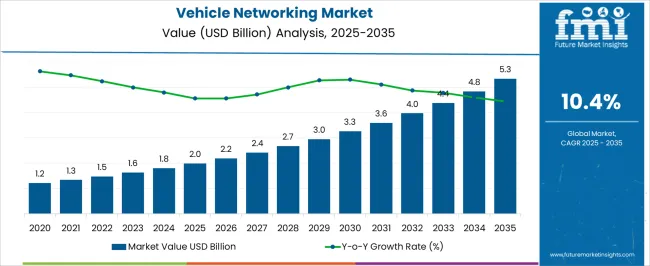

The vehicle networking market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period.

The market’s growth is driven by the increasing integration of advanced networking technologies within modern vehicles, where each technology contributes differently to overall value generation. Key technologies include Controller Area Network (CAN), Ethernet-based networks, FlexRay, and wireless communication protocols such as V2X (Vehicle-to-Everything). In 2025, CAN and legacy bus systems constitute the largest share due to their established presence and reliability in standard vehicle architectures, providing essential communication between electronic control units.

Ethernet-based networking, while initially contributing a smaller share, is poised to grow rapidly, particularly from 2027 onwards, as higher bandwidth requirements emerge for autonomous and connected vehicle functions. FlexRay continues to serve critical safety applications, maintaining moderate contribution, whereas wireless V2X solutions exhibit exponential growth, especially in fleet management and cooperative driving scenarios. By 2035,

Ethernet and wireless technologies dominate contribution, accounting for a substantial portion of the USD 5.3 billion market, reflecting their critical role in high-speed data transmission, advanced driver-assistance systems, and vehicle-to-infrastructure communications. Incremental annual growth across the decade highlights the shift from traditional bus systems to integrated, high-bandwidth networking architectures. The contribution analysis demonstrates a technology-driven transformation, where legacy networks maintain foundational support, while emerging Ethernet and V2X technologies increasingly dictate market value and adoption priorities.

| Metric | Value |

|---|---|

| Vehicle Networking Market Estimated Value in (2025 E) | USD 2.0 billion |

| Vehicle Networking Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

The Vehicle Networking Market is witnessing robust momentum as modern vehicles become increasingly software-defined, connected, and intelligent. The current market landscape is influenced by the automotive industry's shift toward electronic architectures that support data-intensive functionalities like autonomous driving, advanced diagnostics, and seamless infotainment experiences. Growth has been accelerated by rising investments in electric and connected vehicle platforms, as highlighted in OEM annual reports and Tier-1 supplier announcements.

Automakers are adopting domain-based and zonal architectures to streamline communication within vehicles, thereby driving demand for high-bandwidth, low-latency networking solutions. Regulatory push for safety, emission reduction, and data compliance is also shaping technology adoption across vehicle classes.

Future market expansion is expected to be supported by the rollout of vehicle-to-everything infrastructure, advancements in over-the-air updates, and consumer demand for immersive, personalized in-vehicle environments These factors collectively indicate a positive outlook for the vehicle networking ecosystem in the years ahead.

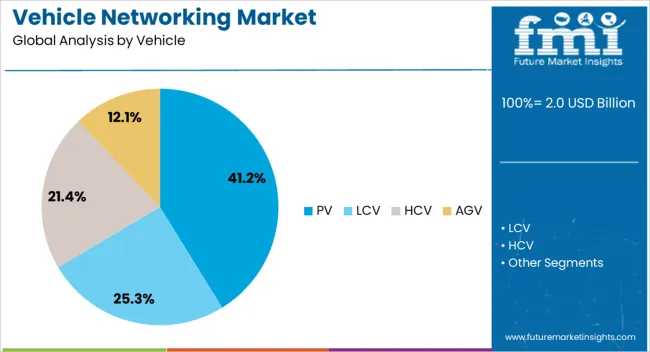

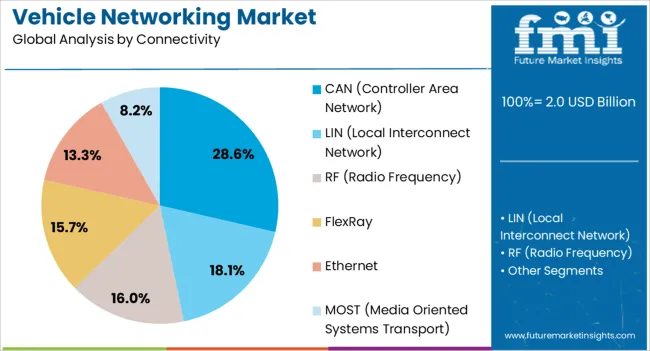

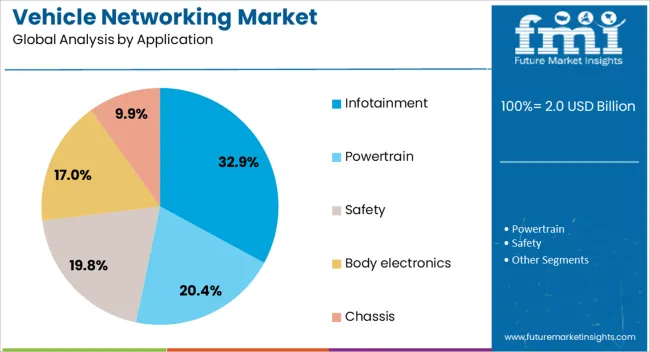

The vehicle networking market is segmented by vehicle, connectivity, application, and geographic regions. By vehicle, the vehicle networking market is divided into PV, LCV, HCV, and AGV. In terms of connectivity, the market is classified into CAN (Controller Area Network), LIN (Local Interconnect Network), RF (Radio Frequency), FlexRay, Ethernet, and MOST (Media Oriented Systems Transport). Based on application, the market is segmented into infotainment, powertrain, safety, body electronics, and chassis. Regionally, the industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger vehicle (PV) segment is anticipated to account for 41.2% of the market revenue share in 2025, making it the largest vehicle category. This dominance is being attributed to the high penetration of advanced driver assistance systems, infotainment platforms, and telematics units in modern passenger vehicles.

Increased consumer expectations for connected features and seamless digital experiences have driven manufacturers to integrate sophisticated networking systems that support real-time data exchange. The segment has also gained traction due to strong production volumes and wider adoption of mid and high-end trims that demand greater network complexity.

Automakers have increasingly relied on scalable electronic platforms in PVs to support software updates, diagnostics, and communication between multiple ECUs These factors, combined with the regulatory pressure for improved safety and emission standards, have solidified the passenger vehicle segment’s leading position in the market.

The controller area network (CAN) segment is projected to capture 28.6% of the Vehicle Networking Market revenue share in 2025, securing its status as the leading connectivity technology. This position is being reinforced by its long-standing reliability, cost-effectiveness, and suitability for in-vehicle communication among electronic control units.

Automotive manufacturers have continued to rely on CAN due to its deterministic message delivery and simplicity in architecture, particularly for powertrain and body control applications. Industry whitepapers and OEM documentation have emphasized that despite the emergence of newer protocols, CAN remains indispensable for critical functions where latency and cost constraints exist.

Its robustness in harsh automotive environments and broad compatibility across legacy and modern platforms have contributed to sustained deployment Furthermore, advancements like CAN FD are extending its utility for higher data requirements without overhauling existing infrastructure, supporting its continued relevance and growth in the market.

The infotainment application segment is expected to lead with 32.9% of the Vehicle Networking Market revenue share in 2025. This leadership is being driven by escalating consumer demand for seamless connectivity, real-time navigation, in-car entertainment, and voice assistant integration. Carmakers are prioritizing the integration of high-speed networking protocols to enable multimedia streaming, smartphone mirroring, and cloud-based services within vehicles.

Tier-1 suppliers and OEMs have been investing in centralized computing and zonal architectures that place infotainment at the core of the digital cockpit experience. The segment’s expansion has also been supported by the growing role of subscription-based digital services, which depend heavily on robust in-vehicle networks.

As vehicles become more connected and software-defined, infotainment systems are being positioned as both a value driver and a brand differentiator These developments have established infotainment as a pivotal application area in the vehicle networking landscape.

The market has been expanding due to increasing demand for connected vehicle technologies, real-time data exchange, and advanced driver assistance systems. Vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-everything (V2X) communications have enabled safer and more efficient transportation networks. Growth has been supported by integration of IoT, 5G, and telematics solutions, which facilitate real-time monitoring, predictive maintenance, and infotainment services. Automotive manufacturers and fleet operators are increasingly adopting networking solutions to enhance operational efficiency, improve road safety, and provide connected mobility experiences globally.

Technological innovations have played a critical role in shaping the vehicle networking market. The adoption of 5G connectivity, edge computing, and IoT-enabled sensors has enabled high-speed, low-latency data transmission between vehicles, infrastructure, and cloud platforms. Advanced telematics systems have facilitated vehicle tracking, predictive maintenance, and driver behavior analysis. Integration of V2X technologies has supported collision avoidance, traffic management, and emergency response systems. Cybersecurity measures, including encryption, authentication, and intrusion detection, have been strengthened to ensure safe data exchange. The development of interoperable protocols and standardized communication frameworks has enhanced connectivity across multiple vehicle brands and transportation networks. Collectively, these technological advancements have driven adoption among automakers, fleet operators, and smart city planners, ensuring that vehicle networking systems remain central to connected mobility initiatives globally.

Government policies and regulatory frameworks have significantly influenced the growth of vehicle networking solutions. Safety regulations in Europe, North America, and Asia have mandated the integration of V2V and V2I communication systems in new vehicles to reduce accidents and improve traffic flow. Smart city initiatives have promoted connected infrastructure deployment, including intelligent traffic lights, sensor-enabled roadways, and centralized monitoring systems. Incentives and funding for research in automotive connectivity and ITS (Intelligent Transportation Systems) have encouraged manufacturers to adopt networking technologies. The standards development organizations have emphasized interoperability and cybersecurity, ensuring reliable and safe communication networks. Regulatory oversight has created a strong market pull, encouraging both OEMs and technology providers to innovate, scale, and deploy advanced vehicle networking solutions across public and private transport sectors globally.

Fleet operators and logistics companies have been major adopters of vehicle networking technologies to improve operational efficiency and safety. Real-time tracking, telematics monitoring, and predictive maintenance have reduced downtime and optimized routing for trucks, buses, and delivery vehicles. Data-driven insights have enabled fuel efficiency improvements, reduced emissions, and enhanced driver performance. Integration with cloud-based fleet management platforms has facilitated centralized monitoring of large vehicle networks across geographic regions. Safety features, including collision alerts, driver fatigue detection, and route risk assessment, have been strengthened through networking solutions. The commercial sector has also leveraged vehicle networking to improve cargo security, compliance reporting, and customer satisfaction. As a result, fleet adoption has emerged as a key driver for scaling the vehicle networking market while demonstrating tangible operational and economic benefits.

The market has been supported by the growing adoption of connected mobility and autonomous driving initiatives. Networking systems enable vehicles to exchange information with other vehicles, roadside units, and central traffic management systems, supporting semi-autonomous and fully autonomous driving technologies. Enhanced situational awareness, collision avoidance, and cooperative driving have been facilitated by integrated sensors, V2X protocols, and AI-based analytics. Urban mobility solutions, including ride-sharing platforms and smart transportation networks, have leveraged vehicle connectivity to improve traffic flow and reduce congestion. Partnerships between automotive manufacturers, telecom providers, and technology companies have accelerated the deployment of advanced networking solutions. Consequently, the expansion of connected and autonomous mobility applications has reinforced demand for reliable, scalable, and secure vehicle networking systems globally.

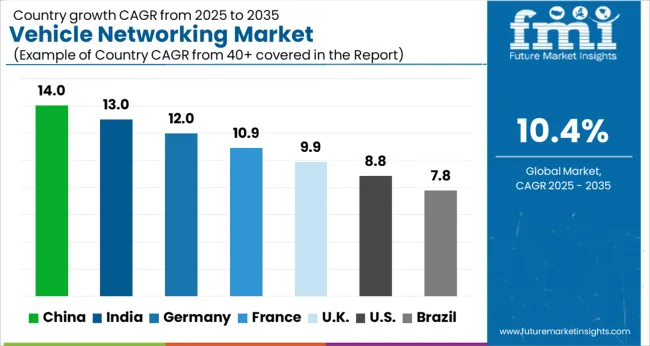

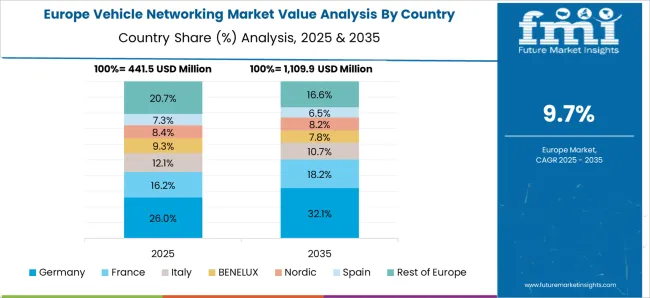

The market is projected to grow at a CAGR of 10.4% between 2025 and 2035, driven by increasing adoption of connected vehicle technologies, V2X communication, and advanced driver assistance systems. China leads with a 14.0% CAGR, propelled by rapid deployment of smart transportation infrastructure and connected mobility solutions. India follows at 13.0%, supported by growing automotive digitization and government initiatives for intelligent transport systems. Germany, at 12.0%, benefits from strong automotive R&D and integration of vehicle-to-vehicle communication technologies. The UK, growing at 9.9%, focuses on connected vehicle pilots and urban mobility networks. The USA, at 8.8%, experiences steady adoption from automotive tech investments and regulatory support for vehicle connectivity. This report covers 40+ countries, with the top markets highlighted here for reference.

China is poised to expand at a CAGR of 14% in the market from 2025 to 2035, propelled by large-scale adoption of connected and autonomous vehicles. Integration of telematics, AI-based traffic management, and vehicle-to-everything (V2X) solutions is enhancing road safety, efficiency, and fleet management. Government initiatives promoting intelligent transport systems and smart cities are accelerating deployment, while collaborations between OEMs and technology providers are driving innovation. Expansion of 5G connectivity and cloud-based vehicle communication platforms is further facilitating real-time data exchange and predictive maintenance. Rising consumer preference for advanced safety systems and digital services in vehicles is stimulating market traction.

India is forecast to grow at a CAGR of 13% in the market during 2025–2035, driven by rapid digitalization and expansion of smart transportation infrastructure. Adoption of IoT-enabled systems, connected car technologies, and AI-powered traffic management is enhancing efficiency and road safety. Automotive OEMs are increasingly deploying advanced telematics and fleet monitoring solutions across passenger and commercial vehicles. Government programs supporting intelligent mobility and connected urban transport are further accelerating market growth. Consumer demand for real-time navigation, predictive maintenance, and in-vehicle infotainment systems is boosting deployment.

Germany is anticipated to grow at a CAGR of 12% in the market between 2025 and 2035, supported by robust automotive manufacturing and advanced technological integration. Expansion of V2X solutions in commercial and luxury vehicles is improving connectivity and safety. Federal initiatives promoting autonomous driving, intelligent transport systems, and smart highways are accelerating adoption. Collaboration between OEMs, telecommunication providers, and technology startups is fostering innovation in cybersecurity, predictive maintenance, and cloud-based vehicle networks. Investment in high-speed connectivity infrastructure and edge computing is strengthening market penetration.

The United Kingdom is projected to grow at a CAGR of 9.9% in the market from 2025 to 2035, with expansion supported by connected car technology and autonomous vehicle trials. Public-private partnerships and government-led smart city projects are accelerating deployment of intelligent transport systems. Automotive OEMs are investing in telematics, AI-assisted traffic management, and predictive maintenance platforms. Adoption of V2X technology and cloud-based solutions is enhancing safety, fleet optimization, and real-time communication. Rising consumer interest in advanced navigation, infotainment, and vehicle monitoring systems is driving demand.

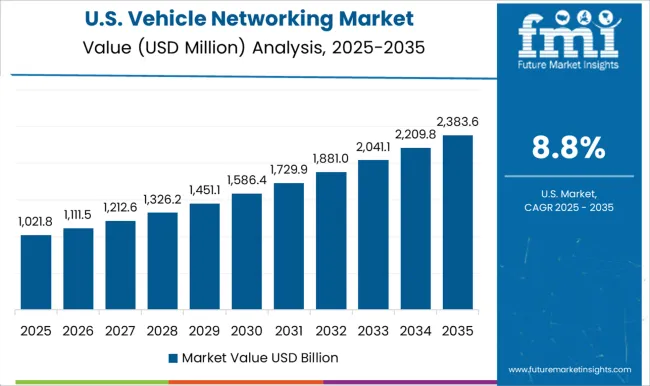

The United States is expected to grow at a CAGR of 8.8% in the market during 2025–2035, driven by rapid adoption of autonomous vehicles, telematics, and V2X solutions. Expansion of AI-based traffic management, cloud-based connectivity, and predictive maintenance is enhancing fleet operations and safety. OEMs and technology providers are deploying advanced communication protocols and edge computing infrastructure to support connected vehicle networks. Government programs supporting intelligent transportation and smart mobility systems are stimulating growth, while consumer demand for real-time navigation, infotainment, and fleet monitoring continues to increase.

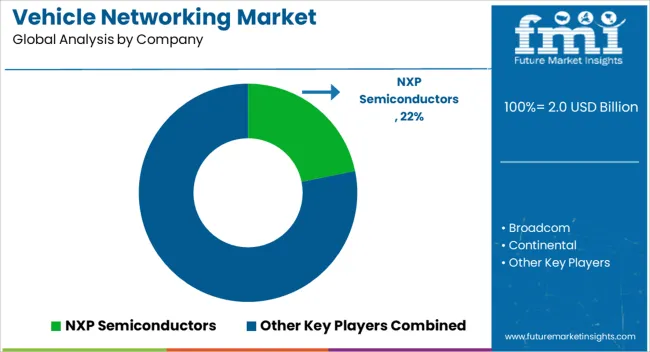

The market comprises semiconductor manufacturers, automotive electronics specialists, and technology integrators delivering advanced connectivity solutions for modern vehicles. NXP Semiconductors holds a leading position by providing automotive networking chips, secure communication controllers, and integrated solutions for in-vehicle data transmission.

Broadcom strengthens the market with high-performance network switches, transceivers, and connectivity modules that support complex vehicle communication systems. Continental contributes through embedded networking solutions, sensors, and control units that facilitate real-time vehicle-to-vehicle and vehicle-to-infrastructure communication. Infineon Technologies and Marvell Semiconductor focus on secure and efficient in-vehicle networking components, enhancing data integrity and reducing latency across automotive networks. ElectRay and Elmos Semiconductor provide specialized ICs and controllers optimized for automotive Ethernet and CAN bus applications. Melexis NV and Microchip Technology deliver microcontrollers, sensors, and network interface solutions that support advanced driver-assistance systems and autonomous functionalities.

Toshiba provides high-reliability networking components suited for harsh automotive environments. High capital expenditure, rigorous compliance standards, and the need for integration with diverse vehicle architectures create significant entry barriers for new market players. Market growth is driven by continuous product launches, R&D investments, and partnerships between semiconductor providers and automotive OEMs, which enable innovative vehicle networking solutions that improve connectivity, safety, and operational efficiency across passenger and commercial vehicles.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Vehicle | PV, LCV, HCV, and AGV |

| Connectivity | CAN (Controller Area Network), LIN (Local Interconnect Network), RF (Radio Frequency), FlexRay, Ethernet, and MOST (Media Oriented Systems Transport) |

| Application | Infotainment, Powertrain, Safety, Body electronics, and Chassis |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NXP Semiconductors N.V.; Broadcom Inc.; Continental AG; Elmos Semiconductor SE; Infineon Technologies AG; Marvell Technology, Inc.; Melexis NV; Microchip Technology Inc.; Toshiba Electronic Devices & Storage |

| Additional Attributes | Dollar sales by network type and vehicle category, demand dynamics across passenger cars, commercial vehicles, and electric vehicles, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in V2X communication, embedded telematics, and cybersecurity solutions, environmental impact of connected vehicle infrastructure and energy consumption, and emerging use cases in autonomous driving, traffic optimization, and real-time fleet management. |

The global vehicle networking market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the vehicle networking market is projected to reach USD 5.3 billion by 2035.

The vehicle networking market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in vehicle networking market are pv, lcv, hcv and agv.

In terms of connectivity, can (controller area network) segment to command 28.6% share in the vehicle networking market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Roadside Assistance Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Armor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Conversion Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Interior Air Quality Monitoring Technology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vehicle Electrification Market Growth - Trends & Forecast 2025 to 2035

Vehicle Control Unit (VCU) Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA