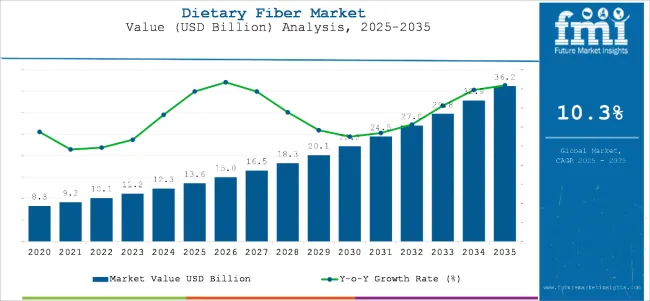

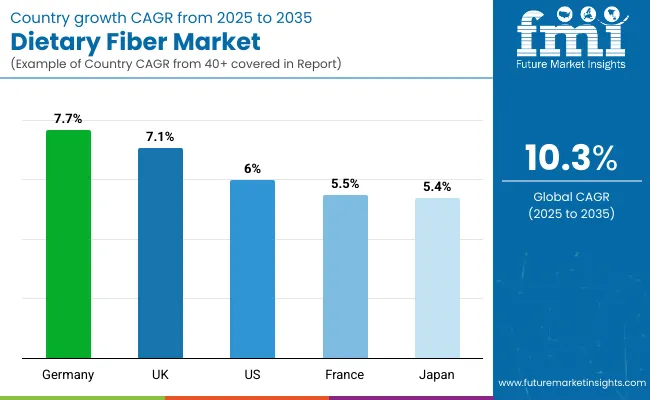

The global dietary fiber market is projected to grow from USD 13.6 billion in 2025 to USD 36.2 billion by 2035, registering a CAGR of 10.3%. The market expansion is being driven by increasing consumer awareness of digestive health, weight management, and preventive healthcare.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 13.6 billion |

| Industry Value (2035F) | USD 36.2 billion |

| CAGR (2025 to 2035) | 10.3% |

Rising preference for natural, plant-based, and vegan food products is encouraging manufacturers to integrate dietary fiber into diverse food and beverage formulations to meet nutritional trends. Additionally, technological advancements in fiber extraction, formulation, and enrichment are enhancing product applications in functional foods, nutraceuticals, and beverages, contributing to broader market adoption.

The market holds varying shares within its parent markets. It accounts for around 15% of the functional food ingredients market and approximately 8% within the nutraceutical ingredients market. In the broader health and wellness ingredients market, dietary fiber commands nearly 10% share, reflecting its importance in preventive nutrition.

Within the overall food ingredients market, it contributes about 5%, while in the vast food and beverage market, its share remains below 0.5%. For the specialty carbohydrates and fibers market, dietary fiber forms a significant portion, estimated at 40-50%, due to its dominant role among functional dietary carbohydrates and fibers.

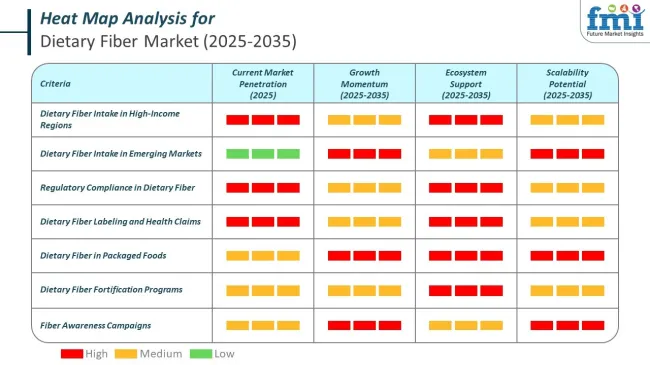

Government regulations impacting the market focus on food safety, health claims, and nutritional labelling. The Food Safety and Standards (Packaging and Labelling) Regulations, 2011 in India, along with guidelines by the Food Safety and Standards Authority of India (FSSAI), set clear requirements for dietary fiber inclusion and claims on packaged foods.

Globally, the United States FDA’s dietary fiber definition and labelling standards, along with the European Food Safety Authority (EFSA) regulations on fibre health claims, drive the adoption of high-quality dietary fiber ingredients to ensure compliance and deliver scientifically backed health benefits to consumers.

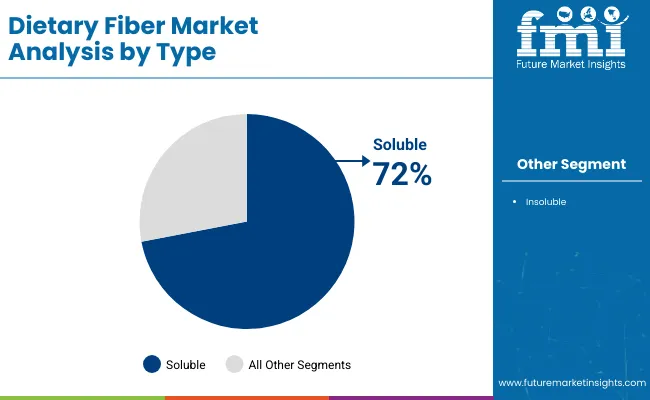

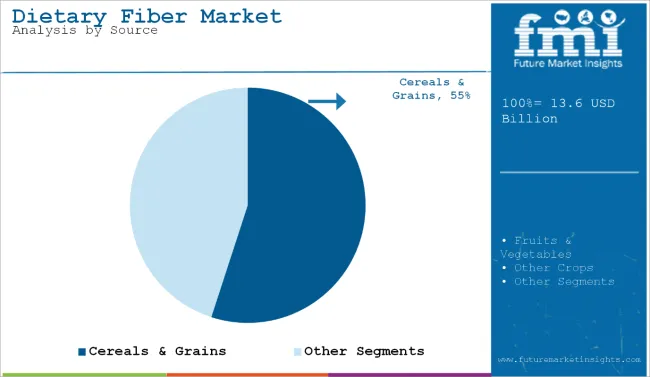

Germany is projected to be the fastest-growing market, expanding at a CAGR of 7.7% from 2025 to 2035. Soluble will lead the type segment with a 72% share, while cereals and grains will dominate the source segment with a 55% share. The USA and UK markets are also expected to grow steadily at CAGRs of 6% and 7.1%, respectively, while Japan and France are projected at 5.4% and 5.5%, respectively.

Per capita consumption levels in the dietary fiber market show notable variation across top economies, with North America and parts of Europe showing higher daily averages. Canada records the highest at 21.5 grams per day, while the United Kingdom and the United States closely follow with intakes near or above 18 grams.

Emerging and transitional economies in the dietary fiber market such as India, Brazil, China, and Japan register lower per capita intake, with most values falling below 13 grams per day. These figures signal untapped potential for fiber-enriched foods across both retail and institutional channels.

Across major economies, the dietary fiber market is shaped by a strict framework of labeling laws and health claim regulations. The United States, China, and Japan enforce detailed policies that define permissible fiber types, thresholds for claims, and safety benchmarks for both food and supplement categories.

In Europe and India, national authorities and regional unions define the scope of permissible claims and fortification efforts across the dietary fiber market. These frameworks aim to ensure consistency in nutritional messaging while promoting higher fiber intake for better population health.

The market is segmented by type, source, application, and region. By type, the market is divided into soluble (inulin, polydextrose, dietary fibres, beta-glucan) and insoluble (cellulose, hemicellulose, chitosan, chitin, lignin, resistant starch). Based on source, the market is classified into cereals & grains (wheat, rice, bran, others), fruits & vegetables (apples, others), and other crops (barley, oats, legumes, and chicory root).

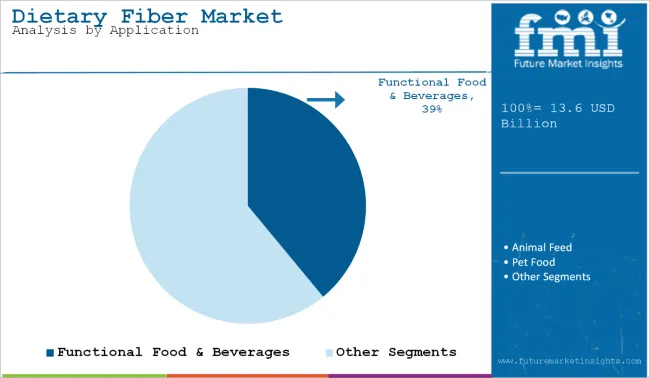

By application, the market is segmented into functional food & beverages, animal feed, pet food, and pharmaceuticals. Regionally, the market is classified into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa.

Soluble dietary fiber will lead the type segment with a 72% market share by 2025, driven by its proven benefits for gut health, cholesterol reduction, and blood sugar control, increasing its use in functional food products.

Cereals and grains are projected to capture 55% of the market share in 2025, driven by their abundant fiber content, high availability, cost-effectiveness, and widespread use in food processing and dietary fiber sourcing applications.

Functional food and beverages are expected to dominate the application segment with a 39% market share by 2025, driven by rising consumer demand for fortified, health-promoting products that enhance digestive health, satiety, and overall nutrition.

The global market is experiencing steady growth, driven by increasing consumer awareness of digestive health, weight management, and the preventive benefits of fiber intake. Dietary fibers play a crucial role in promoting gut health, reducing cholesterol levels, and supporting overall well-being, making them a key ingredient in functional food, beverages, and nutraceuticals.

Recent Trends in the Dietary Fiber Market

Challenges in the Dietary Fiber Market

Germany dietary fiber market momentum is driven by health-focused functional foods, clean-label nutrition trends, and regulatory alignment with EU preventive health policies. France and the UK maintain consistent demand driven by national dietary guidelines and investments in public health nutrition programmes. In contrast, developed economies such as the USA (6% CAGR), Japan (5.4%), and Germany (7.7%) are expanding at a steady 0.52-0.75x of the global growth rate.

The report covers in-depth analysis of 40 plus countries; five top-performing OECD countries are highlighted below.

The Japan dietary fiber revenue is poised to grow at a CAGR of 5.4% from 2025 to 2035. Growth is driven by rising demand for prebiotic ingredients in beverages, nutraceuticals, and traditional food applications. As a technology-driven OECD economy, Japan prioritizes functional food innovations integrating soluble fibers like inulin and beta-glucan.

The sales of dietary fiber in Germany are poised to expand at 7.7% CAGR during the forecast period, below the global average but strongly regulation-led. EU health and nutrition goals, preventive healthcare programmes, and clean label trends are driving adoption of diverse dietary fibers. Key applications include bakery, cereals, dairy, and dietary supplements.

The French dietary fiber market is projected to grow at a 5.5% CAGR during the forecast period, mirroring Germany in its regulation-led adoption trajectory. Demand is driven by national nutrition policies, preventive health initiatives, and rising consumer focus on digestive health.

The USA dietary fiber market is projected to grow at 6% CAGR from 2025 to 2035, translating to 0.58x the global rate. Unlike emerging markets focused on volume growth, USA demand is driven by health-conscious consumers seeking digestive health, weight management, and cardiovascular benefits.

The UK dietary fiber revenue is projected to grow at a CAGR of 7.1% from 2025 to 2035, representing moderate growth among top OECD nations at 0.69 times the global pace. Growth is supported by government-led nutrition policies targeting children's health, obesity prevention, and digestive health. Demand is rising for soluble and functional fibers in bakery, cereals, and beverages.

The market is moderately consolidated, with leading players like DIC Corporation, Church & Dwight Co Inc, Hero Nutritionals LLC, Nutranext, and Herbaland Naturals Inc dominating the industry. These companies provide a wide range of dietary fiber products catering to applications in functional foods, beverages, nutraceuticals, and dietary supplements. DIC Corporation focuses on innovative fiber formulations for food and health products, while Church & Dwight Co Inc specializes in fiber-enriched consumer health brands.

Hero Nutritionals LLC delivers dietary fiber gummies and supplements targeted at children and adults. Nutranext offers premium dietary fiber supplements under multiple health brands, and Herbaland Naturals Inc is known for its vegan and plant-based fiber gummies.

Other key players like ABH Nature's Products, Inc, Life Science Nutritionals, Bayer AG, Zanon Vitamec, The Honest Company, Inc, Pharmavite LLC, Boscogen Inc, Wellnext Health, Taura Natural Ingredients Ltd, and Viva 5 Corporation contribute by providing specialized, high-quality dietary fiber ingredients and formulations for diverse consumer and industrial applications.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 13.6 billion |

| Projected Market Size (2035) | USD 36.2 billion |

| CAGR (2025 to 2035) | 10.30% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Type Analyzed | Soluble (Inulin, Polydextrose, Dietary Fibres, Beta-Glucan) and Insoluble (Cellulose, Hemicellulose, Chitosan, Chitin, Lignin, Resistant Starch) |

| Source Analyzed | Cereals & Grains (Wheat, Rice, Bran, Others), Fruits & Vegetables (Apples, Others), and Other Crops (Barley, Oats, Legumes, and Chicory Root) |

| Application Analyzed | Functional Food & Beverages, Animal Feed, Pet Food and Pharmaceuticals |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea and Australia |

| Key Players Influencing the Market | DIC Corporation, Church & Dwight Co Inc, Hero Nutritionals LLC, Nutranext, Herbaland Naturals Inc, ABH Nature's Products, Inc, Life Science Nutritionals, Bayer AG, Zanon Vitamec, The Honest Company, Inc, Pharmavite LLC, Boscogen Inc, Wellnext Health, Taura Natural Ingredients Ltd, Viva 5 Corporation |

| Additional Attributes | Dollar sales by type, share by source, regional demand growth, health claim regulations, formulation trends, competitive benchmarking |

The market is valued at USD 13.6 billion in 2025.

The market is forecasted to reach USD 36.2 billion by 2035, reflecting a CAGR of 10.3%.

Soluble will lead the type segment, accounting for 72% of the global market share in 2025.

Cereals and grains will dominate the source segment with a 55% share in 2025.

Germany is projected to grow at the fastest rate, with a CAGR of 7.7% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dietary Fiber Gummies Market Size and Share Forecast Outlook 2025 to 2035

Food Dietary Fibers Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Insoluble Dietary Fiber Business

Dietary Supplement Market Insights - Growth & Demand 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Pet Dietary Supplement Companies

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Korea Dietary Supplements Market Analysis by Ingredients, Form, Application, and Region Through 2035

UK Pet Dietary Supplement Market Growth – Trends, Demand & Forecast 2025-2035

USA Pet Dietary Supplement Market Insights – Size, Share & Industry Growth 2025-2035

ASEAN Pet Dietary Supplement Market Report – Demand, Growth & Trends 2025-2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Demand for Dietary Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Europe Pet Dietary Supplement Market Trends – Growth, Demand & Outlook 2025-2035

Australia Pet Dietary Supplement Market Analysis – Size, Share & Forecast 2025-2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Dietary Supplements Market Analysis by Ingredients, Form, Application, and Country Through 2025 to 2035

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Dog Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA