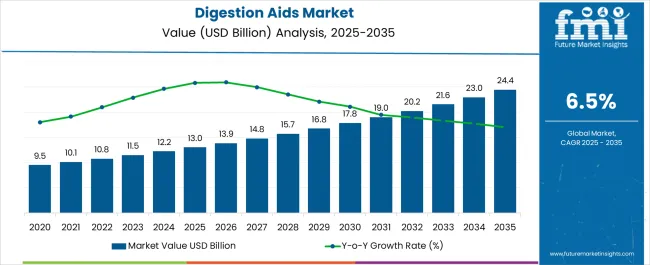

The Digestion Aids Market is estimated to be valued at USD 13.0 billion in 2025 and is projected to reach USD 24.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Digestion Aids Market Estimated Value in (2025 E) | USD 13.0 billion |

| Digestion Aids Market Forecast Value in (2035 F) | USD 24.4 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The digestion aids market is witnessing steady expansion, driven by increasing awareness regarding gastrointestinal health and the growing prevalence of digestive disorders across both developed and emerging economies. Rising demand for functional food and dietary supplements designed to support gut health is playing a critical role in shaping market dynamics. Consumers are increasingly seeking natural and preventive solutions, which is encouraging wider adoption of products that enhance digestive efficiency and nutrient absorption.

Technological advancements in formulation science and delivery systems are enabling the development of more effective and consumer-friendly digestion aid products. The market is further supported by the influence of changing dietary patterns, rising stress levels, and lifestyle factors that contribute to digestive imbalances, fueling long-term demand for such solutions.

Expanding healthcare expenditure, increased focus on preventive health, and growing acceptance of over-the-counter digestive supplements are also contributing significantly to market growth As global health awareness continues to rise, the digestion aids market is expected to remain on a positive growth trajectory, supported by product innovation, wider distribution, and regulatory emphasis on safe and effective gastrointestinal support solutions.

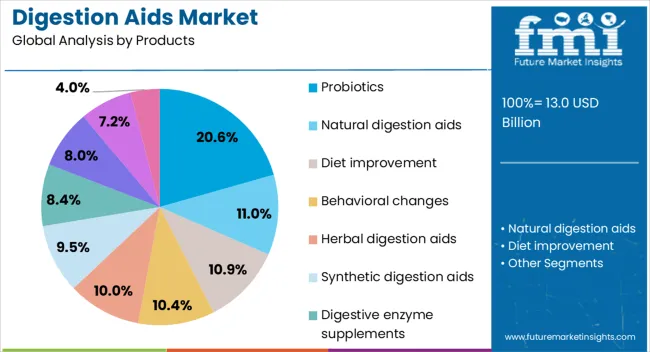

The digestion aids market is segmented by products, and geographic regions. By products, digestion aids market is divided into Probiotics, Natural digestion aids, Diet improvement, Behavioral changes, Herbal digestion aids, Synthetic digestion aids, Digestive enzyme supplements, Antacids, Nutritional supplements, and Red wine. Regionally, the digestion aids industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The probiotics segment is projected to account for 20.6% of the digestion aids market revenue share in 2025, positioning it as a leading product category within the market. Its dominance is being supported by increasing consumer awareness of the critical role that gut microbiota plays in maintaining digestive health and overall immunity. Probiotics are being widely adopted as they offer clinically proven benefits in restoring microbial balance, alleviating digestive discomfort, and improving nutrient absorption.

The segment is benefiting from expanding product availability across diverse formats including capsules, powders, yogurts, and functional beverages, making probiotics more accessible to consumers with varying preferences. Continuous advancements in strain selection and formulation are ensuring higher efficacy and stability of probiotic products, further boosting adoption.

Regulatory approvals and scientific endorsements are also reinforcing consumer trust and supporting stronger demand across multiple demographics With the rising global focus on preventive healthcare, probiotics are expected to remain a preferred digestion aid product, driven by their ability to deliver natural, safe, and effective gastrointestinal health solutions that align with evolving consumer wellness trends.

Digestion aids are the substances which helps in breaking down and digestion of food particles such as enzymes, pancrelipase, bromelain and papain, improper digestive process leads to complications such as excess gas, nausea, diarrhea and constipation.

According to National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), millions of Americans are affected by digestive diseases which include peptic ulcer, inflammatory bowel disease, chronic constipation and gastrointestinal infections.

To minimize these symptoms and improve digestive health, changes in diet and lifestyle such as increase in fiber intake, avoid fatty foods, avoid sodium, artificial sweeteners, starches, eat probiotics and drink lots of water are required.

Digestion aids market witnessing the maximum growth in near future owing to changing in the lifestyle, improper diet which lead to health issues and creates a demand for enzymes and healthy digestion among population. Increase in the demand for digestion aids products leads to entering small players in the market which creates competition for existing players.

Side effects associated with the synthetic digestion aids which includes chemicals hinder the growth of digestion aids market.

Based on synthetic digestion aids, probiotics dominates the overall digestion aids market followed by nutritional supplements and enzymes owing to most success product categories such as refrigerated juices, baby food, refrigerated condiments, frozen desserts functional beverages, food supplements, other dairy, yogurt, and kefir. National Digestive Disease information Clearinghouse (NDDIC) stated that digestive concerns affect millions of people each year in USA and Europe market which is expected to grow at a faster pace owing to common preference for dietary supplements with growing health concerns.

Depending on geographic region, digestion aids marketis segmented into seven key regions: North America, Latin America, Eastern Europe, Western Europe, Asia Pacific, Japan, and Middle East & Africa. Asia Pacific dominates the global digestion aids market followed by Europe, Japan and North America driven by Japanese players by introducing the concept of probiotics worldwide and creates opportunity for digestive health ingredients manufacturers and suppliers.

The developing nations in Asia Pacific, Middle East and Africa hold huge potential and shows significant growth in terms of wide acceptance of new productsowing to awareness among population and benefits of enzymes and increasing healthcare expenditure.

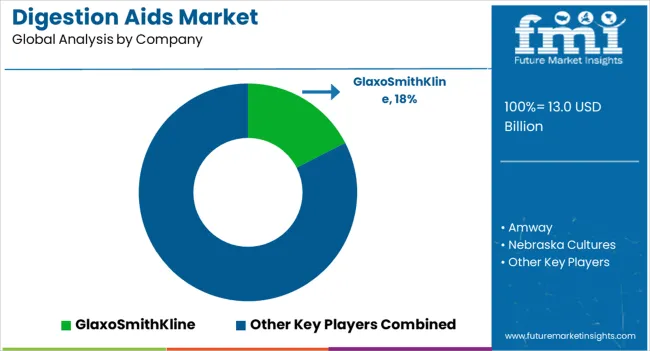

Key players of digestion aids market are Nebraska Cultures, Inc., Chr. Hansen, Yakult Honsha Co. Ltd, Abbott Laboratories, Dabur India Ltd, Pfizer Inc., GlaxoSmithKline plc., Amway, Specialty Enzymes & Biotechnologies, Amano Enzyme, Inc., Atrium Innovations Inc., Mead Johnson & Company, LLC., Beneo, Nestle S.A, National Enzyme Company and Cargill, Incorporated and others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types, technology, material and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

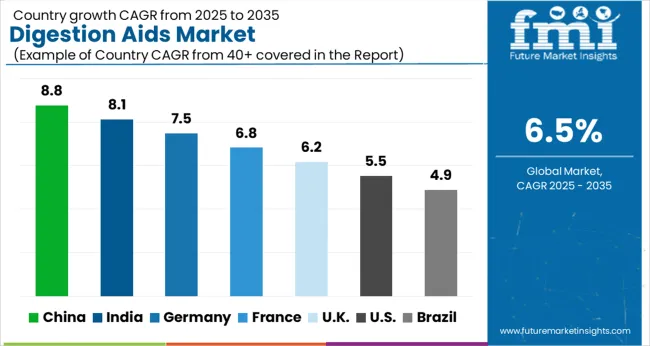

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The Digestion Aids Market is expected to register a CAGR of 6.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.8%, followed by India at 8.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.9%, yet still underscores a broadly positive trajectory for the global Digestion Aids Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.5%. The USA Digestion Aids Market is estimated to be valued at USD 4.6 billion in 2025 and is anticipated to reach a valuation of USD 7.9 billion by 2035. Sales are projected to rise at a CAGR of 5.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 659.3 million and USD 429.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.0 Billion |

| Products | Probiotics, Natural digestion aids, Diet improvement, Behavioral changes, Herbal digestion aids, Synthetic digestion aids, Digestive enzyme supplements, Antacids, Nutritional supplements, and Red wine |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GlaxoSmithKline, Amway, Nebraska Cultures, Pfizer, Cargill, Abbot, Yakult Honsha, Dabur India, and Nestle |

The global digestion aids market is estimated to be valued at USD 13.0 billion in 2025.

The market size for the digestion aids market is projected to reach USD 24.4 billion by 2035.

The digestion aids market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in digestion aids market are probiotics, natural digestion aids, diet improvement, behavioral changes, herbal digestion aids, synthetic digestion aids, digestive enzyme supplements, antacids, nutritional supplements and red wine.

In terms of , segment to command 0.0% share in the digestion aids market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digestion Resistant Maltodextrin Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Digestion Resistant Maltodextrin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Digestion-Resistant Maltodextrin Industry Analysis in Western Europe - Growth & Market Insights 2025 to 2035

Digestion-Resistant Maltodextrin Market in Japan - Growth & Demand from 2025 to 2035

Anaerobic Digestion Equipment Market Size and Share Forecast Outlook 2025 to 2035

Demand for Digestion Resistant Maltodextrin in EU Size and Share Forecast Outlook 2025 to 2035

AIDS Related Primary CNS Lymphoma Market Report – Growth & Forecast 2025 to 2035

Hearing Aids Market Forecast and Outlook 2025 to 2035

Mobility Aids and Transportation Equipment Market is segmented by Product and Distribution Channel from 2025 to 2035

Ambulatory Aids Market Size and Share Forecast Outlook 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Custom Hearing Aids Market Growth - Trends & Forecast 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Bariatric Walking Aids Market Size and Share Forecast Outlook 2025 to 2035

Plaque Disclosing Aids Market Size and Share Forecast Outlook 2025 to 2035

Bluetooth Hearing Aids Market Trends – Growth & Forecast 2025 to 2035

Infant Positioning Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA