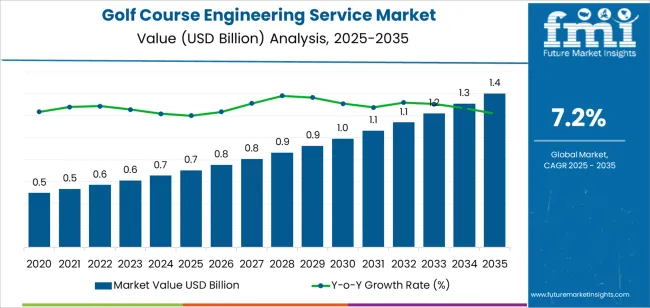

The golf course engineering service market is valued at USD 0.7 billion in 2025 and is projected to reach USD 1.4 billion by 2035, advancing at a CAGR of 7.2%. Market growth is supported by increasing development and modernization of golf facilities, rising tourism-linked course construction, and the need for specialized engineering solutions that address drainage, irrigation, landscape shaping, and environmental sustainability. Growing demand for upgraded course infrastructure, including renovation of aging layouts and integration of water-efficient systems, continues to strengthen the market.

Construction services represent the leading segment, driven by the technical requirements of course grading, greens shaping, bunker formation, and fairway development. These services integrate soil engineering, hydrology management, and environmental planning to ensure durable course performance under varying climate conditions. Advancements in precision earthmoving, digital terrain modeling, and resource-efficient irrigation design are enhancing construction accuracy and long-term course reliability.

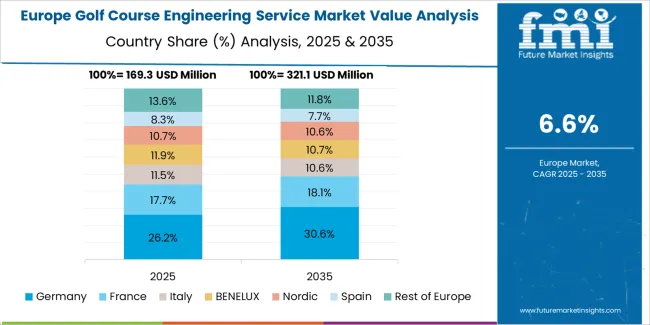

Asia Pacific leads global market expansion due to increasing golf participation and growth in sports tourism across China, Japan, South Korea, and Southeast Asia. Europe and North America maintain steady demand through course renovation cycles and modernization of established facilities. Key service providers include Nicklaus Design, Rees Jones Inc, BrightView, Duininck Inc, MJ Abbott, Boss Engineering, and CJW Golf, focusing on technical design, construction quality, and integrated course management solutions.

Breakpoint analysis shows two key transition phases shaped by construction activity, environmental standards, and modernization cycles. The first breakpoint, expected between 2026 and 2029, will coincide with rising investment in new course development and renovation of aging layouts. Demand during this phase will be supported by upgrades to irrigation systems, drainage design, and turf-performance engineering aligned with ecofriendly requirements.

A second breakpoint is likely between 2031 and 2033 as the market shifts from expansion-driven projects to optimization-led services. Engineering firms will focus on precision water management, ecological restoration, and digital course-mapping integration rather than large-scale construction. Growth will become steadier as renovation cycles stabilize and environmental compliance frameworks mature across major golfing regions. The progression across these breakpoints reflects a market moving from development-intensive activity toward long-term operational refinement, supported by resource-efficiency goals, climate adaptation needs, and the broader shift toward data-informed course-management practices.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.7 billion |

| Market Forecast Value (2035) | USD 1.4 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The golf course engineering service market is growing because developers and course owners require specialised technical planning for irrigation, drainage, land shaping, turf systems and environmental compliance. Rising investment in golf tourism, resort development and residential communities that include course facilities increases demand for engineering expertise. Many older courses require renovation to improve water use, update infrastructure and meet modern playing standards. Engineering firms provide site analysis, soil studies, layout optimisation and construction management that support efficient long term operation.

Growth is also influenced by interest in ecofriendly course design that reduces water consumption and environmental impact. Constraints include high project cost, lengthy approval timelines, and complex coordination among architects, environmental regulators and construction teams. Variation in land availability and local regulations can also limit new course development in certain regions.

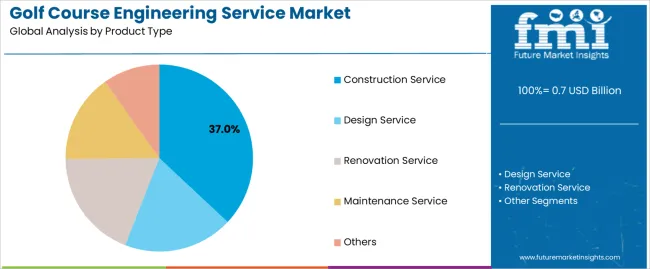

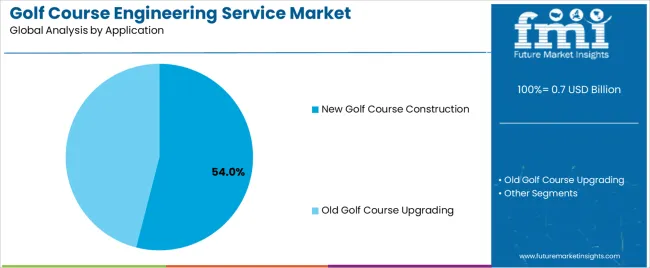

The golf course engineering service market is segmented by product type and application. By product type, the market includes design service, renovation service, construction service, maintenance service, and others. Based on application, it is categorized into new golf course construction and old golf course upgrading. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

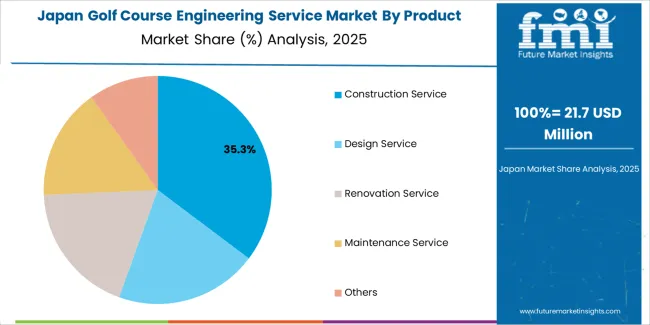

The construction service segment holds the leading position in the golf course engineering service market, representing an estimated 37.0% of total market share in 2025. Construction services cover earthworks, drainage engineering, irrigation systems, turf installation, bunker shaping, green contouring, and infrastructure integration. These activities require specialized technical expertise and substantial project resources, driving a higher share of engineering expenditure.

The design service segment follows with an estimated 26.0%, driven by demand for ecological planning, course routing, water-efficiency strategies, and performance-oriented layout development. The renovation service category, at roughly 21.0%, supports modernization projects targeting sustainability, water management upgrades, and redesign of aging greens and fairways. Maintenance services, accounting for about 13.0%, involve ongoing agronomic assessment, mechanical system upkeep, and performance optimization. The others segment represents the remaining 3.0%.

Key factors supporting the construction service segment include:

The new golf course construction segment accounts for approximately 54.0% of the market in 2025. This category includes greenfield course development for resorts, integrated residential communities, and standalone golf facilities. Demand is influenced by tourism development, real estate expansion, and investment in destination recreation.

The old golf course upgrading segment, representing about 46.0%, involves redesigning greens, updating irrigation systems, modernizing bunkers, improving sustainability, and adapting layouts to current playability standards. Growth is supported by environmental compliance requirements and efforts to improve operational efficiency in aging courses.

Primary dynamics driving demand from the new golf course construction segment include:

Rising investment in golf infrastructure, expansion of tourism-linked sports facilities, and increased demand for ecofriendly course design are driving market growth.

The golf course engineering service market is expanding as developers, resort operators, and sports authorities invest in new courses and modernization projects. Countries promoting sports tourism and hospitality development rely on engineering teams to design courses that balance playability, safety, and environmental performance. The shift toward integrated resort models, which combine hotels, event venues, and recreational amenities, strengthens demand for engineering services capable of managing terrain modeling, water management, and irrigation planning. Growth in professional tournaments and membership-based clubs encourages operators to upgrade existing fairways, bunkers, and drainage systems. Engineering firms are also improving course longevity through soil analysis, turf optimization, and mechanical system integration for irrigation and surface management.

High project cost, land availability constraints, and regulatory requirements are restraining adoption.

Golf course engineering involves significant capital expenditure covering land preparation, environmental studies, hydrological surveys, and compliance approvals. These costs limit new development in regions with tight budgets or low membership demand. Land scarcity in urban and semi-urban areas restricts opportunities for new course construction, reducing project pipelines in densely populated markets. Environmental regulations related to water usage, wetland protection, and biodiversity preservation add further complexity and may delay project timelines. Maintenance requirements for engineered irrigation, drainage, and turf systems can also discourage long-term commitments from operators with limited resources.

Growth in ecofriendly water management solutions, adoption of digital course-mapping tools, and rising development in emerging golf regions are shaping industry trends.

Engineering firms are prioritizing water-efficient irrigation systems, reclaimed water strategies, and drought-tolerant turf layouts to support ecofriendly goals. Digital mapping platforms, including GIS-based terrain modeling, drone surveying, and simulation software, are improving design precision and reducing construction errors. Emerging markets in Asia Pacific, the Middle East, and parts of Eastern Europe are experiencing increased investment in golf facilities linked to tourism and residential development. Engineering teams are also focusing on renovation projects that modernize older courses with improved drainage, accessible layouts, and updated competitive standards.

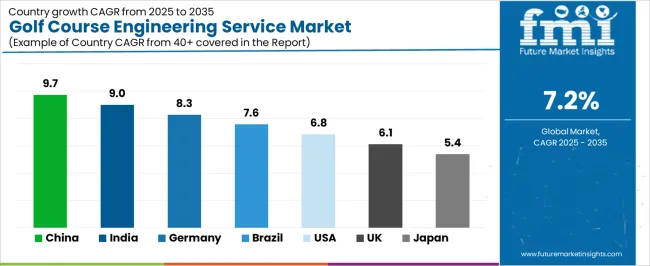

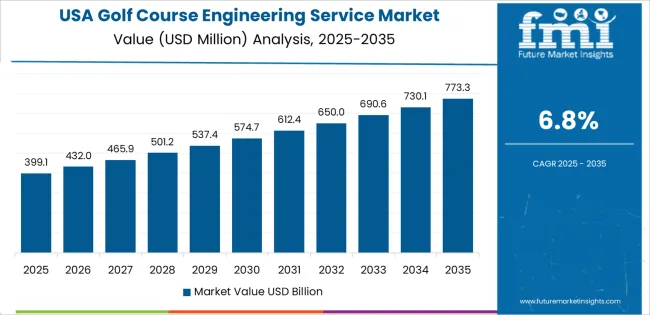

The global golf course engineering service market is expanding through 2035, supported by rising investments in sports infrastructure, broader adoption of terrain-optimization services, and increased focus on irrigation efficiency, environmental compliance, and course-design modernization. China leads with a 9.7% CAGR, followed by India at 9.0%, reflecting strong tourism-sector projects and new recreational-facility development. Germany grows at 8.3%, supported by regulated environmental standards and structured engineering practices. Brazil records 7.6%, driven by tourism and private-course upgrades. The United States grows at 6.8%, while the United Kingdom (6.1%) and Japan (5.4%) maintain steady demand through course-renovation cycles and long-established golfing ecosystems.

| Country | CAGR (%) |

|---|---|

| China | 9.7 |

| India | 9.0 |

| Germany | 8.3 |

| Brazil | 7.6 |

| USA | 6.8 |

| UK | 6.1 |

| Japan | 5.4 |

China’s market grows at 9.7% CAGR, supported by expanding sports-infrastructure investments, resort-driven recreational developments, and increasing adoption of engineered course-planning solutions. Golf course engineering services are used for drainage optimization, irrigation-network design, slope grading, environmental-impact assessment, and turf-system engineering. Large tourism-region projects integrate hydrology mapping and soil-profile evaluation to support sustainable course layouts. Domestic and international engineering firms participate in high-end resort courses and urban golf facilities requiring performance-focused design models. Growth in leisure real-estate development further elevates demand for specialized course-engineering services.

Key Market Factors:

India’s market grows at 9.0% CAGR, driven by expanding hospitality infrastructure, increased interest in sports tourism, and steady development of new golf facilities across metropolitan and resort regions. Engineering services support terrain analysis, irrigation-efficiency planning, soil stabilization, and climate-suitable turf engineering. Developers rely on specialized engineering inputs to manage water-sensitive designs and monsoon-responsive drainage systems. Growth in private golf communities, leisure resorts, and sports-academy facilities enhances long-term adoption. Engineering firms also provide renovation services for existing courses requiring updated layouts and water-management technology.

Market Development Factors:

Germany’s market grows at 8.3% CAGR, supported by regulated environmental standards, structured approach to land-use engineering, and rising renovation requirements for established courses. Golf course engineering services focus on eco-compliant land grading, water-resource planning, and integration of erosion-control systems. Engineering consultancies develop irrigation layouts aligned with energy-efficient pumping networks and ecofriendly water-circulation models. Renovation of older courses to meet modern environmental guidelines increases engineering activity. Strong participation from golf associations and regional planning authorities reinforces consistent demand.

Key Market Characteristics:

Brazil’s market grows at 7.6% CAGR, driven by tourism-focused facility development, expansion of resort-based golf properties, and broader adoption of engineered course-layout services. Engineering firms support terrain profiling, hydrology design, and soil-conditioning strategies adapted to tropical climates. Increased construction of leisure and hotel-linked courses strengthens demand for irrigation systems designed for seasonal rainfall patterns. Existing golf facilities adopt redevelopment services involving drainage upgrades and turf-condition management. Digital design tools and geospatial mapping technologies support improved planning for new projects.

Market Development Factors:

The United States grows at 6.8% CAGR, supported by an established golf ecosystem, ongoing renovation projects, and steady demand for engineering services focused on water-efficiency improvements. Engineering firms provide expertise in drainage redesign, irrigation-system optimization, slope grading, bunker reconstruction, and turf-science integration. Many existing courses require modernization to meet updated ecofriendly guidelines and regional water-use regulations. Growth in residential golf communities, resort courses, and municipal facility upgrades strengthens engineering demand. Digital mapping, soil analytics, and precision-irrigation models further support service adoption.

Key Market Factors:

The United Kingdom’s market grows at 6.1% CAGR, supported by a long-standing golf culture, steady course-maintenance needs, and increased adoption of engineering upgrades to meet environmental and drainage requirements. Services include land grading, hydrology assessment, bunker engineering, and turf-condition improvements tailored to temperate climates. Coastal courses require erosion-management and structural design inputs, increasing reliance on specialized engineering consultancies. Renovation of traditional courses to improve playability and drainage efficiency further contributes to market activity.

Market Development Factors:

Japan’s market grows at 5.4% CAGR, supported by established golf facilities, complex terrain requirements, and steady demand for engineering services focused on slope stability, drainage solutions, and precision-turf systems. Mountain-region courses require specialized land-shaping and erosion-control engineering, while urban and suburban courses emphasize water-efficient irrigation and compact-footprint designs. Engineering firms provide hydrology simulations, soil reinforcement methods, and environmental-impact assessments aligned with local regulations. Aging courses undergoing modernization further strengthen demand.

Key Market Characteristics:

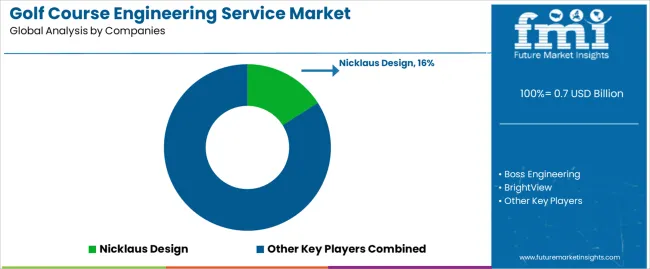

The golf course engineering service market is moderately fragmented, with about fifteen specialist firms offering design, construction engineering, agronomy, and renovation services for private, municipal, and resort courses. Nicklaus Design leads the market with an estimated 16.0% global share, supported by its extensive project portfolio, established design methodologies, and long-term engagement with international golf developments. Its position is reinforced by documented engineering standards and broad geographical experience.

Rees Jones, Inc, BrightView, Duininck Inc, and MJ Abbott follow as major competitors, providing integrated engineering, drainage, irrigation, and course construction services. Their competitive strengths include multidisciplinary technical teams, experience with large renovation projects, and reliable delivery aligned with environmental and playability requirements. Boss Engineering, CJW Golf, CJW Golf International, and Flagstick maintain solid mid-tier roles through regionally focused engineering support and project management for new builds and course upgrades.

Companies such as Envirotech Engineering, Fineturf, FSE Engineering Group, Mcdonald and Sons, Shearon Golf, SURTEC Golf Agronomy, and Weston & Sampson contribute to market diversity by offering specialized services including turf management planning, water-use analysis, bunker redesign, and precision grading.

Competition in this market centers on engineering accuracy, environmental compliance, drainage performance, construction quality, and integration with modern irrigation technologies. Demand is driven by course modernization, ecofriendly requirements, and increased renovation activity aimed at improving water efficiency, turf resilience, and overall course playability across diverse geographic regions.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Design Service, Renovation Service, Construction Service, Maintenance Service, Others |

| Application | New Golf Course Construction, Old Golf Course Upgrading |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Boss Engineering, BrightView, CJW Golf, CJW Golf International, Duininck Inc., Envirotech Engineering, Fineturf, Flagstick, FSE Engineering Group Limited, Mcdonald And Sons, MJ Abbott, Nicklaus Design, Rees Jones Inc., RJ Burnside, Shearon Golf, SURTEC Golf Agronomy, Weston & Sampson |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of golf course design, construction, and agronomy service providers; advancements in ecofriendly golf course engineering, turf management, and water conservation technologies; integration with modern sports facility planning and large-scale recreational land development. |

The global golf course engineering service market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the golf course engineering service market is projected to reach USD 1.4 billion by 2035.

The golf course engineering service market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in golf course engineering service market are construction service, design service, renovation service, maintenance service and others.

In terms of application, new golf course construction segment to command 54.0% share in the golf course engineering service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Batteries Market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Golf Ball Picker Robot Market Size and Share Forecast Outlook 2025 to 2035

Golf Putter Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Battery Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Market Analysis - Size, Share, and Forecast 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Golf Outfit Market Growth - Trends & Forecast 2025 to 2035

Golf Tourism Market Analysis - Size, Share, and Forecast 2025 to 2035

Golf Course Maintenance Robot Market Size and Share Forecast Outlook 2025 to 2035

UK Golf Tourism Market Analysis

USA Golf Tourism Market Analysis

Japan Golf Tourism Market Analysis

Europe Golf Tourism Market Insights - Growth & Forecast 2025 to 2035

Germany Golf Tourism Market Trends – Growth, Demand & Forecast 2025–2035

Electric Golf Cart Market Growth – Trends & Forecast 2025 to 2035

GCC Electric Golf Cart Market Outlook – Demand, Growth & Forecast 2025-2035

GCC Countries Golf Tourism Market Analysis – Growth, Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA