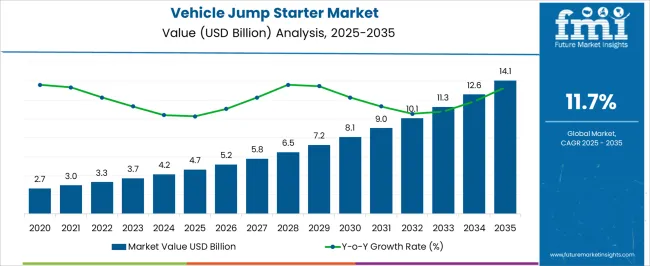

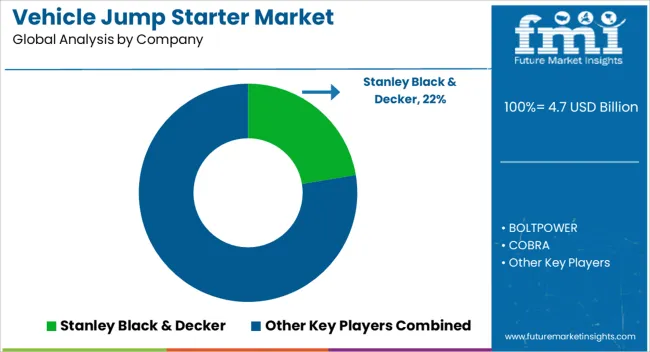

The Vehicle Jump Starter Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 14.1 billion by 2035, registering a compound annual growth rate (CAGR) of 11.7% over the forecast period.

| Metric | Value |

|---|---|

| Vehicle Jump Starter Market Estimated Value in (2025 E) | USD 4.7 billion |

| Vehicle Jump Starter Market Forecast Value in (2035 F) | USD 14.1 billion |

| Forecast CAGR (2025 to 2035) | 11.7% |

The Vehicle Jump Starter market is experiencing robust growth driven by the increasing adoption of portable power solutions for personal and commercial vehicles. The current market scenario reflects heightened demand for compact, reliable, and high-performance jump starters that provide rapid engine ignition support during emergencies. Factors influencing market expansion include the rising number of automotive vehicles globally, growing awareness regarding vehicle battery maintenance, and the adoption of smart, multifunctional automotive accessories.

Technological advancements in battery chemistry, safety features, and compact form factors have further enhanced consumer appeal. The market outlook is shaped by ongoing innovations in lithium-ion batteries and hybrid power systems, which enable improved energy efficiency, lighter weight, and longer operational life.

As vehicle electrification and hybrid mobility continue to gain momentum, the need for portable jump-start solutions is expected to rise, creating opportunities for manufacturers to introduce versatile, software-enabled, and modular products that meet diverse vehicle requirements Market growth is also supported by increased distribution networks and e-commerce penetration, allowing rapid accessibility to consumers in urban and semi-urban regions.

The vehicle jump starter market is segmented by product type, battery type, output voltage, vehicle, and geographic regions. By product type, vehicle jump starter market is divided into Jump Boxes and Plug-In Units. In terms of battery type, vehicle jump starter market is classified into Lithium Ion Battery and Lithium Acid Battery. Based on output voltage, vehicle jump starter market is segmented into Between 12 Volts And 24 Volts, Below 12 Volts, and Above 24 Volts. By vehicle, vehicle jump starter market is segmented into Passenger Cars, Compact Passenger Cars, Mid-Sized Passenger Cars, SUVs, Commercial Vehicles, LCVs, and HCVs. Regionally, the vehicle jump starter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

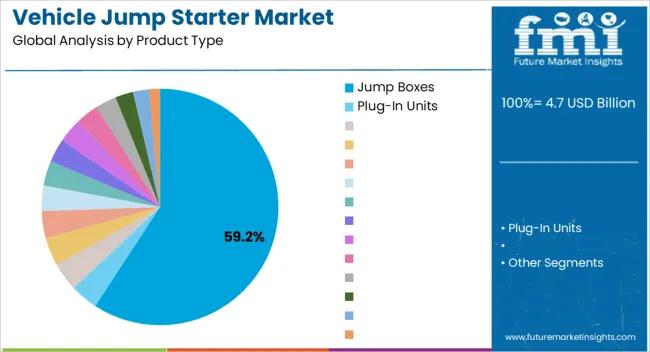

The Jump Boxes product type is projected to hold 59.20% of the Vehicle Jump Starter market revenue share in 2025, making it the leading segment in terms of product type. This dominance is being driven by the convenience, portability, and multifunctional capabilities offered by jump boxes. These devices are designed to deliver reliable engine starting in emergency scenarios while also providing auxiliary power for electronic devices, which enhances their value proposition.

Adoption has been fueled by urban and rural vehicle owners seeking compact and easy-to-use solutions for battery failure. The modularity of jump boxes allows integration with different battery chemistries and output configurations, supporting a wide range of automotive vehicles.

Additionally, improved safety mechanisms and durable casing materials have increased consumer confidence and contributed to widespread adoption The segment's growth is expected to continue as demand rises for portable, multifunctional power solutions that can serve both personal and commercial applications, ensuring sustained revenue contribution to the overall market.

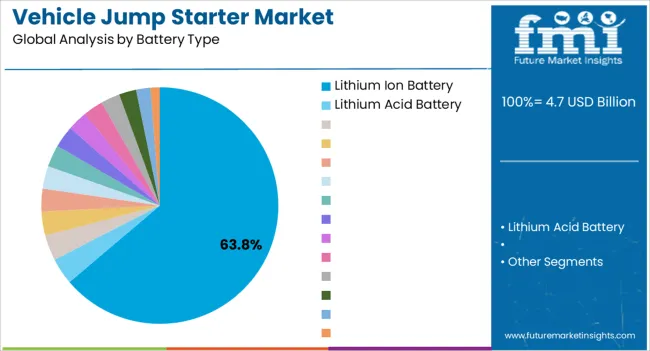

The Lithium Ion Battery segment is anticipated to capture 63.80% of the Vehicle Jump Starter market revenue share in 2025, reflecting its prominence in battery technology. Growth in this segment is being driven by the high energy density, lightweight nature, and longer lifecycle of lithium-ion batteries compared to traditional lead-acid alternatives.

These batteries enable faster charging, higher efficiency, and better portability of jump starter devices, making them particularly appealing to vehicle owners seeking compact and reliable solutions. The segment's expansion has been reinforced by technological advancements in battery management systems, which enhance safety, prevent overcharging, and optimize performance.

Increased adoption of lithium-ion batteries is also influenced by the global push towards greener automotive technologies and the rising prevalence of hybrid and electric vehicles As consumer expectations evolve for durable, high-performing, and low-maintenance power solutions, lithium-ion-based jump starters are expected to maintain their leading position and continue driving the market forward.

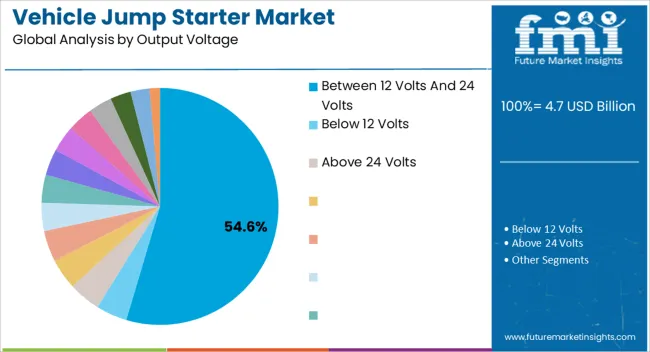

The Between 12 Volts and 24 Volts output voltage segment is projected to account for 54.60% of the Vehicle Jump Starter market revenue share in 2025, making it the dominant output configuration. This segment's leadership is being driven by the compatibility of this voltage range with a wide variety of vehicles, including passenger cars, SUVs, and light commercial vehicles.

The versatility of 12-24 volt jump starters allows users to operate the devices across multiple vehicle types without needing separate products, enhancing convenience and cost-effectiveness. Adoption has been fueled by the increasing trend of portable and multifunctional jump starters that can also power auxiliary electronics, requiring stable and flexible voltage outputs.

Additionally, safety and reliability improvements in voltage regulation have strengthened consumer trust in these devices As vehicle ownership continues to expand globally and demand for convenient, emergency-ready power solutions rises, this segment is expected to maintain its dominance by offering broad compatibility and dependable performance for diverse automotive needs.

In the automobiles, giving a boost to a discharged or dead battery of a vehicle via a temporary connection, such as a battery or another external power source, is commonly known as vehicle jump starter.

Lithium ion and lithium acid battery types are the two main types of batteries used in a vehicle jump starter. Vehicle jump starter is handy in case of bad weather, or if the driver/passenger is in a stranded area and need to recharge the battery, in that case, one can restart the engine by giving a boost to the battery by vehicle jump starter. Vehicle jump starters are usually of two types - Jump Boxes and Plug-in Units. Jump box type has maintenance free lithium batteries with a jumper cable, and plug-in unit type is capable of delivering higher amperage.

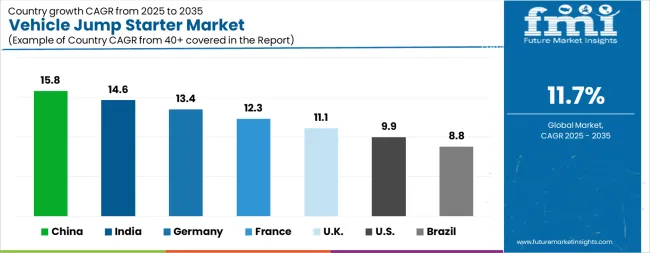

| Country | CAGR |

|---|---|

| China | 15.8% |

| India | 14.6% |

| Germany | 13.4% |

| France | 12.3% |

| UK | 11.1% |

| USA | 9.9% |

| Brazil | 8.8% |

The Vehicle Jump Starter Market is expected to register a CAGR of 11.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 15.8%, followed by India at 14.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 8.8%, yet still underscores a broadly positive trajectory for the global Vehicle Jump Starter Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 13.4%. The USA Vehicle Jump Starter Market is estimated to be valued at USD 1.7 billion in 2025 and is anticipated to reach a valuation of USD 4.4 billion by 2035. Sales are projected to rise at a CAGR of 9.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 251.0 million and USD 133.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Product Type | Jump Boxes and Plug-In Units |

| Battery Type | Lithium Ion Battery and Lithium Acid Battery |

| Output Voltage | Between 12 Volts And 24 Volts, Below 12 Volts, and Above 24 Volts |

| Vehicle | Passenger Cars, Compact Passenger Cars, Mid-Sized Passenger Cars, SUVs, Commercial Vehicles, LCVs, and HCVs |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stanley Black & Decker, BOLTPOWER, COBRA, CARKU, KAYO MAXTAR, Inc, Newsmy, Duracell, Schumacher, Shenzhen Benrong Technology, Shenzhen NianLun Electronic, BESTEK, and Shenzhen Sbase Electronics Technology |

The global vehicle jump starter market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the vehicle jump starter market is projected to reach USD 14.1 billion by 2035.

The vehicle jump starter market is expected to grow at a 11.7% CAGR between 2025 and 2035.

The key product types in vehicle jump starter market are jump boxes and plug-in units.

In terms of battery type, lithium ion battery segment to command 63.8% share in the vehicle jump starter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Roadside Assistance Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Armor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Conversion Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Interior Air Quality Monitoring Technology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vehicle Electrification Market Growth - Trends & Forecast 2025 to 2035

Vehicle Control Unit (VCU) Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA