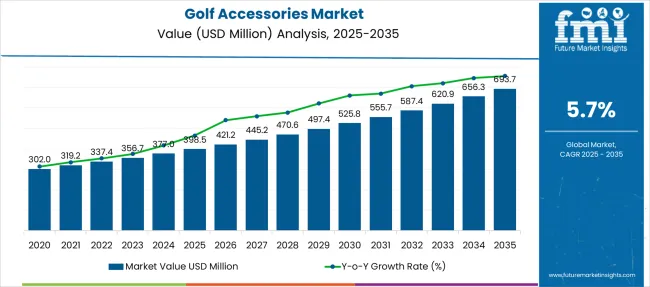

The Golf Accessories Market is estimated to be valued at USD 398.5 million in 2025 and is projected to reach USD 693.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. The CAGR shows a moderate but consistent value accumulation curve. Between 2025 and 2030, the market is forecasted to rise to approximately USD 525.8 million, yielding USD 127.3 million in added value or 43% of the total decade-long growth. From 2030 to 2035, the remaining USD 167.9 million is expected to accumulate, suggesting a slightly stronger second-half curve slope.

The shape of the long-term accumulation curve exhibits convex characteristics, where growth accelerates gradually in absolute terms despite a tapering relative growth rate. Annual increments rise from USD 22.7 million between 2025 and 2026 to USD 37.4 million from 2034 to 2035.

This suggests a healthy adoption rate of premium and smart accessories, including GPS-enabled rangefinders, connected ball tracking kits, and swing analysis tools. Brands like Callaway, Titleist, and Garmin are expected to contribute to this value expansion through product differentiation and tech integration. The accumulation curve implies stronger contribution margins in the latter half of the forecast period due to increased value-added offerings.

| Metric | Value |

|---|---|

| Golf Accessories Market Estimated Value in (2025 E) | USD 398.5 million |

| Golf Accessories Market Forecast Value in (2035 F) | USD 693.7 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The golf accessories market represents about 35% of the golf equipment and apparel segment, including items like golf gloves, bags, hats, and footwear purchased alongside clubs and clothing. It contributes roughly 20% to the broader sports and recreation accessories market, which includes swing trainers, range finders, and practice aids.

Around 15% of the golf course and club operations market demand these accessories for pro shops, course retail, and golfer amenities. Retail sporting goods account for close to 18% of overall sales, as accessories are often bundled or cross-sold with other gear. The remaining 12% falls within the outdoor leisure and fitness goods market, where lifestyle golf items, fitness-enhancing tools, and golf-themed leisure products continue to grow.

The industry is evolving with growing interest from younger players and increasing engagement through social and digital platforms. Smart accessories such as GPS rangefinders, swing trackers, and motion-sensing gloves are gaining popularity among both amateurs and professionals seeking performance feedback.

Demand for eco-friendly products is rising, with biodegradable tees, recycled-content golf bags, and sustainable apparel becoming common choices. Customization trends are driving interest in personalized gear, including engraved ball markers and monogrammed head covers. Online retail channels are expanding visibility and access to premium accessories, while collaborations with lifestyle brands are adding fashion and functionality to traditional golf equipment.

The growth of the golf accessories market is fueled by increasing participation in recreational and professional golf, particularly across North America, Europe, and parts of Asia-Pacific. Demand for specialized accessories is rising as consumers seek improved performance, protection, and convenience during play.

The resurgence of golf as a leisure activity post-pandemic, supported by growing memberships in golf clubs and wider coverage through televised events, has created a favorable environment for accessory manufacturers. Additionally, advancements in material quality and customization options have further elevated consumer interest in premium accessories.

The future outlook remains optimistic, supported by golf infrastructure developments based on tourism and the increasing popularity of outdoor sports. As consumers become more willing to invest in product longevity and comfort, accessory innovation and functionality are expected to play a pivotal role in sustaining market momentum.

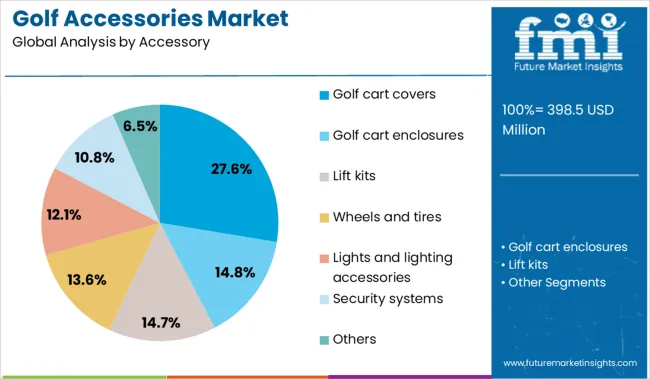

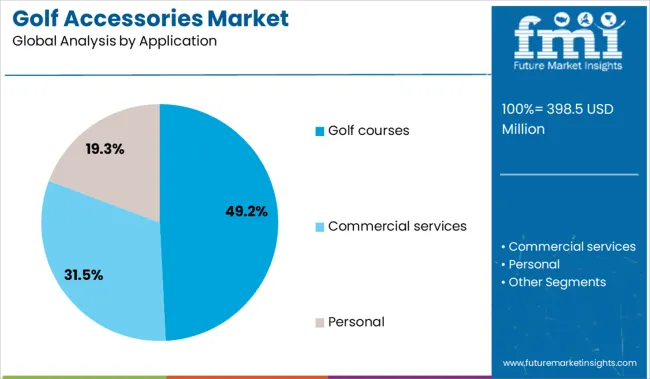

The golf accessories market is segmented by accessory type, application, and region. By accessory, it includes golf cart covers, golf cart enclosures, lift kits, wheels and tires, lights and lighting accessories, security systems, and other related products that enhance performance and convenience. In terms of application, the segmentation comprises golf courses, commercial services, and personal use, indicating a diverse customer base across professional and recreational settings. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The golf cart covers segment leads the accessory category with a 27.6% market share, underscoring its importance in providing essential protection against weather elements and enhancing vehicle longevity. These covers are increasingly favored for their ability to shield carts from UV exposure, rain, dust, and debris, contributing to reduced maintenance costs and extended equipment life.

Manufacturers are responding to demand by offering water-resistant, breathable, and custom-fit covers that appeal to both casual golfers and course operators. Growth in this segment is also driven by the increasing adoption of electric golf carts, which require added protection for battery longevity and performance.

As golf cart usage expands beyond traditional courses to resorts and gated communities, the demand for high-quality covers continues to rise. The segment is expected to maintain its growth trajectory due to its role in preserving asset value and ensuring comfort for users in variable weather conditions.

The golf courses segment holds a dominant 49.2% share in the application category, reflecting its central role in shaping demand for a broad range of golf accessories. As the primary venue for both professional and recreational play, golf courses serve as a continuous source of demand for high-quality and durable accessories that enhance the player experience and support course operations.

From protective equipment to utility add-ons, accessories used at golf courses are typically purchased in bulk by course operators, ensuring steady sales cycles for manufacturers. The expansion of golf tourism and the development of new golf resorts have contributed to the growth of this segment, alongside efforts to upgrade existing course facilities.

Sustainability initiatives are also encouraging the procurement of eco-friendly accessories, driving innovation in design and materials. Continued investment in course maintenance and modernization is expected to sustain the segment’s leadership within the market.

Growing focus on personalized gear, technology-assisted performance improvements, and leisure spending upswing is fueling demand. Opportunities include customizable product lines, digital coaching integrations, and partnerships with clubs, retail, and travel platforms.

Golfers increasingly invest in accessories that elevate comfort, precision, and personalization. Products such as custom-fitted grips, high-performance gloves, ergonomic headcovers, and swing-enhancing training aids are in demand. GPS devices and portable launch monitors provide real-time swing analysis and distance tracking, appealing to players seeking measurable improvements. Leisure travel packages and golf tourism are driving accessory purchases as players seek branded kits and kit-ready luggage, ball markers, and premium gloves for course use. Demand grows as more people view golf as both a sport and a lifestyle. Equipment designers respond with lightweight, weather-resistant materials and performance fabrics. Golf retailers and pro shops are offering curated accessory bundles, further encouraging on-course accessory sales.

The accessory market is expanding through tailored offerings that integrate personalization with technology. Brands offering DIY embroidery for headcovers, monogrammed gloves, or custom color schemes attract loyal buyers. Digital platforms that pair accessories with virtual coaching tools, like app-based swing feedback tied to club usage, enhance the utility of products. Collaboration with golf clubs, travel venues, and online course reservations enables bundling accessories with membership packages or stay-and-play experiences.

Subscription-based clubs delivering fresh golf balls, gloves or training aids directly to consumers tap recurring revenue. Expanding into lifestyle and sport travel channels, social media influencer campaigns, and pop-up shop experiences at tournaments helps reach broader customer sets. These strategies drive adoption by combining performance, personalization, and convenience.

| Countries | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

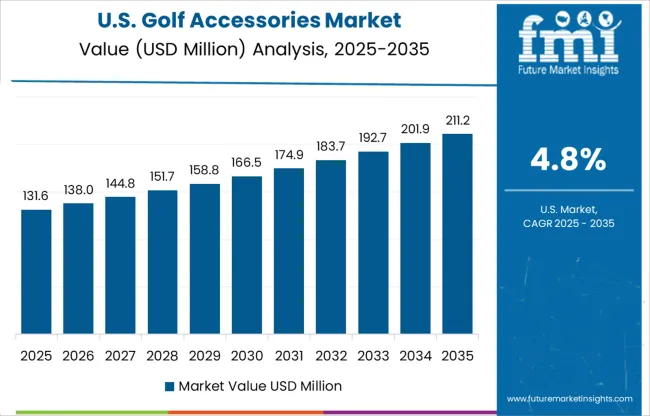

| USA | 4.8% |

| Brazil | 4.3% |

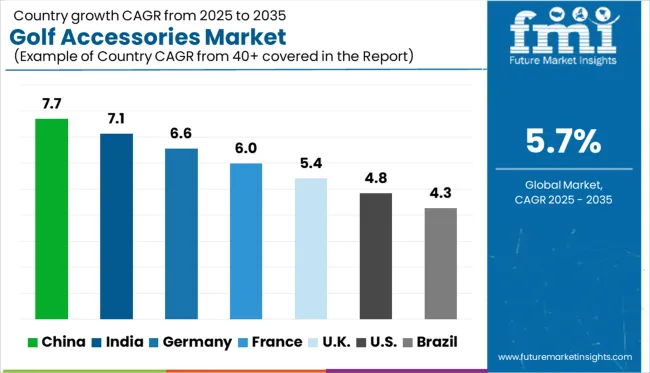

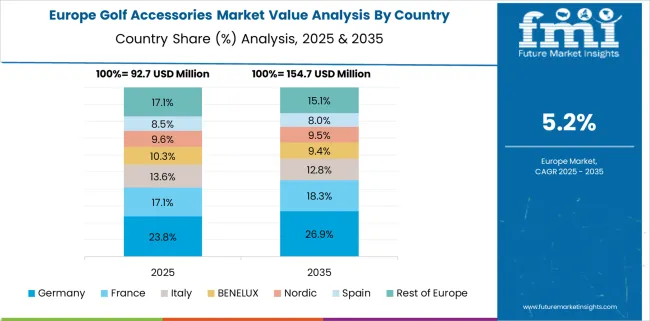

The global golf accessories market is projected to grow at a CAGR of 5.7% from 2025 to 2035, fueled by growing participation in recreational golf, rising disposable income, and increasing international golf tourism. China leads with a 7.7% CAGR, supported by rising interest in premium leisure sports, expanding golf course infrastructure, and high-end consumer demand. India follows at 7.1%, reflecting urban elite engagement and development of golfing facilities in metro cities. Germany, an OECD nation, posts a 6.6% CAGR, driven by aging demographics and a preference for outdoor sports.

The UK maintains steady demand with a 5.4% CAGR due to its established golfing tradition. The US trails with 4.8%, indicating a mature market with sustained but moderate growth. This report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is likely to lead with a 7.7% CAGR, which shows a steady YoY growth driven by increased participation across high-income metro populations. Accessories such as gloves, caps, tees, and golf-specific footwear are gaining popularity through both pro shops and online channels. Club memberships in regions like Guangdong and Beijing are influencing demand for personalized and premium-grade gear.

Domestic brands are expanding their presence by offering quality alternatives at competitive prices, targeting younger players and leisure-oriented buyers. Training academies and corporate golf programs are also stimulating entry-level accessory sales. The shift from rental to personal gear is contributing to strong volume growth.

India is advancing at a 7.1% CAGR, with clear YoY gains seen in golf-centric urban pockets such as Delhi NCR, Bengaluru, and Pune. Accessories are witnessing a shift from occasional purchases to recurring upgrades, especially among amateur golfers entering coaching programs. Branded gloves, visors, rangefinders, and multi-pocket bags are among the most popular products.

Growth is supported by golf academies, which package gear recommendations into beginner sessions. Local sports retailers are beginning to stock more golf SKUs, offering buyers wider price points. Though still niche in reach, the market is gaining a loyal customer base across private and corporate courses.

Germany is anticipated to grow steadily at a 6.6% CAGR, with YoY sales rising across both professional and casual golfing segments. Accessories such as waterproof bags, soft spikes, and all-weather gloves are in consistent demand due to variable outdoor conditions. The country’s golf culture favors individual ownership of gear, pushing buyers toward specialized and premium accessory lines.

Product upgrades are common before the spring season, leading to predictable sales spikes. Club-level retail outlets are effective distribution points, often bundling accessories with seasonal promotions. Importers and specialty brands benefit from a stable, experience-oriented customer base that values longevity and function over novelty.

The United Kingdom is expanding at a 5.4% CAGR, with modest YoY improvement supported by long-standing golf traditions and steady demand across club communities. Accessories such as club headcovers, grip kits, weather-resistant gear, and training aids continue to see seasonal traction. Consumer behavior skews toward utility-focused purchases rather than high fashion or branded exclusivity.

Demand is most visible in Scotland and southern England, where established clubs and links courses maintain consistent participation. Online retailers are competing with club pro shops, offering bundled starter sets and mid-range gear packs. Though volume remains stable, the pace of growth is tempered by economic caution among hobbyist players.

The United States is registering a 4.8% CAGR, with stable but slower YoY growth in accessory sales across recreational and mid-tier players. Most purchases occur around golf shoes, gloves, rangefinders, and club cleaning kits, driven by replacement needs rather than new entries. Golf remains a mature sport in the USA, and growth in accessories largely depends on repeat customers and upgrades.

Suburban courses and resort-based facilities account for the highest sales activity, especially in southern states. Online platforms and large-format retailers dominate distribution, with seasonal bundling and gift-oriented packages performing well during holidays and tournament seasons.

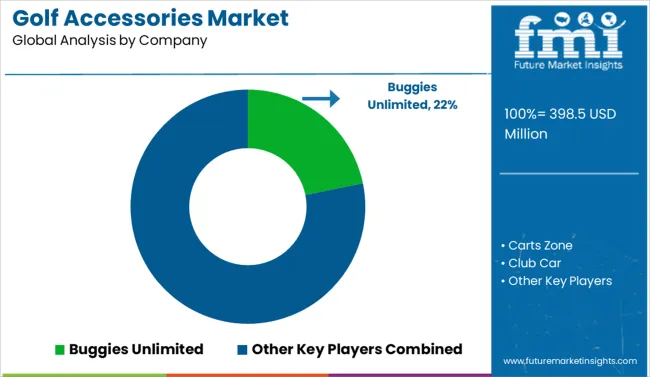

The golf accessories market is moderately fragmented, featuring a combination of specialized aftermarket suppliers, golf cart manufacturers, and battery technology firms. Buggies Unlimited leads the market with a strong presence in aftermarket parts and accessories, including seat kits, lift kits, and replacement components for various golf cart brands. Companies such as Club Car, EZGO, and Yamaha Golf-Car Company are prominent OEMs that offer integrated accessories, appealing to both individual golfers and commercial golf course operators.

Carts Zone and Red Hawk focus on customization and distribution of third-party accessories, servicing both end users and dealerships. US Battery Manufacturing Company plays a key role in powering the ecosystem by providing deep-cycle batteries essential for electric golf carts and accessory performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 398.5 Million |

| Accessory | Golf cart covers, Golf cart enclosures, Lift kits, Wheels and tires, Lights and lighting accessories, Security systems, and Others |

| Application | Golf courses, Commercial services, and Personal |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Buggies Unlimited, Carts Zone, Club Car, EZGO, Red Hawk, US Battery Manufacturing Company, and Yamaha Golf-Car Company |

| Additional Attributes | Dollar sales by accessory type, sales channel, and player skill level; regional demand driven by rising golf participation, tourism, and club memberships; innovation in performance-tracking gear, eco-friendly materials, and personalization; cost dynamics influenced by brand positioning, seasonal demand, and product bundling; environmental impact from synthetic materials and packaging; and emerging use cases in smart wearables, training aids, and youth-focused golf programs. |

The global golf accessories market is estimated to be valued at USD 398.5 million in 2025.

The market size for the golf accessories market is projected to reach USD 693.7 million by 2035.

The golf accessories market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in golf accessories market are golf cart covers, golf cart enclosures, lift kits, wheels and tires, lights and lighting accessories, security systems and others.

In terms of application, golf courses segment to command 49.2% share in the golf accessories market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Batteries Market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Golf Ball Picker Robot Market Size and Share Forecast Outlook 2025 to 2035

Golf Course Maintenance Robot Market Size and Share Forecast Outlook 2025 to 2035

Golf Putter Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Battery Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Market Analysis - Size, Share, and Forecast 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Golf Outfit Market Growth - Trends & Forecast 2025 to 2035

Golf Tourism Market Analysis - Size, Share, and Forecast 2025 to 2035

UK Golf Tourism Market Analysis

USA Golf Tourism Market Analysis

Japan Golf Tourism Market Analysis

Europe Golf Tourism Market Insights - Growth & Forecast 2025 to 2035

Germany Golf Tourism Market Trends – Growth, Demand & Forecast 2025–2035

Electric Golf Cart Market Growth – Trends & Forecast 2025 to 2035

GCC Electric Golf Cart Market Outlook – Demand, Growth & Forecast 2025-2035

GCC Countries Golf Tourism Market Analysis – Growth, Trends & Forecast 2025–2035

ASEAN Electric Golf Cart Market Trends – Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA