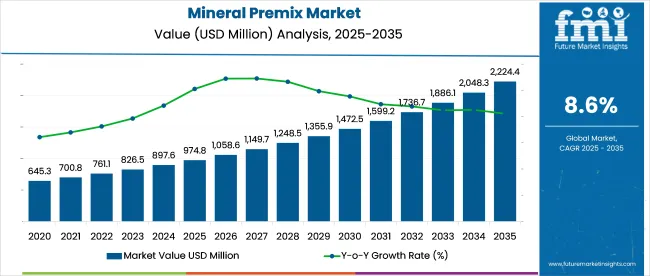

The mineral premix market was estimated at USD 974.8 million in 2025 and is expected to rise to USD 2,224.5 million by 2035, reflecting an 8.6% CAGR. Growth is being fueled by expanded use in animal nutrition, functional foods, and dietary supplements as essential micronutrient fortification is being required to improve livestock productivity and human health.

| Attributes | Value |

|---|---|

| Industry Size (2025) | USD 974.8 million |

| Projected Industry Size (2035) | USD 2,224.5 million |

| CAGR (2025 to 2035) | 8.6% |

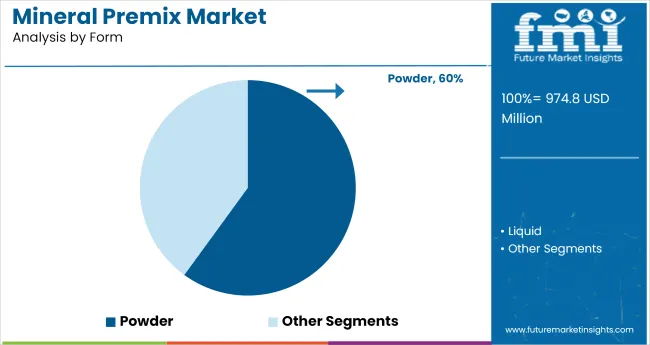

Powdered formats are being preferred for their stability and ease of blending, but liquid premixes are being recognized for quicker nutrient delivery. It is argued that manufacturers investing in precision nutrition, microencapsulation, and AI-driven formulation will outperform traditional counterparts.

In 2024, Adriano Marcon, CEO of Cargill Animal Nutrition, addressed the expanding role of the premixes in both livestock feed and human nutrition. As fortified food consumption rises globally, Cargill has focused on improving the quality and functionality of its premix formulations to meet evolving nutritional standards.

The company has also invested in localized production and traceable ingredient sourcing to enhance product consistency and industry responsiveness. Emphasizing Cargill’s commitment to public health and food systems, Marcon stated, “Mineral premixes are vital for meeting the nutritional needs of both livestock and humans. As demand for healthy and fortified foods rises, we are committed to delivering highquality, sustainable mineral solutions that contribute to global food safety and nutrition.”

The industry holds a specialized share within its parent markets. In the food and beverage additives market, it accounts for approximately 2-3%, as mineral premixes are used to fortify foods and beverages with essential minerals. Within the animal feed market, the share is higher, around 10-12%, as mineral premixes are critical for the nutritional health of livestock, poultry, and aquaculture.

In the nutraceuticals market, the share is about 5-6%, as mineral premixes are integral to dietary supplements and health products. In the agricultural chemicals market, their share is around 2-3%, used mainly in soil amendments and fertilizers. In the pharmaceuticals market, the share is approximately 1-2%, as mineral premixes are used in specific pharmaceutical applications, particularly in supplements and medicated feeds.

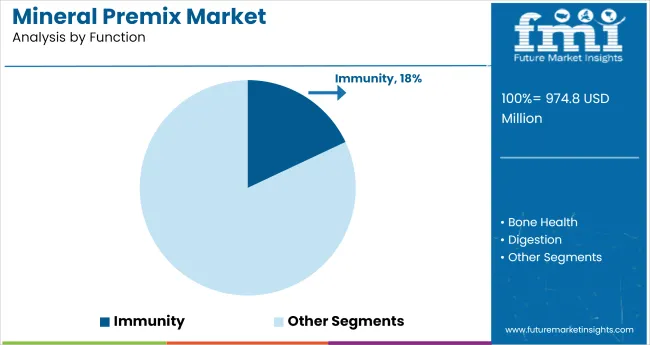

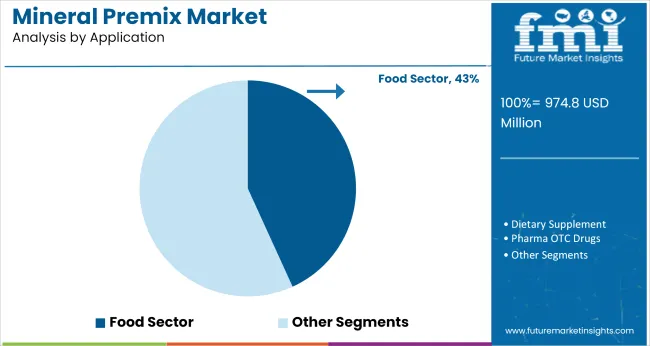

The industry is projected to grow in 2025, with powder form leading the industry at 60%. Immunity will dominate the function segment at 18%, while the food sector will capture 43.2% of the application segment share.

Powdered premix is expected to dominate the industry with 60% of the industry share in 2025. This form of the premix is highly favored due to its ease of use, versatility, and compatibility with a wide range of applications, including food and beverage formulations, animal nutrition, and dietary supplements.

The powder format also supports longer shelf life, ease of transport, and precise dosing, which makes it ideal for large-scale manufacturing processes. The growing demand for ready-to-mix products and the trend toward functional foods are expected to further solidify powder's industry dominance.

Immunity-focused mineral premixes are expected to capture 18% of the industry share in 2025. The demand for immunity-boosting products has risen significantly as consumers increasingly seek functional ingredients to support overall health, particularly in the wake of global health challenges.

Minerals like zinc, magnesium, and selenium are key components in these formulations due to their well-documented roles in immune function. The growing awareness of immune health across global populations and the integration of immunity-focused ingredients in foods and supplements are driving the growth of this segment.

The food sector is projected to hold 43.2% of the industry share in 2025. The integration of the premixes into the food sector is primarily driven by the demand for fortified and functional food products that enhance nutritional value.

These premixes are commonly used in baked goods, dairy products, beverages, and snack foods, where they improve nutritional content, such as vitamins and minerals, without altering the flavor or texture. As consumer awareness of the benefits of fortified foods rises, the food sector remains the largest application for the premixes, with continued growth expected globally.

The industry is growing due to increased demand for optimized animal and poultry feed nutrition, driven by rising meat and dairy consumption. Raw material price fluctuations and supply chain disruptions are limiting industry growth, particularly for smaller manufacturers.

Increasing Demand for Animal and Poultry Feed Nutrition

The industry is driven by rising demand for optimized nutrition in animal and poultry feed. As global meat and dairy consumption grows, there is a strong need for feed formulations that enhance growth, immunity, and overall animal health.

The premixes, which supply essential minerals like calcium, phosphorus, and magnesium, are increasingly used to improve feed quality. This growing demand for better-performing livestock feed is propelling industry growth, particularly in regions with expanding agricultural industries.

Supply Chain Disruptions and High Raw Material Costs

Despite strong growth prospects, the industry faces challenges related to supply chain disruptions and high raw material costs. Fluctuations in the prices of raw materials, such as minerals and trace elements, can cause production cost instability.

Additionally, supply chain disruptions-due to factors like transportation delays and raw material shortages-can limit production capacity and affect the timely availability of premixes. These issues, particularly for smaller manufacturers, hinder the widespread adoption of the premixes, especially in developing industries with less robust infrastructure.

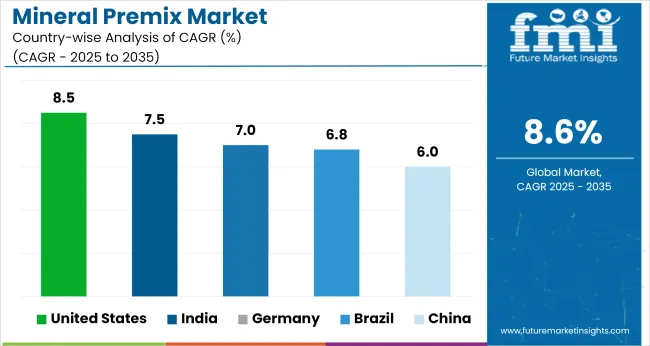

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 8.5% |

| China | 6% |

| Germany | 7% |

| India | 7.5% |

| Brazil | 6.8% |

Global industry demand is projected to rise at an 8.6% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, the United States leads at 8.5%, followed by India at 7.5%, and Germany at 7.0%, while Brazil posts 6.8% and China records 6.0%. These rates translate to a growth premium of -1% for the United States, -12% for China, and -18% for Brazil versus the baseline, while India shows relatively strong growth. Divergence reflects local catalysts: increasing awareness of fortified food in India, Germany, and the USA, while China and Brazil experience slower growth due to industry maturity and increasing competition from other nutritional supplements.

The industry in the United States is projected to grow at a CAGR of 8.5% from 2025 to 2035. Growth is driven by strong demand across the animal feed and functional food sectors. Manufacturers are fortifying snacks, bakery goods, and dairy alternatives with tailored mineral blends to meet evolving nutritional needs.

Pet food brands are incorporating specialized premixes targeting mobility, skin health, and immunity. The rise in preventive healthcare is shifting dietary preferences toward fortified products. Large-scale processors and contract formulators are prioritizing traceable ingredients, especially calcium, magnesium, and zinc blends aligned with clinical research.

The industry in China is expected to grow at a CAGR of 6.0% between 2025 and 2035. The country’s fortified food sector continues to expand due to dietary insufficiencies and government nutrition campaigns. Infant formula and maternal nutrition products lead premix applications, followed by health drinks and functional confections.

Major suppliers are investing in localized production to avoid import bottlenecks. Mineral delivery formats are shifting toward soluble powders and microcapsules. Public health programs and digital health platforms are creating greater awareness around micronutrient supplementation, particularly in second-tier cities and rural regions.

The industry in Germany is anticipated to expand at a CAGR of 7.0% from 2025 to 2035. High consumer demand for clean-label fortified foods and supplements underpins industry expansion. The premixes are used in functional bakery mixes, meat substitutes, and dairy alternatives.

German firms emphasize precision blending and traceability, often sourcing minerals from certified EU suppliers. Institutional industries such as elderly care and clinical nutrition remain key segments. Demand is rising for magnesium, calcium, and iron premixes tailored to the aging population. Regulatory alignment with EFSA standards reinforces manufacturer confidence and product claims.

The industry in India is projected to grow at a CAGR of 7.5% from 2025 to 2035. Demand is being shaped by nutritional shortfalls across rural and peri-urban populations. Public health programs and private fortification partnerships are expanding the use of premixes in flour, rice, and salt.

The animal feed segment, particularly poultry and aquaculture, drives bulk purchasing of zinc, selenium, and phosphorus blends. Growth is further supported by the rise in preventive health formats like mineral-fortified snacks and RTD beverages. Domestic blenders are scaling operations with automated batching systems to meet demand from food and pharma clients.

The industry in Brazil is anticipated to grow at a CAGR of 6.8% through 2035. The growth is underpinned by the expansion of the livestock sector, especially cattle and poultry, requiring consistent mineral supplementation. The human nutrition segment is seeing increased demand for fortified juices, snacks, and dairy alternatives. Domestic formulators are integrating chromium, calcium, and iron premixes into wellness foods targeting metabolic and bone health.

Export-driven producers are aligning with traceability and certification protocols to meet EU import standards. Strategic alliances with local cooperatives and feed processors are improving regional distribution across the South and Midwest.

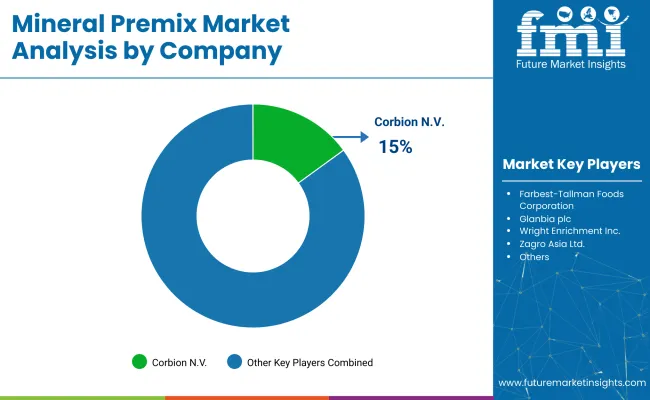

Leading Company - Corbion N.V.Industry Share - 15%

The global industry is led by Corbion N.V., holding a significant share of approximately 15%.Corbion's strong position is attributed to its comprehensive portfolio of the premixes, catering to various industries, including food, beverages, and animal nutrition.The company's commitment to quality and innovation has solidified its leadership in the industry.Corbion's strategic initiatives, such as expanding production capacities and enhancing distribution networks, have further strengthened its industry presence.The company's focus on meeting the growing demand for fortified products has contributed to its sustained growth in the sector.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 974.8 million |

| Industry Value (2035) | USD 2,224.5 million |

| Forecast CAGR (2025 to 2035) | 8.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand tons for volume |

| Form Segmentation | Powder, Liquid |

| Function Segmentation | Bone Health, Immunity, Digestion, Energy, Heart Health, Weight Management, Vision Health, Brain Health and Memory, Resistance, Others |

| Application Segmentation | Food Sector, Dietary Supplement, Pharma OTC Drugs, Pet Food, Other Applications |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Leading Brands | Corbion N.V., Farbest -Tallman Foods Corporation, Glanbia plc, Koninklijke DSM N.V., Nutreco N.V., SternVitamin GmbH & Co. KG, Vitablend Nederland BV, Watson Foods Co., Inc., Wright Enrichment Inc., Zagro Asia Ltd. |

| Additional Attributes | Dollar sales by form, function, and application, rising demand for functional foods and dietary supplements, growing awareness about the premixes in pet food, increasing use in pharmaceutical and nutraceutical applications, regional trends in mineral fortification and dietary requirements. |

Form-based segmentation includes Powder and Liquid.

Functions covered include Bone Health, Immunity, Digestion, Energy, Heart Health, Weight Management, Vision Health, Brain Health and Memory, Resistance, and Others.

Application categories include Food Sector, Dietary Supplement, Pharma OTC Drugs, Pet Food, and Other Applications.

Regional analysis spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The size of the industry in 2025 is USD 974.8 million.

The value of the industry in 2035 is projected to reach USD 2,224.5 million, with a CAGR of 8.6%.

Powder form leads the industry with a 60% share.

The United States will lead the industry with an 8.5% CAGR from 2025 to 2035.

The leading company in the industry is Corbion N.V., with a 15% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mineral Enrichment Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Premix Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mineral Sunscreen Market Size and Share Forecast Outlook 2025 to 2035

Mineral Based Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Mineral Wool Material Market Size and Share Forecast Outlook 2025 to 2035

Mineral Insulated Cables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Premix Bottled Cocktails Market Trends - Growth & Consumer Shifts 2025 to 2035

Premix Bread Flour Market Growth - Trends & Applications 2025 to 2035

Mineral Wool Market by Type & Application from 2025 to 2035

Key Companies & Market Share in the Mineral Wool Sector

Mineral Feed Market Analysis - Growth, Demand & Livestock Nutrition

Mineral Fortification Market Insights – Nutrient-Rich Foods & Industry Growth 2024 to 2034

Premixed Cocktail Shots Market Growth - Consumer Trends 2024 to 2034

Mineral Adsorbent Market

Demineralized Whey Powder Market Size, Growth, and Forecast for 2025 to 2035

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA