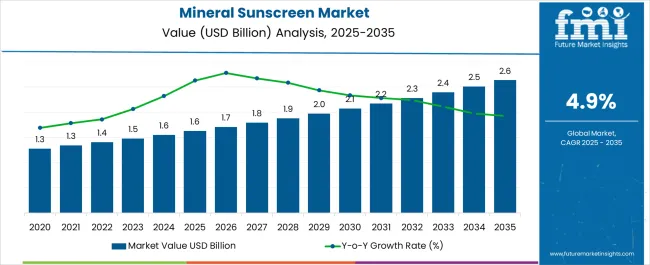

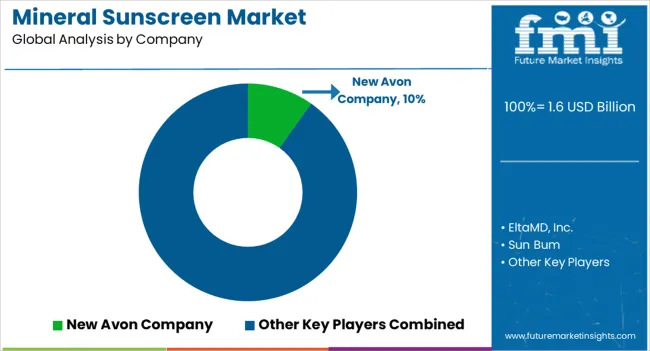

The Mineral Sunscreen Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Mineral Sunscreen Market Estimated Value in (2025 E) | USD 1.6 billion |

| Mineral Sunscreen Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The mineral sunscreen market is expanding steadily, supported by rising consumer awareness about skin health, concerns over UV-induced skin damage, and growing demand for clean-label personal care products. Dermatological studies and health organization campaigns have emphasized the safety and efficacy of mineral formulations, particularly zinc oxide and titanium dioxide, which are favored for their broad-spectrum protection and low irritation profile.

Industry press releases have highlighted investments in product innovation, including tinted and lightweight formulations, to improve consumer experience and appeal to broader demographics. Increasing regulatory scrutiny on chemical sunscreen ingredients has further accelerated the shift toward mineral-based alternatives.

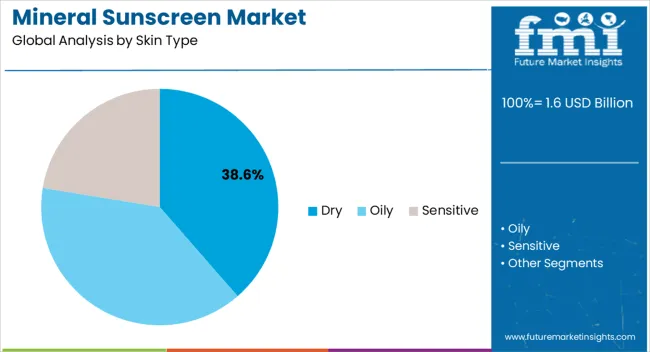

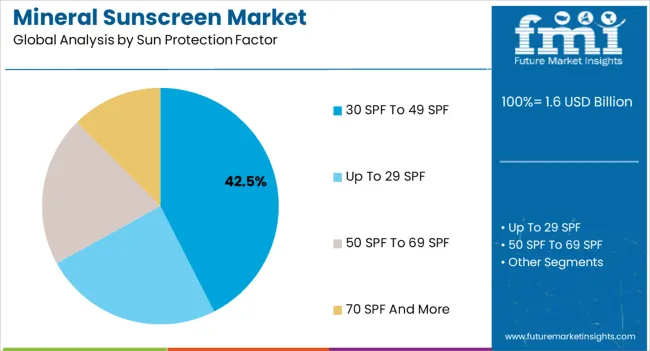

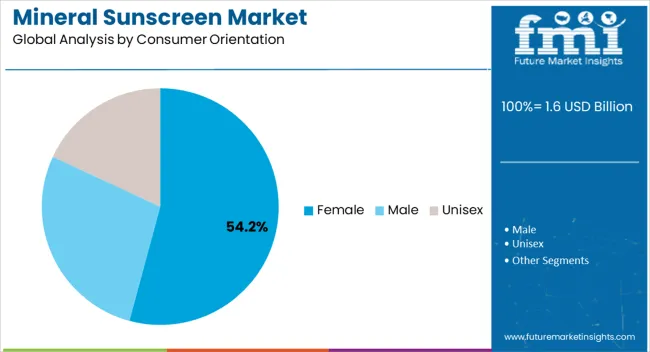

Retail distribution has broadened across e-commerce, pharmacies, and specialty stores, driving accessibility. Looking ahead, continued demand for natural, eco-friendly skincare, coupled with advancements in formulation technologies such as nano and non-nano mineral particles, is expected to reinforce growth. Segmental momentum is anticipated to be led by dry skin-focused products, sunscreens in the 30 SPF to 49 SPF range, and female-oriented consumer products, reflecting targeted skincare needs and purchasing behavior.

The Dry skin segment is projected to account for 38.60% of the mineral sunscreen market revenue in 2025, maintaining its leadership among skin type categories. Growth of this segment has been driven by consumer demand for sunscreens that provide hydration alongside UV protection.

Dermatological publications have emphasized that individuals with dry skin are particularly vulnerable to barrier damage from sun exposure, necessitating formulations enriched with moisturizing agents such as ceramides, hyaluronic acid, and botanical oils.

Brands have responded with mineral sunscreens that combine physical UV filters with skin-replenishing ingredients, strengthening adoption. Retail trends have shown consistent consumer preference for products marketed specifically for dry skin, particularly in regions with arid climates or seasonal dryness. With rising awareness of skin barrier protection and multifunctional skincare, the Dry skin segment is expected to maintain strong momentum in the mineral sunscreen market.

The 30 SPF to 49 SPF segment is projected to contribute 42.50% of the mineral sunscreen market revenue in 2025, positioning itself as the most preferred SPF range. This dominance has been supported by dermatological guidelines recommending SPF levels of 30 or higher for effective daily protection against UVA and UVB rays.

Consumers have shown high adoption of sunscreens in this range, balancing adequate protection with cosmetic acceptability, as higher SPFs often require thicker formulations.

Industry product launches have emphasized lightweight, non-greasy formulations within this SPF category, boosting consumer satisfaction and repeat purchases. Additionally, public health initiatives promoting daily sunscreen use for skin cancer prevention have reinforced demand for SPF 30 to 49 products as practical, everyday solutions. With growing consumer education and emphasis on preventive skincare, this SPF range is expected to remain the leading choice for mineral sunscreen users.

The Female segment is projected to account for 54.20% of the mineral sunscreen market revenue in 2025, sustaining its dominance in consumer orientation. This segment’s growth has been influenced by strong purchasing power and higher skincare engagement among female consumers.

Beauty and wellness campaigns have frequently targeted women, highlighting mineral sunscreens as safe, effective, and compatible with broader skincare and makeup routines.

Product innovations, such as tinted sunscreens and formulations catering to sensitive skin, have resonated strongly with female buyers. Additionally, women’s preference for eco-friendly and dermatologically tested products has aligned with the mineral sunscreen category, reinforcing adoption. Retail data has shown higher trial and repeat purchase rates among women compared to male consumers, further anchoring this segment’s leadership. With ongoing product diversification and marketing strategies tailored to women’s skincare priorities, the Female segment is expected to remain a key driver of growth in the mineral sunscreen market.

Adaptive Technology Represents the Future of Sun Protection

Mineral sunscreen products are becoming more adaptable to varying lighting situations due to the incorporation of cutting-edge technologies, making them more suitable for a variety of outdoor activities. Technology that can detect variations in UV radiation levels is frequently used in adaptive mineral sunscreen formulations. These sunscreens expand their protective barrier and provide more SPF coverage when exposed to intense sunlight.

On the other hand, in low light or indoor settings, they provide lower protection. Too much coverage might be redundant and possibly irritating the skin. As consumer demand for smarter skincare products is rising, businesses are adopting adaptive technologies as a differentiator to stand out from rivals in the bustling mineral sunscreen market.

Mineral Sunscreen Industry Embracing Evolving Beauty and Cosmetic Trends

Customers are looking for products with cleaner and more natural components. Avoiding abrasive substances, synthetic additives, and fake fragrances is an increasingly popular trend. In response, companies are creating products using plant-based, organic, and sustainably sourced components.

Furthermore, gender-neutral beauty is questioning prevailing notions of beauty. Brands are releasing products and marketing initiatives that are inclusive of all genders and reject conventional gender stereotypes. In a rising trend, CBD and hemp-based products are in higher demand in the mineral sunscreen market. Due to its potential relaxing and anti-inflammatory effects, hemp- and cannabidiol-based skincare and cosmetics are becoming progressively more popular. Marketing for these products frequently focuses on relieving skin issues, including redness and inflammation.

| Attributes | Details |

|---|---|

| Mineral Sunscreen Market Size (2020) | USD 1,145.5 million |

| Mineral Sunscreen Market Size (2025) | USD 1,403.0 million |

In recent years, self-care routines have increased as consumer seek a way to relax and rejuvenate in their hectic lifestyles. Wellness and beauty are getting increasingly entwined. Customers are searching for solutions to improve attractiveness and advance general well-being. Products having nutritional value and stress-relieving qualities fall under this category. Furthermore, social media sites like Instagram and YouTube greatly impact how people view beauty products and trends. Sales of cosmetics and skincare are boosted by the tremendous influence that makeup tutorials and beauty influencers have on customer decisions.

The beauty sector will continue to undergo a digital revolution over the coming years. With the development of e-commerce, augmented reality (AR), virtual try-ons, and AI-driven recommendations, consumers will be able to enjoy highly customized beauty experiences. This dominance of digital platforms will transform how customers find, choose, and buy beauty items. It is anticipated that beauty will become increasingly more personalized. Beauty routines will become more effective and efficient through cutting-edge technology like artificial intelligence (AI) and data analytics, which will offer customers personalized product recommendations and regimens.

| Attribute | Details |

|---|---|

| Trends |

|

| Opportunities |

|

| Threats |

|

In 2025, the dry skin segment is leading by occupying nearly 26.99% share of the market by skin type.

| Top Skin Type | Dry |

|---|---|

| Market Share (2025) | 26.99% |

Numerous factors, including the climate (cold weather, low humidity), over-cleansing, the use of harsh skincare products, and underlying medical disorders, may lead to dry skin. A wide range of dry skin products are available due to the underlying causes' diversity. Individuals of different ages, genders, and skin tones can experience dry skin, making it a universal issue that crosses all demographic divisions. Brands frequently promote products designed especially for dry skin, highlighting their capacity to offer relief and enhance skin texture. Customers who have dry skin problems respond well to this customized marketing strategy.

In 2025, the direct sales channel segment remains highly preferred, capturing 8.66% of the mineral sunscreen industry share. Though several beauty and skincare brands are adopting a hybrid approach by utilizing both direct and indirect sales channels, direct sales channel maintain their supremacy in the long run.

| Top Sales Channel | Direct Sales |

|---|---|

| Market Share (2025) | 8.66% |

Through direct sales channels, brands maintain more control over their merchandise, prices, and branding. This control may be necessary for luxury or niche brands that want to maintain their positioning and image. Direct communication with clients allows for building relationships and getting insightful feedback. This is especially advantageous for businesses that value client loyalty and wish to customize their goods and services to suit customer preferences. By making limited-edition products or special promotions available only through their own stores or websites, brands can evoke a feeling of exclusivity, fostering direct sales in the mineral sunscreen market.

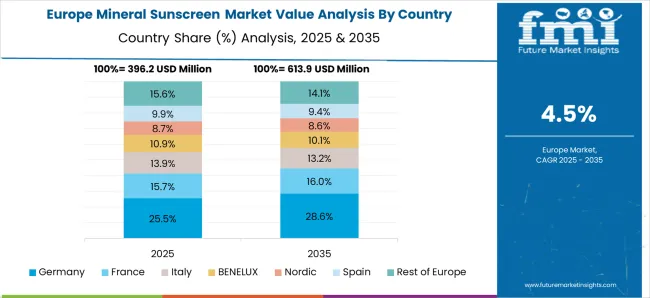

The table provides a revenue share analysis of the major markets in the competitive landscape. China holds a significant share of the global mineral sunscreen market.

| Countries | Market Share (2025) |

|---|---|

| Canada | 4.3% |

| Germany | 4.4% |

| India | 4.5% |

| China | 6.1% |

| Australia | 2% |

Canada’s mineral sunscreen market holds a market share of 4.3% in 2025 and is developing due to several factors. The market is largely expanding owing to skincare's integration with pharmaceutical and medical aesthetics procedures. For holistic results, consumers are combining non-invasive cosmetic procedures with skincare regimens.

The clean beauty movement in Canada has accelerated, following global trends. The desire for products free of potentially dangerous substances among consumers has fueled the expansion of clean and natural cosmetic brands, driving sales of mineral sunscreens. Indie beauty firms are growing in popularity in Canada, bringing new, specialized items to the market. These smaller companies frequently concentrate on original formulations and meet certain consumer demands.

Germany’s mineral sunscreen market holds a 4.4% share of the global revenue in 2025. Many German consumers have delicate skin that is prone to irritability. Mineral sunscreens are renowned for being mild and hypoallergenic since they contain physical UV blockers like zinc oxide and titanium dioxide. Mineral sunscreens are now widely available and actively marketed as safe and reliable solutions for sun protection as a result of the strict regulations the European Union has placed on sunscreen compositions.

Outdoor pursuits, including motorcycling, hiking, and sports, are popular in Germany. This active way of life fuels the desire for trustworthy sunscreens that can endure perspiration and outdoor elements, thereby strengthening mineral sunscreen market expansion in the long run.

India’s mineral sunscreen market accounts for a share of 4.5% in 2025. Indian consumers are getting more conscious of the importance of sun protection due to growing knowledge about the damaging effects of UV radiation and pollution on skin health. Because they are so good at preventing skin damage, mineral sunscreens are in high demand.

India has a long history of using herbal and Ayurvedic remedies for skin care. Mineral sunscreens complement the trend for herbal and Ayurvedic treatments because they are frequently made with natural ingredients. Natural and non-toxic beauty products are in high demand in India's beauty sector. Mineral sunscreens fit this trend toward natural beauty.

China’s mineral sunscreen market holds a share of 6.1% of global sales in 2025. Fair skin with a healthy glow is highly regarded in China. Mineral sunscreens are favored because they can keep skin fair since they are frequently designed to protect without darkening skin.

Chinese consumers are becoming more interested in multi-step skincare regimens and clean beauty products, such as mineral sunscreens, thanks to the influence of Korean and Japanese beauty trends. China's wellness and health trends are driving the need for sunscreens that provide additional skin advantages beyond UV protection. Many nutritious and skin-improving elements can be found in mineral sunscreens, which drives their demand in the Chinese mineral sunscreen market.

In 2025, Australia’s mineral sunscreen market accounted for a 2% share of the global market. Skin cancer prevention is an important safety priority because Australia has one of the most severe cases of skin cancer in the world.

Medical practitioners frequently suggest mineral sunscreens due to their demonstrated effectiveness against UV rays, which are the primary cause of skin cancer. It can get hot and humid in Australia.

Mineral sunscreens are preferred for their comfort in such circumstances because they frequently have a matte and non-greasy feel. When it comes to preventive health measures, Australians are proactive. In order to avoid UV damage and premature aging, mineral sunscreens are considered to be a crucial component of a preventive skincare regimen.

The mineral sunscreen industry is extremely competitive with established competitors, up-and-coming independent brands, diversification efforts, innovation, branding strategies, sustainability initiatives, and a heavy emphasis on consumer education and compliance driving the market. The best-positioned brands in this cutthroat environment are those that adjust to changing consumer preferences and market conditions. By acquiring smaller niche companies, reputable skincare and beauty corporations are uniting the market. They are able to reach a wider audience and vary their product offerings due to these investments.

Recent Developments in the Mineral Sunscreen Market

Key Players in the Mineral Sunscreen Market

The global mineral sunscreen market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the mineral sunscreen market is projected to reach USD 2.6 billion by 2035.

The mineral sunscreen market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in mineral sunscreen market are dry, oily and sensitive.

In terms of sun protection factor, 30 spf to 49 spf segment to command 42.5% share in the mineral sunscreen market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mineral Enrichment Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mineral Based Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Mineral Wool Material Market Size and Share Forecast Outlook 2025 to 2035

Mineral Insulated Cables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mineral Premix Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Mineral Wool Market by Type & Application from 2025 to 2035

Key Companies & Market Share in the Mineral Wool Sector

Mineral Feed Market Analysis - Growth, Demand & Livestock Nutrition

Mineral Fortification Market Insights – Nutrient-Rich Foods & Industry Growth 2024 to 2034

Mineral Adsorbent Market

Demineralized Whey Powder Market Size, Growth, and Forecast for 2025 to 2035

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Boron Minerals and Chemicals Market Size and Share Forecast Outlook 2025 to 2035

White Mineral Oil Market Analysis by Food, Pharmaceutical, Technical Through 2035

Trace Minerals in Feed Market Analysis by Type, Livestock, Chelate Type, Form and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA