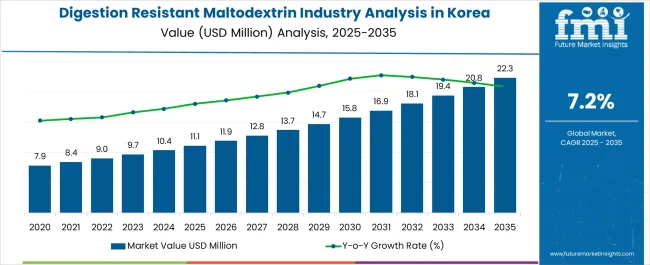

The Digestion Resistant Maltodextrin Industry Analysis in Korea is estimated to be valued at USD 11.1 million in 2025 and is projected to reach USD 22.3 million by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Digestion Resistant Maltodextrin Industry Analysis in Korea Estimated Value in (2025 E) | USD 11.1 million |

| Digestion Resistant Maltodextrin Industry Analysis in Korea Forecast Value in (2035 F) | USD 22.3 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

The digestion resistant maltodextrin industry in Korea is experiencing robust growth. Increasing consumer awareness of dietary fibers, rising demand for functional foods, and the integration of health-focused ingredients into daily nutrition are driving market expansion.

Current dynamics are influenced by growing adoption of fiber-enriched products across the food and beverage sector, supportive regulatory frameworks for dietary supplements, and advancements in manufacturing technologies that enhance solubility and taste profiles. The future outlook is characterized by rising innovation in convenient and ready-to-consume formats, expanding applications across beverages, bakery, and dairy products, and increasing penetration into health-conscious and urban populations.

Growth rationale is based on the functional benefits of digestion resistant maltodextrin in promoting gut health, weight management, and glycemic control, combined with the ability of producers to optimize production efficiency and maintain high product quality Strategic partnerships with food manufacturers and the development of versatile formulations are expected to sustain adoption rates and drive consistent revenue growth over the forecast period.

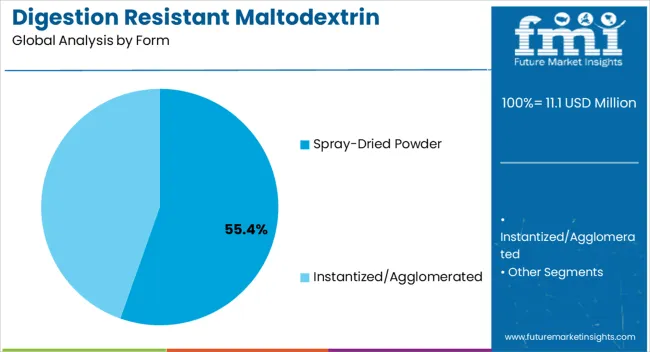

The spray-dried powder segment, holding 55.40% of the form category, has been leading due to its ease of incorporation into diverse food and beverage matrices. Adoption has been supported by superior solubility, uniform texture, and compatibility with industrial processing requirements.

Its performance in maintaining functional fiber content while preserving sensory attributes has reinforced preference among manufacturers. Technological advancements in spray-drying and particle size optimization have enhanced quality and consistency.

Supply reliability and compliance with safety standards have further strengthened market acceptance Growth potential is being enhanced by product diversification and tailored formulations for specific applications, ensuring the spray-dried powder segment maintains its dominant position within the digestion resistant maltodextrin market in Korea.

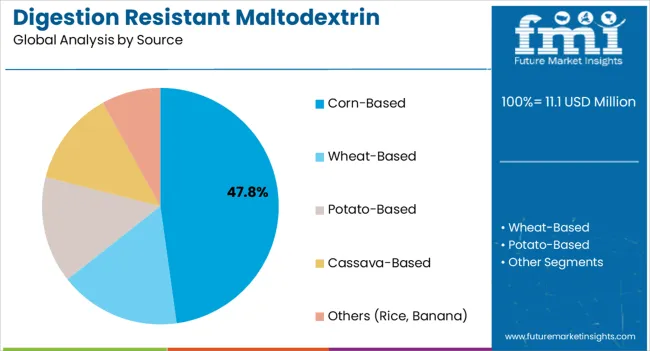

The corn-based segment, representing 47.80% of the source category, has maintained leadership owing to the abundant availability of corn raw materials and established processing infrastructure. Adoption has been reinforced by cost-effectiveness, stable supply chains, and consistent fiber content suitable for functional food applications.

The segment benefits from regulatory acceptance and established processing protocols that ensure safety and quality. Technological improvements in extraction and purification processes have optimized yield and functional performance.

Growing demand for plant-based and clean-label ingredients has further solidified market preference for corn-based maltodextrin Strategic sourcing and integration with major food manufacturers are expected to sustain the segment’s market share and support long-term growth in the Korean market.

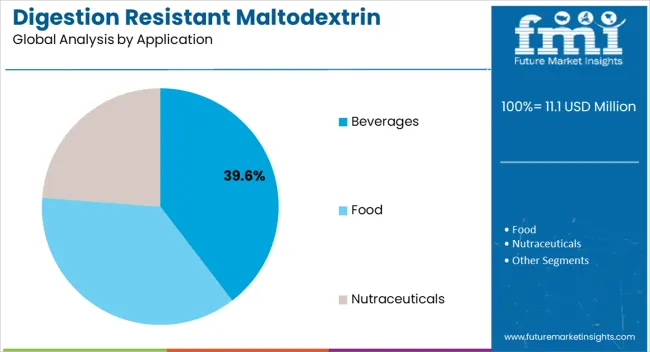

The beverages segment, accounting for 39.60% of the application category, has emerged as the leading application due to high consumer adoption of functional and fiber-enriched drinks. Integration into beverages has been facilitated by excellent solubility, minimal impact on taste, and compatibility with liquid formulations.

Market growth is supported by increasing consumer preference for health-oriented ready-to-drink products and regulatory support for fiber fortification. Manufacturers have leveraged innovative formulations to enhance product appeal and maintain nutritional efficacy.

Distribution through modern retail and convenience channels has reinforced accessibility and market penetration Continued innovation in functional beverage formats and expanding health-conscious consumer segments are expected to sustain the beverages segment’s share and contribute significantly to the overall growth of the digestion resistant maltodextrin industry in Korea.

Corn is the most popular base for digestion resistant maltodextrin in Korea. For 2025, corn-based digestion resistant maltodextrin is expected to account for 57.3% of the industry share.

Corn already has a prominent place in Korean cuisine. As the popularity of corn-based food increases worldwide, Korea is also witnessing significant trends in corn-based products. Thus, corn-based digestion resistant maltodextrin is dominant in Korea. Additionally, the simple and cost-effective extraction and storage process of corn are also contributing to the growth of the product in the country.

| Demand for Digestion Resistant Maltodextrin in Korea Based on Source | Corn |

|---|---|

| Industry Share in 2025 | 57.3% |

Digestion resistant maltodextrin is most commonly found in the form of spray-dried powder in Korea. For 2025, spray-dried powder is predicted to contribute to 63.5% of the industry share by form.

With the increasing use of digestion resistant maltodextrin in food items, manufacturers are looking to simplify the process of incorporating the ingredient into food. Spray-dried powder is a convenient method for producers to include the product in foods and beverages. Thus, spray-dried powder is triumphant as a form in Korea.

| Demand for Digestion Resistant Maltodextrin in Korea Based on Form | Spray-Dried Powder |

|---|---|

| Industry Share in 2025 | 63.5% |

Korea is an emerging market for digestion resistant maltodextrin. As such, industry players are still exploring the potential of the product in the country. They are also aiming to address the lack of awareness among Koreans about the product. The health benefits of the product are highlighted on foods and beverages containing digestion resistant maltodextrin, while adhering to established government labeling guidelines.

Recent Developments Observed in Digestion Resistant Maltodextrin in Korea

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 11.1 million |

| Projected Industry Size by 2035 | USD 22.3 million |

| Anticipated CAGR between 2025 to 2035 | 7.2% CAGR |

| Historical Analysis of Demand for Digestion Resistant Maltodextrin in Korea | 2020 to 2025 |

| Demand Forecast for Digestion Resistant Maltodextrin in Korea | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Key Insights for Digestion Resistant Maltodextrin in Korea, Insights on Global Players and Leading Industry Strategy in Korea, Ecosystem Analysis of Local and Regional Korea Providers |

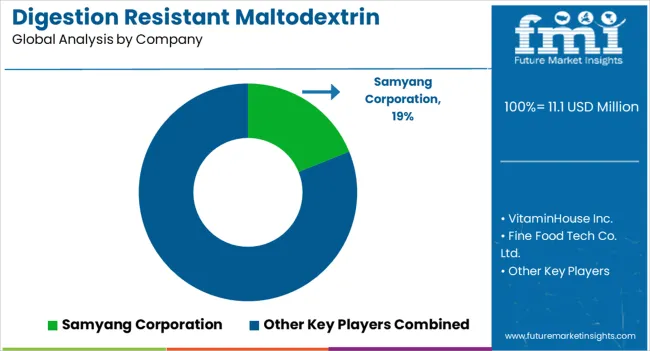

| Key Companies Profiled | Samyang Corporation; VitaminHouse Inc.; Fine Food Tech Co. Ltd.; Day Well Jeu; Amicogen; DAESANG Co., Ltd.; Global Food Korea Co. Ltd. |

| Key Provinces Profiled | South Gyeongsang, North Jeolla, South Jeolla, Jeju |

The global digestion resistant maltodextrin industry analysis in Korea is estimated to be valued at USD 11.1 million in 2025.

The market size for the digestion resistant maltodextrin industry analysis in Korea is projected to reach USD 22.4 million by 2035.

The digestion resistant maltodextrin industry analysis in Korea is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in digestion resistant maltodextrin industry analysis in Korea are spray-dried powder and instantized/agglomerated.

In terms of source, corn-based segment to command 47.8% share in the digestion resistant maltodextrin industry analysis in Korea in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digestion Aids Market Size and Share Forecast Outlook 2025 to 2035

Digestion Resistant Maltodextrin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Digestion-Resistant Maltodextrin Market in Japan - Growth & Demand from 2025 to 2035

Digestion-Resistant Maltodextrin Industry Analysis in Western Europe - Growth & Market Insights 2025 to 2035

Anaerobic Digestion Equipment Market Size and Share Forecast Outlook 2025 to 2035

Demand for Digestion Resistant Maltodextrin in EU Size and Share Forecast Outlook 2025 to 2035

Resistant Starch Market Analysis by Product Type, Source, End Use and Region Through 2035

PD1 Resistant Head and Neck Cancer Market Size and Share Forecast Outlook 2025 to 2035

Oil Resistant Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Oil-Resistant Packaging Providers

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Slip Resistant Shoes Market Insights - Trends & Forecast 2025 to 2035

Heat Resistant Glass Market Size & Trends 2025 to 2035

Heat Resistant LED Light Market Analysis by End Use Industry, Material, and Region: Forecast for 2025 to 2035

Heat-Resistant Ceramic Tableware Market Analysis – Growth & Trends 2025 to 2035

Fire Resistant Hydraulic Fluid Market Growth – Trends & Forecast 2024-2034

Heat Resistant Polymer Market

Drug Resistant Pulmonary Tuberculosis Market

Pest Resistant Crops Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA