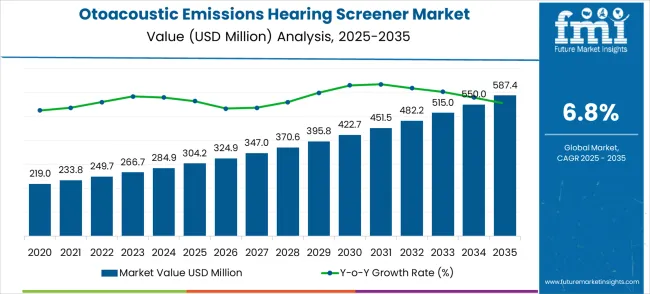

The otoacoustic emissions hearing screener market is projected to reach USD 587.4 million by 2035, recording an absolute increase of USD 283.2 million over the forecast period. The market is valued at USD 304.2 million in 2025 and is projected to grow at a CAGR of 6.8% during the forecast period. The overall market size is expected to grow by nearly 1.93 times during the same period, supported by increasing awareness of early hearing loss detection and growing adoption of newborn hearing screening programs worldwide. However, high equipment costs and limited accessibility in developing regions may pose challenges to market expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 304.2 million |

| Market Forecast Value (2035) | USD 587.4 million |

| Forecast CAGR (2025-2035) | 6.8% |

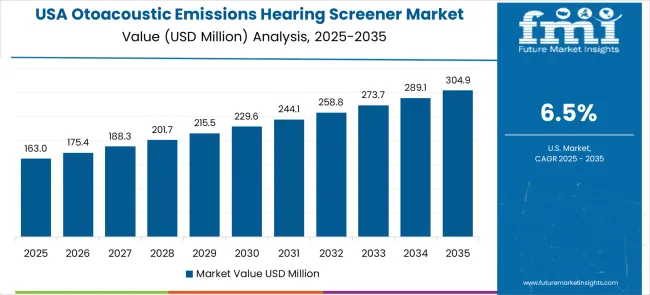

Between 2025 and 2030, the Otoacoustic Emissions Hearing Screener Market is projected to expand from USD 304.2 million to USD 422.7 million, resulting in a value increase of USD 118.5 million, which represents 41.8% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for early hearing detection solutions, product innovation in noise suppression technologies and portable screening devices, and expanding integration with digital health platforms and telemedicine applications. Companies are establishing competitive positions through investment in advanced acoustic technologies, user-friendly interfaces, and strategic market expansion across healthcare facilities, educational institutions, and occupational health sectors.

From 2030 to 2035, the market is forecast to grow from USD 422.7 million to USD 587.4 million, adding another USD 164.7 million, which constitutes 58.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized screening systems, including wireless connectivity and cloud-based data management platforms tailored for specific healthcare applications, strategic collaborations between technology providers and healthcare equipment manufacturers, and an enhanced focus on preventive healthcare and early intervention programs. The growing emphasis on hearing health awareness and universal newborn hearing screening initiatives will drive demand for advanced otoacoustic emissions screening solutions across diverse healthcare applications.

The market grows by enabling healthcare providers to conduct non-invasive, rapid hearing assessments that detect hearing loss in its earliest stages, particularly in newborns and infants, where traditional testing methods are impractical. Healthcare facilities face mounting pressure to implement comprehensive hearing screening programs, with newborn hearing screening becoming mandatory in most developed countries, making otoacoustic emissions testing essential for early detection and intervention. The medical community's need for objective, reliable hearing assessment tools creates demand for advanced screening devices that can detect otoacoustic emissions without requiring patient cooperation or response, enabling effective screening across all age groups. Regulatory requirements and healthcare quality standards drive adoption in hospitals, clinics, and audiological centers, where early hearing loss detection directly impacts treatment outcomes and quality of life. However, budget constraints for medical equipment purchases and the complexity of interpreting test results may limit adoption rates among smaller healthcare providers and developing regions with limited specialized training resources.

The otoacoustic emissions hearing screener market presents compelling growth opportunities as global healthcare systems prioritize preventive medicine and early intervention programs. With the market projected to expand from USD 304.2 million in 2025 to USD 587.4 million by 2035 at a 6.8% CAGR, medical device manufacturers and healthcare technology providers are positioned to capitalize on universal newborn hearing screening mandates, aging population demographics, and technological advancement in portable diagnostic solutions.

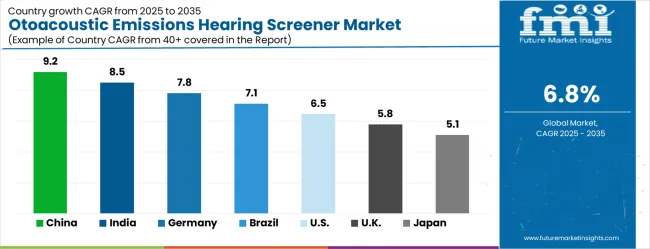

The convergence of mandatory hearing screening programs, increasing healthcare infrastructure investment, and digital health platform integration creates sustained market expansion opportunities. Geographic growth differentials are particularly pronounced in China (9.2% CAGR) and India (8.5% CAGR), where healthcare modernization and government health initiatives drive substantial adoption. Technology advancements in noise suppression, portability, and automated testing offer differentiation opportunities, while medical test applications dominate revenue streams.

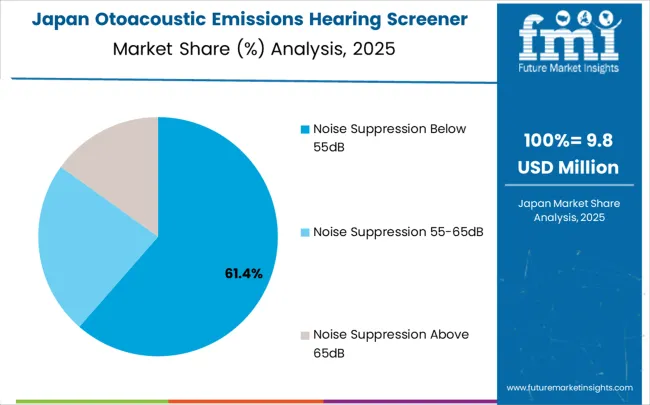

Noise suppression below 55dB systems leads market demand, indicating established foundations for precision diagnostics, while emerging applications in telemedicine and remote screening represent growth vectors. Healthcare quality standards and regulatory requirements support sustained procurement, while preventive healthcare emphasis drives operational deployment across diverse medical settings.

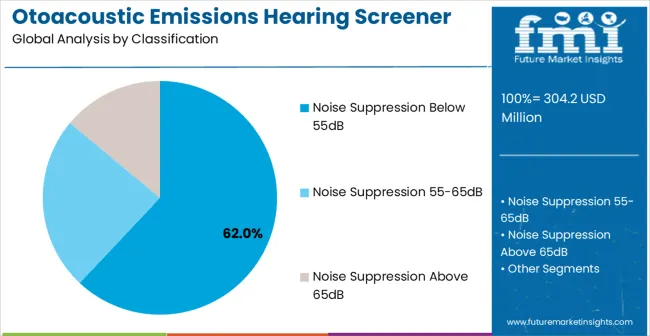

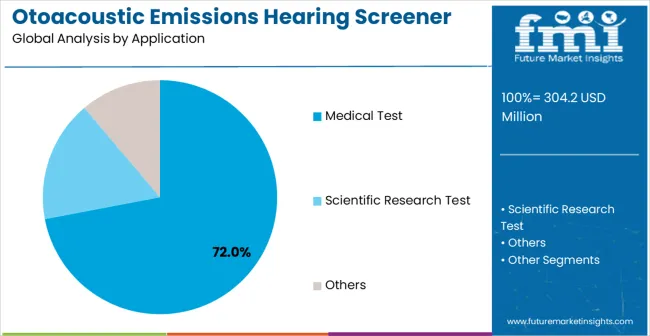

The market is segmented by Noise Suppression Level, Application, and region. By Noise Suppression Level, the market is divided into Noise Suppression Below 55dB, Noise Suppression 55-65dB, Noise Suppression Above 65dB, and Others. Based on the Application, the market is categorized into Medical Test, Scientific Research Test, and Others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Noise Suppression Below 55dB is projected to account for the 62% share of the Otoacoustic Emissions Hearing Screener Market in 2025. This dominant position is supported by the technology's ability to provide highly sensitive hearing assessments in quiet environments, enabling the detection of subtle hearing impairments and giving accurate results in controlled clinical settings. The segment allows stakeholders to benefit from superior signal clarity, reduced background interference, and enhanced diagnostic accuracy that supports reliable hearing screening protocols in professional healthcare environments.

Key advantages include:

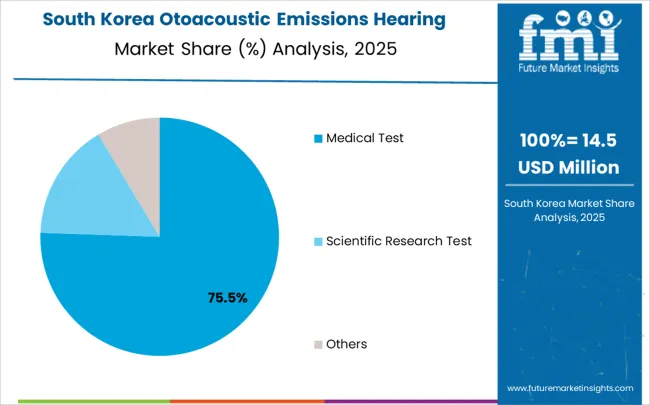

Medical Test applications are expected to represent the 72% share of Otoacoustic Emissions Hearing Screener applications in 2025. This leading position reflects the critical role of otoacoustic emissions testing in clinical diagnostics, newborn hearing screening programs, and routine audiological evaluations, where objective hearing assessment is essential for patient care. The segment provides critical support for healthcare providers conducting hearing assessments in hospitals, clinics, and specialized audiological centers where accurate diagnosis directly impacts treatment planning and patient outcomes. Growth drivers include universal newborn hearing screening mandates, increasing awareness of hearing health importance, and the need for efficient diagnostic tools that provide rapid, non-invasive hearing evaluation across diverse patient populations.

Key market dynamics include:

The market is driven by three concrete demand factors tied to healthcare outcomes. First, universal newborn hearing screening programs implemented in most developed countries create mandatory adoption scenarios, with over 95% of newborns now screened for hearing loss within the first month of life, requiring comprehensive otoacoustic emissions testing infrastructure. Second, aging population demographics drive increasing demand for hearing assessment services, with hearing loss prevalence rising by 25-30% among adults over 65, necessitating efficient screening solutions for early detection and intervention. Third, technological advancement in portable screening devices and automated testing protocols enables cost-effective implementation across diverse healthcare settings while improving diagnostic accuracy and reducing testing time.

Market restraints include high equipment acquisition costs that can deter smaller healthcare facilities from implementing comprehensive hearing screening programs, particularly in developing regions where healthcare budget allocation for specialized equipment remains limited. Technical expertise requirements pose another significant challenge, as implementing and maintaining otoacoustic emissions screening programs require specialized training for healthcare personnel, potentially leading to delays in program deployment and increased operational costs. Regulatory compliance requirements across various healthcare systems introduce additional complexity for manufacturers and healthcare providers, necessitating ongoing adaptation to diverse medical device standards and certification processes.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly in China and India, where expanding healthcare infrastructure and increasing health awareness are driving the implementation of comprehensive hearing screening programs. Design shifts toward portable, wireless screening devices with cloud-based data management capabilities enable telemedicine applications and remote screening programs, extending access to underserved populations. However, the market thesis could face disruption if alternative hearing assessment technologies or significant changes in healthcare screening protocols reduce reliance on traditional otoacoustic emissions testing methods.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| USA | 6.5% |

| UK | 5.8% |

| Japan | 5.1% |

The otoacoustic emissions hearing screener market is gathering pace worldwide, with China taking the lead thanks to rapid healthcare infrastructure expansion and government-backed newborn screening initiatives. Close behind, India benefits from growing healthcare awareness and expanding medical facility networks, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows steady advancement, where integration of advanced diagnostic technologies strengthens its role in the European healthcare equipment supply chain.

Brazil is sharpening its focus on universal healthcare access and preventive screening programs, signaling an ambition to capture growing opportunities in South American healthcare markets. Meanwhile, the USA stands out for its established screening protocols and advanced technology adoption, and the UK and Japan continue to record consistent progress in hearing health programs. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the Otoacoustic Emissions Hearing Screener Market with a CAGR of 9.2% through 2035. The country's leadership position stems from massive healthcare infrastructure expansion, government-mandated newborn hearing screening programs, and increasing awareness of hearing health importance, driving adoption of advanced screening technologies. Growth is concentrated in major metropolitan areas, including Beijing, Shanghai, Guangzhou, and Shenzhen, where hospitals and healthcare centers are implementing comprehensive hearing screening protocols for enhanced patient care and early intervention programs.

Chinese healthcare providers are adopting intelligent screening systems for diagnostic accuracy optimization and patient data management capabilities in high-volume medical facilities. Distribution channels through medical equipment distributors and government-approved suppliers expand deployment across public hospitals, private clinics, and specialized audiological centers. The country's "Healthy China 2030" strategy provides policy support for preventive healthcare initiatives, including advanced hearing screening program implementation.

Key market factors:

In Mumbai, Delhi, Bangalore, and Chennai, adoption of otoacoustic emissions hearing screeners is accelerating across hospitals and healthcare centers, driven by expanding healthcare access and government health insurance programs, creating demand for comprehensive screening services. The market demonstrates strong growth momentum with a CAGR of 8.5% through 2035, linked to comprehensive healthcare infrastructure development and increasing focus on preventive medicine and early detection programs. Indian healthcare providers are implementing advanced screening systems and digital health platforms to enhance diagnostic capabilities while meeting growing patient demand in expanding metropolitan healthcare networks. The country's National Health Mission creates sustained demand for hearing screening solutions, while increasing emphasis on mother and child health drives adoption of newborn screening technologies.

Advanced healthcare sector in Germany demonstrates sophisticated implementation of otoacoustic emissions hearing screening systems, with documented case studies showing 30% improvement in early hearing loss detection rates through comprehensive screening program deployment in major medical centers. The country's healthcare infrastructure in cities including Berlin, Munich, Hamburg, and Frankfurt showcases integration of advanced screening technologies with existing audiological services, leveraging expertise in medical device engineering and precision diagnostics.

German healthcare facilities emphasize quality standards and evidence-based medicine, creating demand for high-accuracy screening solutions that support clinical research initiatives and patient care optimization programs. The market maintains steady growth through focus on medical technology innovation and healthcare quality improvement, with a CAGR of 7.8% through 2035.

Key development areas:

Market expansion in Brazil is driven by diverse healthcare demand, including public hospital systems in São Paulo and Rio de Janeiro, private healthcare networks in major metropolitan areas, and comprehensive healthcare access programs across multiple states. The country demonstrates promising growth potential with a CAGR of 7.1% through 2035, supported by federal health ministry initiatives and state-level healthcare development programs focusing on preventive care and early intervention services.

Brazilian healthcare authorities face implementation challenges related to budget constraints and technical expertise availability, requiring phased deployment approaches and international cooperation for technology transfer and training programs. However, growing healthcare regulations and universal health coverage expansion create compelling adoption scenarios for screening technologies, particularly in metropolitan areas where healthcare infrastructure development directly impacts population health outcomes.

Market characteristics:

The USA market leads in advanced hearing screening innovation based on integration with electronic health records, telemedicine platforms, and artificial intelligence-powered diagnostic analysis for enhanced clinical decision-making. The country shows solid potential with a CAGR of 6.5% through 2035, driven by established newborn hearing screening mandates, comprehensive healthcare quality standards, and ongoing modernization of audiological services across hospitals, clinics, and specialized hearing centers.

American healthcare facilities are adopting intelligent screening systems for workflow optimization and regulatory compliance, particularly in regions with strict healthcare quality requirements and comprehensive insurance coverage for preventive services. Technology deployment channels through medical equipment distributors and direct manufacturer relationships expand coverage across hospital systems, outpatient clinics, and specialized audiological practices.

Leading market segments:

In London, Manchester, Birmingham, and Edinburgh, healthcare systems are implementing otoacoustic emissions hearing screening solutions to meet national health service quality standards and improve patient care outcomes, with documented case studies showing 22% improvement in early hearing loss detection through comprehensive screening programs. The market shows moderate growth potential with a CAGR of 5.8% through 2035, linked to National Health Service quality initiatives and comprehensive healthcare access programs that mandate hearing screening for specific population groups. British healthcare providers are adopting advanced screening technologies and data management platforms to enhance diagnostic accuracy while maintaining cost-effectiveness standards required by public healthcare funding models. The country's established healthcare system creates sustained demand for screening solutions that integrate with existing audiological services and electronic patient record systems.

Market development factors:

Japan's Otoacoustic Emissions Hearing Screener Market demonstrates sophisticated implementation focused on precision healthcare and quality assurance optimization, with documented integration of advanced screening systems achieving 25% improvement in diagnostic consistency across hospitals and specialized audiological centers. The country maintains steady growth momentum with a CAGR of 5.1% through 2035, driven by healthcare facilities' emphasis on quality standards and continuous improvement methodologies that align with evidence-based medicine principles applied to hearing health programs. Major metropolitan areas, including Tokyo, Osaka, Nagoya, and Fukuoka, showcase advanced deployment of intelligent screening platforms where diagnostic systems integrate seamlessly with existing electronic health records and comprehensive patient management systems.

Key market characteristics:

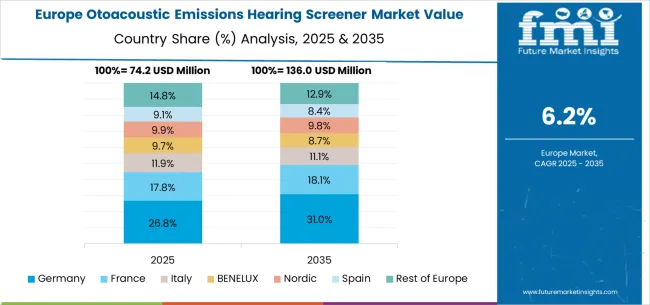

The otoacoustic emissions hearing screener market in Europe is projected to grow from USD 78.3 million in 2025 to USD 147.6 million by 2035, registering a CAGR of 6.5% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 30.8% by 2035, supported by its advanced healthcare infrastructure and comprehensive hearing screening programs across major medical centers in Berlin, Munich, and Frankfurt.

France follows with a 21.4% share in 2025, projected to reach 21.7% by 2035, driven by national healthcare initiatives promoting early detection and comprehensive audiological services in Paris, Lyon, and other metropolitan healthcare networks. The United Kingdom holds an 18.6% share in 2025, expected to maintain 18.3% by 2035 through National Health Service quality standards and hearing screening program implementation. Italy commands a 13.7% share, while Spain accounts for 10.9% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 4.2% to 4.8% by 2035, attributed to increasing hearing screening adoption in Nordic countries and emerging Eastern European healthcare systems implementing comprehensive audiological programs.

The Japanese Otoacoustic Emissions Hearing Screener Market demonstrates a mature and precision-focused landscape, characterized by sophisticated integration of noise suppression technologies with existing healthcare quality management infrastructure across hospitals, specialized audiological centers, and comprehensive hearing health programs. Japan's emphasis on quality assurance and evidence-based medicine drives demand for high-precision screening solutions that support continuous improvement initiatives and clinical research requirements in healthcare delivery.

The market benefits from strong partnerships between international technology providers like Grason-Stadler, Natus, and domestic medical equipment leaders, including RION, creating comprehensive service ecosystems that prioritize diagnostic accuracy and healthcare professional training programs. Healthcare centers in Tokyo, Osaka, Nagoya, and other metropolitan areas showcase advanced screening program implementations where diagnostic systems achieve 96% accuracy through integrated quality control programs, while the country's focus on preventive healthcare and early intervention supports steady adoption of advanced noise suppression and automated screening technologies across diverse healthcare applications.

The South Korean Otoacoustic Emissions Hearing Screener Market is characterized by strong international technology provider presence, with companies like Grason-Stadler, Natus, and Interacoustics maintaining dominant positions through comprehensive system integration and healthcare services capabilities for hospital networks and specialized audiological facilities. The market is demonstrating a growing emphasis on localized technical support and rapid response capabilities, as Korean healthcare providers increasingly demand customized solutions that integrate with domestic healthcare information systems and comprehensive patient management platforms deployed across the Seoul Metropolitan Area and other major medical centers.

Local medical equipment companies and regional healthcare distributors are gaining market share through strategic partnerships with global providers, offering specialized services including healthcare professional training programs and certification services for audiological personnel. The competitive landscape shows increasing collaboration between multinational screening equipment manufacturers and Korean healthcare technology specialists, creating hybrid service models that combine international diagnostic expertise with local market knowledge and healthcare relationship management, particularly in the country's concentrated healthcare regions around Seoul, Busan, and Daegu, where comprehensive medical networks drive continuous demand for advanced hearing screening solutions.

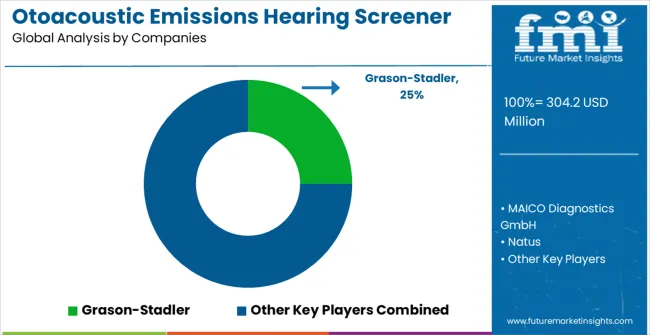

The Otoacoustic Emissions Hearing Screener Market features approximately 12-15 meaningful players with moderate concentration, where the top three companies control roughly 50-55% of global market share through established technology platforms and extensive healthcare industry relationships. Competition centers on technological differentiation, clinical accuracy, and service capabilities rather than price competition alone.

Market leaders include Grason-Stadler, MAICO Diagnostics GmbH, and Natus, which maintain competitive advantages through comprehensive audiological solution portfolios, global distribution networks, and deep healthcare industry expertise, creating high switching costs for customers. These companies leverage installed base relationships and ongoing service contracts to defend market positions while expanding into adjacent diagnostic applications.

Challengers encompass RION and E3 Diagnostics, which compete through specialized screening solutions and strong regional presence in key healthcare markets. Technology specialists, including Interacoustics, Baxter, and Neurosoft, focus on specific screening technologies or vertical applications, offering differentiated capabilities in noise suppression, portable screening systems, and data management platforms.

Regional players and emerging technology providers create competitive pressure through cost-effective solutions and rapid deployment capabilities, particularly in high-growth markets including China and India, where local presence provides advantages in customer support and regulatory compliance. Market dynamics favor companies that combine advanced acoustic technologies with comprehensive healthcare service offerings that address the complete screening system lifecycle from installation through ongoing clinical support and maintenance optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 304.2 million |

| Noise Suppression Level | Noise Suppression Below 55dB, Noise Suppression 55-65dB, Noise Suppression Above 65dB, Others |

| Application | Medical Test, Scientific Research Test, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, the USA, the UK, Japan, and 40+ countries |

| Key Companies Profiled | Grason-Stadler, MAICO Diagnostics GmbH, Natus, RION, E3 Diagnostics, Interacoustics, Baxter, Neurosoft |

| Additional Attributes | Dollar sales by noise suppression level and application categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with technology providers and healthcare equipment manufacturers, healthcare facility preferences and requirements, integration with digital health platforms and telemedicine applications, innovations in acoustic technology and portable screening systems, and development of specialized screening applications with clinical accuracy capabilities. |

The global otoacoustic emissions hearing screener market is estimated to be valued at USD 304.2 million in 2025.

The market size for the otoacoustic emissions hearing screener market is projected to reach USD 587.4 million by 2035.

The otoacoustic emissions hearing screener market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in otoacoustic emissions hearing screener market are noise suppression below 55db, noise suppression 55-65db and noise suppression above 65db.

In terms of application, medical test segment to command 72.0% share in the otoacoustic emissions hearing screener market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Photoacoustic Tomography Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Microscopy Market Growth – Industry Trends & Forecast 2024-2034

Emissions Management Market Size and Share Forecast Outlook 2025 to 2035

Vision Screener Market Size and Share Forecast Outlook 2025 to 2035

Hearing Aids Market Forecast and Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Hearing Implant Market Analysis - Trends & Forecast 2025 to 2035

Hearing Amplifiers Market

Hearing Aid Dehumidifier Market

Sheep Shearing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Custom Hearing Aids Market Growth - Trends & Forecast 2025 to 2035

Bluetooth Hearing Aids Market Trends – Growth & Forecast 2025 to 2035

Bone Conduction Hearing Devices Market

Smart Behind-The-Ear Hearing Aid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA