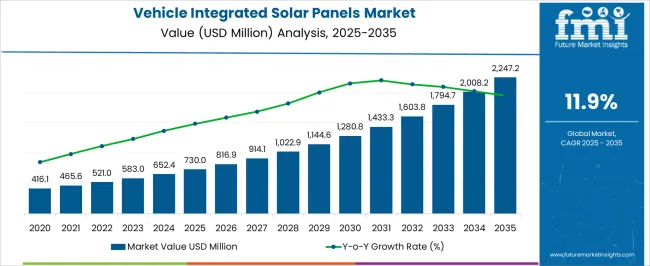

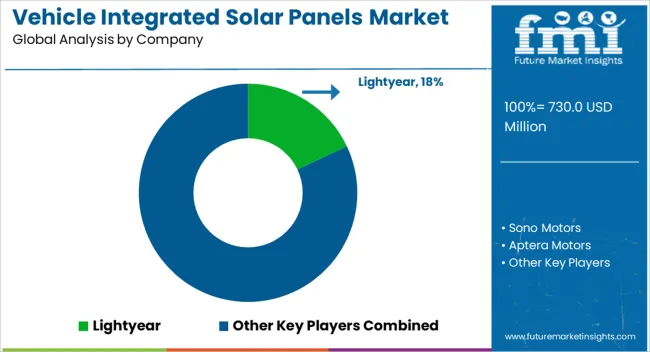

The vehicle integrated solar panels market is estimated to be valued at USD 730.0 million in 2025 and is projected to reach USD 2247.2 million by 2035, registering a compound annual growth rate (CAGR) of 11.9% over the forecast period.

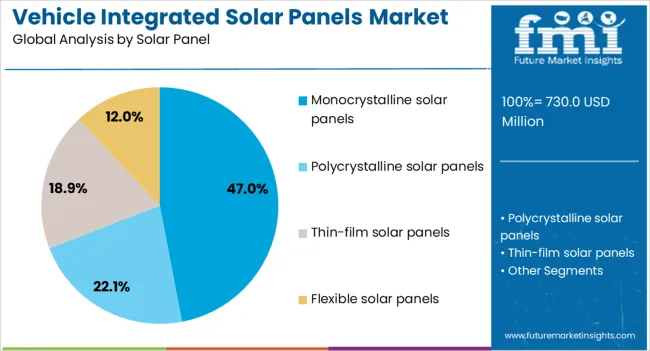

Thin-film solar panels are positioned as early growth drivers due to their lightweight structure, flexibility, and adaptability to curved vehicle surfaces. Although their conversion efficiency remains lower than crystalline technologies, their ease of integration makes them suitable for mass-market passenger vehicles and commercial fleets. This segment is expected to hold a considerable share in the initial years of adoption. Monocrystalline solar panels contribute significantly to premium applications, particularly in electric vehicles requiring higher efficiency and range extension. Their higher power density justifies higher costs, making them critical for long-range EVs, recreational vehicles, and high-end automotive models.

As efficiency improvements reduce cost-per-watt, this technology is projected to gain a growing portion of the market value. Emerging technologies such as perovskite solar cells and hybrid tandem solutions are expected to contribute strongly in the latter half of the forecast period. These technologies promise higher efficiency, durability improvements, and lower production costs. Their contribution will enhance adoption in both passenger and commercial applications, pushing the market towards wider scalability and long-term competitiveness.

| Metric | Value |

|---|---|

| Vehicle Integrated Solar Panels Market Estimated Value in (2025 E) | USD 730.0 million |

| Vehicle Integrated Solar Panels Market Forecast Value in (2035 F) | USD 2247.2 million |

| Forecast CAGR (2025 to 2035) | 11.9% |

The vehicle integrated solar panels market is regarded as an emerging segment across the automotive and renewable energy sectors. It is calculated at 1.5% within automotive components, as adoption is still at an early stage. In electric vehicle components, a 2.8% share is assessed, where integration is seen as a range-extending technology. Solar energy technologies contribute 1.1%, highlighting a niche application of photovoltaics. In renewable automotive energy systems, the market holds about 3.4% due to growth in sustainable mobility demand. Within advanced photovoltaic materials, a 1.7% share is observed, tied to flexible and lightweight solar cell innovation.

Recent industry trends highlight increasing development of lightweight, high-efficiency solar modules suitable for curved vehicle surfaces. Groundbreaking progress includes perovskite tandem cells, organic photovoltaics, and thin-film technologies that enhance conversion efficiency while reducing weight. Key players are pursuing partnerships between automotive OEMs and solar technology developers to create integrated roof and body panels. Strategies involve pilot fleet testing, joint research programs, and commercial launches of solar-powered passenger and commercial vehicles. The industry is also adopting modular manufacturing approaches and scaling thin-film solar coating processes, with strong emphasis on improving durability and energy yield under variable driving conditions.

The market is experiencing notable expansion, driven by the increasing adoption of sustainable mobility solutions and the push toward reducing carbon emissions in the transportation sector. Growing awareness of renewable energy integration within vehicles is influencing manufacturers to incorporate solar technologies as a means to extend driving range, enhance energy efficiency, and reduce dependence on grid-based charging.

The rise in electric and hybrid vehicles has further accelerated the demand for integrated solar solutions, as these systems provide supplemental energy to power auxiliary functions or directly charge batteries. Advances in photovoltaic efficiency, lightweight panel materials, and design innovations are enabling seamless integration into vehicle structures without compromising aesthetics or aerodynamics.

Regulatory support for clean energy initiatives, combined with consumer demand for eco-friendly transportation options, is fostering strong growth prospects As automotive OEMs and technology providers continue to invest in this area, vehicle integrated solar panels are expected to become a key feature in future mobility platforms.

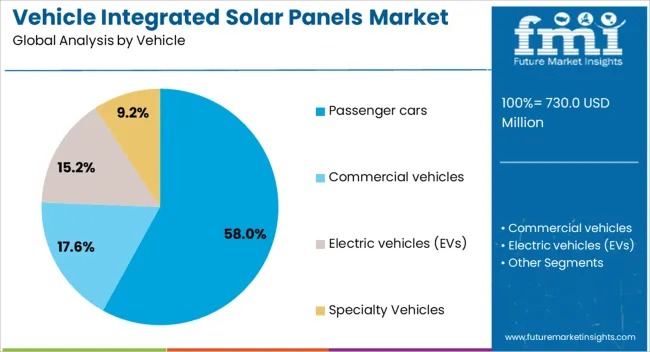

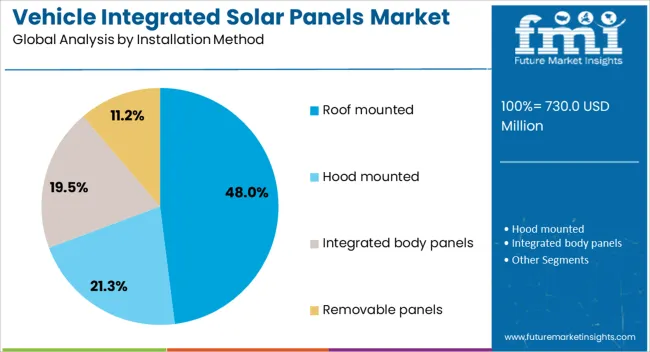

The vehicle integrated solar panels market is segmented by vehicle, solar panel, installation method, application, and geographic regions. By vehicle, vehicle integrated solar panels market is divided into passenger cars, commercial vehicles, electric vehicles (EVs), and specialty vehicles. In terms of solar panel, vehicle integrated solar panels market is classified into monocrystalline solar panels, polycrystalline solar panels, thin-film solar panels, and flexible solar panels. Based on installation method, vehicle integrated solar panels market is segmented into roof mounted, hood mounted, integrated body panels, and removable panels. By application, vehicle integrated solar panels market is segmented into battery charging, auxiliary power supply, heating systems, and power generation. Regionally, the vehicle integrated solar panels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger cars segment is projected to account for 58% of the market revenue share in 2025, positioning it as the dominant vehicle category. Growth in this segment has been driven by the widespread adoption of solar integration in electric and hybrid passenger cars, where the additional energy generated helps extend driving range and reduce charging frequency.

Consumer interest in sustainable vehicle features has been reinforced by rising fuel costs and stricter emissions regulations, prompting manufacturers to enhance energy efficiency through innovative solar applications. Passenger cars offer larger and more adaptable surface areas for solar installation, particularly on rooftops, enabling optimal exposure and energy capture.

The adoption rate has also been supported by premium and mid-range models incorporating solar technologies as a differentiating feature Continuous improvements in photovoltaic performance and panel durability are further encouraging integration into passenger vehicles, ensuring long-term reliability and cost benefits for owners, thereby sustaining the segment’s market leadership.

The monocrystalline solar panels segment is anticipated to hold 47% of the market revenue share in 2025, making it the leading solar panel type. This dominance is attributed to the high energy conversion efficiency of monocrystalline panels, which allows maximum energy generation from limited surface areas such as vehicle roofs. Their compact design and superior performance in varying light conditions make them highly suitable for automotive applications.

The durability and longer lifespan of monocrystalline panels enhance their appeal to vehicle manufacturers seeking low-maintenance, high-output solutions. Their ability to deliver consistent energy output even in partially shaded environments contributes to operational reliability.

The premium market positioning of vehicles equipped with these panels has also supported adoption, as consumers associate them with advanced technology and sustainability Continued advancements in cell architecture and material efficiency are expected to strengthen the competitiveness of monocrystalline panels within vehicle-integrated applications, ensuring their sustained market leadership.

The roof mounted installation method is projected to command 48% of the market revenue share in 2025, emerging as the most widely adopted installation approach. This method has been favored due to its ability to maximize exposure to sunlight, thereby optimizing energy capture throughout the day. Roof mounting allows for seamless integration with the vehicle’s design while maintaining aerodynamics and structural integrity.

The approach is also versatile, accommodating different panel sizes and types, which supports adoption across a wide range of vehicle models. The method benefits from lower installation complexity compared to alternative placements, reducing manufacturing costs and time.

Enhanced safety standards and improved adhesive and mounting technologies have further reinforced its popularity by ensuring long-term panel stability under diverse environmental conditions As manufacturers continue to prioritize efficiency and cost-effectiveness in solar integration, roof mounted systems are expected to maintain their leadership in installation methods for vehicle-integrated applications.

The market has been shaped by the push for renewable energy adoption within the transportation sector. The integration of solar panels directly into vehicle surfaces has been explored to reduce dependence on charging stations and extend the operational range of electric vehicles. This approach has been seen in passenger cars, buses, and commercial fleets where solar energy can supplement battery power. The technology has also gained attention in regions with high solar irradiance. Partnerships among automakers, solar technology companies, and battery manufacturers have been observed as critical drivers of product development and deployment across global markets.

A major dynamic influencing this market has been the ability of solar panels to extend driving range by generating supplementary power. Vehicle integrated solar systems have been designed to convert sunlight into usable energy, reducing battery depletion rates. This has allowed electric vehicles to achieve longer ranges between charging cycles, which has been a crucial factor in addressing range anxiety. Additionally, auxiliary systems such as air conditioning and lighting have been supported by solar-generated power, improving overall vehicle efficiency. Such integration has offered both environmental and operational benefits, positioning solar panels as a complementary technology in the electrification journey of the mobility sector.

Public and commercial transportation operators have been early adopters of solar integrated vehicle systems due to their continuous operational requirements. Buses, delivery vans, and refrigerated trucks have been equipped with solar panels to reduce fuel consumption or extend electric operation. In regions with strong government support for clean mobility, solar bus projects and fleet trials have been introduced to evaluate efficiency gains. These initiatives have demonstrated the potential of solar integration in reducing emissions while lowering fuel and maintenance costs. As urban transport operators and logistics firms focus on cost savings and emission regulations, the adoption of vehicle integrated solar panels has been strengthened.

Continuous advancements in photovoltaic technologies have been a vital dynamic in expanding the feasibility of solar panels on vehicles. Flexible thin-film solar panels, perovskite cells, and high-efficiency silicon panels have been engineered to integrate seamlessly with curved vehicle surfaces without compromising design. Lightweight and durable solutions have been prioritized to ensure minimal impact on aerodynamics and overall vehicle weight. Such innovations have allowed automakers to incorporate solar roofs and hoods as standard or optional features in electric vehicles. The evolution of photovoltaic efficiency has therefore reinforced the economic and practical attractiveness of vehicle integrated solar systems in the mobility industry.

Despite technological advancements, cost, durability, and efficiency challenges have remained significant. Solar panels on vehicles have provided supplementary rather than primary power, as the limited surface area restricts energy generation. High integration costs and the need for robust panels capable of withstanding vibration, weather, and impact have created technical barriers. Furthermore, efficiency has been influenced by geographical factors, as vehicles in low sunlight regions benefit less compared to those in sun-rich areas. These constraints have slowed large-scale adoption and kept solar integration as a niche innovation. Continued cost reduction and durability improvements have been required to expand commercial acceptance.

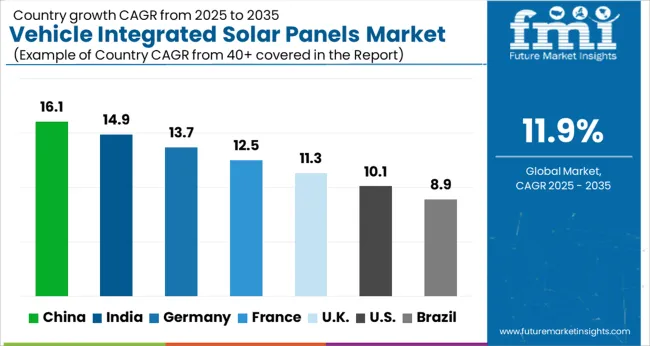

| Country | CAGR |

|---|---|

| China | 16.1% |

| India | 14.9% |

| Germany | 13.7% |

| France | 12.5% |

| UK | 11.3% |

| USA | 10.1% |

| Brazil | 8.9% |

The market is forecasted to expand at a CAGR of 11.9% between 2025 and 2035, with strong momentum from the shift toward renewable-powered mobility solutions. China, leading with a 16.1% CAGR, is scaling deployment through aggressive investments in electric vehicle manufacturing and solar integration technologies. India, at 14.9%, is gaining traction as automotive players explore solar-assisted electric mobility to address rising energy demand. Germany, growing at 13.7%, focuses on advanced solar module efficiency and integration into premium vehicle segments. The UK, at 11.3%, is enhancing research into lightweight solar panel applications for passenger and commercial fleets, while the USA, at 10.1%, emphasizes sustainable transportation initiatives and solar-electric hybrid developments. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is anticipated to grow at a CAGR of 16.1%, supported by the nation’s extensive investments in renewable energy technologies and electric vehicle innovation. Solar integration in vehicles is increasingly being adopted to extend driving ranges, reduce grid dependency, and optimize energy efficiency. Strong government incentives for clean transportation and renewable energy utilization are accelerating domestic production. Chinese automakers are actively investing in research collaborations and pilot projects to integrate solar modules within electric cars, buses, and commercial fleets, positioning the country as a global leader in this sector.

India’s market is projected to advance at a CAGR of 14.9%, driven by government initiatives in clean mobility and increasing demand for energy-efficient transport solutions. Solar integration in vehicles is being promoted to reduce reliance on fossil fuels and optimize operational costs in both passenger and commercial segments. Pilot projects are being initiated in electric buses and utility vehicles to test solar panel efficiency in diverse conditions. Domestic manufacturers, along with research organizations, are working toward cost optimization and scalability, which is expected to strengthen adoption in the coming years.

Germany’s market is forecast to expand at a CAGR of 13.7%, supported by strong commitments toward renewable energy and automotive innovation. German automakers and technology providers are integrating solar modules into electric vehicles to enhance range and energy efficiency. Applications extend to passenger cars, logistics fleets, and long-haul transport, where solar integration reduces charging requirements. Government-backed projects and EU-funded programs further strengthen Germany’s position as a hub for solar-automotive innovation. The country’s engineering expertise and established renewable infrastructure are playing a crucial role in driving market expansion.

The market in the United Kingdom is expected to witness a CAGR of 11.3%, supported by rising interest in renewable-powered mobility and sustainable fleet management. Solar integration in vehicles is being considered for passenger cars, delivery vans, and municipal transport systems to enhance efficiency and reduce operational costs. Research institutions are collaborating with automakers to test solar integration performance under local conditions. Although large-scale adoption is in the early phase, increasing renewable investments and technology pilots are expected to expand market potential in the UK automotive sector.

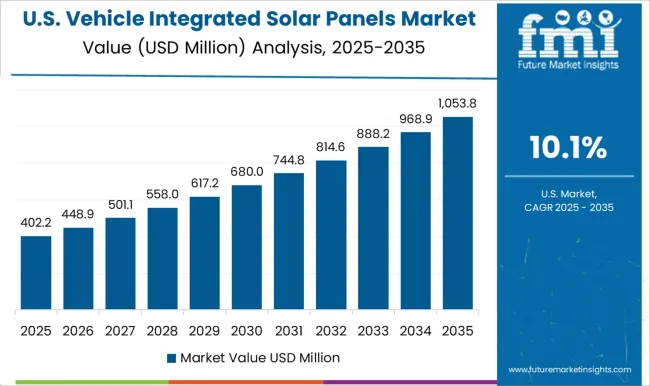

The market in the United States is projected to rise at a CAGR of 10.1%, driven by strong innovation in electric mobility and renewable energy adoption. Automakers and technology firms are actively exploring solar integration in passenger vehicles, trucks, and recreational vehicles to optimize energy use. Several pilot projects are already being tested to reduce dependency on external charging. Government R&D investments and private sector innovation are expected to accelerate the deployment of solar-integrated vehicles across both commercial and consumer segments, reinforcing the nation’s position in clean automotive solutions.

The market is defined by the involvement of both niche innovators and global automotive manufacturers that are exploring solar technology integration for extended driving range and energy efficiency. Lightyear has gained recognition as a pioneer in this field, designing vehicles with large-area solar panels integrated into the roof and hood. Their approach has showcased the technical feasibility of reducing dependency on external charging infrastructure. Sono Motors has advanced similar ambitions, introducing solar body panels into passenger vehicles with a focus on affordability and scalable manufacturing. Aptera Motors has presented a futuristic three-wheeled design where lightweight construction and solar integration combine to deliver significantly higher efficiency than conventional models. These companies highlight the experimental and innovation-driven side of the market. Mainstream automakers have also begun to explore integration pathways.

Toyota Motor Corporation has tested solar panels on select hybrid and electric vehicles to increase auxiliary power and extend driving efficiency. Tesla Inc. has signaled interest in solar-related vehicle solutions, aligning with its broader energy ecosystem, although adoption remains limited within current models. Hyundai Motor Company has already introduced solar roof technology in certain hybrid and EV platforms, providing real-world validation of the concept. Ford Motor Company and Volkswagen are also studying feasibility, working toward solar-enabled solutions within their electrification strategies. The presence of these automotive leaders suggests that solar integration may evolve from niche prototypes into broader commercial adoption as panel efficiency improves and cost barriers decline. The competitive landscape therefore remains diverse, shaped by early-stage startups and established global brands working on distinct approaches to solar-enabled mobility.

| Item | Value |

|---|---|

| Quantitative Units | USD 730.0 Million |

| Vehicle | Passenger cars, Commercial vehicles, Electric vehicles (EVs), and Specialty Vehicles |

| Solar Panel | Monocrystalline solar panels, Polycrystalline solar panels, Thin-film solar panels, and Flexible solar panels |

| Installation Method | Roof mounted, Hood mounted, Integrated body panels, and Removable panels |

| Application | Battery charging, Auxiliary power supply, Heating systems, and Power generation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lightyear, Sono Motors, Aptera Motors, Toyota Motor Corporation, Tesla Inc., Hyundai Motor Company, Ford Motor Company, and Volkswagen |

| Additional Attributes | Dollar sales by panel type and vehicle category, demand dynamics across passenger cars, commercial vehicles, and specialty transport, regional trends in solar mobility adoption, innovation in efficiency, lightweight integration, and durability, environmental impact of material sourcing and recycling, and emerging use cases in range extension, auxiliary power, and off-grid vehicle operations. |

The global vehicle integrated solar panels market is estimated to be valued at USD 730.0 million in 2025.

The market size for the vehicle integrated solar panels market is projected to reach USD 2,247.2 million by 2035.

The vehicle integrated solar panels market is expected to grow at a 11.9% CAGR between 2025 and 2035.

The key product types in vehicle integrated solar panels market are passenger cars, _hatchback, _sedan, _suv, commercial vehicles, _light commercial vehicles, _medium commercial vehicles, _heavy commercial vehicles, electric vehicles (evs), specialty vehicles, _recreational vehicles (rvs), _golf carts and _military or emergency vehicles.

In terms of solar panel, monocrystalline solar panels segment to command 47.0% share in the vehicle integrated solar panels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Moving Services Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Roadside Assistance Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Armor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Conversion Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Interior Air Quality Monitoring Technology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vehicle Electrification Market Growth - Trends & Forecast 2025 to 2035

Vehicle Control Unit (VCU) Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA