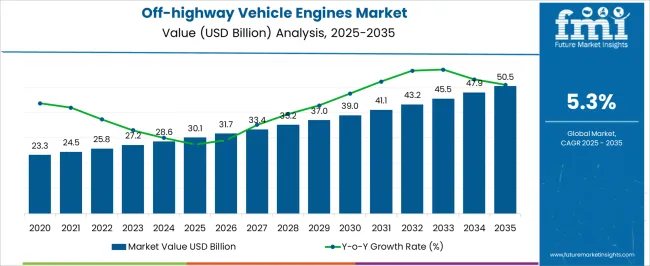

The global off-highway vehicle engines market is projected to grow from USD 30.1 billion in 2025 to USD 50.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.3%. During the early adoption phase (2020–2024), market growth was gradual, with limited deployment in niche applications such as construction, agriculture, and mining. Manufacturers focused on demonstrating engine reliability, performance, and integration with existing vehicle platforms.

By 2025, as the market reaches USD 30.1 billion, the scaling phase begins, characterized by broader adoption, increased production capacity, and the gradual expansion of applications across multiple off-highway vehicle segments. Between 2025 and 2030, the market grows steadily from USD 30.1 billion to approximately USD 37–39 billion. Adoption expands across regional markets, supported by enhanced production and distribution capabilities. The consolidation phase from 2030 to 2035 sees the market reaching USD 50.5 billion, with growth stabilizing. By this stage, off-highway vehicle engines are widely deployed, supply chains are mature, and production processes are optimized. The market transitions from steady expansion to a stable, well-established segment, reflecting predictable demand and standardized integration across vehicle types and industry applications.

| Metric | Value |

|---|---|

| Off-highway Vehicle Engines Market Estimated Value in (2025 E) | USD 30.1 billion |

| Off-highway Vehicle Engines Market Forecast Value in (2035 F) | USD 50.5 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The off-highway vehicle engines market, growing from USD 30.1 billion in 2025 to USD 50.5 billion by 2035 at a CAGR of 5.3%, exhibits key breakpoints that highlight shifts in adoption and market dynamics. The first significant breakpoint occurs around 2025, when the market reaches USD 30.1 billion. At this stage, adoption moves from early-stage, selective deployment to broader commercial integration across construction, agriculture, and mining vehicles. Increased production capacity, reliability of engines, and successful early implementations drive confidence among manufacturers and end-users. This phase represents the scaling period, with accelerating adoption, expanded manufacturing capabilities, and gradual establishment of supply chain and distribution networks.

A second critical breakpoint emerges between 2030 and 2032, as the market approaches USD 43–45 billion. By this stage, off-highway vehicle engines are widely adopted, and the market begins transitioning from rapid growth to consolidation. Major manufacturers solidify their market positions, and supply chains, distribution, and after-sales services stabilize. By 2035, reaching USD 50.5 billion, the market reflects full consolidation, with engines for off-highway vehicles established as standard components. Mature production, optimized logistics, and predictable adoption patterns ensure long-term stability, positioning the market as a well-established segment within heavy equipment and industrial vehicles.

The Off Highway Vehicle Engines market is experiencing notable growth, supported by rising infrastructure development, expansion in mining activities, and increasing mechanization in agriculture and construction sectors. Demand has been driven by the need for high-performance engines capable of operating under extreme environmental conditions while ensuring fuel efficiency and durability. Advancements in engine design, integration of electronic control systems, and compliance with stringent emission standards have further enhanced adoption across diverse applications.

The shift toward more powerful and fuel-efficient engines is being reinforced by the expansion of large-scale infrastructure projects and global supply chain modernization. Growing demand in emerging markets, combined with the replacement of aging fleets in developed regions, is sustaining momentum.

Additionally, investments in alternative fuel technologies and hybrid solutions are opening pathways for future innovation As regulatory frameworks evolve and industrial operations expand, off highway vehicle engines are positioned to remain integral to high-demand sectors, ensuring consistent growth in the years ahead.

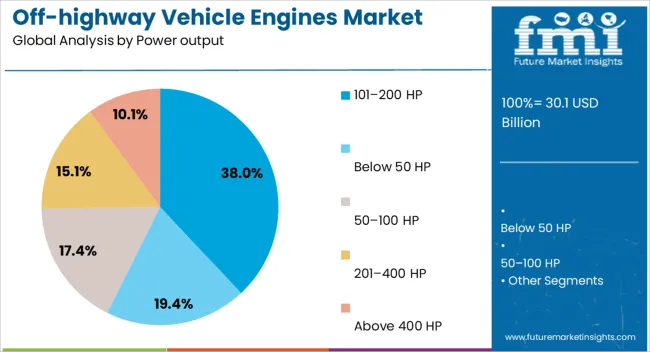

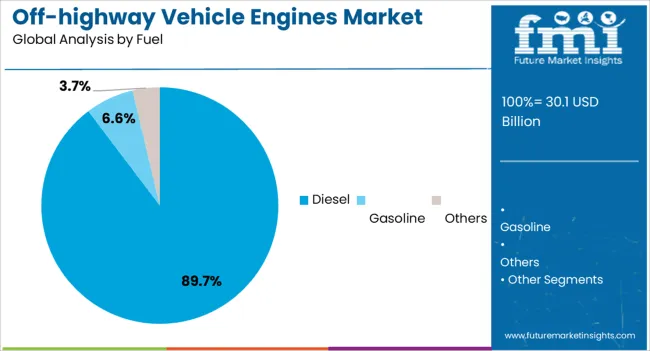

The off-highway vehicle engines market is segmented by power output, fuel, application, engine, and geographic regions. By power output, off-highway vehicle engines market is divided into 101–200 HP, Below 50 HP, 50–100 HP, 201–400 HP, and Above 400 HP. In terms of fuel, off-highway vehicle engines market is classified into Diesel, Gasoline, and Others.

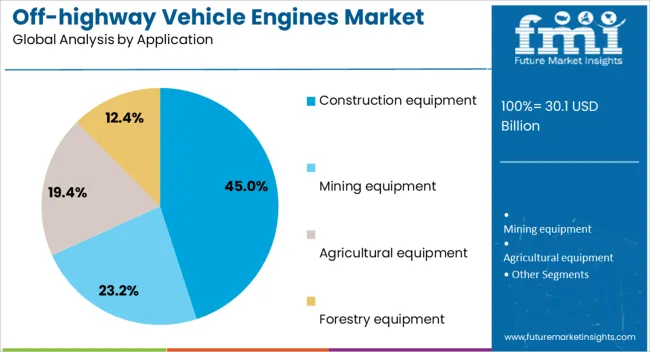

Based on application, off-highway vehicle engines market is segmented into Construction equipment, Mining equipment, Agricultural equipment, and Forestry equipment. By engine, off-highway vehicle engines market is segmented into Internal combustion engines (ICE), Hybrid engines, and Electric engines. Regionally, the off-highway vehicle engines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 101–200 HP power output segment is projected to hold 38% of the Off Highway Vehicle Engines market revenue share in 2025, making it the leading output category. This dominance has been supported by its suitability for a wide range of off highway vehicles, including those used in construction, agriculture, and mining.

Engines in this range provide an optimal balance of power, fuel efficiency, and operational versatility, meeting the performance demands of mid-sized equipment while maintaining manageable operating costs. Their ability to deliver reliable performance under varied load conditions has reinforced their adoption in high-utilization environments.

The segment’s growth is further strengthened by advancements in engine technology, which enhance torque output, reduce emissions, and extend service intervals. As demand for versatile machinery increases in infrastructure and resource-driven industries, engines within the 101–200 HP range continue to represent the preferred choice for operators seeking durability, efficiency, and adaptability across multiple operational requirements.

The diesel fuel segment is expected to account for 89.70% of the Off Highway Vehicle Engines market revenue share in 2025, underscoring its dominant position. This leadership is attributed to the superior torque, fuel efficiency, and durability offered by diesel engines, which are essential for heavy-duty applications in challenging environments.

Diesel engines have been widely adopted for their ability to operate efficiently over long durations while handling significant load demands, making them ideal for off-highway vehicles in construction, mining, and agriculture. The segment’s prominence has been reinforced by continued improvements in diesel engine technology, including advanced fuel injection systems, turbocharging, and exhaust after-treatment solutions that ensure compliance with evolving emission regulations.

Additionally, the extensive global infrastructure for diesel fuel distribution supports consistent availability and cost-effectiveness. As industries continue to prioritize high-output, long-life engines for demanding operations, diesel remains the fuel of choice, maintaining its substantial share in the overall market.

The construction equipment segment is projected to hold 45% of the Off Highway Vehicle Engines market revenue share in 2025, positioning it as the leading application area. This dominance has been driven by the rising demand for infrastructure development, urban expansion, and large-scale construction projects worldwide. Engines used in construction equipment are required to deliver high power output, durability, and operational efficiency under continuous and demanding workloads.

The segment’s growth is further supported by increased investment in road building, commercial real estate, and industrial facility development, particularly in emerging economies. Technological advancements in engine design, including fuel efficiency improvements and reduced emissions, have made these engines more cost-effective and environmentally compliant.

The capacity of modern engines to integrate with telematics and monitoring systems has also enhanced equipment productivity and lifecycle management. With global construction activity continuing to accelerate, the demand for high-performance engines in this segment is expected to remain strong and sustain its leading market position.

The off-highway vehicle engines market is growing as demand rises for efficient, durable, and high-performance engines across construction, agriculture, mining, and industrial sectors. Engines for off-highway vehicles must meet stringent emission standards, fuel efficiency requirements, and reliability expectations in challenging environments. Adoption is fueled by advancements in engine technology, such as turbocharging, electronic fuel injection, and hybrid solutions. Growing emphasis on sustainability, operational cost reduction, and regulatory compliance is shaping market trends. Companies that deliver robust, low-emission, and technologically advanced engines are well-positioned to capitalize on modernization initiatives and expanding industrial and agricultural mechanization globally.

Off-highway vehicle engines face significant challenges related to emissions compliance, durability, and performance under harsh operating conditions. Engines are subject to long operational hours in dusty, uneven, or high-temperature environments, which can affect reliability and maintenance cycles. Meeting evolving emission regulations across different regions adds complexity to engine design and increases production costs. Engine manufacturers must optimize combustion, fuel injection, and exhaust systems to maintain performance while minimizing environmental impact. Integration with hybrid or alternative fuel systems further increases design complexity. Additionally, aftermarket service infrastructure and skilled maintenance personnel are critical to sustain engine performance in remote locations. Companies must focus on advanced materials, precision manufacturing, and rigorous testing to overcome these operational and regulatory challenges.

The off-highway vehicle engines market is trending toward electrification, hybrid powertrains, and advanced fuel systems. Manufacturers are increasingly developing engines that combine diesel, natural gas, or battery-electric components to improve efficiency and reduce emissions. Turbocharging, electronic fuel injection, and intelligent engine management systems are enhancing performance and operational flexibility. Integration with telematics and IoT-based monitoring systems allows predictive maintenance, real-time performance tracking, and improved fleet management. There is also growing adoption of engines optimized for alternative fuels, including biofuels and hydrogen, in line with sustainability goals. These trends reflect the industry's focus on energy efficiency, environmental compliance, and smarter engine solutions to meet evolving customer and regulatory demands in construction, mining, agriculture, and industrial sectors.

The off-highway vehicle engines market offers substantial opportunities driven by infrastructure development, industrial expansion, and agricultural mechanization. Construction projects, road development, mining operations, and large-scale agricultural initiatives increase demand for robust and high-performance engines. Emerging markets present significant potential as mechanization and industrialization accelerate, creating a need for reliable off-highway machinery. Demand for engines with low operating costs, fuel efficiency, and emission compliance is increasing. Additionally, aftermarket services, retrofitting, and upgrading of older engines present business opportunities for manufacturers. Partnerships with OEMs, government programs promoting infrastructure development, and the adoption of digital monitoring solutions can enhance market penetration. Companies that provide versatile, durable, and environmentally compliant engines can capture significant growth across diverse applications.

Market growth for off-highway vehicle engines is restrained by high manufacturing costs, technical complexity, and stringent regulatory requirements. Advanced engines with low emissions, hybrid systems, or alternative fuel compatibility involve significant R&D, precision manufacturing, and quality control. The complexity of integrating new technologies while maintaining reliability under harsh conditions can increase production timelines and costs. Fuel availability and infrastructure for alternative energy sources may limit adoption in certain regions. Maintenance requirements and the need for skilled technicians further impact total operational costs for end-users. Until production costs decrease and technical challenges related to emissions compliance, hybrid integration, and durability are addressed, engine adoption may remain concentrated in high-value, large-scale industrial, construction, and agricultural applications.

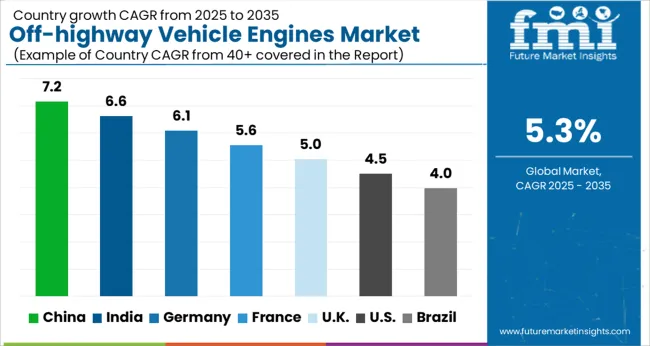

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global off-highway vehicle engines market is projected to grow at a CAGR of 5.3% through 2035, supported by increasing demand across construction, agriculture, and mining applications. Among BRICS nations, China has been recorded with 7.2% growth, driven by large-scale production and deployment in construction and agricultural machinery, while India has been observed at 6.6%, supported by rising utilization in mining, agriculture, and industrial vehicles. In the OECD region, Germany has been measured at 6.1%, where production and adoption for off-highway engines in industrial and construction applications have been steadily maintained. The United Kingdom has been noted at 5.0%, reflecting consistent use in construction and agricultural machinery, while the USA has been recorded at 4.5%, with production and utilization across mining, agriculture, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The off-highway vehicle engines market in China is growing at a CAGR of 5.3%, driven by rising infrastructure projects, agriculture mechanization, and construction equipment demand. Engine manufacturers are focusing on improving fuel efficiency, emission compliance, and durability for heavy machinery, agricultural tractors, and construction vehicles. Government policies promoting sustainable transport, low emission zones, and industrial modernization are supporting market growth. R&D investments are targeting advanced engine technologies, hybrid solutions, and emission reduction systems. Pilot programs in construction and mining projects demonstrate operational benefits such as lower fuel consumption and reduced maintenance costs. Collaborations between domestic manufacturers and international technology providers are enhancing engine performance and reliability. Increasing demand for high performance, environmentally friendly, and cost effective engines continues to support steady growth in China’s off-highway vehicle sector.

Off-highway vehicle engines market in India is expanding at a CAGR of 5.3%, fueled by growth in agriculture, mining, and construction industries. Engines are required for tractors, excavators, loaders, and other heavy machinery, with increasing focus on fuel efficiency, emissions compliance, and reliability. Government programs promoting mechanization, rural infrastructure development, and industrial modernization are accelerating market adoption. Engine manufacturers are investing in hybrid solutions, advanced combustion technologies, and emission control systems. Pilot projects in mining, construction, and agriculture are demonstrating improved operational efficiency and lower maintenance costs. Collaborations between domestic firms and international technology providers are enhancing engine performance and compliance with global emission standards. Rising demand for cost effective, durable, and environmentally compliant engines is supporting steady market growth across India’s off-highway vehicle sector.

Off-highway vehicle engines market in Germany is recording a CAGR of 6.1%, supported by strong industrial, construction, and agricultural sectors. Engines are widely used in tractors, excavators, loaders, and industrial machinery, with focus on fuel efficiency, durability, and emission compliance. Manufacturers are investing in hybrid engines, emission reduction technologies, and advanced combustion solutions. Pilot projects in construction sites, farms, and industrial plants are validating operational benefits such as reduced fuel consumption and improved productivity. Government regulations promoting low emission machinery, renewable energy powered vehicles, and sustainable industrial practices are encouraging adoption. Collaborations between research institutes, technology firms, and manufacturers are advancing engine performance, reliability, and compliance with strict European emission standards. Germany’s strong industrial base continues to drive steady demand for high performance off-highway vehicle engines.

The United Kingdom is experiencing a CAGR of 5.0% in the off-highway vehicle engines market, driven by demand in construction, agriculture, and mining industries. Engine manufacturers are focusing on improving fuel efficiency, durability, and compliance with emission standards for tractors, excavators, and loaders. Government policies promoting sustainable machinery, energy efficiency, and infrastructure development are supporting market growth. R&D initiatives are targeting advanced combustion engines, hybrid solutions, and emission reduction systems. Pilot projects in construction and agricultural operations demonstrate operational benefits including lower fuel consumption and reduced maintenance costs. Collaborations between domestic manufacturers and international technology partners are enhancing engine performance, reliability, and emission compliance. Increasing adoption of environmentally friendly and high performance engines is supporting steady growth in the UK off-highway vehicle sector.

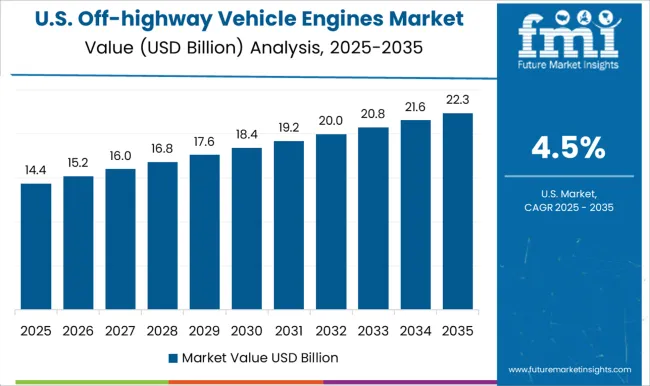

The United States off-highway vehicle engines market is growing at a CAGR of 4.5%, driven by adoption in agriculture, construction, and mining sectors. Engines are required for tractors, loaders, excavators, and other heavy machinery, with emphasis on fuel efficiency, reliability, and emissions compliance. Manufacturers are investing in hybrid engines, emission control technologies, and advanced combustion systems. Pilot projects in construction sites, farms, and industrial plants demonstrate benefits such as reduced fuel consumption, lower maintenance costs, and higher productivity. Government regulations promoting low emission engines, energy efficient machinery, and sustainable industrial practices are encouraging adoption. Collaborations between domestic firms and international technology providers are enhancing performance, durability, and emission compliance. Rising demand for cost effective, high performance, and environmentally friendly engines continues to drive steady market growth.

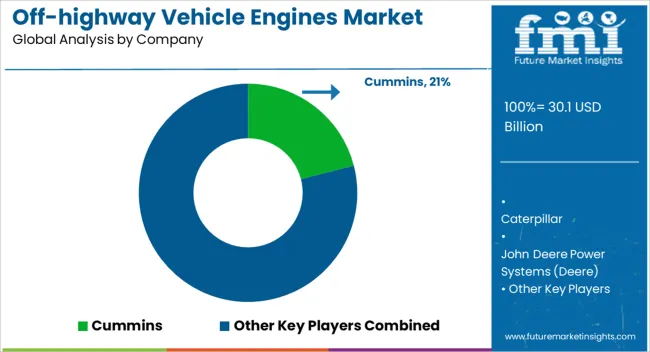

The off-highway vehicle engine market is intensely competitive, with key players like Cummins, Caterpillar, John Deere, Kubota, Volvo Penta, Yanmar, FPT Industrial, and others vying for dominance. Cummins differentiates itself by offering a diverse range of engines, including diesel, natural gas, and alternative fuel options, catering to various off-highway applications such as construction, agriculture, and mining. Their product brochures emphasize performance, durability, and compliance with global emission standards, providing detailed specifications and application scenarios to assist OEMs in selecting the appropriate engine for their needs. Caterpillar's product literature highlights their commitment to delivering high-performance engines designed for heavy-duty off-highway applications, focusing on fuel efficiency, reliability, and integration with their extensive equipment lineup.

John Deere's brochures showcase their PowerTech™ engines, emphasizing their versatility and compliance with stringent emission regulations, offering solutions for a wide range of off-highway equipment. Kubota's product materials highlight their compact and efficient engines, suitable for utility vehicles and small construction equipment, focusing on ease of maintenance and fuel efficiency. Volvo Penta's brochures detail their Stage V-compliant engines, emphasizing low emissions, fuel efficiency, and integration with their marine and industrial applications. Yanmar's product literature focuses on their compact and powerful engines, suitable for a variety of off-highway applications, highlighting their durability and fuel efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 30.1 Billion |

| Power output | 101–200 HP, Below 50 HP, 50–100 HP, 201–400 HP, and Above 400 HP |

| Fuel | Diesel, Gasoline, and Others |

| Application | Construction equipment, Mining equipment, Agricultural equipment, and Forestry equipment |

| Engine | Internal combustion engines (ICE), Hybrid engines, and Electric engines |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cummins, Caterpillar, John Deere Power Systems (Deere), Kubota, Volvo Penta, Yanmar, FPT / Fiat Powertrain, and Others (Weichai, Deutz, Isuzu, Mahindra, etc.) |

| Additional Attributes | Dollar sales by type including diesel, gasoline, and electric engines, application across agriculture, construction, mining, and forestry vehicles, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising mechanization in agriculture, increasing infrastructure projects, and demand for fuel-efficient and low-emission engine technologies. |

The global off-highway vehicle engines market is estimated to be valued at USD 30.1 billion in 2025.

The market size for the off-highway vehicle engines market is projected to reach USD 50.5 billion by 2035.

The off-highway vehicle engines market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in off-highway vehicle engines market are 101–200 hp, below 50 hp, 50–100 hp, 201–400 hp and above 400 hp.

In terms of fuel, diesel segment to command 89.7% share in the off-highway vehicle engines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Off-Highway Vehicle Telematics Market Size and Share Forecast Outlook 2025 to 2035

Off-Highway Vehicle Telematics Market - Growth, Trends & Forecast 2025 to 2035

Off-highway Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-Mounted Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Roadside Assistance Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Armor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA