The off highway tires market is estimated to reach a valuation of USD 11 billion in 2025. By 2035, demand is likely to reach USD 23.8 billion, with a CAGR of 8%. For an industry dependent on specialized tires engineered for extreme conditions, rugged terrain, and heavy loads, this illustrious stride underpins the significance of diversification.

Off highway tires are tailored to facilitate vehicles meant to operate off the standard roads: tractors, excavators, loaders, harvesters, dump trucks, and forklifts. These tires are under special demands like resistance against abrasion, traction, load-bearing capacity, better paint, and long service life. With industrial and infrastructure development, the need for durable and efficient off highway tires is intensifying in emerging industries worldwide.

The off highway tiresare used widely in construction due to the increased infrastructure projects all over the world, urbanization, and settlements. Backhoe loaders, bulldozers, and cranes require high-performance tires that can perform in difficult and varied ground conditions. So, also in the fast-expanding mining sector, where demands for critical minerals and metals are driving the need for tires that withstand very hostile, abrasive environments and heavy loads with minimal replacement rates.

A very strong increasing trend in mechanized farming in developing countries is drawing many more tractors, harvesters, and sprayers equipped with off highway tires into agriculture altogether. Innovations in tire design and technology have also been directed toward better soil protection, improved fuel efficiency, and better traction in wet and dry fields. Advanced radial and bias tire constructions will soon be more pronounced. These constructions are to provide greater comfort and longer service life for farm machinery.

Such technological advances have taken form in tire materials, tread patterns, and design. A green focus is being adopted by most manufacturers nowadays, paving the way for eco-friendly materials and options for retreadable tries to minimize lifecycle costs and lower environmental impact. Smart tire technologies integrated with sensors to monitor the pressure of tires, temperature, and wear in real time are also flourishing across fleets, improving safety, performance, and predictive maintenance.

Currently, the Asia-Pacific region dominates this industry. It would continue its leadership over the entire forecast period due to rapid industrial development, government investments in infrastructure and, for the most part, vigorous agricultural activity in such countries as China, India, and Southeast Asian countries. North America and Europe would also account for huge industries due to large-scale construction, mining activities, and technological innovations. Latin America and Africa are emerging opportunities, distinctly in the area of agriculture and resource extraction.

Theindustrywould experience a very dynamic growth pattern, wherein more and more industries put more reliance on these high-performing, durable tires to respond to the challenges of their working environments. Infrastructure, mining, mechanized farming, and technological advancement in tires would be driving the growth of this industry on a global scale for billion-dollar prospects for manufacturers, OEMs, and aftermarket players.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 11 billion |

| Industry Value (2035F) | USD 23.8 billion |

| CAGR (2025 to 2035) | 8% |

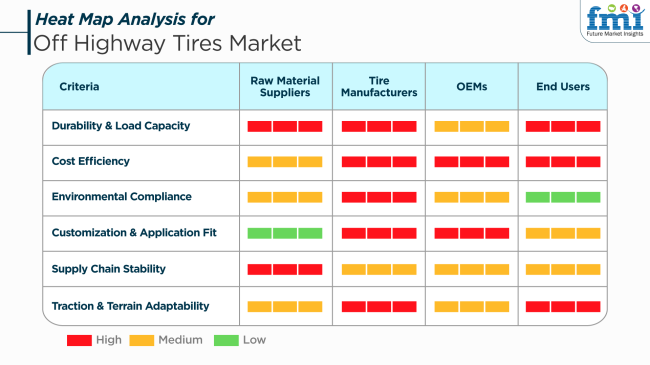

Off Highway Tires Market(Stakeholders: Raw Material Suppliers, Tire Manufacturers, OEMs (Original Equipment Manufacturers), End Users [Agriculture, Construction, Mining])

he industry is strategically situated to serve the agriculture, construction, mining, and industrial transport sectors, where vehicles are used under extreme conditions. These tires are engineered for higher endurance, higher load capacity, and adaptability to rough terrains-all very essential attributes in reducing downtime and improving productivity.

Raw material suppliers place great emphasis on delivering high quality and a consistent supply of natural and synthetic rubber, carbon black, and reinforcing agents, as these are chiefly responsible for the mechanical strength of tires. Tire manufacturers focus their attention on optimizing costs, complying with environmental regulations, and innovating in performance towards developing application-specific solutions in line with the demands of respective industry segments.

They integrate these tires in the production of OEM machinery and equipment, placing a high value on customization, durability, and lifecycle cost efficiency, as the selection of tires greatly influences the reliability of the end product. End users, from farmers to mining operators, emphasize traction, load capacity, and replacement costs to choose tires that enhance productivity, minimize operational risks, and avoid maintenance interruptions.

The industry is expected to enjoy stable growth due to increased mechanization in agriculture, infrastructure growth, and mining expansion across emerging economies. On the other hand, regulatory pressure around emission and waste management and the mandate for sustainable rubber sourcing and a recycling process are aggressively modifying the way production and supply chains behave. Asia Pacific and Latin America will continue to drive volume. Still, North America and Europe are the de facto centers of demand for advanced technology for radial and specialty off-road tires.

The years 2020 to 2024 marked a slow recovery for the industry, with a particularly steady growth during the post-pandemic phase because construction and mining activities resumed, albeit behind schedule. Demand surge from infrastructure development in emerging economies, especially Asia-Pacific, was a main propeller of the larger industry. Traditional radial tires dominated this time with little penetration of higher technologies. OEMs were focused on durability, life of tread, and cost cutting, and retreading tires continued to make sense for cost-conscious industries.

During the decade 2025 to 2035, however, the industry will be revolutionized. There will be a sudden rise in the adoption of smart tires with real-time pressure and temperature sensing, driven by the demand for fleet efficiency and operating safety. For instance, smart tire technology is gaining traction in driverless mining vehicles and precision farm equipment, where sensor-based tires feed information to vehicle control units.

Low rolling resistance technology and biologically based rubber materials will be characteristic elements in eco-friendly production processes. Further, tire emissions regulations worldwide and lifecycle traceability are poised to stimulate R&D spending in self-healing and adaptive materials for tires. Electric off-road vehicles will also create the need for specialty tire compounds, resulting in advanced tire architecture and smart material integration.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Gradual recovery after the post-COVID period, with revived construction and mining operations. | Lucrative global expansion, with autonomous and intelligent fleet requirements across sectors fueling growth. |

| Low-level radial tires with minimal digital integration. | Smart tires with sensor-embedded devices, cloud connections, and predictive maintenance capabilities. |

| Emerging eco-friendly practices, confined to leading manufacturers. | Great thrust towards sustainable materials, circular economy practices, and low-emission manufacturing. |

| Asia-Pacific dominance with increased infrastructure in China and India. | Asia-Pacific growth sustained along with growing demand from North American mining and South American agricultural industries. |

| Emphasis on tread life and strength of structure. | Advanced technologies such as self-healing materials, adaptive tread, and AI-optimized tire performance. |

| Little regulatory impact on product innovation. | Growing worldwide regulations on tire emissions, recyclability, and smart safety features to drive compliance. |

| Limited, with conventional combustion-engine equipment dominating. | Substantial influence-custom low-resistance, noise-reducing tires for electric off-road and autonomous vehicles. |

| Limited connectivity-some OEMs testing telematics-based pressure monitoring. | Full integration with vehicle control systems and cloud-enabled dashboards for large fleets. |

There are many risks to the industry affecting both growth and profitability, all of which are under the present global assignment toward sustainability and changes in economic conditions. Supply chain disruptions are a primary risk. The industry essentially survives on key raw materials like rubber, carbon black, and steel, which constantly fluctuate in price, environmental conditions (natural rubber availability), and geopolitical factors. Any interruptions in the supply of these materials may hamper production schedules and increase costs.

Another significant risk involves regulatory pressures stemming from environmental complaints. Governments worldwide are instituting more stringent regulations regarding tire recycling, emissions from tire manufacturing, and the use of sustainable materials. Any manufacturer that does not comply with these regulations could incur fines as well as be subject to reputational damage and costly upgrades to adhere to new standards.

The transition toward electric and autonomous vehicles, in particular off-highway sectors like mining and agriculture, may also require further changes to tire design and technology, which could pose a risk of technological obsolescence for tire manufacturers who cannot adapt in time.

Economic downturns or fluctuations in commodity prices also pose risks to the industry, particularly sectors like mining and construction, which are themselves subjected to global economic vagaries. The other way around is that the demand for heavy machinery may drop due to a slack economy or plummeting capital expenditure, which, in turn, reduces the demand for off highway tires as well.

Another risk could be the cost and supply of labor in tire manufacturing, especially in regions with rising wages or labor shortages. Intense price competition among manufacturers could intensify the pressure on margins, especially in emerging industries, where cost-conscious buyers could opt for low-cost options at the expense of high-performance tires.

Finally, the emerging technologies and demand for tailored solutions (such as tires that improve performance on terrains or machinery) challenge tire manufacturers to differentiate and innovate their product offerings continually. Companies that fail to keep up with industry trends or that fail to provide the performance features expected by prospective buyers may lose industry share.

Notwithstanding these high risks, the constant growth in demand for construction, mining, and agriculture activities in developing regions also provides immense opportunities for those able to overcome these barriers through innovation, sustainability, and supply chain management.

In 2025, the industry is largely dominated by the replacement tires segment, which accounts for approximately 65% of the total industry share, while the Original Equipment Manufacturer (OEM) segment holds the remaining 35%.

The extended lifecycle and intensive use of off-highway vehicles across sectors such as agriculture, mining, construction, and forestry drive the dominance of the Replacement Tires segment. In these industries, vehicles constantly work in harsh and challenging environments that fast-track tire wear, prompting frequent replacements of tires.

Furthermore, fleet operators often opt for aftermarket tires that they find to be superior in terms of cost and serviceability to OEM options. The global tire brands Michelin, Bridgestone, and Balkrishna Industries Ltd. (BKT) have a strong replacement tire portfolio that is further developed to provide superior traction, puncture resistance, and durability. For instance, BKT's Earthmax series and Michelin's XTRA Load tires are well-received by the construction and mining sectors due to their reinforced structure and heat-resistant compounds.

The OEM segment, representing the remaining 35% of the industry, is largely dependent on the introduction of new off-highway vehicles. OEM sales, typically around the latest equipment being delivered from major machinery manufacturers like Caterpillar, John Deere, Komatsu, and CNH Industrial, have an OEM partnership with tire companies to outfit vehicles with special tire solutions in line with performance specifications.

For instance, Caterpillar dump trucks are supplied with Goodyear OEM tires, while Trelleborg supplies factory-fitted tires for agricultural tractors from manufacturers such as Fendt and Massey Ferguson. To this end, even though the OEM segment is a small share, it gives considerable leverage in instilling brand preference and long-term customer loyalty, particularly for first-time purchases of equipment.

Collectively, the two segments provide interrelated support to the survival of the off-highway tire system, with the replacement segment being sustained by recurrent demand at high volumes.

Agricultural and Industrial applications are the end uses by which the global industry would be segmented by 2025, showing Agriculture at the top with about 30% of the total industry share. In contrast, the Industrial share would be 25%.

The agriculture segment dominates the share of the industry, which is primarily attributed to the sufficient numbers of tractors, harvesters, sprayers, and other machinery for farm work requiring specialized off-road tires. The segment thrives mainly because of the demand for high traction and soil-friendly tires around the world, especially in countries such as the United States, India, Brazil, and China.

Some of the top names in agricultural tires, under biased and radial sections, include Trelleborg, BKT, and Mitas, which offer better field performance, minimized soil compaction, and energy efficiency. Innovations such as VF (Very High Flexion) and IF (Increased Flexion) technologies are continuously introduced in Europe and are set to be used for mainstream heavy-duty operations in agriculture.

The Industrial segment, which is about 25%, includes applications using skid steer loaders, forklifts, and other construction-related utility vehicles in material handling, logistics, port operations, and construction. These are built closely into durable, high-load bearing, and puncture-resistant tires. Emerging markets' industrial growth, warehouse automation, and infrastructure development projects have strengthened their demand for these tires.

Continental, Camso, and MAXAM are some of the industry insiders among thousands more that supply Industrial Tires focused on wear resistance, stability, and longevity. Camso's SOLIDEAL Magnum and SC20+ by Continental are widely used on forklifts and compact construction machinery operating on hard floors.

Both segments will continue, for the most part, to record a steady rate of growth, agriculture being strengthened by mechanization in emerging economies and industrial demand having the buoyancy of increasing construction and logistics worldwide.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| UK | 4.1% |

| France | 3.8% |

| Germany | 4.5% |

| Italy | 3.6% |

| South Korea | 4.3% |

| Japan | 3.9% |

| China | 6.4% |

| Australia | 4.7% |

| New Zealand | 3.4% |

The USA industry is expected to have a strong CAGR of 5.2% from 2025 to 2035. Development is fueled mainly by continuous investment in building and infrastructure development, which is encouraged by government efforts to develop transport and logistics infrastructure. The growth of the agriculture and mining industry is expected to generate steady demand for specialized types of tires, such as radial and bias-ply tires, for durability and rugged terrain handling.

Large industry players like Titan International, Goodyear, and Michelin North America are driving industry growth by creating strategic partnerships with OEMs and aftermarket distributors and through technology innovation. The deployment of advanced materials, pressure monitoring systems, and smart tire technologies is also increasing operational efficiency and lifecycle management for heavy-duty applications.

The UK industry is projected to register a CAGR of 4.1% during the forecast period from 2025 to 2035. Rising mechanization of farming and greater emphasis on rural development are likely to fuel demand for tough and performance-based tire solutions. Expansion is also driven by heightened infrastructure growth in urban areas and the application of eco-efficient construction machinery.

Key players such as Continental, Bridgestone UK, and Trelleborg are increasing competitiveness in local markets by launching low-rolling resistance and long-service-life tire products. The shift towards electric and hybrid off-highway vehicles is fueling demand for tires that support new drivetrain configurations and reduced noise outputs.

France's industry is anticipated to record a CAGR of 3.8% during the forecast period. The agricultural sector remains one of the major drivers of demand, supported by precision farming techniques and greater utilization of high-capacity machines. The construction industry, particularly in central and southern regions, is predicted to adopt enhanced tire solutions to meet evolving terrain and load-carrying requirements.

Major industry leaders like Michelin, Nokian Tyres, and BKT are investing more emphasis on soil compaction minimization and energy-saving rolling dynamics-related research and development. Growing pressure toward industrial segment automation will continue to pour motivation into the incorporation of smart tire technologies into off-highway machines.

German industry will grow during 2025 to 2035 with a CAGR of 4.5%. Promoters are construction sustainability and industrial automation driven by higher technology-efficient equipment usage along with the respective brilliant performance anticipated out of the tire. Higher activity within the mining and forestry industries, especially within the east lands, also bolsters industry demand.

Industry leaders like Michelin, Mitas, and Continental AG are capitalizing on Germany's engineering base to create high-performance tires with added traction and lifespan. Intelligent tire integration, onboard sensors, and remote monitoring capability are also becoming a differentiator in cost-reduction and fleet management initiatives.

Italy's industry is forecasted to grow at a CAGR of 3.6% during the forecast period. The construction sector is witnessing a recovery, fueled by government and EU-funded infrastructure development initiatives, which are contributing to higher usage of load-handling and earthmoving equipment. The agricultural industry, especially in northern Italy, continues to spend on tire products that provide flotation and stability.

Local manufacturers like Marangoni, Trelleborg, and Pirelli are capitalizing on domestic demand through advances in tire tread design and reinforcement technologies. Eco-consciousness has promoted inventions of recycled and bio-based material alternatives for new products, as the nation's agenda for sustainability reflects.

South Korea's industry is expected to register a CAGR of 4.3% during the period from 2025 to 2035. Rising mining activities and construction, particularly in urban redevelopment areas, are at the forefront of industry growth. The implementation of smart manufacturing techniques is transforming tire production processes into more tailored and efficient ones.

These include Hankook Tire, Kumho Tire, and Nexen Tire, which emphasize endurance and heat resistance with products engineered to handle high temperatures. Digital diagnostic and predictive maintenance capabilities are propelling more general industrial automation trends in South Korea's heavy machinery industry.

Japan's industry is anticipated to record a CAGR of 3.9% over the forecast period. Aging infrastructure and ongoing public works projects are propelling equipment replacement cycles, thereby fueling growing demand for advanced tire solutions. Japan's domestic agricultural industry is also getting modernized, requiring tire models that can optimize fuel efficiency while minimizing soil disturbance.

Key players like Yokohama Rubber, Bridgestone Corporation, and Toyo Tires are investing in next-generation materials and tread technology. Smart tires with onboard telematics are becoming dominant, especially in fleet-intensive applications, as business decision-makers seek to reduce operating costs and increase service intervals.

The Chinese industry is expected to record the highest CAGR among the countries under study, exceeding 6.4% in 2025 to 2035. This is owed to gigantic infrastructure development, high-speed urbanization, and significant investments in mining operations and modernization of agriculture. Government-led economic programs continue to fund the purchase of high-performance off-highway vehicles and accessories.

Local titans like Triangle Group, Zhongce Rubber, and Aeolus Tyre are building export capability and upgrading technological expertise by automating and using AI-powered design. Rising demand for environmentally friendly tires and compliance with changing emission and efficiency regulations are driving the competitive landscape and speeding up innovation.

The Australian industry will grow at 4.7% CAGR between 2025 and 2035. Mining continues to be the strongest growth driver, especially in Queensland and Western Australia, with a continued demand for ultra-large tire sizes. Industry growth in the construction sector is driven by public-private partnerships in infrastructure for transportation and energy, which also accelerates industry growth.

Producers like Bridgestone Mining Solutions, Michelin Australia, and Goodyear Dunlop are creating regional-by-regional solutions that are responsive to tough environments. Focus on reducing downtime and elevating tire wear forecasting is translating to the growing deployment of monitoring systems and data-driven fleet management software.

New Zealand's industry is expected to advance at a 3.4% CAGR between 2025 to 2035. Agricultural use, mostly dairy and horticulture, is the major driver of demand dynamics, with increasing needs for low-ground-pressure and fuel-efficient tires. Continuous growth in the construction industry is also fueling the uptrend in the industry.

Leading players like Trelleborg, BKT, and Alliance Tire Group are reaching out further with dealer networks and product customization. Procurement policies that emphasize sustainability are driving the adoption of long-life, retreadable tire solutions, thus impacting product development strategies in the regional industry.

The off highway tires market is extremely competitive, with large manufacturers focused on durability, advanced tread designs, and sustainable materials. Industry leaders, including Bridgestone, Michelin, and Goodyear, are at the forefront of the industry with reinforced sidewalls, AI-enabled predictive maintenance, as well as self-healing rubber compounds. These companies are further investing in smart tire technology for the real-time monitoring of tire performance and adaptive inflation systems, enhancing efficiency across applications in agriculture, construction, as well as mining.

Geographical diversification, partnership deals, and product differentiation shape the industry competition. Michelin leads with its airless radial technology, giving puncture-resistant offerings for extreme terrains. Bridgestone focuses on low-rolling-resistance compounds and applications for autonomous vehicles to improve fuel efficiency for construction and agricultural machinery. On the other hand, Goodyear is a leader in the development of intelligent tires that integrate IoT-enabled monitoring systems for improved traction and wear patterns in extreme conditions.

Innovation is another important differentiator, with Yokohama Tire focusing on extreme weather conditions for high-traction rubber compounds. At the same time, China National Tire & Rubber expands its global footprint with cost-competitive off-highway tire solutions of high durability. Continental AG is forging ahead with the sustainable development of off highway tires, relying upon bio-based and recycled materials, all the while maintaining durability standards.

The industry is also driven by government regulations and environmental sustainability goals, which are met by the demands of fleet operators for extended tire life cycles. MRF and Cheng-Shin Rubber are both concentrating on affordable, high-load capacity tires for emerging industries, while Eurotire and Belshina are serving the mining and heavy equipment sectors with enhanced rubber technology. The next phase of the competition will, therefore, hinge on the development of smart tire ecosystems, automated pressure regulation as well as eco-consideration innovations.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Bridgestone | 20-24% |

| Michelin | 18-22% |

| Goodyear | 14-18% |

| Yokohama Tire | 10-14% |

| China National Tire & Rubber | 8-12% |

| Combined Others | 20-30% |

| Company Name | Offerings & Activities |

|---|---|

| Bridgestone | Smart tire technology with AI-driven wear monitoring and autonomous vehicle integration. |

| Michelin | Airless radial off highway tires with puncture-proof design and extended durability. |

| Goodyear | IoT-enabled tires with predictive maintenance as well as adaptive traction control. |

| Yokohama Tire | High-traction rubber compounds for extreme terrain and weather resilience. |

| China National Tire & Rubber | Cost-effective, high- durability off highway tires with a global expansion strategy. |

Key Company Insights

Bridgestone (20-24%)

Bridgestone leads the industry with AI-powered smart tire solutions, offering self-regulating pressure and advanced tread durability for autonomous and heavy-duty off-highway vehicles.

Michelin (18-22%)

Michelin pioneers airless radial technology, reducing downtime in construction and agricultural applications while enhancing sustainability with recycled materials.

Goodyear (14-18%)

Goodyear's intelligent off highway tires leverage IoT monitoring to optimize performance, reduce wear, and enhance grip in extreme conditions.

Yokohama Tire (10-14%)

Yokohama Tire specializes in high-traction compounds engineered for severe weather resistance and high-load applications in mining and forestry.

China National Tire & Rubber (8-12%)

China National Tire & Rubber focuses on affordable, long-lasting off-highway tire solutions, expanding in Asia, Africa as well as Latin America.

Other Key Players

By sales channel, the industry is categorized into replacement tires and OEM.

By end use, the industry is divided into industrial, agriculture, mining, and construction.

By region, the industry is segmented into North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia and Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, and The Middle East and Africa.

The industry is expected to reach a size of USD 11 billion by 2025.

Sales are projected to grow significantly, reaching USD 23.8 billion by 2035.

China is the leading country, posting a growth rate of 6.4%.

Replacement tires dominate the segment, driven by frequent usage in demanding off-road conditions.

Key players include Bridgestone, Michelin, Goodyear, Yokohama Tire, China National Tire & Rubber, MRF, Continental AG, Belshina, Cheng-Shin Rubber, and Eurotire.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Off Highway Vehicles Brake Systems Market Size and Share Forecast Outlook 2025 to 2035

Off-Highway Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Off-highway EV Component Market Size and Share Forecast Outlook 2025 to 2035

Off-highway Vehicle Engines Market Size and Share Forecast Outlook 2025 to 2035

Off Highway Radar Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Off-highway Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Off-Highway Vehicle Telematics Market - Growth, Trends & Forecast 2025 to 2035

Off-road Tires Market Size and Share Forecast Outlook 2025 to 2035

Electric Off-Highway Equipment Market Size and Share Forecast Outlook 2025 to 2035

Offshore Fibre Optic Cable Lay Market Size and Share Forecast Outlook 2025 to 2035

Office Supply Market Forecast and Outlook 2025 to 2035

Offshore Wind Market Forecast and Outlook 2025 to 2035

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Highway Maintenance Market Size and Share Forecast Outlook 2025 to 2035

Office Boiler Market Size and Share Forecast Outlook 2025 to 2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Offset Ink Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Off Road Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA