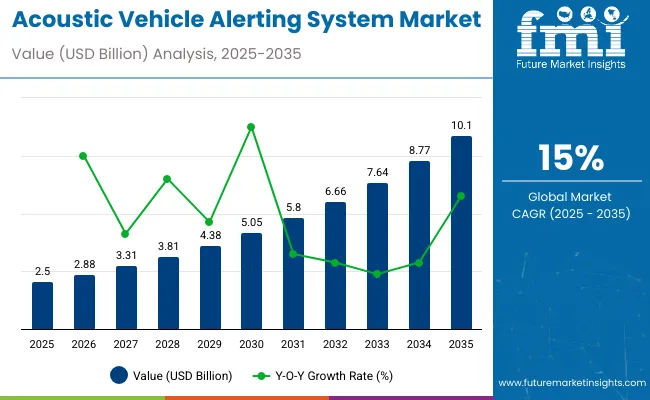

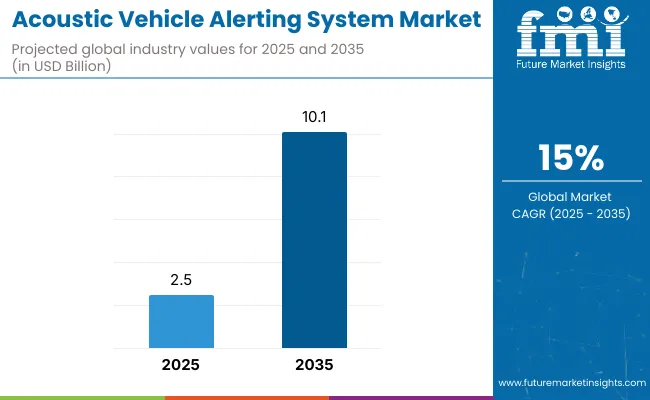

The global acoustic vehicle alerting system (AVAS) market is anticipated to reach 2.5 billion in 2025 and 10.1 billion by 2035, expanding at a CAGR of 15% with a multiplying factor of about 4 over the decade. Inflection point mapping highlights the phases where regulatory changes, technology adoption, and market acceptance drive accelerated growth.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.5 billion |

| Forecast Value in (2035F) | USD 10.1 billion |

| Forecast CAGR (2025 to 2035) | 15% |

The first inflection point emerged when global safety authorities mandated sound systems for electric and hybrid vehicles to improve pedestrian awareness. This regulatory push created the foundation for rapid adoption.

A second inflection point is expected around the early 2030s as manufacturers integrate advanced sound design technologies, enabling customizable and adaptive acoustic alerts that enhance both safety and brand differentiation. Widespread use of electric vehicles, combined with advancements in digital signal processing, will further accelerate adoption.

By 2035, with the market reaching 10.1 billion, inflection point mapping shows a transition from regulatory compliance to value-driven adoption, where AVAS becomes a standard feature tied to user experience and vehicle identity. The progression across these points demonstrates how regulation, consumer expectations, and technological innovation interact to define growth pathways and position AVAS as an integral part of future mobility ecosystems.

The AVAS market is influenced by several parent sectors. Automotive electronics and vehicle safety systems account for around 33%, as alert systems are integrated into electric and hybrid vehicles. Vehicle manufacturing and assembly contributes roughly 30%, driven by new EV launches and regulatory requirements.

Sound engineering and acoustic devices represent about 17%, supplying speakers, tone generators, and control modules. Software platforms and connectivity solutions make up approximately 12%, enabling adaptive sound modulation and integration with driver assistance systems. Regulatory compliance and aftermarket services account for around 8%, supporting retrofits, testing, and certification for safety standards.

The market is advancing with adaptive sound technologies, energy-efficient designs, and regulatory alignment. Automakers are introducing customizable sound profiles that adjust volume and tone depending on vehicle speed, proximity to pedestrians, and environmental noise.

Electric and hybrid vehicle adoption is accelerating AVAS deployment, as silent vehicles need audible alerts for safety. Compact, lightweight, and low-power alert modules are increasingly preferred. Collaboration between car manufacturers, audio technology providers, and safety authorities is driving standardization, improving system performance, and ensuring global compliance. Integration with smart vehicle platforms enables real-time adjustment and predictive safety alerts.

The global acoustic vehicle alerting system market is projected to reach USD 2.5 billion in 2025, with a strong CAGR of 15%, reflecting increasing demand for pedestrian safety solutions in electric and hybrid vehicles. Regulatory mandates in Europe, North America, and Asia require sound-emitting devices for vehicles traveling below 30 km/h, driving adoption.

Sales are highest in passenger electric cars, while commercial electric buses and delivery vans are gaining traction. Integration with advanced driver-assistance systems is enhancing system functionality.

Driving Force Safety Regulations and EV Growth

The primary driver is regulatory compliance, with over 40 countries mandating AVAS on electric and hybrid vehicles. Electric passenger cars represent nearly 60% of adoption due to low inherent engine noise. AVAS adoption enhances pedestrian and cyclist safety, reducing accidents in urban areas.

Integration with vehicle control systems allows variable sound output based on speed and environment. OEMs are increasingly offering AVAS as standard equipment in EV and hybrid models to meet compliance while improving brand safety perception.

Growth Avenue Advanced Signal Technology

Manufacturers are developing directional sound systems and multi-frequency AVAS for enhanced safety without contributing to urban noise. Compact, lightweight units reduce vehicle weight by 0.5-1 kg per system, improving energy efficiency. Software-controlled sound profiles allow OEMs to customize alerts by model and region.

Integration with autonomous driving systems and pedestrian detection enhances response times. AVAS systems with modular speakers allow easy replacement and upgrades, extending lifecycle and reducing maintenance costs.

Emerging Trend Smart Connectivity and IoT Integration

Connected AVAS units are being linked to vehicle telematics, enabling real-time monitoring of sound output and system health. Some units now include adaptive volume control, adjusting sound intensity based on ambient noise levels. Predictive maintenance notifications via vehicle diagnostics reduce downtime and warranty claims.

Integration with IoT-enabled fleet management systems allows operators to track AVAS performance across multiple vehicles. These smart features are increasingly demanded by fleet operators and premium OEMs, enhancing safety compliance and operational reliability.

Market Challenge Cost and Integration Complexity

AVAS unit costs, ranging from USD 250 to USD 450, add incremental costs to EV and hybrid vehicle pricing. Integration into existing vehicle electronics and chassis can require additional calibration, increasing engineering hours by 5-8%.

OEMs face supply constraints in speaker components, amplifiers, and control electronics, extending lead times by 6-10 weeks. Smaller vehicle manufacturers find compliance cost-prohibitive, limiting adoption in emerging markets. Regulatory differences across countries also increase design complexity, requiring multiple sound profiles and certifications.

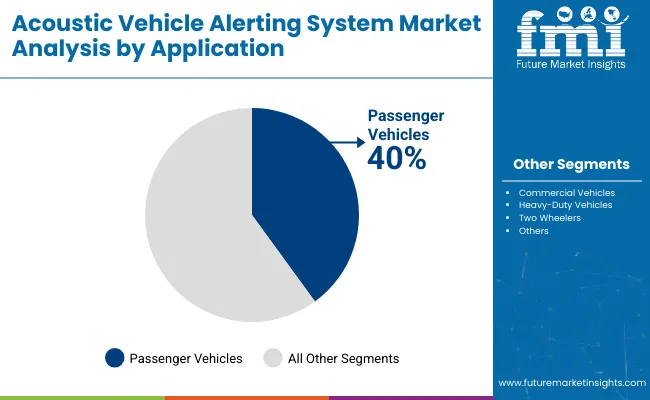

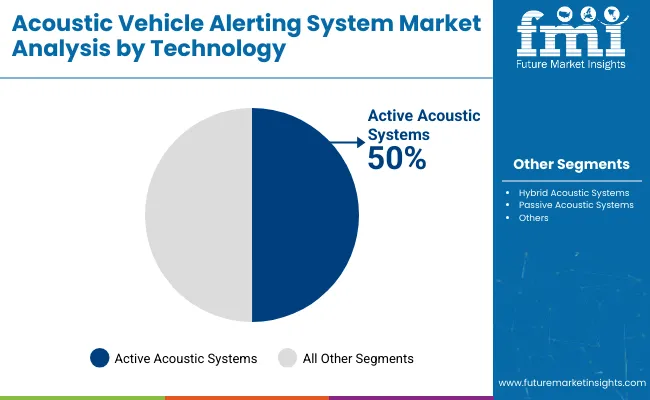

The Acoustic Vehicle Alerting System market is shaped by application, technology, vehicle type, and end user. Passenger vehicles dominate demand, accounting for 40% of usage, followed by commercial and heavy-duty vehicles. Active acoustic systems capture 50% of the technology market, providing enhanced sound generation for low-speed electric and hybrid vehicles. Key players such as Bosch, Continental, Denso, and Valeo focus on integrating high-efficiency acoustic modules, customizable sound profiles, and compliance with pedestrian safety standards across global fleets.

Passenger vehicles account for 40% of AVAS demand, reflecting regulatory pressure for pedestrian safety in urban environments. Commercial vehicles follow with 25%, heavy-duty vehicles 20%, and two-wheelers 15%. Passenger EVs and hybrids utilize AVAS for low-speed sound generation under 20 km/h to alert pedestrians.

Companies like Bosch, Valeo, and Denso design compact, energy-efficient systems tailored for passenger cars, ensuring minimal impact on battery life. Urban mobility trends, city noise regulations, and pedestrian safety standards drive adoption. Passenger AVAS systems often feature adjustable sound profiles for speed-dependent alerts and customizable tones.

Active acoustic systems hold 50% share in AVAS technology due to superior real-time sound generation and programmable features. Hybrid systems capture 30% and passive systems 20%. Active systems use speakers and amplifiers to emit variable frequency sounds, adapting to vehicle speed and ambient noise.

Valeo, Continental, Bosch, and Denso integrate active systems into EVs and hybrids for compliance with UNECE R138 standards. These systems improve pedestrian detection in urban areas while minimizing energy consumption. Growth is also driven by smart city initiatives requiring enhanced safety features for low-speed urban mobility.

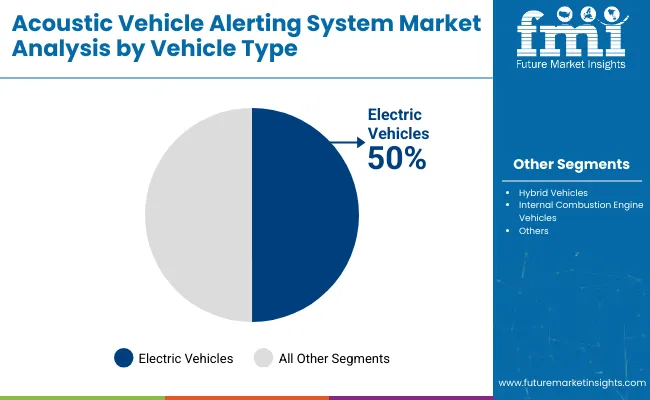

Electric vehicles account for 50% of AVAS adoption as silent operation at low speeds necessitates pedestrian alerting. Hybrid vehicles follow at 30%, and ICE vehicles at 20%, primarily for regulatory compliance in urban zones. EV manufacturers, including Tesla, Nissan, BMW, and Hyundai, integrate AVAS as standard equipment for new models.

AVAS modules are typically positioned at the front and rear of the vehicle, producing directional sound for safety. The increasing share of EVs in global fleets, particularly in Europe and North America, accelerates AVAS deployment, while hybrids and plug-in hybrids adopt AVAS selectively depending on low-speed electric operation.

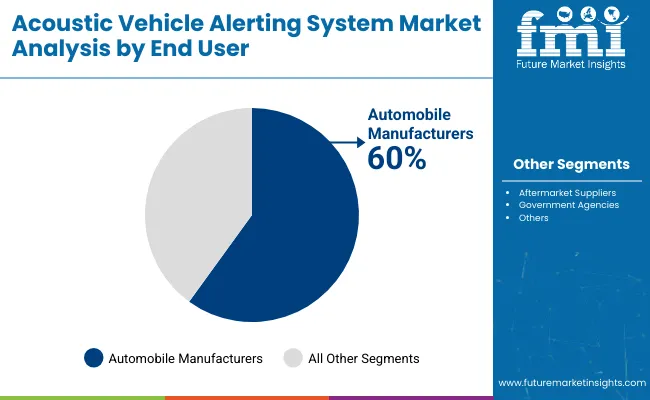

Automobile manufacturers account for 60% of AVAS demand, incorporating the systems during production to meet global pedestrian safety regulations. Aftermarket suppliers contribute 25%, providing retrofit solutions for older EVs and hybrids, while government agencies account for 15%, funding urban safety and fleet retrofitting programs.

Major AVAS suppliers such as Bosch, Continental, Valeo, and Denso partner with OEMs for integrated design, ensuring compliance and minimal impact on vehicle efficiency. Adoption is highest in regions with strict UNECE or FMVSS standards, including Europe, Japan, and North America. End-user focus ensures reliable performance, standardized sound levels, and cost-effective production.

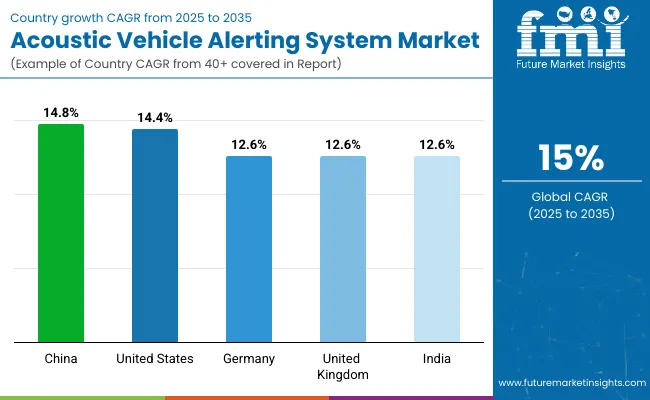

The global acoustic vehicle alerting system (AVAS) market grows from 2.5 billion USD in 2025 to 10.1 billion USD by 2035, registering a CAGR of 15%. China records 14.8%, slightly below the global rate, driven by BRICS-supported electric vehicle deployment and urban safety measures.

The United States follows at 14.4%, −4% under the global CAGR, influenced by OECD-backed regulations and gradual adoption across passenger and commercial vehicles. Germany, the United Kingdom, and India each stand at 12.6%, −16% compared with the global benchmark, reflecting steady expansion in vehicle fleets and phased adoption of alerting systems. Overall, BRICS economies, particularly China and India, are accelerating adoption, while OECD markets maintain steady progress through regulatory and technological measures.

China is expected to grow at a CAGR of 14.8%, fueled by rapid electric vehicle adoption and regulatory mandates requiring acoustic vehicle alerting systems for all hybrids and EVs. The government has invested heavily in safety standards, and major automakers are integrating AVAS across passenger cars, buses, and light commercial vehicles.

R&D in customizable sound emissions and pedestrian detection technology is accelerating, while local suppliers are scaling production to meet both domestic and export demand. Urban centers are implementing pedestrian safety programs that increase the necessity of AVAS in high-traffic areas. By 2035, China is projected to lead the global AVAS production landscape and become a major exporter of components to Europe and North America.

The United States AVAS market is projected to grow at a CAGR of 14.4%, supported by federal pedestrian safety regulations and rising hybrid and electric vehicle penetration. Adoption is strongest in commercial fleets and metropolitan regions, where safety requirements are stringent. Automakers are investing in AI-enabled adaptive alert sounds and integrating AVAS with advanced driver assistance systems.

Infrastructure programs are also promoting the installation of AVAS-compatible test tracks and urban EV safety zones. California remains a core market, but nationwide expansion is underway as awareness of silent vehicle risks rises. By 2035, AVAS-equipped vehicles are expected to become standard across all new EV and hybrid models.

Germany is expanding at a CAGR of 12.6%, driven by stringent European Union vehicle safety directives and growing electric vehicle adoption. Premium and mid-tier automotive manufacturers are integrating AVAS across passenger cars and light commercial vehicles. Investment in advanced noise management and acoustic design is a priority, enabling quieter and more effective pedestrian alert systems.

Germany also focuses on exporting AVAS components to neighboring countries, capitalizing on technical expertise and manufacturing quality. Urban mobility programs in cities like Berlin and Hamburg are increasing demand for AVAS in fleet vehicles. By 2035, Germany is projected to maintain a significant role in AVAS R&D and supply for European electric vehicles.

The United Kingdom is growing at a CAGR of 12.6%, supported by electric vehicle adoption and regulatory emphasis on pedestrian safety. Growth is strongest in urban commuting vehicles, where high pedestrian density drives the need for acoustic alerts. The UK market focuses on modular AVAS systems that can be integrated into multiple vehicle types, including buses and delivery fleets.

Public transport authorities are increasingly specifying AVAS compliance for procurement. Research on customizable sound profiles tailored to city traffic conditions is underway. By 2035, the UK is expected to achieve near-universal AVAS deployment in metropolitan EVs, while small manufacturers are exploring low-cost solutions for suburban electric vehicles.

India is expanding at a CAGR of 12.6%, driven by increasing electric two-wheeler and passenger car adoption in urban and semi-urban areas. Safety regulations are being phased in, requiring AVAS for EVs sold in major cities. Local manufacturers are producing cost-effective systems compatible with low-speed vehicles, while startups focus on integrating low-cost sensors and customizable alert sounds.

Growing awareness among consumers about silent vehicle risks supports adoption in private and fleet vehicles. By 2035, India is expected to see a rapid increase in AVAS-equipped electric vehicles, particularly for public transport, shared mobility, and last-mile delivery solutions.

The acoustic vehicle alerting system (AVAS) market features a combination of automakers and specialized suppliers, each employing strategies to enhance vehicle safety and meet regulatory requirements. Toyota Motor Corporation leads the market by integrating AVAS into its hybrid and electric vehicles, providing customizable alert sounds for pedestrians and cyclists.

Subaru Corporation and Honda Motor Co Ltd focus on consistent acoustic signals for low-speed operations, ensuring both safety and user comfort. Volkswagen AG and BMW AG combine in-house development with supplier partnerships to deliver reliable alerting systems across multiple EV and hybrid models.

Specialized technology providers strengthen the market by offering modular and premium solutions. Aisin Seiki Co Ltd and Harman International develop adaptable AVAS components suitable for different vehicle platforms. Voxx International and Bose focus on high-quality audio alert systems, while Continental AG and Daimler AG integrate AVAS with broader vehicle safety solutions.

Nissan Motor Co Ltd and Ford Motor Company continue to refine sound output and volume control for regional compliance. These approaches, including product development, strategic partnerships, and integration into new EV models, allow companies to maintain competitiveness while promoting adoption of acoustic vehicle alerting systems worldwide.Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.5 billion |

| Projected Market Size (2035) | USD 10.1 billion |

| CAGR (2025 to 2035) | 15% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Application Segments Analyzed | Passenger Vehicles, Commercial Vehicles, Two Wheelers, Heavy-Duty Vehicles |

| Technology Segments Analyzed | Active Acoustic Systems, Passive Acoustic Systems, Hybrid Acoustic Systems |

| Vehicle Type Segments Analyzed | Electric Vehicles, Hybrid Vehicles, Internal Combustion Engine Vehicles |

| End-User Segments Analyzed | Automobile Manufacturers, Aftermarket Suppliers, Government Agencies |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, United Kingdom, France, Italy, Spain, Netherlands, Sweden, Poland, China, Japan, India, South Korea, Thailand, Vietnam, Australia, New Zealand, United Arab Emirates, Saudi Arabia, South Africa, Turkey, Egypt |

| Leading Players | Toyota Motor Corporation, Honda Motor Co Ltd, Volkswagen AG, BMW AG, Subaru Corporation, Ford Motor Company, Nissan Motor Co Ltd, Daimler AG, Aisin Seiki Co Ltd, Harman International, Continental AG, Voxx International |

| Additional Attributes | Dollar sales by system type and vehicle category, demand dynamics across electric, hybrid, and commercial vehicles, regional adoption trends across North America, Europe, and Asia-Pacific, innovation in customizable sound profiles, AI-enabled detection, low-frequency alerts, environmental impact of energy use and noise pollution, and emerging use in pedestrian safety, urban mobility, and autonomous vehicle integration |

The market is projected to reach USD 10.1 billion by 2035.

The market is forecasted to grow at a CAGR of 15% during 2025 to 2035.

Passenger vehicles are expected to hold 40% share in 2025.

Active acoustic systems account for 50% of the market share in 2025.

Toyota Motor Corporation leads the market with a 25% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acoustic Wave Sensors Market Size and Share Forecast Outlook 2025 to 2035

Acoustic Wave Filters Market Size and Share Forecast Outlook 2025 to 2035

Acoustic Insulation Market Analysis & Forecast for 2025 to 2035

Acoustic Respiration Sensors Market Outlook 2025 to 2035

Acoustic Camera Market Growth - Size, Trends & Forecast 2025 to 2035

Acoustic Puncture Assist Devices Market

Acoustic Neurinoma Treatment Market

Otoacoustic Emissions Hearing Screener Market Size and Share Forecast Outlook 2025 to 2035

Bioacoustics Sensing Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Tomography Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Microscopy Market Growth – Industry Trends & Forecast 2024-2034

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Sustained Acoustic Medicine Market

Underwater Acoustic Communication Market Growth - Trends & Forecast 2025 to 2035

Lightweight Acoustic Floor Systems Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA