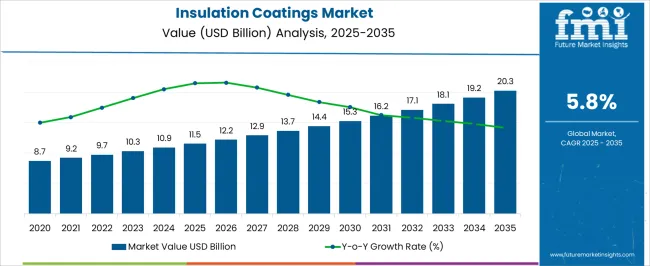

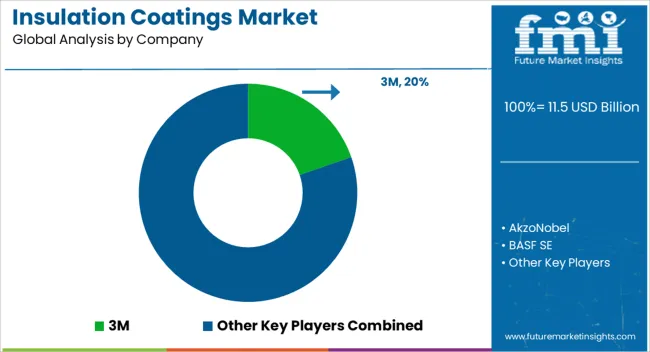

The insulation coatings market is estimated to be valued at USD 11.5 billion in 2025 and is projected to reach USD 20.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The insulation coatings market is projected to grow from USD 11.5 billion in 2025 to USD 20.3 billion by 2035, advancing at a CAGR of 5.8%. The 10-year growth comparison shows steady progress, with values moving from 11.5 billion in 2025 to 13.7 billion in 2028 and 15.3 billion by 2030. This gradual increase reflects rising demand for thermal and acoustic insulation coatings across industries such as construction, automotive, and energy. Analysts suggest that this predictable growth trajectory signals strong, sustained demand driven by regulatory requirements, energy efficiency targets, and the increasing focus on reducing energy consumption in both commercial and residential buildings.

By 2031, the market is expected to reach 16.2 billion, advancing to 17.1 billion in 2033 and 19.2 billion in 2034. The comparison highlights consistent value creation, with ongoing adoption in building materials, machinery, and equipment. Market observers argue that the insulation coatings market will continue to expand due to the growing importance of maintaining temperature control, enhancing safety, and improving operational efficiency. The trajectory confirms that insulation coatings will remain a crucial component in multiple sectors, with growth driven by both new developments and retrofitting of existing structures.

| Metric | Value |

|---|---|

| Insulation Coatings Market Estimated Value in (2025 E) | USD 11.5 billion |

| Insulation Coatings Market Forecast Value in (2035 F) | USD 20.3 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The insulation coatings market holds a notable share within broader sectors like coatings and construction materials. Within the coatings market, it represents about 5-6%, driven by the growing demand for protective, energy-efficient solutions in various industries. In the construction materials market, the insulation coatings segment contributes approximately 8-10%, as these coatings are essential for enhancing the energy performance of buildings and reducing operational costs. The thermal insulation market, directly related to insulation coatings, accounts for about 12-14%, reflecting the significant role coatings play in maintaining temperature control across buildings and industrial applications.

In the industrial coatings market, insulation coatings capture around 7-8%, as they are used in machinery, pipes, and equipment to ensure optimal energy retention and prevent heat loss. Within the broader building materials market, the share is smaller, approximately 3-4%, as insulation coatings are part of a wider product range, including cement, roofing, and concrete materials. The increasing focus on reducing energy consumption and enhancing building performance drives the growth of the insulation coatings market. These shares highlight the market's relevance in both construction and industrial applications, where energy efficiency remains a key priority.

The insulation coatings market is experiencing steady expansion driven by the rising need for energy efficiency, corrosion protection, and surface durability across industrial and infrastructure sectors. Increasing adoption in high temperature environments, along with the push for reduced energy losses, has accelerated demand.

Technological advancements in coating formulations are enhancing thermal resistance, chemical stability, and environmental safety, making these products suitable for a wide range of applications. Regulatory frameworks aimed at reducing carbon emissions and improving workplace safety are further encouraging adoption.

The market outlook remains positive as industries continue to invest in sustainable and high performance coating solutions that offer both operational and cost advantages, while meeting environmental compliance requirements.

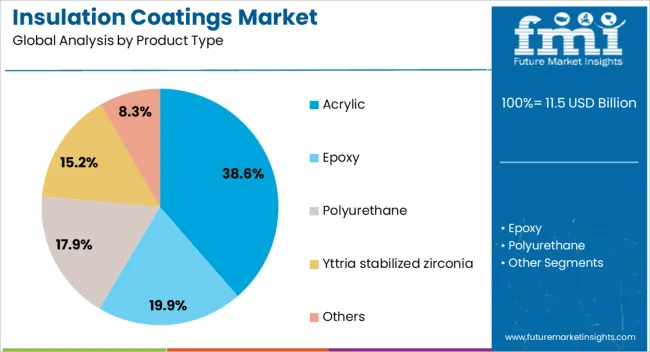

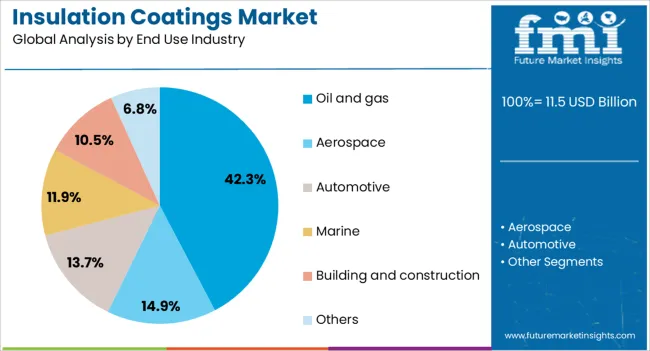

The insulation coatings market is segmented by product type, end use industry, and geographic regions. By product type, insulation coatings market is divided into acrylic, epoxy, polyurethane, yttria stabilized zirconia, and others. In terms of end use industry, insulation coatings market is classified into oil and gas, aerospace, automotive, marine, building and construction, and others. Regionally, the insulation coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylic segment is projected to hold 38.6% of the total market revenue by 2025 within the product type category, making it the leading segment. This dominance is attributed to its versatility, ease of application, and strong adhesion properties that enhance performance across diverse substrates.

Acrylic coatings provide effective thermal insulation along with resistance to ultraviolet radiation, weathering, and moisture, making them suitable for both indoor and outdoor applications. Additionally, their relatively low cost and compatibility with water based formulations support broader adoption in industries aiming to balance performance with sustainability.

The segment’s ability to meet regulatory standards while delivering long term durability continues to reinforce its market leadership.

The oil and gas segment is expected to account for 42.3% of total market revenue by 2025 within the end use industry category, positioning it as the most prominent segment. This growth is being fueled by the sector’s need for advanced insulation solutions to manage extreme temperature variations, protect infrastructure from corrosion, and enhance operational efficiency.

Insulation coatings are widely applied to pipelines, storage tanks, and processing equipment to minimize energy losses and extend service life. The ability to perform under harsh environmental conditions, including offshore and high pressure environments, has solidified their adoption.

As the oil and gas industry continues to modernize and optimize energy usage, insulation coatings remain a critical component of its operational and maintenance strategies.

The insulation coatings market is expected to grow steadily as demand for energy efficiency, corrosion resistance, and temperature regulation increases across industries. Demand is being reinforced by applications in construction, automotive, and industrial machinery. Opportunities are emerging with the rise of eco-friendly, high-performance coatings that offer enhanced thermal properties and environmental benefits. Trends focus on water-based formulations, fire-retardant properties, and multifunctional coatings. Challenges include fluctuating raw material prices, strict regulatory compliance, and the need for high-performance coatings in harsh environments.

Demand in the insulation coatings market is driven by industries seeking cost-effective solutions for energy efficiency, corrosion resistance, and temperature control. In construction, coatings are used to improve building insulation, reducing heating and cooling costs. Similarly, automotive and aerospace sectors use insulation coatings to enhance vehicle performance, protect components, and improve fuel efficiency. Industrial machinery, pipelines, and storage tanks also benefit from corrosion-resistant coatings that prolong the life of equipment. In our opinion, the market will continue to expand as industries prioritize both performance and cost savings in their insulation solutions.

Opportunities are emerging with the growing demand for eco-friendly, high-performance insulation coatings that offer better thermal management and environmental benefits. Water-based coatings are becoming more popular due to their lower environmental impact compared to solvent-based options. The increasing focus on reducing carbon footprints and meeting environmental regulations is prompting manufacturers to innovate with non-toxic, recyclable formulations. In our view, the most promising opportunities will come from markets that emphasize both functionality and sustainability, where high-performance coatings can meet both technical and environmental standards.

Trends in the insulation coatings market indicate a shift toward water-based formulations, which offer lower volatile organic compound (VOC) emissions and improved environmental safety. Fire-retardant properties are becoming more common in insulation coatings, particularly in commercial and residential buildings, to meet stricter safety regulations. There is also a growing interest in multifunctional coatings that not only provide thermal insulation but also protect against weathering, corrosion, and mechanical wear. In our opinion, the trend toward multifunctionality and eco-friendly solutions will shape the next phase of growth for insulation coatings.

Challenges in the insulation coatings market are driven by fluctuations in raw material prices, which can impact production costs and pricing strategies. Regulatory compliance is another obstacle, as manufacturers must meet stringent safety and environmental standards, which can vary by region. Ensuring the performance of insulation coatings in extreme conditions, such as high temperatures or aggressive chemical environments, remains a significant hurdle for many applications. In our view, overcoming these challenges will require innovative approaches to raw material sourcing, regulatory compliance, and the development of coatings that meet the rigorous demands of different industries.

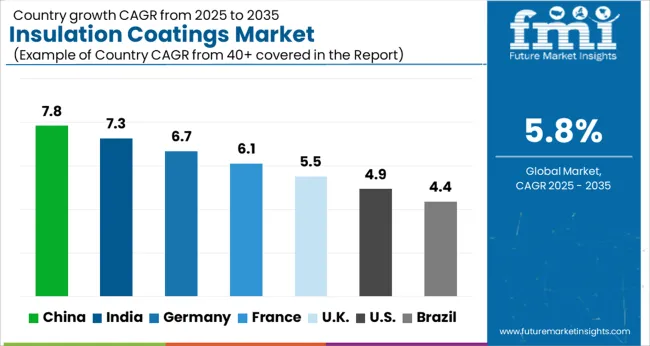

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

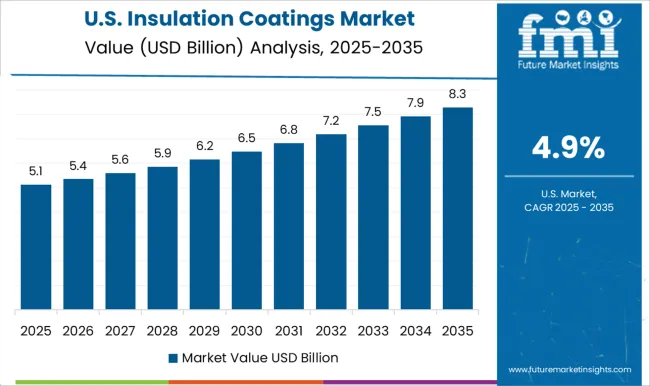

| USA | 4.9% |

| Brazil | 4.4% |

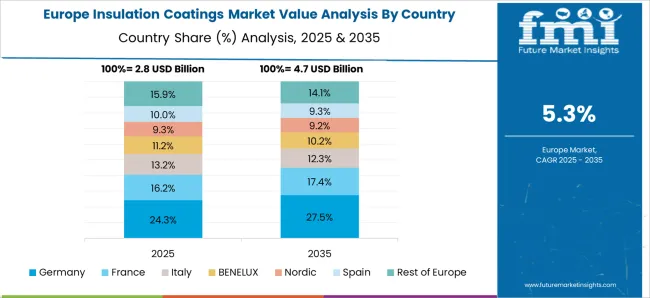

The global insulation coatings market is projected to grow at 5.8% from 2025 to 2035. China leads at 7.8%, followed by India 7.3% and Germany 6.7%; the United Kingdom 5.5% and United States 4.9% follow. Demand is driven by the increasing need for energy-efficient solutions in industries like construction, automotive, and manufacturing. Insulation coatings offer benefits such as thermal efficiency, fire resistance, and noise reduction, making them vital for enhancing performance and reducing energy consumption. The rising demand for eco-friendly solutions, coupled with stricter environmental regulations, is further propelling market growth. Asia is expected to lead in volume production, while Europe and North America will focus on high-performance and regulatory-compliant solutions. In our view, companies focusing on product innovation, cost efficiency, and compliance with environmental standards will capture the largest market share. This report includes insights on 40+ countries; the top markets are highlighted here for reference.

The insulation coatings market in China is expected to expand at 7.8%. Growth is being driven by the rapid expansion of industrial sectors, such as construction, manufacturing, and energy, where energy-efficient solutions are increasingly in demand. The government’s push for green building standards and the adoption of eco-friendly materials is further increasing the demand for insulation coatings. Additionally, China’s growing automotive industry is adopting insulation coatings to improve energy efficiency and reduce noise. With a strong local manufacturing base and cost-effective production, China is well-positioned to lead the global market.

The insulation coatings market in India is projected to grow at 7.3%. The demand for insulation coatings is increasing due to the country’s expanding construction sector, particularly in commercial and industrial buildings, where energy efficiency is a priority. The growing automotive industry is also contributing to the market’s growth, as manufacturers adopt insulation coatings for noise and heat control. India’s push for sustainable development, energy conservation, and green building certifications is fueling the adoption of advanced insulation solutions. As a rapidly growing economy, India is expected to see strong demand for cost-effective and efficient insulation coatings in both the residential and commercial sectors.

The insulation coatings market in Germany is expected to rise at 6.7%. The German market is driven by the country's strong regulatory framework supporting energy-efficient and sustainable building practices. Insulation coatings are in high demand in the construction sector, particularly for new buildings and renovation projects, to improve thermal performance and reduce energy consumption. Additionally, the automotive industry in Germany is adopting insulation coatings to enhance energy efficiency and noise reduction in vehicles. The increasing emphasis on reducing carbon emissions and improving energy efficiency across sectors is driving the adoption of insulation coatings.

The insulation coatings market in the UK is projected to expand at 5.5%. The UK market is primarily driven by the increasing adoption of energy-efficient solutions in the construction and automotive sectors. Building insulation, particularly for residential and commercial buildings, is a key application area for insulation coatings, as the UK government’s emphasis on sustainability and energy conservation pushes for better thermal management solutions. Additionally, the UK automotive industry is adopting insulation coatings to meet fuel efficiency standards and reduce noise pollution in vehicles. The growing demand for eco-friendly materials and sustainable development practices is further contributing to the market's growth.

The insulation coatings market in the United States is projected to grow at 4.9%. The USA market is driven by the growing demand for energy-efficient solutions in the construction, automotive, and industrial sectors. Insulation coatings are increasingly being used in commercial and residential buildings to improve thermal performance and reduce heating and cooling costs. The automotive industry is also a key driver, as the need for energy-efficient and noise-reducing coatings increases with the adoption of electric vehicles. Government policies supporting green building certifications and sustainability initiatives are further boosting the adoption of insulation coatings in the USA

Competition in the insulation coatings market has been shaped by how companies present thermal efficiency, durability, and sustainability in their brochures. 3M, BASF SE, and The Dow Chemical Company lead with brochures that highlight advanced thermal insulation properties, moisture resistance, and energy-saving benefits, targeting industries such as construction, automotive, and industrial applications. AkzoNobel and Sherwin-Williams emphasize their high-performance coatings that provide long-term protection against extreme temperatures, corrosion, and wear, with brochures showcasing compliance with international standards and environmental certifications.

PPG Industries and Hempel A/S position their coatings as solutions for both internal and external applications, with brochures focusing on flexibility, ease of application, and low-maintenance features. These brochures typically feature comprehensive technical data, including thermal conductivity values, longevity tests, and compatibility with various substrates. Strategy has been executed by providing clear, actionable information on key product attributes, including application methods, coverage rates, and performance benchmarks under different conditions.

Companies highlight energy efficiency gains, cost savings, and reduced carbon footprints, making their products appealing to environmentally-conscious buyers. Brochures often emphasize the ease of installation, with detailed application guides and case studies that demonstrate the coatings' effectiveness in real-world scenarios. Competitive advantage is achieved by clearly communicating the benefits of these coatings, such as their ability to maintain structural integrity and enhance operational efficiency over time. In this market, the brochure serves as a critical decision-making tool, providing buyers with the technical details and performance data needed to select the most suitable insulation coating for their specific needs.

| Items | Values |

|---|---|

| Quantitative Units | USD 11.5 billion |

| Product Type | Acrylic, Epoxy, Polyurethane, Yttria stabilized zirconia, and Others |

| End Use Industry | Oil and gas, Aerospace, Automotive, Marine, Building and construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, AkzoNobel, BASF SE, Hempel A/S, PPG Industries, Sherwin-Williams, and The Dow Chemical Company |

| Additional Attributes | Dollar sales by coating type (thermal, electrical, corrosion-resistant, fire-retardant), Dollar sales by application (construction, automotive, aerospace, electronics, industrial), Trends in eco-friendly and high-performance coatings, Role in enhancing energy efficiency, durability, and safety, Growth driven by industrialization and energy efficiency mandates, Regional demand across North America, Europe, Asia Pacific. |

The global insulation coatings market is estimated to be valued at USD 11.5 billion in 2025.

The market size for the insulation coatings market is projected to reach USD 20.3 billion by 2035.

The insulation coatings market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in insulation coatings market are acrylic, epoxy, polyurethane, yttria stabilized zirconia and others.

In terms of end use industry, oil and gas segment to command 42.3% share in the insulation coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Insulation Boards Market Size and Share Forecast Outlook 2025 to 2035

Insulation Testing Instrument Market Size and Share Forecast Outlook 2025 to 2035

OEM Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cork Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Wool Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

Market Leaders & Share in the Pipe Insulation Products Industry

Tank Insulation Market Growth – Trends & Forecast 2024-2034

Foam Insulation Market Growth – Trends & Forecast 2024-2034

Wire Insulation & Jacketing Compounds Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA