from USD 603.8 million to USD 866.8 million, with YoY growth averaging 7–7.6%. Wider adoption occurs across mining, construction, and off-road recreational vehicle sectors, supported by growing fleets and replacement cycles. From 2030 to 2035, growth continues steadily to USD 1,244.4 million, with annual increases around 7.4–7.7%. The YoY analysis highlights predictable expansion, with recurring procurement, fleet upgrades, and rising adoption across industrial and recreational applications driving stable and sustained market growth during this period.

| Metric | Value |

|---|---|

| Off-road Tires Market Estimated Value in (2025 E) | USD 603.8 million |

| Off-road Tires Market Forecast Value in (2035 F) | USD 1244.4 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The off-road tires market is witnessing steady growth, driven by increasing participation in adventure sports, recreational off-roading, and the rising demand for vehicles capable of performing in challenging terrains. Expanding infrastructure for off-road trails, combined with the growing popularity of utility vehicles for both recreational and commercial purposes, is creating sustained demand for specialized tire solutions. Advancements in tread design, rubber compounding, and sidewall reinforcement are improving durability, traction, and performance under extreme conditions.

The market is also benefiting from increasing adoption of off-road tires in military, construction, and agricultural sectors where rugged terrain performance is essential. Growing disposable incomes in emerging markets are enabling higher spending on off-road capable vehicles, which directly supports tire sales.

Moreover, manufacturers are focusing on introducing tires with improved puncture resistance, self-cleaning capabilities, and optimized grip for diverse surfaces such as mud, sand, and rocky terrain With global interest in outdoor activities and off-road motorsports continuing to rise, along with technological innovations in tire manufacturing, the market is poised for consistent expansion over the coming years.

The off-road tires market is segmented by material, tire height, vehicle, distribution channel, and geographic regions. By material, off-road tires market is divided into Synthetic rubber, Natural rubber, Fabrics & wire, Carbon black, and Others. In terms of tire height, the off-road tires market is classified into 31-40 inches, below 31 inches, 41-45 inches, and above 45 inches. Based on vehicle, off-road tires market is segmented into SUV, 4WD HDT, UTV, Dirt bikes & quad, OTR, and Others.

By distribution channel, off-road tires market is segmented into Secondary/replacement, Original equipment, and Distributor/dealer equipped. Regionally, the off-road tires industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic rubber segment is projected to account for 34.2% of the off-road tires market revenue share in 2025, making it the leading material category. This dominance is attributed to the superior performance characteristics synthetic rubber offers, including enhanced abrasion resistance, better heat tolerance, and consistent elasticity in varying temperature conditions. The ability to customize compound formulations allows manufacturers to optimize grip, durability, and cut resistance for off-road applications.

The segment is benefiting from growing adoption across premium and performance-oriented off-road tire ranges, where longevity and resilience against harsh terrain are essential. Synthetic rubber also provides more predictable performance in wet and muddy environments compared to certain natural rubber blends, further strengthening its market position.

Advancements in polymer chemistry are enabling the creation of compounds that balance flexibility with structural integrity, ensuring reliable traction and minimal wear even under high load conditions. As demand for high-performance off-road tires increases across both recreational and industrial sectors, the synthetic rubber segment is expected to maintain its leadership through continuous material innovation and widespread applicability.

The 31-40 inches tire height segment is anticipated to hold 32.8% of the off-road tires market revenue share in 2025, establishing itself as the dominant height category. This segment’s leadership is being reinforced by its versatility, offering a balance between ground clearance, traction, and handling stability. Tires in this height range are well-suited for a variety of off-road vehicles, including SUVs, trucks, and specialized recreational models, making them a popular choice for both enthusiasts and professionals.

The increased surface contact area enhances grip on loose or uneven terrain, improving vehicle control in demanding conditions. Manufacturers are developing 31-40 inch tires with advanced tread patterns that optimize self-cleaning capabilities, reduce rolling resistance, and maintain stability on mixed surfaces.

This height range is also compatible with a wide range of aftermarket modifications, appealing to consumers seeking both performance and aesthetic upgrades. As the market for multipurpose off-road vehicles expands, the demand for tires within this size range is expected to grow, supported by ongoing innovations in tire design and material engineering.

The SUV segment is expected to represent 29.8% of the off-road tires market revenue share in 2025, making it the leading vehicle category. This dominance is driven by the increasing popularity of SUVs as both lifestyle and utility vehicles, with many models offering factory-fitted off-road capabilities.

The SUV category benefits from rising consumer preference for vehicles that combine on-road comfort with off-road performance, creating a strong demand for specialized tire solutions. Off-road tires for SUVs are engineered to provide enhanced sidewall strength, improved traction on loose surfaces, and resistance to punctures, meeting the diverse needs of urban, rural, and recreational users.

The segment is also supported by the growing availability of aftermarket tire options tailored specifically for SUV fitments, enabling owners to customize their vehicles for varied terrains As SUVs continue to dominate global passenger vehicle sales and manufacturers introduce more off-road capable variants, the demand for durable, high-performance off-road tires in this category is projected to remain strong, underpinned by continuous advancements in tread design and rubber compounding technologies.

The off-road tires market is growing due to increasing demand from agriculture, construction, mining, and recreational vehicles. These tires provide enhanced traction, durability, and performance on unpaved or rough terrains. North America and Europe lead in recreational and utility vehicle adoption, while Asia-Pacific dominates agricultural and construction demand. Manufacturers focus on tread design, puncture resistance, and load-bearing capacity to improve performance. Innovation in rubber compounds and manufacturing techniques is driving product differentiation for commercial and consumer applications.

Agricultural machinery, tractors, and construction equipment rely heavily on off-road tires capable of handling uneven, muddy, or rocky terrains. These tires provide high traction, load capacity, and durability to ensure operational efficiency in challenging environments. Manufacturers develop reinforced sidewalls, specialized treads, and puncture-resistant designs to minimize downtime and maintenance costs. Regional infrastructure development and mechanization trends drive adoption in emerging markets. Until alternative tire technologies match the combined performance, durability, and cost-effectiveness of traditional off-road tires, demand from agriculture and construction will continue to expand steadily.

The rise of remote work, virtual teams, and cloud-based collaboration has driven enterprises to adopt mobile VoIP for unified communications. Businesses leverage VoIP for video conferencing, voice calls, and messaging, reducing operational costs while maintaining connectivity. Features like call forwarding, virtual numbers, and integration with CRM systems enhance productivity. Security, encryption, and quality of service are critical for enterprise adoption. Providers offering secure, scalable, and customizable VoIP platforms gain competitive advantage. Until alternative solutions can match mobile VoIP’s cost-effectiveness, flexibility, and integration with business workflows, enterprises will continue to prioritize VoIP for mobile communication and remote collaboration.

The quality of mobile VoIP calls depends on network stability, bandwidth, and latency. Providers focus on optimizing data transmission, employing codecs, and implementing adaptive jitter buffering to maintain call clarity. Poor network conditions can cause dropped calls, echo, or delays, impacting user experience. Telecom operators and app developers are working to enhance performance over variable mobile networks, particularly in areas with fluctuating connectivity. Until alternative mobile communication technologies provide consistent quality at similar cost, mobile VoIP will remain preferred for users seeking reliable and efficient voice and video communication over data networks.

As mobile VoIP transmits voice and data over the internet, security and privacy are key concerns. Encryption, secure authentication, and compliance with data protection regulations influence adoption. Enterprises and consumers prioritize providers that safeguard against hacking, eavesdropping, and call interception. Regional regulations regarding VoIP usage, taxation, and licensing impact market penetration, especially in countries with restricted VoIP policies. Providers ensuring secure, regulatory-compliant services gain consumer and enterprise trust. Until alternative communication channels offer similar security and regulatory adherence, mobile VoIP remains a trusted solution for private and business communications globally.

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

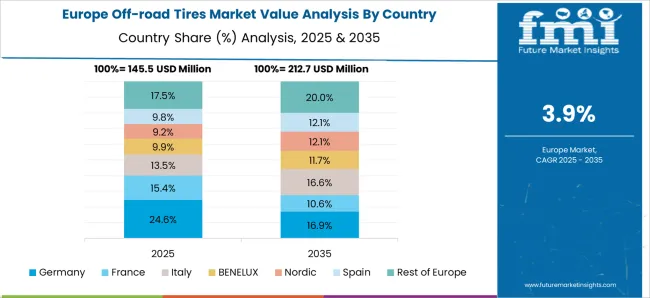

The global Off-road Tires Market is projected to grow at a CAGR of 7.5% through 2035, supported by increasing demand across construction, agriculture, and commercial vehicle applications. Among BRICS nations, China has been recorded with 10.1% growth, driven by large-scale production and deployment in industrial, agricultural, and construction vehicles, while India has been observed at 9.4%, supported by rising utilization in commercial and off-road vehicle fleets. In the OECD region, Germany has been measured at 8.6%, where production and adoption for construction, agricultural, and industrial vehicles have been steadily maintained. The United Kingdom has been noted at 7.1%, reflecting consistent use in off-road and commercial vehicle applications, while the USA has been recorded at 6.4%, with production and utilization across agricultural, construction, and commercial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The off-road tires market in China is expanding at a CAGR of 10.1%, driven by growth in construction, mining, agriculture, and military sectors. Increased demand for durable and high-performance tires to withstand harsh terrains supports market growth. China’s rapid industrialization, infrastructure development, and mechanization of agriculture contribute to steady demand for off-road vehicles and tires. Technological advancements such as reinforced sidewalls, enhanced tread patterns, and improved traction performance further enhance adoption. Rising adoption of 4x4 vehicles, construction machinery, and specialized heavy-duty vehicles also fuels market expansion. Government initiatives to improve industrial efficiency, infrastructure projects, and mining activities positively impact tire demand. Manufacturers are investing in research and development to produce long-lasting, fuel-efficient, and environmentally compliant tires suitable for off-road applications across China.

The off-road tires market in India is growing at a CAGR of 9.4%, supported by rising construction, mining, and agricultural activities. Industrial expansion and infrastructure development increase demand for heavy-duty vehicles equipped with high-performance tires. Technological innovations, such as enhanced grip, puncture resistance, and durability, boost adoption. Growth in the automotive sector, including commercial and utility vehicles, further supports market expansion. Government initiatives focusing on rural road development, mechanized agriculture, and mining operations stimulate tire demand. Manufacturers are emphasizing eco-friendly and fuel-efficient tire designs to comply with regulatory standards. Increasing adoption of all-terrain vehicles for industrial, military, and recreational purposes also contributes to steady market growth. Rising awareness of tire safety, performance, and longevity ensures sustained adoption of off-road tires across India.

The off-road tires market in Germany is growing at a CAGR of 8.6%, driven by demand from construction, agriculture, and forestry sectors. High-performance tires are required for vehicles operating in rugged terrains, including excavators, loaders, and off-road utility vehicles. Germany’s stringent safety and environmental standards encourage manufacturers to develop durable and eco-friendly tire solutions. Technological advancements such as improved tread design, enhanced load-bearing capacity, and optimized traction help meet industrial and commercial requirements. Adoption of off-road tires in mining and infrastructure projects further supports market growth. The market also benefits from investments in research and development to improve tire longevity and fuel efficiency. Growing demand for specialized vehicles in industrial applications ensures steady off-road tire consumption across Germany.

The off-road tires market in the United Kingdom is expanding at a CAGR of 7.1%, supported by industrial, agricultural, and recreational vehicle applications. Vehicles used in construction sites, farms, and forestry require durable and reliable tires capable of handling uneven terrains. Manufacturers focus on improving traction, durability, and fuel efficiency to meet market requirements. Technological innovations, such as reinforced sidewalls, optimized tread patterns, and puncture resistance, enhance performance. Government programs promoting infrastructure development, agricultural mechanization, and safety regulations drive market growth. Recreational off-road activities, including motorsports and adventure tourism, also contribute to increased tire adoption. With rising demand for high-quality, environmentally compliant off-road tires, the market in the UK is poised for steady growth.

The off-road tires market in the United States is growing at a CAGR of 6.4%, fueled by demand from construction, mining, agriculture, and recreational sectors. Industrial and commercial vehicles require high-performance tires with enhanced traction, durability, and resistance to wear and tear. Technological advancements such as improved tread designs, fuel-efficient tires, and reinforced sidewalls support market adoption. Government initiatives in infrastructure development, rural road connectivity, and agricultural mechanization positively influence tire demand. The USA market also benefits from off-road recreational activities, including motorsports, ATV usage, and adventure tourism, which drive consumer demand for specialized tires. Rising emphasis on safety, durability, and eco-friendly tire solutions ensures steady growth in off-road tire consumption across the United States.

The off-road tires market plays a pivotal role in providing specialized traction, durability, and performance for vehicles operating in rugged terrains, including construction sites, mining operations, agricultural fields, and recreational off-roading. These tires are engineered to withstand extreme conditions such as mud, gravel, rocks, and uneven surfaces, ensuring vehicle stability, safety, and longevity. The market growth is driven by the expansion of construction and mining activities, rising demand for all-terrain recreational vehicles, and technological innovations in tire compounds and tread designs.

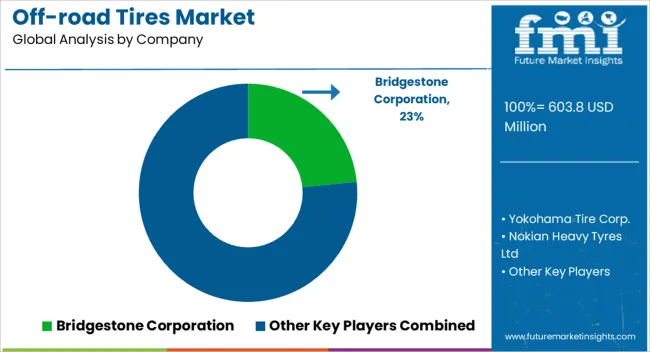

Key players dominating the off-road tires market include Bridgestone Corporation, renowned for its high-performance and durable tires suitable for heavy-duty applications. Yokohama Tire Corporation offers a wide range of off-road tire solutions designed for enhanced traction and safety across diverse terrains. Nokian Heavy Tyres Ltd specializes in tires for forestry, mining, and construction equipment, emphasizing ruggedness and reliability. JK Tyre & Industries Ltd provides cost-effective and durable off-road tires for industrial and agricultural machinery, particularly in emerging markets. Nortec is another significant player, focusing on durable and versatile off-road tires tailored for commercial and heavy equipment applications.

These manufacturers continually invest in research and development to introduce innovative tire technologies, such as advanced rubber compounds, self-cleaning treads, and reinforced sidewalls, to improve performance and lifespan. As off-road vehicles continue to see increased adoption across multiple industries and recreational activities, these leading suppliers are positioned to expand their footprint, offering robust and reliable tire solutions to meet evolving market demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 603.8 Million |

| Material | Synthetic rubber, Natural rubber, Fabrics & wire, Carbon black, and Others |

| Tire Height | 31-40 inches, Below 31 inches, 41-45 inches, and Above 45 inches |

| Vehicle | SUV, 4WD HDT, UTV, Dirt bikes & quad, OTR, and Others |

| Distribution Channel | Secondary/replacement, Original equipment, and Distributor/dealer equipped |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bridgestone Corporation, Yokohama Tire Corp., Nokian Heavy Tyres Ltd, JK Tyre & Industries Ltd, and Nortec |

| Additional Attributes | Dollar sales vary by tire type, including all-terrain, mud-terrain, and rock-terrain tires; by vehicle type, spanning SUVs, trucks, ATVs, and agricultural/off-highway vehicles; by application, such as construction, agriculture, mining, and recreational off-roading; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising off-road vehicle adoption, infrastructure development, and demand for durable, high-performance tires. |

The global off-road tires market is estimated to be valued at USD 603.8 million in 2025.

The market size for the off-road tires market is projected to reach USD 1,244.4 million by 2035.

The off-road tires market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in off-road tires market are synthetic rubber, natural rubber, fabrics & wire, carbon black and others.

In terms of tire height, 31-40 inches segment to command 32.8% share in the off-road tires market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV Tires Market Growth – Trends & Forecast 2025 to 2035

Winter Tires Market

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Off Highway Tires Market Growth - Trends & Forecast 2025 to 2035

Performance tires Market

Rechargeable Tires Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Tires Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Super Swamper Tires Market

Automotive Green Tires Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA