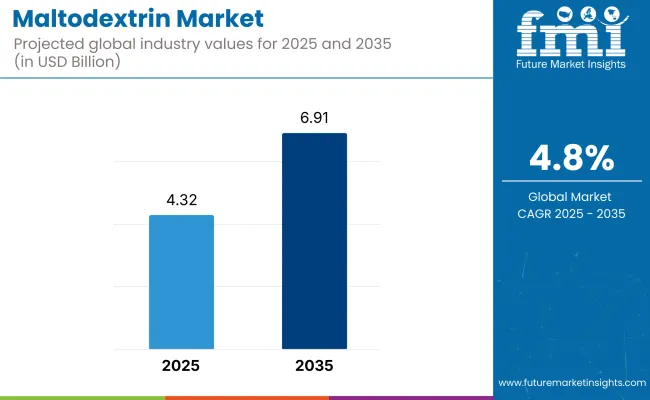

The demand for Maltodextrin market is expected to be valued at USD 4.32 Billion in 2025, forecasted at a CAGR of 4.8% to have an estimated value of USD 6.91 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 4.6% was registered for the market.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 4.32 Billion |

| Projected Global Industry Value (2035F) | USD 6.91 Billion |

| Value-based CAGR (2025 to 2035) | 4.8% |

Despite being a carbohydrate maltodextrin goes through a number of processes. Starch from potatoes corn wheat or rice is used to make this white powder. In order to further break it down its creators first cook it and then add acids or enzymes.

The end result is a white powder with a neutral flavor that dissolves in water. To replace sugar and enhance texture shelf life and flavor the powder is added to the products mentioned above. The white powder that is produced is tasteless and soluble in water. Apart from the amount of sugar they contain maltodextrins and corn syrup solids are chemically similar.

The market is still expanding steadily on a global scale mostly due to its extensive use in a variety of sectors including food and beverage pharmaceuticals and cosmetics. As demand for clean-label and health-focused products grows, functional food ingredients continue to shape product innovation across global markets.

As maltodextrin can be used as a thickening agent stabilizer and filler in processed foods and beverages the food and beverage industry continue to be the biggest consumer. Convenience and functional food consumption are on the rise which is driving up demand in the market.

| Segment | Value Share (2025) |

|---|---|

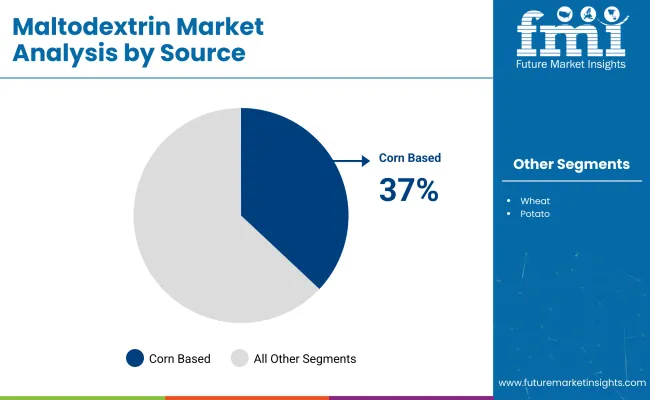

| Corn Based (Source) | 37% |

By 2025 maltodextrin derived from corn is anticipated to hold a 37% market share. These are some of the elements affecting the development of maltodextrin derived from corn. For the most part maltodextrin producers prefer to use corn as their source because of its abundance and ease of extraction.

Maltodextrin derived from corn thus wins the source segment. Because the maltodextrin made from corn retains its flavor and texture there is a constant need for corn-based maltodextrin.

| Segment | Value Share (2025) |

|---|---|

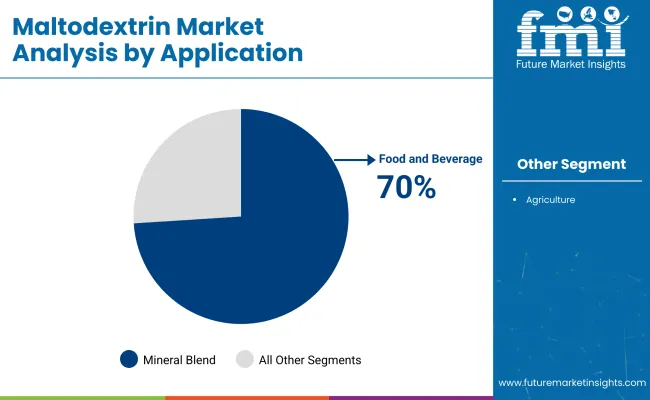

| Food and Beverages (Application) | 70% |

In 2025 the largest segment share was accounted for by food and beverages. The industry that uses maltodextrin the most in a variety of products is food and beverage. Among maltodextrins qualities are their capacity to replace fat thicken stabilize bulk and prevent caking. are incorporated into the recipes of food and drink products.

Making powder from liquid or oil-based products is one of the industrys most common applications for maltodextrin. To make instant pudding mixes for example maltodextrin is utilized. It is also frequently utilized as a fat substitute in low-calorie food products without changing the final products flavor or mouthfeel.

Awareness in It’s Funtion is Driving the Market Growth

The components of maltodextrin are glucose oligosaccharides polysaccharides and maltose. In order to produce maltodextrin which is 15-25% dextrose equivalent starch must be hydrolyzed refined and then spray-dried. One of the artificial sugars with a subtle sweetness is maltodextrin.

Maltodextrin is a widely used food additive that can be found in a variety of packaged foods including but not limited to seasonings cereal potato chips desserts soups and sauces canned fruits snacks spice mixes baked goods instant pudding salad dressings nutrition bars sauces yogurt sugar-free sweeteners cake mixes and meal replacement shakes.

During the period 2020 to 2024, the sales grew at a CAGR of 4.6%, and it is predicted to continue to grow at a CAGR of 4.8% during the forecast period of 2025 to 2035.

The need for maltodextrin is increasing due to the growing popularity of maltodextrin syrups. Maltodextrin and food products containing it are becoming more and more popular due to the growing interest in natural and organic ingredients. The use of sports supplements is rising as more people participate in sports as part of fitness trends. Due to the widespread use of maltodextrin in these sports supplements the products demand is rising.

The demand for maltodextrin is being driven by its use in fast soups and snacks like chips. Because maltodextrin is used in so many different products including drinks dietary supplements pastes and more there is a greater demand for it. Peoples growing inclination towards gluten-free diets is driving up demand for maltodextrin. The market for maltodextrin is seeing growth as ice cream production expands and the treat becomes more popular even in far-flung areas.

The maltodextrin market is being driven by consumer demand for clean-label products. More parents are choosing to use infant formula for their children as a result of growing awareness about it. Increased parental acceptance of maltodextrin which is used in infant formula is helping the market.

The markets growth is anticipated to be constrained by substitutes for sugar alternative thickening agents and other factors. For instance, agave and corn syrup are thought to be good substitutes for maltodextrin.

Tier 1 companies comprises industry leaders acquiring a 30% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 50%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 20%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and India come under the exhibit of high consumption, recording CAGRs of 3.9%, 3.2% and 6.1%, respectively, through 2035.

| Country | CAGR 2025 to 2035 |

|---|---|

| United States | 3.9% |

| Germany | 3.2% |

| India | 6.1% |

In the USA the markets compound annual growth rate (CAGR) is projected to be 3.9% during the forecast period. The demand for maltodextrin is rising in the USA due to the growing popularity of gluten-free diets and Americans growing health consciousness.

The United States growing obesity problem is causing people there to prefer healthier foods. The demand for maltodextrin is rising in the nation as a result of its use in supplements health shakes and other food items.

It is anticipated that the Indian market will grow at a CAGR of 6.1% until 2035. Because of its flavor and ease of production corn-based maltodextrin is becoming more and more popular in India where the market is expanding along the corn avenue. Indias growing gym-going population is contributing to the countrys increased use of dietary supplements which is good for the maltodextrin market.

In Germany the market is anticipated to grow at a CAGR of 3.2%. In Germany people are becoming more health conscious and avoiding sugar. Thus, maltodextrin is becoming more and more popular in Germany as a sugar substitute. Germanys sports culture is encouraging more people to use sports supplements which is driving up demand for maltodextrin in the nation.

The goal of market participants is to increase the use of maltodextrin in food and other applications. As a result, working together with other food and beverage industry stakeholders is typical. Using maltodextrin to enhance foods flavor and texture is the main goal of Grain Processing Corporation one of the well-known businesses in the industry.

Through acquisitions the business is also increasing its market share. To gain a competitive advantage other business in the market are attempting to lower production costs.

By source, methods industry has been categorized into Corn, Wheat and Potato

By application, industry has been categorized into Agriculture, Food and beverages

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is expected to grow at a CAGR of 4.8% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 6.91 Billion.

Awareness in its function is increasing demand for Maltodextrin Market.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Roquette, Matsutani, Ingredion and more.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tapioca Maltodextrin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Digestion Resistant Maltodextrin Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Digestion Resistant Maltodextrin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Digestion-Resistant Maltodextrin Market in Japan - Growth & Demand from 2025 to 2035

Digestion-Resistant Maltodextrin Industry Analysis in Western Europe - Growth & Market Insights 2025 to 2035

Demand for Digestion Resistant Maltodextrin in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA