The Europe golf tourism market growth is propelling as the popularity of golf as a professional and leisure sport continues to rise which is projected to grow notably during the forecast period 2025 to 2035. From exquisite resorts to world-class courses and varied landscapes, Europe continues to be sought-after travel destination both for professional and amateur golfers alike. The continent’s glorious golfing legacy, from Scotland’s ancient courses to Spain’s sunbathed tees, has established Europe as the world’s premier golf touristic market.

The growing popularity of golf trips, whereby travellers enjoy upscale golf experiences combined with luxury stays, wellness facilities, and fine dining, is one of the main growth factors in this market. Golf tourism dates back many decades and is not just for the pros anymore business retreats, amateur duffers and vacationers are all on the same courses looking for leisure. Combining golf with other tourism activities spa retreats, wine tours, cultural excursions is also extending the market’s reach.

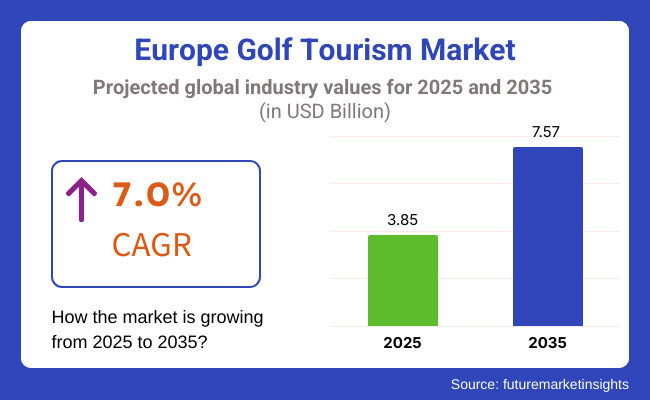

The Europe golf tourism market accounted for USD 3.85 billion in the year 2025 and is expected to reach USD 7.57 billion by the year 2035, at a CAGR of 7.0% during the forecast period.

Technology has been playing an important role in golf tourism as digital booking platforms, virtual golf course tours, and AI-driven personalized golf packages are making it easier for travellers. Online platforms have simplified things for golfers, enabling them to plan personalised trips, take real-time weather reporting and even potentially arrange lessons with professional instructors ahead of their trip. And in terms of the market's growth, social media and influencer marketing have also played a role, making golf courses and exclusive golf resorts look picturesque for viewers.

Sustainability is increasingly becoming a major focus within the golf tourism sector. European golf resorts are increasingly following suit: including water-saving, organic landscaping and renewable energy. As responsible tourism continues to be at the forefront of golf's agenda, golf destinations are recognizing the need to position themselves as green to attract the environmentally conscious traveller.

Scotland, Spain and Portugal still lead the market as classic golf destinations, content in their wealth, but new golf destinations in Eastern Europe are on the rise. Countries like Czech Republic, Poland and Bulgaria are building golf infrastructure to attract international travellers. Moreover, the market is also benefited due to government's initiatives promoting sports tourism along with the growing number of international golf tournaments across Europe.

Golf tourism is steeped in history in Northern Europe, particularly in Scotland, Ireland and the UK. Scotland, the "Home of Golf," draws thousands of visitors each year to legendary courses like St Andrews, Gleneagles and Royal Troon. Ireland is a golf tourism powerhouse too, with top-class links dotted along the Wild Atlantic Way. In addition, big golf events in the UK help in driving consistent tourist flow.

Due to its excellent climate, luxury golf hotels, and beautiful coastal courses, Southern Europe, specifically Spain, Portugal, and Italy, is one of the leading areas in golf tourism. Portugal’s Algarve and Spain’s Costa del Sol are two of the most popular associations amongst golf travellers, with year-round playability and high-quality golfing establishments. Italy, which boasts some of the most beautiful golf courses in Europe, is investing substantially in golf tourism as part of its wider luxury tourism expansion.

Western Europe (France, Germany and the Netherlands) is a blend of championship courses, countryside retreats and integrated golf resorts with cultural tourism. France, which staged the Ryder Cup in 2018, has been attracting increasing numbers of international golf tourists. Golf in Germany as Home to both leisure and competition players, Germany has a mixture of modern and historic golf courses. Dutch golf courses attracting global interest for eco-friendliness and uncommon layout.

Poland and the Czech Republic and Hungary are among the emerging golf tourism destinations in Eastern Europe. These nations are pouring resources into golf infrastructure to lure fresh visitors, providing top-quality courses at discounted rates. The Czech Republic, in particular, has created luxury golf resorts in picturesque areas, whereas Poland is holding international golf events to raise its profile in the industry.

Challenges

Seasonality and Environmental Regulations

As golf tourism relies heavily on good weather conditions and thus faces challenges with seasonal demand fluctuations, this is one key challenge for the Europe Golf Tourism Market. The cooler months see less inflow of tourists to Northern and Central Europe which in turn disrupts the stability of revenue for golf resorts and tour operators. When tough environmental regulations on water usage, pest control, and sustainable golf courses come into play, golf destinations are left with operational headaches. Complying with eco-friendly standards demands investment in chemical-free course management, water conservation technologies, and biodiversity conservation.

Opportunities

Luxury Golf Tourism and Emerging Destinations

As the demand for premium golf tourism experiences grows, the opportunities for growth are substantial. Luxury Golf Resorts Will Be More Relevant than Ever Golf resorts with five-star accommodations, wellness and spas, as well as, exclusive memberships will be in greater demand Post Pandemic. New golf markets in Eastern and Southern Europe - the Algarve in Portugal, the Costa del Sol in Spain and Belek in Turkey are also growing in popularity. Golf resorts, travel agencies, and event organizers are joining forces so that international golf tourism to the area is further enhanced.

The Europe Golf Tourism Market witnessed both rises and falls over the period 2020 to 2024 owing to travel restrictions caused by the pandemic, which resulted in a reduction in international golf tourism. Market conditions bounced back following the influx of domestic and regional golf tourism as golf resorts have since introduced flexible booking policies, as well as private golf packages. Valuable investments in sustainability initiatives, from eco-friendly golf course management to carbon-neutral travel programs, gained traction. Overall, while progress was made, challenges remained: high travel prices, availability of limited direct flights to some golf destinations.

Heavy with data in this context and, moving closer in the long-term future over 2025 to 2035, the digitalization accessibility of sustainability, including an experience-driven concept of golf tourism. Look for AI-powered golf training, smart golf resorts, and virtual reality golf simulations to take the customer experience to another level. Moreover, golf tourism will get beyond the traditional packages and also include wellness retreats, cultural excursions, and family-friendly golf resorts. Sustained growth in the market will come from investment in green-certified golf courses; immersive golfing experiences; and personalized golf concierge services.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adhering to both local environmental legislation and sustainability policies |

| Golf Tourism Growth | Increase in regional and domestic golf travel |

| Industry Adoption | The demand for flexible booking and private golf experiences |

| Sustainability & Energy Efficiency | focusing on water conservation and reducing pesticide usage |

| Market Competition | Stronghold of traditional golf destinations such as Scotland, Spain and Portugal |

| Customer Preferences | Data excludes search interest for these specific resorts and packages. |

| Technology Integration | Digital reservation platforms, mobile golf apps |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | More eco-friendly golf programs, tighter regulations on water and land conservation |

| Golf Tourism Growth | Increased high-end golf tourism, development of new golf destinations |

| Industry Adoption | Rise of AI-powered golf coaching, smart golf course technologies |

| Sustainability & Energy Efficiency | On carbon neutral golf courses and sustainable golf resort management. |

| Market Competition | New golf tourism hotspots emerging in Eastern and Southern Europe |

| Customer Preferences | Growth in luxury golf retreats, personalized golf experiences with wellness and leisure activities |

| Technology Integration | Virtual reality golf simulations, AI-driven swing analysis |

Every year thousands of golf enthusiasts visit the top golf tourism destination in Europe, Spain, due to its incredible climate, world-class golf courses and luxury resorts. Spain’s Mediterranean coastline - especially, the Costa del Sol (a.k.a. the “Costa del Golf”), Costa Blanca and the Balearic Islands - is studded with one of the most luxurious golf resorts in Europe.

The main area for golf tourism in Spain is indeed Andalusia, which counts over 100 golf courses and world famous Valderrama Golf Club. It has great weather, direct international flights, and a high density of luxury golf resorts. Similarly, Barcelona and Madrid are implementing golf tourism centers combining high-end golf resorts with cultural and gastronomic tourism experiences.

Increasing demand for golf and wellness retreats are exhibiting a growing trend towards luxury golf villas or tournament-based tourism and investment in sustainable golf courses to develop a world-class golfing destination in Spain for amateur and professional players alike. Its reputation is enhanced further given the country’s continual staging of European Tour events.

| Country | CAGR (2025 to 2035) |

|---|---|

| Spain | 7.5% |

Portugal has become one of Europe’s leading golf tourism destinations, with its top golf resorts, beautiful coastal courses and mild year-round climate. Portugal’s golf tourism industry is centered in the Algarve region, where more than 40 of its golf courses are championship level. It draws golfers from all over Europe, especially the United Kingdom, Germany and Scandinavia. More recently, Lisbon’s Cascais and Estoril regions are emerging as luxury golf destinations with private golf resorts featuring five-star accommodation, spa retreats and fine dining. The Madeira and Azores archipelagos are off-the-beaten-path golf destinations for high-net-worth traveling golfers seeking isolation and nature. Portugal pools several advantages that makes it an attractive destination: good air connectivity, comparatively inexpensive green fees and high quality golf training facilities all make it attractive to the leisure and professional golfer. The country’s commitment to sustainable tourism and environmentally friendly golf course development only adds to its appeal.

| Country | CAGR (2025 to 2035) |

|---|---|

| Portugal | 7.3% |

The UK is still a powerhouse of golf tourism, home to many of the world’s oldest and most traditional courses including St Andrews, Royal Birkdale and Royal St George’s plus Wentworth Golf Club. The country draws domestic and international travellers eager to play links courses, parkland courses and Ryder Cup venues. Scotland is the heart of golf tourism in the UK nicknamed the "Home of Golf", it is home to world-famous courses like St Andrews, Gleneagles and Turnberry. The rest of the world takes second place, with England closely behind, where professional tournaments and leisure golfers alike have high-profile courses in Surrey, Kent and the Midlands. This is evident at major events hosted in the UK, such as The Open Championship and Ryder Cup, which have a huge impact on inbound golf tourism. Moreover, increasing golf, and whisky tourism to Scotland, golf heritage tours, and bespoke private golf retreats is fueling the market growth. But local weather constraints and higher average costs relative to Southern Europe, continue to present difficulties.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

France is an increasingly popular golf tourism destination, particularly since the 2018 Ryder Cup, which took place at Le Golf National in Paris. The country is garnering interest from both leisure and competitive golfers, as golf resorts, vineyard-based golf retreats and cultural golf tours increase in number. Provence, the French Riviera, and Bordeaux are among regions that are investing in golf tourism, blending luxury golf with wine tourism and coastal leisure experiences. And Normandy and Brittany are drawing European golfers looking for traditional parkland courses with historic landscapes. Paris still is exceptionally well positioned as a golf tourism city with immensely good international access and courses, culture and luxury travel options. The French Alps also are experiencing an increase in demand for alpine golf courses, sought by those searching for courses with stunning mountain backdrops. With government programs encouraging golf as a facet of France’s luxe tourism offerings, high-end golf tourism in the country is forecasted to continue expanding.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 7.1% |

Italy golf tourism market generates ever-increasing interest, which has opened up a comprehensive course and tourism development to take advantage of attractive courses combined with luxury accommodation, golf-integrated cultural tourism. The hotspot for high-end golf resorts and championship-level courses is in the Lombardy, Tuscany and Sardinia regions. There is new investment in urban golf resorts in Milan and Rome as well as luxury island golf destinations on Sicily and Sardinia. There were visitations including from the 2023 Ryder Cup in Rome, which only increased Italy’s global appeal around the game, which drove international demand for Italy.

| Country | CAGR (2025 to 2035) |

|---|---|

| Italy | 7.2% |

The Europe golf tourism market is dominated by a number of direct suppliers with already established operations to provide excellence and convenience in golf travel. Airlines & Hotels - Providing Services That Just Win On Golf Courses Visit.

Golf tourism: Airlines added services to help expand golf tourism in Europe. Major carriers fly direct to world-famous links, such as Spain, Portugal, and Scotland, for hassle-free transport for visitors outside the United States and domestically.

Multiple airlines have adopted golf-friendly policies, permitting travellers to check golf gear at little or no extra cost, which has also contributed to increasing demand. Similar goes with the charter airlines - these have not only expanded their offering, but also started targeting premium golf travellers who want exclusivity and a seamless experience. The growing range of golf-focused flights packages and satellite winter routes into tournament hosting destinations demonstrate the significance of airlines to the viability of Europe’s golf holiday sector.

Route expansion & golf tourist focus despite variable fuel prices & some travel restrictions (that have since been lifted), airlines are constantly expanding their routes and building customer-focused strategies to attract golf tourists. Airlines and golf resorts have partnered to enhance accessibility, making golf tourism even more integrated and appealing

Hotel companies are leading the way in golf tourism, providing exclusive lodging near premier golf courses and resorts. Top hospitality names have taken the golf experience to the next level with course proximity, tailored coaching, exclusive tee times and specialized guides.

Luxury hotels and golf resorts in key markets - the United Kingdom, France, and Italy - cater to high-end golf travellers looking for grounding experiences. Complete stay-and-play packages that cover green fees, transport and tailored itineraries are also available at many properties, all making for an effortless and luxe golf trip.

Green initiatives have also been a considerable focus among hotels, with eco-friendly initiatives finding their way into golf tourism offerings. To attract eco-conscious golf tourists, hotel companies are partnering with environmental organizations, sustainable golf courses, and energy-efficient accommodations.

Indirect suppliers are the intermediaries that provide a comprehensive connection point between the budding golf traveller and tour package deals and competitive booking options. Golf travel has also seen the widespread adoption of online travel agencies (OTAs) as well as travel agencies forward, both of which continue to be industry leaders and help provide golfing travel services that meet the specific wants and needs of consumers.

When it comes to golf tourism, online travel agencies (OTAs) have changed the game completely by offering immediate booking opportunities, discounted rates and custom planning. Some of the leading platforms also come with filters tailored for golf, which enable travellers to book flights, accommodations and tee times within the same interface.

OTAs use AI-powered recommendations to customize golf travel bundles, catering to different traveller segments. From all-inclusive golf holidays to tournament experiences and bespoke coaching programs, golfers have the option to select from several bundled services.

The market presence of OTAs is further enhanced by the rapid adoption of mobile booking and last minute golf getaway deals. Despite issues surrounding transparency of prices and limitations in customer service, OTAs remain the booking channel of choice for today’s golf travellers.

Although OTAs have disrupted the booking space, traditional travel agencies play a vital role in catering to golf tourists who want ultra-personalized, premium travel experiences. Golf tourism agencies design tailored packages, from private charters and VIP course access to guided golf tours spanning the continent’s best destinations.

Several of those agencies work directly with luxury golf resorts, private clubs and premium airlines to create premium experiences for wealthy golf travellers. These physical travel stores are different from online-focused companies that stand out using their exclusive concierge services, tailored itineraries, and customer support on the ground.

The Europe golf tourism market is supported by the high demand for premium golf tours among international and domestic tourists, strengthening the share of luxury accommodation offerings and cultural exploration. Golfing resorts, travel agencies, and hospitality sector brands: AI is used to create dynamic destinations including AI powered golf vacation booking packages, high-end exclusive resort experiences, more. Trends to keep an eye out for among golf tourism businesses include sustainability, VIP golf concierge services, and integrated wellness and golf retreats. The market is especially booming in top golf destinations like Spain, Portugal, Scotland and France.

Market Share Analysis by Key Players & Cruise Operators

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Golfbreaks (by PGA TOUR) | 18-22% |

| Your Golf Travel | 12-16% |

| PerryGolf | 10-14% |

| Holidays Golf (Golfing Holidays Europe) | 8-12% |

| Premier Golf | 5-9% |

| Others | 30-40% |

Key Company Cruise Offerings

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Golfbreaks (by PGA TOUR) | Premium golf vacation packages, international golf breaks, and tournament hospitality experiences. |

| Your Golf Travel | Custom golf holiday bookings, including all-inclusive golf resorts, PGA Championship course access, and golf cruises. |

| PerryGolf | Luxury golf travel experiences with exclusive access to Scotland’s top courses, including St. Andrews and Royal Troon. |

| Holidays Golf (Golfing Holidays Europe) | Golf and leisure vacation packages, offering golf and spa retreats, Mediterranean golf resorts, and pro-coaching trips. |

Golfbreaks (by PGA TOUR) (18-22%)

Golfbreaks: Golfbreaks is one of the largest golf tour operators in Europe, offering everything from high-end golf vacation packages to corporate golf days through direct relationships with the best golf resorts in Europe.

Your Golf Travel (12-16%)

Your Golf Travel is one of the largest multi-branded golf tour operators in the world, offering golf holiday packages to some of the most popular and beautiful golf destinations, along with personalized golf vacations, exclusive luxury golf cruises and VIP experiences to some of the most prestigious tournaments.

PerryGolf (10-14%)

PerryGolf (perrygolf.com): Known for its top-of-the-line golf travel offerings, PerryGolf specializes in high-end Scottish and Irish golf vacations, signature events on championship courses and historic golf venues.

Holidays Golf (Golfing Holidays Europe) (8-12%)

Holidays Golf is a leading provider of European golf breaks including all-inclusive golf resort packages, golf & spa experiences and accompanied golf coaching.

Premier Golf (5-9%)

Premier Golf offers premium packages to high-profile golf events like the Ryder Cup, The Open and other international tournaments, as well as top-drawer golf destination enrollment.

Other Key Players (30-40% Combined)

The overall market size for Europe golf tourism market was USD 3.85 billion in 2025.

The Europe golf tourism market is expected to reach USD 7.57 billion in 2035.

The demand for golf tourism in Europe will rise due to increasing consumer preference for premium and destination-based golfing experiences, driven by the growing influence of sports tourism, rising spending on luxury golf resorts, and the expanding presence of international golf tournaments in key European locations.

The top 5 regions which drives the development of Europe golf tourism market are Spain, Portugal, France, and UK.

Airline and OTA (Online Travel Agency) supplier to command significant share over the assessment period.

Table 01: Total Tourist Arrivals (Million), 2022

Table 02: Total Spending (US$ Million) and Forecast (2018 to 2033)

Table 03: Number of Tourists (Million) and Forecast (2018 to 2033)

Table 04: Spending per Traveller

Figure 01: Total Spending (US$ Million) and Forecast (2023 to 2033)

Figure 02: Total Spending Y-o-Y Growth Projections (2018 to 2033)

Figure 03: Number of Tourists (Million) and Forecast (2023 to 2033)

Figure 04: Number of Tourists Y-o-Y Growth Projections (2018 to 2033)

Figure 05: Spending per Traveller (US$ Million) and Forecast (2023 to 2033)

Figure 06: Spending per Traveller Y-o-Y Growth Projections (2018 to 2033)

Figure 07: Current Market Analysis (% of demand), By Purpose, 2022

Figure 08: Current Market Analysis (% of demand), By Age Group, 2022

Figure 09: Current Market Analysis (% of demand), By Booking Method, 2022

Figure 10: Current Market Analysis (% of demand), By Demographics, 2022

Figure 11: Current Market Analysis (% of demand), By Nationality, 2022

Figure 12: Current Market Analysis (% of demand), By Group Type, 2022

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Golf Tourism Market Analysis - Size, Share, and Forecast 2025 to 2035

UK Golf Tourism Market Analysis

USA Golf Tourism Market Analysis

Europe Winter Tourism Market Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Japan Golf Tourism Market Analysis

Europe Educational Tourism Market Trends - Growth & Forecast 2025 to 2035

Germany Golf Tourism Market Trends – Growth, Demand & Forecast 2025–2035

GCC Countries Golf Tourism Market Analysis – Growth, Trends & Forecast 2025–2035

Trends, Growth, and Opportunity Analysis of Rail Tourism in Europe Size and Share Forecast Outlook 2025 to 2035

China Outbound Meetings, Incentives, Conferences, Exhibitions (MICE) Tourism to Europe Market Size and Share Forecast Outlook 2025 to 2035

Golf Course Engineering Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Golf Cart Batteries Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA