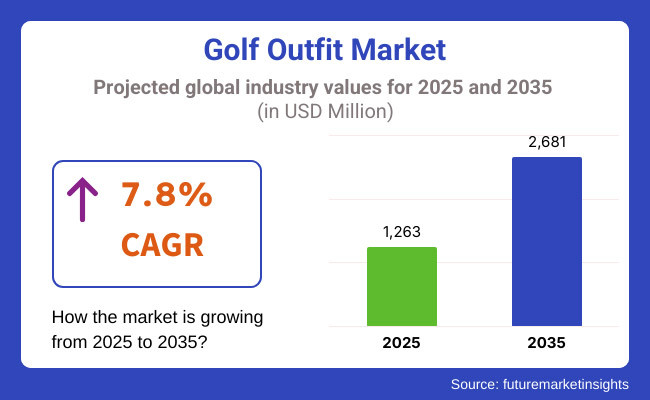

The golf outfit market will witness incredible development in 2025 to 2035 based on growth reliant on golf activity expansion, athleisure penetration expansion, and high-performance sporting wear expenditure expansion. The market will grow to approximately USD 1,263 million in 2025 and USD 2,681 million in 2035 with a compound annual growth rate (CAGR) of 7.8% during 2025 to 2035.

There are numerous drivers that are propelling transformation in this market. Out of them, the most applicable maybe is increasing popularity of golfing as sports recreation activity for recreation, so increasing demand of fashion and functional sportswear.

Golfing apparel is made technical by incorporating new technology on apparel like moisture-wicking, sun guard, and stretch fabric to facilitate performance. Fashion trend for sportswear, including premium and casual, also evokes premium product demand. Although the fashion market consists of designer golf wear and replicas, overt market extension by firms selling authenticity of products, and prices.

The market offers different golf shirt sizes, pants, skirts, shoes, and accessories. Sweat and breathing performance golf shirts are demanded more by professional and amateur golfers. Golf pants and skirts offer elastic material with freedom of mobility and pleasing appearance. Golf spikeless fashion shoes are gaining popularity with comfort and versatility and can be utilized on and off the golf course.

North America has a world-leading golf outfit market when it comes to comprehensive golf vacation coverage, reasonably high percentage of total consumer spend, and upscale golf apparel penetration in the fashion category. America has a developed golf culture with more than 16,000 golf courses and, as a result, fashion without a sacrifice to comfort golf apparel becomes paramount. Power brands such as Nike, Adidas, and Under Armour continue to pour money into temperature-regulating and moisture-evaporation high-end golfing apparel.

The continent is also experiencing a growing number of women golfers, and this is also stimulating demand for fashion and unisex apparel. Sustainability is also on the rise as companies create recycled and sustainable golfing apparel in an effort to tap into green consumers.

It has strong market demand and market share backed by countries like Germany, Spain, and the UK. Holiday golf generates sales, especially from countries like Spain, Scotland, and Portugal, where foreign golf tournaments generate fashion buys.

Ralph Lauren and Hugo Boss dominate European golfwear market high-fashion brands with fashion trends and slim-fit tactics. Customers demand greenways while European environmental law governs the use of organic fibers and environmentally friendly manufacturing methods. Apparel and sportswear joint ventures also offer new fashion ideas to the market to fill fashion and performance requirements demanded by the modern golfer.

Asia-Pacific will be the source of most of the golfwear market growth due to increasing disposable incomes, increasing social popularity of golfing, and increasing numbers of golf courses in China, Japan, South Korea, and Australia. Premium sportswear consumption by Asia's rising middle class is also propelling higher growth in the market.

China's golf wear industry has been thriving phenomenally, phenomenally quickly with the help of ever-expanding high-end-consumer shoppers in quest of style-focused but technologically advanced golf wear. Japan, famous for accuracy detail in apparel technology, is conquering the lightweight and weather-sensitive golf wear across the globe. South Korea, famous for style trend globally, is revolutionizing the golf wear industry with fashionably yet practically designed attire with huge backing from celebrity K-pop and sport legends.

However, strict controls on importation and high fees on importation duty for high-end golfwear restrict the sale of foreign brands in the Asia-Pacific region. Firms therefore devise regional lines and alliances on the same regions in a bid to cope with variation in culture.

Challenge

High Price Sensitivity and Counterfeit Goods

Luxury golf attire is so costly, and thus price remains a critical matter to the average buyer. The company is also so vulnerable to counterfeit golf uniform outfits, particularly in nations whose intellectual property is not strong. Counterfeit materials not only jeopardize brand integrity but also equal missed sales for genuine producers.

Due to this, anti-counterfeiting technology such as blockchain authentication and single-case individual numbering is being put into high-end golf fashion companies. Middle-end product line quality control also fascinates cost-cutters.

Opportunity

Golf Clothing Technology Advances

Smart clothing with smart material is a monolithic opportunity for the golfing apparel industry. Nanotechnology-based sportswear with self-cleaning, odour-resistance, and sweat-resistance is being marketed by firms. Weather-adjustable golf wear with temperature-control capability is available in the market, and this is gaining ground to provide ultimate comfort to the golfer.

Besides this, direct-to-consumer (DTC) trendability allows businesses to provide custom-fit golfwears like custom-fit polos, pants, and shoes. TravisMathay and Lululemon are using the internet for providing buyers custom golfwear options, and it increases customer relationship and loyalty toward one particular brand.

Golf fashion during 2020 to 2024 included the athleisure-clothing-style trend that introduced comfort and practicality to fashion. Celebrity culture and social media platforms extended to golf fashion trends among golfers as wear and clothing became trendy and fashionable. The trend towards sustainable fashion also pushed businesses to create recycled and biodegradable golf wear.

Between 2025 and 2035, the business will be more devoted to sustainable innovation, intelligent textile technology, and inclusive design. Golf fashion apparel brands will be introducing a trend of wearable technology such as UV-sensing clothing and AI-based swing-enhancing clothing. Future digital buying will redefine golf apparel consumer buying, spurring innovation and business growth.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | The golf outfit market felt the surge in sustainability legislation, as big players started using green fabrics such as recycled polyester and organic cotton. |

| Technological Advancements | Moisture-wicking stretch and UV protection performance fabrics were de rigueur. Intelligent temperature-management and antibacterial fabrics made upstart appearances. |

| Consumer Preferences | Increased demand for stylish yet practical golfing attire fuelled by young adults embracing golf as a lifestyle. |

| Material Innovation | Small collections with high-fashion houses skyrocketed. |

| E-commerce & Retail Trends | Sustainable materials like recycled polyester and bamboo fibre emerged, with firms investing in green production. |

| Environmental Sustainability | Direct-to-consumer businesses were using online fitting technology and influencer marketing for selling. |

| Production & Supply Chain Dynamics | Swing analysis zones were being employed by physical stores to highlight experiential shopping. |

| Market Growth Drivers | Leading brands reduced water consumption at dyeing operations and implemented take-back programs for used clothes. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulations promote more stringent environmental requirements, which drive brands to include biodegradable fabrics and circular fashion systems. Governments also encourage sustainable production and fair labour standards. |

| Technological Advancements | AI-enhanced golf attire features real-time adjustments in fabric breathability and moisture-wicking. Apparel with wearable sensors monitor swing dynamics and body positioning, enhancing player performance. |

| Consumer Preferences | Athleisure expands the golf apparel industry even further, with clothes that move fluidly from golf course to daily wear. Virtual customization allows the consumer to customize their own golf attire. |

| Material Innovation | Biomimicry next-gen biodegradable and self-fixing materials flood the marketplace and cut apparel wastage drastically. Nanotech aids in improved stain resistance and abrasion. |

| E-commerce & Retail Trends | Virtual try-ons and augmented reality (AR) are the norm with online shopping and smart mirrors offering real-time clothing suggestions through the analysis of body movement. |

| Environmental Sustainability | The sector shifts towards a zero-waste strategy with total recyclability of golf attire. Circular economy business models become the norm, with resale and refurbishment of high-end golf wear. |

| Production & Supply Chain Dynamics | Localized production and 3D-knitting technology simplify manufacturing, lowering carbon footprint. AI-powered supply chain optimization boosts efficiency and reduces excess inventory. |

| Market Growth Drivers | Intelligent golf wear, green-driven innovation, and tailor-made shopping experiences fuel market growth. Emerging market growth increases industry top line. |

The American golf outfit market is growing, driven by the popularity of the game among women and millennials. Sales have been supported by social media fashion and golf influencers and a need for stylish, functional clothing. Major brands are prioritizing sustainability, making clothing out of recycled materials and using ethical manufacturing methods.

Market growth in the next few years will be fuelled by technological innovations in customization and smart fabrics.

Technology Integration in Golf Wear: Technology integration in golf wear, as wearable technology, is a top trend in the USA market. On-board swing analysis sensors in high-performance golf tops are increasingly popular. The clothes give instant feedback to golfers, enabling them to make precise adjustments to their swings.

Athleisure and Cross-Industry Success: The athleisure phenomenon has also resulted in golf clothing functioning as dual-purpose daywear, fostering cross-industry partnerships between fashion and sportswear companies. As the USA market for athleisure is over USD 100 billion, golf clothing companies are taking advantage of this phenomenon for higher market visibility.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The UK golf wear market is increasing consistently with the sport's expanding availability and youth demographic usage. UK green economy policies are imposing sustainability regulations in the shape of completely recyclable and biodegradable materials.

Innovation of Eco-Friendly Materials: British brands are committing to plant-based dyes and organic materials, reducing their environmental impact. Utilization of bioengineered materials, which are biodegradable without harming the ecosystem, is becoming a source of competitive edge.

Golf Fashion Conscious: Luxury golf clothing is on the rise in the UK with luxury brands launching runway-inspired collections specifically designed for the sport. Where fashion meets golf is evident in luxury and designer collaborations.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

EU golf outfit market is fuelled by strict sustainability regulations, which prompt the use of sustainable production processes and ethical labour practices. There is a strong golfing culture in Spain, France, and Germany, which fosters driving a surge in demand for high-performance fashion.

Circular Economy & Recycling Initiatives: Closed-loop recycling cycles, whereby used golf clothing is recycled into new clothing, are being led by EU golf fashion brands. EU sustainability policy compliance reinforces eco-friendly brand credibility.

Advanced Performance Wear: Weather-resistant, lightweight golf clothing for year-round play is becoming increasingly popular, especially in Central and Northern Europe, where the climate is highly variable.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.0% |

Japan's technology-oriented golf outfit market is being propelled by emerging high-performance sportswear technology. Innovative textile engineering-based high-end golf apparel is gaining popularity.

Smart Textiles & AI-Powered Wearables: The use of AI-powered fabrics that adapt based on body movement and temperature is picking up pace in Japan. Golf apparel with posture correction sensors is transforming the training of golfers.

Functional & Minimalist Aesthetic: Japanese golf fashion is cantered on minimalist aesthetic with super-high functionality. Superlight, wrinkle-free clothes with better breathability are preferred by Japan's love for functional as well as fashionable wear.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

South Korea's golf wear market is buzzing because of more popularity of the sport among the youth and cross-over of K-fashion trends into golf clothing.

K-Fashion's Impact on Golf Wear: It is Korean golfing brands, with their chic, slim-cut designs fusing streetwear clothing and classic golfing wear, that are presently spearheading global fashion. Popularity of K-pop and endorsement by celebrities reinforce the demand for style-oriented golfing wear.

Green & Smart Golf Wear: Korean companies are combining green materials with smart materials, providing UV radiation protection, sweat-wicking, and integrated biometric sensors. This is in accordance with South Korea's drive for sustainable fashion technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

Top wear leads the golf wear market, mainly owing to the need for moisture-wicking, breathable, and UV-protective materials. Performance polo shirts, quarter-zip pullovers, and compression tops remain among the most sought-after options of golfers who appreciate comfort and style. Flagship brands such as Under Armour and Nike incorporate stretch and sweat-resistant fabric in a bid to move more and keep going during competition. Increased demand for environmentally friendly and recycled content, especially among upmarket golfing fashion, further fuels the increase in the flagship wear category, particularly within North America and Europe regions.

The market for golf shoes has seen a migration towards spikeless and hybrid options that, in turn, prove to be on-course as well as off-course versatile. Large manufacturers such as Adidas and FootJoy brought forward light, cushioned shoes with traction, supporting extended periods of comfort. Mass applications of waterproofing technology and intelligent insoles with pressure-mapping technology have also spurred growing demand. Furthermore, golf fashion culture's growth, with fashionable sneaker-like golfing shoes on the upswing, has spurred the growth of the segment, especially in young Americans and Japanese golfers.

Men continue to be the largest consumer category for golf wear due to a strong traditional base and ongoing involvement in professional and amateur golf. But the women's category is growing more rapidly, with companies such as Lululemon and Ralph Lauren rolling out more customized, athleisure-driven fashion suitable for female golfers. Greater exposure via the media and popularity of women's golf tournaments have fuelled the percentage of the women's golfwear market growing, particularly in markets such as South Korea and the UK

Individual consumers remain the largest golf apparel purchaser in the golf apparel market, with professional and amateur golfers purchasing premium products. Institutional buyers, including corporate golf tournament sponsors, golf clubs, and golf resorts, are increasingly purchasing uniforms and logoed apparel. Luxury golf resorts and private golf clubs in Europe, the USA, and the Middle East have established premium apparel products, resulting in the institutional segment's consistent growth.

The online sale channel is experiencing most dynamic growth among golf apparel industry players due to increasing consumer-direct brands and personalized wear. Internet channels such as PGA Tour Superstore, Golf Galaxy, and company websites offer personalized monogramming, embroidery, and limited-edition drops, thus enhancing the shopping experience for consumers. Although off-line sales via pro shops and specialty stores remain high priority, demand for digital convenience and virtual fitting technology is driving on-line sales, particularly in North America and Asia-Pacific.

Golf wear market is a dynamic competitive environment, led by international players and emerging regional brands. Giant brands dominate huge market shares on which they maintain performance fabrics innovation, sustainable manufacture, and re-designed sporty silhouettes. These businesses focus particularly ensuring that their clothing gets even cozier, breezier, and climate-proof to manage professional athletes as well as casuals. Mainstream fashion giants propel the business with niche performance businesses, new direct-to-consumer players battling out there on digital websites.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Nike Golf | 15-20% |

| Adidas Golf | 12-16% |

| Under Armour | 8-12% |

| Puma Golf | 6-10% |

| FootJoy | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Nike Golf | Develops high-performance golf apparel integrating Dri-FIT technology for moisture management. Focuses on innovative, athlete-inspired designs and sustainability initiatives. |

| Adidas Golf | Specializes in eco-friendly golf apparel made from recycled ocean plastics and breathable materials. Invests heavily in performance-driven golf wear. |

| Under Armour | Provides heat-regulating golf outfits using HeatGear and ColdGear technology. Targets high-performance sports apparel with durable and flexible materials. |

| Puma Golf | Offers bold, fashion-forward golf attire with PWRWARM technology for temperature control. Collaborates with professional golfers for trendsetting designs. |

| FootJoy | Manufactures premium golf apparel and outerwear with an emphasis on all-weather adaptability. Known for its superior craftsmanship and tour-level performance gear. |

Key Company Insights

Nike Golf (15-20%)

Nike Golf is a leader in tech-based performance golf wear with Dri-FIT moisture-wicking fabric, lightweight stretchy fabric, and ergonomic fits. Nike has also spent heavily on green apparel through recycled polyester and bio-based materials. Its endorsement partnerships with top professional golfers such as Rory McIlroy and Tiger Woods add to its market leadership as an innovative and fashionable golf wear champion.

Adidas Golf (12-16%)

Adidas Golf is a strong runner-up that is famous for its commitment to performance and sustainability. Primegreen and Primeblue technologies spearheaded by the company reduce its impact without compromising high-level performance. Adidas collaborates continuously with golf professionals to design creative apparel suitable for different course conditions, offering adaptive and stylish golfing attire.

Under Armour (8-12%)

Under Armour has led the market with weather-reactive golf apparel. Under Armour features golf apparel throughout the year through its HeatGear and ColdGear technology, providing enhanced flexibility and moisture management. Under Armour also considers compression-fit golf apparel, targeting professional golfers and fit golfers seeking best-in-class flexibility and endurance.

Puma Golf (6-10%)

Puma Golf merges fashion trends with golf apparel performance. It has picked up steam with player endorsements like Rickie Fowler, incorporating vibrant colors and chic designs. The brand's PWRWARM technology ensures comfort in unstable weather, while its lightweight, flexible materials ensure freedom of movement on the course. Puma continues to merge fashion and performance to resonate with young golfers.

FootJoy (5-9%)

FootJoy boasts high-end golf apparel and outerwear, a favorite among the pros. FootJoy demands weather-resistant and ventilated constructions that deliver a line-up of polos, jackets, and pants built to perform and remain comfortable. Its shoe prowess translates to clothing, offering the full line of quality golf wear trusted by passionate golfers all over the world.

Other Key Players (40-50% Combined)

Besides these market leaders, several brands collectively spearhead the growth and innovation of the golf outfit market. These companies include:

The overall market size for the golf outfit market was USD 1,263 million in 2025.

The golf outfit market is expected to reach USD 2,681 million in 2035.

The rising popularity of golf as a leisure and professional sport, coupled with increasing consumer spending on premium and performance-driven sportswear, fuels the golf outfit market during the forecast period.

The top 5 countries which drive the development of the golf outfit market are the USA, UK, Japan, South Korea, and Australia.

On the basis of product type, golf apparel is expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Consumer Orientation, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Buyer Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Buyer Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 28: Global Market Attractiveness by Buyer Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 58: North America Market Attractiveness by Buyer Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Buyer Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Buyer Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Buyer Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Buyer Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Buyer Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Buyer Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Consumer Orientation, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Buyer Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Buyer Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Buyer Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Buyer Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Buyer Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Golf Course Engineering Service Market Size and Share Forecast Outlook 2025 to 2035

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Batteries Market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Golf Ball Picker Robot Market Size and Share Forecast Outlook 2025 to 2035

Golf Course Maintenance Robot Market Size and Share Forecast Outlook 2025 to 2035

Golf Putter Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Battery Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Cart Market Analysis - Size, Share, and Forecast 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Golf Tourism Market Analysis - Size, Share, and Forecast 2025 to 2035

UK Golf Tourism Market Analysis

USA Golf Tourism Market Analysis

Japan Golf Tourism Market Analysis

Europe Golf Tourism Market Insights - Growth & Forecast 2025 to 2035

Germany Golf Tourism Market Trends – Growth, Demand & Forecast 2025–2035

Electric Golf Cart Market Growth – Trends & Forecast 2025 to 2035

GCC Electric Golf Cart Market Outlook – Demand, Growth & Forecast 2025-2035

GCC Countries Golf Tourism Market Analysis – Growth, Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA