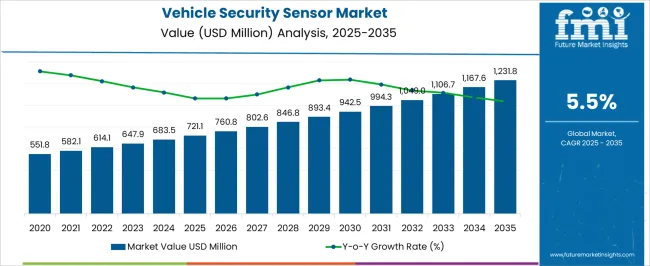

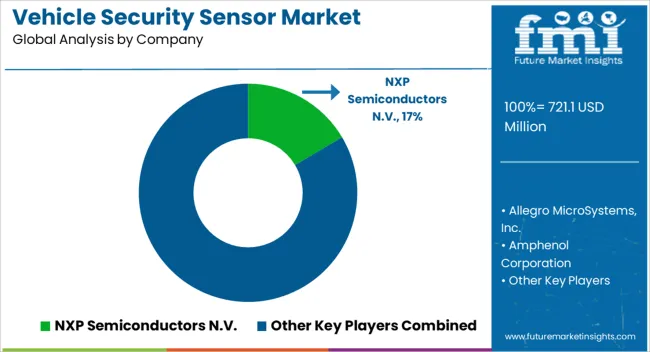

The vehicle security sensor market, estimated at USD 721.1 million in 2025 and projected to reach USD 1,231.8 million by 2035 with a CAGR of 5.5%, demonstrates a progressive contribution from multiple sensor technologies that collectively drive market expansion. Among these, motion sensors, proximity sensors, and biometric access systems are expected to dominate technology contributions throughout the forecast period.

Motion sensors account for a substantial share due to their widespread application in anti-theft alarm systems and intrusion detection, providing real-time alerts and enhancing vehicle safety. The steady growth from USD 721.1 million in 2025 to USD 893.4 million in 2029 indicates that motion sensor adoption remains foundational in standard vehicle security architectures.

Proximity sensors contribute significantly to the market by enabling advanced keyless entry systems and automated locking mechanisms. Their integration in both passenger and commercial vehicles supports incremental market growth, with values rising from USD 942.5 million in 2030 to USD 1,106.7 million in 2034. Biometric technologies, including fingerprint and facial recognition modules, represent a smaller but rapidly increasing contribution, particularly in luxury and premium vehicle segments where security differentiation is critical. The contribution analysis indicates that no single technology exclusively drives the market; rather, incremental adoption across motion, proximity, and biometric sensor systems collectively shapes market expansion. Technological diversification ensures sustained growth, reinforces system reliability, and encourages the gradual incorporation of advanced security features across the automotive landscape, leading to the forecast value of USD 1,231.8 million by 2035.

| Metric | Value |

|---|---|

| Vehicle Security Sensor Market Estimated Value in (2025 E) | USD 721.1 million |

| Vehicle Security Sensor Market Forecast Value in (2035 F) | USD 1231.8 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The vehicle security sensor market represents a specialized segment within the global automotive safety and electronic systems industry, emphasizing theft prevention, real-time monitoring, and passenger protection. Within the broader automotive electronics market, it accounts for about 5.4%, driven by adoption in passenger vehicles, commercial fleets, and connected cars. In the automotive safety and security systems segment, it holds nearly 4.8%, reflecting demand for motion detection, intrusion alerts, and access control technologies.

Across the smart vehicle and connected car solutions market, the share is 4.2%, supporting integration with telematics, GPS tracking, and remote monitoring systems. Within the automotive aftermarket and accessory category, it represents 3.7%, highlighting use in retrofitted security solutions and fleet safety upgrades. In the IoT-enabled vehicle monitoring and management sector, it secures 3.4%, emphasizing predictive analytics, real-time alerts, and operational efficiency. Recent developments in this market have focused on sensor integration, connectivity, and advanced threat detection. Innovations include ultrasonic, infrared, and radar-based sensors, AI-powered intrusion detection, and multi-layered vehicle security systems.

Key players are collaborating with automotive manufacturers, telematics providers, and IoT solution developers to enhance vehicle safety and user convenience. Adoption of smart alarm systems, remote immobilization, and cloud-enabled monitoring platforms is gaining traction to improve response time and theft prevention. The modular sensor kits, wireless connectivity, and integration with mobile apps are being deployed to expand consumer and commercial adoption.

The Vehicle Security Sensor market is experiencing substantial growth driven by increasing demand for advanced safety and security solutions in both passenger and commercial vehicles. Current market trends highlight the rising adoption of intelligent sensor systems that enhance vehicle monitoring, theft prevention, and occupant safety.

Growth is being influenced by stricter government regulations on vehicle safety standards and the growing consumer preference for technologically advanced vehicles equipped with smart security features. The integration of sensors with vehicle electronics and connected car ecosystems is enabling real-time threat detection and response, which is becoming a key selling point for automakers.

Continued innovation in sensor technologies, increasing production of electric and autonomous vehicles, and expanding aftermarket applications are expected to sustain the market’s positive trajectory. The future outlook is further strengthened by investments in research and development to improve sensor accuracy, reduce false alarms, and enhance environmental adaptability, paving the way for more reliable and user-friendly vehicle security systems.

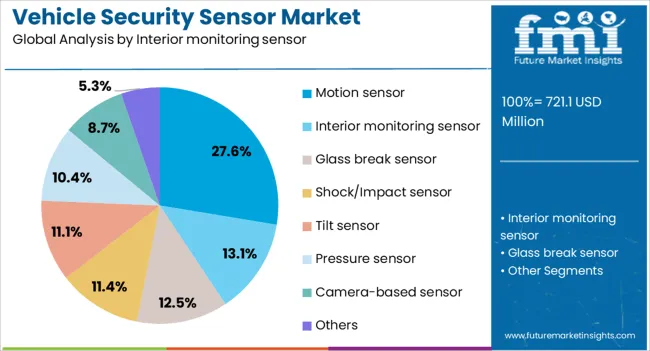

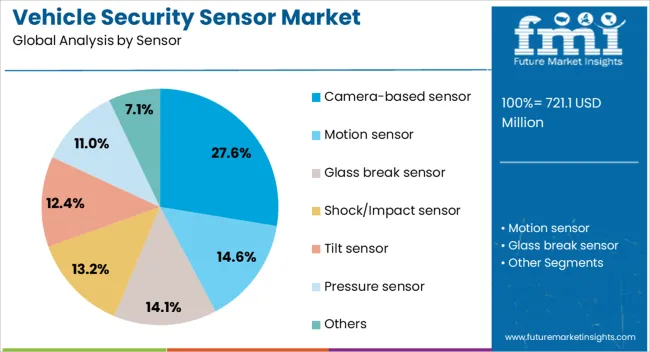

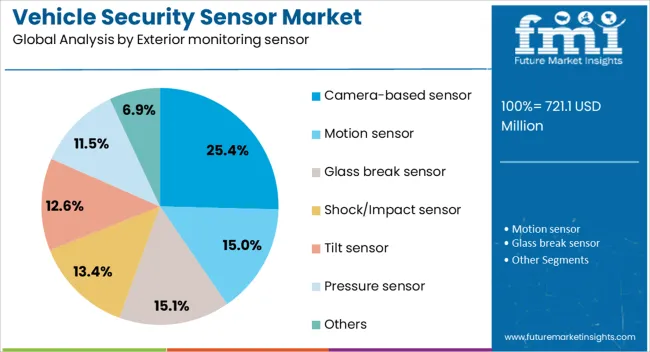

The vehicle security sensor market is segmented by sensor, interior monitoring sensor, exterior monitoring sensor, vehicle, sales channel, and geographic regions. By sensor, vehicle security sensor market is divided into Camera-based sensor, Motion sensor, Glass break sensor, Shock/Impact sensor, Tilt sensor, Pressure sensor, and Others. In terms of interior monitoring sensor, vehicle security sensor market is classified into Motion sensor, Interior monitoring sensor, Glass break sensor, Shock/Impact sensor, Tilt sensor, Pressure sensor, Camera-based sensor, and Others. Based on exterior monitoring sensor, vehicle security sensor market is segmented into Camera-based sensor, Motion sensor, Glass break sensor, Shock/Impact sensor, Tilt sensor, Pressure sensor, and Others.

By vehicle, vehicle security sensor market is segmented into SUV, Passenger car - Compact, Passenger car - Mid-size, Passenger car - Luxury, and Light commercial vehicle. By sales channel, vehicle security sensor market is segmented into OEM and Aftermarket. Regionally, the vehicle security sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The interior monitoring sensor segment is expected to hold 27.6% of the overall Vehicle Security Sensor market revenue in 2025. This leading share is being driven by the increasing need for in-cabin safety and security features that monitor occupant behavior, detect unauthorized access, and provide driver assistance.

The rise of connected vehicle technologies has facilitated the integration of interior sensors capable of recognizing seat occupancy, detecting movement, and monitoring driver alertness. This segment’s growth is also supported by the expanding adoption of ride-sharing and fleet management services, where interior monitoring enhances passenger safety and compliance with regulatory requirements.

The ability of these sensors to be upgraded through software updates and their compatibility with other vehicle security systems have further boosted adoption. Additionally, advancements in sensor miniaturization and sensitivity have improved detection accuracy, allowing automotive manufacturers to offer sophisticated security packages that meet evolving consumer expectations and regulatory standards.

The exterior monitoring sensor segment is projected to capture 27.6% of the Vehicle Security Sensor market revenue in 2025. This growth is being attributed to the rising implementation of perimeter security features that monitor vehicle surroundings for potential threats or impacts. Sensors such as motion detectors and camera-based systems are increasingly used to provide 360-degree awareness, enabling early warning of approaching objects, unauthorized entry attempts, or suspicious activities around parked vehicles.

The increasing prevalence of advanced driver-assistance systems has complemented exterior monitoring by enhancing both security and safety through real-time environment scanning. Growing concerns over vehicle theft, vandalism, and parking lot security further drive the demand for exterior sensors.

Moreover, improvements in sensor durability, weather resistance, and integration capabilities have made these sensors highly effective for varied vehicle types and operating environments. As consumer and regulatory emphasis on vehicle protection intensifies, the exterior monitoring sensor segment is poised to maintain its significant market presence.

Camera-based sensors are anticipated to hold 25.4% of the Vehicle Security Sensor market revenue in 2025, representing a substantial portion of the market. This prominence is due to their versatility in delivering detailed visual data for both interior and exterior monitoring applications. Camera-based sensors enable features such as facial recognition, gesture control, object detection, and enhanced perimeter surveillance, contributing to comprehensive vehicle security solutions.

Their ability to integrate with AI-powered software analytics and support real-time data processing has increased their adoption in modern vehicles. The segment’s growth has been bolstered by advances in image resolution, low-light performance, and processing speed, which enhance detection accuracy and reduce false alarms.

Furthermore, the scalability of camera-based sensors across various vehicle models and price segments has allowed manufacturers to implement them widely. The continuous evolution of smart camera technologies and decreasing costs are expected to further drive demand, making camera-based sensors a key pillar in the future of vehicle security systems.

The market has expanded significantly as automotive manufacturers and fleet operators increasingly prioritize safety, theft prevention, and real-time monitoring. Sensors integrated into vehicles detect unauthorized access, abnormal movement, and environmental changes, enabling rapid alerts and automated countermeasures. Rising adoption of connected cars, telematics, and IoT-enabled security systems has enhanced demand for advanced sensor technologies, including ultrasonic, infrared, radar, and motion detection modules. Consumers are showing growing preference for vehicles with integrated security features, while insurance companies incentivize sensor-equipped vehicles through premium reductions.

The rise of connected and smart vehicles has driven adoption of vehicle security sensors to provide real-time monitoring and automated protection. Fleet operators utilize sensors to track vehicle location, monitor unauthorized access, and prevent theft or tampering, improving operational efficiency. In passenger vehicles, advanced security modules integrate with infotainment systems and mobile applications to alert owners instantly in case of intrusion or impact. Regulatory agencies encourage installation of anti-theft systems, particularly in high-risk urban areas. Integration with telematics, GPS, and IoT platforms allows predictive analytics for security events. Consumer awareness of vehicle theft risks and interest in smart monitoring solutions have significantly expanded the adoption of vehicle security sensors across automotive segments.

Technological innovation has played a crucial role in improving the performance and reliability of vehicle security sensors. Ultrasonic, radar, infrared, and capacitive sensors provide precise detection of movement, proximity, and environmental anomalies. Integration with vehicle telematics, cloud connectivity, and AI-based analytics enhances real-time response, predictive maintenance, and automated alerts. Low-power and compact sensor designs facilitate seamless installation in various vehicle models without affecting aesthetics or ergonomics. Continuous development in signal processing and sensor fusion has improved detection accuracy, reduced false alarms, and enhanced user trust. These advancements have made security sensors a standard feature in modern vehicles, supporting both personal safety and asset protection objectives.

Commercial fleet operators have increasingly adopted vehicle security sensors to safeguard high-value assets, optimize logistics, and ensure regulatory compliance. Sensors monitor door access, cargo integrity, and vehicle movement, preventing theft, vandalism, and unauthorized usage. Integration with fleet management software provides centralized control, real-time alerts, and reporting tools for operational efficiency. Commercial applications in logistics, ride-sharing, and public transportation require scalable and reliable sensor solutions capable of handling diverse environmental conditions. The emphasis on reducing insurance claims, minimizing downtime, and improving overall fleet security drives demand for sensor technologies. Expansion of commercial vehicle segments globally has consequently fueled the market for vehicle security sensors, supporting both operational and safety goals.

Despite strong growth prospects, the vehicle security sensor market faces challenges related to high costs, technical integration, and cybersecurity concerns. Advanced sensor modules, particularly those with AI or IoT connectivity, increase vehicle manufacturing costs. Retrofitting older vehicles or integrating multiple sensor types into existing systems may present compatibility challenges and require specialized installation. Data security and privacy risks associated with connected sensor networks demand robust encryption, software updates, and compliance with regulatory standards. To overcome these hurdles, manufacturers are focusing on cost-effective, modular sensor solutions, streamlined integration procedures, and secure communication protocols.

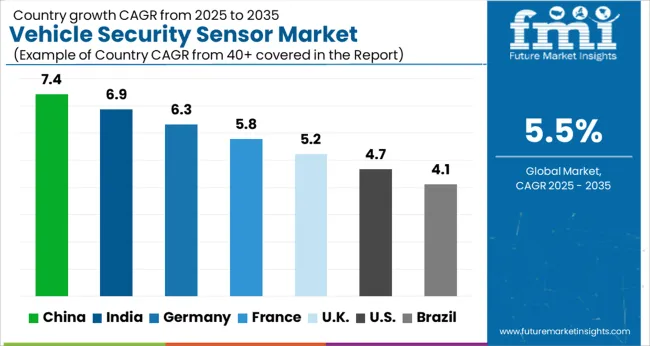

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The market is projected to grow at a CAGR of 5.5% from 2025 to 2035, reflecting increasing demand for automotive safety and anti-theft solutions. Germany recorded 6.3, supported by integration of advanced sensing technologies in premium vehicles and fleet management systems. India reached 6.9, driven by rising adoption in passenger vehicles and commercial transport. China led with 7.4, benefiting from strong manufacturing capabilities, technological investments, and widespread vehicle electrification. The United Kingdom achieved 5.2, fueled by research in connected and autonomous vehicle security, while the United States recorded 4.7, where regulatory compliance and smart vehicle solutions contributed to steady market development. Together, these nations represent a diverse ecosystem of production, deployment, and technological innovation influencing global market dynamics. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 7.4%, driven by increasing adoption of advanced driver assistance systems, anti-theft mechanisms, and smart vehicle technologies. Adoption has been reinforced by growing automotive production, rising demand for enhanced vehicle safety, and integration of IoT enabled security solutions. Domestic manufacturers focus on radar, ultrasonic, and infrared sensors designed for passenger vehicles, commercial fleets, and electric vehicles. Market growth is further supported by government regulations promoting vehicle safety and rising consumer awareness regarding anti-theft systems.

India is expected to record a CAGR of 6.9%, supported by rising vehicle production, adoption of connected car technologies, and demand for anti-theft solutions. Adoption has been reinforced by increased integration of sensors with alarm systems, telematics, and fleet management solutions. Domestic manufacturers focus on cost effective, reliable, and easy to install security sensors suitable for passenger vehicles and commercial fleets. Market expansion is further driven by awareness campaigns, insurance incentives, and collaborations with automotive OEMs to include factory fitted security solutions.

Germany is projected to grow at a CAGR of 6.3%, influenced by strong demand for vehicle safety, advanced driver assistance systems, and anti-theft mechanisms. Adoption has been reinforced by German automotive OEMs integrating sensors into new passenger vehicles, luxury cars, and commercial fleets. German manufacturers focus on high precision radar, ultrasonic, and infrared sensors with smart integration for vehicle monitoring and theft prevention. Market growth is also supported by automotive safety regulations and rising adoption of electric vehicles requiring advanced security solutions.

The United Kingdom market is expected to grow at a CAGR of 5.2%, driven by increasing demand for anti-theft systems, connected vehicle security, and fleet monitoring solutions. Adoption has been reinforced by technological advancements in radar, camera, and motion detection sensors for passenger and commercial vehicles. Imported sensors from Germany and China supplement domestic production to meet demand. The market outlook is expected to remain steady as both individual consumers and commercial fleets prioritize security and monitoring capabilities.

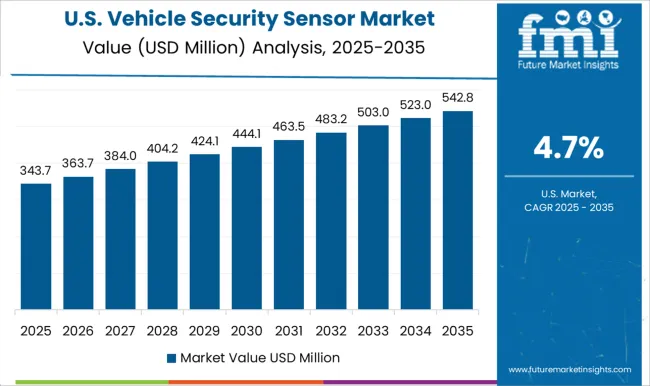

The United States market is projected to expand at a CAGR of 4.7%, supported by adoption in passenger vehicles, commercial fleets, and electric vehicles. Adoption has been reinforced by demand for integrated alarm systems, telematics, and smart monitoring solutions. Leading manufacturers focus on high reliability, advanced detection, and ease of installation. Market growth remains moderate but consistent as both OEMs and aftermarket providers increasingly incorporate vehicle security sensors to enhance safety and prevent theft.

The market is highly competitive, driven by increasing adoption of advanced driver-assistance systems (ADAS), connected vehicles, and vehicle anti-theft technologies. Leading players such as NXP Semiconductors N.V., Allegro MicroSystems, Inc., Infineon Technologies AG, Analog Devices, Inc., and TDK Corporation dominate the market through innovation in high-performance sensors, microcontrollers, and security modules. These companies focus on enhancing sensor accuracy, reliability, and integration with telematics systems to meet the growing demand for intelligent and secure vehicles.

Specialized providers including Amphenol Corporation, Avital Inc., Clifford Inc., Firstech, LLC (Compustar), and Fortin Electronic Systems compete in niche segments by offering tailored security solutions such as immobilizers, remote keyless entry, and vehicle monitoring sensors. Their strategies include technology partnerships, aftermarket expansion, and customization for OEM and fleet applications to strengthen their market position. The competitive landscape is further shaped by rapid advancements in IoT-enabled sensors, cost-effective manufacturing, and compliance with evolving automotive safety standards. Companies investing in R&D, strategic collaborations, and scalable production capabilities are poised to capture growth opportunities driven by increasing vehicle security concerns and rising consumer preference for connected, smart, and secure mobility solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 721.1 Million |

| Sensor | Camera-based sensor, Motion sensor, Glass break sensor, Shock/Impact sensor, Tilt sensor, Pressure sensor, and Others |

| Interior monitoring sensor | Motion sensor, Interior monitoring sensor, Glass break sensor, Shock/Impact sensor, Tilt sensor, Pressure sensor, Camera-based sensor, and Others |

| Exterior monitoring sensor | Camera-based sensor, Motion sensor, Glass break sensor, Shock/Impact sensor, Tilt sensor, Pressure sensor, and Others |

| Vehicle | SUV, Passenger car - Compact, Passenger car - Mid-size, Passenger car - Luxury, and Light commercial vehicle |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NXP Semiconductors N.V., Allegro MicroSystems, Inc., Amphenol Corporation, Analog Devices, Inc., Avital Inc., Clifford Inc., Firstech, LLC (Compustar), Fortin Electronic Systems, Infineon Technologies AG, and TDK Corporation |

| Additional Attributes | Dollar sales by sensor type and application, demand dynamics across passenger, commercial, and fleet vehicles, regional trends in automotive security adoption, innovation in detection accuracy, integration with smart systems, and wireless connectivity, environmental impact of electronic component production and disposal, and emerging use cases in theft prevention, fleet monitoring, and autonomous vehicle safety systems. |

The global vehicle security sensor market is estimated to be valued at USD 721.1 million in 2025.

The market size for the vehicle security sensor market is projected to reach USD 1,231.8 million by 2035.

The vehicle security sensor market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in vehicle security sensor market are camera-based sensor, motion sensor, _passive infrared (pir) sensor, _ultrasonic sensor, _microwave sensor, _millimeter wave sensor, glass break sensor, shock/impact sensor, tilt sensor, pressure sensor and others.

In terms of interior monitoring sensor, motion sensor segment to command 27.6% share in the vehicle security sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Roadside Assistance Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Armor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Conversion Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Interior Air Quality Monitoring Technology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vehicle Electrification Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA