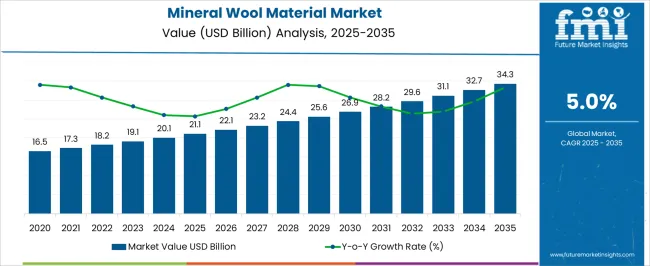

The mineral wool material market is projected to grow from USD 21.1 billion in 2025 to USD 34.3 billion by 2035, reflecting a CAGR of 5.0%. This expansion represents an absolute dollar opportunity of USD 13.2 billion over the decade. The market shows steady year-on-year growth, starting from USD 16.5 billion in the earlier years and reaching USD 26.9 billion by 2030. Companies focusing on large-scale construction projects, infrastructure, and industrial insulation will find consistent revenue potential. Establishing capacity, expanding distribution, and optimizing product portfolios during this period enables stakeholders to capture incremental gains from the expanding mineral wool demand. The absolute dollar opportunity from 2025 to 2035 emphasizes reliable annual increases, with market size growing from USD 21.1 billion to USD 34.3 billion.

Incremental steps include USD 22.1 billion in 2026, USD 24.4 billion in 2028, and USD 29.6 billion in 2032, before reaching USD 34.3 billion by 2035. This predictable trajectory provides businesses with visibility to plan operations, investments, and long-term strategies effectively. By aligning production and market positioning with these growth milestones, companies can secure meaningful revenue expansion, enhance competitive presence, and maximize returns across both developed and emerging segments of the mineral wool material market.

| Metric | Value |

|---|---|

| Mineral Wool Material Market Estimated Value in (2025 E) | USD 21.1 billion |

| Mineral Wool Material Market Forecast Value in (2035 F) | USD 34.3 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

A breakpoint analysis of the mineral wool material market identifies two clear phases of growth. The first breakpoint spans 2025 to 2029, where the market rises from USD 21.1 billion to USD 25.6 billion, with annual increments of USD 0.8–1.2 billion. This stage reflects steady adoption and offers businesses the chance to consolidate production and expand regional presence. It is a critical phase for companies to establish long-term supply agreements and strengthen logistics.

Capturing share early during this stable phase allows firms to secure predictable revenue streams before the market enters a stronger growth cycle in the next decade. The second breakpoint emerges between 2030 and 2035, as the market accelerates from USD 26.9 billion to USD 34.3 billion, with annual increments climbing to USD 1.3–1.6 billion. This stage signals stronger momentum and larger revenue opportunities for companies able to scale capacity and diversify product offerings. Strategic expansion during this phase ensures participation in the highest-value period of the market. Stakeholders that align investments with this acceleration will benefit from compounding returns and enhanced competitiveness. Recognizing these breakpoints helps businesses plan entry, expansion, and resource allocation effectively in the mineral wool material market.

The mineral wool material market is experiencing steady expansion, supported by the growing emphasis on energy efficiency, fire safety, and sustainable building practices. Industry reports, construction sector updates, and corporate disclosures have pointed to increasing adoption of mineral wool insulation driven by stricter building codes and rising demand for thermal and acoustic insulation in both residential and commercial projects.

Manufacturers have focused on improving product performance through innovations in fiber composition, density, and moisture resistance, enhancing long-term durability in diverse climate conditions. Additionally, the market has benefited from heightened awareness of the role of insulation in reducing greenhouse gas emissions and lowering operational energy costs.

Public sector investments in infrastructure and retrofitting projects have further boosted mineral wool consumption, while the integration of eco-friendly production methods has strengthened its appeal in green building certifications. Looking ahead, growth is expected to be led by glass wool as a versatile product type, board form for its structural utility, and building & construction applications as the primary end-use sector.

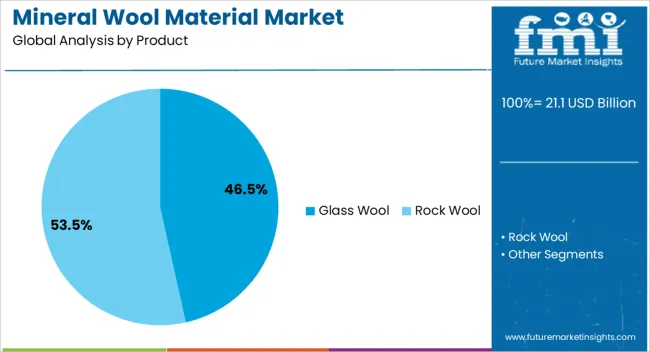

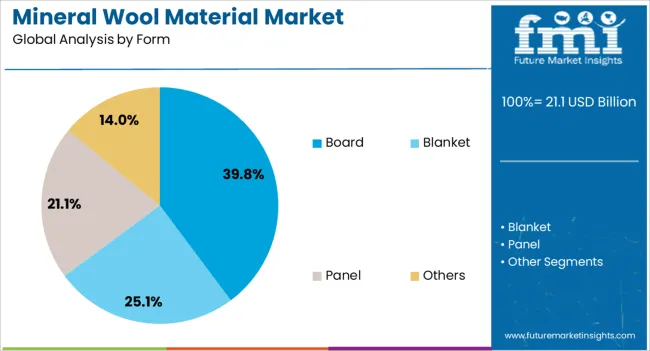

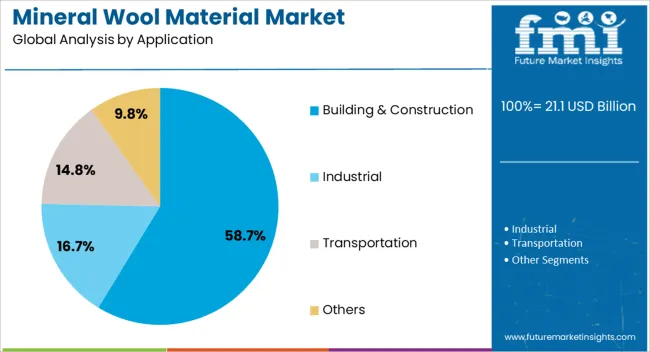

The mineral wool material market is segmented by product, form, application, and geographic regions. By product, mineral wool material market is divided into Glass Wool and Rock Wool. In terms of form, mineral wool material market is classified into Board, Blanket, Panel, and Others. Based on application, mineral wool material market is segmented into Building & Construction, Industrial, Transportation, and Others. Regionally, the mineral wool material industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glass wool segment is projected to account for 46.5% of the mineral wool material market revenue in 2025, maintaining its leadership in the product category due to its versatility, lightweight nature, and cost-effectiveness.

Glass wool’s fine fiber structure provides excellent thermal and acoustic insulation, making it suitable for a wide range of applications. Manufacturers have enhanced production efficiency and fiber uniformity, resulting in improved performance and easier handling during installation.

Furthermore, glass wool’s fire-resistant properties and recyclability have supported its adoption in both new construction and renovation projects. Its adaptability across various building types and compatibility with different installation formats have also reinforced its strong market presence. These attributes, combined with favorable cost-to-performance ratios, are expected to sustain the glass wool segment’s dominance in the mineral wool material market.

The board segment is projected to hold 39.8% of the mineral wool material market revenue in 2025, emerging as the leading form due to its structural strength, ease of installation, and suitability for multiple insulation applications.

Boards offer consistent thickness and density, ensuring uniform thermal and sound insulation performance across large surfaces. Their rigidity makes them particularly effective for external wall insulation systems, roofing, and industrial equipment insulation.

Industry advancements have led to the development of moisture-resistant and high-compression boards, expanding their utility in challenging environmental conditions. Additionally, the board form’s durability and compatibility with finishing materials have increased its preference among contractors and architects. As construction projects increasingly prioritize long-lasting and high-performance insulation materials, the board segment is expected to retain its market leadership.

The building & construction segment is projected to contribute 58.7% of the mineral wool material market revenue in 2025, securing its position as the largest application area.

Growth in this segment has been driven by expanding construction activities worldwide and the incorporation of stricter energy efficiency standards in building codes. Mineral wool’s thermal insulation properties help reduce energy consumption, while its fire resistance enhances building safety compliance.

Demand has been reinforced by government-led initiatives promoting sustainable construction and retrofitting of existing structures to meet modern insulation standards. Furthermore, mineral wool is increasingly used in green-certified projects, aligning with global sustainability goals. With continued urbanization, infrastructure investment, and the adoption of energy-efficient building designs, the building & construction segment is expected to remain the dominant application for mineral wool materials.

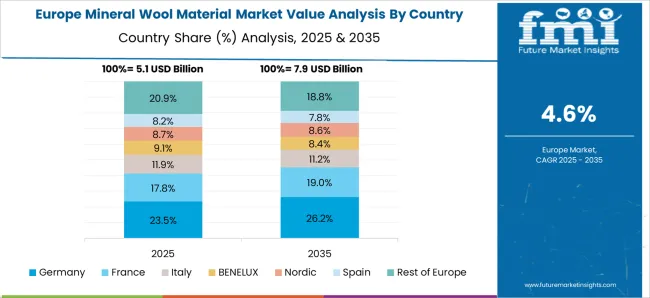

The mineral wool material market is expanding due to rising demand for thermal insulation, fire safety, and acoustic control in buildings and industrial facilities. Europe leads with stringent building codes mandating insulation, while North America emphasizes retrofitting projects and energy-efficient construction. Asia-Pacific shows the fastest growth, supported by rapid urbanization and infrastructure development. Manufacturers differentiate through fiber density, installation ease, and compliance with fire-resistance standards. Market growth is fueled by green building certifications, stricter safety regulations, and the rising need for energy conservation across residential, commercial, and industrial sectors.

Mineral wool materials differ in density, thermal conductivity, and sound absorption properties. Europe and North America prioritize high-density, premium-grade products for energy-efficient housing and commercial retrofits. Asia-Pacific markets often adopt medium-density materials balancing affordability with acceptable insulation performance for large-scale residential projects. Efficiency levels directly influence adoption in climate-sensitive and noise-prone areas. Leading global producers maintain strict control over performance consistency, while regional suppliers focus on lower-cost solutions for mass construction. These variations in efficiency and density guide material selection, influence pricing strategies, and shape competitiveness across developed and emerging regions.

Mineral wool’s natural fire-resistant properties are critical in adoption. Europe enforces strict standards under fire safety regulations, driving demand for non-combustible, high-melting-point products. North America follows strong safety codes in commercial and industrial construction, while Asia-Pacific regulations vary by country, with some regions still prioritizing affordability over strict compliance. Differences in adherence to fire-resistance requirements affect supplier credibility, contract eligibility, and regional expansion. Manufacturers meeting international safety standards secure high-value projects, while smaller producers with limited certifications compete in cost-driven markets. These regulatory contrasts strongly influence global positioning, procurement decisions, and long-term growth opportunities.

Demand for mineral wool materials is shaped by construction activity. Europe and North America prioritize retrofitting older buildings with efficient insulation systems to meet sustainability targets. Asia-Pacific growth is driven by new housing, industrial complexes, and infrastructure projects requiring large-scale, cost-efficient insulation. Differences in sectoral priorities influence product specifications, demand volumes, and supplier strategies. Global companies supply advanced materials for performance-sensitive projects, while local players provide affordable products for high-volume residential demand. These contrasts highlight how construction cycles and regional housing policies drive adoption, pricing, and competitiveness in the mineral wool market.

Mineral wool production relies on basalt, slag, and high-temperature processing. Europe and North America operate advanced, energy-efficient plants with consistent output, whereas Asia-Pacific emphasizes high-capacity, cost-driven production with variable process control. Raw material availability, energy costs, and logistics efficiency impact supply reliability and pricing. Multinational producers with diversified raw material sourcing maintain steady supply for global projects, while smaller regional manufacturers may face disruptions during peak demand. These contrasts in production scale and sourcing practices shape supplier credibility, pricing stability, and the ability to meet long-term demand in residential, commercial, and industrial applications.

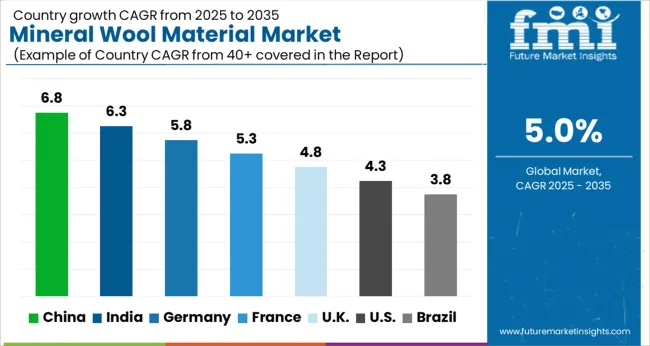

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global mineral wool material market was projected to grow at a 5.0% CAGR through 2035, driven by demand in construction, insulation, and industrial applications. Among BRICS nations, China recorded 6.8% growth as large-scale production facilities were commissioned and compliance with material quality standards was enforced, while India at 6.3% growth saw expansion of manufacturing units to meet rising regional construction and industrial demand. In the OECD region, Germany at 5.8% maintained substantial output under strict building and material regulations, while the United Kingdom at 4.8% relied on moderate-scale operations for insulation and industrial applications. The USA, expanding at 4.3%, remained a mature market with steady demand across construction and industrial segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Mineral wool material market in China is growing at a CAGR of 6.8%. Between 2020 and 2024, growth was driven by increasing construction activity, industrial insulation demand, and government initiatives promoting energy efficient buildings. Manufacturers focused on high quality thermal and acoustic insulation products for residential, commercial, and industrial applications. In the forecast period 2025 to 2035, growth is expected to accelerate with adoption of eco-friendly, fire-resistant, and high performance mineral wool materials. Rising urbanization, building retrofitting programs, and industrial expansion will further support market development. China remains a leading market due to its large construction sector, industrial growth, and emphasis on energy efficiency.

Mineral wool material market in India is growing at a CAGR of 6.3%. Historical period 2020 to 2024 saw growth supported by rising residential and commercial construction, infrastructure projects, and demand for energy efficient insulation. Manufacturers focused on durable, high performance, and cost effective mineral wool products. In the forecast period 2025 to 2035, market growth is expected to continue with adoption of fire-resistant and environmentally friendly insulation solutions, along with increased retrofitting of older buildings. Government incentives for green buildings and industrial modernization will further drive growth. India is projected to maintain strong growth due to expanding construction sector and growing demand for energy efficient materials.

Mineral wool material market in Germany is growing at a CAGR of 5.8%. Between 2020 and 2024, growth was supported by industrial insulation, residential renovations, and government regulations for energy efficiency. Manufacturers focused on high quality, sustainable, and fire-resistant products. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption of eco-friendly mineral wool, advanced thermal and acoustic insulation, and industrial applications. Strict energy efficiency standards, technological innovation, and sustainability initiatives will further support adoption. Germany remains a key European market due to its industrial base and regulatory focus on energy efficiency.

Mineral wool material market in the United Kingdom is growing at a CAGR of 4.8%. During 2020 to 2024, adoption was driven by residential and commercial construction, retrofitting projects, and insulation requirements for energy efficiency. Manufacturers focused on high performance, eco-friendly, and durable mineral wool products. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption in sustainable buildings, fire-resistant insulation, and industrial applications. Government energy efficiency programs and building regulations will further support market expansion. The United Kingdom market reflects stable growth with emphasis on sustainability, performance, and durability.

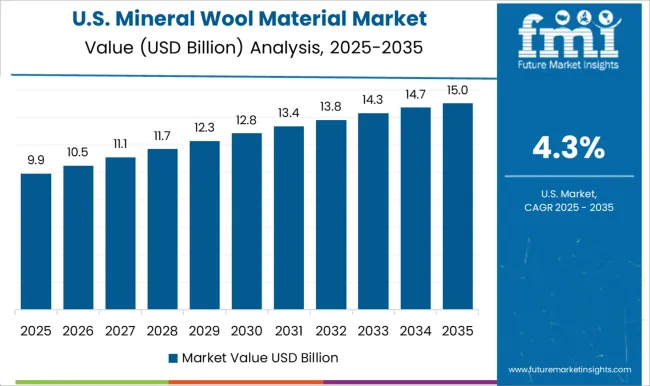

Mineral wool material market in the United States is growing at a CAGR of 4.3%. Historical period 2020 to 2024 saw growth driven by residential and commercial insulation, industrial applications, and demand for fire-resistant materials. Manufacturers focused on high performance, durable, and eco-friendly mineral wool products. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption in energy efficient buildings, industrial insulation, and retrofitting older structures. Regulatory compliance, sustainability initiatives, and technological innovation will further support expansion. The United States market demonstrates steady growth with emphasis on durability, fire resistance, and eco-friendly insulation solutions.

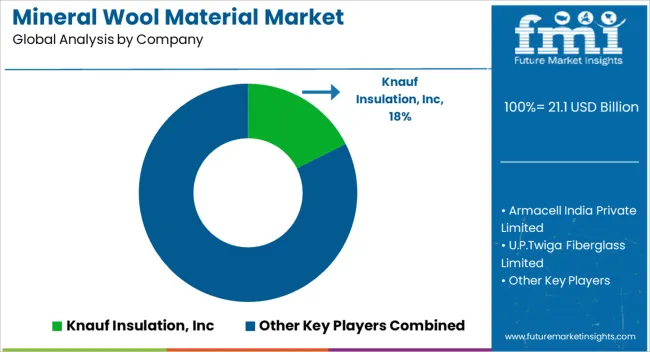

The mineral wool material market is supplied by Knauf Insulation, Inc, Armacell India Private Limited, U.P. Twiga Fiberglass Limited, Gyptech Systems Pvt. Ltd, Lloyd Insulations (India) Limited, Saint-Gobain India Pvt. Ltd, and Rockwool India Pvt. Ltd. Competition is shaped by thermal resistance, acoustic performance, and fire-retardant properties. Knauf Insulation and Rockwool brochures highlight slabs, rolls, and pipe insulation products with thermal conductivity values, density, and fire classification. Saint-Gobain and Armacell datasheets detail multilayer insulation systems, rigid boards, and soundproofing solutions for residential, commercial, and industrial applications.

U.P. Twiga and Gyptech provide specifications including thickness, compressive strength, and moisture absorption, while Lloyd Insulations emphasizes lightweight and easy-to-install mineral wool batts. Observed industry trends indicate rising demand for energy-efficient and fire-resistant building materials across new construction and retrofitting projects. Market strategies focus on product differentiation, technical support, and distribution networks.

Knauf Insulation invests in high-density and high-performance boards targeting industrial and commercial sectors, while Rockwool India positions itself in premium building insulation applications with acoustic and thermal performance guarantees. Saint-Gobain India and Armacell India emphasize modular and flexible insulation solutions compatible with HVAC, piping, and structural systems. Observed patterns show suppliers expanding regional manufacturing and warehousing capacities to improve delivery timelines.

U.P. Twiga Fiberglass and Gyptech focus on cost-effective solutions for residential and light commercial projects, while Lloyd Insulations highlights easy installation and labor efficiency. Cross-supplier strategies include certification support, performance testing, and training programs for architects, engineers, and contractors. Product brochures and technical datasheets communicate critical specifications including density, R-value, thermal conductivity, fire resistance, acoustic insulation rating, moisture absorption, and dimensions.

Knauf Insulation and Rockwool provide detailed installation guides, handling precautions, and cut-to-size recommendations. Saint-Gobain and Armacell include diagrams on layering, fastening methods, and HVAC compatibility. U.P. Twiga, Gyptech, and Lloyd Insulations highlight mechanical strength, compressive performance, and durability under varying humidity and temperature.

Clear technical documentation allows contractors, engineers, and builders to select products based on verified thermal efficiency, acoustic performance, and compliance with fire and building safety codes, ensuring optimal material performance for energy-efficient and safe construction projects.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.1 Billion |

| Product | Glass Wool and Rock Wool |

| Form | Board, Blanket, Panel, and Others |

| Application | Building & Construction, Industrial, Transportation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Knauf Insulation, Inc, Armacell India Private Limited, U.P.Twiga Fiberglass Limited, Gyptech Systems Pvt. Ltd, Lloyd Insulations (India) Limited, Saint Gobain India Pvt. Ltd, and Rockwool India Pvt. Ltd |

| Additional Attributes | Dollar sales vary by product type, including glass wool, rock wool, and slag wool; by application, such as thermal insulation, acoustic insulation, fire protection, and industrial equipment; by end-use industry, spanning building & construction, automotive, industrial, and marine; by region, led by Europe, North America, and Asia-Pacific. Growth is driven by rising energy efficiency regulations, demand for sustainable insulation materials, and infrastructure development. |

The global mineral wool material market is estimated to be valued at USD 21.1 billion in 2025.

The market size for the mineral wool material market is projected to reach USD 34.3 billion by 2035.

The mineral wool material market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in mineral wool material market are glass wool and rock wool.

In terms of form, board segment to command 39.8% share in the mineral wool material market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mineral Enrichment Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mineral Sunscreen Market Size and Share Forecast Outlook 2025 to 2035

Mineral Based Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Mineral Insulated Cables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mineral Premix Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Mineral Feed Market Analysis - Growth, Demand & Livestock Nutrition

Mineral Fortification Market Insights – Nutrient-Rich Foods & Industry Growth 2024 to 2034

Mineral Adsorbent Market

Mineral Wool Market by Type & Application from 2025 to 2035

Key Companies & Market Share in the Mineral Wool Sector

Demineralized Whey Powder Market Size, Growth, and Forecast for 2025 to 2035

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Boron Minerals and Chemicals Market Size and Share Forecast Outlook 2025 to 2035

White Mineral Oil Market Analysis by Food, Pharmaceutical, Technical Through 2035

Trace Minerals in Feed Market Analysis by Type, Livestock, Chelate Type, Form and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA