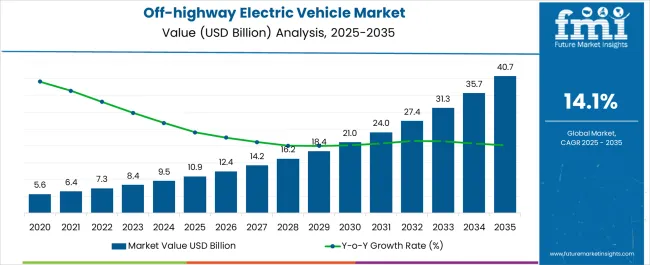

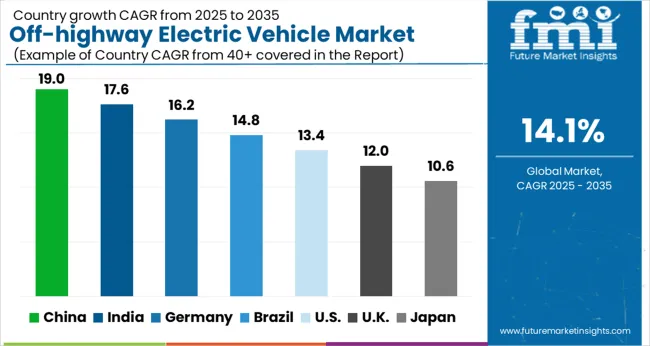

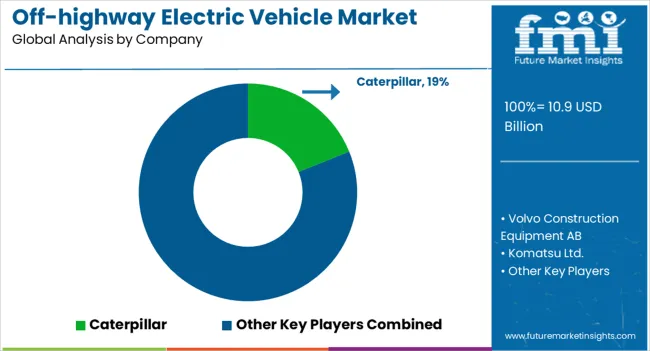

The Off-highway Electric Vehicle Market is estimated to be valued at USD 10.9 billion in 2025 and is projected to reach USD 40.7 billion by 2035, registering a compound annual growth rate (CAGR) of 14.1% over the forecast period.

| Metric | Value |

|---|---|

| Off-highway Electric Vehicle Market Estimated Value in (2025 E) | USD 10.9 billion |

| Off-highway Electric Vehicle Market Forecast Value in (2035 F) | USD 40.7 billion |

| Forecast CAGR (2025 to 2035) | 14.1% |

The off highway electric vehicle market is expanding rapidly owing to the increasing adoption of sustainable mobility solutions across construction, agriculture, and mining sectors. Escalating fuel costs and stringent emission regulations have accelerated the transition from conventional vehicles to electric alternatives.

Advancements in battery technologies, including higher energy densities and faster charging capabilities, are enabling longer operating hours and improved efficiency in demanding off road environments. Government incentives and corporate sustainability commitments are further encouraging the deployment of electric fleets.

Additionally, integration of smart telematics and automation features is enhancing operational productivity and cost efficiency, making electric models increasingly attractive. The market outlook remains robust as industries seek to reduce carbon footprints while maintaining productivity, creating significant opportunities for manufacturers and technology providers.

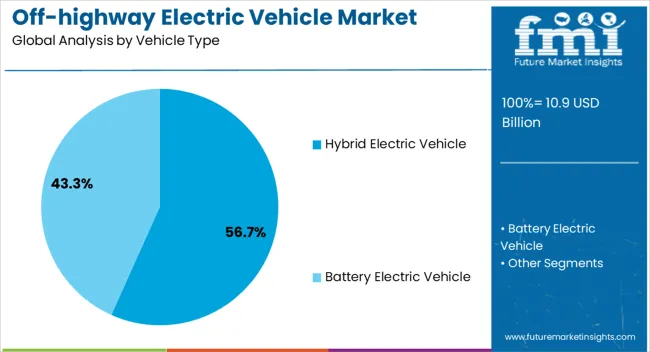

The hybrid electric vehicle type is anticipated to represent 56.70% of total market revenue by 2025, establishing itself as the dominant vehicle type. This growth is driven by the balance hybrids provide between extended operational range and reduced emissions.

Their ability to switch between electric and fuel power has proven valuable in heavy duty off road applications where uninterrupted performance is critical. Reduced dependency on charging infrastructure and lower overall operational costs have further reinforced adoption.

As industries prioritize efficiency while transitioning gradually toward full electrification, hybrid electric vehicles continue to maintain leadership in this segment.

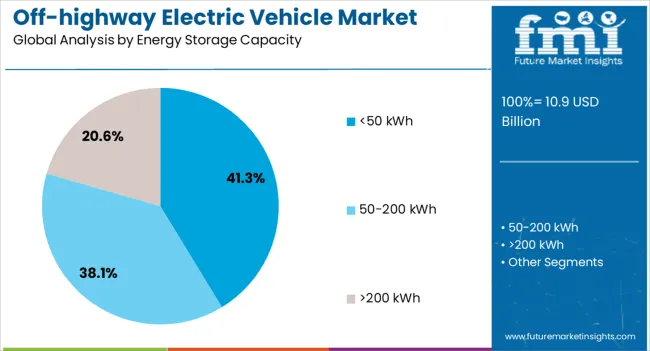

The below 50 kWh energy storage capacity segment is projected to account for 41.30% of total market revenue by 2025, making it the leading capacity range. This dominance is attributed to its suitability for compact and medium duty vehicles used in agriculture, construction, and light industrial operations.

Lower energy requirements paired with reduced charging times offer practical benefits for operators with shorter duty cycles. Cost efficiency, lighter vehicle weight, and easier integration into existing operations have enhanced preference for this capacity range.

As demand rises for affordable and reliable electric vehicles across off highway applications, the below 50 kWh category is expected to retain its strong market share.

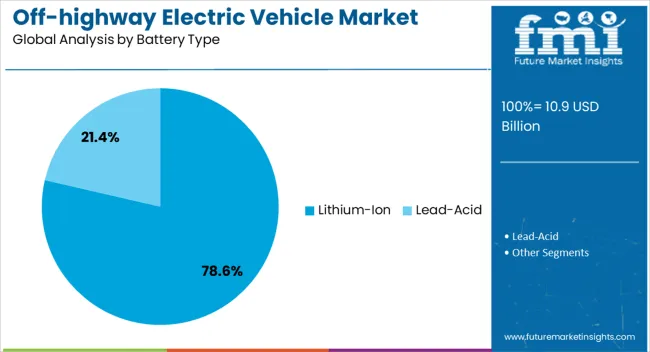

The lithium ion battery type segment is expected to hold 78.60% of market revenue by 2025, making it the leading battery technology. This is largely due to superior energy density, longer cycle life, and faster charging capabilities compared to alternative chemistries.

The ability of lithium ion batteries to withstand rigorous duty cycles while maintaining efficiency has positioned them as the standard in electric off highway vehicles. Continuous advancements in thermal management, safety, and cost reduction are further accelerating adoption.

Their adaptability across hybrid and fully electric models reinforces their dominance, establishing lithium ion as the preferred battery type for the off highway electric vehicle market.

From 2020 to 2025, the off-highway electric vehicle market grew significantly. For a variety of variables, including escalating environmental concerns, strict governmental rules, and expanding investment in electric vehicle technology, the industry experienced a boom in demand.

The rise in demand for electric cars in the construction, mining, and agricultural industries is responsible for the market's expansion. The switch to electric cars has resulted in a considerable decrease in carbon emissions and increased operating efficiency for these businesses, which were previously reliant on fossil fuel-powered vehicles.

The market has expanded as a result of developments in battery technology and charging infrastructure. Longer operational ranges and quicker charging periods made possible by the use of lithium-ion batteries have improved the viability of electric cars for off-highway applications.

The off-highway electric vehicle market is expected to experience significant growth in the coming years. Here are several short-term, mid-term, and long-term growth opportunities for the market:

Customers could benefit from this by having more options and shorter lead times. By providing incentives and subsidies, governments throughout the world are encouraging the usage of electric cars. The demand for off-highway electric cars is projected to increase as a result in the near future.

These factors are anticipated to support a 3.7X increase in the off-highway electric vehicle market between 2025 and 2035. The market is projected to be worth USD 40.7 billion by the end of 2035, according to FMI analysts.

The North America off-highway electric vehicle market dominates the global market. This market is anticipated to expand at a CAGR of 29% over the projected period. The expansion can be attributable to the existence of important businesses in North America such as Deere & Company, CNH Industrial N.V., Volvo Group, and Caterpillar. Also, the expansion of the local construction sector is boosting demand for off-highway electric machinery.

The United States off-highway electric vehicle market is expected to experience significant growth in the coming years. The United States is one of the leading off-highway electric vehicle markets given its strong infrastructure and favorable government policies that promote the adoption of electric vehicles. The construction industry is one of the leading users of off-highway electric vehicles in the United States, as electric excavators, bulldozers, and other equipment have become increasingly popular due to their lower functioning expenses and condensed environmental impact.

The primary trend in the off-highway electric vehicle business is for well-known firms to introduce new products to keep ahead of their competitors. For instance, in January 2025, The Volvo Group unveiled an electric truck in the United States with a greater range. With a range extension of up to 85% and quicker charging, this truck is a modified Volvo VNR Electric. This class 8 electric truck type has an operational range of up to 440 km and a larger energy storage capacity of up to 565 kWh.

To reduce hazardous emissions, the United States has put in place severe laws. The United States Environment Protection Agency (EPA) claims that in 2020, off-road vehicles and equipment contributed close to 30% of all greenhouse gas emissions. Companies have released electric versions of their off-highway vehicles on the market in response to growing GHG emissions. The government seeks to spend USD 9.5 million on the nation's infrastructure through the INFRA discretionary grant program, the United States Department of Transportation (DoT) announced in June 2024. The government places a high focus on the nation's infrastructure. As a consequence, throughout the projection period, opportunities are likely to present themselves for market players in off-road electric cars.

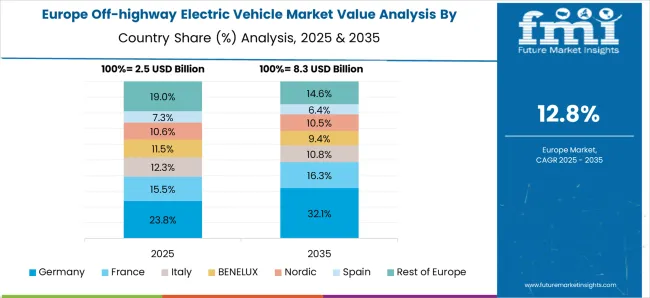

Throughout the projection period, Europe’s off-highway electric vehicle market is anticipated to expand at a CAGR of 25%. The market in Europe is expected to increase significantly as a result of rising infrastructure investments and rules limiting diesel emissions from heavy equipment.

For the past few years, the German government has continuously made investments in top-notch infrastructureThe German government has implemented several initiatives to encourage the adoption of electric vehicles, including off-highway vehicles. One of the main initiatives is the National Platform Future of Mobility, which aims to promote sustainable and eco-friendly transportation solutions, including off-highway electric vehicles.

Owing to Germany's rapidly increasing infrastructure industry, which is particularly strong in the field of roads, highways, and transportation infrastructure, other concrete and road machinery markets in the nation could experience substantial growth. The Off-highway Electrification Roadmap is an initiative that the German Federal Ministry for the Environment, Natural Conservation, and Nuclear Safety (BMU) initiated in 2020 to encourage the creation and use of electric off-highway vehicles. By 2035, the initiative hopes to reduce CO2 emissions from off-highway vehicles by 30%. Additionally, Germany has implemented the "Environmental Bonus" program that provides financial incentives for the purchase of electric vehicles, including off-highway vehicles.

Off-road electric cars have lately been created by several firms for the German market. For instance, John Deere has created the SESAM (Sustainable Energy Supply for Agricultural Machinery) electric tractor, which employs a hybrid energy source made up of batteries and an onboard generator. In the interim, Fendt created the e100 Vario electric tractor, which comes equipped with an electric motor and battery-powered driving system.

The Cat 323F Z-line is the first electric excavator produced by Caterpillar, the leading manufacturer of construction equipment in the world. The EC55 Electric, EC60E Electric, and EC220E Electric are just a few of the electric excavators that have been introduced by Volvo Construction Equipment, another significant competitor in the sector.

The United Kingdom off-highway electric vehicle market has been growing in recent years, with increasing government initiatives to promote the adoption of electric vehicles across the country. Off-highway vehicles are one of the efforts the government in the United Kingdom has made to encourage the use of electric cars there. A USD 5.6 million fund was established by the government in 2020 to build out the nation's infrastructure for electric car charging stations. Also, the government gave subsidies and tax breaks for companies buying electric vehicles.

The government has been aggressively encouraging the use of electric cars through several programs, including the Road to Zero policy, which intends to phase out the sale of conventional petrol and diesel vehicles by 2040. The government has also unveiled a USD2.71 billion strategy to promote EV adoption, which includes boosting the use of electric public transportation and expanding EV charging infrastructure. To promote the purchase of electric cars, including off-highway EVs, the government has also established tax incentives and subsidies.

The off-highway electric vehicle market in the United Kingdom is seeing significant investment from several manufacturers. An electric mini-excavator and an electric dumper truck, for instance, were created by JCB, one of the biggest producers of construction equipment worldwide. Together with the introduction of an electric compact excavator by Volvo Construction Equipment, other businesses like Caterpillar and Komatsu are also making investments in the creation of electric machinery.

According to FMI projections, the CAGR for the Asia Pacific off-highway electric vehicle market could be 15% between 2025 and 2035. With increasing construction activities, the region is anticipated to be a prominent market. A rise in infrastructure spending helped nations like Japan and China have a successful year in 2025.

The China off-highway electric vehicle market is growing rapidly, driven by government support for electrification and the country's push toward clean energy. China is a key producer of construction equipment because of its numerous original equipment manufacturers (OEMs), inexpensive labor, low production costs, and top-notch manufacturing facilities. Given the ongoing One Belt One Road effort, crane demand is rising in China. The program is likely to support the construction of buildings, railroads, and energy projects, among other forms of infrastructure.

Off-highway vehicle sales have increased as a result of an increase in mineral exploration locations and the ensuing need for sophisticated processing equipment. In 2020, China accounted for more than 50% of the global electric vehicle market, including off-highway electric vehicles. Shanxi province in China has loosened up on strict government regulations and expects to increase coke production capacity by approximately 11 million tonnes to satisfy rising demand.

The Chinese government has implemented several policies to promote the use of off-highway electric vehicles, such as tax incentives, subsidies, and the inclusion of electric vehicles in its "Made in China 2025" plan. In 2024, the government announced a new policy that incentivizes the production and sale of off-highway EVs, including tax breaks, subsidies, and preferential treatment for companies that develop and produce these vehicles.

Many Chinese companies are investing in the development of off-highway electric vehicles, with leading players such as XCMG, Sany, and Zoomlion already offering electric versions of their construction machinery. Chinese EV manufacturer BYD has been expanding its off-highway EV portfolio, with products ranging from forklifts to excavators. In 2024, the company announced a partnership with Brazilian mining company Vale to develop a fleet of electric mining trucks.

The Japan off-highway electric vehicle market is rapidly growing, driven by government initiatives and the recent development of manufacturers. Japanese manufacturers are actively developing off-highway EVs to meet the demand and take advantage of government incentives. To cut emissions and improve energy efficiency, the Japanese government has encouraged the deployment of EVs in the off-road industry. The government introduced a subsidy scheme in 2024 to promote the purchase of off-highway EVs, including construction equipment, agricultural equipment, and forklifts. The program offers qualified organizations up to 50% of the cost of EVs.

Komatsu, one of the leading construction equipment manufacturers in Japan, has been developing hybrid and all-electric construction equipment. The company launched its first all-electric mini excavator, the PC30E-5, in 2024. In September 2025, Komatsu accomplished the actual transfiguration of biomass combustion ash into fertilizer at its Awazu Plant, assisting in the lessening of industrial waste by reprocessing forest resources in Japan's Ishikawa Prefecture's Kaga area.

Hitachi Construction Machinery Co., Ltd. is a significant competitor in the market. Over the past few years, the business has been creating electric-powered forklifts and excavators. The ZX60E-5A electric excavator from Hitachi was introduced in 2024 which has a lithium-ion battery and can run for up to five hours on a single charge. Other factors influencing the off-highway electric vehicle industry in Japan are the growing emphasis on sustainability and the demand for lower emissions. Also, the price of electric vehicles has been gradually falling, making them more accessible to both consumers and companies.

The Hybrid Electric Vehicle (HEV) segment has emerged as the dominant force in the off-highway electric vehicle market. Since they combine an electric motor with a gasoline or diesel engine, HEVs are more energy-efficient than conventional internal combustion engines. Whereas the gasoline or diesel engine delivers power at high speeds, the electric motor offers power at low speeds and during acceleration. With the help of this combination, HEVs can run more effectively while using less gasoline.

HEVs provide more versatility in terms of utilization. They can be utilized in a variety of off-highway operations like construction, mining, ranching, and forestry. HEVs are a preferred option for manufacturers of off-highway vehicles due to their adaptability. Regarding dependability and durability, HEVs have a solid track record. They have shown to be strong and reliable over their many years of usage in the automobile sector. This has increased consumer and producer trust in their performance and helped them become widely used in the off-highway industry.

The development of the HEV segment in the off-highway industry has also been significantly influenced by government incentives and restrictions. HEVs satisfy the standards set forth by several governments that are pushing for the use of cleaner and more effective automobiles. HEV uptake has also been aided by incentives like tax exemptions and subsidies for their purchase.

The off-highway electric vehicle market is dominated by the construction sector for several reasons. First off, there is a rising need for more sustainable practices in the construction sector because the sector contributes significantly to greenhouse gas emissions. Off-highway electric vehicle use is one such environmentally friendly approach that lowers the carbon footprint of the sector.

Second, numerous heavy-duty labor in the construction sector necessitates the use of robust equipment. Off-highway electric vehicles can give the necessary strength and durability and, over time, are more economical and energy-efficient. Eventually, since the construction market is so fiercely competitive, businesses are constantly seeking methods to cut expenses and boost productivity. Off-highway electric vehicle use contributes to the achievement of these objectives by lowering fuel consumption and upkeep expenses.

Lastly, governments and regulatory agencies are pushing harder than ever to encourage the adoption of sustainable energy in the construction sector. Off-highway electric vehicles are becoming more appealing as a consequence of incentives and tax credits being provided to firms who invest in them. This helps them to save on expenses and comply with rules.

Manufacturers in the off-highway electric vehicle market have been implementing various strategies to capture a share of the growing market. Here are certain key strategies and recent developments:

Electric powertrain development: Several manufacturers are creating their own electric powertrains or collaborating with businesses that are experts in the field. For instance, Caterpillar and Fisker Inc. have collaborated on the design and production of electric off-road vehicles. The 310L EP, the company's first entirely electric digger, was unveiled by John Deere in 2024. The introduction of a solely remote-controlled, entirely electric (non-hydraulic drive), tiny excavator was announced by Komatsu Ltd. in July 2024. This 3-ton class excavator is entirely electric and is powered by a lithium-ion battery.

Electrification of existing products: Excavators, bulldozers, and loaders are just a few examples of the current goods that several manufacturers are creating electric versions of. For instance, Caterpillar introduced the Cat 323F Z-line, its first electric excavator, in 2024. It delivers performance comparable to that of its diesel cousin, but with fewer emissions and operational expenses. Using 350 kW permanent magnet synchronous motors, high-energy-density lithium iron phosphate batteries, and contemporary monitoring capabilities including real-time monitoring, performance analysis, and remote diagnostics, SANY Group introduced the electric version of its truck mixers in August 2024.

Battery technology: Off-highway electric vehicle success depends on the development of cutting-edge battery technology. Many producers are making investments in battery research & development activities and collaborations with battery suppliers. Proterra and Komatsu announced a cooperation in 2024 to manufacture electric mining machinery using Proterra's high-power battery technology.

Digitalization and connectivity: Off-highway electric vehicle performance and economy can be improved through digitalization and networking. To track and improve car performance, manufacturers are implementing digital technology like telematics, GPS, and artificial intelligence. For instance, in 2024 Volvo CE unveiled an electric wheel loader with telematics for remote vehicle performance monitoring.

Partnerships and collaborations: To expand their selection of electric vehicles, several manufacturers have formed partnerships with other businesses. For instance, Komatsu and battery producer Proterra collaborated to create an electric excavator with a quick-charging mechanism. To provide electric drivetrain solutions for off-highway vehicles, John Deere has also joined up with electric powertrain supplier AxleTech.

Acquisitions and investments: To acquire access to cutting-edge technology and experience, several firms are buying or investing in electric car businesses. To guarantee a supply of environmentally friendly batteries for its electric machinery, Volvo Construction Equipment bought a stake in battery maker FREYR in 2024. To increase its selection of electric vehicles, Hitachi Construction Machinery bought a share in KCM the same year.

Sustainability and environmental impact: Manufacturing companies are investing in electric off-highway vehicles as a method to lessen the environmental effect of their goods in light of the growing emphasis on sustainability and cutting carbon emissions. The 19C-1E, a completely electric small excavator from JCB that emits no emissions, was introduced in 2020. John Deere declared its intention to cut its greenhouse gas emissions by 30% by 2035 in 2024.

Research and development: Numerous manufacturers are spending money on research & development activities to raise the effectiveness and performance of their electric cars. For instance, Kubota has created an electric tractor with self-driving capabilities, while JCB has created an electric compact excavator with a five-hour range. The introduction of a solely remote-controlled, entirely electric (non-hydraulic drive), mini excavator was announced by Komatsu Ltd. in July 2024. This 3-ton class excavator is entirely electric and is powered by a lithium-ion battery.

Marketing and promotion: Manufacturers are also emphasizing the advantages of lower pollutants, less noise, and cheaper running costs when marketing their electric vehicles to stakeholders and consumers. To promote its electric cars and environmental activities, for instance, Volvo Construction Equipment has started a worldwide marketing campaign called "Building Future."

The global off-highway electric vehicle market is estimated to be valued at USD 10.9 billion in 2025.

The market size for the off-highway electric vehicle market is projected to reach USD 40.7 billion by 2035.

The off-highway electric vehicle market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in off-highway electric vehicle market are hybrid electric vehicle and battery electric vehicle.

In terms of energy storage capacity, <50 kwh segment to command 41.3% share in the off-highway electric vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Off-Highway Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Off-highway Vehicle Engines Market Size and Share Forecast Outlook 2025 to 2035

Off-Highway Vehicle Telematics Market - Growth, Trends & Forecast 2025 to 2035

Electric Off-Highway Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA