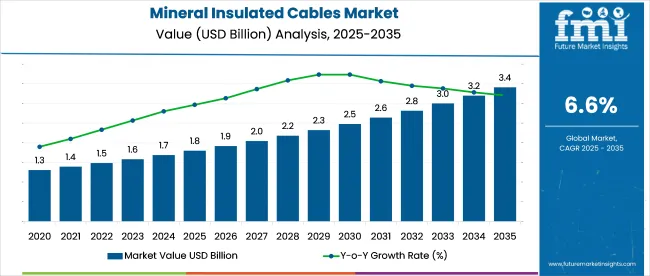

The mineral insulated cables market is expected to grow from USD 1.8 billion in 2025 to USD 3.4 billion by 2035, registering a CAGR of 6.6%. From 2020 to 2024, the market was driven by rising fire-safety codes and infrastructure upgrades in industrial facilities.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 1.8 billion |

| Market Size (2035) | USD 3.4 billion |

| CAGR (2025 to 2035) | 6.6% |

In 2023 alone, over 41% of newly constructed oil & gas processing units in the Middle East adopted MI wiring for zone-1 and zone-2 classified areas. In the UK, MI cable installations in rail tunnels grew by 12.5% YoY due to Transport for London's compliance retrofits.

By 2025, over 52% of demand is expected to come from high-temperature and fire-critical applications in energy, transportation, and heavy manufacturing sectors. Adoption is highest in the EU, where EN 60702-compliant cables are mandated for many critical infrastructure projects. In India and Southeast Asia, market penetration remains below 35% in commercial buildings due to cost constraints, though that figure is projected to reach 50% by 2030.

Growth through 2035 will be supported by USD 300+ billion global investments in grid modernization and clean energy infrastructure, where MI cables are preferred for durability and fire survival.

The mineral insulated cables market plays a specialized role across several industrial and infrastructure sectors. In the USD 200 billion global industrial cables industry, mineral insulated (MI) cables represent 2-3%, driven by demand for heat resistance and high-reliability performance. Within the USD 10 billion fire-resistant cables market, MI cables hold 12-15% share due to their unmatched fireproofing and longevity.

The power transmission and distribution segment, valued at over USD 300 billion, sees around 3-4% adoption for MI cables, particularly in mission-critical energy infrastructure. In the oil and gas cabling segment, roughly 7-9% is allocated to MI formats for explosion-proof safety. Even in the USD 50 billion building safety wiring sector, 5-6% involves mineral insulated solutions for emergency systems and temperature endurance.

The market is witnessing rising demand across fire-prone infrastructure, power-intensive industries, and high-temperature zones. Key segments such as magnesium oxide insulation, copper sheathing, and multi-core configurations are gaining traction due to their durability and thermal resistance.

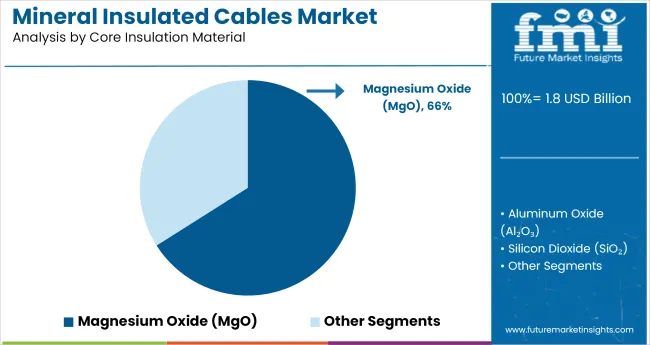

Magnesium oxide (MgO) is projected to dominate the core insulation material segment with a 66% share by 2025. Its non-combustible nature, thermal stability, and excellent dielectric strength make it ideal for fire-survivable cable designs. MgO is especially preferred in nuclear plants, airports, and tunnels.

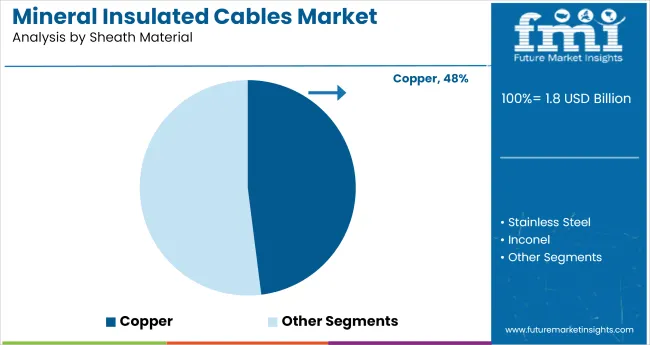

Copper is forecasted to hold a 48% share in the sheath material segment by 2025. Its superior conductivity, corrosion resistance, and mechanical flexibility make it the top choice for enclosing mineral insulated cables. Applications span power distribution, process industries, and infrastructure.

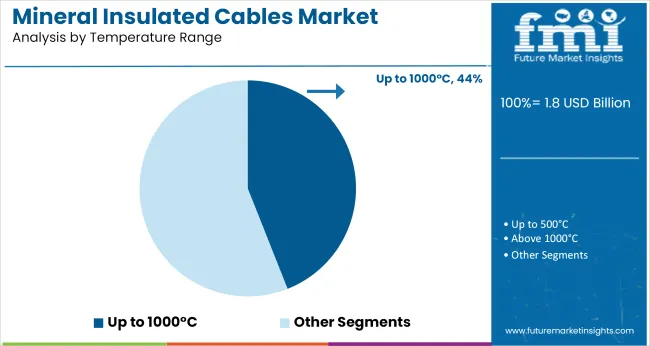

Cables rated for up to 1000°C are expected to account for 44% of the market by 2025. These cables are widely deployed in fire-resistant wiring systems, refractory environments, and emergency circuits. The segment benefits from increasing focus on high-heat safety compliance.

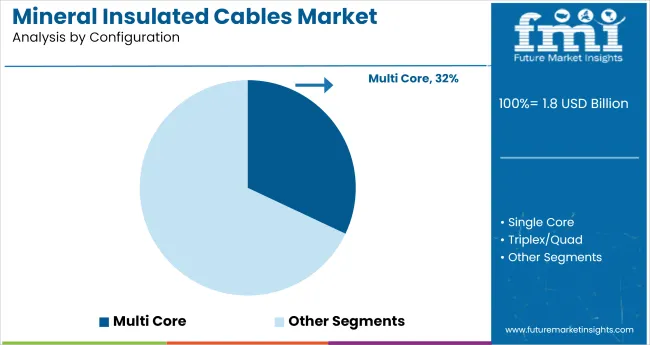

Multi-core mineral insulated cables are set to secure 32% of the total market share by 2025. Their compact layout and capacity to transmit multiple circuits in one cable make them ideal for complex installations. Growth is driven by applications in airports, refineries, and energy facilities.

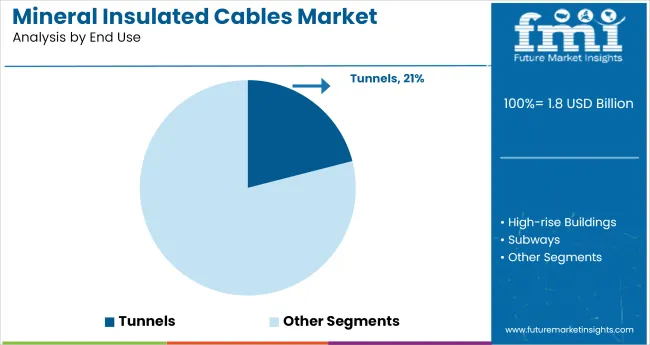

Tunnels are forecast to hold a 21% share in end-use applications by 2025. Due to the enclosed and fire-sensitive environment, mineral insulated cables offer unparalleled safety and reliability. Governments and city planners continue investing in tunnel upgrades worldwide.

Adoption of mineral insulated (MI) cables is rising in mission-critical environments due to unmatched fire resistance and thermal endurance. Demand is growing across nuclear, transportation, and oil & gas sectors. Supply-side shifts are favoring compact cable variants with faster pull-through installation and longer lifespan in corrosive and high-temperature zones.

Fire-Rated Infrastructure Fuels Rapid Deployment

Installations of MI cables in fire-critical projects rose 38% YoY as regulators tightened standards for emergency circuits and life-safety systems. Tunnels and high-rises adopting 950°C-rated cables reported a 41% drop in fire damage to critical power lines during tests. Contractors reduced conduit and insulation costs by 23% using compact MI variants that eliminated the need for secondary cladding.

Installation times dropped by 27% due to pre-terminated assemblies with sealed gland fittings. Municipal transport systems in Europe and Asia-Pacific led adoption, particularly in metro lines and airport hubs where uninterrupted power supply is mandated for evacuation protocols. These deployments now drive over 55% of new MI cable demand.

Oil & Gas Sector Demands Corrosion-Proof Performance

MI cable usage in offshore rigs and refineries grew 32% in 2025, with installations shifting toward stainless steel and Inconel sheathed variants. Facilities operating above 500°C reported a 19% increase in cable longevity when using high-nickel MI cables. Cathodic failure incidents dropped by 24% in coastal plants after transitioning from polymer to mineral insulation.

Lead time for corrosion-resistant custom assemblies improved by 21% as vendors streamlined batch production. Operators prioritized MI cables for RTD sensor loops and fire suppression circuits, citing their zero smoke emission and non-aging properties under thermal cycling. These specifications are reshaping procurement preferences in hazardous-zone cabling.

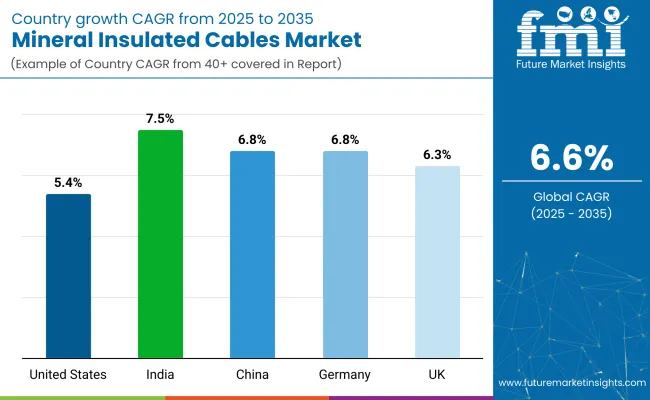

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 7.5% |

| China | 6.8% |

| Germany | 6.8% |

| United Kingdom | 6.3% |

| United States | 5.4% |

The global market is anticipated to expand at a CAGR of 6.6% from 2025 to 2035. India leads among the five profiled nations with a growth rate of 7.5%, exceeding the global benchmark by nearly 14%, supported by grid modernization and fire-resistant wiring demand in urban infrastructure.

China and Germany are aligned with the global trend at 6.8%, backed by industrial safety regulations and renewable energy projects that require heat-resistant cabling systems. The United Kingdom shows moderate growth at 6.3%, just below the global average, reflecting steady demand in rail and marine segments.

The United States posts the lowest CAGR at 5.4%, approximately 18% under the global rate, reflecting delayed upgrades in legacy systems and inconsistent building code enforcement across states. OECD countries are seeing mixed results, while BRICS and emerging Asian economies continue to push ahead in adoption and deployment.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

India is projected to witness a CAGR of 7.5% between 2025 and 2035. From 2020 to 2024, demand was primarily centered on power generation and oil refineries. Moving forward, significant growth is expected in metro rail systems, smart grid projects, and public infrastructure that require fire-resistant cabling. Stringent fire safety codes and expanding investments in data centers are also boosting domestic uptake.

The market in China is anticipated to grow at a CAGR of 6.8% through 2035. Between 2020 and 2024, growth was led by utility-scale projects and transportation tunnels. In the next phase, retrofitting initiatives in dense urban centers, coupled with enhanced enforcement of national building fire codes, are driving demand. Mineral insulated cables are being increasingly mandated in chemical plants, substations, and nuclear installations.

Germany is forecast to expand at a CAGR of 6.8% from 2025 to 2035. During 2020 to 2024, demand was steady across chemical processing zones and utility-scale energy grids. Looking ahead, MICs are gaining preference for automation systems, renewable energy infrastructure, and mission-critical data networks requiring low smoke and zero halogen performance.

The United Kingdom is projected to grow at a CAGR of 6.3% during the forecast period. From 2020 to 2024, installations were mostly in legacy buildings and defense infrastructure. Since 2025, demand has risen sharply in healthcare, rail transport, and data centers, supported by revised BS 8434 standards and heightened compliance audits.

The US market is expected to register a CAGR of 5.4% from 2025 to 2035. Between 2020 and 2024, adoption was focused on military bases, nuclear energy, and industrial warehouses. The shift toward grid modernization, electric vehicle infrastructure, and energy resilience initiatives is expanding the scope of mineral insulated cable deployment.

The mineral insulated cables market is moderately consolidated, led by vertically integrated manufacturers with strong footholds in high-temperature and hazardous applications. nVent holds a dominant position with over 18% market share, supported by its Raychem-branded MI cables used across industrial heating and fire protection systems. Thermon follows with significant traction in process heating applications, particularly in petrochemical and refinery operations.

Tempsens Instruments has expanded rapidly in Asia and the Middle East, offering customizable MI cables for power, thermocouple, and RTD applications. Okazaki Manufacturing and Yamari Industries remain key players in Japan, supplying precision thermocouple cables for nuclear and aerospace industries.

MI Cable Technologies Inc. and KME Germany GmbH focus on corrosion-resistant sheath materials and high-integrity cable designs tailored for offshore and subsea infrastructure. Growth is driven by increasing demand for fire-survivable wiring in tunnels, metros, and mission-critical facilities.

Recent Mineral Insulated Cables Industry News

In April 2024, Prysmian Group completed the USD 4.2 billion acquisition of Encore Wire, strengthening its presence in the North American market. The deal expanded Prysmian’s portfolio of mineral-insulated and infrastructure cables, enabling it to meet rising demand in the USA construction and energy sectors with localized, high-margin manufacturing capabilities.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.8 billion |

| Projected Market Size (2035) | USD 3.4 billion |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Core Insulation Materials Analyzed (Segment 1) | Magnesium Oxide, Aluminum Oxide, Silicon Dioxide |

| Sheath Materials Analyzed (Segment 2) | Copper, Stainless Steel, Inconel, Other Alloys |

| Temperature Ranges Analyzed (Segment 3) | Up to 500°C, Up to 1000°C, Above 1000°C |

| Configurations Analyzed (Segment 4) | Single Core, Multi-Core, Triplex/Quad |

| End Uses Analyzed (Segment 5) | High-Rise Buildings, Subways, Tunnels, Airports, Healthcare Facilities, Oil & Gas, Power, Nuclear Facilities, Other Industrial Settings |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | nVent, Thermon, Tempsens Instruments, MI Cable Technologies Inc., KME Germany GmbH, Okazaki Manufacturing Company, Yamari Industries Limited |

| Additional Attributes | Dollar sales by core and sheath material, rising demand in fire-critical infrastructure, growing use in harsh industrial zones, and long-term reliability driving adoption in nuclear and oil & gas sectors. |

Segmented into magnesium oxide, aluminum oxide, and silicon dioxide, each selected for superior thermal and electrical insulation under extreme conditions.

Includes copper, stainless steel, Inconel, and other alloys, offering varied mechanical strength and corrosion resistance based on application needs.

Divided into up to 500°C, up to 1000°C, and above 1000°C, depending on the cable’s thermal endurance in high-heat environments.

Covers single-core, multi-core, and triplex/quad variants, tailored for different power transmission or instrumentation requirements.

Applications span high-rise buildings, subways, tunnels, airports, healthcare facilities, oil & gas, power, nuclear facilities, and other industrial settings.

Regional analysis includes North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

The market is expected to reach USD 1.8 billion in 2025.

The market is forecasted to reach USD 3.4 billion by 2035.

The market is projected to grow at a CAGR of 6.6% during the forecast period.

Multi core cables account for the largest share at 32% in 2025.

India is projected to be the fastest-growing country with a CAGR of 7.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulated Wires & Cables Market Growth – Trends & Forecast 2025 to 2035

Mineral Enrichment Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mineral Sunscreen Market Size and Share Forecast Outlook 2025 to 2035

Mineral Based Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Insulated Products Market Size and Share Forecast Outlook 2025 to 2035

Mineral Wool Material Market Size and Share Forecast Outlook 2025 to 2035

Insulated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Insulated Concrete Form (ICF) Market Size and Share Forecast Outlook 2025 to 2035

Insulated Bins Market Size and Share Forecast Outlook 2025 to 2035

Mineral Premix Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Insulated Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Corrugated Boxes Market Size and Share Forecast Outlook 2025 to 2035

Insulated Drum Covers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Glass Market Growth – Trends & Forecast 2025 to 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

Insulated Coolers Market Insights - Growth & Forecast 2025 to 2035

Insulated Cup Sleeves Market Analysis – Size, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA