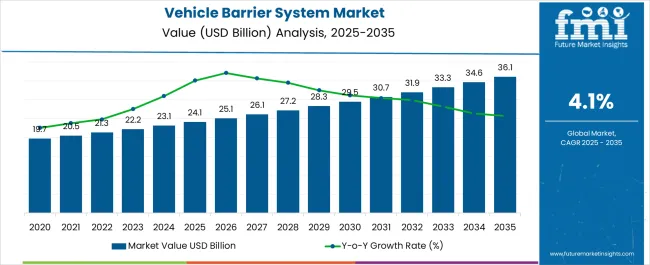

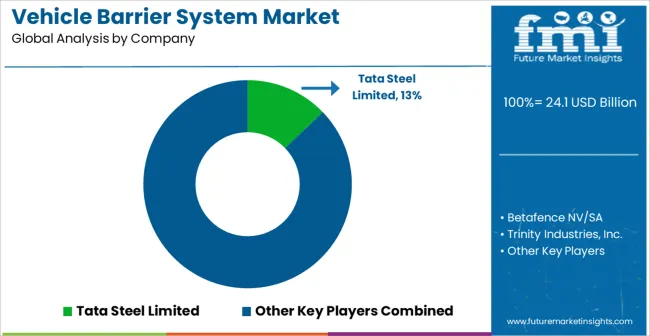

The Vehicle Barrier System Market is estimated to be valued at USD 24.1 billion in 2025 and is projected to reach USD 36.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Vehicle Barrier System Market Estimated Value in (2025 E) | USD 24.1 billion |

| Vehicle Barrier System Market Forecast Value in (2035 F) | USD 36.1 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The Vehicle Barrier System market is experiencing strong growth, driven by increasing global emphasis on security and access control across transportation infrastructure, commercial facilities, and critical assets. Rising concerns related to vehicle-borne threats and unauthorized access have intensified demand for advanced barrier systems that can efficiently manage vehicle flow while ensuring safety. Growth is further supported by advancements in automation technology, including integration of sensors, AI-driven monitoring, and remote control capabilities.

These systems enable real-time access control, reduce human intervention, and improve operational efficiency. Increasing investment in intelligent transportation systems, urban infrastructure development, and smart city initiatives is creating additional opportunities for vehicle barrier deployment.

The market is also being shaped by stringent regulatory requirements for traffic safety, perimeter security, and public infrastructure protection As governments and private enterprises continue to focus on security, efficiency, and automation, the Vehicle Barrier System market is expected to sustain robust growth, with technological innovation and high-performance materials playing a central role in driving adoption.

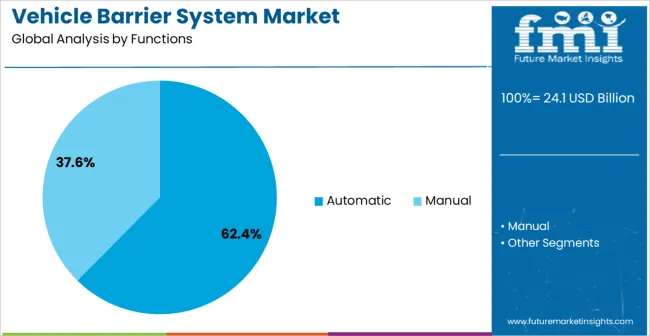

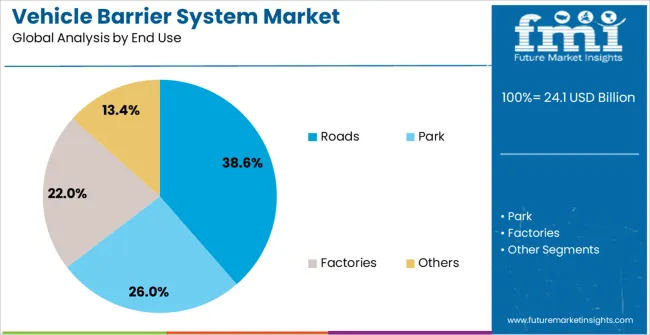

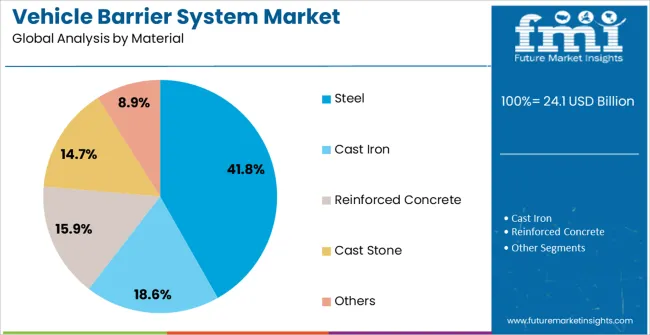

The vehicle barrier system market is segmented by functions, end use, material, and geographic regions. By functions, vehicle barrier system market is divided into Automatic and Manual. In terms of end use, vehicle barrier system market is classified into Roads, Park, Factories, and Others. Based on material, vehicle barrier system market is segmented into Steel, Cast Iron, Reinforced Concrete, Cast Stone, and Others. Regionally, the vehicle barrier system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic functions segment is projected to hold 62.4% of the market revenue in 2025, establishing it as the leading function category. Growth in this segment is being driven by the demand for barrier systems that offer automated control of vehicle entry and exit, reducing the need for manual intervention and enhancing security efficiency. Automated barriers enable seamless integration with access control systems, including card readers, sensors, and AI-based monitoring solutions.

These systems improve operational efficiency, reduce response times, and provide scalable solutions for both small and large infrastructure projects. Rising adoption in urban roads, commercial complexes, parking facilities, and critical installations has strengthened the segment’s market position.

The reliability, precision, and adaptability of automated barriers to diverse operational conditions, including high-traffic areas, contribute to their preference over manual or semi-automatic alternatives As infrastructure security requirements continue to evolve, the automatic functions segment is expected to maintain its leadership, supported by continuous advancements in automation technology and system integration capabilities.

The roads end-use segment is anticipated to account for 38.6% of the market revenue in 2025, making it the leading application sector. Its growth is being driven by the increasing need for traffic management, toll collection, and safety control on highways, urban roads, and restricted access areas. Vehicle barrier systems help regulate vehicle flow, prevent unauthorized access, and enhance overall road safety.

Integration with intelligent transportation infrastructure, such as traffic monitoring systems and automated toll management, further reinforces adoption. The ability to combine barrier systems with surveillance, monitoring, and emergency response technologies enhances operational effectiveness. Governments are increasingly deploying barriers to meet regulatory and safety standards while supporting the development of smart road networks.

The scalability and adaptability of barrier systems to various road conditions, traffic volumes, and environmental factors ensure their continued preference As urbanization accelerates and road infrastructure expands, the roads end-use segment is expected to remain a primary driver of market growth, supported by safety, efficiency, and regulatory compliance.

The steel material segment is projected to hold 41.8% of the market revenue in 2025, making it the leading material category. Growth in this segment is being driven by the material’s strength, durability, and resistance to wear, impact, and environmental conditions. Steel enables barrier systems to withstand high-traffic usage and potential vehicle collisions while maintaining long-term structural integrity.

Its adaptability for different designs and automated systems makes it a preferred choice among manufacturers and infrastructure planners. Steel-based barriers also provide enhanced safety and reliability for commercial, urban, and critical installations. Ongoing innovations in material treatment, corrosion resistance, and surface finishing are improving longevity and performance.

Cost efficiency combined with high mechanical performance reinforces adoption in infrastructure projects, highways, and restricted access areas As the demand for robust, long-lasting, and high-performance vehicle barrier systems continues to rise, the steel material segment is expected to maintain its market leadership, supported by reliability, structural integrity, and suitability for automated applications.

In order to prevent the entry of unauthorized vehicles in buildings and thereby protect visitors, employees and building functions, vehicle barrier systems are used. With an increase in the number of construction projects, such as roads, buildings, offices and multiplexes, the demand for vehicle barrier systems is increasing year on year. Some of the barriers keep the vehicles in defined spaces, such as in the case of roads or specific parking areas.

The vehicle barrier industry is primarily unregulated. Some criteria and testing standards (such as PAS, UFC, DOD, IWA, DOS, ASTM and ISO) are used as selection parameters for vehicle barrier systems. However, there are no overarching federal statutes or formal policies that direct or control users in their choice of vehicle barrier or manufacturer.

Many barriers are fitted with equipment, which allow people/vehicles with codes or passes to enter. Also, these systems helps ensure that the property is protected from theft, terrorism or other hazards. Automatic vehicle barrier systems control & manage the traffic where multiple lane traffic needs to zip down to one lane.

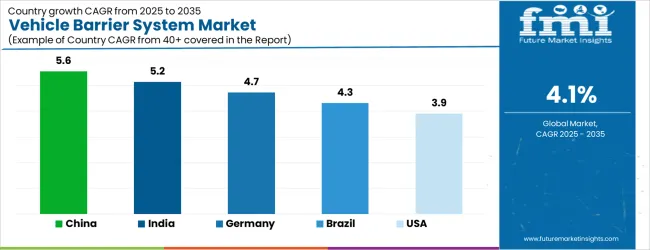

| Country | CAGR |

|---|---|

| China | 5.6% |

| India | 5.2% |

| Germany | 4.7% |

| Brazil | 4.3% |

| USA | 3.9% |

| UK | 3.5% |

| Japan | 3.1% |

The Vehicle Barrier System Market is expected to register a CAGR of 4.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.6%, followed by India at 5.2%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.1%, yet still underscores a broadly positive trajectory for the global Vehicle Barrier System Market.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.7%. The USA Vehicle Barrier System Market is estimated to be valued at USD 8.6 billion in 2025 and is anticipated to reach a valuation of USD 8.6 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.1 billion and USD 763.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.1 Billion |

| Functions | Automatic and Manual |

| End Use | Roads, Park, Factories, and Others |

| Material | Steel, Cast Iron, Reinforced Concrete, Cast Stone, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tata Steel Limited, Betafence NV/SA, Trinity Industries, Inc., Lindsay Corporation, Valmont Industries, Inc., Hill and Smith PLC, Delta Scientific Corporation, Automatic Systems S.A., Barrier1 Systems, LLC, A-Safe HQ Limited, Avon Barrier Corporation Ltd, HySecurity Gate, Inc., Concentric Security, LLC, and Senstar Corporati |

The global vehicle barrier system market is estimated to be valued at USD 24.1 billion in 2025.

The market size for the vehicle barrier system market is projected to reach USD 36.1 billion by 2035.

The vehicle barrier system market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in vehicle barrier system market are automatic and manual.

In terms of end use, roads segment to command 38.6% share in the vehicle barrier system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barrier System Market Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

In-Vehicle Ethernet System Market Growth – Trends & Forecast 2025 to 2035

Vehicle Speed Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Stolen Vehicle Tracking System Market

Acoustic Vehicle Alerting System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automatic Vehicle Washing System Market

Off Highway Vehicles Brake Systems Market Size and Share Forecast Outlook 2025 to 2035

New Energy Vehicle Electric Drive Systems Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Automotive Thermal System Market Analysis by Application, Vehicle Type, Propulsion Type, Component, and Region Through 2035

Unmanned Railway Vehicle Washing Systems Market Size and Share Forecast Outlook 2025 to 2035

North America Keyless Vehicle Access Control Market - Growth & Forecast through 2035

Vehicle-Mounted Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA