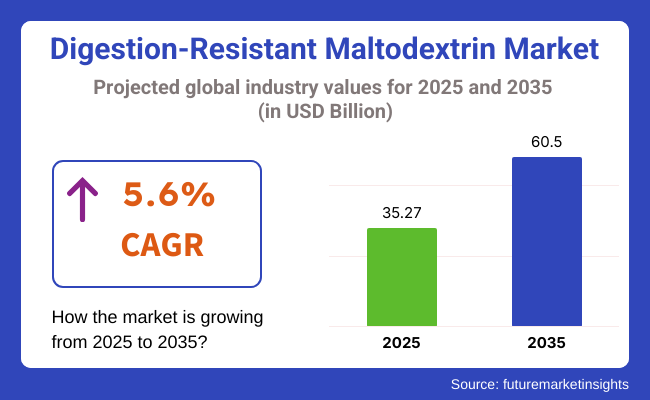

The digestion-resistant maltodextrin market in Western Europe is valued at USD 35.27 million in 2025, with a projected CAGR of 5.6% from 2025 to 2035, reaching a worth of USD 60.5 million by 2035. Factors such as increasing awareness concerning the benefits of digestive health, high customer demand for fiber-rich products, and due interest in the use of functional ingredients in the food and beverage industry are mainly driving growth.

Western Europe is a key market for functional food ingredients; consumer demand for health-promoting products is increasing even more. The well-informed consumer in the region who needs these products is looking for ingredients that promote digestive health, control blood sugar levels, and increase satiety - and building up to those claims about digestion-resistant maltodextrin is highly appreciated. This ingredient enjoys wide application, fighting it out with other lines of food, dairy, bakery, beverages, and dietary supplements.

Western Europe enjoys the privilege of being associated with the culture of healthy living and preventive health, which provides a wide avenue for selling products that go beyond nutritional sustenance. The increasing trend and attention given to dietary problems such as obesity, diabetes, and diseases related to the gastrointestinal system have contributed much to the use of fiber-based ingredients such as DRM, which take care of the gut and provide good metabolic health.

In addition, the realization and understanding of the importance of a healthy gut microbiome among current consumers have raised the use of DRM in nutraceuticals and common foods.

The support of regulations for functional foods and ingredients in Europe, especially within the European Union, has also acted as a catalyst in the industry growth. The favorable regulatory framework of the EU regarding health claims regarding emerging products, whose numbers are on the rise, and, indeed, getting approval would create sufficient scope for manufacturers to establish DRM as a beneficial ingredient, strengthened by scientific data.

DRM's versatility and natural origin would also make it appealing for manufacturers looking to tap into these consumer wants. Consumers, as always, are not compromising on clean labels and allergen-free products anymore. With a mild flavor and textural improvement and, at the same time, high solubility, DRM leads the way in the development of low-sugar, high-fiber, and functional products.

Corn-based digestion-resistant maltodextrin will lead to a significant share of 58.3% in the Digestion-Resistant Maltodextrin (DRM) industry by Western Europe in 2025. Wheat-based DRM tightly follows with a 15.8% share.

Cost efficiency and established supply chains are other reasons for corn-based DRM's prevalence in Western Europe, which facilitates its use in a range of food and beverage applications. Tate & Lyle, one of the region's top suppliers of food ingredients, markets corn-based DRM in its PROMITOR® Soluble Fiber range, which is well utilized in bakery goods, beverages, and nutritional supplements.

Cargill also makes DREAM - corn-based - from its European manufacturing hubs to meet the strong demand for clean labeling and functional fiber-rich foods. Products agreed upon by European food manufacturers focus on digestive health claims under dairy alternatives, breakfast cereals, and health drinks.

Furthermore, through its health science division, Nestlé employs corn-based DREAM in its medical nutrition and functional food lines sold in countries like Germany, France, and the UK. Due to its neutral taste, high fiber content, and proven gastrointestinal tolerance, corn-based DRM is mainly preferred in Western Europe.

Wheat-based DRM, although not significant, is being developed by manufacturers interested in finding alternative sources of fiber or special dietary requirements. BENEO, a functional ingredient supplier based out of Germany, sources wheat-derived DRM for its line of prebiotic fibers marketed under the Orafti® brand.

Another major player worldwide in plant-based ingredients, Roquette, has extended its wheat-based DRM line for formulators interested in gluten-sensitive alternatives, especially for organic and allergen-friendly niche markets. Danone has begun incorporating wheat-based DRM into some of its products under the Alpro plant-based product line for increased fiber content while maintaining smooth textures and clean labels. Wheat-based DRM often finds its applications in special settings where unique textural or labeling attributes are needed, such as in gluten-reduced or special foods.

By form, the digestion-resistant maltodextrin (DRM) industry in Western Europe is segmented into spray-dried powder, which accounts for a share of 62.7%. In contrast, the instantiated/agglomerated form will occupy 37.3% of the industry.

The spray-dried powder is the prevailing form of DRM in Western Europe because of its wide compatibility with large-scale food production; this form is the most cost-effective and provides good shelf-life stability. Tate & Lyle provides, via their PROMITOR® line, a substantial quantity of spray-dried DRM for high-fiber applications in bakery products, powdered drink mixes, and breakfast cereals.

Cargill also produces spray-dried DRM from corn at their European processing plants and supplies the functional fibers to manufacturers in Germany, France, and the Netherlands. This form is chosen as it allows producers to fortify food with fiber without any impact on taste or texture. FrieslandCampina, the Dutch dairy giant, incorporates spray-dried DRM into its nutritional beverage powders and in-house lines for adult nutrition owing to its excellent blending and digestive properties.

Instantized DRM or agglomerated DRM holds a smaller share. Still, it carries high value in applications developed mainly for criteria of quick solubility and smooth texture, which are especially high-end products or consumer-facing products. Many times, instantized DRM from BENEO in Germany is applied to nutritional beverages and fiber-fortified yogurts.

Roquette has developed agglomerated DRM ingredients aimed at dietary supplements and functional powders that require optimal flowability and quick dispersibility in liquids. Danone, using instantized DRM in its Fortimel and Alpro product lines, acts to improve mouthfeel and create nutritional products that can be very rapidly prepared for the elderly and wellness-conscious consumers. This form is particularly appreciated in RTD beverages, sachets, and meal replacement powders, where consumer experience and convenience take pride.

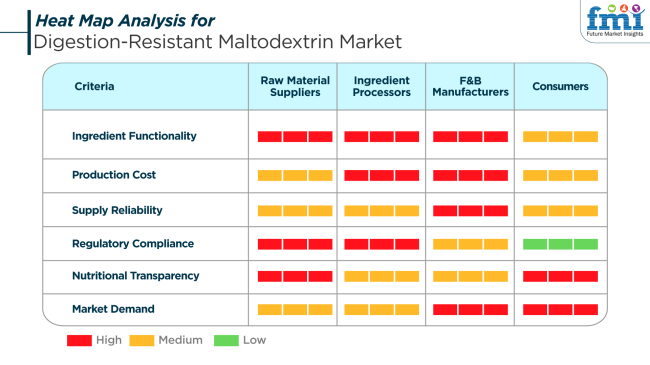

The Western European DRM industry is on an upward trend due to rising consumer awareness of digestive health, weight management, and the demand for fiber-rich foods. Stakeholders have different priorities along the DRM production and consumption chain.

Raw material suppliers look for the functionality of ingredients (red) so that the DRM products reach the consumer with potent fiber benefits, such as better gut health and satiety. Sustainability in sourcing is becoming equally important since consumers and manufacturers are getting more and more concerned about eco-friendliness.

Suppliers keep regulatory compliance high on their agenda since they abide by very stringent food safety regulations in the area.These ingredient processors focus on both systematic ingredient performance and good regulatory work (red). These concerns are rivaled by the focus on production costs, considering the technology investments being placed in enzymatic treatments and fiber extraction. This latter category contributes to the already premium price tag of DRM.

Concerns for food & beverage manufacturers include cost of production, demand in the industry, and supply reliability (red). With a growing demand for functional foods, manufacturers are keen to incorporate DRM into the options that cater to consumer preferences towards healthier products.

However, ensuring cost-effectiveness and a continuous supply of reliable, quality DRM remains a key challenge. Consumers are becoming more and more cognizant of nutritional transparency and health claims-chief among those are digestive benefits and fiber content (red). Highly informed, Western European consumers, especially those from Germany, France, and the UK, are out to seek foods with clear health benefits. They focus their purchasing on gut-healthy products and those that assist in weight management, so the demand for DRM is huge.

The Western European digestion-resistant maltodextrin market from 2020 to 2024 also experienced substantial growth, driven by growing consumer interest in digestive health and heightened demand for functional foods. With healthier lifestyles on the part of increasing numbers of consumers, demand for fibers such as DRM in diet food and beverages rose, particularly in diet supplements and functional drinks.

The consumer increasingly sought clean-label products, and allergen-free and gluten-free versions grew in popularity. The regulatory environment also grew tighter, with the legislation on food labeling and health claims in the European Union becoming stricter, which compelled product formulation and marketing strategies.

In the period towards 2025 to 2035, the industry will be influenced by the growing demand for tailored nutrition and wellness solutions. Product form innovation will cater to the ever-increasing need for convenience food and beverages fortified with functional ingredients like DRM.

Sustainability will be another influencer in product innovation as the companies will focus on sustainable packaging and green procurement. With customers becoming increasingly health-conscious, they will demand higher transparency, and DRM-based products will also evolve according to such needs, opening new opportunities for growth.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Digestive health and dietary fiber for overall well-being | Personalized nutrition and functional well-being |

| Functional foods, nutritional supplements, drinks | On-the-go convenience foods, personalized nutrition products, functional drinks |

| Tighter food labeling and health claim rules throughout the EU | Greater emphasis on sustainability and transparency in labeling |

| Health-aware consumer demand for fiber and gut-friendly products | Personalized nutrition trends and demand for sustainable, clean-label products |

| Clean-label, allergen-free formulations and product transparency | Green packaging and sustainable sourcing for DRM products |

Expenses involved in the production of DRM are a serious concern. Manufacturing processes include complicated enzymatic reactions, which constitute a larger production cost than common maltodextrins or any other dietary fiber. That cost factor can influence the pricing of the final product, which would eventually be a deterrent to use in price-sensitive markets or by cost-conscious consumers.

Consumer awareness is yet another obstacle. The more health-conscious consumers who are still unaware of DRM and its benefits, especially in emerging markets, contribute variables to the situation and rationale for the slow pace of market entry and adoption thereafter.

Also, the regulatory environment becomes another difficulty; some countries may have very different regulations concerning the use and labeling of DRM and other dietary fibers. Some of these regulatory hurdles create variability in definitions and labeling requirements and allow health claims, limiting market potential in specific regions.

A blockade due to competition posed by other dietary fibers is another restraint here. Numerous nutritional fibers such as inulin, polydextrose, and soluble corn fiber have similar health benefits and relatively lower costs. It further adds to the revenue share contest among the respective dietary fibers against soy fibers and gives Contest Outright problems for manufacturers of DRM.

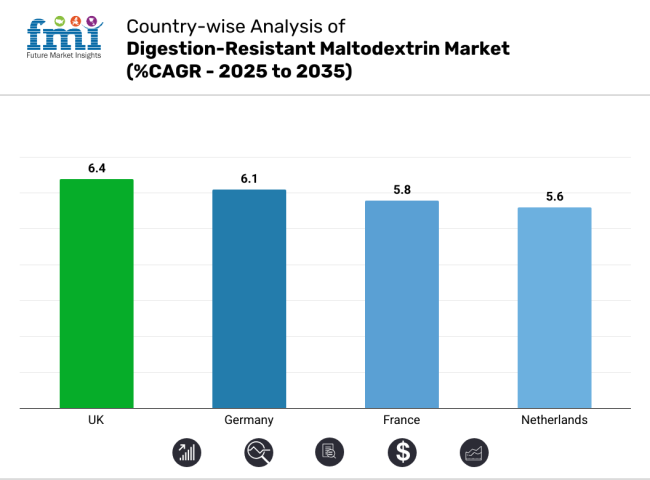

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.4% |

| Germany | 6.1% |

| France | 5.8% |

| Netherlands | 5.6% |

The UK will continue at a 6.4% CAGR between 2025 and 2035. A greater emphasis on diets high in fiber and functional foods is driving demand for the application of Digestion-Resistant Maltodextrin in the UK. As an increasingly health-aware populace seeks to assist digestive wellness and well-being, DRM is increasingly gaining favor as a clean-label ingredient, delivering fiber through formulations of low-calorie, digestion-friendly foods.

Food manufacturers are adding DRM to plant-based beverages, protein bars, and fortified baked goods to boost fiber levels without affecting product flavor or texture.

Reduced sugar and increased fiber intake promotion campaigns conducted by the UK government are further fueling the adoption of DRM. Harmonization of regulatory standards with EFSA and consumers' enthusiasm for science-supported health labels enable food companies to market DRM-enabled products successfully. Digital health platforms, influencer training, and retail packaging continue to propel consumer awareness of digestive fibers, keeping DRM at the forefront of functional foods and supplementing markets.

Germany is estimated to grow at a 6.1% CAGR during the research period of 2025 to 2035. The nutraceutical and functional food industries of Germany are developing aggressively, and the demand for ingredients like multifunctional digestion-resistant maltodextrin is growing significantly.

With a well-educated and health-aware consumer base, Germany presents a receptive market for those ingredients with clinical evidence and product versatility. DRM is being widely adopted in high-fiber snacks, dairy-free foods, and sports nutrition products. Clean-label and health-focused product innovation is of prime importance among German manufacturers.

DRM is ideally positioned for this trend as it is non-GMO by nature, heat stable, and prebiotic. Gut health, weight management, and glycemic control are among the leading wellness concerns in the country, and DRM addresses all three. The expansion of consumer education and awareness programs and increased visibility of functional food brands at natural and organic food stores further boost visibility.

The regulatory clarity of Germany and the product safety regulatory regime under EFSA contribute to the rising popularity of DRM across the pharma, food, and wellness segments.

The French market is forecasted to grow at 5.8% CAGR from 2025 to 2035. French consumers have historically been concerned with culinary integrity and the quality of ingredients. New trends toward eating for health are creating opportunities for ingredients such as Digestion-Resistant Maltodextrin. With the growing demand for low-sugar, high-fiber, and gut-friendly food solutions, DRM is coming into the spotlight in the reformulation of bakery foods, cereals, and ready-to-drink meal replacements.

French functional food manufacturers are riding DRM's clean-label-compatible and taste-neutral profile to enhance fiber content without impacting flavor. The growing demand for prebiotic nutrition and France's aging population are also propelling the fiber enrichment trend into regular diets.

While consumer awareness is only beginning to pick up pace compared to other markets, wellness brand marketing campaigns and clinical endorsement are helping DRM pick up steam. Regulatory harmonization with EFSA allows for health-related communication that enhances trust and enables product uptake.

The Netherlands market will increase by 5.6% CAGR during the 2025 to 2035 study. The Netherlands market is tending towards more innovation in plant-based as well as functional nutrition, thereby making Digestion-Resistant Maltodextrin an essential ingredient in healthy high-fiber products.

Consumer education in digestive health and metabolism is high via a highly developed retail network and exposure to content-based health sources. DRM is being applied across a wide array of food items like fiber-enhanced snacks, clinical nutrition, and beverage items.

We are witnessing top Dutch food companies actively taking up ingredients that address clean label demands and include supported health benefits. The rising prevalence of personalized nutrition and solutions targeting the gut microbiome is also driving DRM growth. EFSA regulatory assistance combined with an innovation-conducive business environment ensures the Netherlands' leadership in driving DRM adoption across the Western European region.

The DRM industry in Western Europe is growing with a focus on gut health, cleanliness, and reduced sugar functionalities. Roquette Freres S.A. commands the industry, utilizing its R&D prowess and sustainability in production to furnish high-performance, prebiotic DRM solutions for the health-wellness sector.

Close on its heels is Tate & Lyle, using a strong European presence and a mix of diversified DRM products, including non-GMO and organic formulations catering to premium markets. Tereos Syral S.A.S., an important player among the agribusiness groups in the region, focuses on eco-environmental production technologies and local sources, thus appealing to the target of eco-friendly consumerism in Western Europe.

While maintaining regulatory compliance, Ingredion Incorporated has developed its presence in the Western European region with application-specific DRM for bakery, dairy, and nutraceutical markets. Grain Processing Corporation and WGC Co. Ltd., on the other hand, maintain niche positions and focus on sports nutrition and medical foods with specialized DRM variations.

Global players, such as Cargill Incorporated as well as Archer Daniels Midland Company, are steadily consolidating their positions through acquisitions and localized processing operations across Europe. Baolingbao Biology Co.Ltd., having entered Western Europe with competitively priced DRM, is attracting the attention of cost-sensitive food manufacturers. In such a mature and highly regulated industry, innovative value-added products with strong traceability mechanisms and clinical validation of health claims are the key factors for success.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roquette Freres S.A. | 23-26% |

| Tate & Lyle | 18-21% |

| Tereos Syral S.A.S. | 14-17% |

| Ingredion Incorporated | 12-15% |

| Grain Processing Corporation | 8-10% |

| Other Players | 16-21% |

Roquette Freres S.A. thus possesses a leading 23-26% share for digestion-resistant maltodextrins in Western Europe. The company has buttressed its leadership by offering scientifically verified, sustainably produced DRM products that suit the increasing need in the region for gut health and less sugar intake.

Similarly, Tate &Lyle holds an estimated 18-21% revenue share and maintains strong momentum through innovative fiber ingredients, such as soluble corn fibers and non-GMO DRM solutions, which make appealing claims to European consumers seeking clean-label products with utmost health importance.

Tereos Syral S.A.S. holds 14-17% of the industry. It is reliant on raw materials grown within Europe and processed with a significant emphasis on environmentally friendly practices. The transparency and local sourcing epitomized in the company complement well with the ecologically inclined Western European public.

That leaves Ingredion Incorporated with 12-15%, yet there is still an expectation of more to come through customer-centric innovation hubs in Europe. There are application-specific, targeted DRM solutions for several functional foods. Grain Processing Corporation, which takes 8-10% of the share, is broadening the industry with its specialty DRM products intended for specific diet needs, such as sports performance and clinical nutrition. In all cases, proven health benefits and ethically sourced methods are redefining the competitive landscape for consumers in Europe.

The segmentation is Corn-based, Wheat-based, Potato-based, Cassava-based, and Others.

The segmentation is into spray-dried powder and instantized/agglomerated powder.

The segmentation is into Beverages (Alcoholic Beverages, Non-alcoholic Beverages), Food (Breakfast Cereals, Dairy Products, Instant Puddings, Margarines and Butters, Salad Dressings, Sauces, Snack Foods, Others), and Nutraceuticals.

The regions covered include the UK, Germany, Italy, France, Spain, and the Rest of Western Europe.

The digestion-resistant maltodextrin industry in Western Europe is expected to reach USD 35.27 million in 2025.

The industry valuation is projected to grow to USD 60.5 million by 2035.

The industry valuation is expected to grow at a CAGR of approximately 5.6% during the forecast period.

The United Kingdom accounts for approximately 6.4% of the regional digestion-resistant maltodextrin market.

Corn-based digestion-resistant maltodextrin is a key segment in Western Europe.

Key players include Roquette Freres S.A., Tate & Lyle, Tereos Syral S.A.S., Ingredion Incorporated, Grain Processing Corporation, WGC Co., Ltd., Kraft Heinz Company, Cargill Incorporated, Archer Daniels Midland Company, and Baolingbao Biology Co. Ltd.

Table 1: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Western Europe Industry Analysis and Outlook Volume (Tons) Forecast by Country, 2018 to 2033

Table 3: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Western Europe Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 5: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Western Europe Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Western Europe Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 9: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 10: UK Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 12: UK Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 14: UK Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: UK Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 17: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 18: Germany Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 19: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 20: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 21: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 22: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 23: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 26: Italy Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 27: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 29: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 31: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 33: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 34: France Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 35: France Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 36: France Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 37: France Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: France Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 39: France Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: France Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 41: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 42: Rest of Western Europe Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 43: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: Rest of Western Europe Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 45: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Rest of Western Europe Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Western Europe Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 2: Western Europe Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 3: Western Europe Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 4: Western Europe Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 5: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 6: Western Europe Industry Analysis and Outlook Volume (Tons) Analysis by Country, 2018 to 2033

Figure 7: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 8: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 9: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 10: Western Europe Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 11: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 12: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 13: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 14: Western Europe Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 15: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 16: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 17: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Western Europe Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 19: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Western Europe Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 22: Western Europe Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 23: Western Europe Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 24: Western Europe Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 25: UK Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 26: UK Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 27: UK Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 28: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 29: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 30: UK Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 31: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 32: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 33: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 34: UK Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 35: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 36: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 37: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 38: UK Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 39: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 40: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 41: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: UK Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 43: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: UK Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 46: UK Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 47: UK Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 48: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 49: Germany Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 50: Germany Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 51: Germany Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 52: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 53: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 54: Germany Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 55: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 56: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 57: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 58: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 59: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 60: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 61: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 62: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 63: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 64: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 67: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Germany Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 70: Germany Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 71: Germany Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 72: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 73: Italy Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 74: Italy Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 75: Italy Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 76: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 77: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 78: Italy Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 79: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 80: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 81: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 82: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 83: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 84: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 85: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 86: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 87: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 88: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 89: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 91: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Italy Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 94: Italy Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 95: Italy Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 96: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 97: France Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 98: France Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 99: France Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 100: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 101: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 102: France Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 103: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 104: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 105: France Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 106: France Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 107: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 108: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 109: France Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 110: France Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 111: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 112: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 113: France Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: France Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 115: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: France Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 118: France Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 119: France Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 120: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 121: Spain Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 122: Spain Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 123: Spain Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 124: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 125: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 126: Spain Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 127: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 128: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 129: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 130: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 131: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 132: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 133: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 134: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 135: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 136: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 137: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 139: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: Spain Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 142: Spain Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 143: Spain Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 144: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 145: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 146: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 147: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 148: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 149: Rest of Western Europe Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 150: Rest of Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 151: Rest of Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 152: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 153: Rest of Western Europe Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 154: Rest of Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 155: Rest of Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 156: Rest of Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 157: Rest of Western Europe Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 158: Rest of Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 159: Rest of Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 160: Rest of Western Europe Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 161: Rest of Western Europe Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 162: Rest of Western Europe Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Western Europe Building Automation System Market by System, Application and Region - Forecast for 2025 to 2035

Western Europe Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Mezcal Industry Analysis in Western Europe Report – Growth, Demand & Forecast 2025 to 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

I2C Bus Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Taurine Industry in Western Europe - Trends, Market Insights & Applications 2025 to 2035

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Pallet Wrap Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Resveratrol Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Polydextrose Industry Analysis in Western Europe Growth, Trends and Forecast from 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheet Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA