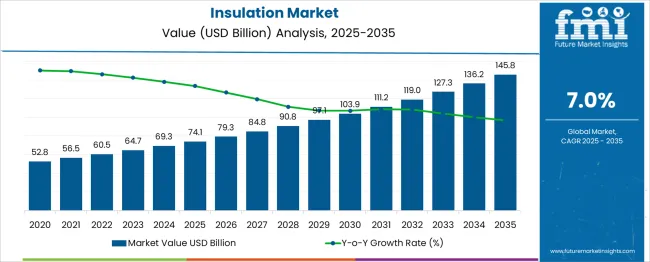

The global insulation market is expected to grow from USD 74.1 billion in 2025 to approximately USD 145.8 billion by 2035, recording an absolute increase of USD 71.67 billion over the forecast period. This translates into a total growth of 96.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.0% between 2025 and 2035. The market size is expected to grow by nearly 1.97X during the same period, supported by the rising demand for energy-efficient building solutions and increasing applications across diverse industrial sectors.

Between 2025 and 2030, the insulation market is projected to expand from USD 74.1 billion to USD 103.4 billion, resulting in a value increase of USD 29.3 billion, which represents 40.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for energy-efficient construction materials, increasing focus on building practices, and growing adoption of advanced insulation technologies in residential and commercial applications. Material manufacturers are expanding their production capabilities to address the evolving requirements of modern construction and industrial insulation applications.

From 2030 to 2035, the market is forecast to grow from USD 103.4 billion to USD 145.8 billion, adding another USD 42.3 billion, which constitutes 59.1% of the ten-year expansion. This period is expected to be characterized by widespread adoption of high-performance insulation materials, integration of smart building technologies, and development of specialized insulation solutions for emerging applications. The growing focus on carbon neutrality and green building certifications will drive demand for more sophisticated insulation materials and comprehensive thermal management solutions.

Between 2020 and 2025, the insulation market experienced robust development, driven by increasing energy efficiency regulations and growing awareness of thermal management requirements across construction and industrial sectors. The market evolved as building contractors and industrial facilities recognized the need for advanced insulation technologies to meet performance standards and energy conservation targets. Construction industry standards began emphasizing specialized material capabilities to support diverse thermal insulation requirements and complex building applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 74.1 billion |

| Forecast Value in (2035F) | USD 145.8 billion |

| Forecast CAGR (2025 to 2035) | 7% |

Market expansion is being supported by the rapid increase in demand for energy-efficient building solutions across construction sectors worldwide and the corresponding need for specialized insulation materials. Modern construction projects rely on advanced thermal performance, moisture control, and structural integrity to ensure optimal building performance across diverse applications, including residential, commercial, infrastructure, and industrial facilities. Advanced insulation materials provide superior thermal resistance, enhanced durability, and improved environmental performance compared to traditional building materials.

The growing complexity of building codes and increasing energy efficiency requirements are driving demand for professional insulation solutions from certified manufacturers with appropriate technical capabilities and expertise. Construction applications increasingly require precise control over thermal bridging, air leakage, and moisture management characteristics. Regulatory compliance and green building standards are establishing specialized requirements for insulation materials that necessitate advanced technological features and comprehensive performance testing capabilities.

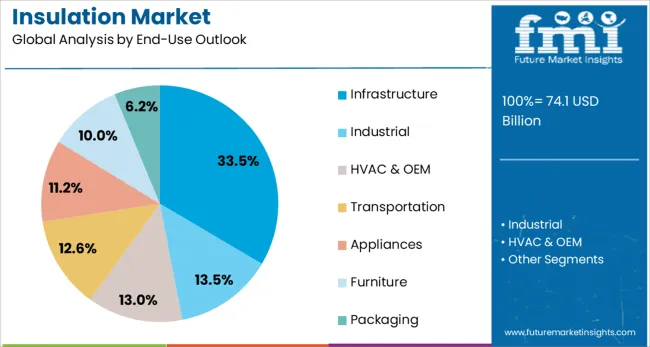

The market is segmented by product type, end-use application, and region. By product type, the market is divided into EPS, XPS, CMS fibers, calcium silicate, aerogel, cellulose, PIR, phenolic foam, polyurethane, glass wool, and mineral wool. Based on end-use application, the market is categorized into infrastructure, industrial, HVAC & OEM, transportation, appliances, furniture, and packaging. Regionally, the market is divided into China, India, Germany, France, United Kingdom, United States, and Brazil.

EPS (Expanded Polystyrene) insulation is projected to account for 27.8% of the insulation market in 2025. This leading share is supported by the widespread adoption of EPS for building insulation applications, which represent the majority of current construction requirements. EPS provides excellent thermal performance, lightweight characteristics, and cost-effective installation, making it the preferred choice for most residential and commercial building applications. The segment benefits from established manufacturing capabilities and comprehensive material availability from multiple suppliers worldwide.

Infrastructure applications are expected to represent 33.5% of insulation demand in 2025. This dominant share reflects the high utilization of insulation materials in commercial buildings, residential construction, and public infrastructure projects. Modern infrastructure development increasingly features multiple insulation requirements that demand sophisticated thermal management, fire resistance, and structural performance capabilities. The segment benefits from growing investment in construction activities and increasing requirements for energy-efficient building materials across urban development and infrastructure modernization projects.

The insulation market is advancing steadily due to increasing energy efficiency requirements and growing recognition of advanced thermal management benefits. The market faces challenges, including fluctuating raw material costs, need for specialized installation expertise, and varying building code requirements across different regional markets. Building standards harmonization efforts and material certification programs continue to influence performance capabilities and market development patterns.

The growing deployment of advanced insulation materials including aerogel, PIR, and specialized composite systems, is enabling enhanced thermal performance, reduced installation complexity, and improved building efficiency across construction applications. Advanced material systems equipped with superior thermal resistance capabilities provide comprehensive performance while reducing material thickness requirements and installation costs. These technologies are particularly valuable for commercial construction projects that require exceptional thermal performance and comprehensive building envelope solutions.

Modern insulation manufacturers are incorporating recycled content materials, bio-based formulations, and production technologies that improve environmental performance and reduce carbon footprint. Integration of recycled glass fibers, natural cellulose materials, and renewable raw materials enables more insulation solutions and comprehensive environmental management capabilities. Advanced material configurations support next-generation building applications including passive house construction and net-zero energy building designs.

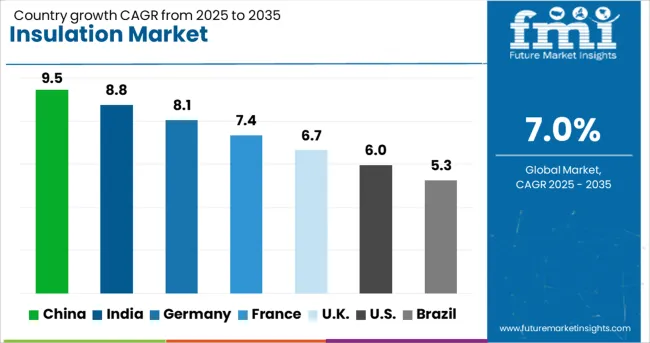

| Countries | CAGR (2025-2035) |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6% |

| Brazil | 5.3% |

The insulation market is experiencing robust growth globally, with China leading at a 9.5% CAGR through 2035, driven by massive infrastructure development, urbanization programs, and government mandates for energy-efficient building standards. India follows closely at 8.8%, supported by expanding construction activity, smart city initiatives, and increasing focus on thermal management solutions. Germany shows strong growth at 8.1%, emphasizing precision engineering, stringent energy efficiency regulations, and advanced building technologies. France records 7.4%, focusing on infrastructure modernization programs and construction practices. The United Kingdom demonstrates 6.7% growth, prioritizing construction practices and comprehensive building performance standards. The United States shows 6% expansion, emphasizing building efficiency technologies and energy-efficient construction methods. Brazil maintains steady growth at 5.3%, driven by construction modernization initiatives and increasing recognition of thermal management benefits.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from insulation materials in China is projected at a CAGR of 9.5%, driven by massive infrastructure development projects and increasing demand for energy-efficient building solutions. The country's expanding construction sector and growing focus on building performance standards are creating substantial demand for advanced insulation technologies. Major construction companies and material manufacturers are establishing comprehensive production capabilities to support the growing requirements of domestic and international markets across residential, commercial, and industrial applications. China's urbanization programs and green building initiatives are supporting development of specialized manufacturing capabilities that enhance material quality and technical performance across construction networks.

Revenue from insulation materials in India is expanding at a CAGR of 8.8%, supported by increasing construction activity and growing demand for thermal management solutions. The country's developing building infrastructure and increasing focus on energy efficiency standards are driving demand for professional insulation technologies. Construction companies and material suppliers are gradually establishing capabilities to serve the growing requirements of diverse building applications across residential, commercial, and industrial sectors. India's smart city initiatives and construction programs are creating opportunities for specialized material suppliers that can support diverse building technologies and performance requirements.

Demand for insulation materials in Germany is projected at a CAGR of 8.1%, supported by the country's focus on energy-efficient construction and advanced building technologies. German construction facilities are implementing comprehensive insulation capabilities that meet stringent thermal performance standards and environmental regulations. The market is characterized by focus on technological innovation, premium material integration, and compliance with comprehensive building energy codes. Germany's construction industry investments prioritize advanced insulation technologies that demonstrate superior thermal performance and are environmentally friendly while meeting European energy efficiency standards.

Demand for insulation materials in France is expanding at a CAGR of 7.4%, driven by increasing focus on building renovation programs and infrastructure modernization initiatives. French construction facilities are implementing comprehensive thermal management capabilities to serve diverse applications across residential, commercial, and public building sectors. The market benefits from established construction infrastructure and comprehensive technical support capabilities that enable sophisticated building performance solutions. France's building renovation programs focus on energy efficiency improvement and environmentally friendly initiatives that enhance thermal performance capabilities and operational efficiency.

Demand for insulation materials in the United Kingdom is projected at a CAGR of 6.7%, supported by a focus on construction practices and advanced building performance standards. British construction facilities are establishing comprehensive insulation capabilities that meet stringent thermal requirements and environmental specifications. The market is characterized by a focus on building performance optimization, advanced material integration, and compliance with comprehensive standards. The UK's construction sector investments prioritize advanced insulation technologies that support diverse building applications while maintaining operational efficiency and environmental compliance.

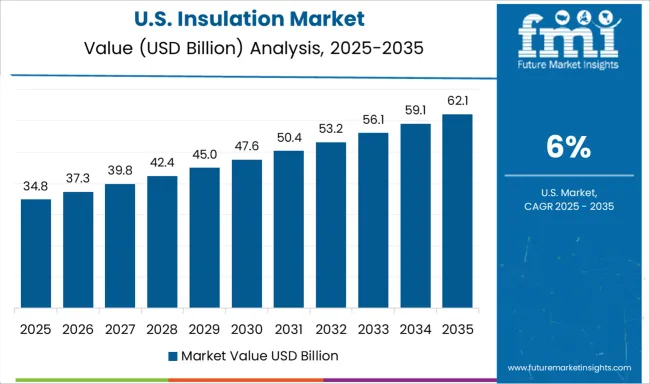

Demand for insulation materials in the United States is expanding at a CAGR of 6%, driven by increasing focus on energy-efficient construction and advanced building technologies. Large construction networks and building contractors are establishing comprehensive insulation capabilities to serve diverse residential and commercial requirements. The market benefits from established material supplier networks and a comprehensive technical support infrastructure that enables consistent thermal performance and operational reliability. American construction consolidation trends enable standardized insulation applications across multiple projects, providing consistent performance capabilities and comprehensive technical coverage throughout regional markets.

Revenue from insulation materials in Brazil is growing at a CAGR of 5.3%, driven by increasing construction activity and growing recognition of thermal management benefits. The country's established construction infrastructure is gradually integrating advanced insulation technologies to serve modern building applications. Construction companies and material suppliers are investing in sophisticated insulation solutions to address growing market demand across residential, commercial, and industrial sectors. Brazil's construction modernization initiatives facilitate adoption of advanced building technologies that support comprehensive thermal performance capabilities across major metropolitan and industrial regions.

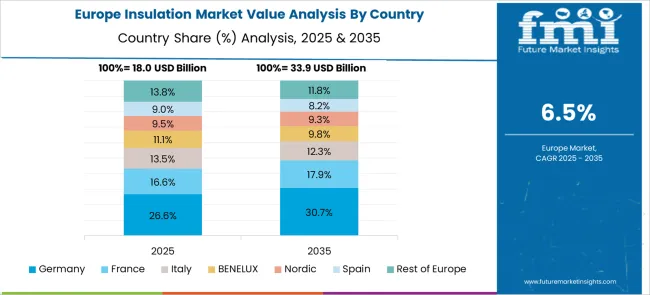

The Insulation market in Europe is projected to reach USD 22.5billion in 2025, with Germany leading the regional market at USD 8.5billion, representing 36.5% of European demand. France follows with USD 7.3 billion, accounting for 33.3% of the regional market, while the United Kingdom contributes USD 6.6 billion, representing 30.2% of European insulation consumption. The European market demonstrates a strong focus on energy efficiency standards and advanced building technologies, particularly in passive house construction and commercial building applications. Germany's leadership position reflects its robust construction industry and stringent energy efficiency regulations, while France's substantial market share indicates significant investment in infrastructure modernization and residential renovation projects. The United Kingdom maintains a strong position through its focus on construction practices and comprehensive building performance standards.

European insulation demand patterns show concentration in high-performance applications, with EPS and mineral wool representing dominant product segments across all three major markets. The region's strict building codes and environmental standards drive preference for certified insulation materials, supporting premium technology adoption and specialized supplier relationships. Germany's construction and industrial clusters, France's infrastructure and residential applications, and the United Kingdom's commercial building activities collectively establish Europe as a critical market for advanced insulation technologies. Regional supply chain integration and technical expertise development continue to strengthen European market position in global building materials and thermal management applications.

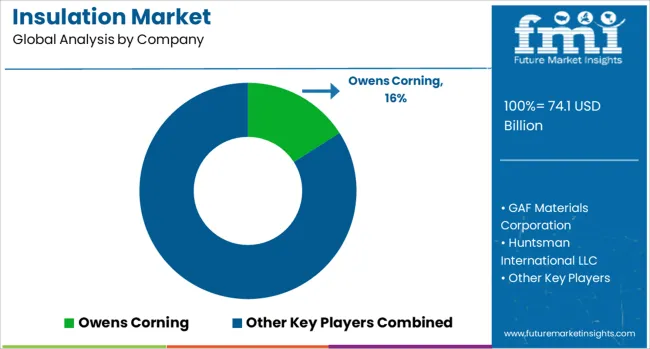

The insulation market is defined by competition among specialized material manufacturers, building products companies, and construction technology providers. Companies are investing in advanced material formulations, production processes, energy-efficient technologies, and comprehensive technical support to deliver precise, reliable, and cost-effective insulation solutions. Strategic partnerships, technological innovation, and global market expansion are central to strengthening material portfolios and market presence.

Owens Corning, United States-based, offers advanced insulation systems with a focus on thermal performance, comprehensive material solutions, and specialized technical expertise. GAF Materials Corporation, operating globally, provides comprehensive insulation solutions integrated with roofing and building envelope technologies. Huntsman International LLC delivers technologically advanced polyurethane insulation with specialized applications and performance capabilities. Johns Manville emphasizes precision manufacturing and comprehensive technical support for building and industrial insulation applications.

Cellofoam North America Inc., Rockwool International A/S, DuPont, and Atlas Roofing Corporation provide specialized insulation expertise, standardized material configurations, and comprehensive technical support across global and regional markets. Saint-Gobain S.A., Kingspan Group, BASF, Knauf Insulation, Armacell International Holding GmbH, URSA, Covestro AG, Recticel NV/SA, Carlisle Companies Inc., Bridgestone Corporation, Fletcher Building, and 3M Company offer specialized material capabilities, advanced technical solutions, and product reliability across diverse construction and industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 74.1 billion |

| Product Type | EPS, XPS, CMS Fibers, Calcium Silicate, Aerogel, Cellulose, PIR, Phenolic Foam, Polyurethane, Glass Wool, Mineral Wool |

| End-use Application | Infrastructure, Industrial, HVAC & OEM, Transportation, Appliances, Furniture, Packaging |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Owens Corning, GAF Materials Corporation, Huntsman International LLC, Johns Manville, Cellofoam North America Inc., Rockwool International A/S, DuPont, Atlas Roofing Corporation, Saint-Gobain S.A., Kingspan Group, BASF, Knauf Insulation, Armacell International Holding GmbH, URSA, Covestro AG, Recticel NV/SA, Carlisle Companies Inc., Bridgestone Corporation, Fletcher Building, 3M Company |

| Additional Attributes | Dollar sales by product type and end-use application, regional demand trends across major markets, competitive landscape with established manufacturers and emerging suppliers, construction preferences for advanced versus conventional insulation materials, integration with smart building technologies and automation platforms, innovations in material formulations and energy-efficient processing capabilities, and adoption of specialized configurations for diverse building and industrial applications. |

The global insulation market is estimated to be valued at USD 74.1 billion in 2025.

The market size for the insulation market is projected to reach USD 145.8 billion by 2035.

The insulation market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in insulation market are eps, xps, cms fibers, calcium silicate, aerogel, cellulose, pir, phenolic foam, polyurethane, glass wool and mineral wool.

In terms of end-use outlook, infrastructure segment to command 33.5% share in the insulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Coatings Market Size and Share Forecast Outlook 2025 to 2035

Insulation Boards Market Size and Share Forecast Outlook 2025 to 2035

Insulation Testing Instrument Market Size and Share Forecast Outlook 2025 to 2035

OEM Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cork Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Wool Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

Market Leaders & Share in the Pipe Insulation Products Industry

Tank Insulation Market Growth – Trends & Forecast 2024-2034

Foam Insulation Market Growth – Trends & Forecast 2024-2034

Wire Insulation & Jacketing Compounds Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA