The acoustic insulation market is projected to grow from USD 16.8 billion in 2025 to USD 29.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.8%. This growth is driven by rising demand for noise control across construction, transportation, and industrial sectors.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 16.8 billion |

| Industry Value (2035F) | USD 29.6 billion |

| CAGR | 5.8% |

Urban population growth and infrastructure densification are contributing to heightened concerns over noise pollution, leading to stricter regulatory frameworks that mandate acoustic performance in residential, commercial, and public spaces.

In the construction sector, fibrous insulation materials such as glass wool and rock wool are being used extensively in walls, floors, and ceilings. These materials offer dual advantages, including sound absorption and thermal insulation, which are being adopted in accordance with building codes aimed at enhancing occupant comfort and energy efficiency.

Developers and contractors are integrating acoustic insulation into new builds and retrofits to meet performance benchmarks, especially in metropolitan areas where ambient noise levels exceed safe thresholds.

The market is also witnessing a shift toward sustainable insulation materials. Glass wool, manufactured from recycled glass, is being favored in projects seeking green building certifications such as LEED and BREEAM. Its recyclability and contribution to indoor environmental quality have made it a preferred choice for environmentally focused construction initiatives. Rock wool, known for its non-combustibility and acoustic damping capabilities, is being specified in applications that require both fire resistance and sound control, such as high-rise buildings, hospitals, and manufacturing plants.

In modular construction and prefabricated housing, foamed plastic insulations like extruded polystyrene (XPS) and expanded polystyrene (EPS) are being selected for their ease of use, low moisture absorption, and compatibility with lightweight structural systems. Manufacturers are increasing output to support demand in commercial fit-outs and modular housing developments.

In the transportation sector, acoustic insulation is being integrated into electric vehicles (EVs), where the reduced engine noise shifts focus to wind and road noise. Multilayer elastomeric foams and composite sound barriers are being used in cabin enclosures and underbody panels to enhance the acoustic profile. EV manufacturers in Germany and Japan have incorporated these solutions to enhance interior sound quality and meet performance targets for passenger comfort.

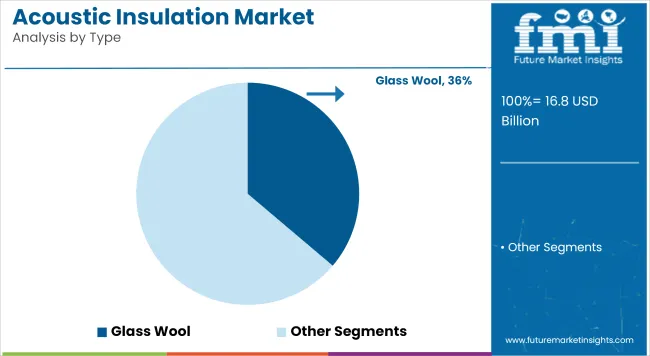

Glass wool is estimated to account for 36.2% of the market share in 2025 and is expected to grow at a CAGR of 5.6% through 2035. Composed of recycled glass fibers bound with resins, it offers thermal insulation and sound attenuation properties. Glass wool is commonly used in partition walls, ceilings, and ventilation ducts. Its lightweight structure and cost efficiency support high adoption in residential and commercial building sectors.

Installation flexibility and compatibility with modular construction methods further contribute to its preference in large-scale developments. Its fire resistance and non-corrosive nature make it suitable for both new builds and renovation projects. In regions such as Europe and North America, energy efficiency mandates and acoustic performance standards are contributing to consistent demand. Glass wool is also used in automotive and appliance enclosures to reduce operational noise.

The building and construction segment is projected to hold 41.8% of the market share in 2025 and is expected to grow at a CAGR of 6.1% through 2035. Rising residential and commercial construction activities are driving the adoption of acoustic insulation materials across floors, ceilings, roofs, and service areas. Building codes in developed markets mandate soundproofing in high-density housing, offices, schools, and hospitals.

Noise control is also being integrated into sustainability frameworks and green building certifications. Retrofitting of existing buildings with insulation upgrades is increasing, particularly in North America and Europe. In Asia Pacific, large urban development projects and smart city initiatives are incorporating noise control as part of livable infrastructure planning. Builders and developers are selecting insulation systems that combine thermal and acoustic performance, supporting dual functionality and efficient space design in multi-use structures.

Future Market Insights conducted an extensive survey among key stakeholders in the acoustic insulation sector to analyze trends, challenges, and the future outlook. The survey involved manufacturers, suppliers, industry professionals, and end-users in various sectors, including construction, automotive, and industrial applications.

The survey aimed to understand the changing demand for acoustic insulation products, the effect of regulatory shifts, and the influence of technological innovation in the market.

The survey revealed that the acoustic insulation industry players are focusing on sustainability. Stakeholders emphasized the use of environmentally friendly materials and energy-efficient solutions. Most manufacturers reported mounting pressure from consumers and regulatory organizations to implement more environmentally friendly technologies, which in turn affects the design and manufacture of insulation products.

Moreover, stakeholders observed that the increase in noise pollution, especially in cities, had increased awareness of the need for effective soundproofing solutions, further boosting demand for acoustic insulation products.

The survey further showed that progress in material science and manufacturing techniques was a principal area of emphasis for firms trying to remain competitive. Stakeholders recognized a movement toward lightweight high-performance insulation materials with enhanced sound absorption. Numerous participants identified investment in research and development (R&D) as a way to innovate and develop more efficient, cost-saving products, with particular interest in incorporating smart technologies like IoT for better monitoring and control of acoustic characteristics.

Survey stakeholders were positive about the prospects of the acoustic insulation market. Most of them believed that demand would continue to increase due to urbanization, stricter noise regulations, and the trend towards sustainable building.

| Countries | Regulations Impacting the Acoustic Insulation Market |

|---|---|

| United States | The US Green Building Council (USGBC) provides an incentive for building acoustic insulation through the LEED certification process, which emphasizes sound attenuation in buildings. - Federal policies such as the Energy Policy Act (EPA) also indirectly support soundproofing solutions by promoting energy-efficient insulation materials |

| European Union | The Energy Performance of Buildings Directive (EPBD) of the EU encourages energy-efficient and sound-absorbing materials to be used in buildings including wall/partition constructions; - Localised noise control legislation, i.e. The UK's Building Regulations Part E(Sound Insulation) is the guideline covering sound transmission between rooms for most countries in the EU. |

| United Kingdom | The Building Regulations Part E outlines sound insulation rules and the minimum level of sound insulation for new and refurbished buildings. The Environmental Noise Directive (END) provides rules for managing and controlling noise pollution, leading to a higher demand for insulation products in noise-sensitive areas. |

| Canada | The National Building Code (NBC) establishes minimum standards for acoustic performance in residential, commercial, and industrial buildings. - Specific noise controls and acoustic insulation requirements are prescribed in the Canadian provinces, including Ontario, for high-density urban environments. |

| Australia | National Construction Code (NCC) - which sets out requirements for the acoustic performance of residential and commercial buildings; (ii) Australian Noise Control Manual - guidelines that promote the use of adequate acoustic insulation in noise-shielded zones. |

| Germany | The German Noise Protection Act stipulates noise insulation for buildings and industrial facilities. The Energy Saving Ordinance (EnEV) encourages the use of energy-efficient materials, which are typically high-performance acoustic insulation products. |

The US acoustic insulation industry is growing steadily due to rising noise pollution issues and more stringent building regulations. As urbanization increases, cities experience greater construction activity, which generates demand for improved soundproofing materials. Government programs, such as the US Green Building Council's LEED rating system, focus on environmentally friendly and energy-efficient building materials, driving demand higher for high-performance acoustic insulation.

In addition, building codes and laws, such as the Energy Policy Act and the National Building Code, require soundproofing to some minimum standard. With the sustainability trend ongoing, stakeholders are looking towards new, sustainable, soundproofing materials that also address acoustic requirements. Technology is enabling the development of more effective sound absorption and lighter, more effective insulation products.

According to FMI’s analysis, the US acoustic insulation market accounts for nearly 20% of the overall market revenue share. In 2025, this translates to roughly USD 5 billion in revenues.

In the UK, Part E of the Building Regulations is a government legislation that ensures buildings are sound-insulated to certain standards for rooms, homes, and external noise. This has created high demand for acoustic insulation in residential and commercial schemes. Additionally, the Environmental Noise Directive affects noise reduction within urban zones, placing further pressure on soundproofing solutions to be effective.

With sustainability remaining a top concern, the industry is experiencing a growing trend towards using environmentally friendly and energy-efficient insulation materials. The initiative towards greener building methods is promoting innovations like soundproofing solutions that help enhance energy efficiency in buildings as well. Demand for acoustic insulation in the UK is estimated to grow at a CAGR of 5.1% through 2035.

Urbanization and the increasing awareness regarding noise pollution drive the acoustic insulation industry in France. Legislation, including the French Environmental Code, mandates that buildings be designed to provide certain levels of noise insulation to reduce disturbance in residential and commercial areas.

French urban areas, particularly Paris, are significantly impacted by noise pollution, and government initiatives to enhance acoustic comfort within buildings have necessitated the use of improved insulation materials. As part of the overall EU push for energy efficiency, the French government encourages the use of sustainable building materials. This has created a growing demand for acoustic solutions that incorporate noise reduction and energy-saving functionality, particularly in new buildings and refurbishment works.

Germany has a robust regulatory environment that oversees noise control and acoustic insulation, including the Noise Protection Act (SchalLärmSchG) and the Energy Saving Ordinance (EnEV). These pieces of legislation promote sound insulation in residential and commercial buildings, as well as energy-efficient construction. Notably, Germany's construction codes enforce stringent thermal and sound insulation requirements, especially for high-density cities.

The industry is shifting towards sustainable insulation solutions as part of Germany's overall environmental ambitions. With the latest technology, German manufacturers are focused on developing materials that enhance both soundproofing and thermal insulation, resulting in a growing demand for high-performance sound insulation solutions.

According to FMI’s analysis, Germany’s acoustic insulation industry accounts for nearly 10% of the global market share. In 2025, the industry is valued at roughly USD 2.5 billion.

Japan's acoustic insulation industry is shaped by the urban density of its population, specifically in urban cities such as Tokyo and Osaka, where noise pollution is a strong issue. Legislation, including the Building Standard Law, establishes requirements for noise suppression in residential, commercial, and industrial buildings. As a result of these regulatory requirements, Japan places a major emphasis on developing innovative materials to reduce noise and enhance energy efficiency.

Moreover, the growing demand for sustainable building and energy efficiency is propelling demand for high-performance acoustic insulation products. Japan's high-tech manufacturing technology also helps to create innovative and high-performance soundproofing solutions, which are extensively used in new buildings and renovation work. Japan’s acoustic insulation industry is projected to expand at a CAGR of 4.7% in the upcoming decade.

China's urbanization and continuous infrastructure development are fueling high demand for acoustic insulation. As cities expand, noise pollution has become a significant issue, particularly in densely populated residential areas and near industrial zones. The government has enforced stricter building codes to handle noise control, including the Noise Pollution Prevention and Control Law.

China is also emphasizing sustainability, promoting the adoption of energy-efficient insulation materials that provide both thermal and acoustic benefits. The demand for high-end acoustic insulation is expected to increase rapidly in both the commercial and residential sectors, driven by the expansion of the green building materials industry.

As the green building materials industry expands, the demand for higher-end acoustic insulation products is expected to increase, particularly in new commercial and residential developments. China’s industry is likely to expand at a 5.9% CAGR from 2025 to 2035.

In Australia, the National Construction Code (NCC) mandates that buildings meet specific acoustic performance standards to minimize noise transmission. This applies to both commercial and residential buildings, and is especially aimed at reducing external noise and noise between adjacent units.

In Sydney and Melbourne, where urban noise levels are high, the acoustic insulation industry is particularly strong. The increased emphasis on sustainability has created a demand for green materials that are effective not only in noise reduction but also in energy efficiency. The push to minimize noise pollution in residential and industrial areas in Australia has also spurred innovations in soundproofing technologies, further fueling the industry's expansion.

South Korea's acoustic insulation industry is expected to experience consistent growth, driven by the strong construction sector and increasing emphasis on noise pollution control. Urbanization continues to increase, and there is a growing need for soundproofing in residential and commercial buildings. The market in the country is likely to expand at a CAGR of 4.5% through 2035.

Stricter building codes, particularly in urban centers, have been enforced by the government to mitigate noise pollution and enhance the quality of life. Moreover, South Korea's emphasis on sustainability is driving the use of environmentally friendly acoustic materials. The growth in infrastructure developments, including public transport systems and renewable energy installations, will also drive demand for acoustic insulation systems further.

Companies are increasingly working towards designing high-performance, innovative materials to meet changing regulatory requirements and customer demand for more eco-friendly and effective solutions. Additionally, the growing emphasis on smart cities and green buildings will further drive the adoption of acoustic insulation in the years to come. As environmental considerations remain at the forefront in South Korea, energy-efficient insulation options will continue to be a mainstay driver for the industry.

The acoustic insulation industry presents numerous growth opportunities driven by shifting construction trends, rising urbanization, and growing environmental concerns. The greatest opportunity is in the growth of green building certifications, which are increasingly adopting acoustic insulation as a major element in sustainable construction. Firms must focus on creating eco-friendly and recyclable insulation products to address the growing demand for sustainable construction materials.

The growth of smart cities and the ongoing process of urbanization will drive demand for noise control products in both residential and commercial properties. Additionally, as concerns over noise pollution rise globally, particularly in urban areas, governments and private developers will face increased pressure to comply with stricter noise regulations. This presents companies with an opportunity to develop new materials that offer enhanced soundproofing and improved energy efficiency.

Within the transportation industry, the shift to electric vehicles and the expansion of public transportation infrastructure will drive demand for specialized insulation solutions. Organizations need to invest in producing light and efficient acoustic materials with specifications that meet the needs of these industries while also offering both energy efficiency and noise reduction.

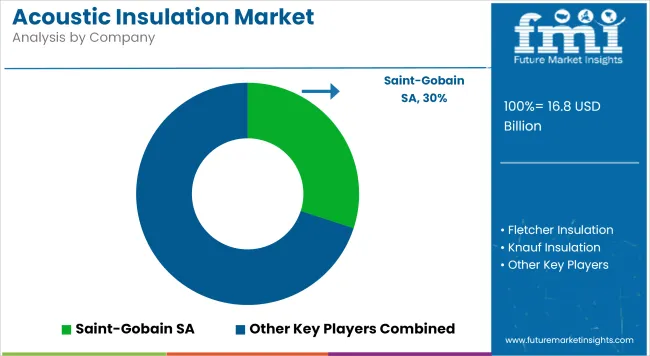

The acoustic insulation market is seeing consolidation and strategic partnerships aimed at expanding product portfolios and market reach. One major player acquired a cellulose-based insulation company to broaden offerings in sustainable thermal and acoustic solutions across North America. Another key company formed a partnership with a global construction firm to integrate acoustic products into large commercial and residential projects, strengthening its presence in both North America and Europe.

These developments underscore a focus on sustainability and collaboration with leaders in the construction industry. Competition is increasingly centered on product innovation, regional market penetration, and alignment with green building standards. Companies are leveraging acquisitions and alliances to address demand for energy-efficient and soundproofing materials in new and retrofit construction.

Glass wool, Rock wool, Foamed Plastic, and Elastomeric Foam

Building and construction, transportation, oil and gas petrochemicals, energy and utilities and industrial and OEM

USA, UK, France, Germany, China, India, Australia

Common types include glass wool, rock wool, foamed plastic, and elastomeric foam.

It reduces heat transfer, lowering energy costs for heating and cooling.

It’s used in construction, transportation, oil & gas, energy, and industrial sectors.

Urbanization, noise regulations, sustainability, and energy efficiency needs.

There’s a push for eco-friendly materials and energy-efficient solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acoustic Vehicle Alerting System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acoustic Wave Sensors Market Size and Share Forecast Outlook 2025 to 2035

Acoustic Wave Filters Market Size and Share Forecast Outlook 2025 to 2035

Acoustic Respiration Sensors Market Outlook 2025 to 2035

Acoustic Camera Market Growth - Size, Trends & Forecast 2025 to 2035

Acoustic Puncture Assist Devices Market

Acoustic Neurinoma Treatment Market

Otoacoustic Emissions Hearing Screener Market Size and Share Forecast Outlook 2025 to 2035

Bioacoustics Sensing Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Tomography Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Microscopy Market Growth – Industry Trends & Forecast 2024-2034

Vehicle Acoustic DSP Chips Market Size and Share Forecast Outlook 2025 to 2035

Sustained Acoustic Medicine Market

Underwater Acoustic Communication Market Growth - Trends & Forecast 2025 to 2035

Lightweight Acoustic Floor Systems Market Size and Share Forecast Outlook 2025 to 2035

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Insulation Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA