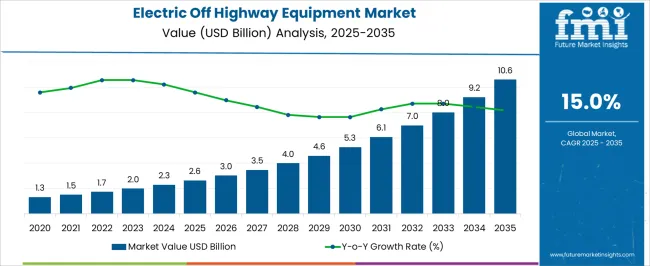

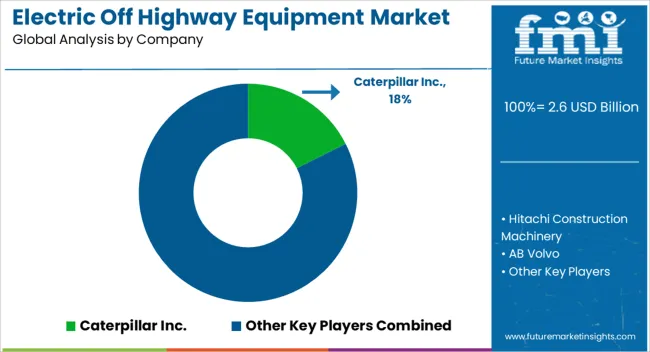

The global electric off-highway equipment market is set to grow from USD 2.6 billion in 2025 to USD 10.6 billion by 2035, reflecting a CAGR of 15.0%. During the early adoption phase (2020–2024), the market expanded from USD 1.3 billion to USD 2.3 billion as manufacturers and industrial operators began experimenting with electric alternatives to traditional diesel-powered machinery. Early adoption was driven by pilot projects in mining, construction, and agriculture, motivated by regulatory pressures to reduce emissions, rising fuel costs, and growing environmental awareness. Technological advancements in battery capacity, charging infrastructure, and motor efficiency were key enablers, while higher upfront costs and limited product availability constrained rapid adoption. From 2025 to 2030, the market enters a scaling phase, with revenues increasing from USD 2.6 billion to roughly USD 5.3 billion.

Accelerated adoption is fueled by improved product availability, cost reductions, and increasing industrial mandates for electrification. Strategic partnerships, government incentives, and advancements in energy storage solutions further boost market penetration. Between 2030 and 2035, the market transitions into consolidation, reaching USD 10.6 billion by 2035. This mature phase is characterized by standardization, optimized supply chains, and dominant players capturing significant market share. Growth stabilizes, driven by incremental innovations in performance, operational efficiency, and sustainability, reflecting a fully developed, competitive, and resilient electric off-highway equipment market.

| Metric | Value |

|---|---|

| Electric Off-Highway Equipment Market Estimated Value in (2025 E) | USD 2.6 billion |

| Electric Off-Highway Equipment Market Forecast Value in (2035 F) | USD 10.6 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The electric off-highway equipment market is advancing rapidly, fueled by the convergence of emission regulations, cost optimization, and advances in battery and drivetrain technologies. Increasing pressure to decarbonize construction, mining, and agricultural operations is prompting a shift from conventional diesel-powered machinery to electric-powered alternatives.

Manufacturers are scaling investments in hybrid-electric and fully electric platforms to meet regulatory standards while offering operational advantages such as reduced maintenance and noise. The integration of smart telematics and energy recovery systems is further enhancing efficiency.

Supportive government incentives, declining lithium-ion battery costs, and growing emphasis on ESG compliance are reshaping procurement strategies in favor of sustainable equipment. Future growth is expected to be driven by improved charging infrastructure, next-gen solid-state batteries, and the extension of electrification into high-load, heavy-duty applications previously dominated by fossil fuels.

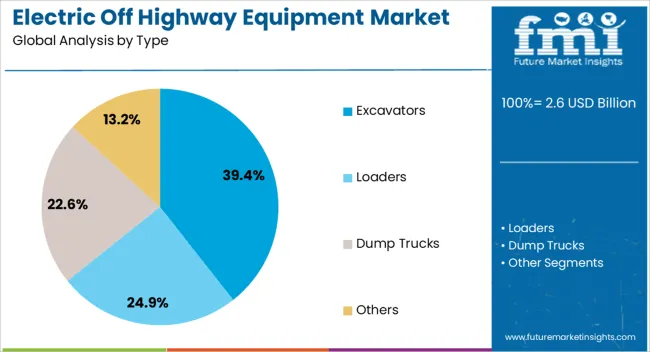

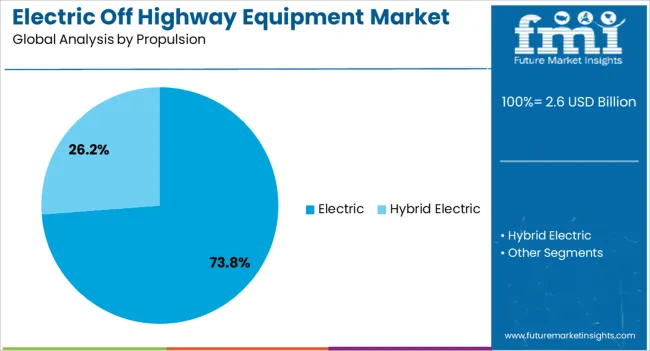

The electric off-highway equipment market is segmented by type, propulsion, and region. By type, the market is divided into excavators, loaders, dump trucks, and others. In terms of propulsion, it is classified into electric and hybrid electric. Regionally, the electric off-highway equipment industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Excavators are projected to contribute 39.40% of total market revenue in 2025, positioning them as the dominant equipment type within the electric off-highway segment. This leadership is attributed to the high utilization of excavators across urban construction, utility projects, and site development activities where emissions and noise restrictions are stringent.

Their relative operational consistency and defined load cycles have made them suitable candidates for early electrification. Manufacturers have optimized electric excavators for shorter duty cycles and rapid charging compatibility, accelerating their adoption across city-level infrastructure and zero-emission zones.

Additionally, compact electric excavators have gained traction for indoor demolition and precision tasks, further solidifying the category’s leadership.

Electric propulsion is expected to command 73.80% of the overall market share in 2025, establishing it as the primary mode of power within off-highway equipment. This dominance stems from regulatory mandates targeting off-road diesel emissions and rising fuel cost volatility.

Battery-electric systems offer significant benefits in terms of lower operational noise, reduced maintenance requirements, and enhanced control over torque delivery key features for operators seeking long-term ROI. With OEMs investing in scalable modular battery platforms and energy-dense chemistries, the range and performance of electric machines have improved markedly.

Government subsidies for electric construction and mining fleets, along with growing integration of renewables into remote charging infrastructure, have made electric propulsion an increasingly viable standard for fleet upgrades.

The electric off-highway equipment market is growing as industries adopt cleaner and more efficient machinery for construction, mining, and agriculture. These machines, powered by advanced battery systems or hybrid configurations, provide reduced emissions, lower noise, and decreased operating costs. Rising regulatory pressure on emissions and fuel consumption encourages fleet electrification. Manufacturers are focusing on battery capacity, energy efficiency, and durability to meet the demands of rugged environments while supporting long operating hours and reliability.

Electric off-highway equipment offers lower fuel costs and reduced dependency on fossil fuels, enhancing operational efficiency. Electric motors provide instant torque, consistent performance, and less maintenance compared to diesel engines, improving productivity in construction, mining, and agricultural operations. Operators benefit from reduced downtime due to fewer mechanical components and simplified powertrain designs. As industries aim for cost-effective long-term operations, adoption of electric off-highway equipment rises, particularly in projects where reliability, precision, and operational efficiency are critical.

Performance of electric off-highway equipment is closely linked to battery capacity and charging infrastructure. Manufacturers are developing high-energy-density batteries to extend operational hours and reduce downtime. Rapid-charging solutions and modular battery systems enable flexible deployment across multiple sites. Availability of reliable charging stations on-site or nearby construction and mining locations further encourages adoption. Companies investing in energy management systems and battery health monitoring improve reliability and operational planning, addressing one of the primary concerns for equipment buyers and supporting wider market growth.

Governments worldwide are enforcing stricter emission and noise regulations for industrial and off-highway machinery. Electric equipment helps operators comply with local and regional environmental requirements while reducing penalties and improving sustainability metrics. Incentives for low-emission machinery, tax benefits, and grants for electrification projects further boost market adoption. Manufacturers aligning equipment with regulatory standards gain market credibility, ensuring their solutions are approved for use in both urban and sensitive ecological zones, making electric machinery more attractive for environmentally conscious operators.

Electric off-highway machinery is being optimized for specific industrial applications, such as underground mining, forestry, and heavy construction. Specialized design considerations include ruggedized battery enclosures, enhanced thermal management, and terrain adaptability. Equipment tailored to operational needs improves performance, safety, and reliability under harsh conditions. Companies providing customized solutions for load capacity, runtime, and control systems differentiate themselves in competitive markets, enabling adoption in sectors that require robust, reliable, and eco-friendly alternatives to conventional diesel-powered equipment.

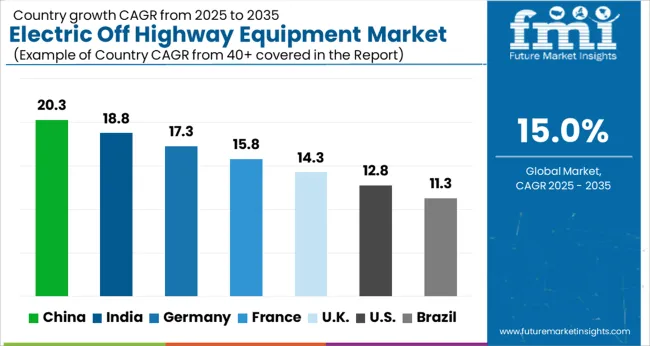

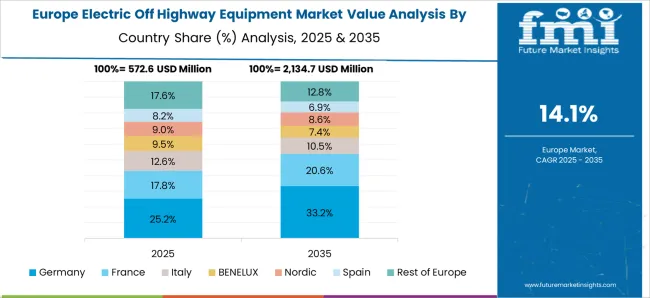

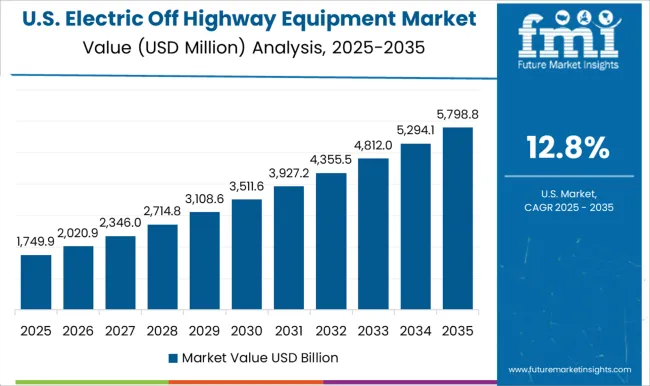

The global electric off-highway equipment market is projected to grow at a CAGR of 15.0%, fueled by rising demand in construction, mining, and agricultural sectors. China leads with a 20.3% growth rate, supported by large-scale infrastructure projects and industrial electrification. India follows at 18.8%, driven by expansion in mining and construction equipment adoption. Germany shows steady growth at 17.3%, leveraging advanced industrial machinery and sustainable energy use. The UK and USA record growth rates of 14.3% and 12.8%, respectively, reflecting gradual adoption in industrial and construction applications. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the electric off-highway equipment market with a 20.3% growth rate, driven by rapid industrialization and infrastructure development. The construction, mining, and agriculture sectors are increasingly adopting electric machinery to reduce emissions and operating costs. Government policies promoting electric mobility and clean energy support market expansion. Technological advancements in battery capacity, energy efficiency, and durability enhance equipment performance. Local manufacturers are investing in R&D to develop high-performance electric off-highway machines. Rising awareness about sustainability and carbon reduction further boosts adoption. China’s large-scale infrastructure projects create significant demand for electric loaders, excavators, and other heavy-duty machines. Export opportunities to neighboring Asian countries also contribute to growth. Continuous improvements in charging infrastructure and maintenance services facilitate market acceptance.

India’s electric off-highway equipment market grows at 18.8%, driven by infrastructure projects, mining expansion, and sustainable construction initiatives. Compared to Germany, India emphasizes cost-effective, energy-efficient electric machines. Government incentives and subsidies encourage adoption of electric loaders, excavators, and dump trucks. Local manufacturers invest in R&D to improve battery life and operational efficiency. Growing awareness of environmental regulations supports electric transition. Rising urbanization and infrastructure modernization increase demand. Public-private partnerships facilitate large-scale deployment of electric equipment. Technological collaborations with international firms improve product reliability and performance. India’s construction and mining sectors provide a steady growth base. Development of charging and maintenance infrastructure enhances adoption across regions.

Germany shows a 17.3% growth rate in electric off-highway equipment, supported by strict emissions regulations and sustainability initiatives. Compared to the UK, Germany focuses on high-performance, environmentally friendly machines. Mining, construction, and agriculture sectors are major users. Technological innovations in batteries, electric drivetrains, and smart controls enhance equipment efficiency. Government incentives and EU-level policies encourage electrification of heavy machinery. Research collaboration with global manufacturers drives product development. Continuous focus on operational safety and reduced carbon footprint supports market adoption. Industrial modernization and automation further increase demand. Export opportunities within the EU strengthen market potential. Germany’s commitment to clean energy solutions ensures long-term market stability.

The UK market grows at 14.3%, driven by demand for sustainable construction and mining equipment. Compared to the USA, the UK emphasizes regulatory compliance and low-emission solutions. Government initiatives encourage electrification of heavy machinery. Technological advancements improve battery efficiency and reduce operational costs. Adoption in urban construction and infrastructure projects increases market penetration. Manufacturers invest in R&D to develop durable and high-performance electric equipment. Export opportunities to Europe support growth. Focus on sustainability and emissions reduction promotes cleaner machinery. Development of charging networks and maintenance services facilitates market adoption. Public-private projects accelerate the deployment of electric off-highway machines.

The USA market grows at 12.8%, supported by electrification trends in construction, agriculture, and mining. Compared to China, the USA focuses on operational reliability and regulatory compliance. Advanced batteries, energy-efficient drivetrains, and smart control systems improve equipment performance. Government incentives and subsidies encourage adoption of electric loaders, excavators, and dump trucks. Industrial modernization and urban infrastructure projects drive market expansion. Manufacturers collaborate with technology providers to enhance product reliability. Adoption of sustainable practices and emissions reduction promotes market growth. Export opportunities in North America further support the market. Continuous improvements in charging infrastructure enhance operational efficiency.

Electric off-highway equipment, including electric excavators, loaders, and mining machinery, offers reduced fuel consumption, lower noise levels, and improved sustainability compared to conventional diesel-powered machinery. This transition is being driven by increasing demand in construction, mining, agriculture, and material handling sectors, where operational costs and environmental impact are critical considerations.

Key players shaping the market include Caterpillar Inc., Hitachi Construction Machinery, AB Volvo, Sennebogen Maschinenfabrik GmbH, and BEML Limited, which offer a range of electric-powered heavy machinery designed for high performance and reliability. Komatsu Ltd., Liebherr-International AG, and SANY Group are also investing heavily in electric and hybrid solutions, combining advanced battery technology with efficient power management systems.

Growing government incentives, corporate sustainability initiatives, and increasing awareness of environmental impact further accelerate adoption. As industries prioritize decarbonization and operational efficiency, electric off-highway equipment is set to become a cornerstone of the next-generation industrial machinery landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Type | Excavators, Loaders, Dump Trucks, and Others |

| Propulsion | Electric and Hybrid Electric |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Hitachi Construction Machinery, AB Volvo, Sennebogen Maschinenfabrik GmbH, BEML Limited, Komatsu Ltd., Liebherr-International AG, SANY Group, Deutz Fahr, Deere & Company, BYD Company LTD, Epiroc, Volvo Construction Equipment, XCMG Group, and JCB |

| Additional Attributes | Dollar sales in the electric off highway equipment market vary by equipment type including electric loaders, excavators, and dump trucks, application across mining, construction, and agriculture, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing adoption of electrification, stringent emission regulations, and demand for sustainable and efficient heavy machinery. |

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrical Safety Personal Protection Equipment (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Explosion-Proof Electrical Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA