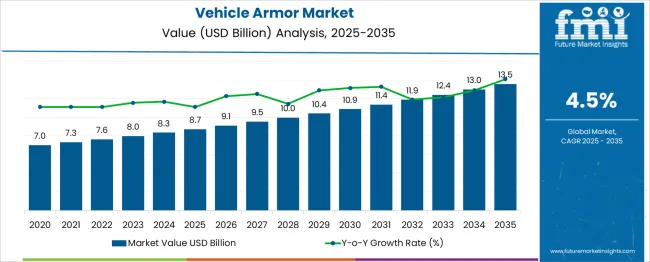

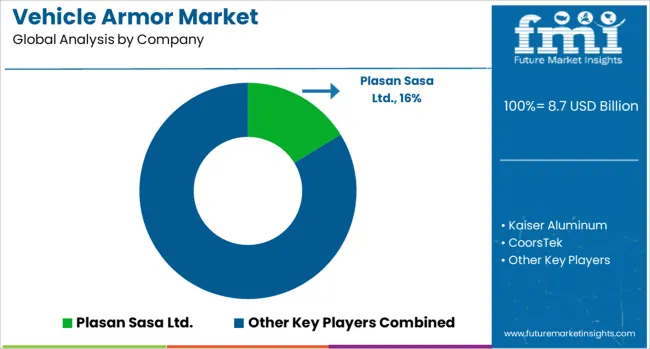

The Vehicle Armor Market is estimated to be valued at USD 8.7 billion in 2025 and is projected to reach USD 13.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. The vehicle armor market is projected to generate an absolute gain of USD 4.8 billion and a growth multiplier of 1.55x over the decade. This growth, supported by a CAGR of 4.5%, is driven by increasing demand for armored vehicles in defense, law enforcement, and commercial applications. During the first five years (2025–2030), the market will rise from USD 8.7 billion to USD 10.9 billion, adding USD 2.2 billion, which accounts for 45.8% of the total incremental growth, with a 5-year multiplier of 1.25x.

The second phase (2030–2035) contributes USD 2.6 billion, representing 54.2% of incremental growth, reflecting steady demand driven by geopolitical instability, urban security concerns, and advancements in armor materials. Annual increments rise from USD 0.4 billion in early years to USD 0.7 billion by 2035, indicating sustained growth as the adoption of lightweight and high-performance armor solutions increases. Manufacturers focusing on advanced composite armor, hybrid technologies, and enhanced mobility for military and civilian applications will capture the largest share of this USD 4.8 billion opportunity globally.

| Metric | Value |

|---|---|

| Vehicle Armor Market Estimated Value in (2025 E) | USD 8.7 billion |

| Vehicle Armor Market Forecast Value in (2035 F) | USD 13.5 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The vehicle armor market is witnessing sustained demand driven by heightened geopolitical tensions, increasing defense modernization efforts, and rising investments in soldier and asset survivability. Governments are prioritizing vehicle survivability in both combat and peacekeeping operations, prompting widespread upgrades to existing fleets and procurement of advanced armored platforms.

The adoption of lightweight, multi-hit resistant materials and modular protection systems is enabling vehicles to maintain mobility while withstanding evolving ballistic and blast threats. Procurement strategies are increasingly focused on lifecycle cost efficiency and interoperability with next-generation defense systems.

Furthermore, the integration of active protection systems, composite armor kits, and sensor-embedded armor is expected to shape long-term development. Emerging threats such as drone strikes and IEDs are also influencing the re-engineering of armored vehicle structures and materials.

The vehicle armor market is segmented by material into metals, ceramics, composites, and others; by vehicle type into armored fighting vehicles, tanks, civilian & law enforcement vehicles, and others; by application into military and non-military; and by region into North America (USA, Canada, Mexico), Latin America (Brazil, Chile, Rest of Latin America), Western Europe (Germany, UK, Italy, Spain, France, Nordic, BENELUX, Rest of Western Europe), Eastern Europe (Russia, Poland, Hungary, Balkan & Baltic, Rest of Eastern Europe), East Asia (China, Japan, South Korea), South Asia & Pacific (India, ASEAN, Australia & New Zealand, Rest of South Asia & Pacific), and Middle East & Africa (Kingdom of Saudi Arabia, Other GCC Countries, Turkiye, South Africa, Other African Union, Rest of Middle East & Africa).

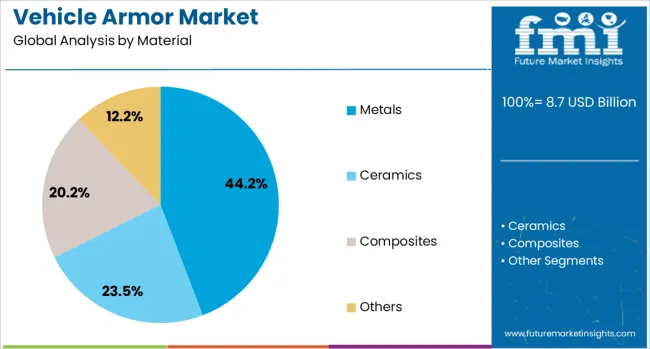

Metals are expected to account for 44.20% of the total vehicle armor market revenue in 2025, making them the leading material segment. Their dominance is being supported by the superior hardness, tensile strength, and cost-effective protection they offer against ballistic threats.

Traditional metal alloys such as high-hardness steel and aluminum remain integral due to their widespread availability, ease of integration, and proven field performance. Advances in processing techniques such as heat treatment and laser welding have enhanced the durability and weight-efficiency of metallic armoring solutions.

Despite increasing attention toward composite and ceramic materials, metals continue to be preferred for baseline protection in both retrofitted and newly built platforms, especially where structural reinforcement and high-impact resistance are critical.

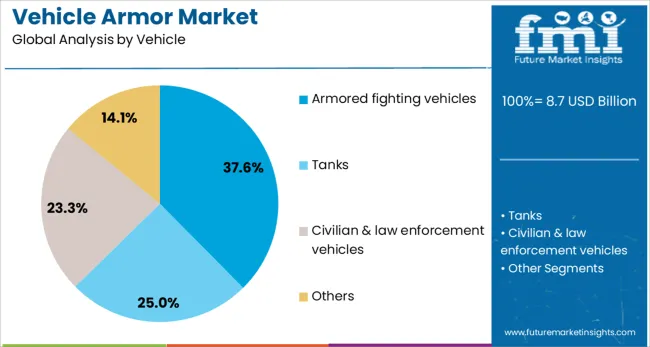

Armored fighting vehicles are projected to capture 37.60% of the overall vehicle armor market revenue in 2025, ranking as the leading vehicle segment. This position is being driven by global defense programs focusing on the development and upgrade of main battle tanks, infantry fighting vehicles, and reconnaissance platforms.

The need for rapid deployability, high survivability, and multi-role versatility has reinforced the use of armored fighting vehicles in modern military operations. Demand has further been supported by increasing cross-border tensions and asymmetric warfare, necessitating vehicles with enhanced mobility and layered protection systems.

Investments in hybrid propulsion and digital command systems have also facilitated the modernization of armored fleets, encouraging the integration of scalable armor kits to meet evolving mission profiles.

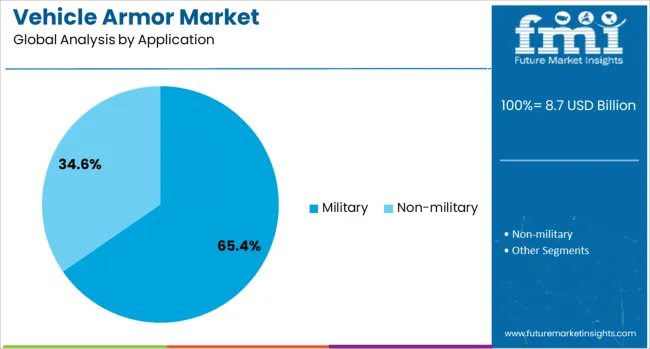

Military applications are anticipated to dominate the vehicle armor market with a 65.40% revenue share in 2025. This leadership is being attributed to increasing procurement of armored vehicles for tactical, transport, and combat operations.

Rising global defense spending, particularly in conflict-prone regions, has driven the requirement for survivability solutions capable of countering ballistic, mine, and improvised explosive threats. National militaries are investing heavily in upgrading fleet protection levels to align with shifting warfare paradigms and battlefield digitization.

In addition to conventional threats, evolving needs for peacekeeping, counter-insurgency, and border patrol operations have led to the widespread deployment of various armored vehicle classes. As security challenges become more sophisticated, the military sector remains the primary end user driving demand for high-performance armor systems.

The vehicle armor market is expanding due to rising security concerns, particularly in defense, law enforcement, and high-risk commercial applications. Growth in 2024 and 2025 was driven by increasing threats and demand for armored vehicles in volatile regions. Opportunities exist in expanding armored vehicle solutions for emerging markets and non-traditional applications like luxury vehicles. Emerging trends include the use of lightweight materials and advanced composite armoring. However, high costs and regulatory hurdles remain significant barriers to broader adoption.

The primary growth driver is the increasing demand for security due to rising threats in conflict zones, high-crime areas, and military operations. In 2024 and 2025, vehicle armor became essential for defense and law enforcement agencies, especially in countries with high security risks. As global conflicts escalate, demand for armored vehicles has surged, with both government and private sectors investing in advanced protective technologies. These security concerns are pushing growth in the vehicle armor market.

Opportunities lie in expanding armored vehicle solutions in emerging markets and luxury sectors. In 2025, armored vehicles gained traction in developing regions facing political instability. Additionally, non-military applications, such as armored luxury vehicles for high-net-worth individuals and executives, became more common. These developments indicate that the market is broadening, with armored vehicle manufacturers tapping into new customer bases seeking personal security solutions in both high-risk environments and affluent sectors.

Emerging trends in the market include the adoption of lightweight materials and advanced composite armoring solutions. In 2024, manufacturers increasingly focused on using materials like carbon fiber and aramid composites to reduce the weight of armored vehicles without compromising safety. These materials provided enhanced mobility and fuel efficiency while maintaining high protective standards. The trend toward lighter, more durable armoring solutions reflects the market’s shift towards optimizing both vehicle performance and protection.

Key restraints include high costs and regulatory compliance challenges. In 2024 and 2025, the high initial investment required for vehicle armoring limited accessibility for smaller organizations and non-governmental buyers. Additionally, the complexity of meeting stringent safety and manufacturing regulations in various regions created barriers to market expansion. These challenges highlight the need for cost-effective production techniques and streamlined regulatory processes to enable broader adoption of vehicle armor solutions in diverse markets.

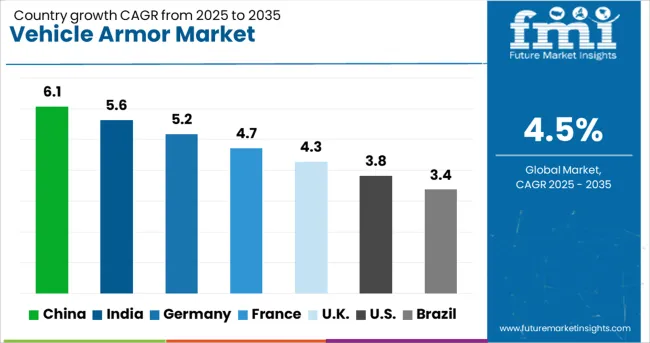

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| United Kingdom | 4.3% |

| United States | 3.8% |

| Brazil | 3.4% |

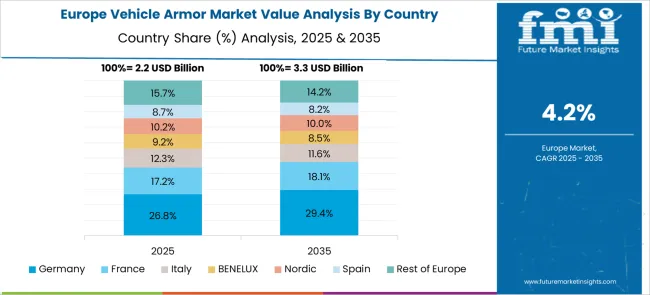

The global vehicle armor market is projected to grow at 4.5% CAGR from 2025 to 2035. China leads with 6.1% CAGR, driven by increasing military and law enforcement vehicle upgrades, as well as rising security concerns. India follows at 5.6%, supported by growing defense expenditure and demand for armored vehicles in both military and civilian sectors. France records 4.7% CAGR, focusing on vehicle armor for military applications and growing demand from law enforcement agencies. The United Kingdom grows at 4.3%, while the United States posts 3.8%, reflecting stable demand in mature markets with a strong emphasis on defense and security vehicle solutions. Asia-Pacific leads growth due to rising defense budgets, while Europe and North America focus on technological innovations and military modernization. This report includes insights on 40+ countries; the top markets are shown here for reference.

The vehicle armor market in China is forecasted to grow at 6.1% CAGR, supported by the country’s robust defense industry and increasing demand for armored vehicles in both military and law enforcement sectors. The rise in security threats, combined with China’s focus on military modernization, drives significant investments in armored vehicles. The expanding demand for armored transport in civil sectors, particularly in high-risk regions, also contributes to the market growth. Additionally, technological advancements in lightweight materials and ballistic protection systems enhance vehicle armor performance.

The vehicle armor market in India is projected to grow at 5.6% CAGR, driven by the country’s increasing defense budget and rising security needs. India’s military and law enforcement agencies continue to modernize their vehicle fleets, including armored personnel carriers (APCs) and transport vehicles. Growing concerns about civil unrest and the need for VIP protection boost demand for armored civilian vehicles as well. Additionally, India’s large-scale defense procurement programs increase the adoption of vehicle armor solutions for military applications.

The vehicle armor market in France is expected to grow at 4.7% CAGR, supported by the country’s commitment to defense readiness and law enforcement modernization. France’s defense sector continues to invest in advanced armored vehicles, including wheeled armored vehicles and infantry fighting vehicles (IFVs). Increased demand for armored law enforcement vehicles for domestic security operations, especially in urban areas, also drives market growth. The country’s focus on ensuring the safety of government personnel and military forces strengthens the need for high-quality, durable vehicle armor.

The vehicle armor market in the United Kingdom is projected to grow at 4.3% CAGR, driven by increasing defense budget allocations and modernization of military vehicle fleets. The UK’s demand for armored vehicles in both military and law enforcement applications is growing, particularly in response to evolving security threats. Additionally, the UK’s focus on upgrading armored vehicles with cutting-edge technologies, including reactive armor and composite materials, fuels market expansion. The government’s emphasis on international peacekeeping and border security also contributes to market demand.

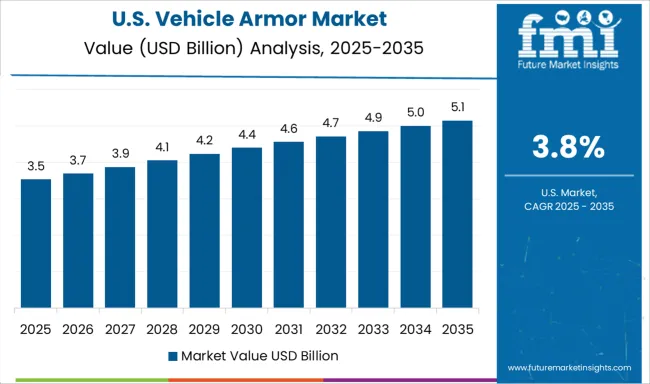

The vehicle armor market in the United States is projected to grow at 3.8% CAGR, reflecting steady demand in a mature defense sector. The U.S. continues to lead the development of cutting-edge armored vehicles for military, law enforcement, and civilian applications. Modernization programs for military ground vehicles, including IFVs and MRAPs, fuel demand for advanced vehicle armor. Additionally, the growing focus on protecting VIPs, government officials, and high-profile assets drives the use of armored civilian vehicles in high-risk regions.

The vehicle armor market is dominated by Plasan Sasa Ltd., which leads with advanced armor solutions designed for military, law enforcement, and civilian vehicles. Plasan's dominance is reinforced by its innovative composite materials and expertise in providing lightweight, high-performance armor systems that enhance vehicle safety without compromising mobility. Key players such as DuPont, Kaiser Aluminum, SSAB, and CoorsTek maintain significant market shares by offering high-strength materials, including ballistic steel and advanced composites, which provide superior protection against both small arms fire and explosive devices. These companies focus on developing multi-layered armor solutions that balance protection, weight, and cost efficiency for defense and commercial applications.

Emerging players like Armormax, ATEK Defense Systems, Garanti Kompozit, Permali, and ASL GRP are expanding their presence by offering customized vehicle armor for niche markets, including high-security civilian vehicles, VIP protection, and specialized military applications. Their strategies include providing modular armor systems, incorporating new materials like ceramic composites, and focusing on regional production to meet the demand for cost-effective solutions. Market growth is driven by the increasing need for armored vehicles in conflict zones, rising security concerns in urban areas, and continuous innovations in lightweight, high-performance armor materials. Advancements in composite technologies, modular armor design, and integration with vehicle systems will continue to shape competitive dynamics in this market.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Additional Attributes | Dollar sales by armor type and vehicle application, demand dynamics across military, law enforcement, and civilian sectors, regional trends in vehicle armor adoption, innovation in lightweight and composite materials, impact of regulatory standards on safety requirements, and emerging use cases in armored electric and autonomous vehicles. |

The global vehicle armor market is estimated to be valued at USD 8.7 billion in 2025.

The market size for the vehicle armor market is projected to reach USD 13.5 billion by 2035.

The vehicle armor market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in vehicle armor market are .

In terms of vehicle, armored fighting vehicles segment to command 37.6% share in the vehicle armor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Armored Vehicle Market

Vehicle-Mounted Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Roadside Assistance Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Conversion Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA