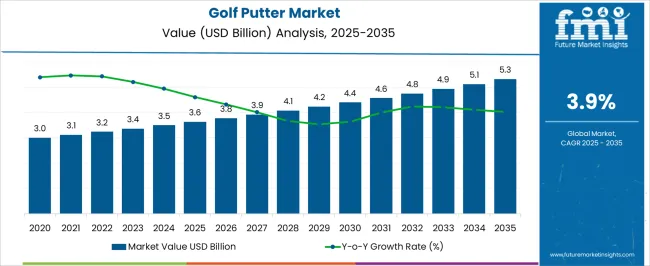

The Golf Putter Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. The moderate and steady growth over the forecast period, from USD 3.6 billion in 2025 to USD 5.3 billion in 2035, reflects widespread market penetration with incremental technological enhancements rather than radical innovation driving adoption.

Early adoption phases, characterized by niche uptake among professional golfers and high-end enthusiasts, have largely transitioned into a stage of gradual expansion across recreational players, facilitated by brand differentiation, ergonomic improvements, and incremental material innovations. The market’s adoption curve indicates that most consumer segments are aware of and have trialed golf putters, with growth primarily driven by replacement cycles, modest product upgrades, and regional expansion into emerging golf markets. Mature market dynamics are evident in the consistent, low double-digit CAGR, reflecting limited disruptive entry and a focus on sustaining brand loyalty and incremental performance enhancements.

As adoption reaches near saturation in established regions such as North America and Europe, emerging regions in the Asia-Pacific and Latin America are contributing to incremental market expansion. The trajectory from USD 3.6 billion in 2025 to USD 5.3 billion in 2035 highlights the market’s position in the late majority stage, where steady adoption and replacement demand dominate. Technological refinements, consumer education, and accessibility initiatives continue to drive growth, while the overall maturity of the market limits rapid acceleration, positioning it as a stable and steadily evolving segment within the broader golf equipment industry.

| Metric | Value |

|---|---|

| Golf Putter Market Estimated Value in (2025 E) | USD 3.6 billion |

| Golf Putter Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The golf putter market is undergoing robust transformation driven by increasing participation in amateur and professional golf, the rise of custom club fitting technologies, and the demand for equipment that supports performance optimization on the green. As putting is recognized as a critical determinant of scoring efficiency, golfers are increasingly seeking precision-tuned putters that align with their stroke mechanics and visual preferences.

Equipment manufacturers are investing in advanced materials such as multi-material inserts and face-milled technologies to improve energy transfer and roll consistency. The growing influence of data-driven training, wearable stroke analyzers, and simulator-based fitting systems is enhancing the appeal of technologically advanced putters.

Additionally, the personalization of putter specifications based on player biomechanics has encouraged the expansion of diverse product categories Expanding retail and online distribution networks, along with increased promotional activity linked to professional endorsements and televised tournaments, are also expected to support future market expansion across both developed and emerging regions.

The golf putter market is segmented by product type, design, length, price range, end-use distribution channel, and geographic regions. By product type, the golf putter market is divided into Face-Balanced Putters and Toe-Balanced Putters. In terms of design, the golf putter market is classified into Mallet Putter and Blade Putter. Based on the length of the golf putter, the market is segmented into Traditional Length (32-36 inches), Belly Putter (41-46 inches), and Long Putter (48-52 inches).

By price range, the golf putter market is segmented into Economy or Mid-Range and Premium or High. By end use, the golf putter market is segmented into Professionals and amateurs. By distribution channel, the golf putter market is segmented into Indirect Sales and Direct Sales. Regionally, the golf putter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

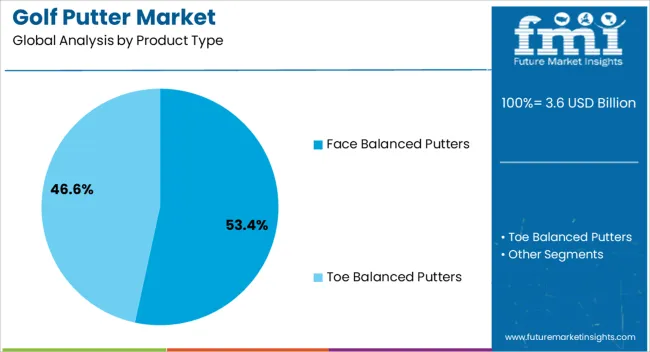

The face balanced putters segment is anticipated to account for 53.4% of the total revenue share in the golf putter market in 2025, reflecting its strong preference among golfers seeking straight-back and straight-through putting strokes. This product type is favored due to its neutral torque alignment, which enhances face stability during the stroke and minimizes unintended clubface rotation.

The segment's growth has been further supported by innovations in perimeter weighting and face balancing techniques that improve directional control and speed consistency. Players with minimal arc in their stroke pattern have increasingly adopted face balanced putters as they allow a higher degree of forgiveness on off-center hits.

The segment also benefits from growing awareness of stroke style fitting, where golfers are matched with optimal putter head balancing through personalized assessments The compatibility of face balanced putters with both amateur and professional users, combined with their ease of use and adaptability across green conditions, has solidified their leading position in the market.

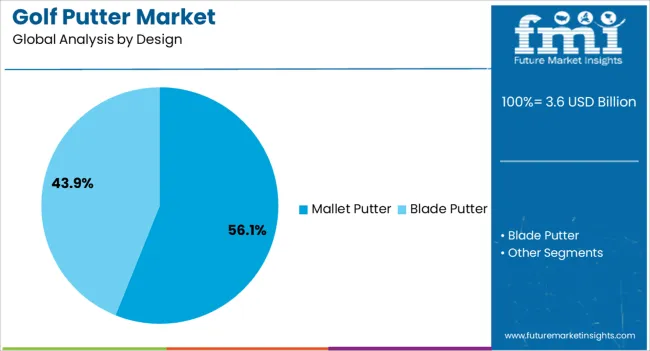

The mallet putter segment is projected to represent 56.1% of the revenue share in the golf putter market in 2025, driven by its widespread acceptance among players looking for higher stability and alignment assistance. Mallet designs have gained favor due to their larger clubhead geometry, which offers enhanced moment of inertia and weight distribution across the face.

This design supports greater forgiveness and improved roll on mis-hits, making it especially attractive for players seeking consistency. The segment has seen a rise in adoption across all skill levels as golfers increasingly value visual alignment aids and customizable face inserts that come standard in mallet-style configurations.

The development of modern mallet designs with high-tech materials and multiple alignment cues has further strengthened their appeal As manufacturers continue to enhance the look, feel, and sound of these putters, their ability to provide confidence at address and support consistent stroke execution has contributed to their dominant presence in the market.

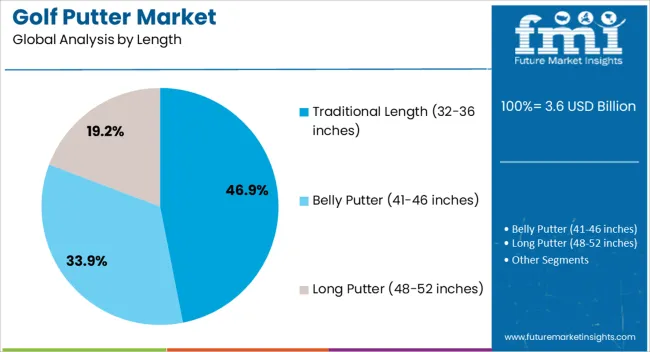

The traditional length segment, comprising putters between 32 to 36 inches, is expected to account for 46.9% of the revenue share in the golf putter market in 2025, highlighting its established role as the standard configuration for most golfers. This length range is considered optimal for maintaining posture, eye alignment, and natural pendulum stroke mechanics across various height profiles.

Its dominance has been sustained by wide availability and alignment with traditional coaching practices that favor this length for most putting styles. Golfers at beginner and intermediate levels often prefer this length due to its comfort and adaptability, while professional players also continue to rely on traditional length for stroke consistency.

The compatibility of this length with both face-balanced and toe-hang putters has allowed broader customization without deviating from proven performance norms. As retailers and fitters continue to promote traditional-length models with enhanced grips and shaft materials, demand is expected to remain strong within this configuration category.

The market has been expanding due to rising demand for high-precision equipment in recreational and professional golfing. Golf putters have been valued for their role in improving short game performance, stroke consistency, and overall scoring. Market growth has been reinforced by advancements in materials, design technology, and customization. Increasing interest in golf as a competitive sport, coupled with the adoption of advanced training tools and analytics, has further strengthened demand, positioning golf putters as essential equipment for golfers seeking performance optimization and enhanced playing experience globally.

The market has been significantly driven by adoption among professional golfers, amateur enthusiasts, and recreational players seeking performance improvement. Putters with precision-engineered faces, balanced weights, and ergonomic grips have allowed accurate stroke execution and improved putting consistency on greens. Golf clubs, resorts, and sports academies have increasingly promoted the use of specialized putters as part of training and competitive preparation. Custom fitting services, including shaft length adjustment, head design, and balance optimization, have been offered to meet individual player requirements. Growth in golf participation, tournaments, and membership programs has reinforced demand for high-quality putters. In addition, digital swing analysis and smart training aids have encouraged adoption of putters that complement personalized performance improvement strategies, further strengthening market growth globally.

Technological innovations have strengthened the market by enhancing material quality, design accuracy, and performance features. High-grade stainless steel, aluminum alloys, and carbon fiber have been utilized to produce lightweight yet durable putter heads. Precision milling, perimeter weighting, and face inserts have improved stroke consistency and feel, while grip ergonomics and alignment aids have enhanced user control. Advanced manufacturing techniques, such as CNC machining and 3D printing, have allowed customized designs tailored for specific stroke types and player preferences. Integration of sensor technology and connectivity with mobile applications has provided real-time feedback on stroke mechanics. These technological advancements have allowed golfers to achieve greater precision, improve training outcomes, and optimize performance on the green, making modern putters indispensable for professional and recreational use worldwide.

The market has been reinforced by growing availability through retail outlets, specialty golf stores, and e-commerce platforms. Online marketplaces have facilitated direct access to a wide range of putter models, brands, and customization options for consumers globally. Retailers and manufacturers have introduced virtual fitting services, 3D visualization tools, and instructional content to enhance purchase confidence and product engagement. Golf academies and sports clubs have promoted bundled putter offerings with accessories and training aids, increasing adoption among new and experienced players. Rising golf tourism and growth of emerging markets have further contributed to product visibility and sales. The integration of digital platforms, online marketing, and personalized shopping experiences has strengthened the reach and accessibility of golf putters, supporting sustained market growth globally.

Despite growth, the market has faced challenges linked to high costs, brand competition, and product differentiation. Premium putters with advanced materials, precision milling, and customization options have been priced higher, limiting adoption among entry-level and casual players. Intense competition among global brands has required continuous innovation in design, marketing, and performance features. Market fragmentation, counterfeit products, and lack of standardized fitting guidance have occasionally influenced consumer trust. Manufacturers have responded with mid-range offerings, warranty programs, and digital fitting solutions to increase accessibility and reliability. Continuous improvements in affordability, product differentiation, and marketing strategies have remained essential for sustaining market adoption while balancing performance expectations and competitive dynamics in the global golf putter market.

| Countries | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

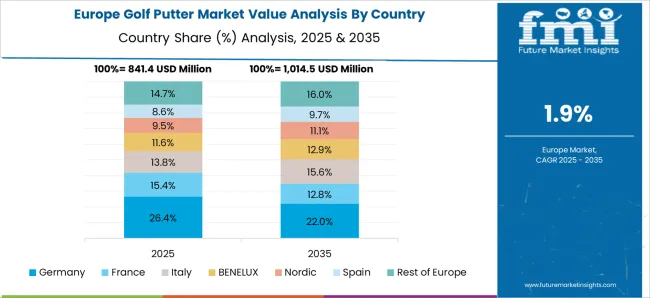

The market is expected to grow at a CAGR of 3.9% from 2025 to 2035, driven by increasing interest in golf sports, rising professional tournaments, and innovations in club design and materials. China leads with a 5.3% CAGR, expanding through growing sports participation and domestic manufacturing of golf equipment. India follows at 4.9%, supported by increasing recreational golf facilities and rising sports awareness. Germany, at 4.5%, benefits from established sporting goods industries and advanced manufacturing technologies. The UK, growing at 3.7%, focuses on premium golf equipment innovation, while the USA, at 3.3%, witnesses steady demand from recreational and professional golfers. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 5.3%, driven by increasing participation in recreational golf and rising interest in professional golf tournaments. Manufacturers are investing in advanced materials, ergonomic designs, and precision engineering to improve performance and appeal to golfers. Technological innovations in putter head design and shaft composition enhance stroke accuracy and player comfort. Partnerships with golf academies and sports clubs are promoting product awareness and adoption. Marketing campaigns targeting amateur and professional players further stimulate demand. Expansion of golf infrastructure and rising disposable income in select urban regions contribute to market growth.

India is expected to grow at a CAGR of 4.9%, fueled by the expansion of golf courses and growing interest in leisure sports. Manufacturers focus on lightweight materials, ergonomic designs, and balance optimization for better swing performance. Partnerships with golf instructors and sports academies help educate consumers on product benefits. The market benefits from increasing exposure to international golf events and rising participation among urban professionals. Targeted marketing initiatives and product demonstrations enhance consumer awareness and stimulate sales. Growth is also supported by technological enhancements in putter heads and grips.

Germany’s market is anticipated to expand at a CAGR of 4.5%, influenced by steady growth in golf club memberships and recreational golfing activities. Manufacturers emphasize quality craftsmanship, material innovation, and precision engineering to meet the demands of enthusiasts. Integration of advanced putter technology, such as alignment aids and optimized weight distribution, supports enhanced player performance. Strategic partnerships with golf retailers and clubs increase market reach. Promotional campaigns and product demonstrations encourage adoption among amateur and professional players. The rising popularity of golfing as a leisure activity in urban centers contributes to demand growth.

The United Kingdom market is projected to grow at a CAGR of 3.7%, driven by increasing participation in recreational golf and local competitions. Manufacturers focus on ergonomics, lightweight materials, and precision balancing to enhance stroke consistency. Collaborations with golf retailers, coaches, and sports clubs promote product awareness and adoption. Marketing initiatives highlighting performance improvements and professional endorsements influence consumer preferences. Expansion of golfing infrastructure and increasing interest among amateur players further supports growth. Technological enhancements in putter shaft and head designs contribute to improved user experience.

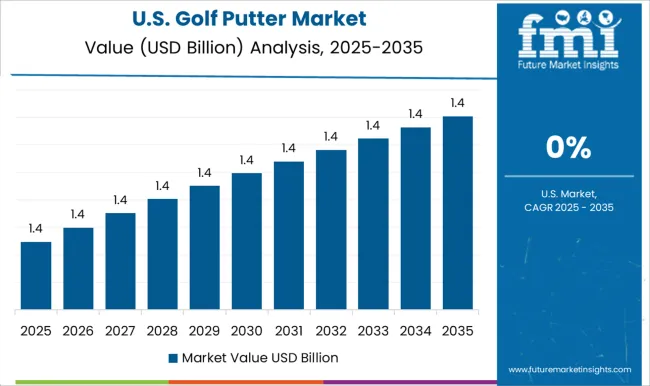

The United States is expected to grow at a CAGR of 3.3%, influenced by high recreational golf participation and professional sports activities. Manufacturers emphasize advanced materials, precision engineering, and ergonomic designs to meet player demands. Collaborations with golf training centers and sports clubs enhance consumer education and adoption. Marketing strategies highlighting technology improvements and performance benefits increase brand visibility. The market also benefits from the popularity of televised golf events and professional tournaments. Continuous innovation in putter head design, shaft composition, and grip materials supports consistent growth in sales and market penetration.

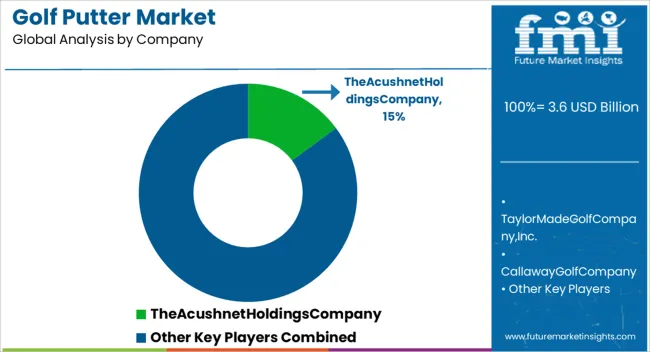

The market is witnessing steady growth due to rising interest in golf as a recreational and professional sport, along with advancements in putter design and materials. The Acushnet Holdings Company, TaylorMade Golf Company, Inc., and Callaway Golf Company dominate the market by offering technologically advanced putters designed for precision, consistency, and performance on the green.

Their products are widely preferred by both amateur and professional golfers due to enhanced feel, stability, and alignment features. Mizuno USA, Inc., Cleveland Golf Company, Inc., and Bridgestone Sports Ltd. strengthen the market through innovation in head materials, weighting systems, and grip technologies, ensuring improved stroke accuracy and distance control. Cobra Golf, Honma Golf Ltd., and Bettinardi Golf focus on customization and premium craftsmanship, catering to niche segments seeking personalized and high-performance golf putters. Adams Golf Inc., Henry Griffitts, Rock Bottom Golf, Vega Golf, Fourteen Golf, and Bobby Grace Putters further expand the competitive landscape with specialized designs emphasizing ergonomics, balance, and visual alignment aids. These leading golf putter providers are driving market growth by blending traditional craftsmanship with modern engineering. Their continued focus on research, player-centric design, and performance optimization ensures the availability of high-quality putters that meet the diverse demands of the golfing community worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Product Type | Face Balanced Putters and Toe Balanced Putters |

| Design | Mallet Putter and Blade Putter |

| Length | Traditional Length (32-36 inches), Belly Putter (41-46 inches), and Long Putter (48-52 inches) |

| Price Range | Economy or Mid-Range and Premium or High |

| End Use | Professionals and Amateur |

| Distribution Channel | Indirect Sales and Direct Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TheAcushnetHoldingsCompany, TaylorMadeGolfCompany,Inc., CallawayGolfCompany, MizunoUSA,Inc, ClevelandGolfCompany,Inc., BridgestoneSportsLtd, CobraGolf, HonmaGolfLtd., BettinardiGolf, AdamsGolfInc., HenryGriffitts, RockBottomGolf, VegaGolf, FourteenGolf, and BobbyGracePutters |

| Additional Attributes | Dollar sales by putter type and material, demand dynamics across professional and recreational segments, regional trends in golf equipment adoption, innovation in design, weight distribution, and alignment technology, environmental impact of manufacturing and material sourcing, and emerging use cases in custom fittings and smart training aids. |

The global golf putter market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the golf putter market is projected to reach USD 5.3 billion by 2035.

The golf putter market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in golf putter market are face balanced putters and toe balanced putters.

In terms of design, mallet putter segment to command 56.1% share in the golf putter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Golf Cart Batteries Market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Golf Ball Picker Robot Market Size and Share Forecast Outlook 2025 to 2035

Golf Course Maintenance Robot Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Battery Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Market Analysis - Size, Share, and Forecast 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Golf Outfit Market Growth - Trends & Forecast 2025 to 2035

Golf Tourism Market Analysis - Size, Share, and Forecast 2025 to 2035

Golf Shoes Market Analysis – Growth, Demand & Forecast 2024-2034

UK Golf Tourism Market Analysis

USA Golf Tourism Market Analysis

Japan Golf Tourism Market Analysis

Europe Golf Tourism Market Insights - Growth & Forecast 2025 to 2035

Germany Golf Tourism Market Trends – Growth, Demand & Forecast 2025–2035

Electric Golf Cart Market Growth – Trends & Forecast 2025 to 2035

GCC Electric Golf Cart Market Outlook – Demand, Growth & Forecast 2025-2035

GCC Countries Golf Tourism Market Analysis – Growth, Trends & Forecast 2025–2035

Japan Electric Golf Cart Market Insights – Demand, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA