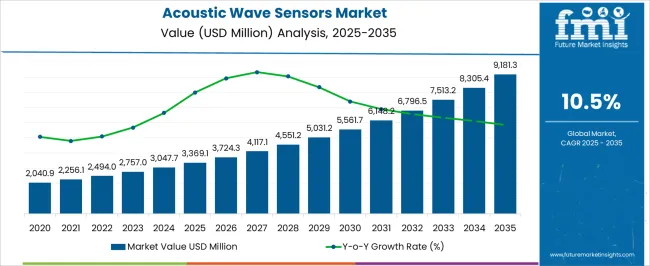

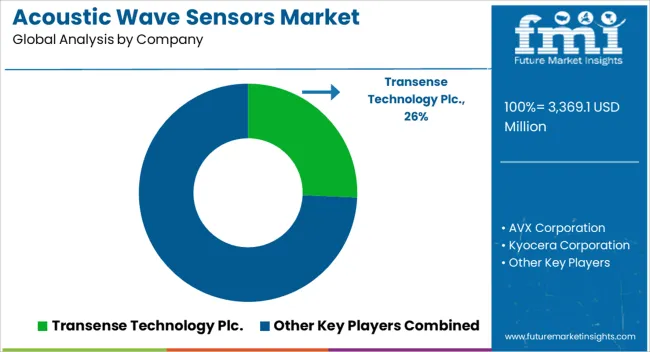

The Acoustic Wave Sensors Market is estimated to be valued at USD 3369.1 million in 2025 and is projected to reach USD 9181.3 million by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period.

| Metric | Value |

|---|---|

| Acoustic Wave Sensors Market Estimated Value in (2025 E) | USD 3369.1 million |

| Acoustic Wave Sensors Market Forecast Value in (2035 F) | USD 9181.3 million |

| Forecast CAGR (2025 to 2035) | 10.5% |

The acoustic wave sensors market is witnessing strong growth driven by increasing demand for highly sensitive and reliable sensing technologies across industrial, defense, and healthcare applications. The ability of these sensors to provide wireless, passive, and real time monitoring without the need for external power has made them highly valuable in harsh environments.

Advances in material science and microelectromechanical systems have enhanced durability, miniaturization, and cost efficiency, supporting adoption across a wider set of applications. Growing emphasis on predictive maintenance, safety, and energy efficiency has further fueled deployment across sectors.

Regulatory support for sensor integration in defense and industrial monitoring systems has strengthened market prospects. The outlook remains positive as rising investments in smart technologies and defense modernization continue to create opportunities for the adoption of acoustic wave sensors globally.

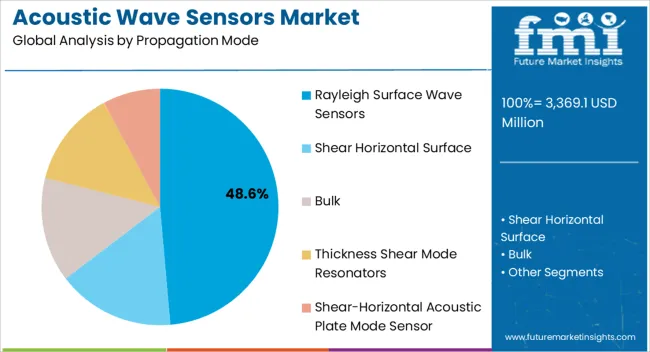

The Rayleigh surface wave sensors segment is expected to represent 48.60% of total revenue by 2025 within the propagation mode category, establishing it as the leading segment. This dominance is attributed to their high sensitivity, superior performance in surface level detection, and ability to operate effectively in a wide range of environmental conditions.

These sensors are extensively used in applications requiring accurate pressure, temperature, and gas monitoring. Their compatibility with wireless and passive sensing systems has further expanded their adoption in mission critical environments.

Enhanced durability and stability in varying conditions have reinforced their position as the preferred propagation mode in the acoustic wave sensors market.

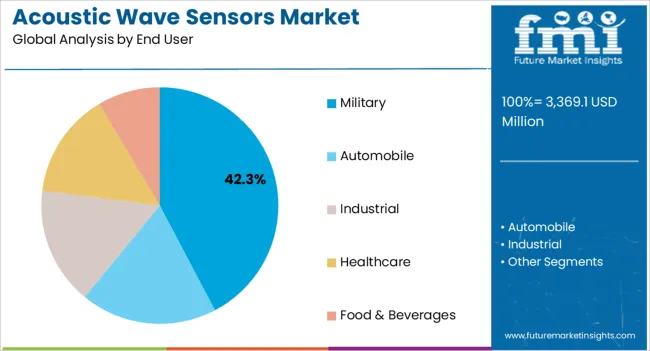

The military segment is projected to hold 42.30% of total market revenue by 2025 within the end user category, making it the most prominent segment. This growth is being driven by the increasing focus on advanced sensing systems for defense operations, including surveillance, navigation, and threat detection.

Acoustic wave sensors are highly valued in military applications due to their reliability, low maintenance needs, and ability to function without external power sources in challenging environments. Rising investments in defense modernization and the integration of advanced sensor technologies into communication and monitoring systems have further accelerated adoption.

These factors have firmly established the military segment as a key driver of growth in the acoustic wave sensors market.

Temperature sensors products are experiencing continuous demand by various end-user industry. Industries incorporate these sensors in their products to reduce costs associated with components replacements and for regulatory adherence. IT also minimizes wear & tear and improves products safety. This is estimated to drive the acoustic wave sensors market growth.

Several benefits, such as a wide temperature range, fast response rate, repeatability, and low cost, increase the demand for SAW-based temperature sensors. This is likely to be a key driver for the acoustic wave sensors market share.

New electric and hybrid vehicles are incorporated with an acoustic warning system to address the issues in traffic management. This is expected to propel market growth in the forecast period. Addition to this, proliferation of base station and smartphones are estimated to drive market growth notably. Key consumer of acoustic wave sensors is telecommunication industry.

These sensors have lesser response time, passive nature, and wireless operations. These is expected to fuel the industry expansion. The acoustic wave sensors possess an ability to convert an electrical signal into mechanical waves. This boost the adoption these sensors in various applications such as sensing and signal processing.

Energy consumption and sensitivity causing technical problems are key drawbacks that are likely to obstruct the acoustic wave sensors market share. Furthermore, the deployment of other sensors in conventional applications instead of saw-based sensors is further anticipated to challenge the growth of the acoustic wave sensors market.

Novel Applications and Advancements

Development of sensor technology and its growing applications in automotive sector is driving the market demand. This sensors integration makes the vehicles safer for travelers. This is expected to create favorable environment for the acoustic wave sensors market.

Already Fitted in Gadgets

Microphones/speakers are already installed in telephone devices and other similar gadgets. This is likely to increase the adoption of acoustic wave sensor applications, which contrives a relatively low deployment cost.

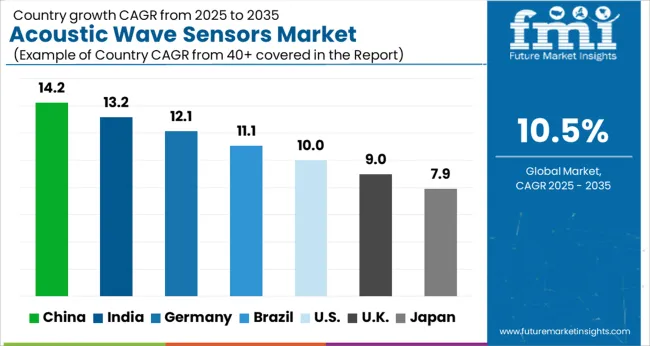

North America, with a significant 31.6% share, is the leading acoustic wave sensors market. This is attributed to the growing penetration of autonomous cars, surging a market avenue for retro-reflective sensors required in parking assistance systems.

The development of mechanically robust, flexible, and adaptive sensing SAW devices is being focused on by prominent market players. Additionally, the healthcare industry surges a growing demand for ultrasonic sensors due to their internal capability to examine the human body.

Governments of this region are allocating funds to aid in the advancement of new technologies. Moreover, the acoustic wave sensors market in the United States and Canada is likely to experience growth due to the growing adoption of ultrasonic sensors in robotics applications and industrial automation.

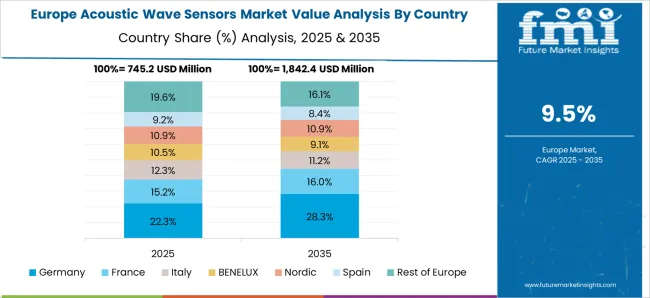

With a revenue share of 23.8%, Europe is the second-leading in the acoustic wave sensors market. This is owing to the rising integration of SAW-gas sensors in automobile applications and the rapid deployment of advanced technologies.

There is a rising adoption in the production of touch-based devices and their advantages, like easy fabrication and low cost, in countries like the United Kingdom and Germany. This factor and increasing technological developments are anticipated to expand the acoustic wave sensors market size.

Acoustic wave sensors have played a crucial role in reducing accidents and decreasing their impact. This makes the devices more popular in the automotive industry.

However, limited applications in various sectors create opportunities and space for improvement for the key market players. Start-up companies are, hence, involved in developing creative strategies to boost the acoustic wave sensors market growth.

Key manufactures are adopting advanced techniques for sensor production. These techniques include surface acoustic waves (SAW) and bulk acoustic waves (BAW). Through research and development activities, as well as the assistance of governmental funds, market players strive to generate newer developments in the devices for the acoustic wave sensors market growth.

Key Market Players of the Acoustic Wave Sensors Market:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 10.5% from 2025 to 2035 |

| The base year for estimation | 2025 |

| Historical data | 2020 to 2025 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors And Trends, Pricing Analysis, |

| Segments Covered | Propagation Mode, End User, and Region. |

| Regional scope | North America; Western Europe, Eastern Europe, The Middle East and Africa, ASEAN, South Asia, Rest of Asia, Australia, and New Zealand |

| Country scope | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, United Arab Emirates, Iran, South Africa |

| Key companies profiled | Honeywell International Inc.; Siemens AG; Electronic Sensor Technology; General Electric Company; CTS Corporation; Transense Technology Plc.; AVX Corporation; Kyocera Corporation; SENSeOR S.A.S; Vectron International Inc.; Microsemi; Qualtre Inc.; NanoTemper Technologies GmbH; Althen GmbH Mess-und Sensortechnik; pro-micron GmbH; H. Heinz Meßwiderstände GmbH; Hawk Measurement Systems; Abracon; A D METRO INC.; API Technologies Corp.; etc. |

| Customization scope | Free report customization (equivalent to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global acoustic wave sensors market is estimated to be valued at USD 3,369.1 million in 2025.

The market size for the acoustic wave sensors market is projected to reach USD 9,181.3 million by 2035.

The acoustic wave sensors market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in acoustic wave sensors market are rayleigh surface wave sensors, shear horizontal surface, bulk, thickness shear mode resonators and shear-horizontal acoustic plate mode sensor.

In terms of end user, military segment to command 42.3% share in the acoustic wave sensors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acoustic Wave Filters Market Size and Share Forecast Outlook 2025 to 2035

Acoustic Respiration Sensors Market Outlook 2025 to 2035

Millimeter Wave Sensors Market by Devices, Frequency Band, Application & Region Forecast till 2025 to 2035

Acoustic Vehicle Alerting System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Waveguide Components and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Wavefront Aberrometers Market Size and Share Forecast Outlook 2025 to 2035

Acoustic Insulation Market Analysis & Forecast for 2025 to 2035

Wavelength Division Multiplexing (WDM) Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Acoustic Camera Market Growth - Size, Trends & Forecast 2025 to 2035

Acoustic Puncture Assist Devices Market

Acoustic Neurinoma Treatment Market

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Otoacoustic Emissions Hearing Screener Market Size and Share Forecast Outlook 2025 to 2035

Bioacoustics Sensing Market Size and Share Forecast Outlook 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

Mid Wave Mid-IR Supercontinuum Laser Market Forecast and Outlook 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA