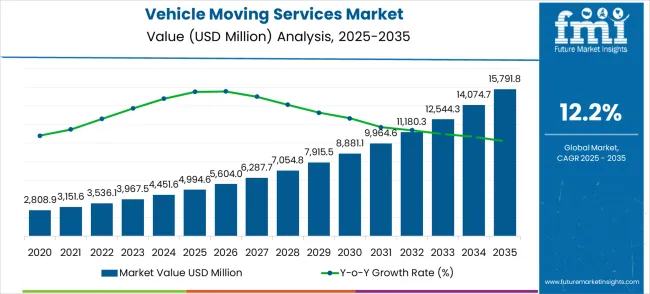

The vehicle moving services market is forecast to grow from USD 4,994.6 million in 2025 to USD 15,791.8 million by 2035, advancing at a CAGR of 12.2%. The early years (2020–2024) form the buildup to the first peak, with values rising from USD 2,808.9 million in 2020 to USD 4,451.6 million in 2024. This stage shows steady expansion as relocation services, auto auctions, and cross-border trade begin to rely more heavily on structured vehicle transport. By 2025, the market reaches USD 4,994.6 million, marking a peak-through moment where demand transitions from fragmented service providers to organized, large-scale operators, setting the stage for sharper growth momentum.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4,994.6 million |

| Forecast Value in (2035F) | USD 15,791.8 million |

| Forecast CAGR (2025 to 2035) | 12.2% |

Between 2025 and 2030, the market advances strongly, climbing from USD 4,994.6 million to USD 7,915.5 million. This phase highlights a major peak-through point as the market benefits from higher vehicle ownership, used-car sales, and global fleet movements. Providers at this stage refine operational efficiency, expand networks, and establish partnerships with logistics and dealership ecosystems. By 2030, surpassing USD 7.9 billion, the industry demonstrates a pronounced peak-through, shifting from regional reliance to widespread adoption across domestic and international vehicle transport markets, driving both scale and revenue intensity.

From 2030 to 2035, the market reaches its most prominent peak-through, surging from USD 7,915.5 million to USD 15,791.8 million. This period doubles market value in just five years, demonstrating the sector’s acceleration into a consolidated and globally integrated industry. By 2035, the market achieves maturity with demand stabilizing at high volumes, reflecting efficiency-driven operations and broader acceptance of outsourced vehicle movement services. This final peak-through underscores the industry’s evolution from an emerging service niche to a robust logistics subsector, enabling consistent long-term growth and reliable profit pools for established players.

Market expansion is being supported by the increasing automotive production volumes worldwide and the corresponding demand for efficient vehicle transportation solutions. Modern automotive supply chains require reliable vehicle moving services to transport new vehicles from manufacturing plants to dealerships, while growing consumer mobility patterns create demand for personal vehicle relocation services. The rise of e-commerce automotive sales and direct-to-consumer delivery models is creating opportunities for specialized vehicle transportation providers.

The growing emphasis on supply chain efficiency and logistics optimization is driving demand for professional vehicle moving services that can ensure safe, timely, and cost-effective transportation. Consumer preference for transparent pricing, real-time tracking, and comprehensive insurance coverage is creating opportunities for innovative service providers. The rising influence of digital platforms and mobile applications is also contributing to increased market accessibility across different customer segments and geographic regions.

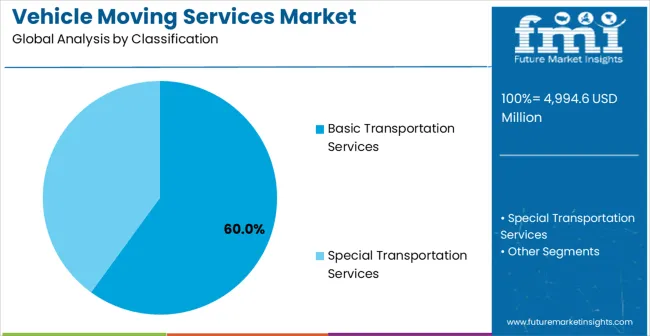

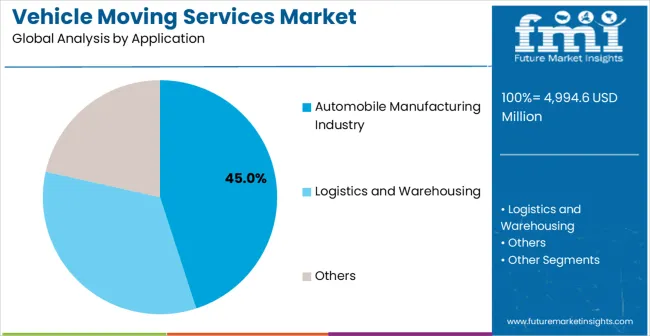

The market is segmented by classification, application, and region. By classification, the market is divided into basic transportation services, special transportation services, and others. By application, the market is categorized into automobile manufacturing industry, logistics and warehousing, consumer relocation, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

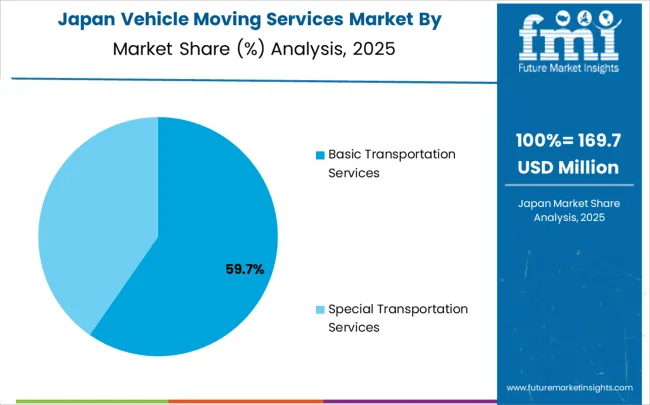

Basic transportation services is projected to account for 60% of the vehicle moving services market in 2025, representing the fundamental vehicle relocation and transportation offerings that form the core of industry operations. This dominant segment encompasses standard vehicle transportation services including open-carrier transport, enclosed transport, and terminal-to-terminal delivery solutions that serve both automotive industry customers and individual consumers requiring vehicle relocation services. The segment benefits from established operational procedures, standardized pricing models, and widespread availability across multiple geographic markets, making it accessible to diverse customer segments with varying transportation requirements.

Basic transportation services enable cost-effective vehicle movement through economies of scale in carrier operations, standardized loading procedures, and optimized routing systems that reduce per-unit transportation costs while maintaining service reliability. The segment serves automotive manufacturers requiring consistent vehicle distribution from production facilities to dealer networks, logistics companies coordinating vehicle inventory management, and individual consumers relocating vehicles for personal or business purposes. Market growth drivers include expanding automotive production volumes, increasing consumer mobility patterns, and growing demand for affordable vehicle transportation solutions that balance cost considerations with service quality requirements.

Manufacturing capacity expansion in automotive industry creates consistent demand for basic transportation services, while consumer relocation trends drive individual service requirements. The segment faces challenges from fuel cost volatility affecting transportation economics, driver shortage issues impacting service capacity, and increasing competition from specialized service providers offering premium transportation alternatives. Quality control requirements for vehicle condition during transport and insurance coverage considerations continue influencing service delivery standards and customer satisfaction metrics.

The automobile manufacturing industry segment is expected to represent 45% of vehicle moving services demand in 2025, reflecting the critical role of vehicle transportation in automotive supply chain operations and distribution networks. This segment encompasses vehicle transportation services required by automotive manufacturers, parts suppliers, dealerships, and distribution centers that coordinate new vehicle movement from production facilities to retail locations. The segment provides essential logistics support for automotive industry operations through specialized transportation solutions, inventory management services, and distribution network coordination that enables efficient vehicle supply chain management.

The automobile manufacturing industry drives consistent demand through production schedule requirements, inventory management needs, and dealer network supply coordination that requires reliable vehicle transportation services. Manufacturing plants require regular vehicle shipment services to distribute newly produced vehicles to dealer networks, while automotive suppliers utilize vehicle moving services for prototype transportation, testing program logistics, and parts delivery coordination. International trade in automotive products creates demand for specialized vehicle transportation services including customs clearance support, international shipping coordination, and regulatory compliance management.

Growth drivers include expanding global automotive production, increasing vehicle model diversity requiring specialized handling, and growing electric vehicle production creating new transportation requirements for battery-powered vehicles. Supply chain globalization trends drive demand for international vehicle transportation services, while automotive industry consolidation creates opportunities for logistics providers offering comprehensive vehicle moving solutions across multiple markets and manufacturing locations.

Special transportation services represents the high-growth opportunity segment within vehicle moving services, currently capturing smaller market share but demonstrating exceptional expansion potential as automotive industry complexity increases and consumer demands for premium services grow. This segment includes enclosed transportation, expedited delivery, white-glove services, classic car transportation, exotic vehicle handling, and specialized equipment transportation that requires enhanced care, security, and expertise compared to basic transportation alternatives.

The segment operates primarily in premium market categories where vehicle value, customer requirements, or transportation complexity justifies higher service costs and specialized handling procedures. Luxury vehicle owners, classic car collectors, automotive enthusiasts, and high-value vehicle dealers drive demand for special transportation services that provide enhanced protection, personalized service, and comprehensive insurance coverage. Commercial applications include prototype vehicle transportation, concept car logistics, racing vehicle transport, and specialty equipment movement requiring custom handling solutions.

Growth catalysts include increasing luxury vehicle sales, expanding classic car market, growing automotive enthusiast community, and rising consumer expectations for premium service experiences. Market trajectory indicates above-average growth rates as disposable income increases support premium service adoption and automotive industry diversification creates specialized transportation requirements. Special transportation services command premium pricing through value-added services, specialized equipment, enhanced insurance coverage, and personalized customer service that differentiates providers from basic transportation competitors.

Future outlook suggests continued expansion as electric vehicle adoption creates new specialized transportation requirements, autonomous vehicle development generates prototype transportation needs, and consumer preferences shift toward premium service experiences. Opportunities include technological integration for enhanced tracking and communication, expansion into emerging vehicle categories, and development of specialized handling procedures for new automotive technologies requiring unique transportation considerations.

The vehicle moving services market is experiencing significant growth, driven by multiple factors across the automotive, logistics, and consumer sectors. One of the primary market drivers is the increasing global automotive production, which fuels demand for efficient transportation of vehicles from manufacturing facilities to dealerships and end consumers. The globalization of the automotive industry has created a growing need for cross-border vehicle transportation, while urbanization and increasing population mobility have led to heightened demand for relocation-related vehicle moving services. Additionally, the rise of e-commerce in automotive sales is transforming the delivery model, with direct-to-consumer vehicle deliveries requiring specialized handling, scheduling, and logistics coordination. The increasing complexity of automotive supply chains also supports the need for integrated vehicle logistics and inventory management services, ensuring timely and safe delivery.

Despite these growth drivers, the market faces several restraints. Fuel cost volatility significantly affects operational expenses and service pricing, while a shortage of skilled drivers limits service capacity and increases labor costs. Regulatory compliance—particularly for cross-border transportation—adds administrative burdens and operational complexity. Infrastructure limitations in emerging markets can constrain service expansion, while stricter environmental regulations impact transportation operations, carrier specifications, and fleet management. Additionally, economic slowdowns reduce both automotive production and consumer spending, affecting demand for vehicle moving services, and rising insurance costs can further compress profit margins.

Key trends in the market reflect technological innovation and a strong focus on customer experience. The adoption of digital platforms allows for real-time vehicle tracking, automated booking, and enhanced communication between providers and clients, improving operational efficiency and transparency. Integration of GPS systems, mobile apps, and automated scheduling tools streamlines service delivery and reduces errors. The growing adoption of electric vehicles (EVs) introduces new transportation requirements, including specialized handling for battery-powered vehicles. Sustainability initiatives are increasingly shaping the market, driving the development of eco-friendly vehicle carriers and carbon offset programs. Finally, providers are emphasizing premium customer experiences, offering flexible delivery options, personalized communication, and enhanced insurance coverage to differentiate themselves in a competitive landscape.

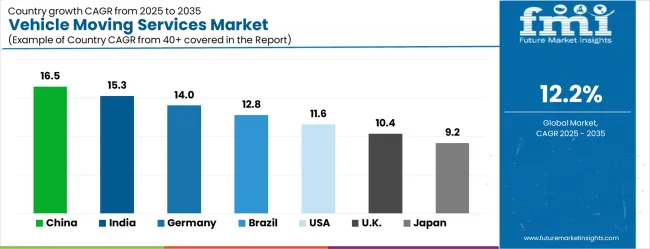

| Country | CAGR (2025-2035) |

|---|---|

| China | 16.5% |

| India | 15.3% |

| Germany | 14.0% |

| Brazil | 12.8% |

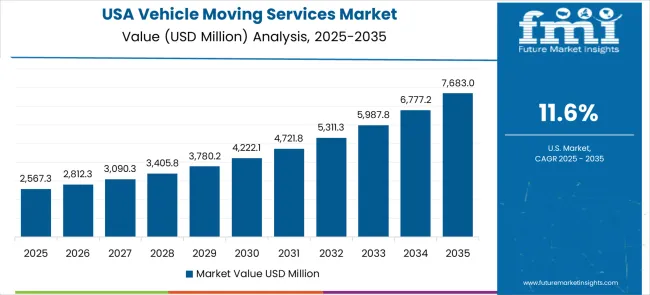

| USA | 11.6% |

| UK | 10.4% |

| Japan | 9.2% |

The vehicle moving services market is experiencing robust growth globally, with China leading at a 16.5% CAGR through 2035, driven by massive automotive production expansion, rapid urbanization, and increasing consumer vehicle ownership creating strong demand. India follows closely at 15.3%, supported by a growing automotive manufacturing sector, rising disposable incomes, and expanding logistics infrastructure. Germany shows strong growth at 14.0%, underpinned by advanced automotive logistics, manufacturing excellence, and strategic European locations. Brazil records a 12.8% CAGR, focusing on domestic automotive industry expansion, increasing vehicle ownership, and growing regional logistics capabilities. The United States grows at 11.6%, driven by automotive modernization, interstate relocation patterns, and the rise of e-commerce in vehicle sales. The United Kingdom expands at 10.4%, fueled by automotive import-export activities, consumer mobility trends, and rising demand for premium vehicle moving services. Japan maintains steady growth at 9.2% characterized by a strong emphasis on service quality, technological integration.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from vehicle moving services in China is projected to grow at a CAGR of 16.5%, reflecting the country’s position as the world’s largest automotive market. The growth is driven by massive expansion in automotive manufacturing, rapid urbanization, and a rising number of vehicle owners requiring both dealer distribution and individual relocation services. Key automotive hubs, including Shanghai, Guangzhou, and Changchun, generate substantial demand for vehicle transportation services, supporting distribution across domestic and international networks. Urban migration and increasing mobility patterns among consumers further drive demand for specialized relocation services for private vehicles. Leading logistics providers are establishing comprehensive networks that integrate real-time tracking, automated scheduling, and fleet management systems to enhance operational efficiency. Government initiatives focused on improving road and transport infrastructure also facilitate smoother distribution and reduce delivery times. The rising middle class and higher disposable income levels create additional demand for personalized and premium vehicle moving services, strengthening China’s dominance in the global vehicle moving market.

India’s vehicle moving services market is expanding at a CAGR of 15.3%, driven by a rapidly growing automotive manufacturing sector, rising disposable incomes, and significant urban migration. Major production centers in Chennai, Mumbai, and Delhi are creating consistent demand for dealer-to-dealer and dealer-to-consumer distribution services. Increasing consumer mobility and vehicle ownership patterns, including relocation for work and education, are fueling demand for individual transport services. Both international and domestic automotive manufacturers are expanding production and distribution networks, requiring specialized logistics and inventory management solutions. Expansion of urban road networks, improved highway infrastructure, and warehouse facilities further enable operational efficiency. Additionally, rising awareness about premium services encourages vehicle owners to opt for secure and insured transport solutions. India’s logistics modernization, combined with the rapid growth of e-commerce in automotive sales, provides opportunities for digital platforms and real-time tracking solutions to improve customer experience. Automotive clusters in Chennai, Mumbai, and Delhi are generating steady demand for vehicle distribution and inventory management, as companies expand production and dealer networks, requiring reliable transportation coordination and secure vehicle handling across regional and metropolitan markets.

Germany’s vehicle moving services market is growing at a CAGR of 14.0%, driven by advanced automotive manufacturing, strategic European location, and sophisticated logistics infrastructure. Automotive leaders like BMW, Mercedes-Benz, and Volkswagen rely on highly efficient vehicle distribution networks, including dealer delivery, export, and cross-border transportation services. German manufacturing regions such as Bavaria, Baden-Württemberg, and Lower Saxony create continuous demand for vehicle moving solutions that integrate inventory management, supply chain coordination, and timely distribution. The country’s position as a central European hub facilitates international vehicle transportation while regulatory compliance expertise ensures smooth cross-border operations. Advanced technology adoption, including real-time tracking, automated scheduling, and digital inventory monitoring, enhances operational efficiency. Additionally, high consumer expectations for reliability and premium service are driving the demand for secure, insured, and professionally managed vehicle transport. Germany’s combination of manufacturing excellence, logistics sophistication, and technology integration positions it as a key market in Europe. Automotive clusters in Bavaria, Baden-Württemberg, and Lower Saxony are creating high demand for specialized vehicle transportation services, supporting dealer deliveries, international exports, and efficient supply chain coordination across multiple European and global markets.

Brazil’s vehicle moving services market is projected to grow at a CAGR of 12.8%, driven by expanding domestic automotive manufacturing, rising vehicle ownership, and improving logistics infrastructure. Key automotive hubs in São Paulo, Minas Gerais, and Rio de Janeiro generate strong demand for dealer-to-consumer and long-distance vehicle transport services. The country’s large geographic size necessitates specialized long-distance relocation solutions, while urbanization and regional mobility trends increase the need for secure and reliable transport for individual consumers. Vehicle manufacturers are investing in fleet management, inventory control, and logistics coordination to support growing production and distribution networks. Additionally, premium service offerings, including insured delivery, GPS tracking, and flexible scheduling, are becoming more popular among consumers. Expanding highway networks and urban road improvements further facilitate operational efficiency, enabling timely delivery and enhancing overall service quality across Brazil’s diverse regions. São Paulo, Minas Gerais, and Rio de Janeiro automotive clusters are generating consistent demand for specialized vehicle transportation services, supporting dealer deliveries, regional distribution, and domestic export logistics with professional handling and coordination.

The USA vehicle moving services market is expanding at a CAGR of 11.6%, supported by automotive modernization, interstate relocation trends, and growth in e-commerce vehicle sales. Production hubs in Michigan, Tennessee, and Texas drive demand for advanced distribution networks, dealer deliveries, and inventory management services. Consumer mobility patterns, including seasonal residence changes and job relocations, create consistent demand for individual vehicle transport services. Digital adoption, including real-time tracking, mobile platforms, and automated scheduling, is improving operational efficiency and customer satisfaction. Insurance requirements and regulatory compliance drive service reliability and safety standards, encouraging providers to focus on premium offerings. The growth of e-commerce in automotive sales also introduces direct-to-consumer delivery requirements, increasing the need for flexible, secure, and timely transport solutions that cater to modern consumer expectations. Automotive manufacturing hubs in Michigan, Tennessee, and Texas are generating strong demand for advanced vehicle transportation services, supporting dealer distribution, supply chain coordination, and inventory management for both domestic and export markets.

The UK vehicle moving services market is projected to grow at a CAGR of 10.4%, driven by automotive import-export activities, rising consumer mobility, and increasing demand for premium transport services. Specialized services are required for right-hand drive vehicles, port-to-dealer deliveries, and international shipments. The UK’s logistical and regulatory framework supports efficient coordination for both domestic and international transportation. Consumer preference for high-quality, secure, and insured vehicle transport is increasing demand for premium service providers. Additionally, growth in urban mobility and regional relocation trends is driving individual transport services, while digital adoption for scheduling, tracking, and fleet management improves operational efficiency. The UK’s automotive import-export activities, combined with rising customer expectations, create a competitive environment encouraging service differentiation through technology integration, enhanced tracking, and personalized communication. Import-export operations require port-to-dealer coordination, customs clearance, and international shipment management, creating a need for specialized vehicle moving services with compliance expertise.

Japan’s vehicle moving services market is expanding at a CAGR of 9.2%, characterized by a strong emphasis on quality, reliability, and technological integration. Key automotive hubs for Toyota, Honda, and Nissan generate consistent demand for dealer deliveries, inter-city transport, and individual relocation services. High consumer expectations for precision, security, and service excellence encourage adoption of premium offerings, including insured transport, real-time tracking, and personalized customer support. Advanced logistics infrastructure, including efficient highways and warehouse facilities, supports operational efficiency. Vehicle moving companies are integrating digital tools, automated scheduling, and fleet management systems to optimize operations and meet stringent quality standards. Urbanization and regional mobility trends further increase demand for professional vehicle transport services, while the country’s established automotive market provides stable opportunities for both domestic and international logistics providers. Automotive manufacturing hubs in Toyota, Honda, and Nissan regions create consistent demand for specialized vehicle transportation services, ensuring timely delivery, secure handling, and support for dealer networks and individual consumers.

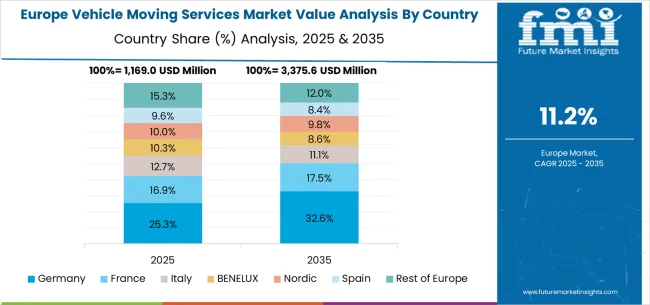

The vehicle moving services market in Europe demonstrates mature development across major economies with Germany showing strong presence through its automotive manufacturing excellence and sophisticated logistics infrastructure supporting both domestic vehicle distribution and international transportation networks. The country's automotive industry concentration creates consistent demand for specialized vehicle transportation services while established logistics companies leverage advanced technology and operational expertise to serve diverse customer requirements across passenger and commercial vehicle segments.

France represents a significant market driven by its automotive manufacturing heritage and strategic location enabling efficient cross-border vehicle transportation throughout Europe. Companies utilize established transportation networks and regulatory compliance expertise to coordinate vehicle movement between manufacturing facilities, distribution centers, and dealer networks across multiple European markets. The UK exhibits considerable growth through its automotive import-export activities and consumer relocation patterns requiring specialized vehicle transportation services for both domestic and international movements.

Italy and Spain show expanding opportunities in automotive logistics and consumer vehicle relocation services, while BENELUX countries contribute through their strategic positions as European logistics hubs facilitating international vehicle transportation and distribution coordination. Eastern European markets display growing potential driven by automotive manufacturing expansion and increasing consumer mobility patterns requiring professional vehicle moving services.

The vehicle moving services market is characterized by competition among established logistics companies, specialized vehicle transportation providers, and emerging digital platform operators. Companies are investing in advanced tracking technologies, fleet optimization systems, customer service platforms, and insurance coverage enhancement to deliver efficient, reliable, and comprehensive vehicle transportation solutions. Operational excellence, service differentiation, and geographic coverage expansion are central to strengthening competitive positions and market presence.

AGS International Movers, globally based, provides comprehensive vehicle moving services with focus on international relocation and specialized handling capabilities. Allied Van Lines, USA-based, offers integrated logistics solutions combining household goods and vehicle transportation services with established network coverage. Links Moving emphasizes technological integration and customer service excellence while ReloSmart Movers Hong Kong specializes in Asian market operations with cross-border expertise. Atlas provides nationwide coverage through franchise network operations while Montway Auto Transport focuses on consumer vehicle transportation with digital platform integration.

Mayflower, USA, delivers comprehensive relocation services including vehicle transportation through established agent networks. AnyVan, UK, provides on-demand transportation services with digital platform focus and flexible service options. PODS combines storage and transportation services while Furniture Removals specializes in comprehensive relocation solutions. Lalamove offers on-demand logistics services with technology-enabled operations, and United Van Lines provides integrated relocation services through nationwide agent networks and comprehensive service portfolios.

Vehicle moving services encompass the specialized transportation of automobiles, motorcycles, commercial vehicles, and specialty automotive equipment across domestic and international markets. With a market valued at USD 4,994.6 million projected to reach USD 15,791.8 million at 12.2% annually, this sector benefits from expanding automobile manufacturing, increasing global trade, growing consumer mobility, and rising demand for specialized logistics solutions. The market's growth requires coordinated efforts across transportation regulators, logistics technology providers, fleet operators, and strategic investment in digital platforms and specialized transport equipment.

How Governments Could Enable Market Expansion?

How Industry Bodies Could Advance Professional Standards?

How Technology and Platform Providers Could Transform the Ecosystem?

How Service Providers Could Strengthen Market Position?

How Investors Could Accelerate Market Development?

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 4,994.6 million |

| Classification | Basic Transportation Services, Special Transportation Services, Others |

| Application | Automobile Manufacturing Industry, Logistics and Warehousing, Consumer Relocation, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | AGS International Movers, Allied Van Lines, Links Moving, ReloSmart Movers Hong Kong, Atlas, Montway Auto Transport, Mayflower, AnyVan, PODS, Furniture Removals, Lalamove, and United Van Lines |

| Additional Attributes | Dollar sales by service classification and vehicle type, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established logistics providers and emerging digital platforms, buyer preferences for basic versus special transportation services, integration with automotive industry supply chains and consumer relocation patterns, innovations in tracking technologies and fleet management systems, and development of specialized services with enhanced insurance coverage and customer experience capabilities. |

The global vehicle moving services market is estimated to be valued at USD 4,994.6 million in 2025.

The market size for the vehicle moving services market is projected to reach USD 15,791.8 million by 2035.

The vehicle moving services market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in vehicle moving services market are basic transportation services and special transportation services.

In terms of application, automobile manufacturing industry segment to command 45.0% share in the vehicle moving services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vehicle-Mounted Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Barrier System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Security Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle To Vehicle Communication Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Roadside Assistance Market Size and Share Forecast Outlook 2025 to 2035

Vehicle as a Service Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Integrated Solar Panels Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Networking Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-Everything (V2X) Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Armor Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Conversion Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Tracking System Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA