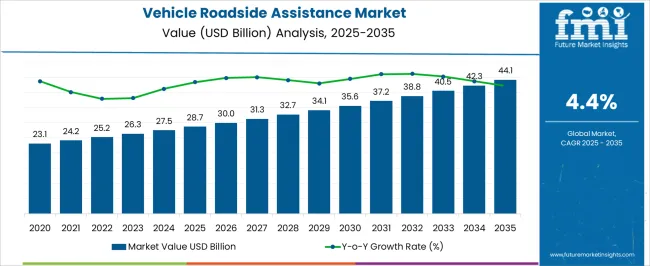

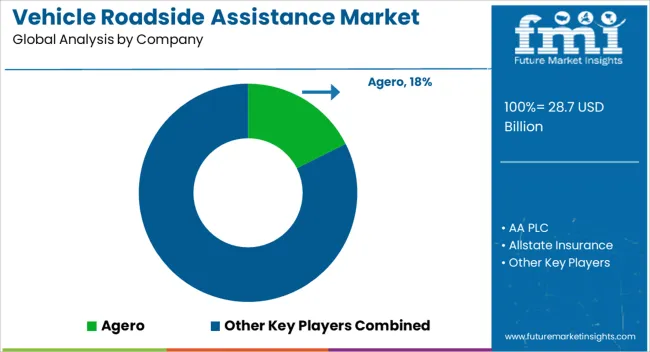

The vehicle roadside assistance market is estimated to be valued at USD 28.7 billion in 2025 and is projected to reach USD 44.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

During the first five years from 2025 to 2030, the market will rise steadily from USD 28.7 billion to USD 35.6 billion, showing predictable year-on-year gains. This upward trajectory reflects the consistent demand for emergency vehicle services, including towing, battery jump-starts, tire replacements, and lockout support. Growing vehicle ownership and the rising number of aging vehicles on the road are increasing reliance on assistance providers. Insurance companies and automobile clubs are also strengthening their offerings, ensuring wider availability of these services. This growth block emphasizes the dependable expansion of a sector closely tied to everyday mobility requirements.

Between 2030 and 2035, the market is projected to advance from USD 35.6 billion to USD 44.1 billion, sustaining its smooth growth curve. This period reflects greater adoption of subscription-based assistance packages, integration of digital platforms for faster service dispatch, and broader partnerships between automakers and service providers. Expanding coverage in emerging economies, where road infrastructure and vehicle fleets are expanding rapidly, is also expected to fuel market value. The shape of this curve suggests that growth will remain stable, supported by consistent demand across both passenger and commercial vehicles. With service innovation, improved response efficiency, and customer-focused solutions becoming key differentiators, the vehicle roadside assistance market is positioned to remain a critical segment within the global automotive services industry.

| Metric | Value |

|---|---|

| Vehicle Roadside Assistance Market Estimated Value in (2025 E) | USD 28.7 billion |

| Vehicle Roadside Assistance Market Forecast Value in (2035 F) | USD 44.1 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The vehicle roadside assistance market holds varied levels of significance within broader service-oriented automotive and mobility domains, with its share reflecting the reliance of drivers and fleet operators on immediate support solutions. Within the automotive aftermarket services market, roadside assistance contributes about 12%, as it complements repair, maintenance, and parts replacement by offering on-the-spot solutions. In the vehicle insurance services market, its share is around 8%, since insurance companies frequently bundle roadside assistance as a value-added service to enhance policy attractiveness. Within the automotive fleet management market, roadside assistance accounts for approximately 10%, reflecting the need for prompt service coverage in commercial fleets where downtime directly impacts operating costs. In the wider mobility and transportation services market, the share of roadside assistance stands near 6%, with ride-hailing operators, rental agencies, and mobility-as-a-service providers increasingly incorporating such coverage.

Finally, within the emergency and safety services market, roadside assistance contributes around 7%, positioned alongside emergency medical, towing, and safety response systems. Collectively, these percentages demonstrate that while roadside assistance is a specialized segment, it achieves stronger positioning in aftermarket and fleet-focused markets where service reliability is paramount. Its moderate contributions in insurance and mobility services underscore its expanding integration into bundled offerings, while its steady share in safety services highlights its role as a vital link in the broader emergency response ecosystem.

The vehicle roadside assistance market is experiencing robust growth due to the rising vehicle ownership rates, increasing vehicle breakdown incidences, and growing consumer awareness about the benefits of roadside assistance plans. Expanding motor insurance penetration and bundled assistance services from insurers and automakers are further boosting adoption rates.

Technological advancements such as real-time GPS tracking and mobile-based service requests are enhancing service efficiency and customer satisfaction. Additionally, growth in long-distance travel, coupled with the rising number of aging vehicles on the road, is driving the need for comprehensive assistance coverage.

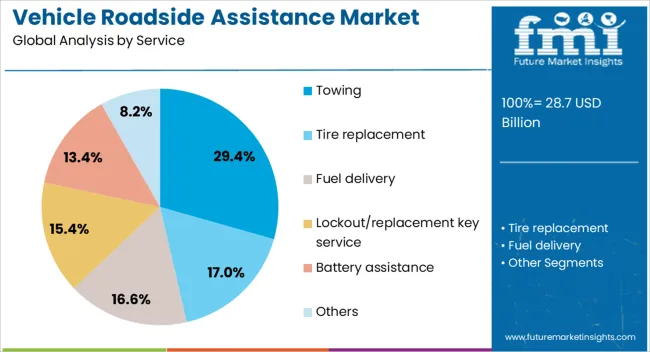

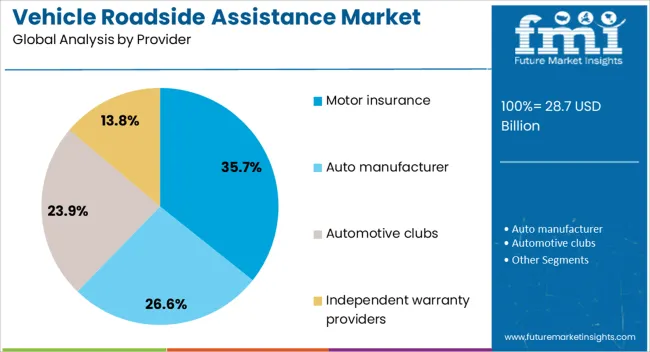

The vehicle roadside assistance market is segmented by service, vehicle, provider, service channel, and geographic regions. By service, vehicle roadside assistance market is divided into towing, tire replacement, fuel delivery, lockout/replacement key service, battery assistance, and others. In terms of vehicle, vehicle roadside assistance market is classified into passenger cars and commercial vehicles. Based on provider, vehicle roadside assistance market is segmented into motor insurance, auto manufacturer, automotive clubs, and independent warranty providers. By service channel, vehicle roadside assistance market is segmented into OEM networks, insurance company networks, independent providers, and third-party service providers. Regionally, the vehicle roadside assistance industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vehicle roadside assistance market is expanding as motorists and fleets increasingly seek reliable emergency support services. Opportunities are strengthening through partnerships with OEMs, insurance firms, and fleet operators, while trends highlight subscription-based and on-demand assistance models integrated with digital platforms. Challenges persist in ensuring wide coverage, managing operational costs, and maintaining fast response times. In my opinion, long-term competitiveness will belong to providers that deliver efficient, technology-enabled, and customer-focused roadside solutions, ensuring stronger positioning in the evolving mobility services landscape.

Demand for vehicle roadside assistance has been strengthened by the increasing number of vehicles on roads and rising concerns over driver safety. Breakdowns, flat tires, battery failures, and fuel shortages have reinforced the need for quick-response roadside solutions. Insurance providers and automobile manufacturers are integrating roadside assistance packages as standard offerings to attract and retain customers. In my opinion, demand will continue to grow as motorists prioritize reliability and convenience, making roadside services an indispensable part of modern vehicle ownership across both developed and developing regions.

Opportunities are widening in connected vehicle services and fleet management, where roadside assistance is becoming a critical value-added feature. Commercial fleets, rental operators, and logistics firms are adopting comprehensive assistance programs to reduce downtime and protect assets. Integration with mobile apps, GPS tracking, and digital payment systems is enhancing customer convenience and loyalty. I believe companies that expand partnerships with automotive OEMs and fleet operators, while offering customizable service packages, will capture strong opportunities and build long-term relationships in this evolving mobility ecosystem.

Trends indicate a shift toward subscription-based services and app-driven on-demand roadside assistance. Consumers are favoring pay-per-use models and flexible memberships that allow access to immediate help without long-term commitments. Partnerships between assistance providers, insurance firms, and mobility platforms are shaping service delivery. In my opinion, this trend reflects the market’s movement toward personalization and convenience, with digital integration emerging as the defining factor in customer satisfaction and competitive differentiation within roadside assistance services worldwide.

Challenges include inconsistent service coverage in remote areas, high operational costs, and dependency on third-party contractors. Maintaining quick response times across geographies remains difficult, particularly in regions with limited infrastructure. Rising costs of fuel, vehicle maintenance, and workforce management also pressure service providers. In my assessment, providers that invest in stronger networks, scalable digital platforms, and efficient resource management will overcome these hurdles, while those unable to balance cost with service quality may face declining customer loyalty and competitive positioning.

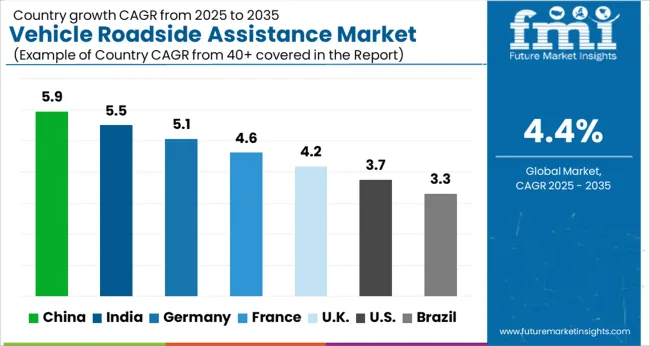

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

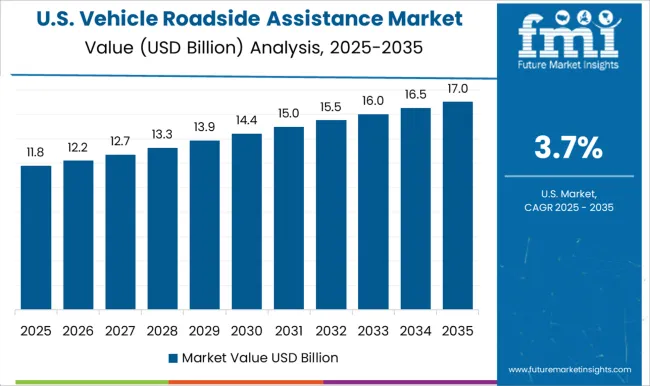

| USA | 3.7% |

| Brazil | 3.3% |

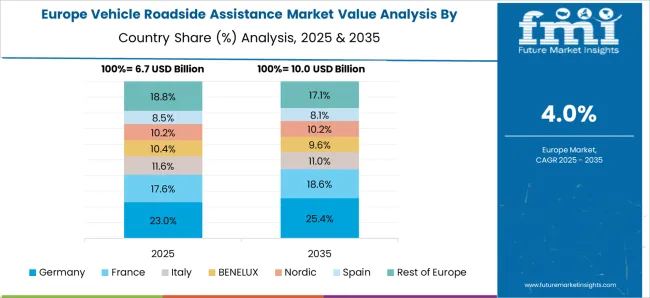

The global vehicle roadside assistance market is projected to grow at a CAGR of 4.4% from 2025 to 2035. China leads with a growth rate of 5.9%, followed by India at 5.5%, and France at 4.6%. The United Kingdom records a growth rate of 4.2%, while the United States shows the slowest growth at 3.7%. Expansion is supported by rising vehicle ownership, increased adoption of extended warranty programs, and growing reliance on roadside support networks. Emerging economies such as China and India benefit from expanding vehicle fleets and stronger service networks, while developed economies like the USA, UK, and France focus on digitization, connected mobility platforms, and value-added assistance offerings. This report includes insights on 40+ countries; the top markets are shown here for reference.

The vehicle roadside assistance market in China is projected to grow at a CAGR of 5.9%. Rising car ownership, expansion of expressways, and higher consumer demand for emergency roadside services are driving market growth. Automobile manufacturers and insurance companies are increasingly offering bundled assistance programs with vehicle purchases and policies. The adoption of mobile apps and telematics systems is making service delivery faster and more efficient. With growing vehicle sales in urban and semi-urban areas, China is positioning itself as one of the most dynamic markets for roadside assistance expansion.

The vehicle roadside assistance market in India is expected to grow at a CAGR of 5.5%. Growth is fueled by rising disposable incomes, increased vehicle ownership, and awareness of roadside safety services. Automobile OEMs and insurance companies are actively promoting roadside assistance as part of extended warranty and customer retention programs. Expanding highway networks and the rise of app-based service providers are improving accessibility. Rapid adoption of digital platforms for on-demand roadside assistance is strengthening the service ecosystem, making India an important growth hub for global and domestic providers alike.

The vehicle roadside assistance market in France is projected to grow at a CAGR of 4.6%. France’s mature automotive industry and widespread insurance coverage are key factors supporting steady demand. Assistance services are typically bundled with vehicle financing and warranty products, ensuring wide consumer access. Growing use of digital channels and mobile apps for real-time assistance requests is improving customer satisfaction. The rising number of electric vehicles is also shaping the market, as specialized roadside services for EVs are being introduced. These dynamics ensure France maintains a strong role in the European roadside assistance landscape.

The vehicle roadside assistance market in the UK is projected to grow at a CAGR of 4.2%. Growth is supported by the country’s established service providers and rising consumer expectations for reliability and convenience. Integration of advanced diagnostics, telematics, and app-based booking systems is transforming service delivery. Assistance programs are increasingly targeting electric and hybrid vehicles, with services tailored to charging and breakdown support. Partnerships between OEMs, insurers, and dedicated roadside providers ensure competitive offerings, keeping the UK market resilient despite slower growth compared to emerging economies.

The vehicle roadside assistance market in the USA is projected to grow at a CAGR of 3.7%. While growth is slower than in Asia, demand remains strong due to high vehicle ownership and a well-established service ecosystem. Insurance companies, automotive clubs, and OEMs play a key role in bundling assistance programs with policies and warranties. The USA market is also evolving toward digital roadside platforms that provide real-time service tracking and improved response times. With a rising EV fleet, specialized roadside assistance is gaining importance, ensuring steady demand despite market maturity.

Competition in the vehicle roadside assistance sector has intensified as insurers, automakers, and specialist providers attempt to differentiate through speed of response, technology integration, and customer loyalty programs. Agero and AAA rely on wide national networks and long-standing member relationships, while AA PLC positions its reputation in the UK with tiered packages that emphasize reliability. Insurers such as Allstate, GEICO, and Liberty Mutual integrate roadside coverage as part of broader policies, creating bundled appeal. Automakers like Nissan Motor deploy branded assistance to strengthen post-sale service, while MAPFRE-ASISTENCIA and ARC compete by offering cross-border reach and multilingual support for drivers in multiple regions.

Strategies are anchored in digital platforms and mobile applications that shorten response times. Predictive analytics and GPS-driven dispatch tools have been deployed to cut waiting periods, with service guarantees promoted as competitive levers. Loyalty points, insurance-linked discounts, and expanded coverage, spanning flat tire fixes, towing, fuel delivery, and lockout help, are packaged to reinforce customer retention. Providers also highlight cost predictability by emphasizing subscription-style models over transactional callouts, allowing them to capture recurring revenue streams. Partnerships with repair shops and tow fleets enhance coverage depth and increase reliability across geographies.

Product brochures emphasize service inclusivity rather than stand-alone perks. Offerings highlight nationwide towing radius, 24/7 multilingual helplines, roadside tech assistance, on-demand claims integration, and exclusive auto-partner tie-ins. Premium packages include concierge services, hotel discounts, and extended travel coverage. Clear visual layouts stress peace of mind, instant connectivity through mobile apps, and guaranteed turnaround times. By showcasing convenience, coverage breadth, and digital ease, brochures are positioned as both marketing tools and reassurance material for policyholders and motorists evaluating long-term commitment.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.7 billion |

| Service | Towing, Tire replacement, Fuel delivery, Lockout/replacement key service, Battery assistance, and Others |

| Vehicle | Passenger cars and Commercial vehicles |

| Provider | Motor insurance, Auto manufacturer, Automotive clubs, and Independent warranty providers |

| Service Channel | OEM networks, Insurance company networks, Independent providers, and Third-party service providers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Agero, AA PLC, Allstate Corporation, American Automobile Association, GEICO, Liberty Mutual Insurance, MAPFRE Asistencia Compañía Internacional de Seguros y Reaseguros, S.A., National General Motor Club, Nissan Motor Co., Ltd. |

| Additional Attributes | Dollar sales by service type (towing, jump-start, fuel delivery, lockout), Dollar sales by vehicle type (passenger cars, commercial vehicles, two-wheelers), Trends in subscription-based mobility services and insurance tie-ups, Use of telematics and mobile apps for service delivery, Growth in highway infrastructure and vehicle ownership, Regional adoption patterns across North America, Europe, and Asia-Pacific. |

The global vehicle roadside assistance market is estimated to be valued at USD 28.7 billion in 2025.

The market size for the vehicle roadside assistance market is projected to reach USD 44.1 billion by 2035.

The vehicle roadside assistance market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in vehicle roadside assistance market are towing, tire replacement, fuel delivery, lockout/replacement key service, battery assistance and others.

In terms of vehicle, passenger cars segment to command 61.8% share in the vehicle roadside assistance market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Armor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Conversion Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Interior Air Quality Monitoring Technology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vehicle Electrification Market Growth - Trends & Forecast 2025 to 2035

Vehicle Control Unit (VCU) Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA