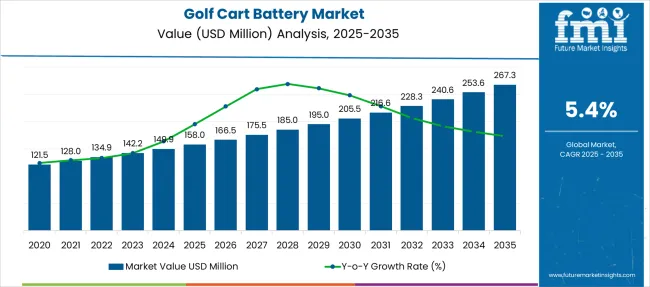

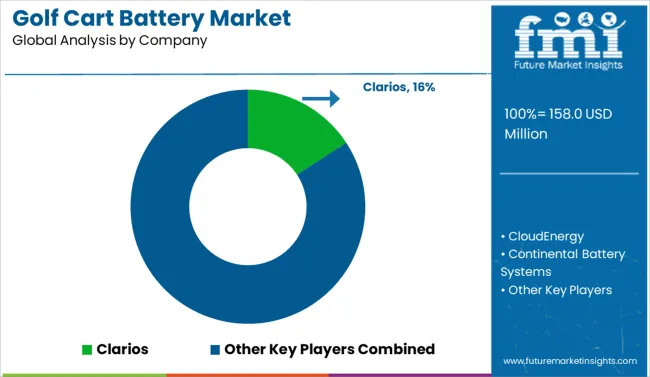

The Golf Cart Battery Market is estimated to be valued at USD 158.0 million in 2025 and is projected to reach USD 267.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Golf Cart Battery Market Estimated Value in (2025 E) | USD 158.0 million |

| Golf Cart Battery Market Forecast Value in (2035 F) | USD 267.3 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The golf cart battery market is expanding steadily, supported by the growing adoption of electric golf carts across golf courses, residential communities, and commercial complexes. As sustainability becomes a key purchasing driver, electric carts powered by rechargeable batteries are replacing traditional fuel-based vehicles.

This transition is driven by increasing awareness around carbon emissions, operational cost benefits, and regulatory pressure favoring green transportation alternatives. Ongoing improvements in battery efficiency, charge capacity, and lifecycle are also encouraging upgrades from existing users.

While the market remains cost-sensitive, demand for reliable and low-maintenance battery systems is driving innovation and preference for established chemistries. The future outlook remains positive as modernization of golf courses and the rising popularity of golf tourism contribute to fleet expansion. Additionally, the diversification of golf carts for use in resorts, airports, and gated communities is expected to sustain long-term battery demand across multiple voltage platforms.

The golf cart battery market is segmented by battery type, voltage, end user, and sales channel and geographic regions. By battery type of the golf cart battery market is divided into Lead-acid and Lithium-ion. In terms of voltage of the golf cart battery market is classified into 6V, 8V, 12V, and Others. Based on end user of the golf cart battery market is segmented into Golf courses and Commercial services. By sales channel of the golf cart battery market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket. Regionally, the golf cart battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

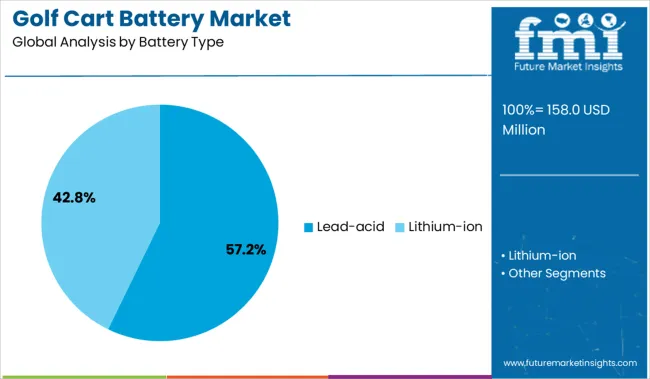

The lead-acid battery segment dominates the battery type category with a 57.2% market share, owing to its cost-effectiveness, widespread availability, and ease of maintenance. These batteries are preferred by golf course operators and fleet managers for their dependable performance in short-distance, low-speed environments typical of golf cart usage.

Despite increasing competition from lithium-ion alternatives, lead-acid technology continues to hold market leadership due to its established supply chains and comparatively lower upfront investment. Technological enhancements such as deep-cycle variants and sealed AGM formats have improved durability and efficiency, reinforcing their value proposition.

The segment benefits from repeat purchase behavior due to limited battery lifespan, which ensures consistent aftermarket demand. As pricing remains a critical factor in battery selection, especially for bulk purchases by golf facilities, lead-acid is projected to remain the dominant choice across developing and cost-sensitive markets.

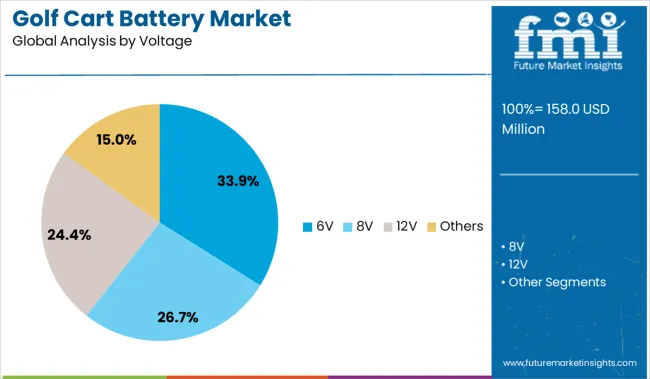

The 6V battery segment accounts for 33.9% of the market by voltage, favored for its balanced output and long cycle life suited for standard golf cart configurations. These batteries are often used in series to match specific voltage and power requirements, allowing operators flexibility in designing energy-efficient systems.

Their widespread use is attributed to a favorable combination of load capacity, affordability, and compatibility with existing golf cart models. Demand for 6V systems continues to remain stable across mid-tier golf courses and utility cart applications, where performance consistency and battery replacement costs are key considerations.

Manufacturers have focused on enhancing the energy density and maintenance ease of 6V batteries to extend runtime and reduce operational downtime. As the golf industry gradually electrifies its fleets, 6V solutions are expected to retain a notable market share, particularly in regions where budget constraints favor conventional systems over high-voltage alternatives.

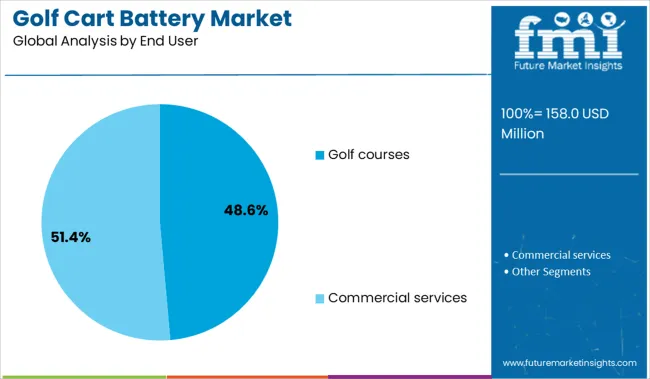

Golf courses represent the largest end-user segment with a 48.6% share, driven by their extensive reliance on electric carts for daily operations and player mobility. These facilities typically manage large fleets and require batteries that offer durability, minimal downtime, and cost-effective performance over repeated charge-discharge cycles.

Battery procurement at golf courses is often governed by operational efficiency and maintenance budgets, which favor reliable and proven battery chemistries. The growth of this segment is further bolstered by renovations of existing clubs and the construction of new golf resorts, particularly in tourism-driven economies.

Additionally, sustainability goals among course operators are encouraging the transition from gas-powered to battery-operated carts, further solidifying demand. As courses expand their fleets and extend operating hours, consistent battery replacement cycles are expected to keep this segment at the forefront of market growth.

Energy storage solutions for golf carts are shifting toward lithium-ion formats to support higher performance, longer runtime, and reduced maintenance. In 2024, lithium batteries accounted for 28 % of new cart installs, especially in resort and rental fleets. Demand is rising in regions deploying electric vehicles for gated communities and commercial venues.

Fleet operators are upgrading to lithium-ion battery systems to extend cart runtime and reduce service cycles. Real-world data shows performance improvement—providing up to 22 % longer operation per charge compared to lead-acid options. Maintenance intervals have increased as replacement frequency dropped by 35 %, thanks to better depth-of-discharge profiles and enhanced thermal management. Charging time has also shortened—lithium carts recharge in about 6–8 hours versus 10–12 hours for conventional batteries. High-temperature variants maintain capacity above 90 % even in hot-weather zones, helping resort cart fleets remain operational through extended summers. These improvements deliver total cost reductions over equipment lifespan and encourage operators to convert entire fleets.

Despite benefits, adoption faces barriers due to battery cost, infrastructure demands, and service readiness. Lithium-ion systems carry a 15–18 % capital premium over lead-acid carts, raising upfront procurement momentum threshold. Charging station installation adds complexity—upgrades to cart barns may require 208 V three-phase wiring, increasing setup lead times by 4–6 days. Where local support for OEM lithium systems is weak, downtime for battery diagnostics or controller resets can stretch over 7–9 days, reducing fleet availability. Retrofit units sometimes face compatibility issues with existing charger models and BMS protocols. These constraints hinder conversion in smaller clubs or cost-sensitive operators, even as total lifetime benefits grow clearer.

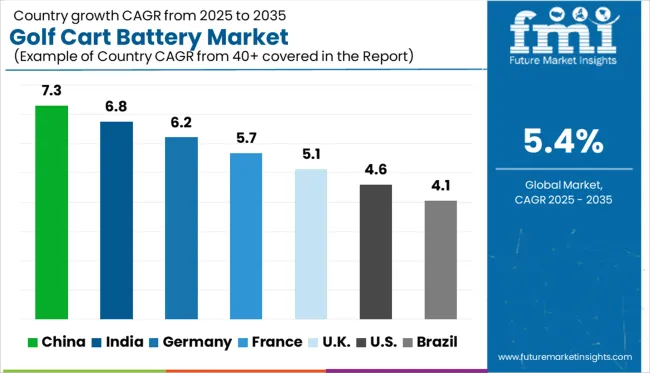

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The global golf cart battery market is expected to grow at a 5.4% CAGR from 2025 to 2035. China registers the highest growth at 7.3%, marking a +35% premium over the global average, driven by domestic golf course expansion and battery manufacturing scale. India follows with 6.8% (+26%) due to rising adoption in leisure and hospitality sectors. Germany posts 6.2% (+15%), reflecting use in gated communities and airports. Growth in the United Kingdom stands at 5.1% (–6%), while the United States, at 4.6%, trails the global average by –15% due to market saturation and longer replacement cycles. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China’s golf cart battery market is growing at a 7.3% CAGR, faster than the global average. Development of electric transport in tourism zones is expanding battery demand, particularly in Hainan, Yunnan, and Zhejiang. LFP batteries are preferred for their longevity in continuous fleet operations. OEMs in Guangdong and Jiangsu are increasing local procurement for core battery components. Electronics firms are working with vehicle manufacturers on diagnostics and regenerative charge support for high-usage carts.

India’s golf cart battery market is projected to grow at 6.8% CAGR. Demand originates from institutional and industrial sites in Karnataka and Telangana. Cart procurement for gated communities in Maharashtra and Gujarat is expanding. Hybrid lithium-lead configurations are used to balance cost and performance. Battery swapping is being piloted to address fleet uptime. Domestic manufacturers are focusing on 48V formats suited to India’s climate, with sourcing now shifting to local Tier 1 suppliers.

Germany’s market is expanding at a 6.2% CAGR. Golf resorts and science parks are adopting faster-charging batteries to support daily usage. LFP systems are selected for stable operation and thermal safety. Resorts in Bavaria and Baden-Württemberg are adding solar-linked charging bays. Battery integrators are focusing on compliance with EU standards and compatibility with imported carts. Fleet operators are increasingly seeking BMS support for diagnostics and service planning.

The UK market is growing at 5.1% CAGR, led by demand from courses, campuses, and tourism locations. Fleets are shifting from lead-acid to gel or lithium batteries due to maintenance and reliability factors. Northern England and Scottish facilities are piloting battery monitors to reduce charge errors and field failures. Retrofit kits are being offered by battery suppliers to help operators meet regulatory preferences for electric vehicles on public-access land.

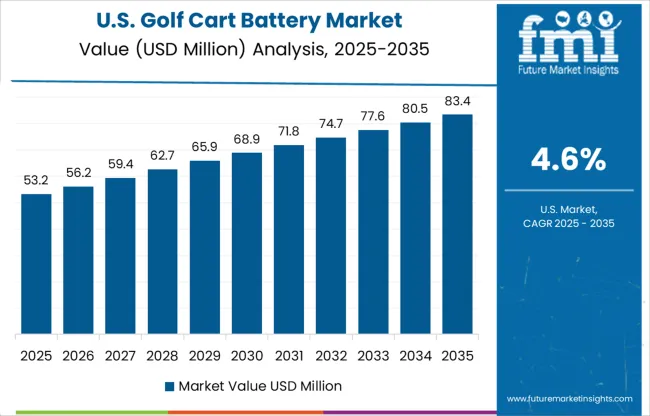

The US market is expected to grow at 4.6% CAGR, slower than global pace. Florida and Arizona dominate usage, especially in residential and resort environments. Flooded lead-acid remains common, though lithium is expanding among commercial users. South Carolina and Georgia-based OEMs are offering BMS-equipped battery systems from factory lines. Service firms are expanding battery maintenance coverage to support seasonal operations and reduce downtime during peak use months.

The golf cart battery market is moderately consolidated, with Clarios holding a significant market share, closely followed by established players like East Penn Manufacturing, EnerSys, and Trojan Battery Company, which specialize in durable deep-cycle lead-acid and advanced lithium-ion solutions. Traditional brands such as Exide Technologies and Interstate Batteries maintain strong footholds in the replacement segment, while innovators like RELiON Batteries and Power Sonic Corporation accelerate the shift toward lithium technologies with lightweight, fast-charging alternatives. The industry is transitioning from flooded lead-acid to AGM and lithium batteries, driven by demands for longer lifespan, reduced maintenance, and higher energy density. Manufacturers are focusing on smart battery management systems and sustainable recycling programs to meet the needs of golf courses, resorts, and utility vehicle operators. Emerging trends include Bluetooth-enabled monitoring and predictive charging for fleet optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 158.0 Million |

| Battery Type | Lead-acid and Lithium-ion |

| Voltage | 6V, 8V, 12V, and Others |

| End User | Golf courses and Commercial services |

| Sales Channel | Original Equipment Manufacturer (OEM) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Clarios, CloudEnergy, Continental Battery Systems, Crown Battery Manufacturing, Duracell, East Penn Manufacturing, EnerSys, Exide Technologies, Fullriver Battery USA, Interstate Batteries, Leoch International Technology, Lifeline Batteries, Power Sonic Corporation, RELiON Batteries, and Trojan Battery Company |

| Additional Attributes | Dollar sales by battery chemistry and cart type, growing demand in lithium-ion systems for resort and commercial fleets, stable usage of lead-acid units in private and recreational courses, innovations in fast-charging technologies and battery management systems improve cycle life and vehicle uptime |

The global golf cart battery market is estimated to be valued at USD 158.0 million in 2025.

The market size for the golf cart battery market is projected to reach USD 267.3 million by 2035.

The golf cart battery market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in golf cart battery market are lead-acid and lithium-ion.

In terms of voltage, 6v segment to command 33.9% share in the golf cart battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Golf Ball Picker Robot Market Size and Share Forecast Outlook 2025 to 2035

Golf Course Maintenance Robot Market Size and Share Forecast Outlook 2025 to 2035

Golf Putter Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Golf Outfit Market Growth - Trends & Forecast 2025 to 2035

Golf Tourism Market Analysis - Size, Share, and Forecast 2025 to 2035

Golf Cart Batteries Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Market Analysis - Size, Share, and Forecast 2025 to 2035

UK Golf Tourism Market Analysis

USA Golf Tourism Market Analysis

Japan Golf Tourism Market Analysis

Europe Golf Tourism Market Insights - Growth & Forecast 2025 to 2035

Germany Golf Tourism Market Trends – Growth, Demand & Forecast 2025–2035

Electric Golf Cart Market Growth – Trends & Forecast 2025 to 2035

GCC Electric Golf Cart Market Outlook – Demand, Growth & Forecast 2025-2035

GCC Countries Golf Tourism Market Analysis – Growth, Trends & Forecast 2025–2035

Japan Electric Golf Cart Market Insights – Demand, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA