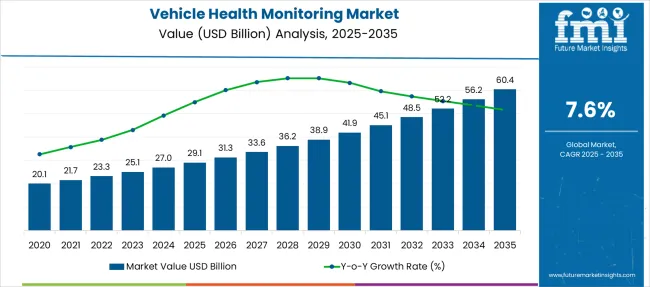

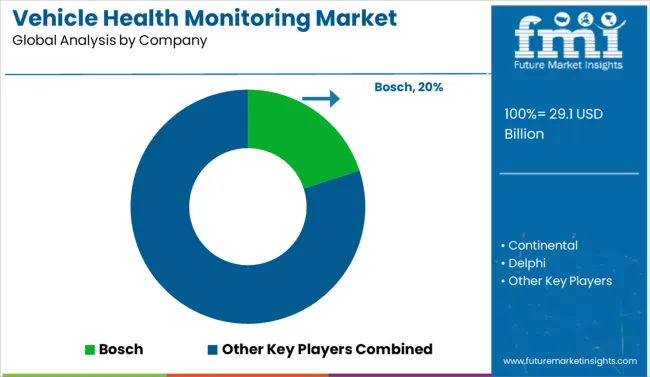

The Vehicle Health Monitoring Market is estimated to be valued at USD 29.1 billion in 2025 and is projected to reach USD 60.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period. Back in 2020, the segment was valued at USD 20.1 billion, revealing continuous gains anchored in predictive maintenance and telematics adoption. A marked uptick between 2027 and 2033 corresponds with OEM integration of sensor-based analytics across connected fleets and passenger vehicles.

The core value proposition lies in reducing unplanned downtime and optimizing lifecycle costs via real-time diagnostics, leveraging AI algorithms for fault prediction. Growth catalysts include fleet electrification, which mandates advanced monitoring for battery and thermal systems, alongside stringent safety mandates in major automotive markets.

Competitive intensity is defined by cloud-backed platforms offering OTA software updates and analytics dashboards for fleet managers. Tier-1 suppliers are expected to consolidate through partnerships with data analytics firms, reinforcing capabilities for predictive failure modeling. Future revenue models may pivot toward subscription-based service contracts bundled with hardware, reshaping monetization paradigms within mobility ecosystems.

Growth is being shaped by the transition toward connected mobility, where real-time diagnostics and predictive maintenance are no longer optional but core to reducing downtime and optimizing fleet performance. Unlike traditional OBD systems, today’s solutions integrate sensors, cloud analytics, and AI-driven algorithms, transforming vehicles into data ecosystems.

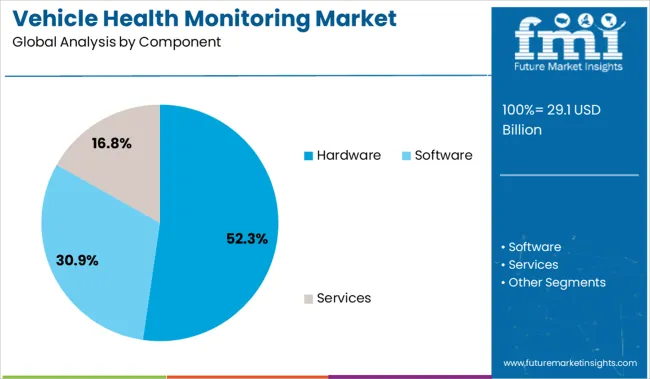

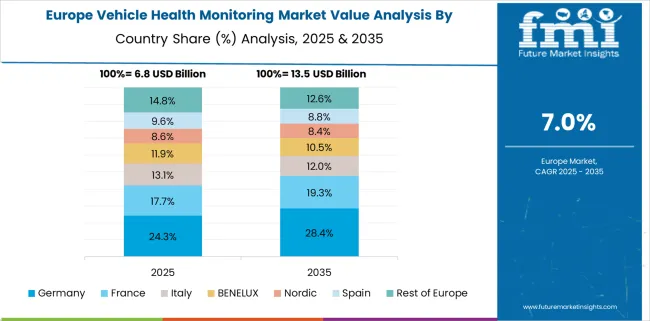

The hardware segment, holding 52.3% share, underpins early adoption as sensor density and electronic control systems expand across internal combustion, hybrid, and electric platforms. North America dominates due to its established telematics infrastructure and advanced regulatory environment, while Asia-Pacific accelerates adoption in ride-hailing fleets and commercial transport, where predictive maintenance translates to direct cost savings. Europe maintains steady momentum, anchored by stringent emission and safety compliance.

Emerging market dynamics point toward convergence of health monitoring with autonomous driving systems, leveraging machine learning for failure prediction and real-time over-the-air corrective actions.

| Metric | Value |

|---|---|

| Vehicle Health Monitoring Market Estimated Value in (2025 E) | USD 29.1 billion |

| Vehicle Health Monitoring Market Forecast Value in (2035 F) | USD 60.4 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The vehicle health monitoring market is evolving rapidly as automotive manufacturers, fleet operators, and consumers prioritize predictive maintenance, safety, and cost optimization. Demand is being fueled by increasing integration of electronic control units and sensors that enable real-time monitoring of vehicle components.

Adoption is further accelerated by regulatory pressures to reduce road accidents and improve emission compliance through early fault detection. Automakers are incorporating advanced diagnostics and telematics to enhance customer experience, reduce warranty costs, and improve vehicle uptime.

Future growth is anticipated to be shaped by the transition toward connected and autonomous vehicles, where health monitoring will play a critical role in ensuring operational reliability. Advances in data analytics, machine learning, and cloud connectivity are paving the way for smarter, more proactive vehicle health management systems that align with the industry’s shift toward mobility-as-a-service and electrification.

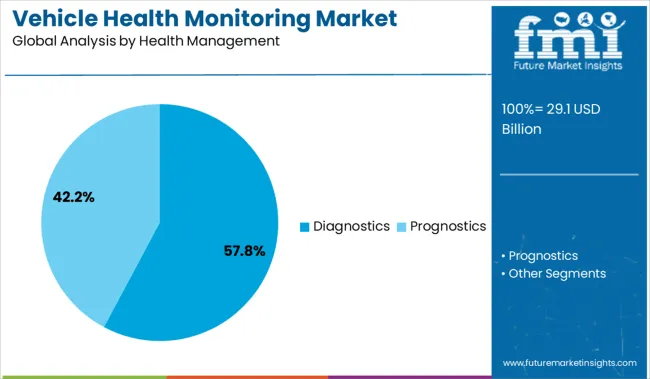

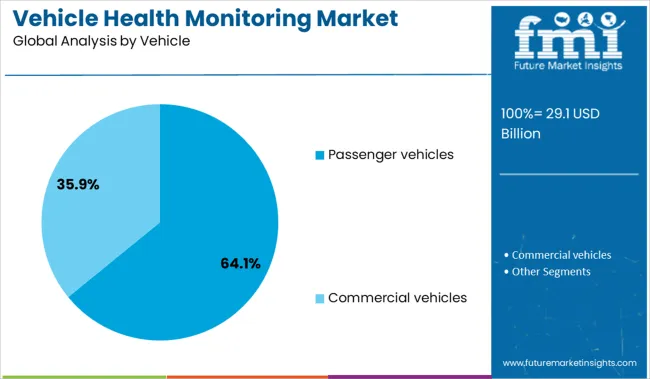

The vehicle health monitoring market is segmented by component, health management, vehicle type, application, and region. By component, it includes hardware such as sensors, GPS systems, and OBD ports, as well as software and services including maintenance and repair services and consulting and integration services. In terms of health management, the segmentation comprises diagnostics and prognostics for condition assessment and failure prediction. Based on vehicle type, the market covers passenger vehicles such as hatchbacks, sedans, and SUVs, along with commercial vehicles including light commercial vehicles (LCV) and heavy commercial vehicles (HCV).

By application, it spans predictive maintenance, real-time vehicle diagnostics, roadside assistance, emission monitoring, fleet management, and vehicle safety and security. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

When segmented by component, the hardware segment is projected to hold 52.3% of the total market revenue in 2025, establishing itself as the leading contributor. This leadership is attributed to the increasing deployment of sensors, controllers, and embedded systems that enable real-time health monitoring of critical vehicle parts.

Hardware solutions have been widely implemented to ensure accurate data capture and seamless integration with on-board and off-board diagnostic systems. The rise in sensor density within vehicles and the growing complexity of vehicle architectures have reinforced the importance of robust hardware platforms.

Manufacturers have also prioritized developing scalable and cost-effective hardware that supports predictive maintenance, which has solidified this segment’s dominance in enabling reliable monitoring capabilities.

In terms of health management, the diagnostics segment is expected to account for 57.8% of the market revenue in 2025, maintaining its leading position. This prominence is driven by the increasing need for early fault detection and predictive insights that minimize vehicle downtime and maintenance costs.

Diagnostics solutions have been integrated extensively to support compliance with stringent safety and emissions regulations while enhancing user experience through timely alerts and actionable recommendations. The expansion of connected vehicle ecosystems has further amplified the relevance of diagnostics, as vehicles generate higher volumes of data that require continuous analysis.

Advancements in diagnostic algorithms and the shift toward cloud-based analytics have also strengthened this segment’s role in facilitating effective health management.

When segmented by vehicle type, the passenger vehicles segment is projected to capture 64.1% of the market revenue in 2025, securing its position as the largest segment. This dominance is reinforced by the increasing adoption of health monitoring systems in personal and shared mobility vehicles to improve safety, reduce maintenance costs, and enhance resale value.

Rising consumer awareness about vehicle longevity and operational reliability has supported the integration of monitoring solutions at scale within passenger vehicles. Automakers have also focused on differentiating their offerings through advanced health monitoring features that appeal to individual buyers and fleet operators alike.

The growing share of connected and electric passenger vehicles has further increased the demand for continuous health monitoring, ensuring optimal performance and compliance throughout the vehicle’s lifecycle.

Predictive maintenance in vehicle health monitoring involves using real-time data from sensors to anticipate component failures before they occur. By analyzing parameters such as temperature, vibration, and fluid levels, the system identifies anomalies that signal wear or malfunction. This approach enables timely servicing, minimizes unexpected breakdowns, and optimizes part replacement cycles. Automotive OEMs and fleet operators use predictive maintenance to enhance reliability, reduce downtime, and improve the overall efficiency of vehicle operations.

Automakers are embedding predictive vehicle health monitoring systems into connected vehicles to detect component degradation before failure occurs. These systems track key metrics such as temperature, vibration, voltage, and fluid levels, analyzing anomalies that signal wear or malfunction. Brands like Tesla, BMW, and Volvo have integrated onboard diagnostics with cloud-based AI to trigger alerts and maintenance recommendations in real time. This has enabled dealerships and service centers to act proactively, scheduling repairs based on actual component performance rather than fixed intervals.

Fleet managers use predictive analytics to minimize breakdowns and reduce service interruptions, especially in logistics and ride-sharing operations. The shift from reactive to preventive servicing through predictive diagnostics is becoming essential in maintaining performance standards in next-generation vehicles.

The transition to electric vehicles is creating new opportunities for advanced vehicle health monitoring systems tailored to battery management, powertrain diagnostics, and software-controlled subsystems. EV manufacturers are equipping vehicles with real-time sensors that monitor charging cycles, thermal behavior, and cell integrity. Companies like Rivian and Lucid Motors are enabling users to receive remote battery health reports via mobile apps, enhancing transparency and owner engagement. Remote diagnostics platforms are also supporting over-the-air troubleshooting, reducing the need for physical service visits.

As EV adoption grows, aftermarket and OEM players are exploring subscription-based health monitoring services, offering insights into component aging, range performance, and safety-critical thresholds. These services are gaining value in fleet electrification, where uptime and efficiency are critical performance metrics.

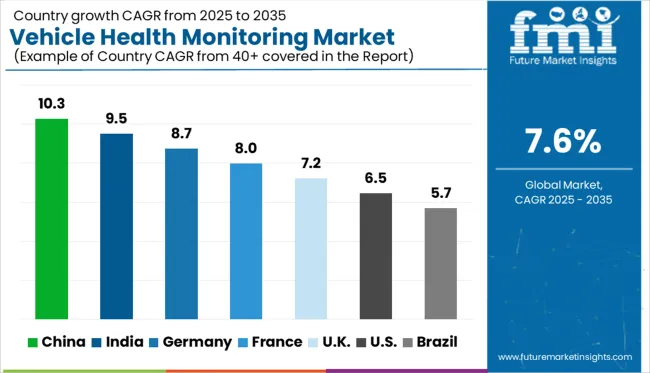

| Countries | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

| USA | 6.5% |

| Brazil | 5.7% |

The global vehicle health monitoring market is expected to grow at a CAGR of 7.6% from 2025 to 2035, driven by rising integration of predictive diagnostics, connected telematics, and OEM-supported onboard sensor suites. China leads at 10.3%, fueled by autonomous vehicle development and platform-based fleet analytics. India follows at 9.5%, supported by rising installation in shared mobility fleets and government incentives for safety integration.

Germany posts 8.7%, led by advanced OEM diagnostics and aftersales service expansion. France records 8.0%, shaped by compliance with EU vehicle condition reporting norms. The United Kingdom grows at 7.2%, influenced by insurer-OEM partnerships and real-time condition alert systems. The report includes analysis of over 40 countries, with five profiled below for reference.

Adoption of vehicle health monitoring systems in China is forecast to accelerate at a CAGR of 10.3% from 2025 to 2035. Expansion is being supported by vehicle digitization mandates and broader deployment of autonomous driving technologies. OEMs are bundling embedded diagnostics with over-the-air (OTA) updates, driving differentiation.

AI-led fault prediction modules and cloud-based analytics platforms are being adopted by ride-hailing networks and logistics firms. Domestic startups are collaborating with chip manufacturers to improve real-time performance monitoring in electric vehicles. Regulatory incentives are being aligned to promote safety compliance and predictive maintenance standards.

Sales of vehicle health monitoring systems in India are projected to rise at a CAGR of 9.5% through 2035. Uptake is being driven by increased deployment in fleet vehicles, commercial trucks, and app-based mobility solutions. Real-time alert systems and engine diagnostics are being prioritized in urban transport networks.

Local manufacturers are integrating sensors in mid-segment models to meet rising consumer demand for predictive service alerts. Collaborations between telematics firms and insurance providers are reshaping maintenance workflows. Government policies promoting vehicle fitness tracking and emission management are creating long-term potential for embedded diagnostics.

Demand for vehicle health monitoring systems is expected to grow at a CAGR of 8.7% between 2025 and 2035. Growth is being propelled by OEM innovation and embedded analytics in luxury and commercial segments. Vehicle diagnostic modules are being combined with onboard firmware diagnostics and cloud-based service histories.

Data-driven platforms are being offered through branded mobile apps, allowing remote access to real-time mechanical data. Compliance requirements under EU automotive safety laws are reinforcing investments in intelligent monitoring systems. Independent garages and dealer networks are adopting scan tools integrated with cloud-based vehicle histories.

Adoption of vehicle health monitoring technologies in the United Kingdom is expected to grow at a CAGR of 7.2% from 2025 to 2035. Use cases are expanding from high-end vehicles to mid-segment cars, driven by insurer incentives and extended warranty coverage. Connected systems offering tire pressure, brake pad, and battery health updates are being bundled by major dealers.

OEMs are enabling cross-platform telematics integration for remote diagnostics and service scheduling. Garage networks are investing in compatibility with manufacturer-linked diagnostic platforms to remain competitive in servicing contracts.

France is forecast to expand at a CAGR of 8.0% in vehicle health monitoring deployment through 2035. National mandates for real-time fault reporting and electronic logbooks are supporting growth. Automakers are embedding diagnostic intelligence in both EVs and internal combustion vehicles to comply with European safety directives.

Component-level failure pattern databases are being used to refine predictive software. Shared mobility fleets are adopting plug-in OBD devices and cloud-based alert systems. Data-sharing policies are shaping platform integration with insurers and service centers.

The vehicle health monitoring industry is led by Bosch, holding a 20.0% market share, driven by its integration of predictive diagnostics into ECU platforms and connected vehicle ecosystems.

Continental and Delphi focus on real-time data analytics and sensor fusion for early fault detection in electric and internal combustion vehicles. Denso and ZF Friedrichshafen offer OEM-grade systems embedded within powertrain and safety modules. Luxoft and Visteon specialize in software-defined dashboards and cloud-based analytics tailored for fleet management.

Octo Group, OnStar, and Zubie serve telematics-driven use cases, supporting insurance, logistics, and mobility services. Market competition is shaped by three factors: embedded AI for predictive maintenance, cybersecurity of onboard diagnostics, and integration with over-the-air update infrastructures across global vehicle platforms.

In December 2024, Continental showcased its “Road to Cloud” software-defined vehicle technologies at CES 2025, unveiling integrated health monitoring dashboards and virtualization platforms for remote diagnostics and predictive maintenance.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.1 Billion |

| Component | Hardware, Sensors, GPS systems, OBD port, Others, Software, Services, Maintenance & repair services, and Consulting & integration services |

| Health Management | Diagnostics and Prognostics |

| Vehicle | Passenger vehicles, Hatchback, Sedan, SUV, Commercial vehicles, Light commercial vehicles (LCV), and Heavy commercial vehicles (HCV) |

| Application | Predictive maintenance, Real-time vehicle diagnostics, Roadside assistance, Emission monitoring, Fleet management, and Vehicle safety & security |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Continental, Delphi, Denso, Luxoft, Octo Group, Onstar, Visteon, ZF Friedrichshafen, and Zubie |

| Additional Attributes | Dollar sales span onboard and aftermarket vehicle health monitoring systems, segmented by solution type such as OBD-II dongles, integrated telematics, and AI-based diagnostics, with telematics gaining share. Demand is rising for predictive maintenance and real-time alert capabilities. OEMs and select contract developers provide turnkey system integration. North America and Europe lead adoption, driven by regulatory mandates and the pursuit of fleet efficiency. |

The global vehicle health monitoring market is estimated to be valued at USD 29.1 billion in 2025.

The market size for the vehicle health monitoring market is projected to reach USD 60.4 billion by 2035.

The vehicle health monitoring market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in vehicle health monitoring market are hardware, sensors, gps systems, obd port, others, software, services, maintenance & repair services and consulting & integration services.

In terms of health management, diagnostics segment to command 57.8% share in the vehicle health monitoring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Roadside Assistance Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Armor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Conversion Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Electrification Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA