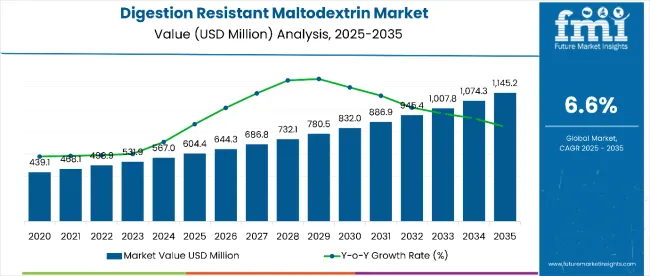

The digestion resistant maltodextrin market is projected to grow from USD 604.4 million in 2025 to USD 1145.2 million by 2035, reflecting a CAGR of 6.6%. This rise is propelled by increasing consumer interest in functional dietary fibers known to support digestive health and gut microbiome balance. Expanding usage in food, beverages, and dietary supplements is fueling demand globally. Rising health consciousness and growth in functional foods and nutraceuticals further promote DRM adoption as a key ingredient for fiber enrichment.

By 2030, the market is expected to reach around USD 832.0million, highlighting steady value addition in the first half of the period. Growing awareness about dietary fiber’s benefits and alignment with clean-label trends are significant growth drivers. Food manufacturers increasingly incorporate DRM to meet consumer demand for healthier and fiber-rich products while maintaining taste and texture. This trend is expected to continue as demand for gut health products rises, especially in emerging regions.

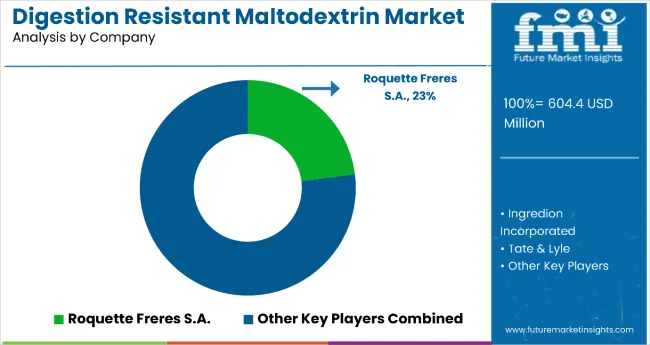

Leading companies such as Roquette Freres S.A., Ingredion Incorporated, and Tate & Lyle are investing in innovation and production capacity expansion. Cost-effective extraction methods and sourcing from natural ingredients strengthen their market positions. These companies focus on regulatory compliance and quality control to address demand in food and nutraceutical sectors. Their R&D efforts focus on improving functional properties, clean-label options, and expanding applications of DRM within functional foods and supplements, ensuring sustained market growth over the forecast period.

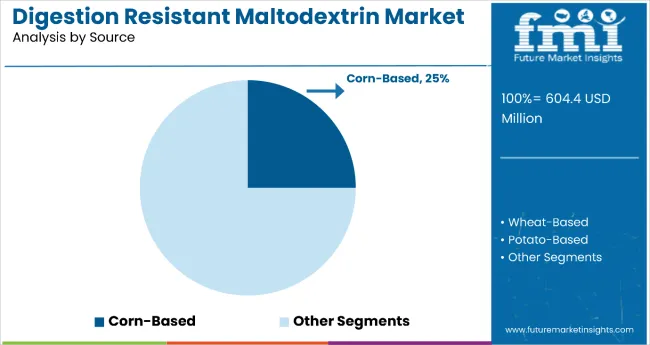

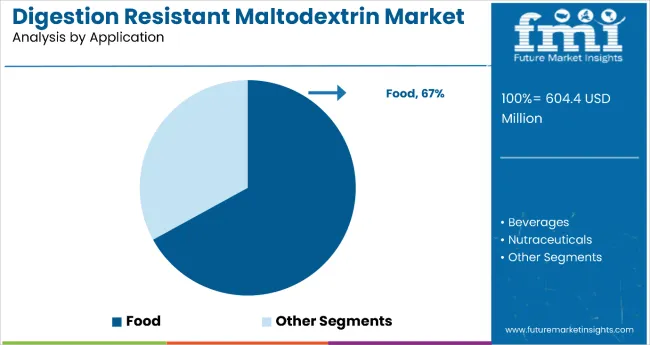

The market accounts for 25% of the source segment, led by corn-based DRM, driven by its abundant availability, cost-effectiveness, and functional benefits in dietary fiber enrichment. It accounts for around 67% of the application segment in food, supported by its widespread use in fiber-enriched functional foods and beverages. The market sees growing adoption in nutraceuticals and dietary supplements, reflecting increasing consumer demand for digestive health and gut microbiome support. Rising health consciousness and clean-label trends are key drivers.

The market is evolving with rising consumer preference for natural, functional ingredients and expanded use across food, beverage, and supplement sectors. Advances in production technologies and cost-effective extraction methods improve product quality, supporting wider applications. Companies are introducing clean-label and specialized formulations tailored to regulatory standards. Strategic innovations and expansion by key players are driving growth in both mature and emerging markets.

Regulatory compliance departments encounter documentation challenges as functional fiber claims require coordination between clinical evidence, nutritional labeling requirements, and health authority submissions across different international markets. Regulatory specialists work with technical documentation teams to establish dossier preparation procedures while coordinating with legal departments about claim substantiation and marketing compliance across varying regulatory frameworks that may affect both ingredient approval and product positioning.

| Metric | Value |

|---|---|

| Estimated Market Value (2025E) | USD 604.4 million |

| Forecast Market Value (2035F) | USD 1,145.2 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

The market is growing primarily due to rising consumer awareness about digestive health and the benefits of dietary fibers. As more people focus on wellness and gut health, functional dietary fibers like DRM are increasingly incorporated into foods, beverages, and dietary supplements. This trend is propelled by the global rise in lifestyle diseases such as diabetes and obesity, pushing consumers towards healthier, low-calorie, fiber-rich alternatives.

Another key driver is the growing market demand for clean-label and natural ingredients, with consumers preferring products that enhance digestive function without compromising taste or texture. Manufacturers are responding with improved extraction technologies and formulation innovations that maintain product quality while meeting regulatory standards.

Additionally, expanding applications in sports nutrition, functional foods, and nutraceuticals are fueling market growth. The ingredient’s ability to support sustained energy release and improve glycemic control appeals to both health-conscious consumers and athletes. Overall, greater health consciousness, evolving dietary trends, and ongoing innovations in production and product development underpin the steady growth of the DRM market.

The market is segmented by source, application, form, and region. By source, the market is divided into corn-based, wheat-based, potato-based, cassava-based, and others (tapioca and mixed starch sources). Based on application, the market is divided into beverages (alcoholic beverages and non-alcoholic beverages), food (breakfast cereals, dairy products, instant puddings, margarines and butters, salad dressings, sauces, snack foods, and others such as bakery products and confectionery)and nutraceuticals. In terms of form, the market is bifurcated into spray-dried powder and instantized/agglomerated. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

The corn-based segment stands out as the most lucrative source segment in the digestion resistant maltodextrin (DRM) market, holding a sizeable market share of 25% in 2025. This segment’s dominance is attributed to the global abundance and cost-effectiveness of corn as a raw material. Corn’s high starch yield facilitates efficient production of resistant maltodextrin with desirable functional properties such as improved solubility, stability, and dietary fiber content, which are highly valued in food and beverage manufacturing.

Moreover, corn-based DRM benefits from well-established agricultural supply chains, technological innovations in starch processing, and versatile application possibilities across baked goods, snacks, dairy, and beverages. These factors collectively reduce production costs, making corn-based products more accessible to manufacturers, especially in price-sensitive markets. Additionally, consumer awareness around digestive health and dietary fiber intake is accelerating demand for corn-derived DRM in functional foods and nutraceuticals. This combination of economic, technological, and consumer-driven factors fuels the corn-based segment’s leading market share and positions it as the most economically attractive source within the DRM industry.

The food segment is the most lucrative application within the digestion resistant maltodextrin (DRM) market, commanding an estimated 67% market share in 2025. This dominance is driven by the broad incorporation of DRM in a wide variety of food products, ranging from breakfast cereals and dairy products to snack foods, sauces, and margarine. DRM’s unique ability to act as a soluble dietary fiber enhances the nutritional profile of food without compromising taste, texture, or caloric content, making it highly appealing to health-conscious consumers.

Rising awareness about gut health and increasing prevalence of digestive disorders are fueling consumer demand for fiber-enriched foods, which is further supported by the clean-label trend emphasizing natural, functional ingredients. Additionally, technological advancements in DRM’s functional properties have enabled food manufacturers to innovate and improve product stability and nutrition simultaneously. Given these factors, plus the expanding global market for functional and healthy foods, the food segment's leading share and continuous innovation pipeline underline its status as the key growth driver and most attractive application in the DRM market.

From 2025 to 2035, growing consumer awareness of digestive health and increasing demand for functional dietary fibers are the primary drivers of growth in the digestion resistant maltodextrin (DRM) market. Rising health consciousness, coupled with the surge in lifestyle diseases like diabetes and obesity, is pushing consumers toward fiber-enriched foods and beverages, fueling market expansion. Manufacturers are innovating with improved extraction techniques and clean-label formulations to meet regulatory standards and consumer preferences.

Growing Demand for Functional Foods Drives Market Expansion

Increasing interest in gut health and digestive wellness is driving manufacturers to incorporate resistant maltodextrin in functional foods, beverages, and dietary supplements. DRM’s ability to enhance fiber content without affecting taste or texture makes it a preferred ingredient. Consumer trends favor natural, low-calorie, fiber-rich ingredients, further boosting adoption across global markets, especially in emerging regions.

Innovations and Sustainability Enhance Market Opportunities

Advancements in production technologies, such as enzymatic extraction and spray-drying, improve DRM’s functional properties and purity, enabling wider use across food and nutraceutical sectors. Companies focusing on sustainable sourcing and clean-label credentials are gaining competitive advantage. Ongoing research into new applications and formulations continues to expand DRM’s market potential, supporting sustained growth throughout the forecast period.

| Countries | CAGR (%) |

|---|---|

| Japan | 6.1 |

| China | 6.0 |

| France | 5.8 |

| Germany | 4.9 |

| India | 4.8 |

| United States | 4.7 |

| United Kingdom | 4.5 |

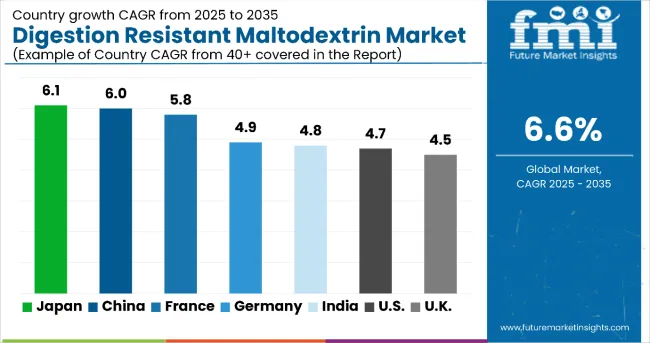

The market growth varies across countries. Japan leads with a CAGR of 6.1%, driven by its aging population and strong regulatory standards. China follows closely at 6.0%, fueled by rising health awareness and government support. France and Germany see steady growth at 5.8% and 4.9%, supported by R&D and advanced food technology. India grows at 4.8%, benefiting from urbanization and e-commerce expansion. The USA market expands at 4.7%, backed by a mature nutraceutical sector and regulatory oversight. The UK records a CAGR of 4.5%, influenced by clean-label trends and growing fiber food demand. Asia-Pacific markets lead growth, while Western regions grow steadily.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Demand for digestion resistant maltodextrin (DRM) in China is expanding robustly at a CAGR of 6.0%, fueled by increasing health awareness and growing incidence of digestive health issues. The rising middle-class population with improved purchasing power is driving demand for functional foods and nutraceuticals fortified with dietary fibers like DRM. Domestic manufacturers invest heavily in scaling production capacity and enhancing technology to reduce reliance on imports. Government initiatives encouraging nutritional wellness and digestive health further accelerate market traction. The food and beverage sector is embracing fiber-enriched formulations, contributing to widespread DRM adoption. Manufacturers are also expanding distribution networks to penetrate rural and urban markets alike. Strong R&D focus on product quality and regulatory compliance supports growth momentum. Overall, China is set to remain a key growth hub for the DRM market globally.

Revenue from digestion resistant maltodextrin in Japan grows at a CAGR of 6.1%, driven by its aging population and increasing focus on preventive health. Consumers prioritize high-quality, natural ingredients that support digestive wellness and gut health, enhancing DRM demand. The pharmaceutical and nutraceutical sectors strongly influence product innovation, with companies developing advanced formulations. Regulatory standards ensure stringent safety and quality controls, bolstering consumer confidence. Local manufacturers are adopting cutting-edge extraction and formulation technologies to improve DRM efficacy and purity. Strategic collaborations between ingredient suppliers and food producers broaden product lines. Market penetration into functional foods continues to rise, with sustained emphasis on clean-label products. Japan’s well-established supply chains facilitate nationwide distribution, ensuring market accessibility. These factors combine to drive steady and sustainable DRM market growth in the country.

Revenue from digestion resistant maltodextrin in France advances at a 5.8% CAGR, propelled by strong research capabilities and consumer focus on digestive and cognitive health. The integration of DRM into specialty dietary supplements and premium functional foods is increasing, supported by R&D investments. Collaboration between nutraceutical companies and ingredient manufacturers drives innovation in tailored formulations. Regulatory environment fosters safe and effective ingredient use, encouraging manufacturer confidence. Growing consumer demand for preventive health and wellness products sustains market expansion. The food industry is actively reformulating products with fiber enhancements, boosting DRM incorporation. Export opportunities through European Union markets further strengthen growth. Increasing awareness campaigns and educational initiatives promote DRM benefits among consumers. These developments underpin France’s evolving and promising digestion resistant maltodextrin market landscape.

Demand for digestion resistant maltodextrin in Germany exhibits a steady 4.9% CAGR, supported by an environmentally conscious and health-driven population. The country’s robust food technology sector advances innovations in fiber-enriched food products. Manufacturers emphasize organic and clean-label DRM sources to meet consumer preferences. Germany’s export-oriented food production benefits from stringent quality controls and safety regulations, enhancing product credibility globally. Awareness of glycemic control through dietary fibers like DRM is growing, further driving market demand. Biotechnology research focuses on optimizing DRM extraction and functional properties. Expansion of dietary supplement formulations separates Germany’s market as a key player in Europe. Gradual increase in fiber intake awareness complements market penetration, ensuring sustained growth.

Revenue from digestion resistant maltodextrin in India is growing at a CAGR of 4.8%, supported by rapid urbanization and rising health consciousness. Increasing disposable incomes and a large, young population drive demand for healthier, fiber-rich foods and supplements. The development of e-commerce platforms facilitates wider product accessibility beyond metropolitan areas. Government programs promoting nutritional well-being foster functional food adoption. Local production capacities are gradually increasing to reduce dependency on imports. Entry of multinational and domestic players expands product offerings and distribution channels. Traditional and modern food sectors are blending DRM to meet evolving consumer tastes. The market outlook remains optimistic as awareness and product innovation continue to advance.

Sales of digestion resistant maltodextrin in the USA are projected to grow steadily at a 4.7% CAGR, fueled by a mature nutraceutical sector and high consumer awareness of digestive health. Manufacturers invest in advanced DRM production technologies to improve ingredient purity and functional benefits. Clean-label and natural ingredient trends resonate strongly with American consumers, boosting product demand. Collaborative partnerships between ingredient suppliers and major food and beverage brands expand application possibilities. Strict FDA regulations ensure product safety and quality, enhancing market trust. Retail channels, both online and offline, broaden distribution reach. Rising prevalence of metabolic diseases underscores the importance of dietary fibers like DRM. This positions the USA as a stable and innovative DRM market with sustained growth potential.

Demand for digestion resistant maltodextrin in the UK grows at a CAGR of 4.5%, driven by increasing consumer preference for fiber-enriched foods and nutritional supplements. Functional food innovation and clean-label trends encourage manufacturers to integrate DRM into diverse product ranges. The expanding health and wellness retail environment supports product visibility and consumer education. Nutraceutical demand, especially for digestive and metabolic health, strengthens DRM adoption. Regulatory frameworks continue to promote safe, functional ingredients in the food supply. Strategic marketing initiatives highlight the digestive benefits of DRM, broadening consumer acceptance. Product launches featuring DRM in snacks, drinks, and supplements increase market variety. The UK market evolves steadily with consumer-centric growth strategies enhancing penetration.

The DRM market is moderately consolidated, with major players such as Roquette Frères S.A., Ingredion Incorporated, Tate & Lyle PLC, Archer Daniels Midland Company (ADM), Cargill Incorporated, Grain Processing Corporation, Baolingbao Biology Co., Ltd., Matsutani Chemical Industry Co., Ltd., Tereos Syral S.A.S., and The AGRANA Group driving the industry through innovation, capacity expansion, and global partnerships. These companies leverage deep expertise in starch and carbohydrate chemistry to develop high-functionality ingredients catering to diverse applications in food, beverages, and nutraceuticals. Continuous R&D investments focus on improving DRM solubility, texture, and prebiotic performance, enhancing its value in functional and clean-label formulations. Manufacturers are also adopting advanced production technologies to achieve greater purity, consistency, and cost efficiency.

Strategic collaborations with leading food and beverage brands and long-term supply agreements strengthen distribution networks and ensure stable market positions. Regulatory compliance and sustainable sourcing practices are key focus areas, reflecting rising consumer demand for natural, health-oriented ingredients. Overall, the competitive landscape emphasizes technological advancement, product diversification, and sustainability, with these global players shaping the market’s evolution toward higher-quality, functionally versatile, and environmentally responsible DRM products.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 604.4 million |

| Source Type | Corn-Based, Wheat-Based, Potato-Based, Cassava-Based, Others (including tapioca and mixed starch sources) |

| Application | Food (Breakfast Cereals, Dairy Products, Instant Puddings, Margarines and Butters, Salad Dressings, Sauces, Snack Foods, Others such as bakery products and confectionery), Beverages (Alcoholic and Non-Alcoholic), Nutraceuticals |

| Form | Spray-Dried Powder, Instantized/Agglomerated |

| Regions Covered | Asia Pacific, Western Europe, North America, Latin America, Eastern Europe, Middle East & Africa |

| Countries Covered | China, Japan, India, United States, United Kingdom, Germany, France, and 40+ other countries |

| Key Companies Profiled | Roquette Frères S.A., Ingredion Incorporated, Tate & Lyle PLC, Archer Daniels Midland Company (ADM), Cargill Incorporated, Grain Processing Corporation, Baolingbao Biology Co., Ltd., Matsutani Chemical Industry Co., Ltd., Tereos Syral S.A.S., The AGRANA Group. |

| Additional Attributes | Dollar sales by source type and application, growing demand for clean-label and fiber-enriched products, increasing digestive health awareness, expansion in functional foods and nutraceuticals, innovations in extraction and formulation technologies, and focus on regulatory compliance |

The global digestion resistant maltodextrin market is estimated to be valued at USD 604.4 million in 2025.

The market size for digestion resistant maltodextrin is projected to reach USD 1,145.2 million by 2035.

The digestion resistant maltodextrin market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The corn-based segment is projected to lead in the digestion resistant maltodextrin market with 25% market share in 2025.

In terms of application, the food segment is projected to command 67% share in the digestion resistant maltodextrin market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digestion Resistant Maltodextrin Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Digestion-Resistant Maltodextrin Industry Analysis in Western Europe - Growth & Market Insights 2025 to 2035

Digestion-Resistant Maltodextrin Market in Japan - Growth & Demand from 2025 to 2035

Demand for Digestion Resistant Maltodextrin in EU Size and Share Forecast Outlook 2025 to 2035

Digestion Aids Market Size and Share Forecast Outlook 2025 to 2035

Anaerobic Digestion Equipment Market Size and Share Forecast Outlook 2025 to 2035

Resistant Starch Market Analysis by Product Type, Source, End Use and Region Through 2035

PD1 Resistant Head and Neck Cancer Market Size and Share Forecast Outlook 2025 to 2035

Oil Resistant Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Oil-Resistant Packaging Providers

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Slip Resistant Shoes Market Insights - Trends & Forecast 2025 to 2035

Heat Resistant Glass Market Size & Trends 2025 to 2035

Heat Resistant LED Light Market Analysis by End Use Industry, Material, and Region: Forecast for 2025 to 2035

Heat-Resistant Ceramic Tableware Market Analysis – Growth & Trends 2025 to 2035

Fire Resistant Hydraulic Fluid Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA