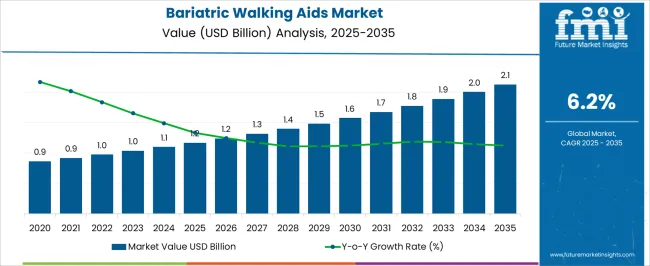

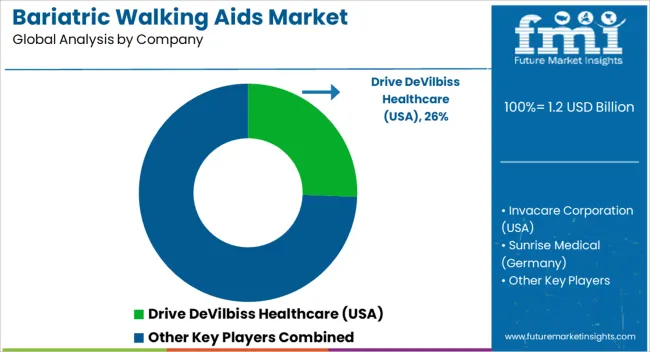

The Bariatric Walking Aids Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Bariatric Walking Aids Market Estimated Value in (2025 E) | USD 1.2 billion |

| Bariatric Walking Aids Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The bariatric walking aids market is demonstrating steady expansion, driven by the rising prevalence of obesity-related mobility challenges and the growing demand for supportive care equipment that enhances independence and safety. Increasing awareness regarding bariatric health and the importance of mobility in improving quality of life is creating favorable conditions for product adoption. Advancements in material engineering and ergonomic designs are making walking aids more durable, stable, and comfortable for users with higher weight needs.

Expanding healthcare infrastructure, coupled with greater focus on home-based rehabilitation, is supporting the integration of bariatric aids into patient care routines. The aging population and the higher risk of mobility impairments among obese individuals are further intensifying demand.

Rising investments by manufacturers in developing innovative aids with improved adjustability, foldability, and user-friendly features are also contributing to growth As the focus on preventive care and long-term mobility solutions strengthens globally, the bariatric walking aids market is anticipated to register consistent growth, supported by evolving healthcare policies and increasing end-user preference for high-quality and reliable mobility support equipment.

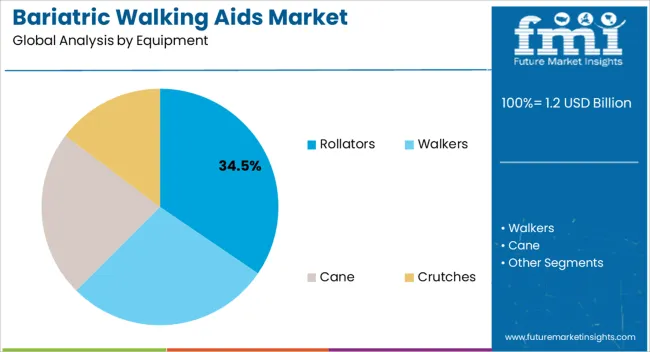

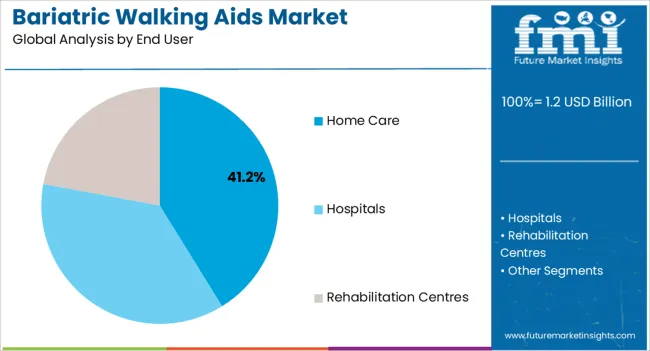

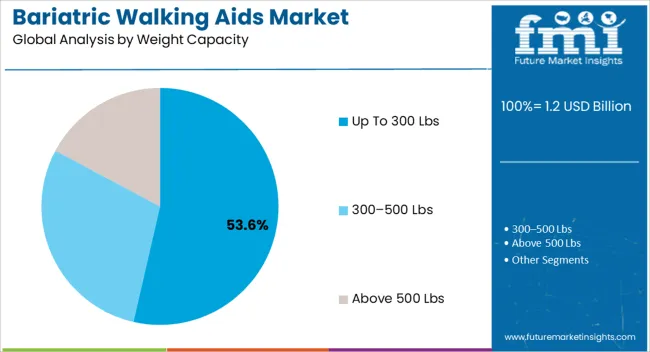

The bariatric walking aids market is segmented by equipment, end user, weight capacity, and geographic regions. By equipment, bariatric walking aids market is divided into Rollators, Walkers, Cane, and Crutches. In terms of end user, bariatric walking aids market is classified into Home Care, Hospitals, and Rehabilitation Centres. Based on weight capacity, bariatric walking aids market is segmented into Up To 300 Lbs, 300–500 Lbs, and Above 500 Lbs. Regionally, the bariatric walking aids industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rollators equipment segment is projected to hold 34.5% of the bariatric walking aids market revenue share in 2025, making it the leading equipment category. This leadership is being driven by the segment’s combination of stability, maneuverability, and user convenience, which makes rollators highly suitable for individuals with bariatric needs. Rollators are designed with reinforced frames, wide seats, and larger wheels that improve durability and provide comfortable mobility assistance in both indoor and outdoor environments.

The segment’s growth is also being supported by the rising adoption of rollators in rehabilitation programs, where their ability to support weight-bearing exercise while ensuring safety is highly valued. Increasing product innovation, such as lightweight folding mechanisms, ergonomic handgrips, and integrated storage solutions, is enhancing user comfort and usability.

The role of rollators in reducing fall risk and encouraging independence has positioned them as the preferred equipment for bariatric users compared to other mobility aids As healthcare providers and caregivers prioritize solutions that combine safety with long-term functionality, rollators are expected to maintain their dominant position within the bariatric walking aids market.

The home care segment is anticipated to represent 41.2% of the bariatric walking aids market revenue share in 2025, establishing itself as the leading end user. This dominance is being supported by the increasing preference of patients to receive mobility assistance within the comfort of their homes rather than in institutional settings. Home care providers are prioritizing bariatric walking aids to facilitate independence, reduce hospital readmissions, and support long-term rehabilitation needs.

The segment’s growth is being reinforced by the rising number of obese and elderly individuals requiring daily mobility support, coupled with healthcare systems encouraging at-home recovery and self-care to reduce the burden on clinical facilities. Manufacturers are focusing on designing products that are compact, easy to transport, and adaptable for household use, making them more attractive for home settings.

The emotional and psychological benefits of maintaining independence at home are also playing a significant role in driving adoption As healthcare delivery shifts toward patient-centered care models, the home care segment is expected to remain the leading end-use category in the bariatric walking aids market.

The up to 300 lbs weight capacity segment is expected to capture 53.6% of the bariatric walking aids market revenue share in 2025, making it the dominant weight capacity category. Its leadership is being attributed to the fact that a large proportion of bariatric users fall within this weight range, making products in this segment more universally applicable. Walking aids designed for this capacity offer a balance of strength, comfort, and affordability, which has widened their accessibility and acceptance among patients and healthcare providers.

The availability of a broad product portfolio catering to this weight class ensures compatibility with diverse user needs in both clinical and home care environments. Manufacturers are also focusing on improving durability, safety, and ergonomics while keeping products lightweight and manageable for daily use.

The segment’s dominance is further strengthened by its suitability for standard rehabilitation programs, where consistent and reliable support is essential As obesity rates continue to rise globally, the demand for aids within the up to 300 lbs category is expected to remain strong, ensuring this segment’s continued leadership in the overall bariatric walking aids market.

Beriatrics is the branch of medicine that deals with the causes, prevention and treatment of obesity. Obesity has become one the major health scares in the recent times. One of the main problems that obese people face is an increased effort required for walking and mobility and maintaining their general lifestyle independence.

Due to this, a large number of people are opting to use the bariatric walking aids. Bariatric equipment and supplies are meant for obese individuals. The major characteristics of bariatric walking aids are that they are designed to be stronger, sturdy and larger in size. Bariatric walking aids have increased weight capacities, heavy duty supports and are wider in width so that obese individuals can fit in. The equipment is defined as bariatric if it has a 300-900 pound limit, even though there is no width or weight limit specified for bariatric equipment.

Looking from another perspective, due to a rise in obese patients, the popularity of bariatric surgery is increasing day by day. Hence, bariatric walking aids market is exhibiting sustained growth and this trend is going to continue in the coming decade. The type of bariatric equipment that is in demand include wheelchairs- both manual and electric, mobility scooters, road scooters, canes, folding canes, offset canes, quad canes, axillary and elbow crutches, forearm crutches, knee walkers and rollators.

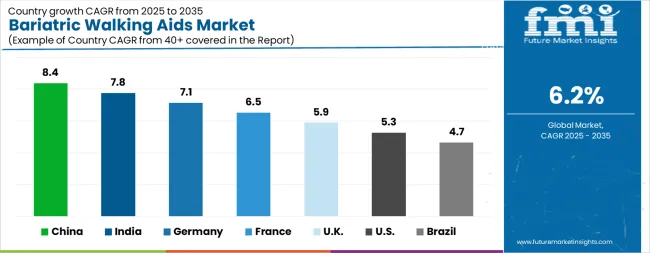

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The Bariatric Walking Aids Market is expected to register a CAGR of 6.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.4%, followed by India at 7.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.7%, yet still underscores a broadly positive trajectory for the global Bariatric Walking Aids Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.1%. The USA Bariatric Walking Aids Market is estimated to be valued at USD 424.1 million in 2025 and is anticipated to reach a valuation of USD 708.7 million by 2035. Sales are projected to rise at a CAGR of 5.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 55.8 million and USD 36.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Equipment | Rollators, Walkers, Cane, and Crutches |

| End User | Home Care, Hospitals, and Rehabilitation Centres |

| Weight Capacity | Up To 300 Lbs, 300–500 Lbs, and Above 500 Lbs |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Drive DeVilbiss Healthcare (USA), Invacare Corporation (USA), Sunrise Medical (Germany), Pride Mobility Products (USA), and Karma Medical (Taiwan) |

The global bariatric walking aids market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the bariatric walking aids market is projected to reach USD 2.1 billion by 2035.

The bariatric walking aids market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in bariatric walking aids market are rollators, walkers, cane and crutches.

In terms of end user, home care segment to command 41.2% share in the bariatric walking aids market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Walking Type Sprinkler Systems Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Surgery Device Market Forecast and Outlook 2025 to 2035

Bariatric Walkers Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Rollator Walkers Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Lifts Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Transport Wheelchairs Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Patient Room Market Size and Share Forecast Outlook 2025 to 2035

AIDS Related Primary CNS Lymphoma Market Report – Growth & Forecast 2025 to 2035

Bariatric Beds Market Analysis and Forecast for 2025 to 2035

Walking Aid Market Analysis by Product, Technology, End-user, and Region 2025 to 2035

Hearing Aids Market Forecast and Outlook 2025 to 2035

Assisted Walking Devices Market Size and Share Forecast Outlook 2025 to 2035

Mobility Aids and Transportation Equipment Market is segmented by Product and Distribution Channel from 2025 to 2035

Digestion Aids Market Size and Share Forecast Outlook 2025 to 2035

Demand for Walking Aid in Japan Size and Share Forecast Outlook 2025 to 2035

Ambulatory Aids Market Size and Share Forecast Outlook 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Custom Hearing Aids Market Growth - Trends & Forecast 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Plaque Disclosing Aids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA