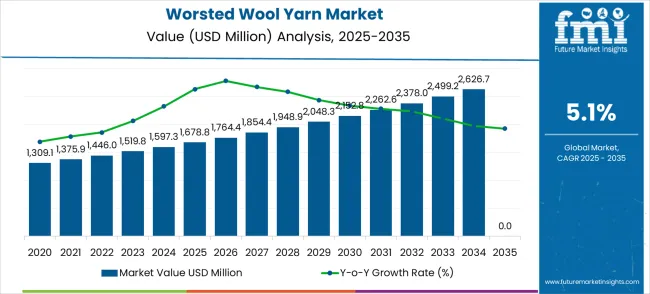

The global worsted wool yarn market is estimated to expand from USD 1,678.8 million in 2025 to approximately USD 2,760.7 million by 2035, recording an absolute increase of USD 1,081.9 million over the forecast period. This translates into a total growth of 64.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.1% between 2025 and 2035. The overall market size is expected to grow by nearly 1.6X during the same period, supported by increasing demand for premium textile materials, growing fashion industry requirements, and rising adoption of high-quality wool products across the global apparel, luxury goods, and textile manufacturing industries.

Between 2025 and 2030, the worsted wool yarn market is projected to expand from USD 1,678.8 million to USD 2,152.8 million, resulting in a value increase of USD 474.0 million, which represents 43.8% of the total forecast growth for the decade. This phase of development will be shaped by increasing premium fashion demand, rising consumer preference for natural fibers, and growing utilization in luxury apparel and high-end textile applications. Textile manufacturers and wool specialists are expanding their capabilities in worsted wool yarn production to meet the growing demand for sustainable and high-quality natural fiber materials in the fashion and textile industries.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,678.8 million |

| Forecast Value in (2035F) | USD 2,760.7 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The worsted wool yarn market is segmented into apparel and fashion garments (42%), upholstery and home textiles (27%), industrial textiles (15%), technical fabrics (10%), and specialty applications such as luxury and designer collections (6%). Apparel leads adoption as worsted wool yarn provides a smooth texture, strength, and wrinkle resistance suitable for high-end garments and tailored suits. Upholstery and home textiles utilize it for durability and refined appearance. Industrial textiles employ worsted wool yarn for insulation, filtration, and protective fabrics. Technical fabrics rely on it for specialty performance needs, while luxury and designer collections benefit from premium quality, softness, and aesthetic appeal.

Trends include innovation in fine-spinning techniques, blended yarns, and eco-conscious wool processing to enhance quality and reduce environmental impact. Manufacturers are developing customized yarn counts, superior tensile strength, and colorfast properties. Expansion into high-fashion apparel, performance textiles, and sustainable home furnishings is driving adoption. Collaborations between wool suppliers, mills, and designers enable tailored solutions that balance aesthetics, performance, and durability, supporting steady global growth.

Market expansion is being supported by the increasing global demand for premium textile materials and the corresponding shift toward natural fiber products that can provide superior comfort and performance while meeting consumer preferences for sustainable and high-quality apparel solutions. Modern fashion brands and textile manufacturers are increasingly focused on incorporating worsted wool yarns to enhance product quality while satisfying demands for natural fiber content and premium positioning. Worsted wool yarns' proven ability to deliver superior durability, comfort, and aesthetic appeal makes them essential materials for luxury fashion, premium suiting, and high-end textile applications.

The growing emphasis on sustainable fashion and a preference for natural fibers is driving demand for high-quality worsted wool yarn products that can support distinctive textile capabilities and premium product positioning across luxury apparel, professional attire, and premium textile categories. Manufacturer preference for materials that combine performance excellence with environmental sustainability is creating opportunities for innovative worsted wool yarn implementations in both traditional suiting and emerging fashion applications. The rising influence of conscious consumerism and premium lifestyle trends is also contributing to increased adoption of premium worsted wool yarn products that can provide authentic natural fiber characteristics.

The market is segmented by wool content, application, and region. By wool content, the market is divided into wool 60-80%, wool 80-90%, and wool>90%. Based on application, the market is categorized into suits, casual wear, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The wool 60-80% segment is projected to account for 36.1% of the worsted wool yarn market in 2025, reaffirming its position as the leading wool content category. Textile manufacturers and fashion brands increasingly utilize 60-80% wool content yarns for their optimal balance of performance, comfort, and cost-effectiveness across diverse apparel applications. Wool 60-80% content technology's balanced fiber composition and versatile processing characteristics directly address the industry requirements for reliable yarn performance and efficient manufacturing processes in commercial textile production operations.

This wool content segment forms the foundation of modern premium textile applications, as it represents the composition with the greatest market versatility and established manufacturing compatibility across multiple apparel production systems. Manufacturer investments in wool blend optimization and processing enhancement continue to strengthen adoption among textile producers. With brands prioritizing quality-to-cost balance and manufacturing efficiency, wool 60-80% content yarns align with both performance objectives and commercial viability requirements, making them the central component of comprehensive premium textile strategies.

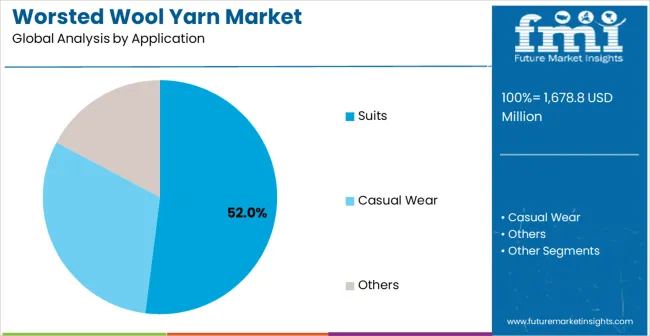

Suits applications are likely to represent the 52% market share of worsted wool yarn demand in 2025, underscoring their critical role as the primary application for premium wool materials in formal wear manufacturing and professional attire production operations. Suiting manufacturers prefer worsted wool yarns for their exceptional drape characteristics, durability properties, and ability to maintain consistent appearance while supporting high-quality formal wear requirements during garment production. Positioned as essential materials for high-performance suiting applications, worsted wool yarns offer both aesthetic excellence and wearing comfort advantages.

The segment is supported by continuous growth in professional wear demand and the growing availability of specialized wool processing technologies that enable enhanced suiting performance and garment quality optimization at the manufacturing level. The fashion manufacturers are investing in premium wool materials to support luxury suiting positioning and professional wear excellence. As formal wear markets continue to evolve and manufacturers seek superior textile material solutions, suit applications will continue to dominate the application landscape while supporting fashion advancement and professional attire quality strategies.

The worsted wool yarn market is advancing steadily due to increasing premium fashion investments and growing demand for natural fiber solutions that emphasize superior quality and sustainability across luxury apparel and professional wear applications. The market faces challenges, including price volatility of raw wool materials, competition from synthetic fiber alternatives, and seasonal variations in wool supply. Innovation in sustainable processing technologies and blend optimization continues to influence market development and expansion patterns.

The growing adoption of worsted wool yarns in sustainable fashion and premium textile applications is enabling textile manufacturers to develop products that provide distinctive environmental benefits while commanding premium positioning and enhanced quality characteristics. Advanced applications provide superior natural fiber content while allowing more sophisticated, sustainable development across various fashion categories and luxury segments. Manufacturers are increasingly recognizing the competitive advantages of natural fiber positioning for premium textile development and conscious consumer market penetration.

Modern worsted wool yarn suppliers are incorporating advanced wool processing technologies, automated production systems, and quality optimization processes to enhance yarn quality, improve manufacturing efficiency, and meet industry demands for consistent and high-performance natural fiber materials. These programs improve yarn performance while enabling new applications, including technical textiles and specialized fashion applications. Advanced processing integration also allows suppliers to support premium market positioning and manufacturing leadership beyond traditional commodity wool products.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| U.S. | 4.8% |

| U.K. | 4.3% |

| Japan | 3.8% |

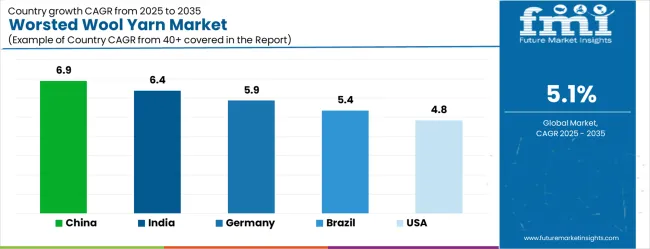

The worsted wool yarn market is experiencing robust growth globally, with China leading at a 6.9% CAGR through 2035, driven by the rapidly expanding textile manufacturing sector, massive investments in premium apparel production, and increasing adoption of high-quality natural fiber technologies. India follows at 6.4%, supported by growing textile industry, rising fashion manufacturing, and expanding luxury apparel capabilities. Germany shows growth at 5.9%, emphasizing advanced textile technology and premium fashion manufacturing. Brazil records 5.4%, focusing on emerging textile applications and fashion industry development. The U.S. demonstrates 4.8% growth, prioritizing premium fashion innovation and textile quality advancement. The U.K. exhibits 4.3% growth, supported by luxury fashion development and advanced textile capabilities. Japan shows 3.8% growth, emphasizing precision textile manufacturing excellence and high-quality yarn production.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The worsted wool yarns market in China is projected to exhibit exceptional growth with a CAGR of 6.9% through 2035, driven by the rapidly expanding textile manufacturing sector and massive investments in premium apparel production capabilities across major industrial centers. The country's growing fashion industry capacity and increasing adoption of high-quality natural fiber technologies are creating substantial demand for premium wool materials in both established and emerging textile applications. Major textile manufacturers and yarn producers are establishing comprehensive production and processing capabilities to serve both domestic consumption and export markets.

The worsted wool yarns market in India is expanding at a CAGR of 6.4%, supported by the growing textile industry, increasing fashion manufacturing, and expanding luxury apparel applications. The country's developing textile ecosystem and expanding manufacturing capabilities are driving demand for quality wool materials across both traditional textile and modern fashion applications. International textile companies and domestic yarn manufacturers are establishing comprehensive distribution and production capabilities to address growing market demand for premium natural fiber solutions.

The worsted wool yarns market in Germany is projected to grow at a CAGR of 5.9% through 2035, driven by the country's advanced textile technology sector, premium fashion manufacturing capabilities, and leadership in high-quality textile solutions. Germany's sophisticated fashion industry culture and willingness to invest in high-performance natural materials are creating substantial demand for both standard and specialized worsted wool yarn varieties. Leading textile companies and fashion manufacturers are establishing comprehensive innovation strategies to serve both European markets and growing international demand.

The worsted wool yarns market in Brazil is projected to grow at a CAGR of 5.4% through 2035, supported by the country's expanding fashion industry, growing textile applications, and increasing adoption of premium materials requiring high-quality natural fibers. Brazilian manufacturers and international companies consistently seek reliable wool materials that enhance product appeal for both domestic applications and regional markets. The country's position as a regional fashion hub continues to drive innovation in textile applications and quality standards.

Revenue from worsted wool yarns in the United States is projected to grow at a CAGR of 4.8% through 2035, supported by the country's advanced premium fashion sector, textile innovation capabilities, and established leadership in luxury apparel solutions. American fashion companies and textile manufacturers prioritize quality and performance, making worsted wool yarns essential materials for both domestic fashion production and premium textile manufacturing. The country's comprehensive fashion industry capabilities and technical expertise support continued market development.

Revenue from worsted wool yarns in the United Kingdom is projected to grow at a CAGR of 4.3% through 2035, supported by the country's luxury fashion development sector, advanced textile capabilities, and established expertise in premium apparel solutions. British fashion manufacturers' focus on innovation, quality, and heritage appeal creates steady demand for premium wool materials. The country's attention to fashion excellence and textile tradition drives consistent adoption across both traditional luxury fashion and emerging premium applications.

Revenue from worsted wool yarns in Japan is projected to grow at a CAGR of 3.8% through 2035, supported by the country's precision textile manufacturing excellence, advanced yarn technology expertise, and established reputation for producing superior natural fiber materials while working to enhance processing efficiency capabilities and develop next-generation wool technologies. Japan's textile industry continues to benefit from its reputation for delivering high-quality fashion materials while focusing on innovation and manufacturing precision.

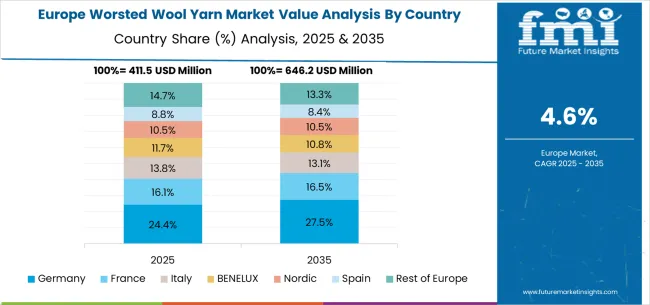

The worsted wool yarn market in Europe is projected to grow from USD 437.2 million in 2025 to USD 678.4 million by 2035, registering a CAGR of 4.5% over the forecast period. Germany is expected to maintain its leadership position with a 29.6% market share in 2025, remaining stable at 29.4% by 2035, supported by its advanced textile technology sector, precision fashion manufacturing industry, and comprehensive innovation capabilities serving European and international markets.

The United Kingdom follows with an 18.9% share in 2025, projected to reach 19.2% by 2035, driven by luxury fashion development programs, advanced textile capabilities, and growing focus on premium natural fiber solutions for high-end applications. France holds a 16.7% share in 2025, expected to maintain 16.5% by 2035, supported by luxury fashion industry demand and premium textile applications, but facing challenges from market competition and economic considerations. Italy commands a 15.2% share in 2025, projected to reach 15.4% by 2035, while Spain accounts for 9.8% in 2025, expected to reach 10.0% by 2035. The Netherlands maintains a 4.6% share in 2025, growing to 4.7% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 14.8% in 2025, declining slightly to 14.5% by 2035, attributed to mixed growth patterns with moderate expansion in some premium fashion markets balanced by slower growth in smaller countries implementing textile industry development programs.

The worsted wool yarn market is characterized by competition among established textile companies, specialized wool yarn manufacturers, and integrated natural fiber solution suppliers. Companies are investing in advanced wool processing technologies, quality optimization systems, application-specific product development, and comprehensive technical support capabilities to deliver consistent, high-quality, and reliable worsted wool yarn products. Innovation in processing efficiency enhancement, natural production methods, and customized textile solutions is central to strengthening market position and customer satisfaction.

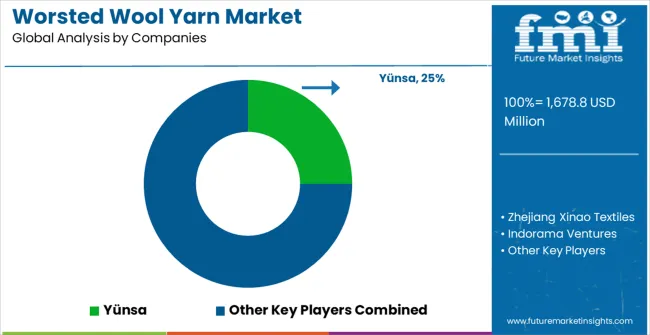

Yünsa leads the market with a strong focus on textile innovation and comprehensive wool yarn solutions, offering sophisticated worsted wool yarn products with emphasis on quality assurance and manufacturing excellence. Zhejiang Xinao Textiles provides specialized textile manufacturing capabilities with a focus on premium yarn applications and Asian market networks. Indorama Ventures delivers advanced synthetic and natural fiber technology with a focus on innovation and eco-friendly textile development. Suedwolle Group specializes in wool processing and yarn manufacturing with emphasis on technical expertise and quality optimization. Novita focuses on premium yarn solutions and advanced textile technologies. Boyner Sanayi emphasizes textile manufacturing expertise with a focus on fashion applications and product quality.

Worsted wool yarn represents premium textile materials characterized by smooth, strong, and lustrous fibers that undergo combing to create parallel alignment, essential for producing high-quality fabrics for suits, luxury garments, and professional attire. With the market projected to grow from USD 1,678.8 million in 2025 to USD 2,760.7 million by 2035 at a 5.1% CAGR, these natural fibers serve the growing demand for fashion, premium textiles, and professional wear where durability and appearance quality are paramount. The dominance of 60-80% wool content (36.1% market share) and its suitability for suit applications reflect the market's focus on balancing performance with cost-effectiveness in formal wear manufacturing. The market expansion faces challenges, including raw wool price volatility, competition from synthetic alternatives, seasonal supply variations, and sustainability pressures throughout the wool supply chain. Maximizing growth potential requires coordinated efforts across wool producers and supply chain managers, textile manufacturers and yarn processors, fashion brands and garment manufacturers, sustainability advocates and certification organizations, and global trade and market development partners.

How Wool Producers and Supply Chain Managers Could Ensure Raw Material Security?

Quality Improvement Programs: Invest in sheep breeding programs, nutrition management, and wool harvesting techniques that improve fiber quality, consistency, and yield while maintaining animal health and welfare. Develop grading systems and quality standards that ensure consistent wool characteristics for different yarn applications and end-use requirements.

Supply Chain Resilience: Build diversified wool sourcing networks across different geographic regions and production systems to mitigate risks from climate variability, disease outbreaks, and market disruptions. Establish strategic partnerships between wool producers, cooperatives, and processors that ensure stable supply relationships and fair pricing structures.

Technology Integration: Adopt precision agriculture technologies, including pasture management systems, animal health monitoring, and wool quality assessment tools that optimize production efficiency while maintaining fiber quality. Implement data analytics platforms that help producers make informed decisions about breeding, nutrition, and harvesting timing.

Market Intelligence and Pricing: Develop comprehensive market intelligence systems that provide wool producers with real-time information about demand trends, pricing dynamics, and quality requirements. Create risk management tools, including forward contracting and price hedging mechanisms that protect producers from market volatility.

How Textile Manufacturers and Yarn Processors Could Drive Innovation and Efficiency?

Advanced Processing Technologies: Invest in modern wool processing equipment, including automated sorting systems, precision combing machinery, and advanced spinning technologies that improve yarn quality, consistency, and production efficiency while reducing waste and environmental impact.

Blend Optimization: Develop expertise in wool blending with other natural and synthetic fibers to create yarns that balance performance characteristics, cost considerations, and sustainability requirements. Create specialized blends for different applications, including 60-80% wool for general suiting, higher wool content for luxury applications, and functional blends for technical textiles.

Quality Assurance Systems: Implement comprehensive quality control programs including fiber testing, yarn strength analysis, and consistency monitoring that ensure finished yarns meet customer specifications and performance requirements. Develop certification systems that verify wool content, processing methods, and sustainability credentials to ensure transparency and accountability.

Waste Reduction and Circular Economy: Establish waste minimization programs that maximize fiber utilization, develop recycling systems for processing waste, and create secondary products from by-products. Implement circular economy principles that enable wool fiber recycling and reprocessing into new yarn products.

Customization and Service: Develop capabilities to produce specialized yarns for specific customer requirements, including custom wool content, color matching, and performance characteristics. Provide technical support services that help customers optimize yarn performance in their manufacturing processes.

How Fashion Brands and Garment Manufacturers Could Drive Market Demand?

Premium Product Development: Create high-quality garments that showcase the superior characteristics of worsted wool yarns, including drape, durability, and comfort. Develop product lines that emphasize the natural benefits of wool, including temperature regulation, moisture management, and odor resistance.

Sustainable Fashion Leadership: Implement comprehensive sustainability programs that prioritize natural fibers, ethical sourcing, and environmental responsibility throughout the supply chain. Develop marketing strategies that educate consumers about the environmental benefits of choosing wool over synthetic alternatives.

Innovation in Design and Manufacturing: Invest in advanced garment manufacturing technologies and design techniques that maximize the performance benefits of worsted wool yarns while minimizing waste and improving efficiency. Create innovative garment constructions that enhance wool's natural properties and extend product life.

Consumer Education: Develop educational campaigns that inform consumers about wool's natural benefits, proper care techniques, and the value proposition of investing in quality wool garments. Create transparency about sourcing practices, manufacturing processes, and sustainability initiatives.

Market Segmentation Strategy: Develop targeted product lines for different market segments including luxury suiting, professional wear, and casual applications that leverage appropriate wool content levels and processing techniques. Create pricing strategies that reflect quality levels while remaining competitive with synthetic alternatives.

How Sustainability Advocates and Certification Organizations Could Support Responsible Growth?

Certification Standards Development: Establish comprehensive certification programs for wool production, including animal welfare standards, environmental impact criteria, and social responsibility requirements. Develop transparent labeling systems that help consumers make informed choices about wool products.

Environmental Impact Assessment: Conduct lifecycle assessments of wool production and processing to identify ecological hotspots and opportunities for improvement. Develop metrics and reporting frameworks that track progress toward sustainability goals including greenhouse gas emissions, water usage, and land management practices.

Animal Welfare Advocacy: Promote humane treatment standards for sheep, including proper nutrition, veterinary care, and stress-free handling practices. Develop monitoring systems and enforcement mechanisms that ensure welfare standards are maintained throughout the wool supply chain.

Supply Chain Transparency: Advocate for complete supply chain traceability that provides visibility into wool origin, processing methods, and working conditions. Support the development of blockchain and digital tracking systems that enable verification of sustainability claims and ethical practices.

Industry Collaboration: Facilitate partnerships between wool producers, processors, brands, and retailers to advance sustainability initiatives and share best practices. Organize forums and working groups that address common challenges and develop industry-wide solutions for sustainable wool production.

How Global Trade and Market Development Partners Could Facilitate Growth?

Market Access and Trade Facilitation: Support the development of international trade relationships and market access for worsted wool yarns, including trade agreements, tariff reduction, and regulatory harmonization. Provide market intelligence and business development services that help manufacturers identify export opportunities and customer requirements.

Technology Transfer and Capacity Building: Facilitate transfer of advanced wool processing technologies and best practices to emerging markets like China (6.9% CAGR) and India (6.4% CAGR) where textile manufacturing is rapidly expanding. Support capacity-building programs that develop local expertise in wool processing and quality management.

Investment and Infrastructure Development: Provide financing for wool processing facility development, equipment upgrades, and infrastructure improvements that enhance production capacity and quality capabilities. Support public-private partnerships that develop wool industry infrastructure in key producing and processing regions.

Risk Management and Financial Services: Develop financial products and risk management tools that help wool industry participants manage price volatility, currency fluctuations, and supply chain risks. Provide insurance products that protect against weather-related losses, disease outbreaks, and market disruptions.

Brand Development and Marketing: Support the development of regional wool brands and origin marketing programs that differentiate wool products based on quality, sustainability, and heritage characteristics. Provide marketing and promotional support that builds consumer awareness and preference for wool products in key markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,678.8 million |

| Wool Content | Wool 60-80%, Wool 80-90%, Wool>90% |

| Application | Suits, Casual Wear, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Yünsa, Zhejiang Xinao Textiles, Indorama Ventures, Suedwolle Group, Novita, Boyner Sanayi, Zegna, Baruffa Lane Borgosesia, The Fibre Co, Di. Vé, E.Miroglio, ESRA, Transilana, Jiangsu Lugang Culture, and Zhejiang Zhengsong Textiles |

| Additional Attributes | Dollar sales by wool content and application, regional demand trends, competitive landscape, technological advancements in wool processing, quality enhancement development initiatives, sustainable production programs, and fashion industry integration strategies |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global prinsepia utilis oils market is estimated to be valued at USD 38.3 million in 2025.

The market size for the prinsepia utilis oils market is projected to reach USD 60.0 million by 2035.

The prinsepia utilis oils market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in prinsepia utilis oils market are .

In terms of application, skin care products segment to command 39.0% share in the prinsepia utilis oils market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA