From the valuation of USD 657.12 million in 2025, the off-highway vehicle telematics market is expected to experience robust growth and expand at a rate of USD 2898.84 million by 2035 at a compound annual growth rate (CAGR) of 16.38% during the forecast period. This promising growth depicts the rapidly growing demand for real-time monitoring, fleet management, and predictive maintenance solutions, which bring operational efficiency, reduction in downtime, and increased safety in various industries such as construction, agriculture, mining, and logistics.

Construction telematics significantly accomplishes the real-time tracking of machines to operators, which can be utilized for the optimization of a particular machine in terms of its use and idling time. It gets even more critical when jobs are highly complex, as they require large fleets of machines to be coordinated across different sites. The telematics system empowers fleet operators to monitor equipment health. Thus, preemptive maintenance scheduling is done to avoid unscheduled breakdowns and costly repairs. Cost savings are achieved, and equipment lifespan is reduced.

By adopting Off-Highway Vehicle telematics, agriculturalists have modernized their farm operations. With telematics solutions on tractors, harvesters, and sprayers, farmers are able to take accurate records of weather and other field conditions to optimize planting schedules, irrigation schedules, and, above all, fuel consumption. Remote monitoring of fleet performance leads to a positive effect on operational efficiency and accuracy in agriculture, which reduces resource waste and increases crop yields.

In the mining industry, Off-Highway Vehicle telematics is of great significance in the management of thousands of mining trucks, excavators, and bulldozers. They operate in extreme conditions, while telematics gives immediate information about critical parameters like tire pressure, fuel levels, and engine performance that are helpful to the operator in reaction to immediate maintenance calls. It collects the performance parameters from various equipment and can improve fuel efficiency as well as maintain optimum equipment performance over a wide range of operable values.

The fast growth of the industry can be linked to various major factors, including increased demand for fleet management solutions, safety and emission regulations imposed on operations, and the gradual shift towards automation and IoT-compliant systems.

Industries that have always been in the race to increase their efficiency and sustainability see telematics systems coming out as vital tools in optimizing off-highway vehicle operations. Furthermore, improvements in 5G connectivity and cloud computing would continue to fuel innovations in telematics systems through faster processing as well as better real-time decision-making.

North America and Europe will continue to dominate with their respective adoptions of advanced telematics systems, which are driven by regulatory needs and technological leadership. The fast-growing region is expected to be Asia-Pacific due to rapid industrialization, increasing investments in infrastructure, and the growing mechanization of agriculture and construction industries in countries such as China, India, and Japan. Emerging industries in Latin America and Africa will also create tremendous opportunities because companies adopt more telematics to boost productivity and reduce costs in their off-highway vehicle fleets.

Market Matrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 657.12 million |

| Market Value (2035F) | USD 2898.84 million |

| CAGR (2025 to 2035) | 16.38% |

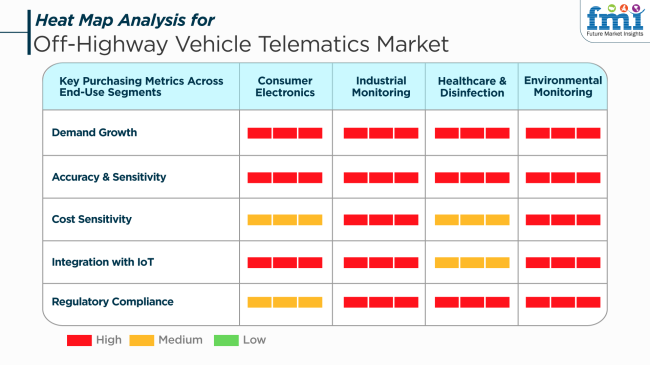

he Off-Highway Vehicle telematics industry is witnessing varied trends in application sectors fueled by different buying priorities. In industrial monitoring, the use of telematics is increasing as a result of the essential requirement for real-time diagnosis and uptime management of heavy equipment. The segment emphasizes strength in accuracy, compliance with regulations, and smooth integration with enterprise IoT networks.

In consumer electronics and environmental monitoring, remote sensing, mobility boosting, and automatic alerts are critical applications of telematics. Demand-driven growth and integration capabilities are also top priorities in fields of operation that overlap with environmental regulation and data openness. Healthcare and disinfection use, however, focuses on high sensitivity and compliance with the precision-based settings under which OHVs function.

Though cost sensitivity across segments is different, regulatory pressure is influencing adoption choices everywhere. End customers are aligning with telematics providers who provide customizable platforms, scalable software solutions, and robust connectivity in out-of-range areas. The future of segment-based adoption will depend on how well solutions combine performance analytics, compliance tracking, and cost-effective deployment.

Between 2020 and 2024, the industry showed growth due to fleet monitoring, equipment optimization, and fuel efficiency requirements in sectors such as construction, agriculture, and mining. OEMs and fleet operators embraced rudimentary telematics solutions like GPS tracking, geofencing, and utilization monitoring during this time. The COVID-19 pandemic delayed the impact at first, but as pressure to move assets remotely resurfaced, demand came back.

The spread was, however, spotty around the world as cost factors, infrastructure, and connectivity limited comprehensive rollouts in emerging economies. Between 2025 and 2035, the sector will go through a transformation through the extensive adoption of predictive maintenance platforms, AI-driven telematics, and edge-computing-based diagnostics technologies.

The addition of 5G connectivity will enable real-time decision-making and address the growing use of autonomous OHVs, particularly in mining and precision agriculture. OEMs will move towards subscription-based telematics-as-a-service offerings to capitalize on recurring revenue.

Eco-friendliness will also come into focus as the telematics platforms will help provide carbon tracking and energy efficiency and help with regulatory reporting needs. Government and regulatory support of digital infrastructure in Asia-Pacific and African countries will also lead to industry growth. Off-Highway Vehicle telematics will be an integral part of heavy-duty vehicle lifecycle management.

Comparative Market Shift Analysis: Off-Highway Vehicle Telematics Market (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| GPS tracking, remote diagnostics, and geofencing were major features. | Complete AI-powered platforms with predictive analytics, edge computing, and real-time automation. |

| Mainly for tracking locations and equipment usage reports. | Sophisticated data analytics for fuel savings, operator behavior analysis, and predictive fleet scheduling. |

| Moderately cloud-supported systems with 3G/4G capabilities. | 5G convergence with end-to-end cloud-edge communication for autonomous operations and real-time decision-making. |

| Hardware-led sales with value-added services on a pay-as-you-go basis. | Transition to subscription-based telematics-as-a-service (TaaS), providing analytics, security, and compliance packages. |

| Manual alert and periodic check-based reactive maintenance. | Predictive maintenance by AI/ML decreases downtime and increases equipment life. |

| Sustainability monitoring support is limited. | Deep energy consumption and emission monitoring; carbon footprint reduction and ESG reporting dashboards. |

| High in North America and Europe, APAC, Africa, and Latin America slowly follow. | With deep global penetration and infrastructure investments, APAC and Latin America have emerged as large growth centers. |

| Telematics is offered as an optional integration with limited standardization. | OEMs provide all-inclusive, branded telematics suites as a value-added standard in equipment packages. |

| Low upfront cost, consolidated networks, and ubiquitous connectivity. | Enhanced affordability, data standardization, and increased connectivity reach through rural 5G and satellite rollout. |

The industry is expected to see tremendous growth, enabled by technological advancement and the increasing demand for enhanced operational efficiencies in construction, agriculture, and mining. Several risks could, however, impede this growth. First is the high initial investment into telematics system installation-e.g., hardware, software, installation, and training-which could become a major barrier to entry for small and medium-sized enterprises (SMEs).

Second, data security and privacy of data become huge concerns, as telematics systems collect very sensitive information concerning vehicle location and operator behavior, making it prone to breaches if reasonable security measures are not taken. Also, navigating the complex threat posed by telematics solutions and assessing them in operating vehicle fleets presents another challenge- integration effort with various customizations for very old legacy equipment.

On the other hand, with changing regional regulatory requirements, Off-Highway Vehicle telematics systems must stay continuously updated to comply with evolving safety and environmental standards. The vast data generated by telematics systems calls for skills and a workforce to interpret and use, and the unavailability of such expertise could impede their effectiveness in other ways.

Connectivity constraints in areas with difficult access, where many of the off-highway vehicles will be in operation, might restrict the transmission of real-time data, further reducing the performance of telematics solutions. Some sectors that resist technological change may also see this as a decelerator of telematics system adoption.

Even so, for stakeholders to mitigate these risks, they should consider designing a scalable telematics solution with flexible pricing, adopting strong security mechanisms such as encryption and authentication protocols, and ensuring interoperability with other machines already on the clients' sites.

Stakeholders should also remain up to date on regulatory changes and offer training to their end users, examine alternative means of connection, and get early stakeholder engagement to address resistance to change. These all contribute to ensuring the successful adoption of telematics solutions and maintaining growth. With aggressive interventions to tackle these risks, the Off-Highway Vehicle telematics industry could sustain its growth path and gain operational efficiency and safety benefits.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 9.1% |

| UK | 8.3% |

| France | 7.9% |

| Germany | 8.6% |

| Italy | 7.5% |

| South Korea | 8.0% |

| Japan | 7.8% |

| China | 9.4% |

| Australia | 7.7% |

| New Zealand | 7.2% |

The USA will reach a CAGR of 9.1% in 2025 to 2035 through increased integration of telematics in the construction and mining industries. Strong uptake of fleet management solutions coupled with robust demand for real-time visibility and predictive maintenance features is fueling growth. Regulatory interest in employee safety and operational insight also powers adoption in heavy-duty trucks.

Technological innovation driven by leaders like Trimble Inc., Caterpillar Inc., and John Deere continually advances the horizon with regard to telematics integration. Growth in the marketplace is facilitated via huge investments in logistics operations, digitization, and infrastructure. Increased connectivity via nationwide 5G rollout enables seamless passage of vehicle diagnostics, location, and usage analytics, considerably increasing operational efficiency.

The UK will grow at a CAGR of 8.3% through the forecast period, driven by modernization in the construction and agriculture industry. The application of government policies encouraging sustainable infrastructure and smart agriculture is enhancing the adoption of telematics. IoT platform connectivity is improving operational visibility and satisfying emissions and safety requirements.

Major players like JCB, CNH Industrial, and Topcon Positioning Systems are investing significantly in region-specific telematics-enabled solutions. Cloud-based telematics platforms are adopted, which provide scalability and ease of installation. As operators aim to optimize resource utilization and asset utilization, telematics is becoming an operational imperative and not a technological indulgence.

France is poised to register a CAGR of 7.9% during 2025 to 2035. Industry growth is driven by automation and digitalization of agricultural machinery in construction. Growth is also supported by supportive government policies to improve infrastructure with less operational inefficiency through the utilization of telematics-based insights.

Principal manufacturers like Manitou Group, Volvo CE, and ACTIA Group are adopting telematics solutions on embedded systems and cloud platforms. Fleet owners are using data analysis to facilitate maintenance scheduling and minimize downtime. Environmental regulation needs and lower fuel consumption propel enhanced usage in fleets used for city construction and large-scale agricultural use.

Germany will be expanding at an 8.6% CAGR during the period 2025 to 2035 on the back of increased adoption of Industry 4.0 strategies and mechanization of heavy machinery. Germany possesses a strong manufacturing and engineering base to support telematics, which is being fueled by technological upgrades in industries such as construction machinery and mining.

Key leaders like Bosch Rexroth, Liebherr, and Deutz AG are concentrating on telematics-based predictive maintenance systems and telematics-based diagnostics. Strict safety and emission regulations are forcing fleet operators to invest in smart solutions to enable real-time monitoring of compliance. Modular telematics platforms, which have become increasingly popular, offer scalable integration across mixed-vehicle fleets, thus maximizing operating performance.

Italy is likely to witness a 7.5% CAGR through 2025 to 2035. The industry is influenced by the expansion of the use of telematics in vineyard and specialty farm equipment, as well as road construction and excavator equipment. Growing efficiency of operations and resource preservation are driving demand for smart vehicle monitoring solutions.

Operators like CNH Industrial, Merlo Group, and Argo Tractors are integrating telematics platforms with asset tracking and maintenance management. Greater connectivity infrastructure enables remote diagnostics and equipment usage reporting. National digital transition plans to modernize traditional industries through real-time data insights also allow adoption.

South Korea will expand at a CAGR of 8.0% throughout the forecast period, driven by the adoption of smart technologies in industrial and farm vehicles. Smart city investment and government-funded infrastructure development have raised the demand for connected equipment in the construction and logistics segments.

Industry players like Doosan Infracore, Hyundai Construction Equipment, and POSCO ICT are spearheading machine learning and AI-driven analytics-based telematics solutions. Autonomous systems and remote monitoring features are driving adoption in mission-critical use cases. With organizations making the process of fleet management digital, the adoption of telematics platforms becomes more critical.

Japan is predicted to show a CAGR of 7.8% between the years 2025 to 2035. Agricultural and construction automation is impacted by perpetual demand because of labor shortages and demographic shifts. Advanced telematics systems integration is allowing operators to maximize vehicle uptime and decrease maintenance procedures.

A list players like Komatsu, Hitachi Construction Machinery, and Kubota are accelerating telematics functionality with AI and cloud computing technologies. Focus on the environment and workplace safety has led to telematics becoming a major driver of equipment life cycle management. Nationwide network-building plans and digital transformation agendas further propel market penetration.

China will dominate with a projected CAGR of 9.4% during 2025 to 2035. Industrialization and infrastructure development in the country are driving the need for smart construction and mining equipment. Government efforts towards smart manufacturing and emissions management have boosted the market maturity.

Thick producers like SANY Group, XCMG, and Zoomlion enhance telematics solutions to offer predictive diagnostics, fleet utilization analysis, and reporting automation. Integration with AI and big data systems also supports project lifecycle decision-making. Growing rural modernization projects and growing applications in mechanized farming further expedite market adoption to diversified segments.

Australia will grow at a CAGR of 7.7% during the forecast period due to increasing adoption in the mining, agriculture, and construction sectors. Isolated locations and remote operations require continuous tracking of fleets and equipment monitoring in real-time, and therefore, telematics is an operational necessity.

Key leaders, including Komatsu Australia, Wenco International, and Position Partners, spearhead innovation through satellite-based tracking and analysis. Government emphasis on resource efficiency and workplace safety boosts the use of telematics-enabled vehicles. As automation and predictive maintenance are more and more dependent, the industry is shifting towards data-driven fleet optimization.

New Zealand will most likely achieve a CAGR of 7.2% during 2025 to 2035. Adoption is driven mainly by the modernization of farming practices and infrastructure development. Increased demand for transparency in operation and equipment life drives growth in telematics applications across different environments.

Trimble Navigation New Zealand and AB Equipment are two firms that offer tailor-made telematics solutions for agricultural and industrial applications. Geospatial and agritech systems integration offers enhanced asset management and control of resources. Telematics platforms then become the determining element to optimize efficiency and remain compliant with the law as the stakeholders undertake digital transformation.

OEMs account for 60% of the industry share, while the aftermarket is 40%. It signifies that the industry is increasingly realizing the performance optimization, safety monitoring, and predictive maintenance capabilities offered by factory-integrated telematics solutions.

OEMs make heavy use of this segment as manufacturers directly insert telematics systems into their vehicles for compliance with regulations, efficient use of equipment, and provision of value-added services. OEM telematics systems are more generally integrated into the vehicle's electrical and mechanical system for greater analytics and reliability.

Leading equipment makers like Caterpillar, Komatsu, Volvo Construction Equipment, and Deere & Company have proprietary telematics platforms, namely Cat Product Link™, Komtrax™, and JDLink™, respectively. These frameworks provide fleet owners with real-time data about fuel usage, idle time, maintenance needs, and location tracking- some of the crucial insights for construction, mining, and agricultural operations.

The aftermarket segment occupies a large slot of 40% but is more relevant in developing areas or with older vehicle fleets without an embedded telematics system. Camcorders and plug-and-play telematics kits that can be retrofitted onto various OHVs-from excavators and loaders to tractors and haulers-are offered by companies such as Trimble, ORBCOMM, and Trackunit, among others. They provide plenty of flexibility and are quite economical, particularly for fleet operators who want a scalable solution for remote monitoring and operational control of their fleets without having to spend on new equipment.

The growing emphasis on remote diagnostics, theft prevention, emissions monitoring, and operational transparency ensures that OEMs and Aftermarket channels will stay relevant in the Off-Highway Vehicle telematics landscape.

By 2025, telephone technology will dominate 75% of the share, and satellite technology will hold 25% of the share.

Most off-highway applications will prefer cellular-based telematics systems because of their affordability, lower latency in their services and network accessibility in the urban and semi-urban localities. Advanced communication networks using 4G LTE and 5G progressively provide high-speed data transfer that allows real-time vehicle diagnostics of a vehicle's health, location, and fleet performance.

There are OEMs, such as Volvo CE, Caterpillar, and CNH Industrial, who have standardized cellular telematics for their factory-installed systems, such as CareTrack™, Cat Product Link™, and AFS Connect™ for such applications.

The solution is that newer technology using satellites consumes about 25% of the total commercial estate while still greatly impacting areas far from the conventional cellular network or with little access to signals from these mobile operators. It can ensure that no interruption is made in the transfer of information or linkages in terrains such as mountains, deserts, offshore operations, and deep mining locations.

Companies such as ORBCOMM and Iridium Communications company can offer robust satellite telematics to serve specific segments like oil & gas, forestry, and extreme-environment mining by ensuring that their systems support mission-critical functions such as asset tracking, emergency alerts and remote equipment diagnostics beyond the reach of cellular infrastructure.

All these come together with a broad operational range covering both the technologies and operational scenarios in the OHV industry. Cellular drives mass-market adoption, and Satellite ensures operational continuity in isolated and high-risk environments.

The Off-Highway Vehicle (OHV) telematics industry is intensely competitive, with fleet efficiency, predictive analytics, and real-time data integration as major differentiators. Omnitracs, ORBCOMM, and Stoneridge lead the provision of AI-based predictive maintenance, fuel optimization, and highly advanced tracking GPS solutions for construction, agriculture, and mining equipment. Their solutions combine machine learning with edge computing, leading to more visibility in fleet management, diagnostics, and eventual automation.

Through strategic partnerships and acquisitions, the industry is also being influenced by the connected vehicle platforms that TeletracNavman and TomTom International continue to develop, along with remote asset management and driver behavior analytics geofencing capabilities. On the other hand, Trackunit A/S has enhanced its positioning by integrating IoT-powered predictive analytics, allowing proactive maintenance and operational efficiencies for large-scale fleet operators.

Among the up-and-coming companies are Zonar Systems and TTCONTROL GMBH, both of which are focused on improving data privacy by implementing cyber security and blockchain-based telematics systems aimed at tamper-proof fleet tracking. Under compact equipment telematics, Wacker Neuson offers real-time tracking and monitoring of utilization on smaller fleets across the construction industry. With the immediate adoption of AI-based telematics dashboards into the commercial area, ACTIA Group is brightening the installation of vehicle diagnostics with real-time user feedback.

Increasingly, there is the emergence of edge AI and cloud-based data ecosystems, as well as integration with digital twin technology. Future growth, therefore, would depend on AI-driven automation, seamless API connectivity, and real-time analytics for fleet operators. Organizations that sustainably manage and secure large volumes of data may not only comply with dynamic regulatory standards but also have a competitive advantage.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Omnitracs | 18-22% |

| ORBCOMM | 16-20% |

| Stoneridge | 14-18% |

| Teletrac Navman | 12-16% |

| TomTom International BV | 10-14% |

| Combined Others | 20-30% |

| Company Name | Offerings & Activities |

|---|---|

| Omnitracs | AI-powered fleet tracking with predictive analytics for off-highway vehicles. |

| ORBCOMM | IoT -integrated telematics for real-time asset monitoring and fuel optimization. |

| Stoneridge | Advanced GPS tracking and automated maintenance scheduling for OHVs. |

| Teletrac Navman | Connected vehicle solutions with geofencing and driver behavior analytics. |

| TomTom International BV | Cloud-based telematics for OHV fleet management with real-time route optimization. |

Key Company Insights

Omnitracs (18-22%)

Omnitracs leverages AI and machine learning for predictive maintenance and real-time fleet optimization, reducing downtime and operational costs for OHV operators.

ORBCOMM (16-20%)

ORBCOMM specializes in IoT-driven telematics, integrating real-time GPS tracking with remote diagnostics to enhance asset utilization and operational efficiency.

Stoneridge (14-18%)

Stoneridge focuses on automated vehicle health diagnostics, integrating AI-based maintenance alerts and sensor-driven fleet management tools.

TeletracNavman (12-16%)

TeletracNavman enhances connected fleet visibility through geofencing, driver behavior analytics, and cloud-based OHV monitoring solutions.

TomTom International BV (10-14%)

TomTom International provides real-time route optimization and cloud-based fleet tracking solutions, reducing fuel costs and improving operational efficiency.

Other Key Players

The segmentation is into Original Equipment Manufacturers (OEMs) and Aftermarket.

The segmentation is into Cellular and Satellite.

The segmentation is into Construction, Agriculture, and Mining.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The industry is estimated to reach USD 657.12 million by 2025.

Sales are projected to grow robustly, reaching USD 2898.84 million by 2035, indicating significant expansion in the off-road mobility sector.

China dominates with a strong 9.4% growth rate, driven by rapid industrialization and increased demand for construction and mining.

OEMs (original equipment manufacturers) are the leading application segment, supported by integration in newly manufactured off-road vehicles.

Notable players include Omnitracs, ORBCOMM, Stoneridge, Teletrac Navman, TomTom International BV, ACTIA Group, Wacker Neuson, Zonar Systems Inc., TTCONTROL GMBH, and Trackunit A/S.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 17: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Technology Type, 2023 to 2033

Figure 19: Global Market Attractiveness by End-Use Application, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 37: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 38: North America Market Attractiveness by Technology Type, 2023 to 2033

Figure 39: North America Market Attractiveness by End-Use Application, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Technology Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End-Use Application, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Technology Type, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End-Use Application, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Technology Type, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End-Use Application, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Technology Type, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End-Use Application, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Technology Type, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End-Use Application, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Technology Type, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End-Use Application, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Off-Highway Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Off-highway Vehicle Engines Market Size and Share Forecast Outlook 2025 to 2035

Off-highway Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Roadside Assistance Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Armor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Conversion Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA