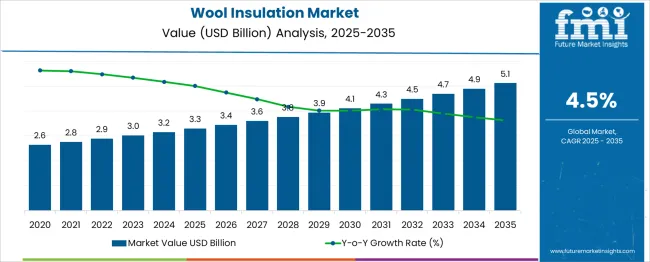

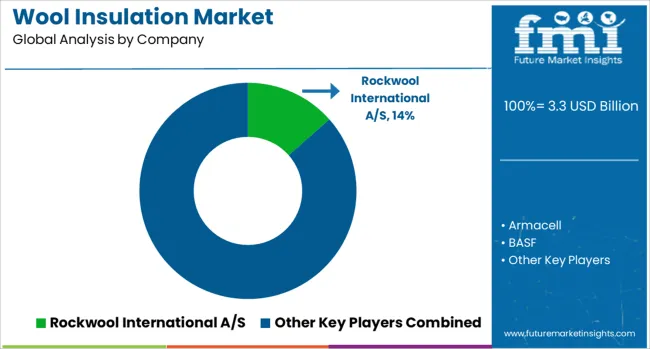

The Wool Insulation Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 5.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Wool Insulation Market Estimated Value in (2025 E) | USD 3.3 billion |

| Wool Insulation Market Forecast Value in (2035 F) | USD 5.1 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

With growing awareness surrounding the environmental and health impacts of conventional insulation materials, natural alternatives such as wool have emerged as preferred options, especially in residential and small-scale commercial applications.

Wool insulation provides excellent thermal and acoustic performance, moisture regulation, and fire resistance, positioning it as a viable replacement for synthetic counterparts. Regulatory pushes for greener buildings and consumer demand for toxin-free indoor environments further strengthen the market outlook.

Market participants are increasingly focusing on expanding product availability and enhancing insulation efficiency through hybrid formulations. As circular economy models and sustainable sourcing take center stage, the wool insulation market is expected to benefit from both policy-driven adoption and consumer-led environmental consciousness in the long term.

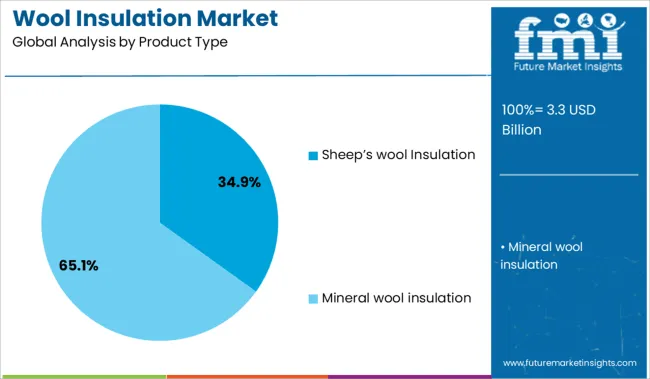

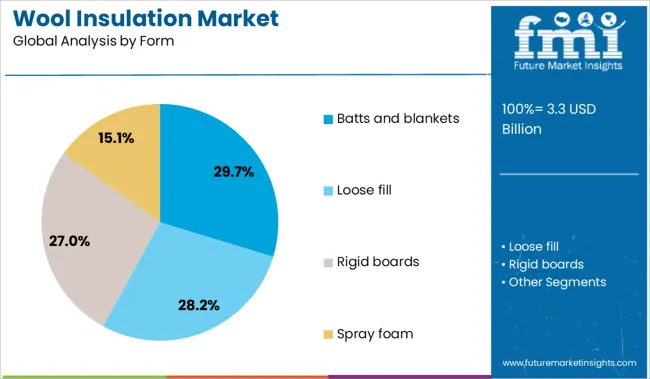

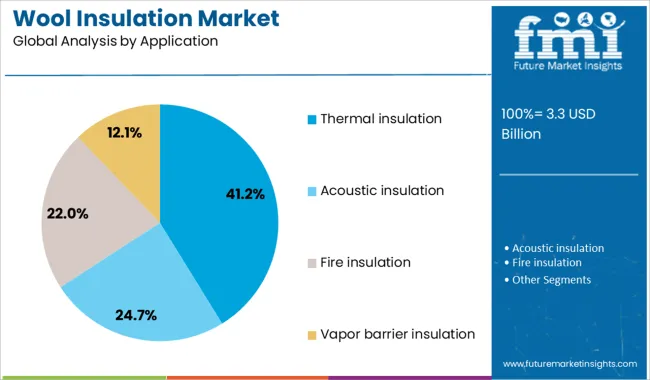

The wool insulation market is segmented by product type, form, application, and end-use and geographic regions. The wool insulation market is divided by product type into Sheep’s wool Insulation and Mineral wool insulation. The wool insulation market is classified into Batts and blankets, Loose fill, Rigid boards, and Spray foam. Based on the application, the wool insulation market is segmented into Thermal insulation, Acoustic insulation, Fire insulation, and Vapor barrier insulation. The wool insulation market is segmented by end-use into Residential, Commercial, and Industrial. Regionally, the wool insulation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Sheep’s wool insulation leads the product type category with a 34.9% market share, driven by its superior natural properties and growing appeal among eco-conscious consumers. This insulation type offers excellent thermal retention, breathability, and humidity control, making it suitable for varying climatic conditions.

Its non-toxic, biodegradable composition has become increasingly attractive in sustainable building projects, particularly where indoor air quality is a priority. Product certifications and endorsements from green building councils further support growth in this segment.

Manufacturers are actively investing in improving processing techniques to retain wool’s natural lanolin and elasticity, which enhances its performance and longevity. The segment’s upward trend is also backed by rising availability through retail and online platforms, making sheep’s wool insulation more accessible to DIY builders and contractors alike. With policy incentives favoring low-carbon materials, this segment is expected to sustain strong demand across both new constructions and retrofitting projects.

Batts and blankets form dominate the form category with a 29.7% share, reflecting their practicality, ease of installation, and cost-effectiveness in both new builds and renovation projects. These pre-cut panels are widely used in wall cavities, attics, and flooring systems, where consistent coverage and moderate thermal resistance are required.

Their standardized sizing and compatibility with traditional framing structures have led to widespread adoption in residential and light commercial sectors. The segment has benefited from growing demand for insulation solutions that combine performance with user convenience.

As sustainability becomes a key focus, wool-based batts and blankets are increasingly favored for their natural composition and reduced environmental impact. Manufacturers continue to enhance this form factor with multi-layered designs and integrated vapor barriers, improving thermal efficiency and installation speed. This segment is likely to remain prominent as construction trends shift toward pre-fabricated and modular building techniques that prioritize simplicity and ecological responsibility.

The thermal insulation application holds a leading 41.2% share in the wool insulation market, emphasizing its role as the core driver of demand across residential, commercial, and industrial construction. Wool insulation is particularly effective in maintaining indoor temperatures, reducing energy consumption, and enhancing comfort in buildings, which has made it a preferred choice for thermal regulation.

Growing energy efficiency regulations and green building certifications have placed thermal insulation at the forefront of sustainable design practices. The segment has also benefited from rising utility costs, which are prompting homeowners and businesses to invest in high-performance insulation solutions.

Wool’s ability to regulate moisture without losing its insulating properties provides a functional advantage over synthetic materials. As architects and developers prioritize natural, renewable building materials, the thermal insulation segment is expected to remain the dominant application, supported by ongoing innovation and expanded product offerings tailored to regional climate needs.

Demand for wool insulation is rising as energy-efficient construction practices and eco-friendly building codes gain global traction. Sales of natural wool batts, blown-in formats, and prefabricated insulation panels are climbing steadily, particularly in residential and light commercial construction segments. Growth is driven by high-performance requirements for thermal regulation, moisture control, and healthy indoor air quality in Europe, North America, and Asia.

Demand for wool insulation jumped by 31% in 2025 as homebuilders and contractors turned away from synthetic materials in favor of natural alternatives. Wool batts and loose-fill systems are prized for their high R-values (≥4.0/inch) and their ability to regulate indoor humidity, making them ideal for both hot and cold climates. Compared to fiberglass, homes insulated with wool reported an 18% reduction in heating energy usage annually. Certifications such as GreenGuard and BBA are accelerating adoption, especially in passive house and net-zero energy developments across Europe.

Sales of blown-in and prefabricated wool insulation rose 27% year-over-year in 2025, largely due to reduced labor requirements and low on-site waste. Pre-cut wool batts, modular cavity-fill solutions, and dust-free blown-in systems are gaining traction in retrofits, modular housing, and large-scale renovations. Builders reported up to 20% savings in labor and a 15% reduction in installation waste versus mineral wool. Firms offering contractor training and fast-installation tools recorded a 23% uptick in project repeat rates. Energy code revisions requiring higher R-values and environmental compliance are accelerating demand in key Western markets.

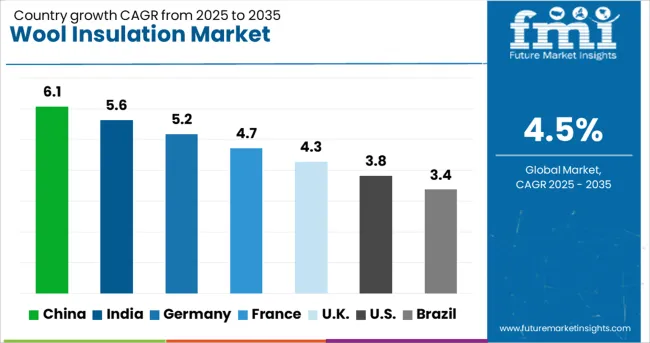

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global market is projected to grow at a CAGR of 4.5% from 2025 to 2035, led by sustainability mandates and demand for low-emission building materials. China leads with a 6.1% CAGR, fueled by strict energy codes and state-led green construction initiatives. India follows at 5.6% as low-cost natural materials are integrated into affordable housing. Germany grows at 5.2% due to federal energy-efficiency mandates and strong adoption in passive house projects. The UK’s 4.3% CAGR is supported by retrofitting grants and growing use in historical restoration. The US, growing at 3.8%, is driven by consumer demand for healthier insulation in coastal and fire-prone areas. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a 6.1% CAGR, driven by stricter building energy standards and increased construction activity in urban and regional hubs. Government programs encourage energy-efficient insulation in large-scale housing developments and public infrastructure. Manufacturers are expanding production capacity for mineral wool panels to meet the growing demand in high-rise projects. State incentives for zero-energy and low-energy building models are also influencing adoption. Integration of wool insulation in HVAC systems for temperature and noise control further enhances its application in commercial complexes. Partnerships with real estate firms for energy-compliant buildings strengthen market prospects.

India is expected to grow at a 5.6% CAGR, supported by public housing programs that promote energy-saving construction practices. Affordable housing projects under national schemes incorporate wool insulation for improved indoor comfort. Builders in high-temperature regions are deploying wool-based products to reduce reliance on cooling systems. Local manufacturers are launching competitively priced insulation products targeting rural and semi-urban markets. Fire-resistant properties of wool insulation offer an advantage over synthetic alternatives in safety-sensitive projects. Growing interest in modular and prefabricated construction enhances opportunities for standardized insulation solutions.

Germany is forecast to grow at a 5.2% CAGR, supported by energy-efficiency directives and renovation of older buildings. Retrofitting projects to meet EU thermal performance requirements account for a major share of demand. Wool insulation is widely applied in passive house models for its soundproofing and thermal benefits. Local producers are improving fiber technology for durability and moisture protection. Construction firms emphasize compliance with energy-saving codes, driving the use of wool insulation in both residential and commercial projects. Public funding for energy upgrades and tax incentives encourage wider material adoption in private housing.

The United Kingdom is expected to grow at a 4.3% CAGR, driven by home energy improvement programs and retrofitting of older properties. Government grants under initiatives like ECO support insulation upgrades in low-income housing. Wool-based insulation is commonly used in heritage projects for its adaptability to existing building structures without compromising aesthetics. Increased application in modular construction and offsite housing projects is contributing to incremental demand. Manufacturers focus on producing multi-layered wool panels with vapor protection for high-moisture environments. Partnerships with local councils help execute large-scale energy-efficiency upgrades across social housing projects.

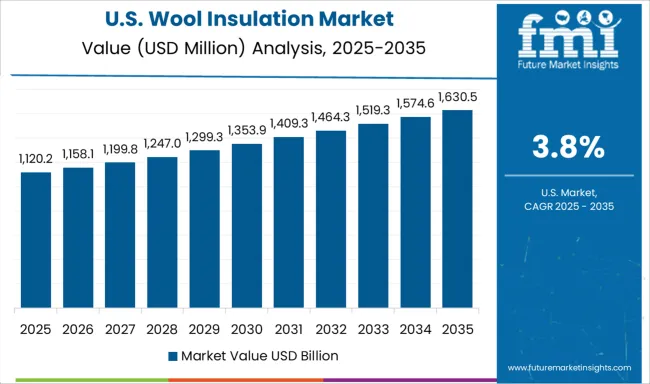

The United States is forecast to grow at a 3.8% CAGR, supported by demand for low-emission, safe insulation materials in residential and light commercial projects. Fire- and moisture-resistant properties of wool insulation make it suitable for use in high-risk regions. Builders are adopting wool-based insulation to meet energy code compliance and indoor air quality standards. Manufacturers are offering blended solutions combining wool with synthetic fibers to improve thermal performance. Retailers and online platforms are increasing product visibility among homeowners seeking easy-to-install insulation. Rising use in prefabricated housing and energy-focused renovations also supports long-term growth.

Rockwool International A/S leads the wool insulation market, offering certified fire-safe and high thermal resistance solutions for diverse construction applications. Armacell, BASF, and Fletcher Insulation emphasize eco-focused designs through prefabricated systems and recyclable materials. Owens Corning and Knauf Insulation invest in vapor-permeable natural wool batts, targeting energy-efficient and net-zero buildings. Johns Manville develops insulation products aligned with LEED and WELL certification requirements. Competitive strategies revolve around improving thermal performance, acoustic comfort, and indoor air quality with low VOC materials. Ease of installation and compliance with global energy codes remain key differentiators. Market players are also focusing on lifecycle sustainability and enhanced product durability to meet the growing demand for advanced building materials in both residential and commercial segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Product Type | Sheep’s wool Insulation and Mineral wool insulation |

| Form | Batts and blankets, Loose fill, Rigid boards, and Spray foam |

| Application | Thermal insulation, Acoustic insulation, Fire insulation, and Vapor barrier insulation |

| End-Use | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rockwool International A/S, Armacell, BASF, Fletcher Insulation, Greenfiber, Huntsman International LLC, Isover, Johns Manville, Kingspan Group, Knauf Insulation, Owens Corning, Pittsburg Corning, Promat International, Saint-Gobain, and Soprema |

| Additional Attributes | Dollar sales by product type (sheep's wool vs mineral wool) and form (batts, rolls, loose-fill), demand dynamics across residential, commercial, and industrial segments, regional leadership in North America and Asia‑Pacific, innovation in recycled-content and corrosion-inhibiting treatments, and environmental impact via biodegradability, moisture buffering, and energy efficiency. |

The global wool insulation market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the wool insulation market is projected to reach USD 5.1 billion by 2035.

The wool insulation market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in wool insulation market are sheep’s wool insulation, mineral wool insulation, _glass wool and _rock wool.

In terms of form, batts and blankets segment to command 29.7% share in the wool insulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Wool Insulation Market Growth - Trends & Forecast 2024 to 2034

Worsted Wool Yarn Market Size and Share Forecast Outlook 2025 to 2035

Mineral Wool Material Market Size and Share Forecast Outlook 2025 to 2035

Mineral Wool Market by Type & Application from 2025 to 2035

Key Companies & Market Share in the Mineral Wool Sector

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Insulation Coatings Market Size and Share Forecast Outlook 2025 to 2035

Insulation Boards Market Size and Share Forecast Outlook 2025 to 2035

Insulation Testing Instrument Market Size and Share Forecast Outlook 2025 to 2035

OEM Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cork Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA