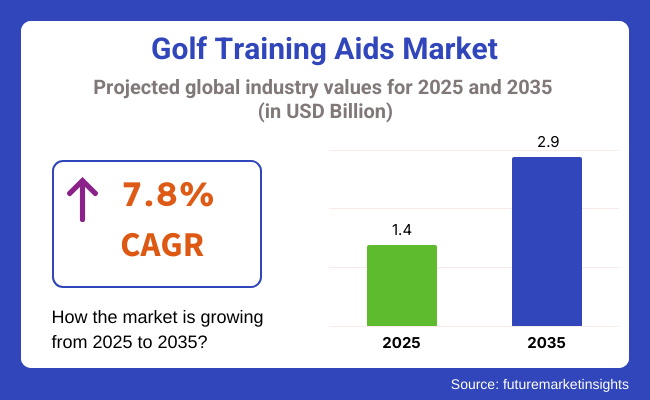

The value of the global golf training aids market was USD 1.4 billion in 2025 and is projected to grow at a 7.8% CAGR between 2025 and 2035. The global golf training aids industry is forecast to be worth USD 2.9 billion in 2035.

Behind this trend, one of the driving forces is the widespread usage of technologically advanced training apparatus and the rising take-up of playing golf as both a recreational activity and competitive game in emerging economies as well as developed ones.

Golf is now more accessible and more technology-oriented as a sport. With growing interest in the younger generation, particularly from nations such as North America, Europe, and part of Asia, there has been a rising demand for intelligent, interactive practice systems.

Machines such as swing analyzers, putting mats, launch monitors, and virtual simulators are now common among golfers looking to improve their game beyond traditional courses.Post-pandemic normalization of mixed lifestyles has played a key role in driving home-based sports training, including golf. Golfers are spending money on equipment that makes training possible within small spaces or home settings.

The convenience and privacy of home training have contributed to the popularity of items such as portable nets, alignment sticks, and putting greens, leading to a secondary level of demand beyond elite or professional use.

Product innovation is also driving expansion. Training aids now feature 8.8 real-time feedback, motion sensors, AI-driven swing correction, and app integration. These features are enticing not only proficient golfers but also beginners in search of structured learning.

With user experience being enhanced as interactive and gamified, new consumers are being drawn into golf through fun, technology-led introductions.The expansion of digital coaching websites is complementing training aid purchases.

More and more golf instructors are integrating personal training aid information into online coaching, and the line between amateur and professional coaching is blurring. The ecosystem of physical aids-digital feedback systems will propel demand in the long term since it is driven by steady rises in golf travel and popular passion for international events.

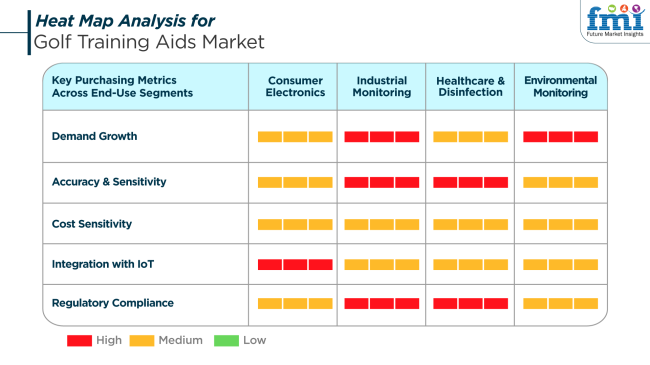

In the consumer purchase behavior of golf training aids, user experience, customization, and cross-platform connectivity are directly related. In the consumer electronics segment, Bluetooth-enabled aids, real-time analysis, and app-related coaching are becoming increasingly popular. Mobile integration allows users to view performance metrics and track improvement over time, thereby increasing engagement.

Industrial and institutional clients such as sports clubs or golf academies-prioritize very high accuracy and regulatory reliability, particularly for equipment used in formal training. They want products that offer strong performance across a range of user-profiles and are simple to integrate into training curricula.

These clients also value high conformity with safety and digital interoperability standards.In healthcare applications, such as rehabilitation using modified golf training aids, sensitivity and motion control are of greater importance.

Therapists and trainers prefer aids that enable precise biomechanics and low-impact feedback. Environmental monitoring enters indirectly, especially if training aids are used outdoors in weather conditions of various intensities. In such an instance, IoT-enabled systems modifying for wind, terrain, or light contribute to the realism of training.

The golf training aids industry is subject to various risks, the most important being technological obsolescence, niche audience constraints, and price pressure. With the increasing saturation of smart products, customer expectations are shooting up. Those companies that cannot innovate at the moment risk losing out as new players launch more interactive or AI-based systems.

The industry is niche, which implies that scalability is a concern. While participation in golf globally is on the rise, it remains a niche segment of the broader sports equipment industry. Therefore, growth rests heavily on the conversion of infrequent users to regular players, which can be a function of economic cycles or shifts in leisure behaviors.

The high-tech aid premium pricing can limit adoption, especially by new or infrequent players. If the investment does not match the perceived value, users may switch to low-cost, traditional methods or online free materials. To sustain growth, industry participants must balance innovation with affordability, locking in long-term user loyalty through price, relevance, and education.

From 2020 to 2024, the golf training aids market saw exponential growth as the sport rose in popularity following and as a result of the pandemic. With socially distant and outdoor activity becoming more attractive, everyone moved to golf, and demand for home-compliant training solutions exploded.

These included putting mats, swing trainers, alignment aids, and launch monitors. Intelligent sensors and digital coaching software also became popular, allowing golfers to enhance off-the-course commentary and tighten their technique.

During the forecast period 2025 to 2035, the industry will undergo a revolutionary shift with AI-driven performance analysis, AR/VR simulation-based training, and wearable technology incorporation. High-end motion detectors and biomechanical data acquisition devices will provide real-time swing diagnosis and injury prevention tips.

Virtual golfing environments with AR/VR will go mainstream, enabling practice sessions and competitive virtual tournaments. Also, ecologically friendly and ergonomic designs will shape new product development, attracting a broader demographic, including younger, more technology-oriented players and health-oriented consumers.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Golf revival after the pandemic, higher demand for outdoor, individual sports and home training. | Requirement for technology-enabled, immersive, data-driven training tools with a focus on performance and wellness. |

| Recreational golfers, beginners, and home learners. | Empowered younger players and part-time pros, and fit older players through technology. |

| Utilization of digital swing analyzers, launch monitors, and putting aids. | Adoption of AI, AR/VR golf simulators, and wearable biomechanics devices for enhanced feedback. |

| Home-based at the start, with simple and portable aids. | Hybrid configurations combining home, virtual reality, and intelligent course settings. |

| Standing mats, alignment sticks, nets, and mobile coaching applications. | Immersive training pods, AI-enabled virtual coaching, and eco-friendly, ergonomic gear. |

| E-commerce, pro shops, golf academies. | Multi-channel: direct-to-consumer internet websites, virtual reality golf networks, and combined coaching platforms. |

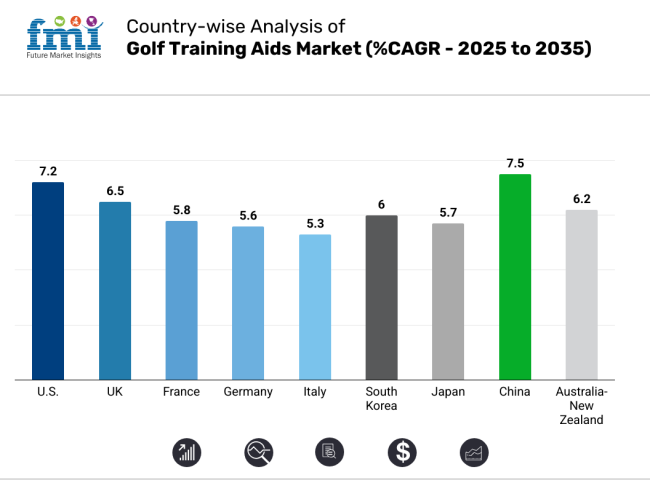

The USA is anticipated to rise at 7.2% CAGR between the years under study. The nation has a mature and strongly rooted golfing culture, sustained by an expansive network of golf courses and a strong consumer base pursuing performance enhancement using sophisticated equipment.

Growing participation in recreational golf, as well as expenditures on digital instruction and swing assessment devices, is fueling the demand for golf training aids. In addition, a high level of product innovation among technologically developed manufacturers and its presence has put in place optimum conditions for a long-term rise.

The increased application of indoor golf simulators and virtual coaching platforms also affects the trend of demand for smart training tools among amateur golfers and pros.

Increased disposable income and prioritization of wellbeing and recreation are driving consumer intentions to spend more on products and growing skills. In addition, youth development initiatives and growth in college golf programs have provided long-term participation opportunities, thus promoting demand for training equipment suitable for skill development.

The UK will grow at 6.5% CAGR throughout the study. The country has experienced consistent participation in golf over the last decade, driven primarily by a historical affinity for the game and a large public and private golf course network. Advances in training technologies, including mobile apps, launch monitors, and swing analyzers, are drawing customers interested in improving performance in a systematic and quantifiable way.

The growing popularity of junior golf academies and the development of club-based coaching schemes are also further enhancing the need for tailored training equipment. UK consumers are increasingly switching to modern, technologically enabled devices that provide immediate feedback.

The change to individual practice routines has triggered the development of the home-use sector, notably putting mats and swing trainers. In addition, increasing health consciousness and the inclusion of golf in corporate fitness programs are leading to an expanded customer base. Retail companies are investing in experience-based products and online shopping portals, making products more accessible and leading to increased adoption of golf training devices.

France will grow at a CAGR of 5.8% over the study period. The golfing population of France has experienced progressive growth with increased government emphasis on sports development and infrastructure improvement, especially in the suburbs. Although the industry size is relatively small, the trend toward leisure golf and the introduction of indoor golf centers are generating new channels of demand for training aids.

French consumers prefer small and travel-sized devices that fit urban lifestyles. Demand is being driven by placing alignment tools, grip trainers, and mobile-based swing analyzers that are attractive to beginners and intermediate-level golfers. The addition of golf to school sports programs and joint efforts by golf associations to attract younger audiences are also driving adoption.

In addition, the increasing influence of foreign golfing events held in the country has been instrumental in enhancing public curiosity and investment in the game. Companies with an emphasis on design aesthetics and multi-purpose tools have been gaining ground in this industry.

Germany will grow at 5.6% CAGR over the study period. Increasing numbers of leisure players and retirees opting for golf as a long-term pastime are driving steady demand growth for training aids. Germany's organized sports culture and established coaching system have provided a platform for innovation and performance improvement in amateur ranks. The focus on accuracy and engineering quality has impacted German consumer design preferences, with consumers valuing high-quality, technologically advanced equipment.

Biofeedback, motion capture, and biomechanical support feature products are experiencing increasing adoption, particularly among hardcore hobbyists and early-career professionals. Having a well-established retail network and increasing online penetration guarantees availability across urban and semi-urban areas.

In the meantime, a collaboration between training academies and equipment manufacturers is raising awareness of the benefits of the product, especially for swing trainers and line alignment systems. Growing older player participation is also creating a demand for learning aids to help keep posture, grip strength, and balance.

Italy is predicted to develop at 5.3% CAGR throughout the study. Although traditionally a niche sport in Italy, golf has become more popular over the last few years as it has increasingly been linked with luxury tourism and leisure lifestyles. This steady transformation in attitudes, particularly among the younger professionals and the health-conscious population, is improving the demand for training aids.

Italian golf clubs are investing in upgrading facilities, such as specific training areas with simulators and diagnostic equipment. Users prefer aids like swing speed trainers and mats for regular off-course practice.

The Mediterranean climate provides the opportunity for golfing throughout the year in most areas, maintaining consistent demand. In addition, the influence of celebrity and television coverage of international tournaments has fueled consumer interest in enhancing gameplay.

Even with high digital penetration, offline retailers are still a major point of contact for product discovery, especially in golf-oriented areas like Lombardy and Tuscany. Prospects for future growth will rely on building participation through school programs and planned marketing campaigns.

South Korea is anticipated to grow by 6.0% CAGR over the study period. A nation known for its competitiveness in the world when it comes to golf, South Korea boasts an active ecosystem that facilitates the consumption and production of high-end training aids. Cultural interest in the sport, particularly among youth and women, is being converted into strong consumer expenditure on equipment and training apparatus.

Urban limitations have spurred a growth in screen golf and indoor golf areas, so constant demand for portable, space-saving training devices has been encouraged. Technology-conscious buyers have shown special interest in products like swing analyzers, launch monitors, and feedback-driven grip trainers. Artificial intelligence and IoT-enabled integration are prime differentiators and drivers of adoption.

Also, cooperation between government and industry in the promotion of golf as a lifelong sport is fostering use for purposes other than competition. With a robust domestic production base and export potential, South Korea is becoming a major consumer and innovator in this field.

Japan will register a growth rate of 5.7% CAGR throughout the study period. With an age-old history of golf and a well-disciplined sporting culture, Japan offers a sound-demand scenario for golf training devices. Strong consumer awareness and interest in precision-driven sports equipment enhance the popularity of sophisticated and versatile devices.

Space-saving home-training equipment like putting greens, tempo trainers, and portable swing analyzers are particularly popular because of limited space in urban areas. The nation also enjoys an extensive distribution network, which provides wide product availability through sporting goods outlets and specialty retailers.

Japan's aging population is driving increasing demand for aids that enhance physical balance, flexibility, and swing mechanics. Health monitoring and real-time guidance support innovations are attracting interest. Training facilities throughout Japan are incorporating these products into their teaching, enhancing product credibility and building reach among new players.

China will have a 7.5% CAGR throughout the study. Economic development, urbanization, and an increasing middle class have transformed golf in China at a rapid pace. Though golf was a traditionally elite sport, it is becoming increasingly accessible, and as a result, demand for training equipment suited for new players is increasing dramatically.

E-learning portals and smartphone-based golf coaching apps are broadening awareness and empowering users to consume training products without assistance. Demand is being pushed by a young demographic that exhibits high digital inclination, using app-connected and game-based training tools.

The government's encouragement to promote sports engagement and infrastructure investment indirectly benefited the golf ecosystem. Metropolitan cities such as Shenzhen, Beijing, and Shanghai are seeing increased sales of portable home-use aids, particularly placing mats, swing trainers, and motion sensors. Global brands penetrating China are customizing products according to domestic tastes, balancing sophisticated functionality with affordability to grab mass-market segments.

The Australia-New Zealand region will grow with a 6.2% CAGR throughout the study. Both nations have experienced a revival of outdoor sports, and golf has particularly benefited due to weather conditions, large open spaces, and increasing interest in recreational wellbeing.

The demand for gold training aids is growing due to leisure players' need to enhance the righttechnique. Higher usage of hybrid practice-pairing digital analytics with physical devices-is catching up around metropolitan areas.

Independent practice-enabled products are widely sought in Australia and New Zealand. The demand also draws on golf tourism and retirement complex development, wherein golfing becomes a part of life planning.

Online shopping websites play a major role in linking global brands with consumers, providing a variety of training aids and educational content. Ongoing investment in youth programs and public course development is likely to support long-term growth.

By product type, hitting nets are expected to dominate with a 38.2% share in 2025, while hitting mats are expected to remain at about 15%. This segmentation is indicative of a growing trend toward demand for indoor practice solutions such as home practice with golf simulators and limited-space practice among amateur and recreational golfers who wish to sharpen their swing mechanics and accuracy.

Hitting nets are useful, portable, and easy to set up. It enables golfers to practice full swings within limited restraints in either an indoor setting or their garage, or backyard-hitting range visits are spared. Rukket Sports, Callaway, and Spornia have some big-selling collapsible net systems.

The Spornia SPG-7 net, for example, has taken off with a cult following thanks to its features, such as ball returns and easy setup. It is made of sturdy material that is great for year-round use. The remote work trend and a renewed interest in fitness have turned hitting nets into a convenient and economical solution for daily practice.

The remaining 15% share is represented by hitting mats. These mats mimic the feel of turf, either simulating fairway or rough grass conditions to train on stance, alignment, and contact. Best sellers from Fiberbuilt and Real Feel Golf Mats relieve the stress on joints while providing incredibly realistic feedback on club impact.

The lower share indicates that they are primarily purchased with the nets and not on their own and that they carry great importance in bringing the experience of an outdoor course into the indoor or simulator environment.

In terms of application, the commercial segment will dominate with 52% of the total share in 2025, while use at household/personal usage will hold 48%. This segmentation shows that golf training aids have become imperative for professionals and also those seeking recreation due to various needs among consumers.

Commercial applications, which encompass golf courses, driving ranges, country clubs, and professional golf trainers, bring most of the revenue, as training aids are used to enhance performance and draw customers.

Such commercial golf destinations and driving ranges continuously invest in high-quality training-transforming equipment, including high-tech golf simulators and hitting nets to provide customers with a higher standard of practice. Companies such as Foresight Sports, TrackMan, and SkyTrak have made a mark with their highly advanced simulators and launch monitors.

The use of this type of product, mostly adopted by professional and serious golfers for swing analysis, ball trajectory, and performance metrics, plays a role in the sales growth of the commercial segment.

On the other hand, household and personal use will hold 48% of the revenue share. This group represents those golf enthusiasts who either practice inside their homes or practice in their backyards, especially at this time when the majority are turning to home fitness and recreational activity.

The increased availability of training aids at affordable and easy-to-carry prices propelled the growth in this area. Rukket Sports, Callaway, SKLZ, and others have all moved into affordable, significant space-saving nets, mats, and swing training devices for golfers who desire convenience and the ability to practice at home. Also, advancements in online tutorials and virtual coaching will instigate more golfers to incorporate home practice into their schedules, which will increase the demand for personal training aids.

The golf training aids industry is dominated by a number of established brands with a broad array of innovative products to help golfers at all levels improve their skills. Key leaders such as Victor and Skytrak lead with innovative technologies and premium quality training aids that suit amateur and professional golfers alike. Victor, with its high-accuracy and simulation capabilities, is a leading pick among golfers that aim to enhance their game with data-driven analysis and training.

Skytrak stands out with its groundbreaking golf launch monitor, which provides golfers with precise performance data to enhance their skills and has become a favorite tool for indoor practice rounds. Other leading brands like Optishot Golf and Foresightsports specialize in high-class simulators as well as training systems that provide golfers with comprehensive feedback and analysis on their swing.

These businesses are now a must-have in training regimens by serious golfers because of how precise and steadfast they provide performance monitoring.To the residential and commercial markets, players like Golfzon and Wingstar appeal by delivering easy-to-use, economical devices for all skill levels of golfers. There are new small players like Greenioy and Golftime building up their brands by providing efficient, economical solutions to traditional systems that appeal to a wider demographic.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Victor | 18-22% |

| Skytrak | 15-18% |

| Optishot Golf | 12-15% |

| Foresightsports | 10-13% |

| Wingstar | 8-10% |

| Other Players | 33-37% |

Key Company Insights

Victor dominates the golf training aids industry with a projected 18-22% share. The reputation of the company for delivering quality golf simulators and launch monitors has established it as a favorite among golfers looking for accurate data and authentic training experiences. Skytrak, accounting for 15-18% share, is famous for its cutting-edge, low-cost, and portable launch monitor that offers golfers detailed swing analysis and performance feedback.

Optishot Golf takes 12-15% of the overall revenue, providing a low-cost but innovative indoor golf simulator that is attractive to casual golfers and for home practice. Foresightsports takes about 10-13% of the share, providing high-end professional-level training equipment, such as simulators, which are often utilized by golf courses and instructors. Wingstar secures an 8-10% share with its versatile and easy-to-use products that cater to both beginners and intermediate golfers, providing excellent value and ease of use.

The segmentation is into Hitting Mats, Hitting Nets, Putting Mats, Strength Trainers, Swing Trainers, Training Putters, and Others.

The segmentation is into Commercial and Household/Personal.

The segmentation is into Below 20 years, 20 to 40 years, and 40 years and Above.

The segmentation is into Online (E-commerce Website, Company Website) and Offline (Supermarket/Hypermarket, Brand Stores, Camping Goods Stores).

The report covers North America, Europe, Asia Pacific, Latin America, and The Middle East & Africa.

The golf training aids industry is expected to reach a valuation of USD 1.4 billion in 2025.

The market is projected to grow to USD 2.9 billion by 2035.

The market is expected to grow at a CAGR of approximately 7.5% during the forecast period.

Hitting nets are a key segment in the golf training aids market.

Key players include Victor, Skytrak, Optishot Golf, Foresightsports, Wingstar, Golftime, Greenioy, Ingersoll Rand, Golfzon, and Nike.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 4: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 11: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 12: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 21: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 13: Global Market Attractiveness by Type, 2024 to 2034

Figure 14: Global Market Attractiveness by Application, 2024 to 2034

Figure 15: Global Market Attractiveness by Region, 2024 to 2034

Figure 16: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 17: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 18: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 28: North America Market Attractiveness by Type, 2024 to 2034

Figure 29: North America Market Attractiveness by Application, 2024 to 2034

Figure 30: North America Market Attractiveness by Country, 2024 to 2034

Figure 31: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 32: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 33: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 43: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 44: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 45: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 46: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 47: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 48: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 52: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 58: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 59: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 60: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 61: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 62: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 73: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 74: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 75: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 76: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 77: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 89: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 91: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 100: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 103: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 104: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 105: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 106: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 107: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 118: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 119: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 120: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Golf Cart Batteries Market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Golf Ball Picker Robot Market Size and Share Forecast Outlook 2025 to 2035

Golf Course Maintenance Robot Market Size and Share Forecast Outlook 2025 to 2035

Golf Putter Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Battery Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Market Analysis - Size, Share, and Forecast 2025 to 2035

Golf Outfit Market Growth - Trends & Forecast 2025 to 2035

Golf Tourism Market Analysis - Size, Share, and Forecast 2025 to 2035

Golf Shoes Market Analysis – Growth, Demand & Forecast 2024-2034

UK Golf Tourism Market Analysis

USA Golf Tourism Market Analysis

Japan Golf Tourism Market Analysis

Europe Golf Tourism Market Insights - Growth & Forecast 2025 to 2035

Germany Golf Tourism Market Trends – Growth, Demand & Forecast 2025–2035

Electric Golf Cart Market Growth – Trends & Forecast 2025 to 2035

GCC Electric Golf Cart Market Outlook – Demand, Growth & Forecast 2025-2035

GCC Countries Golf Tourism Market Analysis – Growth, Trends & Forecast 2025–2035

ASEAN Electric Golf Cart Market Trends – Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA