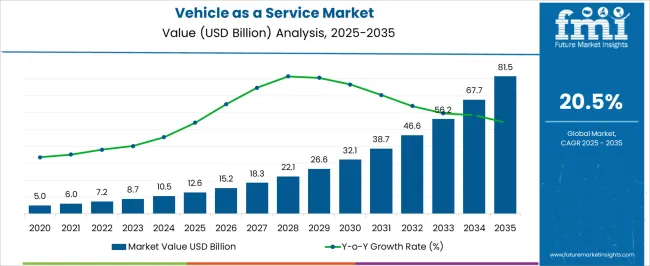

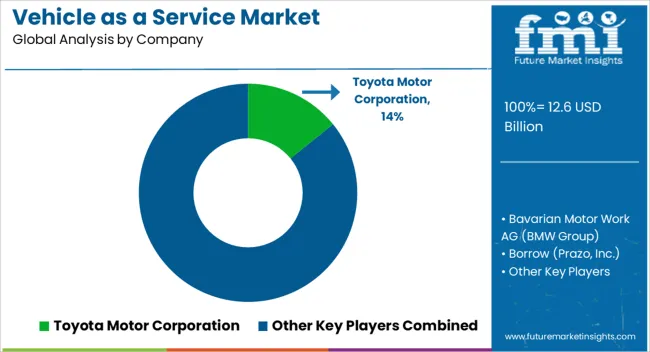

The vehicle-as-a-service market is estimated to be valued at USD 12.6 billion in 2025 and is projected to reach USD 81.5 billion by 2035, registering a compound annual growth rate (CAGR) of 20.5% over the forecast period. This trajectory highlights a rapid expansion phase where adoption is accelerating due to changing mobility preferences and digital infrastructure readiness. In terms of the market maturity curve, the sector is currently positioned in the growth stage, moving steadily toward early maturity by the end of the forecast horizon.

The steep rise between 2025 and 2030 indicates a period of strong uptake, as consumers and enterprises increasingly favor subscription, leasing, and shared mobility models over traditional ownership. This phase is characterized by experimentation, competitive diversification, and technological integrations involving connected platforms and electric vehicles. The adoption lifecycle further shows concentration in the early adopter and early majority phases during the next five years.

By 2030 onward, penetration into the late majority segment is expected as cost benefits, service reliability, and regulatory incentives strengthen the appeal of service-based models. Resistance from laggards will persist, particularly in regions with entrenched ownership culture, but overall demand consolidation is anticipated. The market evolution suggests a steady shift from rapid expansion toward broader normalization and systemic integration across industries.

| Metric | Value |

|---|---|

| Vehicle as a Service Market Estimated Value in (2025 E) | USD 12.6 billion |

| Vehicle as a Service Market Forecast Value in (2035 F) | USD 81.5 billion |

| Forecast CAGR (2025 to 2035) | 20.5% |

Enterprises and consumers are increasingly opting for service-based vehicle access over traditional ownership, influenced by evolving urban mobility preferences and rising environmental concerns. According to industry news sources and corporate announcements, subscription-based and on-demand vehicle services are being actively adopted across developed and emerging economies.

Regulatory pressures to reduce emissions, coupled with technological advancements in vehicle connectivity and fleet management, are supporting widespread deployment of scalable service models. Automotive manufacturers and tech providers are collaborating to create comprehensive service ecosystems, integrating maintenance, insurance, and digital user experiences.

As highlighted in investor presentations and automotive press coverage, the growth outlook remains positive as urbanization, digital transformation, and sustainability initiatives align with consumer demand for convenience and cost-efficiency. These factors are expected to strengthen the market’s position as a mainstream mobility solution across both commercial and personal transportation segments.

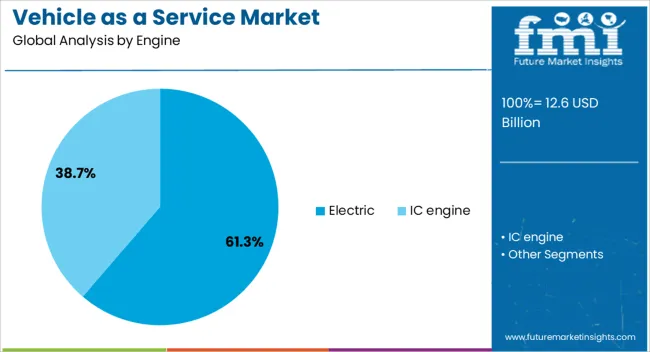

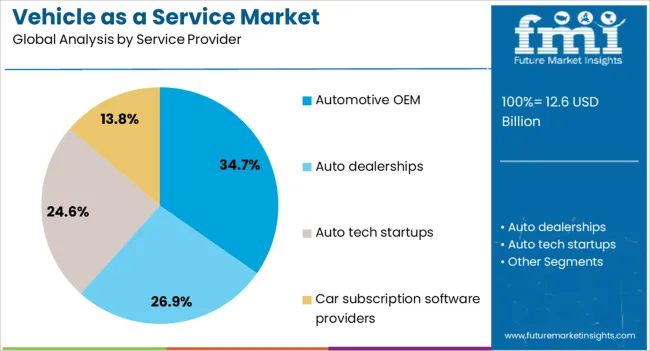

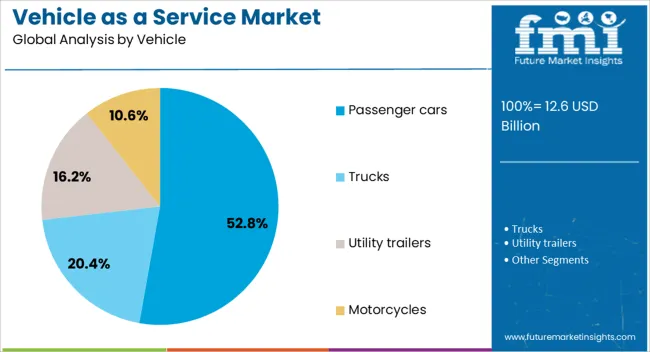

The vehicle as a service market is segmented by engine, service provider, vehicle, and geographic regions. By engine, the vehicle as a service market is divided into Electric and IC engine. In terms of service providers, the vehicle as a service market is classified into Automotive OEMs, Auto dealerships, Auto tech startups, and Car subscription software providers. Based on vehicle, the vehicle as a service market is segmented into Passenger cars, Trucks, Utility trailers, and Motorcycles.

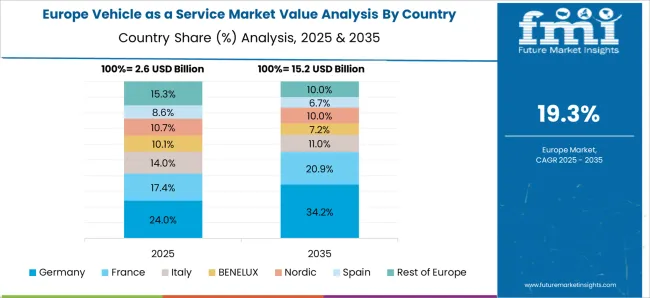

Regionally, the vehicle as a service industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric engine segment is expected to account for 61.3% of the Vehicle as a Service market revenue share in 2025, making it the leading engine type segment. This growth has been driven by increasing regulatory mandates to curb emissions and rising consumer preference for sustainable mobility solutions. Automotive news publications and OEM press releases have emphasized that electric vehicles are being integrated into service fleets at a rapid pace, supported by improved battery technology, expanded charging infrastructure, and declining operational costs.

Fleet operators have favored electric models for their lower maintenance requirements and long-term cost benefits. In addition, incentives from governments and municipalities have accelerated the deployment of electric vehicles across urban mobility platforms.

The segment’s prominence has been further supported by the alignment of electric mobility with corporate ESG goals and the growing adoption of shared and subscription services that prioritize clean transportation.

The automotive OEM segment is projected to hold 34.7% of the Vehicle as a Service market revenue share in 2025, making it the leading service provider category. Growth in this segment has been supported by manufacturers' direct entry into the service-based mobility space, allowing them to retain long-term customer relationships and generate recurring revenue streams. Automotive companies have leveraged their established brands, distribution networks, and after-sales service capabilities to launch tailored mobility offerings.

Press releases and investor briefings from leading OEMs have highlighted strategic investments in subscription services, fleet leasing, and digital mobility platforms. This vertical integration has enabled greater control over user experience, pricing models, and technology deployment.

Furthermore, OEMs have been focusing on software-defined vehicle platforms to facilitate remote diagnostics, updates, and usage-based billing models. The ability to offer bundled services with transparency and scalability has reinforced the dominance of OEMs in this space, establishing them as preferred providers in the evolving Vehicle as a Service ecosystem.

The passenger cars segment is forecasted to contribute 52.8% of the Vehicle as a Service market revenue share in 2025, maintaining its position as the leading vehicle category. The segment’s growth has been fueled by rising consumer demand for flexible access to personal transportation without the burdens of ownership. According to mobility-focused publications and announcements from fleet operators, passenger cars are widely adopted across subscription models, ride-hailing platforms, and leasing services.

Their suitability for urban commuting, business travel, and short-term rentals has made them the most versatile and accessible option in the market. In addition, manufacturers and service providers have increasingly focused on offering compact and electric passenger vehicles, aligning with sustainability goals and city-specific regulations.

The segment's dominance is also supported by the availability of a broad vehicle portfolio across price points and user preferences. As digital platforms streamline the customer journey and enhance service delivery, passenger cars continue to lead the shift toward user-centric mobility models.

The market has been influenced by the growing need for flexible mobility solutions across urban and intercity transportation. Instead of ownership, individuals and businesses have increasingly preferred subscription, leasing, and ride-sharing models that reduce upfront costs and maintenance responsibilities. This model has enabled access to modern fleets equipped with telematics and smart connectivity features. Industry participants have benefited from recurring revenue streams, while consumers have gained customizable access to vehicles. These structural shifts have shaped the expansion of the market.

Subscription-based services have been gaining prominence as they provide customers with short- or long-term access to vehicles without the burden of ownership. These services have included insurance, maintenance, and roadside assistance, offering a complete package under a single monthly fee. Automakers and fleet operators have utilized this model to enhance fleet utilization and reduce idle time. Businesses have also benefited from scalable fleets tailored to specific needs, reducing capital expenditure on vehicle purchases. Customers have valued the flexibility to switch vehicle models depending on their requirements, such as moving between compact cars and premium SUVs. This adaptability has positioned subscription models as a competitive alternative to leasing and purchasing, encouraging automotive companies to expand offerings. The rise in corporate mobility solutions and shared economy trends has reinforced this segment’s growth within the market.

Ride-hailing and car-sharing platforms have become integral components of the vehicle as a service market. Companies have deployed fleets for app-based booking systems, enabling quick and cost-efficient transportation for individuals. Urban populations have increasingly relied on ride-hailing for short-distance commuting, while car-sharing has catered to customers requiring temporary vehicle access. The efficiency of these models has reduced traffic congestion and vehicle ownership costs for consumers. Ride-hailing operators have invested in advanced mapping systems, dynamic pricing algorithms, and safety features to improve user experience. The electric vehicles have been gradually integrated into shared fleets, aligning with environmental goals and cost reduction initiatives. Partnerships between technology providers, automotive firms, and mobility startups have further stimulated innovation. This combination of affordability, convenience, and efficiency has made ride-hailing and car-sharing central drivers in the market expansion worldwide.

The integration of telematics and connected vehicle technologies has transformed fleet operations within the vehicle as a service market. Real-time tracking, predictive maintenance, and route optimization have been applied to maximize fleet efficiency and reduce downtime. Service providers have monitored vehicle usage patterns to create personalized pricing and subscription models. Advanced data analytics have improved vehicle allocation, ensuring that demand surges are met without compromising service quality. The safety monitoring systems and driver behavior analytics have been deployed to reduce accident risks and operational costs. Fleet electrification strategies have been supported by telematics through battery health monitoring and charging optimization. This technological influence has strengthened the appeal of vehicle as a service platform for businesses and consumers alike, reinforcing the role of data-driven decision-making. The competitive advantage provided by digital fleet management solutions has been a crucial factor in shaping the market trajectory.

Business fleet applications have accounted for a significant portion of the vehicle as a service demand. Enterprises have shifted to this model to optimize operational efficiency while avoiding large upfront investments in fleet ownership. Logistics firms, delivery services, and corporate mobility providers have embraced vehicle as a service to maintain flexible and scalable fleets. Seasonal fluctuations in demand have been managed effectively by adding or reducing vehicles under subscription or lease contracts. This has enabled firms to control costs and allocate capital to core business functions. Corporate adoption has also expanded due to the inclusion of electric vehicles in service fleets, reducing fuel expenses and aligning with regulatory guidelines. Employee mobility programs and business travel solutions have further promoted the use of this model. By offering a cost-effective, adaptable, and reliable alternative to ownership, corporate fleets have emerged as a key growth driver in the global vehicle as a service market.

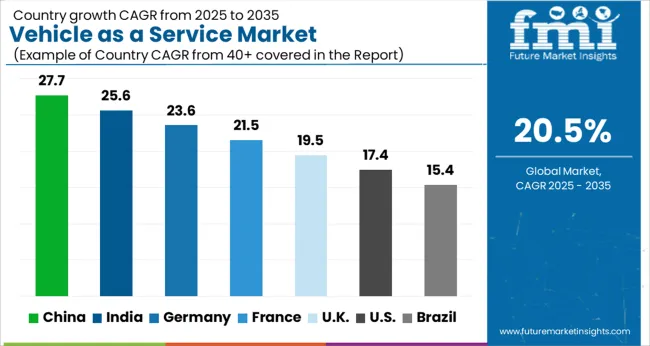

The market is projected to record a CAGR of 20.5% between 2025 and 2035, supported by increasing mobility-as-a-service models, connected fleets, and digital subscription platforms. China leads with a 27.7% CAGR, driven by rapid adoption of ride-hailing platforms, electric shared fleets, and government-backed smart mobility initiatives. India follows at 25.6%, supported by rising demand for shared mobility in urban centers and expansion of subscription-based vehicle ownership alternatives. Germany, with 23.6%, is strengthening its mobility ecosystem through investments in digital infrastructure and integration of autonomous-ready fleets. The UK, at 19.5%, is focusing on regulatory reforms and enhanced electric mobility adoption. The USA, with 17.4%, shows strong participation from ride-hailing leaders and growing penetration of flexible vehicle leasing platforms. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 27.7% from 2025 to 2035. Rapid adoption of shared mobility platforms and subscription-based models is driving demand. Government efforts to reduce urban congestion and promote electric vehicles are providing significant opportunities for the market. Technology-driven mobility startups are playing a pivotal role in scaling services and enhancing fleet efficiency. With consumers preferring flexible ownership models, China is expected to remain a frontrunner in shaping the global vehicle as a service market.

India is anticipated to record a CAGR of 25.6% in the market during 2025 to 2035. Rising smartphone penetration and demand for affordable mobility solutions are key growth drivers. The increasing popularity of ride-hailing services and vehicle leasing platforms is reshaping consumer transport patterns. Government policies encouraging EV adoption and digital infrastructure development are further strengthening prospects. Expanding urban population and growing preference for flexible transport ownership are expected to sustain momentum in the Indian market.

Germany is forecast to achieve a CAGR of 23.6% in the market through 2025 to 2035. Strong automotive manufacturing capabilities and emphasis on sustainable mobility solutions are propelling growth. The integration of digital platforms with smart mobility services is enhancing consumer convenience. Shared mobility is gaining popularity in urban regions as cost efficiency and sustainability gain importance. Continued research and innovation in EVs and connected vehicles will further reinforce Germany’s market position in this segment.

The United Kingdom is projected to grow at a CAGR of 19.5% in the market from 2025 to 2035. Growing acceptance of car-sharing, leasing, and subscription models is shaping mobility behavior. Policies supporting low-emission transport and digital innovation are expanding adoption rates. Startups and established automakers are collaborating to provide innovative and flexible ownership solutions. Demand for EV-based fleets is rising steadily, supported by nationwide charging infrastructure expansion. These trends are set to position the UK as a significant European market in this sector.

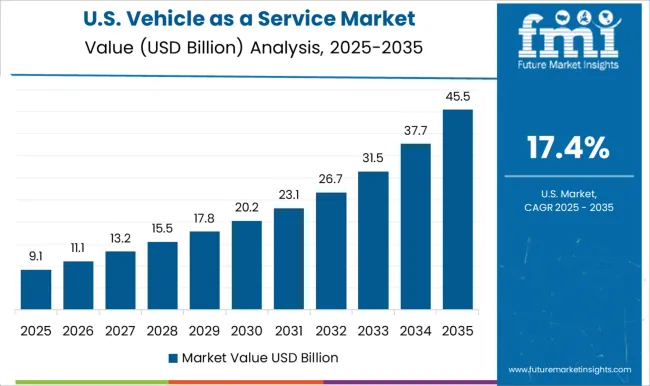

The United States is expected to grow at a CAGR of 17.4% in the market between 2025 and 2035. Increasing consumer demand for cost-effective alternatives to ownership is driving the adoption of leasing and subscription services. Large technology firms and automakers are heavily investing in mobility platforms to expand service reach. EV adoption in VaaS fleets is accelerating due to supportive incentives and infrastructure improvements. With rising demand for flexible mobility solutions, the US market will continue to play a crucial role globally.

The market is driven by established automotive manufacturers and mobility-focused platforms that integrate subscription, leasing, and rental models to meet evolving consumer transportation preferences. Toyota Motor Corporation, BMW Group, Daimler AG, Volkswagen AG, and General Motors Company are among the leading original equipment manufacturers offering structured mobility services, leveraging strong brand loyalty and extensive fleets. Porsche AG and Volvo AB extend premium subscription models that attract customers seeking flexibility without ownership constraints. Technology-driven ventures such as Borrow, Cluno GmbH, Drover Ltd. (Cazoo), and Flexdrive (Lyft) introduce innovation into the market by targeting younger urban populations with digital-first solutions.

CarNext B.V. and OpenRoad contribute to used car subscription services, creating cost-efficient alternatives. Traditional rental and leasing specialists like Hertz Corporation and Sixt SE provide large-scale fleets, ensuring global reach across business and leisure travel segments. In Asia, Hyundai Motor Company, TATA Motors Limited, and Zoomcar India Private Ltd. are expanding mobility offerings tailored to regional demand, supported by the rising adoption of app-based platforms. These providers are shaping the competitive landscape through collaborations, strategic alliances, and technology integration. The overall market structure demonstrates a mix of established automakers, innovative startups, and rental service providers, collectively pushing Vehicle as a Service toward becoming a mainstream alternative to ownership across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.6 Billion |

| Engine | Electric and IC engine |

| Service Provider | Automotive OEM, Auto dealerships, Auto tech startups, and Car subscription software providers |

| Vehicle | Passenger cars, Trucks, Utility trailers, and Motorcycles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota Motor Corporation, Bavarian Motor Work AG (BMW Group), Borrow (Prazo, Inc.), CarNext B.V., Cluno GmbH, Daimler AG (Mercedes-Benz Group), Porsche AG, Drover Ltd. (Cazoo), Flexdrive (Lyft), General Motors Company, Hertz Corporation, Hyundai Motor Company, OpenRoad (Portfolio), Sixt SE, TATA Motors Limited, Volkswagen AG, Volvo AB, and Zoomcar India Private Ltd. |

| Additional Attributes | Dollar sales by subscription model and fleet type, demand dynamics across ride hailing, car sharing, and corporate leasing, regional trends in digital mobility ecosystems, innovation in telematics and fleet management software, environmental impact of shared vehicle operations, and emerging use cases in autonomous mobility platforms, logistics fleet outsourcing, and integrated mobility-as-a-service solutions. |

The global vehicle as a service market is estimated to be valued at USD 12.6 billion in 2025.

The market size for the vehicle as a service market is projected to reach USD 81.5 billion by 2035.

The vehicle as a service market is expected to grow at a 20.5% CAGR between 2025 and 2035.

The key product types in vehicle as a service market are electric and ic engine.

In terms of service provider, automotive oem segment to command 34.7% share in the vehicle as a service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Armor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Analytics Market Report – Trends & Forecast 2017-2022

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Growth – Trends & Forecast 2024-2034

Vehicle Starter Motor Market

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Surveillance Market Report – Growth & Forecast 2025 to 2035

Vehicle Interior Air Quality Monitoring Technology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vehicle-to-Grid Market Growth – Trends & Forecast 2024-2034

Vehicle Electrification Market Growth - Trends & Forecast 2025 to 2035

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Conversion Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA