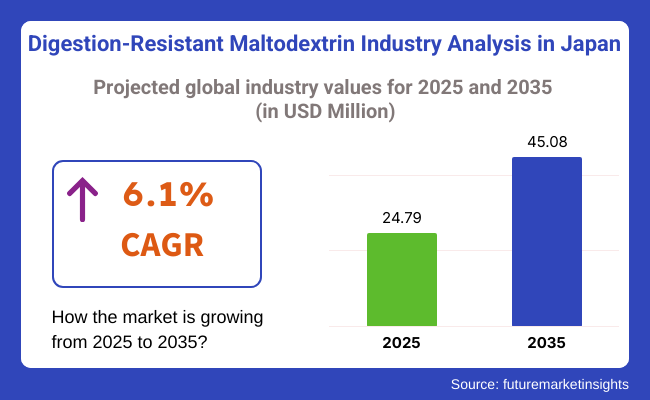

The digestion-resistant maltodextrin market in Japan was valued at USD 24.79 million in 2025 and is projected to grow at a CAGR of 6.1% over the forecast period, which is expected to amount to USD 45.08 million by 2035. This growth trajectory reflects the increasing importance placed on digestive health, fiber-enriched diet, and growing demand for functional ingredients aligned with changing consumer preferences in Japan.

An aging population that is health-conscious has been driving demand in Japan for ingredients that support gut health, control blood sugar, and promote overall wellness. Digestion-resistant maltodextrin is a soluble dietary fiber derived from starch that is recognized for its ability to promote intestinal regularity and improve metabolic outcomes without compromising taste or texture in food applications; hence, it finds use in many product categories, including nutritional beverages, dairy products, baked goods, and functional supplements.

Sales growth has been significantly boosted by functional foods, especially those eligible for health-related claims under the FOSHU and FFC systems in Japan. Digestion-resistant maltodextrin is increasingly included in these approved formulations due to their clinically supported benefits and favorable regulatory conditions that allow the manufacturers to proclaim their health benefits to the consumers.

Moreover, since Japanese consumers are looking for healthier alternatives to traditional food items, manufacturers have made use of digestion-resistant maltodextrin to serve as functional substitutes to get a less-sugar and low-calorie dense product but still retain desirable taste and texture. Because the ingredient is highly soluble and stable, it has become very suitable for applications on low-sugar, plant-based, and clean-label products. The trend continues to gain momentum in Japan's health and wellness industry.

Innovations in product formulation and broadened applications in meal replacements and medical nutrition, combined with strategic partnerships with universities and health food companies, are projected to see further ramping up of the adoption of digestion-resistant maltodextrin. Thus, digestion-resistant maltodextrin stands out for closing such fiber gaps while also satiating modern dietary needs, as fiber intake continues to fall short of recommended levels for many Japanese consumers.

In 2025, Japan's digestion-resistant maltodextrin industry will have a corn-based DRM lead with a 58.1% share, followed by the wheat-based segment with a share of 18.4%.

Corn-based DRM overtakes are due to the abundance and cheaper corn processing infrastructure developed in Japan. Ajinomoto, one of the world's major food and chemical companies, incorporates corn-based DRM into its Amino VITAL line of functional beverage products aimed at athletes and those wishing to enhance digestive health.

Also, Mitsubishi Corporation is using corn for DRM to market a range of dietary supplements and functional foods to consumers wanting to promote gut health and manage blood glucose levels. Kirin Holdings promotes corn-based DRM in its Metabolic Health range, which is directed at those managing diabetes and obesity. Corn-based DRM has been chosen for its digestive benefits while possessing versatility for incorporation into several food and beverage formulations.

Wheat-based DRM has a smaller but significant share of 18.4% of the industry. Showa Denko, a Japanese leader in the food-grade business, uses wheat-DRM-for food ingredients and functional foods, mainly targeting consumers looking for gluten-free and hypoallergenic options. Another option for wheat-based DRM is the Lifemeal product line introduced by Mitsui Chemicals for digestive health.

Japan could indeed reap profits from wheat-centered DRM in its beige functional yogurts under the Meiji Probio range, along with many available supplements designed to help such consumers satisfy their needs related to their gut microbiome. Wheat-based DRM has often been used for specialty applications in gluten-free or alternative starch supply.

By form, the digestion-resistant maltodextrin (DRM) industry is segmented into Spray-Dried Powder, accounting for 63.1% of the share, and 36.9% for Instantized/Agglomerated DRM.

With accessible technologies and longevity of shelf life, spray-dried powder is expected to remain the dominant form in DRM, maintaining a healthy share of the industry. For example, Ajinomoto continues to use spray-dried powder in the Amino VITAL portfolio to provide additional digestive support to athletes in convenient dissolvable forms.

Suntory also uses the spray-dried variant of DRM powder in its Suntory Digestive Health Drink to provide consumers with a ready-to-drink option. This form seems to be preferred for major mass production in the food industry for its flexibility in incorporation into several product formats and affordability. Kirin Health Science markets spray-dried powder through a functional range of health drinks targeting gut health, emphasizing the quick dissolution and stability of its liquid forms.

Instantization makes agglomerated dry-rendered meat (DRM) forms take over a significant industry share. This property relates to a specific behavioral specialty of DRM forms, such as rapid solubility and texture, as applied in functional food products, which require fast dissolution and a smooth tongue feel. For example, DRM in Meiji's Probio functional yogurt range by Meiji Holdings values rapid dissolution for consumer experience.

Another case shows the increasing popularity of instantized DRM products among dieters by Showa Denko with their partnership. Mitsui Chemicals applies the agglomerated concept to DRM for its product Lifemeal; the company focuses on improving the digestibility of lines of functional food products. Instantiation will be selected generally for applications as ready-to-drink (RTD) products, with the emphasis being on consumer convenience and texture and the possibility of premium-grade high-performance marketing.

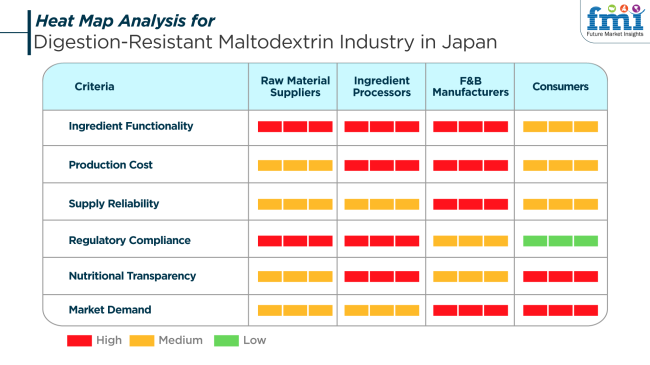

The digestion-resistant maltodextrin (DRM) industry in Japan is boosted by the increase in demand for dietary fibers that promote digestive health. Suppliers of raw materials and ingredient processors, on the red side, keep a strong emphasis on the functionality of the ingredients along with regulatory compliance, ensuring that the DRMs satisfy Japan's stringent food safety and nutritional labeling laws. The medium supply reliability is also an area of concern for the suppliers, given that they depend on imported starch sources and fermentation processes.

The ingredient processors involved in the refinement and commercialization of DRM into usable forms tend to be exceedingly cost-aware and demand transparency. The exorbitantly high production costs are considered a big thing across processors and F&B manufacturers, given the advanced enzymatic processing needing all-around quality control. However, manufacturers see supply reliability and market demand (both red) as vital, considering consumers have a growing tendency toward lifestyle products with health benefits.

Consumers-unconcerned, on the whole, about regulation -are very strong when it comes to nutritional transparency and digestive wellness. Fiber-fortified products in the beverage industry, infant formula, and functional snacks have been gaining traction among Japanese consumers, particularly among the aging and health-conscious millennials. There is pressure on manufacturers to develop clean-label products and scientifically validated health claims.

In summary, the DRM industry shows a tendency toward the increasing fusion of health science, functional food innovation, and consumer awareness. The prominent actors, like Matsutani Chemical Industry, Tate & Lyle Japan, and ADM, are gearing their product offerings toward changing expectations.

(Stakeholders: Raw Material Suppliers, Ingredient Processors, Food & Beverage Manufacturers, Consumers)

Between the years 2020 and 2024, the Japanese digestion-resistant maltodextrin market was dominated by increasing general interest in the health of the gut and the specific role dietary fiber plays in general health. With its prebiotic functionality and digestive improvement characteristics, DRM tended to be preferred for consumption more than ever by customers looking for health as well as food processors in need of value addition to products. The ingredient witnessed growing acceptance in bakery, functional foods, and nutritional supplements. Clean-label and allergen-free products were found to be areas of innovation focus but still were of utmost concern in terms of consumer education and regulatory compliance. The future

From2035, there will be a strong emphasis on functional food innovation and personalization. DRM will be increasingly integrated into on-the-go health foods and drinks that are designed to promote digestive equilibrium. With the increasing popularity of personalized nutrition, DRM can be personalized to one's microbiome signature. Sustainability and transparency will also drive the agenda, shaping packaging and sourcing practices. Greater consumer knowledge, allied with increasing food formulation technology advances, will fuel product innovation and create new opportunities throughout the wellness and prevention of disease segments.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Gut wellness and fiber for overall well-being | Individualized digestive hea lth and preventive wellness |

| Functional foods, supplements, baked goods | Portable snacks, customized nutrition solutions |

| Clean-label, allergen-free, specialty diets | Individualized formulations, microbiome-informed product development |

| Health food stores, supermarkets | Online platforms, wellness-oriented e-commerce |

| Focus on safety and transparent labeling | Increased emphasis on sustainability and transparency |

The digestion-resistant maltodextrin (DRM) industry in Japan is expected to see some good movement in the future, but not without certain underlying perils that are likely to affect its long-term stability. The first and most notable of all these scenarios is competition from rival dietary fibers like those from inulin, polydextrose, and other resistant starches, providing arguably similar functional benefits in improved gut and blood glucose control. Such advantages might be available at a lesser cost or higher visibility in specific application formats, probably limiting opportunities for DRM.

There are uncertainties regarding regulations, such as the ones that relate specifically to standards of dietary fiber labeling and health claims. Japan has very stringent rules regarding food labeling; hence, once there is any change in such policy framework, it will require reformulation, relabeling, and, in certain instances, limits on marketing claims that potentially may delay product launches or even block them completely from gaining much consumer traction.

Another important risk, raw material source risk and price volatility, is another major category. Corn is the main raw source for DRM in Japan, and fluctuations in the price of corn due to climatic reasons, trade policies, or conventional supply chain constraining factors will have a consequential effect on production and retail prices.

Japan is a price-sensitive country, where consumers are currently giving importance to functional ingredients in terms of cost-benefit ratios. In addition, there is minor awareness of DRM among consumers compared with older dietary fibers, which is a barrier as health consciousness is rising. Still, DRM, being a highly technical new medium, will not be adopted easily without some very good educational marketing and scientific backing.

Industry saturation and innovation fatigue could pose risks if consumers start to view fiber-enhanced products as homogeneous. Any company that does not have an extremely clear value proposition or does not offer a novel form of a product will find it very difficult to motivate consumers to purchase. It is evident, therefore, that active strategies for innovative product development, keeping up with regulations, and educating consumers are the best ways to address all of these threats and lessen those external factors that would hinder growth in the DRM industry in Japan.

The Japanese digestion-resistant-maltodextrin (DRM) market is experiencing steady growth as a constituent element of the nation's overall movement toward health-focused food solutions. With one of the world's most health-mindful consumer bases and a mature functional food industry, Japan offers receptive conditions for the expansion of DRM-founded ingredients.

The ingredient is generally known to be supportive of digestive health, control blood sugar and provide dietary fiber, which is well in line with national nutritional guidelines and consumer desire. DRM is being used more and more in beverages, nutritional supplements, meal replacements and reduced-calorie processed foods.

Japanese producers are taking advantage of DRM's bland flavor, good solubility, and heat and acid stability to redevelop traditional and new foods without texture or flavor profile changes. The aging population has also been a factor in the increased demand for dietary fiber-supplemented foods that can maintain gastrointestinal regularity and metabolic equilibrium. Clinical evidence of DRM's advantages, including enhanced frequency of bowel movements and decreased postprandial glucose peaks, has also increased consumer confidence and industry uptake.

Consumer trends show growing demand for clean-label and function-specific products, leading food and beverage manufacturers in Japan to emphasize DRM content as part of health-oriented branding. Regulatory transparency under the Food for Specified Health Uses (FOSHU) and Foods with Function Claims (FFC) systems promotes innovation while protecting consumers.

With personalized nutrition, gut health and metabolic health taking center stage in Japan's health food industry, the position of DRM is likely to increase across categories, making it a star ingredient of tomorrow's next-generation functional products.

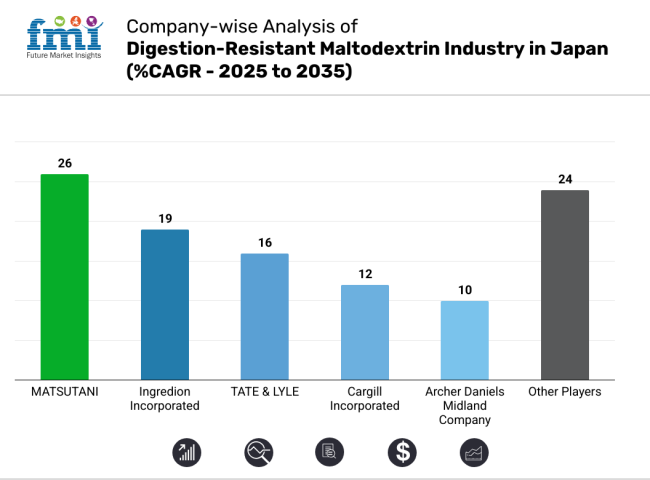

Japan's digestion-resistant maltodextrin (DRM) industry is highly competitive, with all the players facing possible extinction due to the growing craze over functional foods, dietary fibers, and gut health. Among the local giants, MATSUTANI stands out with the introduction of its innovative Fibersol® products, which have found applications in beverages, nutrition bars, and clinical nutrition products. Through strategic alliances with local food and beverage businesses, Ingredion Incorporated is steadily setting its presence in Japan, especially emphasizing clean labels and reduced sugar formulations.

Besides creating novel prebiotic DRM technologies, new developments by TATE & AMERICAN CUSTOMS will provide competitiveness against Japan's older population looking for products that improve gut health. Niche areas for the two companies are sports nutrition and diabetic-friendly products with specific DRM applications, Grain Processing Corporation and WGC, respectively.

Cargill Incorporated and Archer Daniels Midland Company are two of the major international players who have been gradually establishing their footprints by integrating DRM into a broader functional ingredient portfolio without losing local manufacturing capabilities and adhering to strict food safety standards of Japan concerning food safety regulatory compliance.

BAOLING BAO BIOLOGY and TEREOS are slowly making inroads into the Japanese market by selling affordable, high-purity DRM ingredients, which will attract health-conscious and clean-label-focused Japanese consumers. The DRM industry, however, is undergoing changes within Japan to more specialized, value-added applications with a very sharp focus on digestive wellness and metabolic health.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| MATSUTANI | 22- 26% |

| Ingredion Incorporated | 16- 19% |

| TATE & LYLE | 13- 16% |

| Cargill Incorporated | 9- 12% |

| Archer Daniels Midland Company | 8- 10% |

| Other Players | 18- 24% |

Key Company Insights

MATSUTANI commands a strong 22-26% market share in Japan's digestion-resistant maltodextrin industry. The company has sustained its leadership through the longstanding success of its Fibersol® brand, which has earned wide acceptance across food service, beverage, and medical nutrition. Ingredion Incorporated, holding a 16-19% share, leverages its expertise in specialty ingredients to present DRM for calorie reduction as well as digestive health without compromising taste, matching the high standards of functional foods expected in Japan.

TATE & LYLE claims approximately 13-16% owing to their science-based prebiotic DRM applications on gut microbiome modulation. Around 9-12% of the market share is owned by Cargill Incorporated, setting them apart in the marketplace by providing integrated solutions that ultimately mix DRM with other kinds of fibers and sweeteners for superior health benefits.

The company that also follows an approach of place-based R&D and partnerships with Japanese companies is Archer Daniels Midland Company, which has an 8-10% market share. All the players in the industry emphasize traceability, substantiation of health claims, and custom-made product development, which are crucial to satisfy the specific requirements of finicky Japanese consumers.

The segmentation is Corn-Based, Wheat-Based, Potato-Based, Cassava-Based, and Others (Rice, Banana).

The segmentation is into spray-dried powder and instantized/agglomerated powder.

The segmentation is into Beverages (Alcoholic Beverages, Non-Alcoholic Beverages), Food (Breakfast Cereals, Dairy Products, Instant Puddings, Margarines and Butters, Salad Dressings, Sauces, Snack Foods, Others), and Nutraceuticals.

The regions covered include Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

The digestion-resistant maltodextrin market in Japan is expected to reach USD 24.79 million in 2025.

The industry valuation is projected to grow to USD 45.08 million by 2035.

The industry valuation is expected to grow at a CAGR of approximately 6.1% during the forecast period.

Corn-based digestion-resistant maltodextrin is a key segment in Japan.

Key players include MATSUTANI, Ingredion Incorporated, TATE & LYLE, Grain Processing Corporation, WGC, Kraft Heinz, Cargill Incorporated, Archer Daniels Midland Company, BAOLING BAO BIOLOGY, and TEREOS.

Table 1: Japan Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Japan Industry Analysis and Outlook Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Japan Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Japan Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 5: Japan Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Japan Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Japan Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Japan Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 9: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 10: Kanto Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 11: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 12: Kanto Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 13: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: Kanto Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 15: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 16: Chubu Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 17: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: Chubu Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 19: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Chubu Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 21: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Kinki Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 23: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 24: Kinki Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 25: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Kinki Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 27: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 29: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 31: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 33: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: Tohoku Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 35: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: Tohoku Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 37: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Tohoku Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Rest of Japan Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 40: Rest of Japan Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 41: Rest of Japan Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 42: Rest of Japan Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 43: Rest of Japan Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 44: Rest of Japan Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Japan Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 2: Japan Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 3: Japan Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 4: Japan Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 5: Japan Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Japan Industry Analysis and Outlook Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Japan Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Japan Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Japan Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 10: Japan Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 11: Japan Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 12: Japan Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 13: Japan Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 14: Japan Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 15: Japan Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 16: Japan Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 17: Japan Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Japan Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 19: Japan Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Japan Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Japan Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 22: Japan Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 23: Japan Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 24: Japan Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 25: Kanto Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 26: Kanto Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 27: Kanto Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 28: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 29: Kanto Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 30: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 31: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 32: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 33: Kanto Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 34: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 35: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 36: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 37: Kanto Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 38: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 39: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 40: Kanto Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 41: Kanto Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 42: Kanto Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 43: Chubu Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 44: Chubu Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 45: Chubu Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 46: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 47: Chubu Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 48: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 49: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 50: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 51: Chubu Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 52: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 53: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 54: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 55: Chubu Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 56: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Chubu Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 59: Chubu Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 60: Chubu Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 61: Kinki Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 62: Kinki Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 63: Kinki Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 64: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 65: Kinki Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 66: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 67: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 68: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 69: Kinki Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 70: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 71: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 72: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 73: Kinki Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 74: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 75: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 76: Kinki Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 77: Kinki Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 78: Kinki Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 79: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 80: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 81: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 82: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 83: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 84: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 85: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 86: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 87: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 88: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 89: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 90: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 91: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 92: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 95: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 96: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 97: Tohoku Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 98: Tohoku Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 99: Tohoku Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 100: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 101: Tohoku Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 102: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 103: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 104: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 105: Tohoku Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 106: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 107: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 108: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Tohoku Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 110: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Tohoku Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 113: Tohoku Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 114: Tohoku Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 115: Rest of Japan Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 116: Rest of Japan Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 117: Rest of Japan Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 118: Rest of Japan Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 119: Rest of Japan Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 120: Rest of Japan Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 121: Rest of Japan Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 122: Rest of Japan Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 123: Rest of Japan Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 124: Rest of Japan Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 125: Rest of Japan Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 126: Rest of Japan Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 127: Rest of Japan Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 128: Rest of Japan Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 129: Rest of Japan Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 130: Rest of Japan Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 131: Rest of Japan Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 132: Rest of Japan Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digestion-Resistant Maltodextrin Industry Analysis in Western Europe - Growth & Market Insights 2025 to 2035

Analysis and Growth Projections for Maltodextrin Business

Tapioca Maltodextrin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Digestion Resistant Maltodextrin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Digestion Resistant Maltodextrin Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Demand for Digestion Resistant Maltodextrin in EU Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA