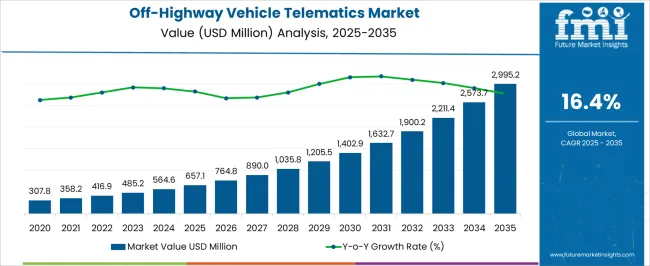

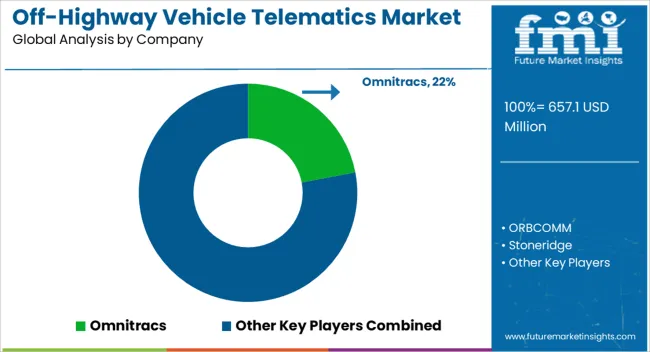

The Off-Highway Vehicle Telematics Market is estimated to be valued at USD 657.1 million in 2025 and is projected to reach USD 2995.2 million by 2035, registering a compound annual growth rate (CAGR) of 16.4% over the forecast period.

| Metric | Value |

|---|---|

| Off-Highway Vehicle Telematics Market Estimated Value in (2025 E) | USD 657.1 million |

| Off-Highway Vehicle Telematics Market Forecast Value in (2035 F) | USD 2995.2 million |

| Forecast CAGR (2025 to 2035) | 16.4% |

The off-highway vehicle telematics market is witnessing significant momentum, driven by the growing emphasis on operational efficiency, predictive maintenance, and safety across industries reliant on heavy machinery. Rapid adoption is being observed as telematics platforms evolve from basic tracking systems into advanced solutions integrating real-time diagnostics, fuel monitoring, and AI-enabled analytics. Increasing investments in digital transformation of construction, mining, and agricultural operations are expanding the market’s footprint, with connectivity solutions providing measurable cost savings through reduced downtime and optimized fleet utilization.

Regulatory mandates for improved worker safety and emissions compliance are also reinforcing telematics integration across equipment fleets. Rising cellular coverage, combined with advancements in cloud platforms and data analytics, is further enhancing system functionality.

As original equipment manufacturers and aftermarket providers expand their offerings with scalable, software-upgradable telematics systems, the market is positioned for sustained growth Expanding global infrastructure projects, combined with heightened demand for connected heavy equipment, are expected to establish telematics as a cornerstone technology in the future of off-highway machinery.

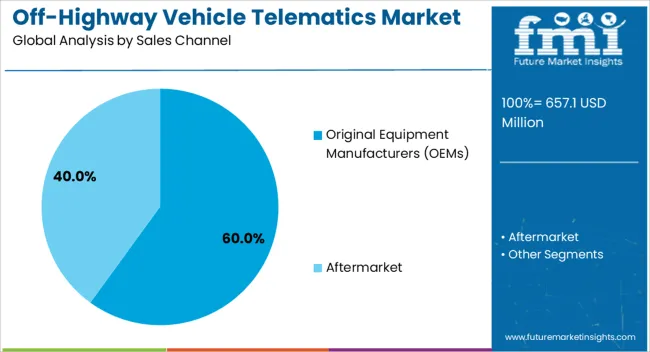

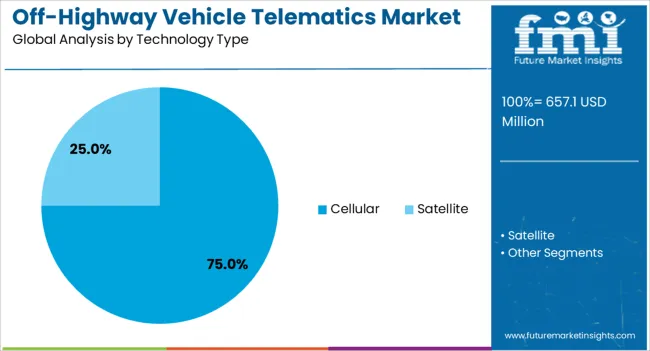

The off-highway vehicle telematics market is segmented by sales channel, technology type, end-use application, and geographic regions. By sales channel, off-highway vehicle telematics market is divided into Original Equipment Manufacturers (OEMs) and Aftermarket. In terms of technology type, off-highway vehicle telematics market is classified into Cellular and Satellite.

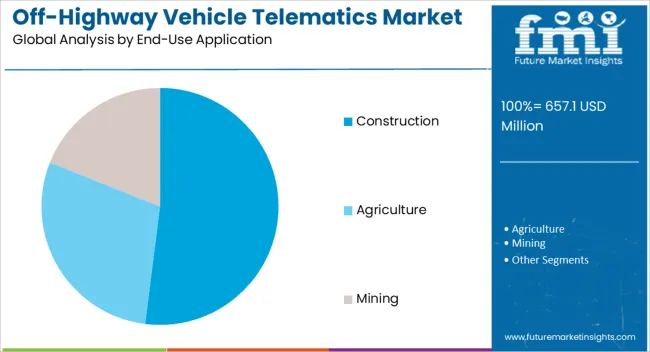

Based on end-use application, off-highway vehicle telematics market is segmented into Construction, Agriculture, and Mining. Regionally, the off-highway vehicle telematics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The original equipment manufacturers sales channel is expected to hold 60.0% of the off-highway vehicle telematics market revenue share in 2025, positioning it as the leading distribution model. This dominance is being driven by the integration of telematics solutions directly into new equipment at the production stage, providing customers with factory-installed systems that are fully optimized and warranty-compliant. The segment benefits from strong trust in OEM brands, as end users prefer equipment that offers built-in digital monitoring and connectivity without requiring aftermarket installation.

By embedding telematics capabilities during manufacturing, OEMs are enabling seamless connectivity, reducing setup complexity, and ensuring higher system reliability. Growing competition among OEMs has also led to bundled offerings where telematics is provided as a standard or optional feature, further accelerating adoption.

As fleet owners prioritize long-term efficiency, the assurance of receiving a certified, pre-installed solution enhances purchasing decisions The strong alignment of OEM strategies with the digital transformation goals of construction and mining industries continues to reinforce the leadership of this segment in the overall market.

The cellular technology type segment is projected to account for 75.0% of the off-highway vehicle telematics market revenue share in 2025, making it the leading technology choice. Its dominance is supported by the widespread availability of cellular networks, which enable real-time communication, remote monitoring, and data analytics across diverse geographies. Cellular systems are preferred due to their scalability, reliability, and ability to handle large volumes of data, including diagnostics, fuel consumption metrics, and geolocation information.

With advancements in 4G and 5G networks, data transmission speeds and connectivity reliability have significantly improved, making cellular telematics well-suited for critical applications in construction, mining, and agriculture. Adoption is further driven by the declining cost of data plans and improved coverage in emerging regions.

The ability to support over-the-air software updates and cloud-based analytics platforms also strengthens the case for cellular dominance As equipment operators demand real-time visibility and predictive insights, cellular technology is expected to remain the backbone of telematics adoption across the off-highway vehicle sector.

The construction application segment is anticipated to hold 52.0% of the off-highway vehicle telematics market revenue share in 2025, establishing it as the leading end-use sector. Its leadership is being reinforced by the increasing need for enhanced safety, efficiency, and productivity in large-scale infrastructure projects. Telematics solutions in construction equipment enable fleet managers to monitor utilization rates, schedule predictive maintenance, and improve operator behavior, resulting in significant cost savings and reduced downtime.

The adoption of connected equipment is also being driven by regulatory compliance requirements related to emissions monitoring and worker safety standards. Construction companies are leveraging telematics data to optimize resource allocation, minimize fuel wastage, and ensure timely project execution. As urbanization and infrastructure investments expand globally, the demand for reliable and intelligent fleet management systems is growing rapidly.

The ability of telematics platforms to provide actionable insights across varied equipment types, from excavators to loaders, ensures strong value creation in this segment This widespread applicability continues to position construction as the primary driver of telematics adoption in off-highway vehicles.

Telematics is the technology of sending, receiving and storing information through the use of telecommunication devices.Off-highway vehicle (OHV) telematics is the integrated use of information and communication with telecommunications technology. The technology of sending, receiving, and storing information pertaining to off-highway vehicles through telecommunication devices is generally termed as off-highway telematics.

OHV telematics business has been witnessing rapid change over the past few years with advancements in the internet, cell phones, and GPS (global positioning system) receivers. GPS receivers and GSM devices, which communicate with the user and web-based software, are installed in each OHV. Overall awareness of OHV telematics has considerably increased in recent years as the technology is now perceived as a convincing solution for improving total vehicular cost of ownership.

Utilisation of off-highway vehicle telematics acts as a readymade solution for enhancing the total cost of ownership, particularly in sectors such as mining, construction, industrial, and agricultural equipment.

The global OHV telematics market is projected to double in size from 2025 to 2025 due to expected growth in demand from end user industries such as mining, construction and industrial. Stringent government normsconcerning vehicle safety and navigation are further expected to drive growth in the market. The global off-highway telematics market is expected to grow at an above average rate when compared with global automotive production.

North America and Europe are the largest contributors in the global OHV telematics market. Asia Pacific is expected to register the highest CAGR, due to high penetration rate of wireless technologies, increasing awareness, and changing government norms.

Globally, among all the above-mentioned segments,the mining industry is expected to provide the maximum potential in the near future as it creates space for technological innovation and advancement. Hence, the demand for OHV telematics solutionswill increase at a promising rate over the next 6 years. Another attractive segment for OHV telematics is agricultural equipment due to implementation of latest technological solutions for improving field productivity, increasing awareness and rising adoption rates in this segment. Reduction in the cost of wireless data and related hardware have also beendriving growth in the market.

Consumers view telematics as one of the best ways to reduce vehicle operating cost. The growth in volume of telematics integrated vehicles is expected to grow after 2025. This growth will be fuelled by the entry of rental equipment provider companies into the telematics market.

The key players in the OHV telematics market includeCaterpillar Inc., Daimler AG, General Motors Co., Omnitracs, MiX Telematics, Telogis, Verizon, Masternaut, AB Volvo, and TomTom. Participants in this market follow the strategy of acquisitions andmergers to enhance their market share and customer base. Moreover, original equipment manufacturers (OEMs)dealing in heavy equipment are going into strategic partnerships with aftermarket vendors to develop advanced solutions. For example, Telogis signed an agreement with Manitowoc Company Inc.in 2025to develop OHV solutions. OEMs do not have sufficient database infrastructure and face difficulty in providing solutions for mixed fleets. Partnering with aftermarket vendors helps OEMs to overcome this shortcoming. OEMs such as Caterpillar, Komatsu, Volvo, and John Deere work with aftermarket suppliers such as Navman Wireless and industry bodies to develop standard APIs for taking care of data such as vehicle identification, location, and hours of use. Rental fleet companies are now working towards standardisation of more advanced data feeds such as geo-fencing, immobilisation, safety devices and alerts.

Caterpillar and Trimble have developed a brand agnostic fleet management and site productivity solutions platform designed for contractors with mixed equipment fleets. The two companies are working on telematics via a joint venture company.

The Association of Equipment Management Professionals (AEMP) and Association of Equipment Manufacturers (AEM) have begun to standardise OHV telematics and provide necessary training to the potential OHV telematics customers. The challenge to install telematics for mixed fleets is expected to be addressed as original equipment manufacturers have started partnering with thirdparty vendors.

There have been many initiatives from AEMP and AEM to standardise and educate customers on the benefits of telematics yet the government regulations regarding safety and security are lacking in their intensity. Growth in the global market is further inhibited because heavy equipment fleet owners prefer basic telematics service due to the high cost associated with high end telematics.

Currently, OHV telematics is in its nascent stage due to limited awareness of the technology. However, globally, governments have been promoting the use of telematics in OHVs, and consumers have begun slowly to understand the importance of having telematics in their OHVs. Due to this, the global OHV telematics market is expected to expand. Mining, construction and industrial sector segments are expected to play an important role in the overall development of this industry.The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.It also contains projections usinga suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types, technology and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts, and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors, along with market attractiveness within the segments. The report also maps the qualitative impact of various market factors on market segments and various geographies.

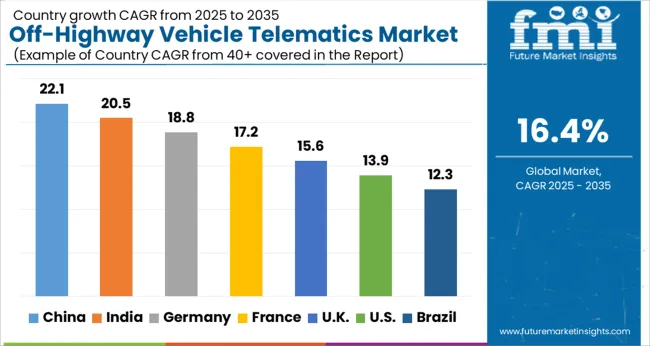

| Country | CAGR |

|---|---|

| China | 22.1% |

| India | 20.5% |

| Germany | 18.8% |

| France | 17.2% |

| UK | 15.6% |

| USA | 13.9% |

| Brazil | 12.3% |

The Off-Highway Vehicle Telematics Market is expected to register a CAGR of 16.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 22.1%, followed by India at 20.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 12.3%, yet still underscores a broadly positive trajectory for the global Off-Highway Vehicle Telematics Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 18.8%. The USA Off-Highway Vehicle Telematics Market is estimated to be valued at USD 227.8 million in 2025 and is anticipated to reach a valuation of USD 838.7 million by 2035. Sales are projected to rise at a CAGR of 13.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 31.9 million and USD 19.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 657.1 Million |

| Sales Channel | Original Equipment Manufacturers (OEMs) and Aftermarket |

| Technology Type | Cellular and Satellite |

| End-Use Application | Construction, Agriculture, and Mining |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Omnitracs, ORBCOMM, Stoneridge, TeletracNavman, TomTom International BV, ACTIA Group, Wacker Neuson, Zonar Systems Inc., TTCONTROL GMBH, and Trackunit A/S] |

The global off-highway vehicle telematics market is estimated to be valued at USD 657.1 million in 2025.

The market size for the off-highway vehicle telematics market is projected to reach USD 2,995.2 million by 2035.

The off-highway vehicle telematics market is expected to grow at a 16.4% CAGR between 2025 and 2035.

The key product types in off-highway vehicle telematics market are original equipment manufacturers (oems) and aftermarket.

In terms of technology type, cellular segment to command 75.0% share in the off-highway vehicle telematics market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA