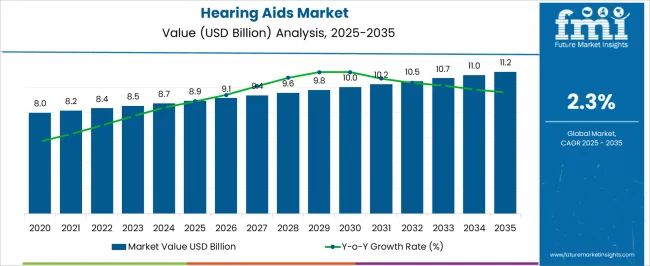

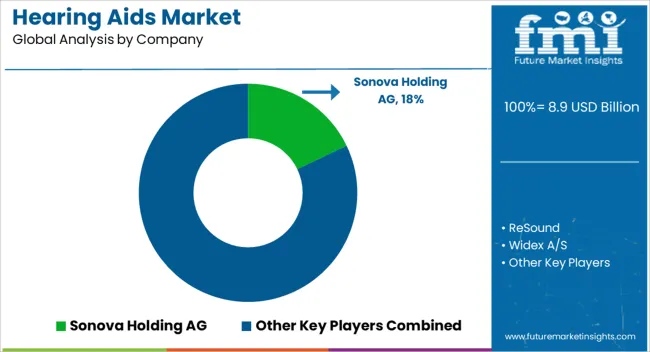

The Hearing Aids Market is estimated to be valued at USD 8.9 billion in 2025 and is projected to reach USD 11.2 billion by 2035, registering a compound annual growth rate (CAGR) of 2.3% over the forecast period.

The hearing aids market is experiencing robust expansion. Increasing prevalence of hearing loss, rising awareness of early diagnosis, and advancements in hearing technology are driving global demand. Current market trends reflect growing acceptance of modern, discreet, and technologically enhanced hearing solutions.

Manufacturers are focusing on improving sound clarity, wireless connectivity, and user comfort to address evolving consumer expectations. Supportive healthcare policies, expanding insurance coverage, and growing adoption among the aging population are further supporting market penetration. Technological innovation, particularly in miniaturization and digital processing, is enhancing product performance and satisfaction levels.

The future outlook remains positive, with integration of artificial intelligence, tele-audiology, and data-driven hearing management expected to redefine user experience The market’s growth rationale is supported by strong demand from both clinical and retail channels, increasing accessibility through online distribution, and a continuous shift toward personalized and programmable hearing devices.

| Metric | Value |

|---|---|

| Hearing Aids Market Estimated Value in (2025 E) | USD 8.9 billion |

| Hearing Aids Market Forecast Value in (2035 F) | USD 11.2 billion |

| Forecast CAGR (2025 to 2035) | 2.3% |

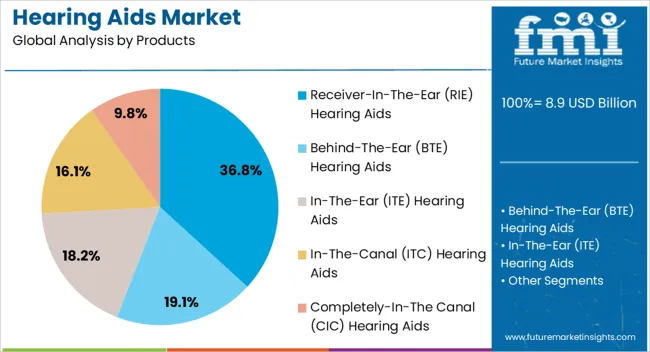

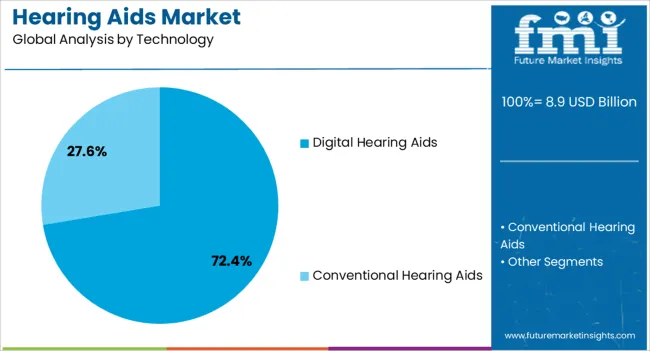

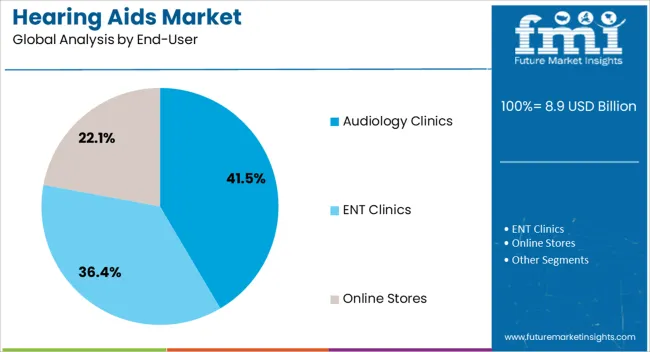

The market is segmented by Products, Technology, and End-User and region. By Products, the market is divided into Receiver-In-The-Ear (RIE) Hearing Aids, Behind-The-Ear (BTE) Hearing Aids, In-The-Ear (ITE) Hearing Aids, In-The-Canal (ITC) Hearing Aids, and Completely-In-The Canal (CIC) Hearing Aids. In terms of Technology, the market is classified into Digital Hearing Aids and Conventional Hearing Aids. Based on End-User, the market is segmented into Audiology Clinics, ENT Clinics, and Online Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The receiver-in-the-ear (RIE) hearing aids segment, holding 36.80% of the product category, has emerged as the leading type due to its compact design, superior sound quality, and enhanced comfort. Its popularity has been reinforced by its ability to combine aesthetic appeal with advanced functionality, making it a preferred choice among both first-time and experienced users.

Continuous technological refinements have improved sound amplification, reduced feedback, and provided seamless connectivity with smartphones and other devices. Manufacturers are focusing on offering customizable fitting options, ensuring greater user satisfaction and long-term adoption.

Increasing retail availability, coupled with supportive clinical recommendations, has strengthened this segment’s market position Continued innovations in wireless technology and moisture resistance are expected to enhance product longevity and sustain demand in both developed and emerging regions.

The digital hearing aids segment, representing 72.40% of the technology category, has maintained its dominant position owing to superior sound processing capabilities and user adaptability. This segment’s growth is driven by advancements in digital signal processing, allowing for real-time sound environment adjustments and noise reduction.

The transition from analog to digital devices has become nearly universal due to improved performance, user comfort, and connectivity features. Integration with mobile applications and remote programming options has enhanced convenience and accessibility.

Manufacturers are investing heavily in artificial intelligence and machine learning technologies to further optimize sound quality and personalization The combination of precision, programmability, and compact form factor ensures that digital hearing aids continue to hold the largest share, with adoption accelerating across all demographic segments.

The audiology clinics segment, accounting for 41.50% of the end-user category, has been leading due to its central role in diagnostics, device fitting, and aftercare services. These clinics serve as the primary distribution and consultation centers for hearing aid users, ensuring professional assessment and customization.

High patient trust, availability of skilled audiologists, and access to advanced diagnostic tools have strengthened their dominance. Collaboration between hearing aid manufacturers and clinic networks has streamlined supply chains and improved service quality.

The segment also benefits from growing awareness about the importance of professional fitting and maintenance, which enhances long-term device performance As awareness programs and government initiatives expand hearing care infrastructure, audiology clinics are expected to maintain a leading role in facilitating product adoption and patient satisfaction globally.

Over the last half-decade, the hearing aids sector has witnessed a favorable trend, with a CAGR of 0.1%. The hearing aids market is expected to continue expanding, albeit at a slow pace, with a projected CAGR of 2.3% through the year 2035.

| Historical CAGR | 0.1% |

|---|

Healthcare providers in developing countries require more financial resources to invest in modern technologies, such as advanced hearing aids. This requires extensive research and development and extensive staff training for safe and efficient maintenance. The development in the hearing aids market leads to increased manufacturing costs and higher prices for the end customers.

Crucial factors that are anticipated to influence the demand for hearing aids through 2035.

Industry participants are going to desire to be wise and flexible over the anticipated period since these difficult attributes position the industry for success in subsequent decades.

Global Hearing Aids Market Trends Bluetooth Connectivity

Bluetooth technology has greatly enhanced the global hearing aid industry by improving user engagement and experience. It enables wireless connection to various audio sources, removing the need for cords and adapters.

Bluetooth-enabled hearing aids provide direct audio streaming, which improves the listening experience. It is also feasible to communicate hands-free, particularly for individuals who struggle with dexterity.

Many hearing aids come with companion mobile apps that allow remote control of settings, allowing users to personalize their listening experience. These aids also integrate with smartphones and tablets, allowing users to receive notifications, access digital assistant services, and control smart home devices directly.

As Bluetooth technology becomes more standardized across devices and platforms, it offers improved compatibility with a wide range of audio sources and accessories, ensuring a seamless user experience. As Bluetooth technology continues to evolve, further innovations are expected to enhance the capabilities and usability of hearing aids, ultimately improving the quality of life for individuals with hearing loss.

Emerging Trend of OTC Hearing Aids Exaggerates Global Demand

The rise of over-the-counter (OTC) hearing aids and direct-to-consumer (DTC) models is revolutionizing the hearing healthcare industry by offering affordable, convenient options for mild to moderate hearing loss.

A larger spectrum of customers are able to employ these gadgets because they need a prescription or a professional fitting. Because of its simple design and ability to self-fit, consumers may alter their gadgets without making additional appointments.

High-quality sound amplification is ensured via wireless connectivity, cutting-edge digital signal processing technology, and configurable features available on some models. Regulatory agencies such as the FDA have implemented new regulations to facilitate the market's introduction.

The trend of using over-the-counter (OTC) hearing aids and direct-to-consumer (DTC) hearing aids is expected to persist, providing greater accessibility and empowerment to individuals with hearing impairment.

Advancements in Self-fitting Hearing Aids Skyrockets in Hearing Aids Market

Self-fitting hearing aids have revolutionized the hearing technology market by eliminating the need for multiple appointments with audiologists or healthcare professionals, making hearing aids more accessible to a wider population.

The hearing impairment devices allow users to customize and adjust according to their preferences, enhancing their satisfaction and engagement. The aids are also more cost effective than traditional hearing aids, making them more accessible to those for whom higher costs may have deterred the demand for hearing aids.

Self-fitting hearing aids also use advanced digital signal processing technology and wireless connectivity features, providing high-quality sound amplification and connectivity options. As technology evolves and regulatory barriers are addressed, self-fitting hearing aids are poised to become increasingly prevalent, driving market growth and improving the quality of life for individuals with hearing impairment.

This section offers in-depth analyses of particular hearing impairment aids market sectors. The two main topics of the research are the segment with the Receiver-In-The-Ear (RIE) hearing aids and the audiology clinics as an end-user segment.

Through a comprehensive examination, this section provides a fuller knowledge of these segments and their relevance in the larger hearing assistance devices market context.

| Attributes | Details |

|---|---|

| Top Product | Receiver-in-the-Ear (RIE) Hearing Aids |

| Market share in 2025 | 83% |

The need to preserve optimal conditions for the infrastructure supporting hearing healthcare drives the need for RIE hearing aids. The following factors, which together account for a significant 83% of the market in 2025, illustrate the rise in demand for receiver-in-the-ear (RIE) hearing aids:

| Attributes | Details |

|---|---|

| Top End User | Audiology Clinics |

| Market share in 2025 | 47% |

The growing demand for hearing aids is developed in the audiology clinics, acquiring almost 47% of the market share in 2025. The demand for hearing aids in audiology clinics is displayed from the following drivers:

China, Japan, Germany, India, and the United Kingdom are some of the most predominant nations on the global stage, and this section anticipates looking at their auditory devices market. Examine the several aspects influencing these nations' need for, acceptance of, and interactions with hearing aids via a thorough investigation.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| China | 4.5% |

| Japan | 1.9% |

| United Kingdom | 2.3% |

| Germany | 2.8% |

| India | 7.1% |

The hearing aids market in China is expected to develop at a CAGR of 4.5%. A significant number of assistive listening devices and a growing geriatric population in China drive the industry. The following factors are propelling the industry's expansion:

The United Kingdom's ENT healthcare sector is embracing novel and modern hearing aids due to rising demand. The industry is developing with a CAGR of 2.3% from 2025 to 2035. Here are a few of the major trends:

The hearing aid industry in Germany is adopting modern technology for the treatment of hearing. The sector is predicted to grow at a CAGR of 2.8% between 2025 and 2035. Some of the primary trends in the industry are:

Japan's digital hearing aid demand is anticipated to swell in the forthcoming decade, owing to the highly developed ENT treatment sector. The market is expected to register a CAGR of 1.9% by 2035. Among the primary drivers are:

The Indian ENT treatment sector develops a significant demand for advanced hearing aids. The demand for hearing aids is expected to increase at a CAGR of approximately 7.1% from 2025 to 2035. Some of the primary trends are:

The global hearing aids industry is being significantly shaped by market players who invest heavily in research and development, introduce new features, and expand their product portfolios to cater to diverse consumer needs.

The companies offer a wide range of hearing aid models, including behind-the-ear (BTE), in-the-ear (ITE), receiver-in-the-ear (RIE), and completely-in-the-canal (CIC), with varying styles, features, and price points.

Companies aim to make hearing aids more accessible and affordable by implementing pricing strategies, offering financing options, and partnering with insurance providers. The key players also explore innovative distribution channels and direct-to-consumer models to reach underserved markets.

Market players collaborate with healthcare providers, audiologists, and research institutions to enhance product development, promote awareness, and improve access to hearing healthcare services. Many of the prominent organizations ensure compliance with regulatory standards to maintain product quality, safety, and efficacy.

The manufacturers of hearing aids prioritize customer experience by offering personalized consultations, fitting services, and ongoing user support. The market players invest in customer education programs, user-friendly interfaces, and remote care solutions to enhance satisfaction and loyalty among hearing aid users.

Market players play a pivotal role in shaping the outlook of the global hearing aids industry by driving innovation, expanding access, fostering partnerships, ensuring compliance, and delivering exceptional customer experiences.

Recent Developments in the Hearing Aids Industry

The global hearing aids market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the hearing aids market is projected to reach USD 11.2 billion by 2035.

The hearing aids market is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in hearing aids market are receiver-in-the-ear (rie) hearing aids, behind-the-ear (bte) hearing aids, in-the-ear (ite) hearing aids, in-the-canal (itc) hearing aids and completely-in-the canal (cic) hearing aids.

In terms of technology, digital hearing aids segment to command 72.4% share in the hearing aids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Custom Hearing Aids Market Growth - Trends & Forecast 2025 to 2035

Bluetooth Hearing Aids Market Trends – Growth & Forecast 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Hearing Implant Market Analysis - Trends & Forecast 2025 to 2035

Hearing Amplifiers Market

Hearing Aid Dehumidifier Market

Sheep Shearing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bone Conduction Hearing Devices Market

Smart Behind-The-Ear Hearing Aid Market Size and Share Forecast Outlook 2025 to 2035

Otoacoustic Emissions Hearing Screener Market Size and Share Forecast Outlook 2025 to 2035

AIDS Related Primary CNS Lymphoma Market Report – Growth & Forecast 2025 to 2035

Mobility Aids and Transportation Equipment Market is segmented by Product and Distribution Channel from 2025 to 2035

Digestion Aids Market Size and Share Forecast Outlook 2025 to 2035

Ambulatory Aids Market Size and Share Forecast Outlook 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Bariatric Walking Aids Market Size and Share Forecast Outlook 2025 to 2035

Plaque Disclosing Aids Market Size and Share Forecast Outlook 2025 to 2035

Infant Positioning Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA