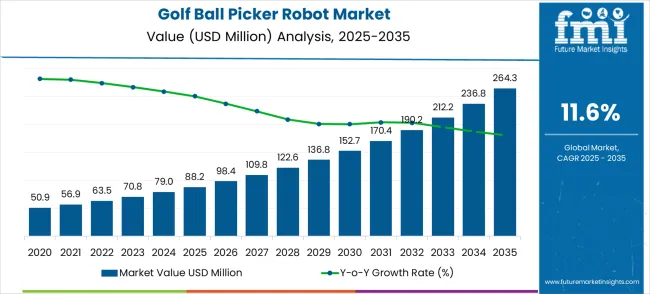

The golf ball picker robot market, valued at USD 88.2 million in 2025 and expected to reach USD 264.3 million by 2035 at a CAGR of 11.6%, shows notable sensitivity to macroeconomic conditions while maintaining consistent growth. Elasticity of growth highlights how demand responds to shifts in economic indicators such as household income, tourism activity, and recreational spending. Higher household income levels in developed and emerging regions increase adoption of autonomous golf course equipment. Expansion in golf courses and leisure tourism further supports market growth, indicating high responsiveness to positive economic trends.

During economic slowdowns or reductions in discretionary spending, demand may temporarily moderate. The market remains moderately resilient where automation improves operational efficiency and reduces labor requirements. Advanced features like AI-assisted navigation, energy-efficient power systems, and user-friendly interfaces enhance the value proposition and support continued adoption.

Short-term fluctuations in the economy create minor variations in uptake, but long-term expansion is sustained by technological innovation and growing interest in autonomous solutions. The projected CAGR of 11.6% reflects the market’s ability to respond to economic factors while maintaining steady growth, driven by both cost-effectiveness for operators and rising interest in automated maintenance solutions across golf facilities worldwide

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 88.2 million |

| Forecast Value in (2035F) | USD 264.3 million |

| Forecast CAGR (2025 to 2035) | 11.6% |

From 2030 to 2035, the market is forecast to grow from USD 152.7 million to USD 264.3 million, adding another USD 111.6 million, which constitutes 63.4% of the ten-year expansion. This period is expected to be characterized by the expansion of artificial intelligence integration in robotic systems, the integration of advanced navigation and obstacle detection technologies, and the development of specialized robots for diverse terrain conditions and facility requirements.

Between 2020 and 2025, the golf ball picker robot market experienced rapid growth, driven by increasing labor cost pressures in golf facility operations and growing recognition of robotic systems as effective solutions for consistent and efficient ball collection with reduced manual labor requirements. The market developed as golf course operators recognized the potential for automated ball picking to enhance operational efficiency while providing consistent service quality and reducing labor dependency. Technological advancement in autonomous navigation and robotic systems began prioritizing the critical importance of maintaining reliable operation and precise ball collection capabilities in diverse outdoor environments.

The growing focus on operational efficiency and cost optimization is driving demand for golf ball picker robots that can support automated facility maintenance, reduce manual labor requirements, and enable consistent service delivery without compromising operational quality or facility appearance. Golf facility operators' preference for equipment that combines automation capabilities with operational reliability and cost-effectiveness is creating opportunities for innovative robotic implementations. The rising influence of facility modernization and competitive operational pressures is also contributing to increased adoption of golf ball picker robots that can provide efficient automation solutions while supporting enhanced customer experience and facility management.

Market expansion is being supported by the increasing global demand for labor-efficient golf facility operations and the corresponding need for automated maintenance solutions that can provide consistent ball collection performance while reducing operational costs across various recreational facilities. Modern golf course operators are increasingly focused on implementing robotic solutions that can enhance operational efficiency, reduce labor dependency, and provide reliable service quality under diverse weather and terrain conditions. Golf ball picker robots' proven ability to deliver autonomous operation, consistent performance, and operational cost savings makes them essential equipment for contemporary golf facility management and sports venue operations.

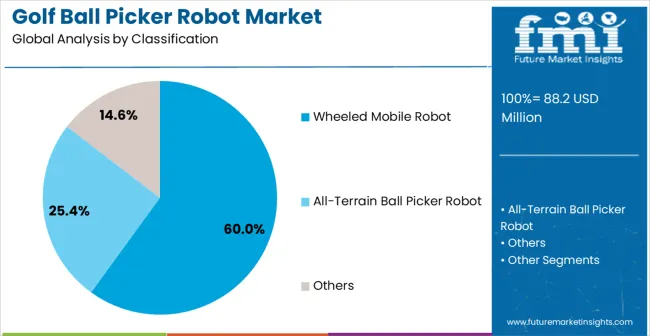

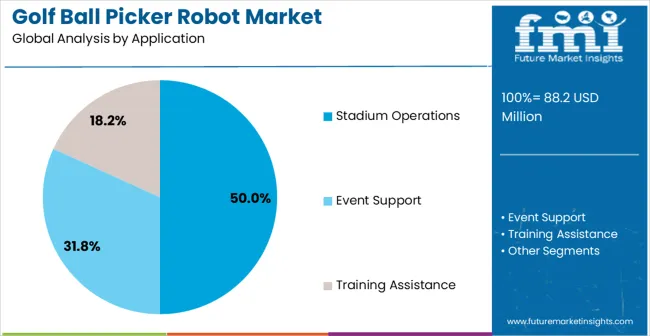

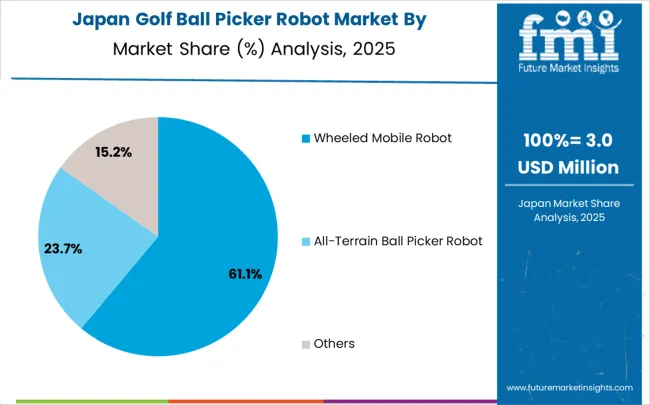

The golf ball picker robot market is expanding, driven by rising automation in golf course operations and event management. Wheeled mobile robots dominate the robot type segment with a 60% market share, while all-terrain ball picker robots account for around 40%. In terms of application, stadium operations lead with a 50% share, followed by event support at 30% and training assistance at 20%. These segments represent the primary areas for investment, reflecting strong adoption in golf courses, sports venues, and training facilities, where efficiency, time-saving, and labor reduction are increasingly prioritized.

Wheeled mobile robots, holding a 60% share of the robot type segment, are the most widely used due to their efficiency, cost-effectiveness, and ease of navigation on standard golf course terrains. These robots are ideal for stadium greens and fairways, providing fast and accurate ball collection while minimizing labor. Leading manufacturers include Star Robotics, OREC, AgriBot, and Robotic Golf Solutions. Wheeled designs offer lower maintenance costs, reliable performance, and compatibility with GPS and automated navigation systems, supporting widespread adoption in golf courses and large-scale event venues.

Stadium operations account for 50% of the market, representing the largest application segment for golf ball picker robots. These robots are essential for maintaining tournament-ready greens, managing high volumes of balls efficiently, and ensuring smooth operations during events. Manufacturers such as Star Robotics, OREC, AgriBot, and Robotic Golf Solutions provide models designed for durability, speed, and precision. The growth of professional golf events, sports complexes, and large-scale golf courses is driving demand. Stadium operations remain the primary focus for investment, given the segment’s consistent demand and operational importance.

The golf ball picker robot market is advancing rapidly due to increasing demand for labor-efficient facility operations and growing adoption of autonomous maintenance technologies that provide consistent performance and operational cost savings across diverse golf facility applications. The market faces challenges, including high initial investment costs, complexity of outdoor autonomous operation, and the need for specialized maintenance and technical support. Innovation in artificial intelligence and advanced navigation systems continues to influence product development and market expansion patterns.

The growing trend toward facility modernization and automation adoption is driving demand for golf ball picker robots that can support comprehensive facility management, reduce operational complexity, and provide consistent maintenance quality across various golf course and practice facility environments. Advanced facility automation enables improved operational efficiency while allowing more effective resource utilization and enhanced customer service delivery across different facility types and usage patterns. Manufacturers are increasingly recognizing the competitive advantages of automation-compatible robotic systems for golf facility market expansion and operational optimization.

Modern golf ball picker robot producers are incorporating artificial intelligence algorithms and advanced navigation technologies to enhance autonomous operation capabilities, improve obstacle detection and avoidance, and provide intelligent path planning for optimal collection efficiency. These technologies enhance operational reliability while enabling new applications, including adaptive terrain navigation and predictive maintenance scheduling. Advanced AI integration also allows facility operators to support sophisticated operational management and performance optimization beyond traditional manual collection methods.

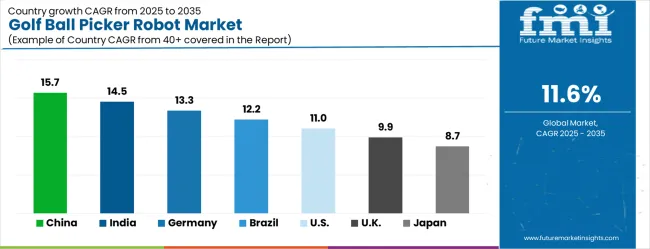

The global golf ball picker robot market is projected to grow at a CAGR of 11.6%, corresponding to a multiplication factor of 1.86 over the 2025–2035 period. China leads at 15.7% (2.04x), 4.1 points above the global average, driven by rising golf course development and adoption of automation in sports facilities. India follows at 14.5% (1.98x), 2.9 points higher than global growth, supported by increasing sports infrastructure, both part of BRICS along with Brazil, which records 12.2% (1.81x), slightly above the global CAGR due to growing recreational and professional golf activities. Germany grows at 13.3% (1.95x), 1.7 points above global growth, reflecting automation in European sports facilities. The USA shows 11.0% (1.77x), slightly below the global rate, while the UK at 9.9% (1.72x) and Japan at 8.7% (1.68x) trail by 1.7 and 2.9 points, respectively. ASEAN and Oceania regions are adopting these robots at 10–13% (1.72–1.95x), driven by modernization of golf courses and labor efficiency requirements. The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

| Country | CAGR (2025-2035) |

|---|---|

| China | 15.7% |

| India | 14.5% |

| Germany | 13.3% |

| Brazil | 12.2% |

| USA | 11.0% |

| UK | 9.9% |

| Japan | 8.7% |

China leads the market with a CAGR of 15.7%, surpassing the global 11.6%. Adoption is concentrated in Guangdong, Jiangsu, and Zhejiang provinces, where golf courses are rapidly increasing. Suppliers like Yamaha and Ecorobotix provide automated, energy-efficient robots for large-scale operations. Growing demand is driven by reduced labor costs, improved operational efficiency, and timely collection across extensive courses. Integration with GPS navigation and scheduling systems enhances coverage. Investment in private clubs and golf tourism accelerates adoption, particularly in metropolitan regions. Energy-efficient, weather-resistant models ensure year-round operation.

India records 14.5% CAGR. Growth is concentrated in Delhi, Mumbai, and Bangalore, where golf course development is expanding. Suppliers including Yamaha and Ecorobotix are offering compact, autonomous robots for private and public courses. Key drivers include reduced labor dependency, faster ball collection, and improved course maintenance. High-capacity robots are used on larger courses to optimize collection speed. GPS and mapping integration ensures operational reliability. Urban recreational demand and golf tourism growth continue to boost adoption.

Germany holds 13.3% CAGR. Adoption is centered in Bavaria, North Rhine-Westphalia, and Baden-Württemberg, where country clubs and private courses are dense. Suppliers like Yamaha and Ecorobotix provide automated robots capable of adapting to varied terrains. Efficiency improvement and labor reduction drive adoption. Integration with course management software allows scheduling and remote monitoring. Energy-efficient models ensure performance under different weather conditions. High-end clubs favor automated systems to maintain consistent course quality.

Brazil records 12.2% CAGR. Adoption is concentrated in São Paulo, Rio de Janeiro, and Minas Gerais, where private and resort courses are growing. Suppliers such as Yamaha and Ecorobotix provide autonomous robots optimized for tropical climates and uneven terrains. Labor reduction and faster collection efficiency are primary drivers. GPS-enabled and sensor-guided systems improve operational performance and safety. Golf tourism expansion and private club memberships continue to support growth. Modular robots allow flexible deployment across diverse terrains.

The United States has 11.0% CAGR. Adoption is focused in Florida, California, and Texas, with dense golf course networks. Suppliers like Yamaha, Ecorobotix, and Toro provide automated, high-capacity robots for large-scale operations. Labor cost reduction, efficiency, and consistent ball collection are key drivers. GPS-integrated robots ensure precise operation across extensive courses. Luxury resorts and private clubs are increasingly adopting robots for optimized maintenance. Recreational spending and national tournaments boost market demand.

The United Kingdom holds 9.9% CAGR. Adoption is concentrated in Scotland, Surrey, and Buckinghamshire, areas with dense golf course networks. Suppliers such as Yamaha and Ecorobotix provide compact, autonomous robots suitable for small to mid-sized layouts. Labor reduction and faster collection are primary drivers. Sensor-guided navigation improves safety and precision. Modular designs allow flexible scheduling and quick deployment. Membership-based courses and recreational facilities support steady adoption.

Japan records 8.7% CAGR, below the global average. Adoption is concentrated in Tokyo, Osaka, and Kanagawa, where private and municipal courses are expanding. Suppliers like Yamaha and Ecorobotix provide compact, autonomous robots for space-limited layouts. Key drivers include reduced labor, precise collection, and operational efficiency. GPS navigation and mapping integration ensure reliability in dense urban areas. High-end private clubs and urban recreational facilities are driving adoption, while automation reduces dependency on seasonal labor.

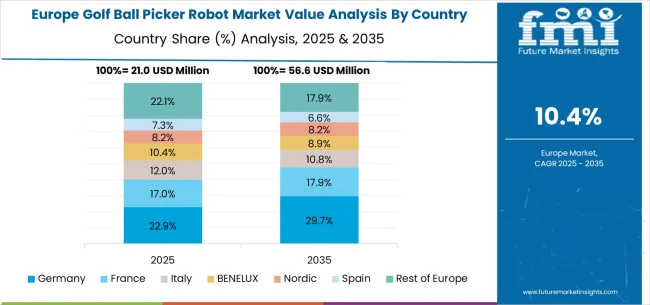

The golf ball picker robot market in Europe is projected to grow from USD 21.0 million in 2025 to USD 56.6 million by 2035, registering a CAGR of 10.4% over the forecast period. Germany will remain the dominant market, rising from 22.9% in 2025 to 29.7% by 2035, supported by its strong robotics industry, automation technology leadership, and advanced golf facility infrastructure.

France is expected to hold 17.0% in 2025, remaining stable at 17.9% by 2035, reflecting steady demand from recreational facilities and urban golf course adoption. Italy will contribute 12.0% in 2025, declining to 10.8% by 2035, due to moderate demand growth in leisure automation markets.

The BENELUX region will represent 10.4% in 2025, softening to 8.9% by 2035, reflecting market saturation in compact recreational spaces. The Nordic countries will account for 8.2% in 2025, increasing to 8.4% by 2035, supported by premium golf infrastructure and advanced robotics deployment.

Spain is forecast to hold 7.3% in 2025, growing slightly to 8.2% by 2035, supported by golf tourism and leisure sector expansion. Meanwhile, the Rest of Europe will decline from 22.1% in 2025 to 17.9% by 2035, reflecting slower robotics adoption in smaller Eastern European markets.

The golf ball picker robot market is characterized by competition among specialized robotics manufacturers, established sports equipment providers, and integrated facility automation companies. Companies are investing in advanced robotics technology research, autonomous navigation enhancement, artificial intelligence integration, and comprehensive maintenance portfolios to deliver consistent, high-performance, and reliable robotic solutions. Innovation in autonomous systems, navigation technologies, and operational efficiency features is central to strengthening market position and competitive advantage.

Korechi leads the market with a strong market share, offering comprehensive robotic maintenance solutions with a focus on golf facility automation and operational efficiency capabilities. Range Servant provides specialized ball collection equipment with a focus on reliable operation and facility integration. Wayrobo delivers innovative robotic technologies with a focus on autonomous navigation and intelligent maintenance systems. Relox Robotics specializes in automated facility maintenance solutions with focus on golf course applications and operational optimization. GroundTech focuses on robotic maintenance systems and comprehensive facility automation solutions.

Golf ball picker robots represent an emerging automation solution transforming facility operations across golf courses, driving ranges, and sports complexes through labor-efficient ball collection systems. With the global market projected to grow from USD 88.2 million in 2025 to USD 264.3 million by 2035 at an 11.6% CAGR, these specialized robots address critical challenges in operational cost management, consistent service delivery, and labour availability. Accelerating market development requires strategic alignment across facility operators, robotics manufacturers, technology integrators, service providers, and capital partners to drive innovation and widespread adoption.

Sports Infrastructure Modernization Programs: Establish grant programs for public golf courses and recreational facilities to adopt automated maintenance equipment, including ball picker robots. Create equipment leasing programs that make advanced robotics accessible to municipal facilities with limited capital budgets while demonstrating operational benefits.

Workforce Transition and Training Support: Fund retraining programs for traditional groundskeeping staff to operate and maintain robotic systems, ensuring smooth workforce transitions. Develop certification programs that validate technical competency in robotic system operation, creating new career pathways in automated facility management.

Technology Adoption Incentives: Provide tax credits for facilities investing in labour-saving automation technologies that demonstrate measurable operational efficiency improvements. Create accelerated depreciation schedules for robotic equipment that encourage facility modernization while supporting domestic robotics industry growth.

Research and Development Funding: Support university-industry partnerships focused on outdoor robotics challenges, including weather resistance, terrain adaptation, and autonomous navigation in complex environments. Finance the development of open-source robotics platforms that enable smaller manufacturers to enter the market with innovative solutions.

Safety and Standards Development: Establish safety protocols for autonomous robots operating in public recreational spaces, ensuring proper integration with facility users and maintenance staff. Create certification requirements for robotic equipment used in commercial recreational facilities while balancing innovation with public safety concerns.

Operational Best Practices Documentation: Develop comprehensive implementation guides covering robot selection criteria, integration procedures, and performance optimization strategies for different facility types. Create case study databases demonstrating successful automation deployments with quantified benefits, including labour cost reductions and service quality improvements.

Technology Evaluation and Certification: Establish standardized testing protocols for robot performance, reliability, and safety across various golf course conditions and terrains. Create certification programs that validate robot capabilities in real-world operational environments while providing facility operators with reliable performance benchmarks.

Collective Procurement and Negotiation: Organize group purchasing programs that enable smaller facilities to access advanced robotics at reduced costs through volume discounts. Facilitate shared maintenance and technical support services that make robotic adoption economically viable for facilities with limited technical resources.

Training and Professional Development: Design comprehensive education programs covering robotic system integration, operational management, and maintenance procedures for facility managers and grounds crews. Create certification pathways that validate professional competency in automated facility operations while building industry expertise.

Market Intelligence and Benchmarking: Coordinate industry surveys tracking automation adoption rates, performance metrics, and return-on-investment data across different facility types and regions. Provide comparative analysis tools helping facility operators evaluate automation opportunities based on specific operational requirements and financial constraints.

Terrain-Adaptive Navigation Systems: Develop advanced sensors and AI algorithms that enable reliable operation across diverse golf course conditions, including wet grass, slopes, bunkers, and varying terrain textures. Create adaptive pathfinding systems that optimize collection routes while avoiding course damage and operational disruptions.

Weather Resistance and Durability: Engineer robotic systems capable of operating in various weather conditions while maintaining collection efficiency and system reliability. Develop protective systems that enable year-round operation in different climates while minimizing maintenance requirements and operational interruptions.

Intelligent Collection Optimization: Integrate machine learning capabilities that analyze ball distribution patterns, optimize collection routes, and predict maintenance requirements based on usage data. Create systems that can adapt to different facility layouts and operational schedules while maximizing collection efficiency.

Remote Monitoring and Fleet Management: Provide cloud-based platforms enabling centralized monitoring of multiple robots across different facilities, with real-time performance tracking and predictive maintenance alerts. Develop mobile applications that allow facility managers to monitor robot status, schedule operations, and receive maintenance notifications remotely.

Modular and Scalable Designs: Create robotic systems that can be easily configured for different facility sizes and operational requirements, from small practice areas to large championship courses. Develop upgrade pathways that allow facilities to enhance robot capabilities over time without complete system replacement.

Comprehensive Service Solutions: Offer complete automation packages including robot selection, installation, training, and ongoing maintenance support tailored to specific facility requirements. Develop service contracts that guarantee operational uptime and performance levels while providing predictable operational costs.

Financing and Leasing Programs: Create flexible financing options that make robotic adoption accessible to facilities with varying capital constraints, including seasonal payment structures aligned with golf course revenue patterns. Offer rent-to-own programs that allow facilities to evaluate robot performance before making full purchase commitments.

Technical Training and Support: Establish regional service centers providing rapid response maintenance, spare parts availability, and technical troubleshooting for robotic systems. Develop comprehensive training programs that ensure facility staff can effectively operate and maintain automated equipment while maximizing operational benefits.

Integration and Customization Services: Provide facility-specific integration services that optimize robot deployment based on unique course layouts, operational patterns, and maintenance schedules. Offer customization capabilities that adapt standard robotic systems to specialized facility requirements and operational preferences.

Performance Monitoring and Optimization: Develop data analytics services that track robot performance, identify optimization opportunities, and provide recommendations for operational improvements. Create reporting systems that quantify automation benefits, including labor savings, collection efficiency, and facility utilization improvements.

Pilot Program Implementation: Deploy robotic systems in controlled environments to validate performance benefits, document operational improvements, and develop best practices for broader industry adoption. Share results and lessons learned with industry associations and peer facilities to advance collective knowledge.

Operational Integration and Workflow Optimization: Develop procedures that effectively integrate robotic collection with existing maintenance operations, staff responsibilities, and customer service requirements. Create training protocols ensuring smooth transitions from manual to automated ball collection systems.

Performance Measurement and Documentation: Implement comprehensive tracking systems to monitor robot performance, operational cost impacts, and customer satisfaction changes following automation adoption. Develop metrics that quantify return on investment while identifying areas for continued optimization.

Staff Development and Change Management: Train existing personnel on robotic system operation and maintenance while creating new roles focused on automated facility management. Develop change management processes that ensure successful workforce transitions and maximize staff engagement with the latest technologies.

Customer Experience Enhancement: Optimize robot operations to minimize customer disruption while improving facility appearance and service consistency. Create communication strategies that educate customers about automation benefits while addressing any concerns about robotic presence on golf facilities.

Robotics Innovation Investment: Fund startups developing breakthrough technologies in outdoor autonomous navigation, weather-resistant robotics, and AI-powered optimization systems for specialized applications. Support companies creating novel solutions for challenging outdoor environments and complex terrain navigation.

Manufacturing Scale-up Capital: Provide growth funding for established robotics manufacturers expanding production capacity to meet increasing global demand for specialized outdoor robots. Finance automation initiatives that improve manufacturing quality while reducing production costs and delivery timelines.

Market Expansion and Distribution: Fund distribution network development and regional service center establishment, particularly in high-growth markets with expanding golf infrastructure. Support localization initiatives that adapt robotic solutions for regional requirements, terrain conditions, and operational preferences.

Technology Integration Platforms: Invest in software companies developing comprehensive facility management platforms that integrate robotic operations with broader maintenance and operational systems. Support the development of analytics platforms that optimize multi-facility robot deployments and performance management.

Acquisition and Consolidation Opportunities: Finance strategic acquisitions combining robotics hardware capabilities with software expertise, creating comprehensive automation solution providers. Support market consolidation that achieves operational efficiencies while maintaining innovation capabilities and customer service quality.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 88.2 million |

| Robot Type | Wheeled Mobile Robot, All-Terrain Ball Picker Robot |

| Application | Stadium Operations, Event Support, Training Assistance |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Korechi, Range Servant, Wayrobo, Relox Robotics, GroundTech, and Steele Robotics |

| Additional Attributes | Dollar sales by robot type and application category, regional demand trends, competitive landscape, technological advancements in robotics systems, navigation innovation, AI integration development, and operational optimization |

The global golf ball picker robot market is estimated to be valued at USD 88.2 million in 2025.

The market size for the golf ball picker robot market is projected to reach USD 264.3 million by 2035.

The golf ball picker robot market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in golf ball picker robot market are wheeled mobile robot, all-terrain ball picker robot and others.

In terms of application, stadium operations segment to command 50.0% share in the golf ball picker robot market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Batteries Market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Golf Putter Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Battery Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Market Analysis - Size, Share, and Forecast 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Golf Outfit Market Growth - Trends & Forecast 2025 to 2035

Golf Tourism Market Analysis - Size, Share, and Forecast 2025 to 2035

Golf Course Maintenance Robot Market Size and Share Forecast Outlook 2025 to 2035

UK Golf Tourism Market Analysis

USA Golf Tourism Market Analysis

Japan Golf Tourism Market Analysis

Europe Golf Tourism Market Insights - Growth & Forecast 2025 to 2035

Germany Golf Tourism Market Trends – Growth, Demand & Forecast 2025–2035

Electric Golf Cart Market Growth – Trends & Forecast 2025 to 2035

GCC Electric Golf Cart Market Outlook – Demand, Growth & Forecast 2025-2035

GCC Countries Golf Tourism Market Analysis – Growth, Trends & Forecast 2025–2035

Japan Electric Golf Cart Market Insights – Demand, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA